RNS Number:7183O

Craneware plc

26 February 2008

Craneware plc

("Craneware" or the "Company")

INTERIM RESULTS

26 February 2008 - Craneware plc, (AIM: CRW) a leader in revenue cycle

management software solutions for the US healthcare market, is pleased to

announce interim results for the half year ended 31 December 2007.

Highlights

- Revenues increased by 24% to $8.7m (H107: $7.0m)

- Profit before share based payments, depreciation and amortisation

increased 21% to $2.0m (H107: $1.68m)

- Basic EPS of $0.064 (H107: $0.026)

- Successful Placing and IPO on AIM in September 2007 raising �5.4

million prior to expenses to fund continued expansion into the US

healthcare market

- 96 new hospitals added in the half, bringing total number to 878

- Flagship product, Chargemaster Toolkit(R), was also once again named

top in its class by the prestigious industry research house KLAS in the US

- Launch of Patient Charge EstimatorTM and Pharmacy ChargeLinkTM

Keith Neilson, CEO of Craneware commented, "We are very pleased with the

performance of the Company having successfully executed on our plan and

positioned ourselves well for future growth. We have attained, and maintained, a

number one position in the market, significantly grown our customer base and

delivered new products into the market. These are being well received and the

broadening of the product range coupled with our improved sales execution means

we are expanding our footprint within each customer and across the market as a

whole. Recent legislative changes have and will continue to work in our favour.

Our pipeline is strong and we are therefore confident of a successful outcome

for the year."

For further information, please contact:

Craneware plc KBC Peel Hunt ICIS

+44 (0)1506 407 666 +44 (0)20 7418 8900 +44 (0)20 7651 8688

Keith Neilson, CEO Oliver Scott Tom Moriarty

Sandy McDougall, CFO Deon Veldtman Caroline Evans-Jones

About Craneware

Founded in 1999, Craneware has headquarters in Livingston, Scotland, with

offices in Florida, Arizona and Kansas, employing approximately 100 staff. The

Company's flagship product, Chargemaster Toolkit(R), assists US healthcare

providers in reducing billing errors, ensuring the timely and accurate

submission of claims and managing compliance risk. More information about

Craneware plc and its services can be found on-line at the Company's corporate

website, www.craneware.com

Chairman's Statement

I am delighted to be able to report that Craneware has delivered according to

its plan at the time of IPO in September last year. The transformation into a

public company has served to strengthen our position within the market.

The increase in customer numbers during the period is of course especially

encouraging, with Craneware's software now in operation in 878 hospitals across

48 states. This spread illustrates the significant market presence of the

Company, and is a testament to the quality of our Chargemaster Toolkit(R) which

is a market leading product in the US healthcare industry. The potential for

further growth continues to be significant with legislative changes and fiscal

pressures on hospitals meaning that billing procedures in the healthcare

industry are facing more scrutiny than ever.

These market drivers combined with strong H1 figures, in particular the 50%

increase in new business wins, means that Craneware is on track for a successful

year and we expect to see this momentum continue into 2009 and beyond. The Board

would like to take this opportunity to thank our teams in Scotland and the US

for their continued hard work and dedication, without which our evolution into a

successful public company would not have been possible.

George Elliott, Chairman

26th February 2008

CEO Review

In these interim results, our first since our successful IPO last year, we are

pleased to report that we have made significant headway in all areas of the

business. As planned we have expanded our customer base, grown our market share

and recently launched new products to support future growth.

The Market

Legislative changes and fiscal pressures on healthcare costs continue to be the

key drivers of growth in our target market of US hospitals. Most recently,

Medicaid and Medicare have announced new measures requiring every US state to

have a Recovery Audit Contractor (RAC) in place by 1st of January 2010 who will

have powers to audit hospital claims back to the 1st October 2007 looking for

errors. Given the logistical problems inherent in attempting to comply with such

regulations in a timely and accurate manner Craneware's software solutions are

becoming an increasingly compelling proposition for the greater than 50% of US

hospitals that still do not have a technology based solution to this issue. We

therefore expect this legislation to continue to drive growth at a steady rate

through 2010 and beyond.

Sales and Marketing

The sales and marketing function of the business has performed very well in the

period with the end result being a like for like increase of 50% in contract

wins over the comparable period last year. This is in terms of both dollar

value and number of new hospitals under contract.

Over the last three years, our Marketing Group has been working closely with our

customers on many projects for future product development. The culmination of

two of those projects has seen the recent introduction of two new product

families to the Craneware brand. Ahead of schedule, the first two products of

these families were launched at the end of H1.

We continue to sell to the same demographic in the market and whilst the

absolute number of hospitals is stable across the US, there are many which still

do not have a technology solution and in those that do we are well positioned to

increase the level of penetration in each hospital given our broadening

capabilities and product range. The pricing environment continues to be

supportive and we are pleased to report that our market driven price increases

have been accepted. Given our success in sales and marketing we believe we

are continuing to outsell our competition and increase our market share.

Product Development

The main focus in the period with regards to product development was the launch

of two major new product lines as part of the next generation of Craneware's

range of software. In November, we launched Patient Charge EstimatorTM, which

enables hospitals to efficiently and accurately provide prospective patients

with estimates of procedural charges. Hospitals are then able to use this

information to obtain prepayments thereby reducing their bad debt provisions

from those patients. In January, just post the close of the half, we launched

Pharmacy ChargeLinkTM enabling hospitals to improve the buying, billing and

reimbursement of pharmacy items.

The first stage of the integration of these products into our marketing strategy

is underway, and will be completed by the end of 2008. These products are taking

the Company into parallel areas giving us the opportunity to tackle new areas

within our market. Further improvements in functionality across the product

range have also boosted our position in the market and we were delighted that

during the period our flagship product, Chargemaster Toolkit(R), was also once

again named top in its class by the prestigious industry research house KLAS in

the US.

We have carried out additional improvements to our software to aid integration,

particularly in enabling our software to "talk to" a number of other software

products commonly in use across multiple hospital departments. This has

broadened the appeal of our offering and we have also white-labelled some of our

products during the period. We continue to investigate other ways in which to

integrate our software with third party products.

Channel Partners

We continue to pursue the development of our third party channels to market and

have made significant progress in the period. Amerinet continues to deliver

leads and sales and we saw our first sales coming through our partner Premier

during the period. Since the period end, we also saw our first sale come through

Cerner Corporation, a leading US supplier of healthcare IT systems. We will

continue to explore opportunities with regards to additional partnerships.

Management Change and Appointments

Whilst there have been no major structural changes to our business we were very

pleased in the half to announce the promotion of James Wilson to President of

Craneware, Inc. our US subsidiary.

Financial Review

On 13th September 2007, the Group raised �5.4 million (prior to expenses of

�1.6m) through a placing by KBC Peel Hunt of 4,247,830 new Ordinary Shares at

the Placing Price of 128p per share. The funds raised via the Placing have been

utilised to strengthen the balance sheet in order to facilitate continued

product development and future strategic acquisitions.

As reported in our H1 Trading Update on 11th January 2008, we increased new

sales bookings and hospital wins by approximately 50% over the comparable period

last year, whilst launching two new product families ahead of plan and

expectations. We continue to be satisfied that the level of renewals continues

to exceed 90% for hospitals whose multi-year contracts expired during the first

half of the year. With an annuity revenue recognition model, the highly

predictable and favourable effect of higher new business levels has allowed us

to accelerate our investment in promoting and further developing our customer

support and sales infrastructure for PCE and PCL.

As regards revenue visibility, the Group had $32.9m of future revenue under

contract at 30th June 2007. New business and renewal activity in H108 added

$12.9m, whilst $8.7m revenue was recognised through the Income Statement during

the period. This has increased future revenue under contract to $37.1m at 31st

December 2007, of which $10.2m is shown as deferred revenue with the balance of

$26.9m to be invoiced in future periods. Of the future revenue under contract as

at 31st December 2007, the Directors consider that $17.7m will be recognised

during FY08 with a further $12.4m and $7.7m respectively to be recognised in

FY09 and FY10. In addition, assuming all contracts renew with no cancellations,

$0.2m revenues will be recognised from renewal activity during H208, with a

further $3.5m and $7.9m respectively in FY09 and FY10 relating to contracts due

for renewal from H208 to the end of FY10.

Following the change in pricing model in 2005 the long term element of deferred

revenues continues to reduce as such contracts mature. The overall level of

deferred revenue has increased from $9.5m to $10.2m over H108 following new

business wins, impacting favourably upon working capital and cash generated from

operations.

Under IFRS 2 "Share-Based Payments" the Group's earnings have now reflected most

of the charge in FY07 and H108 relating to share options which existed at IPO.

The lower tax charge, and related reduction in tax payable, reflects the tax

deductions originating from the exercise of such options during H1.

R&D expenditure on PCE and PCL continues to be capitalised during H1 with

amortisation starting in H2 following initial sales of these new products. Trade

and other payables are relatively constant throughout the period from H107

through FY07 to H108, when the timing effect of Corporation Tax payments are

adjusted.

The Group continues to hold the IPO proceeds in GBP to meet expected UK costs

over the period to June 2009. Nevertheless GBP cash balances require to be

re-valued each month-end and this has resulted in a charge of $129,000 during H1

as the US dollar strengthened to 1.985 at 31st December from 2.028 at IPO on

13th September. The natural hedge position will cause this to unwind by the end

of FY09.

Outlook

We are very pleased with the performance of the Company having successfully

executed on our plan and positioned ourselves well for future growth. We have

attained, and maintained, a number one position in the market, significantly

grown our customer base and delivered new products into the market. These are

being well received and the broadening of the product range coupled with our

improved sales execution means we are expanding our footprint within each

customer and across the market as a whole. Recent legislative changes have and

will continue to work in our favour. Our pipeline is strong and we are therefore

confident of a successful outcome for the year.

Keith Neilson, Chief Executive Officer

26th February 2008

Craneware PLC

Interim Results FY08

Consolidated Income Statement

H1 2008 H1 2007 FY 2007

$'000 $'000 $'000

Revenue 8,693 7,026 15,111

Cost of sales (587) (362) (808)

Gross profit 8,106 6,664 14,303

Net operating expenses (6,796) (6,122) (12,906)

Operating profit 1,310 542 1,397

Analysed as:

Profit before share based payments, depreciation and

Amortisation 2,034 1,680 3,796

Share based payments (606) (1,052) (2,191)

Depreciation of plant and equipment (90) (62) (152)

Amortisation of intangible assets (28) (24) (56)

Finance income 310 224 446

Profit before taxation 1,620 766 1,843

Tax charge (150) (261) (627)

Profit for the year 1,470 505 1,216

Earnings per share for profit attributable to

equity holders of the Company during the Half Year

- Basic ($ per share) 0.064 0.026 0.061

- Diluted ($ per share) 0.06 0.023 0.054

Craneware PLC

Interim Results FY08

Consolidated balance sheet as at 31 December 2007

H1 2008 HI 2007 FY 2007

$'000 $'000 $'000

ASSETS

Non-Current Assets

Plant and equipment 435 492 487

Intangible assets 719 271 434

Deferred Tax 300 450 810

Trade and other receivables 75 - 75

1,529 1,213 1,806

Current Assets

Inventory - 88 8

Trade and other receivables * 4,804 3,513 4,016

Cash and cash equivalents 18,923 10,184 9,664

23,727 13,785 13,688

Total Assets 25,256 14,998 15,494

EQUITY AND LIABILITIES

Non-Current Liabilities

Deferred income 561 1,609 903

561 1,609 903

Current Liabilities

Deferred income 9,663 7,516 8,579

Trade and other payables 1,333 2,837 2,261

10,996 10,353 10,840

Total Liabilities 11,557 11,962 11,743

Equity

Called up share capital 505 1 1

Share premium account 9,261 1,823 1,823

Other reserves 3,014 1,338 2,477

Retained earnings 919 (126) (550)

Total Equity 13,699 3,036 3,751

Total Equity and Liabilities 25,256 14,998 15,494

* includes $374k corporation tax receivable in current period

Craneware PLC

Interim Results FY08

Consolidated cashflow statement for the six months ended 31 December 2007

Notes H1 2008 HI 2007 FY 2007

$'000 $'000 $'000

Cash flows from operating activities

Cash generated from operations 3 2,205 450 2,626

Interest received 310 224 446

Tax (paid) / refunded (777) - (1,638)

Net cash from operating activities 1,738 674 1,434

Cash flows from investing activities

Purchase of plant and equipment (58) (419) (504)

Capitalised intangible assets (312) (238) (433)

Net cash used in investing activities (370) (657) (937)

Cash flows from financing activities

Dividends paid to company shareholders (1,000)

Gross proceeds from the Placing 10,503 - -

Less costs for the Placing (2,612) - -

Net cash used in financing activities 7,891 - (1,000)

Net (decrease) / increase in cash and cash equivalents 9,259 17 (503)

Cash and cash equivalents at the start of the year 9,664 10,167 10,167

Cash and cash equivalents at the end of the year 18,923 10,184 9,664

Craneware PLC

Interim Results FY08

Notes to the Financial Statements

1 Earnings per Share

(a) Basic

H1 2008 H1 2007 FY 2007

Profit attributable to equity holders of the Company ($'000) 1,470 505 1,216

Weighted average number of ordinary shares in issue (thousands) 22,870 19,799 19,799

Basic earnings per share ($ per share) 0.064 0.026 0.061

(b) Diluted

H1 2008 H1 2007 FY 2007

Profit attributable to equity holders of the Company ($'000) 1,470 505 1,216

Weighted average number of ordinary shares in issue (thousands) 22,870 19,799 19,799

Adjustments for: - share options (thousands) 1,637 2,524 2,719

Weighted average number of ordinary shares for 24,507 22,323 22,518

diluted

earnings per share (thousands)

Diluted earnings per share ($ per share) 0.060 0.023 0.054

2 Called up share capital

H1 2008 H1/FY 2007

Number $'000 Number $'000

Allotted called-up and fully paid

Equity share capital

Ordinary shares of 1p each 24,963,850 505 50,500 1

Ordinary A shares of 1p each - - 13,093 -

Authorised

Equity share capital

Ordinary shares of 1p each 50,000,000 1,014 9,980,361 165

Ordinary A shares of 1p each - - 19,639 -

Incentive shares of 0.1p each - - 5,087 -

3 Cash flow generated from operating activities

Reconciliation of profit before tax to net cash inflow from operating

activities

Group H1 2008 H1 2007 FY 2007

$'000 $'000 $'000

Profit before tax 1,620 766 1,843

Finance income (310) (224) (446)

Depreciation on plant and equipment 90 62 152

Amortisation on intangible assets 28 24 56

Share based payments 606 1,052 2,191

Movements in working capital:

Decrease / (increase) in inventory 8 (69) 11

(Increase) / decrease in trade and other (414) (478) (1,056)

receivables

(Decrease) / increase in trade and other payables 577 (683) (125)

Cash generated from operations 2,205 450 2,626

4. Basis of Preparation

The interim financial statements are unaudited and do not constitute statutory

accounts as defined in S240 of the Companies Act 1985. These statements have

been prepared applying accounting policies that were applied in the preparation

of the Group's consolidated accounts for the year ended 30th June 2007. Those

accounts, with an unqualified audit report, have been delivered to the Registrar

of Companies.

5. Segmental Information

The Directors consider that the Group operates in one business segment, being

the creation of software sold entirely to the US Healthcare Industry, and that

there are therefore no additional segmental discolsures to be made in these

financial statements.

The interim report was approved by the Board of Directors on 22nd February 2008.

Significant Accounting Policies

The significant accounting policies adopted in the preparation of these

statements are set out below.

6. Reporting Currency

The Directors consider that as the Group's revenues are primarily denominated in

US dollars the principal functional currency is the US dollar. The Group's

financial statements are therefore prepared in US dollars.

7. Currency Translation

Transactions denominated in foreign currencies are translated into US dollars at

the rate of exchange ruling at the date of the transaction. Monetary assets and

liabilities expressed in foreign currencies are translated into US dollars at

rates of exchange ruling at the balance sheet date. Exchange gains or losses

arising upon subsequent settlement of the transactions and from translation at

the balance sheet date, are included within the related category of expense

where separately identifiable, or in general and administrative expenses.

8. Revenue Recognition

The Group follows the principles of IAS 18, "Revenue Recognition", in

determining appropriate revenue recognition policies. In principle revenue is

recognised to the extent that it is probable that the economic benefits

associated with the transaction will flow into the Group.

Revenue comprises the value of software license sales, installation, training,

maintenance and support services, and consulting engagements. Revenue is

recognised when (i) persuasive evidence of an arrangement exists; (ii) delivery

has occurred or services have been rendered; (iii) the sales price has been

fixed and determinable; and (iv) collectability is reasonably assured.

For software arrangements with multiple elements, revenue is recognised

dependent on whether vendor-specific objective evidence ("VSOE") of fair value

exists for each of the elements. VSOE is determined by reference to sales to

external customers made on a stand-alone basis. Where there is no VSOE revenue

is recognised rateably over the full term of each contract.

Revenue from standard license products which are not modified to meet the

specific requirements of each customer is recognised when the risks and rewards

of ownership of the product are transferred to the customer. from consulting

engagements when all obligations under the consulting agreement have been

fulfilled.

Revenue from installation and training is recognised as services are provided,

and Software sub licensed to third parties is recognised in accordance with the

underlying contractual agreements. Where separate services are delivered,

revenue is recognised on delivery of the service. All other revenue is

recognised rateably over the term of the sub licence agreement.

The excess of amounts invoiced and future invoicing over revenue recognised, is

included in deferred revenue. If the amount of revenue recognised exceeds the

amounts invoiced the excess amount is included within accounts receivable.

9. Intangible Assets - Research and Development Expenditure

Expenditure associated with developing and maintaining the Group's software

products are recognised as incurred. Where, however, new product development

projects are technically feasible, production and sale is intended, a market

exists, expenditure can be measured reliably, and sufficient resources are

available to complete such projects, development expenditure is capitalised

until initial commercialisation of the product, and thereafter amortised on a

straight-line basis over its estimated useful life. Staff costs and specific

third party costs involved with the development of the software are included

within amounts capitalised.

The Group considers whether there is any indication that capitalised development

expenditure may be impaired on an annual basis. If there is such an indication,

the Group carries out an impairment test by measuring the assets' recoverable

amount, which is the higher of the assets' fair value less costs to sell and

their value in use. If the recoverable amount is less than the carrying amount,

an impairment loss is recognised.

10. Cash

Cash and cash equivalents include cash in hand, deposits held with banks and

short term highly liquid investments. For the purpose of the cash flow

statement, cash and cash equivalents comprise of cash on hand, deposits held

with banks and short term high liquid investments.

11. Share-Based Payments and Taxation Implications

The Group issues equity-settled share-based payments to certain employees. In

accordance with IFRS 2, "Share-Based Payments" equity-settled share-based

payments are measured at fair value at the date of grant. Fair value is measured

by use of the Black-Scholes pricing model as amended to cater for share options

in issue where vesting is based on future valuation performance conditions. The

fair value determined at the date of grant of the equity-settled share-based

payments is expensed on a straight-line basis over the vesting period, based on

the Group's estimate of the number of shares that will eventually vest.

The share-based payments charge is shown separately on the income statement and

is also included in 'Other reserves'.

In the UK and the US, the Group is entitled to a tax deduction for amounts

treated as compensation on exercise of certain employee share options under each

jurisdiction's tax rules. As explained under "Share-based payments", a

compensation expense is recorded in the Group's income statement over the period

from the grant date to the vesting date of the relevant options. As there is a

temporary difference between the accounting and tax bases a deferred tax asset

is recorded. The deferred tax asset arising is calculated by comparing the

estimated amount of tax deduction to be obtained in the future (based on the

Company's share price at the balance sheet date) with the cumulative amount of

the compensation expense recorded in the income statement. If the amount of

estimated future tax deduction exceeds the cumulative amount of the remuneration

expense at the statutory rate, the excess is recorded directly in equity against

retained earnings.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PUUAPPUPRPUA

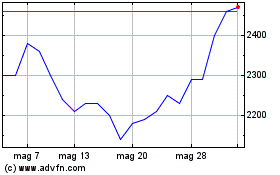

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024