RNS Number : 9920C

Craneware plc

09 September 2008

Craneware plc

("Craneware" or the "Company")

FINAL RESULTS

9 September 2008 - Craneware plc, (AIM: CRW) a leading provider of financial performance improvement software for US healthcare

organisations, is pleased to announce Final Results for the year ended 30 June 2008.

Financial Highlights

* Revenues increased by 24% to $18.7m (2007: $15.1)

* Profit (before share based payments, depreciation and amortisation) increased to $4.5m (2007: $3.8m)

* Profit after tax increased to $4.2m (2007: $1.8m)

* Basic EPS increased to $0.14 (2007: $0.06) and diluted to $0.13 (2007: $0.05)

* Dividend of 3.1p per share

Operational Highlights

* Number of US hospitals employing Craneware's software increased by 19% to 950 (2007: 801)

* Successful launch of the first products in two new product families: Patient Charge Estimator* and Pharmacy ChargeLink*

* Increasing fiscal and legislative pressures continuing to drive market growth

Keith Neilson, CEO of Craneware commented,

"Our first year as a public company has seen Craneware increase its customer base, broaden its product set and maintain its market

leading position in the US healthcare financial performance improvement market. With legislation and fiscal pressures continuing to be key

drivers of growth in our market, exerting pressure on US hospitals to improve their financial management, we expect demand for our suite of

products to grow for the foreseeable future.

"Trading in the current year has started well. Our high level of visibility over $18.3m of revenue at the beginning of the year has been

augmented by a strong pipeline of new sales opportunities, as a result of which we expect to exceed our expectations for the full year.

"I would like to thank our staff, customers and investors for their continued support and look forward to another successful year of

growth."

For further information, please contact:

Craneware plc KBC Peel Hunt ICIS

+44 (0)1506 407 666 +44 (0)20 7418 8900 +44 (0)20 7651 8688

Keith Neilson, CEO Oliver Scott Tom Moriarty

Sandy McDougall, CFO Deon Veldtman Caroline Evans-Jones

About Craneware

Founded in 1999, Craneware has headquarters in Livingston, Scotland, with offices in Florida, Arizona and Kansas, employing over 100 staff.

Craneware is a recognised leader of solutions that improve the financial performance of US healthcare organisations. Craneware partners with

healthcare organisations to improve returns, increase productivity and manage risk, driving better financial and operational performance

using market-driven revenue management solutions. By enhancing revenue capture processes, Craneware solutions allow those organisations to

optimise reimbursement, improve operational efficiency, and support compliance.

Visit www.craneware.com.

Chairman's Statement

I am delighted to report to shareholders on an outstanding first year for Craneware as a public company. We continued the growth begun

as a privately owned company, delivering on all targets set by management at the time of the IPO.

The management team have secured revenue growth in the year of 23.6% and increased operating profits from $1.4m to $3.6m. The number of

US hospitals utilising our software has increased from 801 at the start of the year to 950 at the end, squarely positioning Craneware as a

leading provider of financial performance improvement solutions for US healthcare organisations.

The quality of our products and commitment to customer service continue to be the foundations of our success. During the year, our

flagship product, Chargemaster Toolkit�, was once again ranked number 1 by the prestigious industry research house KLAS, and we launched two

new products ahead of schedule at the end of the first half of the year, augmenting our product portfolio and introducing two new product

areas: Supply Management and Strategic Pricing. Customer feedback on these has been extremely encouraging, with 30% of new sales in the year

including either one or both products. This forms an excellent platform for our growth in 2009.

The year was successfully concluded with two large system sales to Catholic Health East and Catholic Healthcare West that will see the

planned roll out of our software across their 58 hospitals in the year to June 2009. This combined with the increasing fiscal pressures on

hospitals driven by legislative changes gives us confidence in another successful year ahead.

The Board is very pleased to welcome Craig Preston into the role of Chief Financial Officer from the 15th of September 2008. Craig comes

with experience in senior financial roles within publicly quoted technology companies with exposure to UK, US and global markets. His most

recent appointments being Group Director of Finance and Company Secretary at Intec Telecom Systems from 2004-2007 and Corporate Development

Manager at London Bridge Software plc from 2000-2004 including the role of Chief Financial Officer with the acquisition target Phoenix

International Inc the NASDAQ quoted Software Company 2001-2002.

The Board would like to convey its thanks to Sandy McDougall, who will step down from the Board and resign from the Company on the same

date, after three years of service. Sandy is to be particularly thanked for his dedication and hard work in the service of the Company in

the build up to the IPO and through this successful first year as a public company. We wish Sandy the best of luck in his future

endeavours.

I would like to take this opportunity to thank our teams in Scotland and the US for their commitment and drive during what has been one

of the most significant years in Craneware's history. We look forward to maintaining momentum into 2009 and beyond.

George Elliott

Chairman

9 September 2008

CEO Statement

We are delighted with the strong operating and financial performance achieved by Craneware during our first year as a public company. We

have delivered on all targets set at the time of the IPO in September 2007, including increasing the scale of our sales operation, growing

our product set and increasing our customer base.

Alongside our internal successes, we have also seen positive developments in our market and beneficial competitive developments which

combined with our excellent reputation have resulted in Craneware maintaining its market leading position.

The Market

The market for financial management solutions for US healthcare providers continues to grow at pace, driven by increasing fiscal and

legislative pressures. Hospitals' billing systems are coming under increasing scrutiny, with the Healthcare Financial Management Association

in the US reporting that currently only 40% of the amounts billed by hospitals are being collected, leading to $31.2 billion nationwide in

uncompensated care. At the same time both the amount of compliance being imposed by the Office of the Inspector General is increasing as is

the rigour with which it is being implemented. Medicare and Medicaid, the two US healthcare programmes for individuals and families with low

incomes and resources have been given increased auditing powers, revealing a high level of inaccuracies in hospital claims leaving hospitals

exposed to potential fines and backdated payments.

In tandem with these pressures, pharmacy and supply costs are increasing with the American Journal of Health System Pharmacists recently

projecting that in 2008 hospital expenditure on drugs would increase by between 4 and 8 per cent.

Hospital management teams are therefore now actively seeking ways in which not only to increase the efficiency and accuracy of their

billing and reimbursement systems, but also to optimise pricing, improve staff productivity and retention, and therefore improve overall

financial performance.

Sales and Marketing

Craneware has been developing its marketing and product positioning strategy over the year to address several key areas of this evolving

market. Our focus is on offering products which enable senior level executives within US healthcare organisations to improve returns,

increase productivity and manage risks. We are building on a strong pedigree in this area, with a track record of continual yearly growth,

best of breed products and excellent customer endorsements.

Key to the development of our marketing strategy has been the appointment in May of Ann Marie Brown, as our first Vice President of

Marketing. With over 20 years experience in marketing both to and for US healthcare organisations, Ann Marie is responsible for Craneware's

strategic marketing and sales planning; product management; and marketing communications, including brand management, corporate

communications, and customer marketing.

We continue to attend several of the key industry trade shows, where we are seeing evidence of our growing reputation through increased

levels of interest at our booths. Our attendance at HFMA in particular in June 2008 culminated in the closing of our two most significant

deals to date.

We were especially pleased by the level of sales of our newly launched products during the year, with 30% of new sales including either

one or both of these products. The pricing environment continues to be supportive and given our success in sales and marketing we believe we

are continuing to outsell our competition and increase our market share.

Product Development

As mentioned above, US healthcare organisations are seeking to enhance their financial performance across all areas of hospital

operations. The launch in November of Patient Charge Estimator*, and in January of Pharmacy ChargeLink* moved the Company into two new

product areas addressing Supply Management and Strategic Pricing. These, combined with Craneware's core area of Revenue Cycle Management

form three fundamental levers by which healthcare organisations can improve their financial performance.

We are now in the final stages of development of a second product within our Supply Management product set, Supplies ChargeLink*, which

we intend to launch during 2009. Supplies ChargeLink* is a software solution that establishes and maintains a connection between a

hospital's supply purchase history and its charge description master (CDM), enabling the hospital to optimise reimbursement by ensuring

accurate pricing, coding, and billing of chargeable supplies.

As mentioned earlier, our product sets continue to win the endorsement of major industry research houses and review boards. In December

our flagship product, Chargemaster Toolkit�, was also once again ranked number 1 in the Revenue Cycle - Chargemaster Management market

category by the prestigious industry research house KLAS in the US. Our Chargemaster Toolkit� also successfully passed one of the industry's

most rigourous reviews, an HFMA Peer review, which screens for the highest standards of effectiveness, quality and usability, price, value

and customer and technical support.

Customers

Our customers range from small community hospitals, to teaching hospitals and large healthcare networks. Our software is now in use at 950

of these organisations, increasing from 801 at the start of the year. Our customers, such as Poudre Valley Hospital, MCG Health, Cleveland

Clinic, the University of California, San Francisco Medical Center, the University of Washington Medical Center and Cedars-Sinai Medical

Center regularly feature in lists of the US* highest ranked healthcare providers,

Channel Partners

We continue to develop our third party channels to market, with sales in the year coming through Amerinet, Premier and Cerner

Corporation. We will continue to explore opportunities with regards to additional partnerships, particularly to support the growth of our

Supply Management family of products.

Financial Review

On 13th September 2007, the Group raised �5.4 million (prior to expenses of �1.6m) through a Placing by KBC Peel Hunt of 4,247,830 new

Ordinary Shares at the Placing Price of 128p per share. The funds raised have been utilised to strengthen the balance sheet in order to

facilitate continued product development and future strategic acquisitions.

As reported in our Trading Update on 10th July 2008, the Group signed 194 new hospitals during the year exceeding targets set at the

time of the IPO in September 2007. We continue to be satisfied that the level of renewals continue to exceed 90% for hospitals with

multi-year contracts expiring during the year.

No revenue has been recognised from the major agreements with Catholic Healthcare West and Catholic Health East in the last month of the

year. However with the Group's annuity revenue recognition model, the level of new business wins, set against a background of continuing

high renewal levels, have allowed revenues to grow from $15.1m to $18.7m during the year.

Operating costs have risen from $12.9m to $14.1m following the decision to accelerate ongoing development of our customer support and

sales infrastructure for the new product pipeline. As a result, profit before share based payments, depreciation, and amortisation has

increased from $3.8m to $4.5m.

R&D expenditure on Patient Charge Estimator* and Pharmacy ChargeLink* continued to be capitalised during H1 until amortisation commenced

in H2 following initial sales of these new products. In accordance with IFRS we continued to capitalise R&D expense on the Supplies

ChargeLink* product during H2.

Under IFRS 2 "Share-Based Payments" the Group's earnings have now reflected most of the charge relating to share options which existed

at IPO. The lower tax charge and related reduction in tax payable reflects the tax deductions originating from the exercise of such options

during the year. In light of the share based payment charge of $0.6m during the year and $2.2m last year, profit before tax increased from

$1.8m to $4.2m, whilst profit after tax increased from $1.2m to $3.3m.

Given our advance annual billing model ahead of revenue recognition, and by paying particular attention to receivables collection in

light of global credit conditions, it is pleasing to report a net working capital inflow during the year. This has allowed cash generated

from operations to increase from $2.6m to $5.0m during the year.

As regards revenue visibility, the Group had $39.9m of future revenue under contract at 30th June 2008 (2007 : $32.9m), $10.3m of which

is shown as deferred revenue (2007 : $9.5m) with the balance of $29.6m (2007 : $23.4m) to be invoiced in future periods. New business and

renewal activity added $25.7m, whilst $18.7m revenue was recognised through the Income Statement during the period.

Of the future revenue under contract the Directors consider that $15.9m will be recognised during FY09 with a further $9.8m and $6.9m

respectively to be recognised in FY10 and FY11. In addition, assuming all contracts renew with no cancellations, $2.4m revenues will be

recognised from renewal activity during FY09, with a further $7.0m and $9.8m respectively in FY10 and FY11 relating to contracts due for

renewal from 1 July 2008 through these years.

Dividend

Basic and diluted earnings per share were $0.14 and $0.13 respectively and the Board recommends a dividend of 3.1p (6.17 cents) per

share. Subject to confirmation at the Annual General Meeting, the final dividend will be paid on 5 December to shareholders on the register

as at 7 November.

Outlook

Our first year as a public company has seen Craneware increase its customer base, broaden its product set and maintain its market

leading position in the US healthcare financial performance improvement market. With legislation and fiscal pressures continuing to be key

drivers of growth in our market, exerting pressure on US hospitals to improve their financial management, we expect demand for our suite of

products to grow for the foreseeable future.

Trading in the current year has started well. Our high level of visibility over $18.3m of revenue at the beginning of the year has been

augmented by a strong pipeline of new sales opportunities, as a result of which we expect to exceed our expectations for the full year.

I would like to thank our staff, customers and investors for their continued support and look forward to another successful year of

growth.

Keith Neilson

Chief Executive Officer

9 September 2008

Consolidated Income Statement

For the year ended 30 June 2008

Notes 2008 2007

$'000 $'000

Revenue 18,676 15,111

Cost of sales (954) (808)

Gross profit 17,722 14,303

Net operating expenses 3 (14,141) (12,906)

Operating profit 3,581 1,397

Analysed as:

Profit before share based payments, depreciation and 4,516 3,796

amortisation

Share based payments 4 (634) (2,191)

Depreciation of plant and equipment (183) (152)

Amortisation of intangible assets (118) (56)

Finance income 607 446

Profit before taxation 4,188 1,843

Tax charge 5 (899) (627)

Profit for the year 10 3,289 1,216

The results relate to continuing operations.

Earnings per share for the period attributable to equity holders

Notes 2008 2007

Basic ($ per share) 6a 0.14 0.06

Diluted ($ per share) 6b 0.13 0.05

Consolidated Balance Sheet as at 30 June 2008

Notes 2008 2007

$'000 $'000

ASSETS

Non-Current Assets

Plant and equipment 415 487

Intangible assets 7 794 434

Deferred Tax 8 1,075 810

Trade and other receivables 75 75

2,359 1,806

Current Assets

Inventory - 8

Trade and other receivables 4,685 4,016

Cash and cash equivalents 21,112 9,664

25,797 13,688

Total Assets 28,156 15,494

EQUITY AND LIABILITIES

Non-Current Liabilities

Deferred income 444 903

444 903

Current Liabilities

Deferred income 9,853 8,579

Trade and other payables 1,760 2,261

11,613 10,840

Total Liabilities 12,057 11,743

Equity

Called up share capital 9 509 1

Share premium account 10 9,253 1,823

Other reserves 10 3,041 2,477

Retained earnings 10 3,296 (550)

Total Equity 10 16,099 3,751

Total Equity and Liabilities 28,156 15,494

Cashflow Statement for the year ended 30 June 2008

Group Company

Notes 2008 2007 2008 2007

$'000 $'000 $'000 $'000

Cash flows from operating activities

Cash generated from operations 11 4,987 2,626 4,376 2,641

Interest received 607 446 607 446

Tax (paid) (1,495) (1,638) (1,168) (1,604)

Net cash from operating activities 4,099 1,434 3,815 1,483

Cash flows from investing activities

Purchase of plant and equipment (111) (504) (59) (418)

Capitalised intangible assets (478) (433) (474) (423)

Net cash used in investing (589) (937) (533) (841)

activities

Cash flows from financing activities

Dividends paid to company - (1,000) - (1,000)

shareholders

Net IPO proceeds 9 7,938 - 7,938 -

Net cash from/(used) in financing 7,938 (1,000) 7,938 (1,000)

activities

Net (decrease) / increase in cash 11,448 (503) 11,220 (358)

and cash equivalents

Cash and cash equivalents at the 9,664 10,167 9,116 9,474

start of the year

Cash and cash equivalents at the end 21,112 9,664 20,336 9,116

of the year

Notes to the Financial Statements

General Information

Craneware plc (the Company) is a public limited company incorporated in Scotland. The Company has a primary listing on the AIM stock

exchange. The address of its registered office and principal place of business is disclosed on page 6 of the financial statements. The

principal activity of the Company is described in the directors' report.

Basis of preparation

The financial statements are prepared in accordance with International Financial Reporting Standards (IFRS), IFRIC interpretations and

with those parts of the Companies Act 1985 applicable to companies reporting under IFRS. The financial statements have been prepared under

the historic cost convention. A summary of the more important accounting policies is set out below, together with an explanation of where

changes have been made to previous policies on the adoption of new accounting standards in the year, if applicable.

The preparation of financial statements in conformity with IFRS requires the use of estimates and assumptions that affect the reported

amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the

reporting period. Although these estimates are based on management's best knowledge of the amount, event or actions, actual results

ultimately may differ from those estimates.

The Company and its subsidiary undertaking are referred to in this report as the Group.

1. Selected principal accounting policies

The selected principal accounting policies adopted in the preparation of these accounts are set out below. These policies have been

consistently applied, unless otherwise stated.

Reporting currency

The Directors consider that as the Group's revenues are primarily denominated in US dollars the principal functional currency is the US

dollar. The Group's financial statements are therefore prepared in US dollars.

Currency Translation

Transactions denominated in foreign currencies are translated into US dollars at the rate of exchange ruling at the date of the

transaction. Monetary assets and liabilities expressed in foreign currencies are translated into US dollars at rates of exchange ruling at

the balance sheet date ($1.9906/�1). Exchange gains or losses arising upon subsequent settlement of the transactions and from translation at

the balance sheet date, are included within the related category of expense where separately identifiable, or in general and administrative

expenses.

New Standards, amendments and interpretations effective in the year

IFRS 7, 'Financial Instruments: Disclosures', and complementary amendment to IAS 1, 'Presentation of financial statements - Capital

disclosures', introduces new disclosure relating to financial instruments that replace the disclosure requirements of IAS 32. This standard

has been applied to both the current and comparative years' information within these financial statements and does not materially change the

financial results.

The following new standards, amendments, and interpretations have become effective in the year, but do not have any impact on the

Group financial statements:- IFRIC 8, 'Scope of IFRS 2', IFRIC 9, 'Re-assessment of embedded derivatives', IFRIC 10, 'Interim financial

reporting and impairment' and IFRIC 11, 'IFRS - Group and treasury share transactions.

New Standards, amendments and interpretations not yet effective

The following new standards, amendments and interpretations are not yet effective. The directors anticipate that the future adoption of

these standards, amendments and interpretations (where relevant to the Group) will have no material financial impact on the financial

statements of the Group. None of the following standards, amendments or interpretations has been adopted early.

IFRS 2, 'Share based payments' - amendment relating to vesting conditions and cancellations.

IFRS 3, 'Business combinations' - a comprehensive revision on applying the acquisition method and the consequential amendments to IAS

27, 'Consolidated and separate financial statements'.

IFRS 8, 'Operating segments' replaces IAS 14, 'Segment reporting'.

IAS 1, 'Presentation of financial statements', a comprehensive revision of the standard that will affect the way financial statements

are presented. IAS 23, 'Borrowing costs' is amended to remove the option to immediately expense borrowing costs that are directly

attributable to a qualifying asset.

IFRIC 12, 'Service concession arrangements', applies to contractual arrangements whereby a private sector operator participates in the

development, financing, operations and maintenance of infrastructure for public sector services.

IFRIC 13, 'Customer loyalty programmes' clarifies that where goods or services are sold together with a customer loyalty incentive, the

arrangement is a multi-element arrangement and the consideration receivable from the customer is allocated between components of the

arrangement using fair values.

IFRIC 14, 'IAS 19 - The limit on a defined benefit asset, minimum funding requirements and their interaction' provides guidance on

assessing the limit in IAS 19 on the amount of the surplus that can be recognised as an asset. It also explains how the pension asset or

liability may be affected by a statutory or contractual minimum funding requirement.

Revenue recognition

The Group follows the principles of IAS 18, "Revenue Recognition", in determining appropriate revenue recognition policies. In principle

revenue is recognised to the extent that it is probable that the economic benefits associated with the transaction will flow into the

Group.

Revenue comprises the value of software license sales, installation, training, maintenance and support services, and consulting

engagements. Revenue is recognised when (i) persuasive evidence of an arrangement exists; (ii) delivery has occurred or services have been

rendered; (iii) the sales price has been fixed and determinable; and (iv) collectability is reasonably assured.

For software arrangements with multiple elements, revenue is recognised dependent on whether vendor-specific objective evidence ("VSOE")

of fair value exists for each of the elements. VSOE is determined by reference to sales to external customers made on a stand-alone basis.

Where there is no VSOE revenue is recognised rateably over the full term of each contract.

Revenue from standard license products which are not modified to meet the specific requirements of each customer is recognised when the

risks and rewards of ownership of the product are transferred to the customer.

Revenue from installation and training is recognised as services are provided, and from consulting engagements when all obligations

under the consulting agreement have been fulfilled.

Software sub licensed to third parties is recognised in accordance with the underlying contractual agreements. Where separate services

are delivered, revenue is recognised on delivery of the service. All other revenue is recognised rateably over the term of the sub licence

agreement.

The excess of amounts invoiced and future invoicing over revenue recognised, is included in deferred revenue. If the amount of revenue

recognised exceeds the amounts invoiced the excess amount is included within accounts receivable.

Intangible Assets - Research and Development Expenditure

Expenditure associated with developing and maintaining the Group's software products are recognised as incurred. Where, however, new

product development projects are technically feasible, production and sale is intended, a market exists, expenditure can be measured

reliably, and sufficient resources are available to complete such projects, development expenditure is capitalised until initial

commercialisation of the product, and thereafter amortised on a straight-line basis over its estimated useful life. Staff costs and specific

third party costs involved with the development of the software are included within amounts capitalised.

Impairment Tests

The Group considers whether there is any indication that non-current assets are impaired on an annual basis. If there is such an

indication, the Group carries out an impairment test by measuring the assets' recoverable amount, which is the higher of the assets' fair

value less costs to sell and their value in use. If the recoverable amount is less than the carrying amount an impairment loss is

recognised.

Taxation

The charge for taxation is based on the profit for the period and takes into account deferred taxation. Taxation is computed using the

liability method. Under this method, deferred tax assets and liabilities are determined based on temporary differences between the financial

reporting and tax bases of assets and liabilities and are measured using enacted rates and laws that will be in effect when the differences

are expected to reverse. The deferred tax is not accounted for if it arises from initial recognition of an asset or liability in a

transaction that at the time of the transaction affects neither accounting nor taxable profit or loss. Deferred tax assets are recognised to

the extent that it is probable that future taxable profits will arise against which the temporary differences will be utilised.

Deferred tax is provided on temporary differences arising on investments in subsidiaries except where the timing of the reversal of the

temporary difference is controlled by the Group and it is probable that the temporary difference will not reverse in the foreseeable future.

Deferred tax assets and liabilities arising in the same tax jurisdiction are offset.

In the UK and the US, the Group is entitled to a tax deduction for amounts treated as compensation on exercise of certain employee share

options under each jurisdiction's tax rules. As explained under "Share-based payments" below, a compensation expense is recorded in the

Group's income statement over the period from the grant date to the vesting date of the relevant options. As there is a temporary difference

between the accounting and tax bases a deferred tax asset is recorded. The deferred tax asset arising is calculated by comparing the

estimated amount of tax deduction to be obtained in the future (based on the Company's share price at the balance sheet date) with the

cumulative amount of the compensation expense recorded in the income statement. If the amount of estimated future tax deduction exceeds the

cumulative amount of the remuneration expense at the statutory rate, the excess is recorded directly in equity against retained earnings.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand, deposits held with banks and short term highly liquid investments. For the purpose of

the cash flow statement, cash and cash equivalents comprise of cash on hand, deposits held with banks and short term high liquid

investments.

Share Based Payments

The Group grants share options to certain employees. In accordance with IFRS 2, "Share Based Payments" equity-settled share based

payments are measured at fair value at the date of grant. Fair value is measured by use of the Black-Scholes pricing model as appropriately

amended. The fair value determined at the date of grant of the equity-settled share-based payments is expensed on a straight-line basis over

the vesting period, based on the Group's estimate of the number of shares that will eventually vest.

The share-based payments charge is included in net operating expenses and is also included in 'Other reserves'.

2. Critical accounting estimates and judgements

The preparation of financial statements in accordance with generally accepted accounting principles requires the directors to make

critical accounting estimates and judgements that affect the amounts reported in the financial statements and accompanying notes. The

estimates and assumptions that have a significant risk of causing material adjustment to the carrying value of assets and liabilities within

the next financial year are discussed below:-

1 Provision for impairment of trade receivables:- the Group assesses trade receivables for impairment which requires the directors to

estimate the likelihood of payment forfeiture by customers.

2 Revenue recognition:- the Group assesses the economic benefit that will flow from future milestone payments in relation to

sub-licensing partnership arrangements. This requires the directors to estimate the likelihood of the Group, its partners, and sub-licensees

meeting their respective commercial milestones and commitments.

3 Capitalisation of development expenditure:- the Group capitalises development costs provided the conditions laid out below have

been met. Consequently the directors require to continually assess the commercial potential of each product in development and its useful

life following launch.

4 Provisions for income taxes:- the Group is subject to tax in the UK and US and this requires the directors to regularly assess the

applicability of its transfer pricing policy.

5 Share based payments:- the Group requires to make a charge to reflect the value of share-based equity-settled payments in the

period. At each grant of options and balance sheet date, the directors are required to consider whether there has been a change in the fair

value of share options due to factors including number of expected participants.

3. Net operating expenses

Net operating expenses are made up as follows:-

2008 2007

$'000 $'000

Sales and marketing expenses 4,857 4,500

Client Servicing 3,359 2,498

Research and development 2,623 2,173

Administrative expenses 2,319 1,398

Share based payments 634 2,191

Depreciation of plant and equipment 183 152

Amortisation of intangible assets 118 56

Exchange loss/(gain) 48 (62)

Net operating expenses 14,141 12,906

4. Share based payments

The Group has an equity-settled share based payment scheme, whereby options over shares in Craneware plc can be granted to employees and

directors. A charge is shown in the income statement of $633,554 (2007: $2,190,911) as detailed in Note 8 above.

Options issued under the 2006 Share Options Plan over Ordinary shares and Incentive shares were granted at par and have been adjusted to

reflect the 299 for 1 share split. Options over Ordinary shares vested on admission to AIM on 13 September 2007 and became fully exercisable

on that date, whilst options over Incentive shares lapsed at this event. Outstanding options lapse upon leaving employment or if not

exercised within 10 years from the date of grant.

The market value of share options exercised during the year ranged from $2.60 (�1.28) at IPO to $4.13 (�2.075). The market value at 30

June 2008 was $4.13 (�2.075).

Under the 2007 Share Options Plan, options over a maximum of 1,400,000 ordinary shares ("initial options") were granted on 14 September

2007 shortly after admission to AIM with an exercise price of $0.02 (�0.01) per share. These options are subject to performance targets,

will not normally vest until 1 October 2010, and will lapse upon leaving employment or 30 April 2011.

Other options over ordinary shares under the 2007 Share Options Plan may be granted with an exercise price no less than the market value

of the Ordinary shares on the date of grant, and in the case of the directors of the Company will be granted subject to sufficiently

stretching performance targets. These options will be subject to time based vesting and will not normally be exercisable before the third

anniversary of grant. Such options will lapse on the tenth anniversary of grant.

The fair value of options granted was estimated on the date of grant using the Black Scholes option pricing model as appropriately

adjusted. The Company estimates the number of options likely to vest by reference to the Group's staff retention rate, and expenses the fair

value over the relevant vesting period. Volatility has been estimated by reference to similar companies whose shares are traded on a

recognised stock exchange.

The assumptions for each option grant were as follows:

Date of Grant 02-May-08 14-Sep-07 13-Sep-07 16-Mar-07 26-Oct-06 11-May-06

Share price at date of grant $3.69 $2.60 $2.60 $2.06* $1.97* $1.87*

Share price at date of grant �1.87 �1.28 �1.28 �1.06* �1.04* �0.99*

Vesting period (years) 3.00 3.04 0.00 0.45 0.84 1.30

Expected volatility 40% 40% 40% 40% 40% 40%

Risk free rate 5.00% 5.75% 5.75% 5.25% 4.75% 4.50%

Dividend yield 1% 1% 1% 2% 2% 2%

Options over Ordinary shares

Exercise price $3.69 $0.02 0.007cents 0.007cents 0.007cents 0.007cents

Exercise price �1.87 �0.01 0.0033p 0.0033p 0.0033p 0.0033p

Number of employees 1 84 1 19 5 48

Shares under option 40,600 1,400,000 50,100 56,700 16,200 1,412,700

Fair value per option $1.11 $0.95 $2.60 $2.04 $1.93 $1.82

Options over Incentive shares

Exercise price 0.001cents 0.001cents 0.001cents

Exercise price 0.0003p 0.0003p 0.0003p

Number of employees 18 5 42

Shares under option 147,900 15,000 1,104,000

Weighted average fair value per option $0.004 $0.037 $0.131

* at directors' valuation prior to IPO

The following options have been granted over Ordinary shares and Incentive shares:

options options

number number

2008 2007

2006 Share Option Plan:-

Ordinary share options (0.0033p exercise price)

Outstanding at 1 July 1,480,800 1,412,700

Granted 50,100 81,900

Forfeited (191,580) (13,800)

Exercised (1,083,420) -

Outstanding at 30 June 255,900 1,480,800

Incentive share options (0.0003p exercise price)

Outstanding at 1 July 1,266,900 1,104,000

Granted - 177,300

Forfeited (1,266,900) (14,400)

Outstanding at 30 June - 1,266,900

2007 Share Options Plan:-

Initial options of ordinary shares (�0.01 exercise price)

Outstanding at 1 July - -

Granted 1,400,000 -

Forfeited (241,200) -

Exercised - -

Outstanding at 30 June 1,158,800 -

Ordinary share options (�0.01 exercise price)

Outstanding at 1 July - -

Granted 40,600 -

Forfeited - -

Outstanding at 30 June 40,600 -

5. Tax on profit on ordinary activities

2008 2007

$'000 $'000

Profit on ordinary activities before tax 4,188 1,843

Current tax

Corporation tax on profits of the period 701 1,242

Adjustments for prior periods (8) 60

Total current tax charge 693 1,302

Deferred tax

Origination & reversal of timing differences 206 (678)

Adjustments for prior periods - 3

Total deferred tax charge / (credit) 206 (675)

Tax on profit on ordinary activities 899 627

The difference between the current tax charge on ordinary activities for the period, reported in the income statement, and

the current tax charge that would result from applying a relevant standard rate of tax to the profit on ordinary

activities before tax, is explained as follows:

Profit on ordinary activities at the UK tax rate 29.5% 1,235 553

(2007: 30%)

Effects of

Adjustment in respect of prior periods

Current tax (8) 61

Deferred tax 31 3

State tax 49 20

Additional US tax on losses 34% (2007: 34%) (40) (40)

Expenses not deductible for tax purposes 79 82

Non-taxable income (61) (60)

Tax deduction on share plan charges (375) -

Adjustment to rate at which deferred tax will unwind (11) 8

Total tax charge 899 627

6. Earnings per share

a) Basic

Basic earnings per share is calculated by dividing the profit attributable to equity holders of the Company by the weighted average

number of shares in issue during the year.

2008 2007

Profit attributable to equity holders of the Company ($'000) 3,289 1,216

Weighted average number of ordinary shares in issue 23,964 19,799

(thousands)

Basic earnings per share ($ per share) 0.14 0.06

b) Diluted

For diluted earnings per share, the weighted average number of ordinary shares calculated above is adjusted to assume conversion of all

dilutive potential ordinary shares. The Group has one category of dilutive potential ordinary shares, being those share options granted to

directors and employees under the share option scheme.

2008 2007

Profit attributable to equity holders of the Company ($'000) 3,289 1,216

Weighted average number of ordinary shares in issue 23,964 19,799

(thousands)

Adjustment for: 1,408 2,719

- Share options (thousands)

Weighted average number of ordinary shares for diluted 25,372 22,518

earnings per share (thousands)

Diluted earnings per share ($ per share) 0.13 0.05

7. Intangible assets

Research and development and computer software

Group Company

In Process Computer In Process Computer

R & D Software Total R & D Software Total

$'000 $'000 $'000 $'000 $'000 $'000

Cost

At 1 July 2007 867 224 1,091 867 170 1,037

Additions 450 28 478 450 24 474

At 30 June 2008 1,317 252 1,569 1,317 194 1,511

Amortisation

At 1 July 2007 536 121 657 536 83 619

Charge for the year 63 55 118 63 44 107

At 30 June 2008 599 176 775 599 127 726

NBV at 30 June 2008 718 76 794 718 67 785

Cost

At 1 July 2006 536 122 658 536 78 614

Additions 331 102 433 331 92 423

At 30 June 2007 867 224 1,091 867 170 1,037

Amortisation

At 1 July 2006 522 79 601 522 55 577

Charge for the year 14 42 56 14 28 42

At 30 June 2007 536 121 657 536 83 619

NBV at 30 June 2007 331 103 434 331 87 418

8. Deferred taxation

Deferred tax is calculated in full on the temporary differences under the liability method using a rate of tax of 28% (2007: 29.5%).

The movement on the deferred tax account is shown below:-

Group Company

2008 2007 2008 2007

$'000 $'000 $'000 $'000

At the 1 July 2007 (810) (135) (460) (66)

Income statement charge/ (credit) 206 (675) 240 (394)

Transfer direct to equity (471) - (61) -

At 30 June 2008 (1,075) (810) (281) (460)

A deferred tax asset of $�����479,408 (2007: $349,846) has arisen in respect of net operating losses and other temporary differences in

Craneware Inc. This asset is recognised in the Group balance sheet as the Directors are of the view that Craneware Inc will establish a

sufficient pattern of profitability.

The movements in deferred tax assets and liabilities during the year are shown below. Deferred tax assets and liabilities are only

offset where there is a legally enforceable right of offset and there is an intention to settle the balances net. The net deferred tax asset

to be recovered from 30 June 2008 was $1,075,367 (2007: $810,272)

Deferred tax assets - Accelerated Short term

recognised

accounting timing Share

depreciation differences Losses Options Total

Group $'000 $'000 $'000 $'000 $'000

At 1 July 2007 (4) (79) - (758) (841)

Charged to income statement (3) (10) (232) 415 170

Charged to equity - - (247) - (247)

Excess DT charged to Equity - - - (224) (224)

Total provided at 30 June 2008 (7) (89) (479) (567) (1,142)

At 1 July 2006 (8) (40) - (88) (136)

Charged to income statement 4 (39) - (670) (705)

Total provided at 30 June 2007 (4) (79) - (758) (841)

Deferred tax liabilities - Accelerated

recognised

tax

depreciation Total

Group $'000 $'000

At 1 July 2007 31 31

Charged to income statement 36 36

Total provided at 30 June 2008 67 67

At 1 July 2006 1 1

Charged to income statement 30 30

Total provided at 30 June 2007 31 31

Deferred tax assets - Accelerated Short term

recognised

accounting timing Share

depreciation differences Losses Options Total

Company $'000 $'000 $'000 $'000 $'000

At 1 July 2007 - - - (492) (492)

Charged to income statement - - - 204 204

Excess charged to equity (60) (60)

Total provided at 30 June 2008 - - - (348) (348)

At 1 July 2006 (8) - - (59) (67)

Charged to income statement 8 - - (433) (425)

Total provided at 30 June 2007 - - - (492) (492)

Deferred tax liabilities - Accelerated

recognised

tax

depreciation Total

Company $'000 $'000

At 1 July 2007 32 32

Charged to income statement 35 35

Total provided at 30 June 2008 67 67

At 1 July 2006 - -

Charged to income statement 32 32

Total provided at 30 June 2007 32 32

9. Called up share capital

Authorised

2008 2007

Number $'000 Number $'000

Equity share capital

Ordinary shares of 1p each 50,000,000 1,014 9,980,361 165

Ordinary A shares of 1p each - - 19,639 -

Incentive shares of 0.1p each - - 5,087 -

Allotted called-up and fully paid

2008 2007

Number $'000 Number $'000

Equity share capital

Ordinary shares of 1p each 25,109,950 509 50,500 1

Ordinary A shares of 1p each - - 13,093 -

The movement in share capital during the year is represented as follows:

Prior to flotation on 6 September 2007:

* All existing classes of Shares were converted into ordinary shares on a 1 for 1 basis.

* A 1 for 299 share split occurred for all ordinary shares.

* A bonus allotment of 700,800 ordinary shares were issued.

On Flotation on 13 September 2007:

* 4,247,830 new Ordinary Shares were issued. The nominal value of each share was �0.01 and the issue price was �1.28 ($2.60). The

proceeds of the issue generated additional share capital of $86,137 and additional share premium of $7,852,000 after deduction of issue and

transaction costs of $3,138,318.

Post Flotation:

* 1,083,420 Ordinary Share options were exercised in the year.

10. Statement of changes in equity

Share

Share Premium Other Retained

Capital Account Reserves Earnings Total

Group $'000 $'000 $'000 $'000 $'000

At 1 July 2006 1 1,823 286 (766) 1,344

Share based payments - - 2,191 - 2,191

Retained profit for the year - - - 1,216 1,216

Dividends (Note 12) - - - (1,000) (1,000)

At 30 June 2007 1 1,823 2,477 (550) 3,751

Share split 386 (386) - - -

Allotment pursuant to IPO 14 (14) - - -

Share based payments - - 564 557 1,121

New shares issued in the year 86 7,852 - - 7,938

Options exercised 22 (22) - - -

Retained profit for the year - - - 3,289 3,289

At 30 June 2008 509 9,253 3,041 3,296 16,099

Company

At 30 June 2006 1 1,823 210 (786) 1,248

Share based payments - - 1,583 - 1,583

Retained profit for the year - - - 1,356 1,356

Dividends (Note 12) - - - (1,000) (1,000)

At 30 June 2007 1 1,823 1,793 (430) 3,187

Share split 386 (386) - - -

Allotment pursuant to IPO 14 (14) - - -

Share based payments - - 402 61 463

New shares issued in the year 86 7,852 - - 7,938

Options exercised 22 (22) - - -

Retained profit for the year - - - 2,560 2,560

At 30 June 2008 509 9,253 2,195 2,191 14,148

Other reserves relate to share-based payments.

11. Cash flow generated from operating activities

Reconciliation of profit before tax to net cash inflow from operating

activities

Group Company

2008 2007 2008 2007

$'000 $'000 $'000 $'000

Profit before tax 4,188 1,843 3,557 2,081

Finance income (607) (446) (607) (446)

Depreciation on plant and 183 152 132 102

equipment

Amortisation on intangible 118 56 107 42

assets

Share based payments 634 2,191 414 1,582

Less US employer tax on (58) - - -

exercise of options

Less related professional fees (12) - (12) -

Movements in working capital:

Decrease / (increase) in 8 11 - -

inventory

(Increase) / decrease in trade (669) (1,056) (580) (964)

and other receivables

(Decrease) / increase in trade 1,202 (125) 1,365 244

and other payables

Cash generated from operations 4,987 2,626 4,376 2,641

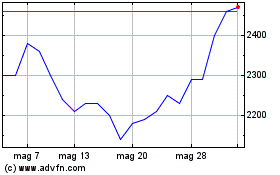

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024