TIDMCRW

RNS Number : 4337H

Craneware plc

22 February 2010

Craneware plc

("Craneware" or the "Company")

Half Yearly Report

22 February 2010 - Craneware plc (AIM: CRW.L), the leader in automated revenue

integrity solutions for the US healthcare market, is pleased to announce its

half year results for the six months ended 31 December 2009.

Financial Highlights H1 2010 (all figures in US dollars)

· Total of $25.0m of contracts signed in the half (H109: $21.8)

o 25% increase in revenues to $13.3m (H109: $10.6m)

o Future revenues under contract increasing to $71.8m (FY09: $60.1m).

· EBITDA1 increased 36% to $3.4m (H109: $2.5m).

· EBITDA1 margin increased to 26% (H109: 24%).

· Profit before taxation increased by 28% to $3.3m (H109: $2.6m).

· Basic EPS increased by 18% to $0.092 (H109: $0.078).

· Interim dividend of 4.7 pence per share (FY09 Interim dividend 1.8p; FY09

Total dividend 4.7p), total dividend for FY10 expected to be in line with stated

progressive dividend policy.

1. EBITDA refers to earnings before interest, tax, depreciation, amortisation

and share based payments

Operational Highlights H1 2010

· Launch and first sales of fifth product, Supplies ChargeLink(TM).

· Product attachment rate increased to 1.5 (FY09: 1.4).

· Signed reseller agreement with McKesson and secured first sales.

· New multi-year contract signed with North Shore-LIJ Health System, the

largest integrated healthcare system in New York State.

Keith Neilson, CEO of Craneware commented:

"We have been pleased with our strong performance in the first half of this

year, which has seen the broadening of our product set, the increase of our

customer base and the strengthening of our market position.

"Legislative and fiscal pressures are continuing to focus our customers on

revenue integrity, a niche of the US IT healthcare market, of which we are at

the forefront. These market dynamics combined with the quality of our software

and our focus on customer support means we have secured another record half of

sales, the main benefit of which will be seen in future years.

"With our sixth product due to launch this calendar year and our ongoing focus

on sales execution, we are confident in our ability to achieve significant

revenue and earnings growth and we continue to look to the future with

confidence."

For further information, please contact:

+----------------+----------------+----------------+

| Craneware plc | KBC Peel Hunt | ICIS |

| | | |

+----------------+----------------+----------------+

| +44 (0)1506 | +44 (0)20 7418 | +44 (0)20 7651 |

| 407 666 | 8900 | 8688 |

+----------------+----------------+----------------+

| Keith Neilson, | Jonathan | Caroline |

| CEO | Marren | Evans-Jones |

+----------------+----------------+----------------+

| Craig Preston, | Richard | Fiona Conroy |

| CFO | Kauffer | |

+----------------+----------------+----------------+

| | Dan Webster | |

+----------------+----------------+----------------+

About Craneware

Craneware (AIM: CRW.L) is the leader in automated revenue integrity solutions

that improve financial performance for healthcare organisations. Craneware's

market-driven, SaaS solutions help hospitals and other healthcare providers more

effectively price, charge and code for services and supplies associated with

patient care. This optimises reimbursement, increases operational efficiency and

minimises compliance risk. By partnering with Craneware, clients achieve the

visibility required to identify, address and prevent revenue leakage. To learn

more, visit craneware.com.

Chairman's Statement

Craneware has delivered another strong six months of growth and profitability,

increasing revenues by 25% to $13.3m and EBITDA1 by 36% to $3.4m. Importantly,

our new products continue to gain traction in the market and we have seen the

average product attachment rate increase from 1.4 at 30 June 2009 to 1.5 in the

current half.

With the US healthcare market facing increasing levels of legislation and

growing fiscal pressures there are compelling external factors adding further to

Craneware's long-term growth potential. As one of the most highly respected

software providers to the US healthcare industry, Craneware occupies a central

position in the emerging industry segment of Revenue Integrity. Craneware's move

to focus its product ranges into this new market segment is giving clarity to

its product positioning and strengthening its marketing, as evidenced by record

sales this half.

The Board believes Craneware has an extending market opportunity ahead of it. Of

the 5,815 hospitals in the U.S, over half still have no automated chargemaster

management solution, the area in which Craneware is an established market

leader, while the new product families are in markets with low penetration.

Building on recent years' product launches, this half saw the launch of Supplies

ChargeLink, a new product in our Supply Management family. We believe the

potential market for this product to be significant, with more than half of US

hospitals believing they are not fully reimbursed for their supplies and over

three-quarters having no automated process to attempt to do so. The first

contracts have been secured for the new product following the launch in December

2009 and extensive marketing is currently on-going. New product momentum will

continue through 2010, which will see the launch of our sixth product; a

solution within our Strategic Pricing family.

In tandem with our focus on direct sales and product development, is our channel

partnership strategy. The partnerships Craneware has in place, such as the

reseller agreement with McKesson are augmenting the Company's own sales team and

extending Craneware's market reach. This half saw the first sales of the

Company's products with McKesson's systems.

In conjunction with the growth plans described above, the Board continues to

assess potential acquisition opportunities in line with our stated M&A policy.

As always, the commitment of the entire Craneware team to customer service is

the foundation on which the Company's success is built and I would like to thank

our employees for their tireless efforts and our customers for their tremendous

loyalty and support.

The Board believes Craneware is extremely well-positioned in a high growth

market and therefore continues to view the future with confidence.

George Elliott, Chairman

19 February 2010

Operational Review

Introduction

Craneware's strong performance in the half has resulted from a continued focus

on sales execution supported by increased marketing initiatives. We continue to

invest considerably in our product set, the benefits of which will flow through

in future years and the half saw the successful launch in December 2009 of our

fifth product, Supplies ChargeLink. Market dynamics continue to work in our

favour and we believe our market opportunity to be expanding.

Market Developments: Increased regulation and industry reform continue to drive

growth

The US healthcare system continues to undergo unprecedented levels of change and

public scrutiny, which combined with the global economic downturn, means

healthcare organisations are experiencing extraordinary fiscal and legislative

pressures. These factors have resulted in healthcare management teams increasing

their focus on making the process and information technology changes that will

deliver more value to their organisations for the services they provide.

This focus is expected to contribute to high industry growth rates. The US

Healthcare IT market, boosted by the American Recovery and Reinvestment Act

(ARRA) of 2009 is the largest of the global healthcare IT markets, with double

digit growth rates expected for the next seven years.

Key industry trends continue to drive demand for Craneware's solutions. Central

to these trends are proposed healthcare reforms which are expected to introduce

increased regulation in areas such as insurance coverage, reimbursement, and the

industry competitive environment. These areas combined with previously

introduced legislation including healthcare compliance audits, have resulted in

an industry acutely focused on information technology to help manage reform.

Sales and Marketing: Focused on Revenue Integrity

During the first half of this year Craneware focused its products within the

newly defined industry segment of Revenue Integrity, an area which is growing in

industry recognition. Several PR and marketing initiatives are currently ongoing

to reinforce Craneware's position as the industry leader within this market.

We continue to strengthen our sales team and processes, formalising our client

sales management teams. A new Executive Vice President of Sales has been

appointed and additional members have been added to the sales team.

Hires have also been made within the business development and channel partner

team, reflecting our focus in this area following the early success of the

Premier, Amerinet and McKesson channel partner agreements.

Product Development: Expansion of the product set

Building on feedback from our customers we have continued to make enhancements

to our current products, increasing areas such as functionality and

accessibility. One key area of development has been the integration of our

products with McKesson's following the signing of a reseller agreement with the

company in September 2009. This work is continuing on schedule and

implementation has already begun in the first hospitals to purchase the combined

system.

The half concluded with the successful launch and the first customer win of a

new product, Supplies ChargeLink(TM), part of our Supply Management family of

products. This software solution helps hospitals better manage and optimise

reimbursement for chargeable supplies, automating the manual processes that most

hospitals use to align their supply chain, charge capture and billing

procedures. The Directors believe the potential market for this new product to

be significant, with a recent Healthcare Financial Management Association

InstaPoll of members finding that more than 50 percent of U.S. hospitals believe

they are reimbursed for less than half of their chargeable supplies. While

another report completed by Porter Research found 75 percent of U.S. hospitals

currently do not use any automation tools to compare their supply purchase

histories with actual billing for supplies.

First to purchase the new software, made generally available in December 2009,

was Washington County Regional Medical Center, a 116-bed, non-profit

organisation serving east Central Georgia since 1960.

Launch of Value-based Pricing Analysis Product

Development work on our forthcoming, Value-based Pricing Analysis product has

progressed well with launch planned for the last quarter of the calendar year.

This will be the fourth new product to be launched since our IPO and will bring

our total number of products to six. Sitting within our Strategic Pricing family

of products, this product will enable hospitals to set appropriate and

defensible pricing policies that optimise reimbursement, increase operational

efficiency, and minimise compliance risk. The product is anticipated to

contribute to revenue by the end of calendar 2010.

Number 1 in KLAS

During the year, the Company's flagship product, Chargemaster Toolkit , was once

again awarded the number one position in its category by the prestigious

industry research house KLAS in the U.S., reaffirming Craneware's market leading

position for the fourth year in a row.

New Contract Win

We are pleased to announce today a new multi-year contract with North Shore-LIJ

Health System, the largest integrated healthcare system in New York State and

winner of the 2010 NQF National Quality Healthcare Award. Further information

regarding the contract is contained in a separate announcement released this

morning. We are delighted to have secured this prestigious organisation in a

competitive situation, maintaining our momentum as we move into the second half

of the year.

Financial Review

Following on from our trading update on 18 January 2010, we are pleased to

report that revenues in the period have increased 25% to $13.3m (H109:$10.6m),

which has resulted in a 36% increase to $3.4m in our reported EBITDA1 (H109:

$2.5m).

The increased investment made in sales and marketing during FY09 and continued

into this period has resulted in a further increase in the total value of

contracts signed during the period. The total value, including renewal activity

was $25.0m, a 15% increase over the corresponding period last year (H109:

$21.8m) which was our previous record.

With our annuity revenue recognition model the majority of the benefit derived

from these contracts has been to increase our visibility over future revenues,

which has now increased to $71.8m. Of this future revenue under contract we have

already invoiced $13.2m which is recorded as deferred income in the Balance

Sheet. The remaining $58.6m will be invoiced in future periods.

Continued control over costs throughout the Company has resulted in net

operating expenses increasing by only $1.2m to $8.9m (H109: $7.7m) allowing us

to increase our EBITDA1 margins to 26% (H109: 24%).

During the period, we have made payments in respect of taxation of $0.9m (H109:

$0.1m) due to the increased tax charge on our increasing profits and the timing

of our advance payments on account. We have also paid out the FY09 final

dividend to shareholders of $1.2m (H109: $1.2m).

Even after taking account of these payments we have increased the cash position

of the Company to $26.9m (H109: $20.8m) from $26.2m at 30 June 2009.

With the reporting currency (and cash reserves) of the Company being in US

Dollars, we have seen a small benefit from the strengthening Dollar during the

period on our UK purchases including the salary costs of our UK based employees.

The average conversion rate for the Company during the reporting period was

$1.64/GBP1 as compared to an average conversion rate in the corresponding period

last year of $1.73/GBP1.

Dividend

The Board has resolved to pay an interim dividend of 4.7p per ordinary share of

the Company (FY09 Interim 1.8p: Total Dividend FY09 4.7p) on 1 April 2010 to

those shareholders on the register as at 5 March 2010. The Company intends to

propose a final dividend, subject to approval at the Annual General Meeting,

such that the total dividend for the FY10 is in line with its stated

"progressive" dividend policy. The ex-dividend date is 3 March 2010.

Outlook

We have been pleased with our strong performance in the first half of this year,

which has seen the broadening of our product set, the increase of our customer

base and the strengthening of our market position. Legislative and fiscal

pressures are continuing to focus our customers on revenue integrity, a niche of

the US IT healthcare market, of which we are at the forefront. These market

dynamics combined with the quality of our software and our focus on customer

support means we have secured another record half of sales, the main benefit of

which will be seen in future years. With our sixth new product due to launch

this calendar year and our ongoing focus on sales execution, we are confident in

our ability to achieve significant revenue and earnings growth and we continue

to look to the future with confidence.

Keith Neilson, Chief Executive Officer

Craig Preston, Chief Financial Officer

19 February 2010

+---------------------------------------+-------+---------+-------+--+----------+

| Craneware PLC | | | | |

| Interim Results FY10 | | | | |

| Consolidated Income Statement | | | | |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| | | H1 | H1 | FY 2009 |

| | | 2010 | 2009 | |

+---------------------------------------+-------+---------+-------+-------------+

| | Notes | $'000 | $'000 | $'000 |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| Revenue | | 13,256 | 10,627 | 22,993 |

+---------------------------------------+-------+---------+----------+----------+

| Cost of sales | | (1,160) | (637) | (1,381) |

+---------------------------------------+-------+---------+----------+----------+

| Gross profit | | 12,096 | 9,990 | 21,612 |

+---------------------------------------+-------+---------+----------+----------+

| Net operating expenses | | (8,906) | (7,703) | (16,262) |

+---------------------------------------+-------+---------+----------+----------+

| Operating profit | | 3,190 | 2,287 | 5,350 |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| Analysed as: | | | | |

+---------------------------------------+-------+---------+----------+----------+

| Operating Profit before share based | | | | |

| payments, depreciation | | | | |

+---------------------------------------+-------+---------+----------+----------+

| and amortisation | | 3,417 | 2,511 | 5,812 |

+---------------------------------------+-------+---------+----------+----------+

| Share based payments | | (46) | (36) | (82) |

+---------------------------------------+-------+---------+----------+----------+

| Depreciation of plant and equipment | | (97) | (100) | (204) |

+---------------------------------------+-------+---------+----------+----------+

| Amortisation of intangible assets | | (84) | (88) | (176) |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| Finance income | | 110 | 285 | 520 |

+---------------------------------------+-------+---------+----------+----------+

| Profit before taxation | | 3,300 | 2,572 | 5,870 |

+---------------------------------------+-------+---------+----------+----------+

| Tax charge | | (965) | (616) | (1,422) |

+---------------------------------------+-------+---------+----------+----------+

| Profit for the period | | 2,335 | 1,956 | 4,448 |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| - Basic ($ per share) | 1a | 0.092 | 0.078 | 0.177 |

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| - Diluted ($ per share) | 1b | 0.089 | 0.074 | 0.170 |

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| | | | | |

+---------------------------------------+-------+---------+----------+----------+

| | | | | | |

+---------------------------------------+-------+---------+-------+--+----------+

+-----------------+---------+---------+----------+----------+---------+

| Craneware PLC |

+---------------------------------------------------------------------+

| Interim Results FY10 |

+---------------------------------------------------------------------+

| Consolidated Statement of Changes in Equity |

+---------------------------------------------------------------------+

| | Share | Share | Other | Retained | Total |

| | Capital | Premium | Reserves | Earnings | |

+-----------------+---------+---------+----------+----------+---------+

| | $'000 | $'000 | $'000 | $'000 | $'000 |

+-----------------+---------+---------+----------+----------+---------+

| At 1 July 2008 | 509 | 9,253 | 3,041 | 3,296 | 16,099 |

+-----------------+---------+---------+----------+----------+---------+

| Share-based | - | - | 36 | 45 | 81 |

| payments | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Retained Profit | - | - | - | 1,957 | 1,957 |

| for the period | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Dividend | - | - | - | (1,172) | (1,172) |

+-----------------+---------+---------+----------+----------+---------+

| | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| At 31 December | 509 | 9,253 | 3,077 | 4,126 | 16,965 |

| 2008 | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Share-based | - | - | 46 | (82) | (36) |

| payments | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Options | 3 | (3) | - | - | - |

| Exercised | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Retained Profit | - | - | - | 2,491 | 2,491 |

| for the period | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Dividend | - | - | - | (745) | (745) |

+-----------------+---------+---------+----------+----------+---------+

| | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| At June 2009 | 512 | 9,250 | 3,123 | 5,790 | 18,675 |

+-----------------+---------+---------+----------+----------+---------+

| | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Share-based | - | - | 46 | 436 | 482 |

| payments | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Retained Profit | - | - | - | 2,335 | 2,335 |

| for the period | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| Dividend | - | - | - | (1,220) | (1,220) |

+-----------------+---------+---------+----------+----------+---------+

| | | | | | |

+-----------------+---------+---------+----------+----------+---------+

| At 31 December | 512 | 9,250 | 3,169 | 7,341 | 20,272 |

| 2009 | | | | | |

+-----------------+---------+---------+----------+----------+---------+

+------------------------------------+--------+--------+--------+--------+

| Craneware PLC | | |

| Interim Results FY10 | | |

| Consolidated Balance Sheet as at 31 December | | |

| 2009 | | |

+------------------------------------------------------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| | | H1 | H1 | FY2009 |

| | | 2010 | 2009 | |

+------------------------------------+--------+--------+--------+--------+

| | Notes | $'000 | $'000 | $'000 |

+------------------------------------+--------+--------+--------+--------+

| ASSETS | | | | |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Non-Current Assets | | | | |

+------------------------------------+--------+--------+--------+--------+

| Plant and equipment | | 309 | 408 | 345 |

+------------------------------------+--------+--------+--------+--------+

| Intangible assets | | 1,475 | 989 | 1,206 |

+------------------------------------+--------+--------+--------+--------+

| Deferred Tax | | 1,223 | 1,086 | 718 |

+------------------------------------+--------+--------+--------+--------+

| Trade and other receivables | | 25 | 50 | 25 |

+------------------------------------+--------+--------+--------+--------+

| | | 3,032 | 2,533 | 2,294 |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Current Assets | | | | |

+------------------------------------+--------+--------+--------+--------+

| Trade and other receivables | | 7,576 | 7,990 | 5,187 |

+------------------------------------+--------+--------+--------+--------+

| Cash and cash equivalents | | 26,917 | 20,818 | 26,169 |

+------------------------------------+--------+--------+--------+--------+

| | | 34,493 | 28,808 | 31,356 |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Total Assets | | 37,525 | 31,341 | 33,650 |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| EQUITY AND LIABILITIES | | | | |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Non-Current Liabilities | | | | |

+------------------------------------+--------+--------+--------+--------+

| Deferred income | | 11 | 126 | 124 |

+------------------------------------+--------+--------+--------+--------+

| | | 11 | 126 | 124 |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Current Liabilities | | | | |

+------------------------------------+--------+--------+--------+--------+

| Deferred income | | 13,172 | 11,885 | 10,964 |

+------------------------------------+--------+--------+--------+--------+

| Trade and other payables | | 4,070 | 2,365 | 3,887 |

+------------------------------------+--------+--------+--------+--------+

| | | 17,242 | 14,250 | 14,851 |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Total Liabilities | | 17,253 | 14,376 | 14,975 |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Equity | | | | |

+------------------------------------+--------+--------+--------+--------+

| Called up share capital | 2 | 512 | 509 | 512 |

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Share premium account | | 9,250 | 9,253 | 9,250 |

+------------------------------------+--------+--------+--------+--------+

| Other reserves | | 3,169 | 3,077 | 3,123 |

+------------------------------------+--------+--------+--------+--------+

| Retained earnings | | 7,341 | 4,126 | 5,790 |

+------------------------------------+--------+--------+--------+--------+

| Total Equity | | 20,272 | 16,965 | 18,675 |

+------------------------------------+--------+--------+--------+--------+

| | | | | |

+------------------------------------+--------+--------+--------+--------+

| Total Equity and Liabilities | | 37,525 | 31,341 | 33,650 |

+------------------------------------+--------+--------+--------+--------+

+-----------------------------------+-------+---------+---------+---------+

| Craneware PLC |

| Interim Results FY10 |

| Consolidated Cashflow Statement for the six months ended 31 |

| December 2009 |

+-------------------------------------------------------------------------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | H1 | H1 | FY |

| | | 2010 | 2009 | 2009 |

+-----------------------------------+-------+---------+---------+---------+

| | Notes | $'000 | $'000 | $'000 |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Cash flows from operating | | | | |

| activities | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Cash generated from operations | 3 | 3,123 | 1,068 | 7,378 |

+-----------------------------------+-------+---------+---------+---------+

| Interest received | | 110 | 285 | 520 |

+-----------------------------------+-------+---------+---------+---------+

| Tax (paid) / refunded | | (851) | (98) | (202) |

+-----------------------------------+-------+---------+---------+---------+

| Net cash from operating | | 2,382 | 1,255 | 7,696 |

| activities | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Cash flows from investing | | | | |

| activities | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Purchase of plant and equipment | | (60) | (93) | (134) |

+-----------------------------------+-------+---------+---------+---------+

| Capitalised intangible assets | | (354) | (284) | (588) |

+-----------------------------------+-------+---------+---------+---------+

| Net cash used in investing | | (414) | (377) | (722) |

| activities | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Cash flows from financing | | | | |

| activities | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Dividends paid to company | | (1,220) | (1,172) | (1,917) |

| shareholders | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Net cash used in financing | | (1,220) | (1,172) | (1,917) |

| activities | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Net (decrease) / increase in cash | | 748 | (294) | 5,057 |

| and cash equivalents | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Cash and cash equivalents at the | | 26,169 | 21,112 | 21,112 |

| start of the period | | | | |

+-----------------------------------+-------+---------+---------+---------+

| | | | | |

+-----------------------------------+-------+---------+---------+---------+

| Cash and cash equivalents at the | | 26,917 | 20,818 | 26,169 |

| end of the period | | | | |

+-----------------------------------+-------+---------+---------+---------+

Craneware PLC

Interim Results FY10

Notes to the Financial Statements

+------------------------------------------+--------+--------+--------+

| 1. Earnings per Share | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| (a) Basic | | | |

+------------------------------------------+--------+--------+--------+

| | H1 | H1 | FY |

| | 2010 | 2009 | 2009 |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| Profit attributable to equity holders of | 2,335 | 1,956 | 4,448 |

| the Company ($'000) | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| Weighted average number of ordinary | 25,298 | 25,123 | 25,187 |

| shares in issue (thousands) | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| Basic earnings per share ($ per share) | 0.092 | 0.078 | 0.177 |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| (b) Diluted | | | |

+------------------------------------------+--------+--------+--------+

| | H1 | H1 | FY |

| | 2010 | 2009 | 2009 |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| Profit attributable to equity holders of | 2,335 | 1,956 | 4,448 |

| the Company ($'000) | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| Weighted average number of ordinary | 25,298 | 25,123 | 25,187 |

| shares in issue (thousands) | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| Adjustments for: - share options | 982 | 1,213 | 1,007 |

| (thousands) | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| Weighted average number of ordinary | 26,280 | 26,337 | 26,194 |

| shares for diluted earnings per share | | | |

| (thousands) | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| | | | |

+------------------------------------------+--------+--------+--------+

| Diluted earnings per share ($ per share) | 0.089 | 0.074 | 0.170 |

+------------------------------------------+--------+--------+--------+

+--------------------------+------------+-------+------------+-------+------------+-------+

| 2. Called up share | |

| capital | |

+--------------------------+--------------------------------------------------------------+

| | H1 2010 | H1 2009 | FY 2009 |

+--------------------------+--------------------+--------------------+--------------------+

| | Number | $'000 | Number | $'000 | Number | $'000 |

+--------------------------+------------+-------+------------+-------+------------+-------+

| Authorised | | | | | | |

+--------------------------+------------+-------+------------+-------+------------+-------+

| Equity share capital | | | | | | |

+--------------------------+------------+-------+------------+-------+------------+-------+

| Ordinary shares of 1p | 50,000,000 | 1,014 | 50,000,000 | 1,014 | 50,000,000 | 1,014 |

| each | | | | | | |

+--------------------------+------------+-------+------------+-------+------------+-------+

| | | | | | | |

+--------------------------+------------+-------+------------+-------+------------+-------+

| | | | | | | |

+--------------------------+------------+-------+------------+-------+------------+-------+

| Allotted called-up and | | | | | | |

| fully paid | | | | | | |

+--------------------------+------------+-------+------------+-------+------------+-------+

| Equity share capital | | | | | | |

+--------------------------+------------+-------+------------+-------+------------+-------+

| Ordinary shares of 1p | 25,297,750 | 512 | 25,143,850 | 509 | 25,297,750 | 512 |

| each | | | | | | |

+--------------------------+------------+-------+------------+-------+------------+-------+

+---------------------------------+---------+---------+-------+

| 3. Cash flow generated from operating activities | |

+-----------------------------------------------------+-------+

| Reconciliation of profit before tax to net cash | |

| inflow from operating activities | |

+-----------------------------------------------------+-------+

| | | | |

+---------------------------------+---------+---------+-------+

| Group | H1 | H1 | FY |

| | 2010 | 2009 | 2009 |

+---------------------------------+---------+---------+-------+

| | $'000 | $'000 | $'000 |

+---------------------------------+---------+---------+-------+

| Profit before tax | 3,300 | 2,573 | 5,870 |

+---------------------------------+---------+---------+-------+

| Finance income | (110) | (285) | (520) |

+---------------------------------+---------+---------+-------+

| Depreciation on plant and | 97 | 100 | 204 |

| equipment | | | |

+---------------------------------+---------+---------+-------+

| Amortisation on intangible | 84 | 88 | 176 |

| assets | | | |

+---------------------------------+---------+---------+-------+

| Share based payments | 46 | 36 | 82 |

+---------------------------------+---------+---------+-------+

| | | | |

+---------------------------------+---------+---------+-------+

| Movements in working capital: | | | |

+---------------------------------+---------+---------+-------+

| | | | |

+---------------------------------+---------+---------+-------+

| (Increase) / decrease in trade | (2,390) | (3,280) | (452) |

| and other receivables | | | |

+---------------------------------+---------+---------+-------+

| (Decrease) / increase in trade | 2,096 | 1,836 | 2,018 |

| and other payables | | | |

+---------------------------------+---------+---------+-------+

| Cash generated from operations | 3,123 | 1,068 | 7,378 |

+---------------------------------+---------+---------+-------+

4. Basis of Preparation

The interim financial statements are unaudited and do not constitute statutory

accounts as defined in S435 of the Companies Act 2006. These statements have

been prepared applying accounting policies that were applied in the preparation

of the Group's consolidated accounts for the year ended 30th June 2009. Those

accounts, with an unqualified audit report, have been delivered to the Registrar

of Companies.

5. Segmental Information

The Directors consider that the Group operates in one business segment, being

the creation of software sold entirely to the US Healthcare Industry, and that

there are therefore no additional segmental disclosures to be made in these

financial statements.

Significant Accounting Policies

The significant accounting policies adopted in the preparation of these

statements are set out below.

6. Reporting Currency

The Directors consider that as the Group's revenues are primarily denominated in

US dollars the principal functional currency is the US dollar. The Group's

financial statements are therefore prepared in US dollars.

7. Currency Translation

Transactions denominated in foreign currencies are translated into US dollars at

the rate of exchange ruling at the date of the transaction. Monetary assets and

liabilities expressed in foreign currencies are translated into US dollars at

rates of exchange ruling at the balance sheet date ($1.6149/GBP1). Exchange

gains or losses arising upon subsequent settlement of the transactions and from

translation at the balance sheet date, are included within the related category

of expense where separately identifiable, or in general and administrative

expenses.

8. Revenue Recognition

The Group follows the principles of IAS 18, "Revenue Recognition", in

determining appropriate revenue recognition policies. In principle revenue is

recognised to the extent that it is probable that the economic benefits

associated with the transaction will flow into the Group.

Revenue comprises the value of software license sales, installation, training,

maintenance and support services, and consulting engagements. Revenue is

recognised when (i) persuasive evidence of an arrangement exists; (ii) delivery

has occurred or services have been rendered; (iii) the sales price has been

fixed and determinable; and (iv) collectability is reasonably assured.

For software arrangements with multiple elements, revenue is recognised

dependent on whether vendor-specific objective evidence ("VSOE") of fair value

exists for each of the elements. VSOE is determined by reference to sales to

external customers made on a stand-alone basis. Where there is no VSOE revenue

is recognised rateably over the full term of each contract.

Revenue from standard license products which are not modified to meet the

specific requirements of each customer is recognised when the risks and rewards

of ownership of the product are transferred to the customer.

Revenue from installation and training is recognised as services are provided,

and from consulting engagements when all obligations under the consulting

agreement have been fulfilled.

Software sub licensed to third parties is recognised in accordance with the

underlying contractual agreements. Where separate services are delivered,

revenue is recognised on delivery of the service.

The excess of amounts invoiced and future invoicing over revenue recognised, is

included in deferred revenue. If the amount of revenue recognised exceeds the

amounts invoiced the excess amount is included within accounts receivable.

9. Intangible Assets - Research and Development Expenditure

Expenditure associated with developing and maintaining the Group's software

products are recognised as incurred. Where, however, new product development

projects are technically feasible, production and sale is intended, a market

exists, expenditure can be measured reliably, and sufficient resources are

available to complete such projects, development expenditure is capitalised

until initial commercialisation of the product, and thereafter amortised on a

straight-line basis over its estimated useful life. Staff costs and specific

third party costs involved with the development of the software are included

within amounts capitalised.

10. Impairment Tests

The Group considers whether there is any indication that non-current assets are

impaired on an annual basis. If there is such an indication, the Group carries

out an impairment test by measuring the assets' recoverable amount, which is the

higher of the assets' fair value less costs to sell and their value in use. If

the recoverable amount is less than the carrying amount, an impairment loss is

recognised.

11. Cash and Cash Equivalents

Cash and cash equivalents include cash in hand, deposits held with banks and

short term highly liquid investments. For the purpose of the cash flow

statement, cash and cash equivalents comprise of cash on hand, deposits held

with banks and short term high liquid investments.

12. Share-Based Payments and Taxation Implications

The Group issues equity-settled share-based payments to certain employees. In

accordance with IFRS 2, "Share-Based Payments" equity-settled share-based

payments are measured at fair value at the date of grant. Fair value is measured

by use of the Black-Scholes pricing model as amended to cater for share options

in issue where vesting is based on future valuation performance conditions. The

fair value determined at the date of grant of the equity-settled share-based

payments is expensed on a straight-line basis over the vesting period, based on

the Group's estimate of the number of shares that will eventually vest.

The share-based payments charge is shown separately on the income statement and

is also included in 'Other reserves'.

In the UK and the US, the Group is entitled to a tax deduction for amounts

treated as compensation on exercise of certain employee share options under each

jurisdiction's tax rules. As explained under "Share-based payments", a

compensation expense is recorded in the Group's income statement over the period

from the grant date to the vesting date of the relevant options. As there is a

temporary difference between the accounting and tax bases a deferred tax asset

is recorded. The deferred tax asset arising is calculated by comparing the

estimated amount of tax deduction to be obtained in the future (based on the

Company's share price at the balance sheet date) with the cumulative amount of

the compensation expense recorded in the income statement. If the amount of

estimated future tax deduction exceeds the cumulative amount of the remuneration

expense at the statutory rate, the excess is recorded directly in equity against

retained earnings.

13. Availability of announcement and Half Yearly Financial Report

Copies of this announcement are available on the Company's website,

www.craneware.com. Copies of the Interim Report will be posted to shareholders,

downloadable from the Company's website and available from the registered office

of the Company shortly.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGUCPPUPUGQB

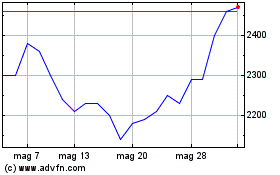

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024