TIDMCRW

RNS Number : 1694S

Craneware plc

06 September 2010

Craneware plc

("Craneware" or the "Company")

FINAL RESULTS

6 September 2010 - Craneware plc (AIM: CRW.L; OTC: CRWRY), the market leader in

automated revenue integrity solutions for the US healthcare market, announces

its results for the year ended 30 June 2010.

Financial Highlights

* Record levels of contracted sales in the year totalling $58.1m (2009: $43.2m),

34% up on the previous year, contributing to:

o 23% increase in revenues to $28.4m (2009: $23.0m)

o 49% increase in future revenues under contract to $89.8m (2009: $60.1m)

* EBITDA increased 31% to $7.6m (2009: $5.8m)

* Profit before taxation increased by 24% to $7.3m (2009: $5.9m)

* Cash position increased 13% to $29.4m after paying dividends of $3m in year

(2009: $26.1m)

* Basic EPS increased to $0.22 (2009: $0.18) and diluted to $0.21 (2009: $0.17)

* Final dividend proposed of 3.3p (4.94 cents) per share giving a total dividend

for the year of 8.0p (11.99 cents) per share (2009: 4.7p (7.43 cents) per share)

Operational Highlights

* Launch and first sales of fifth product, Supplies ChargeLink(TM).

* Significant investment in sales and marketing capacity during the year.

* Strengthened market position through signing in the year of two significant

partnerships with Premier Healthcare Alliance and McKesson Corporation.

* Signing of several major multi-site contracts, including with Intermountain

Healthcare, described by President Obama and other U.S. leaders as 'a model for

the rest of the nation.'

Keith Neilson, CEO of Craneware commented:

"Whilst this has been a record year for sales, perhaps more significant has been

the investment we have made in the business over the year. We have increased our

sales team, expanded our network of alliances and enhanced our product set and

customer offering.

"The U.S. healthcare industry is starting to debate the early effects of the

reforms which were outlined in January 2010 and will gradually be introduced

over the next eight years, meaning the drivers for growth in coming years could

be yet higher than those which we have experienced this year. Our focus on the

mitigation of risk for our customers, and the delivery of financial and

operational efficiencies means we are extremely well positioned to benefit from

the unprecedented changes we expect to see in healthcare in the U.S., no matter

the final form of healthcare reform.

"These factors, plus the $89.8m of revenues we currently have under contract for

future years gives us high levels of confidence in our success in the years

ahead. With industry leading product sets and an enviable customer base our

focus now will be on achieving operational excellence and providing the next

generation of solutions to help with the challenges of healthcare reform that

face our customers."

For further information, please contact:

+--------------------+-----------------+-----------------------+

| Craneware plc | KBC Peel Hunt | Threadneedle |

| | | Communications |

+--------------------+-----------------+-----------------------+

| +44 (0)1506 407 | +44 (0)20 7418 | +44 (0) 20 7653 9850 |

| 666 | 8900 | |

+--------------------+-----------------+-----------------------+

| Keith Neilson, CEO | Jonathan Marren | Caroline Evans-Jones |

| | | |

+--------------------+-----------------+-----------------------+

| Craig Preston, CFO | Richard Kauffer | Fiona Conroy |

+--------------------+-----------------+-----------------------+

| | Dan Webster | |

+--------------------+-----------------+-----------------------+

About Craneware

Founded in 1999, Craneware has headquarters in Livingston, Scotland with offices

in Atlanta and Arizona, employing over 140 staff. Craneware is the leader in

automated revenue integrity solutions that improve financial performance and

mitigate risk for healthcare organisations. Craneware's market-driven, annuity

SaaS solutions help hospitals and other healthcare providers more effectively

price, charge and code for services and supplies associated with patient care.

These optimise reimbursement, increase operational efficiency and minimise

compliance risk. By partnering with Craneware, clients achieve the visibility

required to identify, address and prevent revenue leakage. To learn more, visit

craneware.com & stoptheleakage.com.

Chairman's Statement

Craneware has enjoyed another excellent year, delivering record sales and

developing the foundations for continued success. With contracted sales growth

of 34%, recorded revenues and profits have both grown by over 20%. Importantly

we now have over $89m of contracted revenue, an increase of 48%, to be

recognised in future years, providing us with excellent visibility for several

years ahead. The planned investment in the infrastructure of the business

continues to increase its scalability and our market position has been

significantly strengthened through several key alliances with some of the

world's largest healthcare organisations.

While uncertainty prevails regarding the final form of U.S. healthcare reforms,

what is certain is that healthcare organisations are seeking ways to increase

efficiencies whilst still providing high levels of patient care. This is at the

heart of the Craneware offering and I believe our best of breed products and our

commitment to supporting our customers in meeting the increasing pressures being

placed upon them, is the foundation of our success.

This has been a record sales year for Craneware, however the Board believes that

the full effect of healthcare reforms and the U.S. Stimulus package is yet to

flow through and will have a greater impact in future years, presenting some

significant new growth opportunities for the Company. For instance, tools

previously developed specifically for current hospital customers who own

physician practices are seeing increased demand from the wider market as a

result of an anticipated trend of hospitals moving back into the ownership of

physician practices.

Craneware's network in the U.S. healthcare market has been considerably

strengthened during the year, with two of the largest organisations in the

market, McKesson and Premier, formalising partnerships with us. Not only does

this provide us with an enhanced route to market, but is also a compelling

endorsement of Craneware's valuable position at the heart of our marketplace.

We have invested significantly in our direct sales teams during the year,

bringing on board additional product and client managers across the U.S. We have

also opened a new office in Atlanta on 1st July, giving us a presence at the hub

of the U.S. healthcare industry. We are confident that we are currently well

resourced and have the means to achieve significant scale in the years ahead,

both organically and through acquisition.

We have been pleased with the initial response to our newly launched Supplies

ChargeLink and are on course to launch our sixth product, Value-based Pricing

Analyzer, at the end of the calendar year. We have a strong portfolio of both

established and new products and are pleased to have seen the average number of

products per customer increase during the year from 1.4 to 1.6.

The strength of our customer base, the quality of our products and the

developments taking place in U.S. healthcare gives the Board confidence that we

have many years of growth ahead.

I would like to thank all the Craneware team, partners and particularly

customers for their continued support.

George Elliott

Chairman

3 September 2010

Operational Review

This has been an extremely positive year for Craneware. We have invested

considerable efforts in developing the scalability of the business and expanding

our position in the marketplace. Throughout the year we have maintained our

market focus and believe both our ability to mitigate risk and drive through

efficiencies continues to earn loyalty from our expanding customer base. We are

confident therefore that we are in an extremely strong position in terms of

products and customers and our focus in the year ahead will be on continued

improvement seeking operational excellence.

We are delighted to have signed several significant deals during the year with

some of the U.S.'s leading hospital systems including Intermountain Healthcare,

which has been described by President Obama and other U.S. leaders as a model

for the rest of the nation. We view our interaction with each customer as a

long-term partnership and this year we have increased the level of training and

support we offer to all our customers in order to ensure they receive high

levels of value and return on investment from our products. We believe this

customer focus is vital for our continued success and is an area in which we

will continue to invest.

The investment in our sales and marketing capabilities and U.S. infrastructure

over the year has been transformational, preparing us for the next stage of

development. With these first steps now complete we are now in a position to

build on our current partnership agreements, seek further alliances and enhance

our go-to-market strategy through selective acquisitions.

The Market

President Obama's healthcare reforms mean that by 2014 it is estimated

approximately 40 million U.S. citizens who are currently uninsured will become

eligible for healthcare assistance through the state and federal Medicare and

Medicaid programmes. While the final form of the legislation is yet to be

decided, what is clear is that hospitals will be required to provide healthcare

facilities and services to an increasing number of patients, at a lower level of

reimbursement per individual. Efficiency and return on investment, two of the

main business drivers behind Craneware's product families, are now therefore

areas of paramount importance to management teams when making their buying

decisions.

$25.8 billion of funds within the American Recovery and Reinvestment Act

announced in February 2009 were allocated to the U.S. healthcare industry.

However the rules by which healthcare organisations can apply for the funds are

only now coming into effect. Capital expenditure by hospitals in general during

the year therefore remained at a low level, impacted by the global economic

conditions. The effect of this constrained expenditure on Craneware has been

minimised as our software generally sits within operational budgets, however it

may well prove that as more funds flow into hospitals we will see a general

upswing in the market and direct benefits to our partners such as McKesson.

The introduction of Revenue Audit Contractors as of 1st January 2010 has

generated some movement in our market place, but as previously stated we believe

the real impetus from this will come in 2011 and 2012.

Another encouraging development during the year, a result of the healthcare

reforms, has been some early evidence of a reversal of a previous trend, which

saw hospitals moving away from the ownership of physician practices. The

apparent shift in this trend could mean a reopening of a significant additional

marketplace which Craneware would be well positioned to service through its

physician based products which were developed for the large hospital owned

physician practices and have been kept current for the installed customer base

that despite previous wider market trends, retained their physician groups.

It is evident that the U.S. healthcare market is only at the very first stages

of reform. Regardless of the various options that the reform may take, the Board

believes Craneware is well-placed to meet the growing needs of its customers and

become the technology vendor of choice to deliver revenue integrity to

healthcare organisations.

Sales and Marketing

As planned, this year saw the continued accelerated investment into our sales

and marketing capabilities. We have added new sales distribution staff,

including client sales managers, assistant sales managers and additional

telephone support. Our new office opened in Atlanta just following the close of

the year, on 1st July and will be home to our training facilities. This is a

focal centre for our U.S. operations, positioning us in the heart of the U.S.

healthcare industry.

We have now substantially completed the restructuring of our sales team, which

has increased by 37% since the start of the year. We have been pleased by a

strong sales performance during the year delivering a record $58.1m of

contracted sales (an increase of 34% on 2009: $43.2m) and have every reason to

believe we can improve on this in the years ahead.

The average length of new contracts has stabilised as predicted at approximately

5 years.

We believe the opportunity for further cross-sales from our enlarged product set

to be significant. With less than 40% of our current hospital base having more

than two products we expect to see this momentum maintained in the coming years

as we continue with our cross-sell marketing initiatives.

Internally Craneware is targeting a revenue split of no more than 50% from any

one product by the start of FY14 (1 July 2013) and is confident that it is

achieving the correct additional balance of non-chargemaster sales to achieve

this.

Product Development

Craneware continues to invest in product development to further its position as

the vendor of choice for solutions which sit in and around the point where

clinical data turns into financial data.

This year saw the successful launch of Supplies ChargeLink, a new product in our

Supply Management family. Early sales have met management's expectations and are

in line with the early successes of the other products we have launched

post-IPO. We believe the potential market for this product to be significant,

with more than half of US hospitals believing they are not fully reimbursed for

their supplies and over three-quarters having no automated process to attempt to

do so. We have been pleased with the initial market response to the product

following its launch in December 2009.

We intend for new product momentum to continue through the remainder of 2010,

with the launch of our sixth product, Value-based Pricing Analyzer which is part

of the Strategic Pricing family, planned for Q4 of the current calendar year.

Again, we believe the market opportunity for this product to be significant.

Replacing consultants and manual processes, Value-based Pricing Analyzer helps

hospitals more effectively, accurately and sustainably manage their pricing

strategies for drugs and supplies, optimising their financial performance while

making strategic decisions in both a transparent and defensible manner.

Customers can use Value-based Pricing Analyzer to balance the reimbursement,

cost and market considerations that drive pricing. The tool allows hospitals to

create multiple pricing scenarios detailed down to the service level, or

aggregated to the facility or care network as a whole. The product is

anticipated to start contributing towards revenue by the end of calendar 2010.

Customers

Well over 1,000 hospital facilities across 48 States utilise one or more of our

software products. We continue to sign up a broad range of customers in terms of

size from small community hospitals to some of the largest healthcare networks

such as Intermountain Healthcare and North Shore-LIJ.

In response to customer feedback we introduced a training and certification

programme in our products during the year and our user groups now carry official

CPE (Continuing Professional Education) certification. We also extended our

online classroom tools to include branded certification in the usage and

implementation of our software and the environment that it goes into, with the

first accreditation certificates awarded to customers who have successfully

completed courses.

We were delighted that during the year not only was our core product,

Chargemaster Toolkit once again awarded the number one position in its category

by the prestigious U.S. industry research house KLAS, but we succeeded in

increasing our scores year on year, reaffirming our number one position in the

industry and our focus on customer commitment. We were particularly pleased to

see that 97% of respondents highlighted Craneware as being part of their

long-term strategy.

For customers coming to the end of their multi-year contracts, renewal rates

remain in line with the high levels achieved in previous years.

Channel Partners

We have made considerable progress in the year in strengthening our

partnerships; these enhance our go to market strategy and provide a strong

endorsement of Craneware's central position in the U.S. Healthcare IT market.

At the start of the financial year we signed a third party agreement with

McKesson the world's largest healthcare services company, to integrate

Craneware's Chargemaster Toolkit software with McKesson's next generation

hospital information system (HIS), Horizon Enterprise Revenue Management(TM) as

part of their ongoing legacy system replacement and upgrading programme. By

integrating the two solutions, McKesson and Craneware are delivering a

synchronised approach to achieving revenue integrity, which aids hospitals in

improving their financial performance.

Early sales through the partnership have all been delivered to plan, with a

healthy pipeline for the future.

Beyond the Horizon system we have developed, and are in the process of

developing further, direct interfaces to the main McKesson legacy systems (Star,

HealthQuest & the Series range), meaning current customers of McKesson will be

able to easily implement integrated Craneware products in the future.

In April 2010 we were pleased to announce the expansion of our relationship with

the Premier healthcare alliance. The new deal between Craneware and Premier is a

five-year reseller agreement, with a minimum value of $15 million. Premier has

begun marketing our solutions to its 2,300 not-for-profit hospital alliance

members and we have been pleased by the strong commitment shown by both parties

in creating a successful partnership. All the initial deliverables under the

agreement have been successfully completed and we are actively seeking

opportunities for further expansion of the agreement going forward.

Partnerships are an important part of the future development of Craneware and we

will continue to invest time and resource into expanding this area.

Financial Review

The financial results represent a further year of strengthened financial

performance. Craneware has delivered another record sales year increasing the

total value of contracts signed (our sales) during the year by 34% to $58.1m

(2009: $43.2m), whilst continuing to invest for further future success.

Craneware recognises revenue through its annuity revenue recognition model. This

model sees software licence revenue recognised over the life of the contracts we

sign (which during the year has remained stable at an average contract life of 5

years), with any associated professional services revenue recognised as we

deliver the services. As a result of this revenue recognition model, the

maximum value of an average contract that can be recognised as revenue in the

current year is 20% plus the value of associated professional services that have

been delivered.

This model has delivered the benefit of significant yet steady revenue growth

during the year, whilst further building the already sizeable revenues under

contract which will be recognised in future years. This highly predictable

future revenue stream allows us to invest in the future of our business whilst

delivering year on year increases in our operating margins.

As a result of this recognition model, against our 34% increase in total

contracts signed during the year, we have increased our reported revenues by 23%

to $28.4m (2009: $23.0m), the balance of these sales increasing our future

revenues under contract. This now provides Craneware with visibility over $89.8m

of future revenue (representing over 3 times current year reported revenues and

an increase of 49% or $29.7m over fiscal 2009). Of this future revenue under

contract we have already invoiced $13.9m which is recorded as deferred income in

the balance sheet, the remaining $75.9m to be invoiced in subsequent years.

Of this $89.8m of future revenue, the directors consider that $25.7m will be

recognised during FY11 with a further $19.7m and $15.4m respectively to be

recognised in FY12 and FY13. In addition, assuming as has happened in the year,

the total monetary value of renewed contracts is at least equal to the total

monetary value of contracts that were due to renew, $2.7m revenues will be

recognised from renewal activity during FY11, with a further $7.6m and $11.9m

respectively in FY12 and FY13 relating to contracts due for renewal from 1 July

2010 through these years.

We have continued our planned investment during the year, increasing our sales

and marketing spend by 16% to $7.1m (2009: 6.1m) and product development by 28%

to $3.8m after capitalising $0.5m of costs relating to new products (2009: $3.0m

after capitalising $0.6m of costs relating to new products). Through these

investments and the full year effect of our investment in product management and

marketing made in the prior year, net operating expenses have risen to $18.8m

(2009: $16.3m). However, as a proportion of revenues, net operating expenses

have reduced to 66% from 71% in FY09.

In regards to customers coming to the end of their multi-year contracts, the

Company's renewal rate remains within the high levels achieved in previous

years. This combined with increased upsell and cross selling to the renewing

hospital base, has resulted in the total monetary value of the current year

renewals increasing by 115% as compared to the original annuity revenue value to

the Company.

As a result of all these factors, earnings before interest, taxation, share

based payments, depreciation, and amortisation ("EBITDA") has increased 31% to

$7.6m (2009: $5.8m) and the associated EBITDA margin has increased to 26.8%

(2009: 25.3%).

We continue to measure the quality of these earnings through our ability to

convert them into operating cash. We are pleased to report that for the second

successive year we have collected more than 100% of our EBITDA as operating

cash. This has resulted in the Group's cash balance increasing to $29.4m (2009:

$26.1m) despite, during the year, having paid over $2.0m in taxation and

returning $3.0m to our shareholders by way of dividend payments.

The Group maintains a strong balance sheet position, not only through our

significant cash balance but with rigorous controls over working capital. At 30

June 2010 we have seen an increase in our net trade receivables balance

increasing to $7.1m from $4.0m in the prior year. This has been the result of

the increase in sales during the year and some significant invoice milestones

having been reached on a number of the large contracts we have previously

announced. This increase in trade receivables has resulted in an expected

corresponding increase in our deferred income balance. As at the balance sheet

date, $5.4m of the trade receivables balance was not yet due, and since the

balance sheet date we have collected $4.1m of the total balance.

With the reporting currency (and cash reserves) of the Company being in US

Dollars, and approximately one third of the cost base being based in the UK

relating primarily to our UK employees (and therefore denominated in Sterling)

we continue to closely monitor the Sterling to US Dollar exchange rate, and

where appropriate consider hedging strategies. During the year, we have not

seen a significant impact through exchange rate movements, with the average

exchange rate throughout the year being $1.5821 as compared to $1.6142 in the

prior year.

Dividend

Basic and diluted earnings per share were $0.22 (2009: $0.18) and $0.21 (2009:

$0.17) respectively and the Board recommends a final dividend of 3.3p (4.94

cents) per share giving a total dividend for the year of 8.0p (11.99 cents) per

share (2009: 4.7p (7.43 cents) per share). Subject to confirmation at the

Annual General Meeting, the final dividend will be paid on 8 December 2010 to

shareholders on the register as at 12 November 2010.

The final dividend of 3.3p per share is capable of being paid in US dollars

subject to a shareholder having registered to receive their dividend in US

dollars under the Company's Dividend Currency Election, or who register to do so

by the close of business on 12 November 2010. The exact amount to be paid will

be calculated by reference to the exchange rate to be announced on 12 November

2010. The final dividend referred to above in US dollars of 4.94 cents is given

as an example only using the balance sheet exchange rate of 1.4961/ GBP1 and may

differ from that finally announced.

M&A

The Board has evaluated a number of M&A opportunities throughout the course of

the year but to date has not concluded on an opportunity that would have been

sufficiently accretive to merit investment. We continue to have a healthy

pipeline of new opportunities which we are evaluating.

Outlook

Whilst this has been a record year for sales, perhaps more significant has been

the investment we have made in the business over the year. We have increased our

sales team, expanded our network of alliances and enhanced our product set and

customer offering.

The U.S. healthcare industry is starting to debate the early effects of the

reforms which were outlined in January 2010 and will gradually be introduced

over the next eight years, meaning the drivers for growth in coming years could

be yet higher than those which we have experienced this year. Our focus on the

mitigation of risk for our customers, and the delivery of financial and

operational efficiencies means we are extremely well positioned to benefit from

the unprecedented changes we expect to see in healthcare in the U.S., no matter

the final form of healthcare reform.

These factors, plus the $89.8m of revenues we currently have under contract for

future years gives us high levels of confidence in our success in the years

ahead. With industry leading product sets and an enviable customer base our

focus now will be on achieving operational excellence and providing the next

generation of solutions to help with the challenges of healthcare reform that

face our customers.

+--------------------------------+--------------------------------+

| Keith Neilson | Craig Preston |

| Chief Executive Officer | Chief Financial Officer |

| 3 September 2010 | 3 September 2010 |

| | |

+--------------------------------+--------------------------------+

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2010

+---------------------------------+-------+----------+----------+

| |Notes | 2010 | 2009 |

+---------------------------------+-------+----------+----------+

| | | $'000 | $'000 |

+---------------------------------+-------+----------+----------+

| Revenue | | 28,397 | 22,993 |

+---------------------------------+-------+----------+----------+

| Cost of sales | | (2,553) | (1,381) |

+---------------------------------+-------+----------+----------+

| Gross profit | | 25,844 | 21,612 |

+---------------------------------+-------+----------+----------+

| Net operating expenses | 3 | (18,781) | (16,262) |

+---------------------------------+-------+----------+----------+

| Operating profit | | 7,063 | 5,350 |

+---------------------------------+-------+----------+----------+

| | | | |

+---------------------------------+-------+----------+----------+

| Analysed as: | | | |

+---------------------------------+-------+----------+----------+

| Operating profit before share | | | |

| based payments, | | | |

+---------------------------------+-------+----------+----------+

| depreciation and amortisation | | 7,622 | 5,812 |

+---------------------------------+-------+----------+----------+

| Share based payments | | (114) | (82) |

+---------------------------------+-------+----------+----------+

| Depreciation of plant and | | (192) | (204) |

| equipment | | | |

+---------------------------------+-------+----------+----------+

| Amortisation of intangible | | (253) | (176) |

| assets | | | |

+---------------------------------+-------+----------+----------+

| | | | |

+---------------------------------+-------+----------+----------+

| Finance income | | 195 | 520 |

+---------------------------------+-------+----------+----------+

| Profit before taxation | | 7,258 | 5,870 |

+---------------------------------+-------+----------+----------+

| Tax charge on profit on | 4 | (1,733) | (1,422) |

| ordinary activities | | | |

+---------------------------------+-------+----------+----------+

| Profit for the year | | 5,525 | 4,448 |

+---------------------------------+-------+----------+----------+

The results relate to continuing operations.

Earnings per share for the period attributable to equity holders

+--------------------------------+-------+-------+-------+

| |Notes | 2010 | 2009 |

+--------------------------------+-------+-------+-------+

| Basic ($ per share) | 6a | 0.218 | 0.177 |

+--------------------------------+-------+-------+-------+

| Diluted ($ per share) | 6b | 0.210 | 0.170 |

+--------------------------------+-------+-------+-------+

Statement of Changes in Equity for the year ended 30 June 2010

+------------------------+---------+---------+----------+----------+---------+

| | | Share | | | |

+------------------------+---------+---------+----------+----------+---------+

| | Share | Premium | Other | Retained | |

+------------------------+---------+---------+----------+----------+---------+

| | Capital | Account | Reserves | Earnings | Total |

+------------------------+---------+---------+----------+----------+---------+

| Group | $'000 | $'000 | $'000 | $'000 | $'000 |

+------------------------+---------+---------+----------+----------+---------+

| At 1 July 2008 | 509 | 9,253 | 3,041 | 3,296 | 16,099 |

+------------------------+---------+---------+----------+----------+---------+

| Share-based payments | - | - | 82 | 211 | 293 |

+------------------------+---------+---------+----------+----------+---------+

| Losses | - | - | - | (248) | (248) |

+------------------------+---------+---------+----------+----------+---------+

| Options exercised | 3 | (3) | - | - | - |

+------------------------+---------+---------+----------+----------+---------+

| Retained profit for | - | - | - | 4,448 | 4,448 |

| the year | | | | | |

+------------------------+---------+---------+----------+----------+---------+

| Dividends (Note 5) | - | - | - | (1,917) | (1,917) |

+------------------------+---------+---------+----------+----------+---------+

| At 30 June 2009 | 512 | 9,250 | 3,123 | 5,790 | 18,675 |

+------------------------+---------+---------+----------+----------+---------+

| Share-based payments | - | - | 114 | 730 | 844 |

+------------------------+---------+---------+----------+----------+---------+

| Options exercised | - | - | - | - | - |

+------------------------+---------+---------+----------+----------+---------+

| Retained profit for | - | - | - | 5,525 | 5,525 |

| the year | | | | | |

+------------------------+---------+---------+----------+----------+---------+

| Dividends (Note 5) | - | - | - | (2,992) | (2,992) |

+------------------------+---------+---------+----------+----------+---------+

| At 30 June 2010 | 512 | 9,250 | 3,237 | 9,053 | 22,052 |

+------------------------+---------+---------+----------+----------+---------+

Consolidated Balance Sheet as at 30 June 2010

+------------------------------------+-------+--------+--------+

| |Notes | 2010 | 2009 |

+------------------------------------+-------+--------+--------+

| | | $'000 | $'000 |

+------------------------------------+-------+--------+--------+

| ASSETS | | | |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| Non-Current Assets | | | |

+------------------------------------+-------+--------+--------+

| Plant and equipment | | 281 | 345 |

+------------------------------------+-------+--------+--------+

| Intangible assets | 7 | 1,474 | 1,206 |

+------------------------------------+-------+--------+--------+

| Deferred tax | | 1,521 | 718 |

+------------------------------------+-------+--------+--------+

| Trade and other receivables | | - | 25 |

+------------------------------------+-------+--------+--------+

| | | 3,276 | 2,294 |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| Current Assets | | | |

+------------------------------------+-------+--------+--------+

| Trade and other receivables | | 8,596 | 5,187 |

+------------------------------------+-------+--------+--------+

| Cash and cash equivalents | | 29,442 | 26,169 |

+------------------------------------+-------+--------+--------+

| | | 38,038 | 31,356 |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| Total Assets | | 41,314 | 33,650 |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| EQUITY AND LIABILITIES | | | |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| Non-Current Liabilities | | | |

+------------------------------------+-------+--------+--------+

| Deferred income | | 218 | 124 |

+------------------------------------+-------+--------+--------+

| | | 218 | 124 |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| Current Liabilities | | | |

+------------------------------------+-------+--------+--------+

| Deferred income | | 13,660 | 10,964 |

+------------------------------------+-------+--------+--------+

| Trade and other payables | | 5,384 | 3,887 |

+------------------------------------+-------+--------+--------+

| | | 19,044 | 14,851 |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| Total Liabilities | | 19,262 | 14,975 |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| Equity | | | |

+------------------------------------+-------+--------+--------+

| Called up share capital | 8 | 512 | 512 |

+------------------------------------+-------+--------+--------+

| Share premium account | | 9,250 | 9,250 |

+------------------------------------+-------+--------+--------+

| Other reserves | | 3,237 | 3,123 |

+------------------------------------+-------+--------+--------+

| Retained earnings | | 9,053 | 5,790 |

+------------------------------------+-------+--------+--------+

| Total Equity | | 22,052 | 18,675 |

+------------------------------------+-------+--------+--------+

| | | | |

+------------------------------------+-------+--------+--------+

| Total Equity and Liabilities | | 41,314 | 33,650 |

+------------------------------------+-------+--------+--------+

Statements of Cash Flows for the year ended 30 June 2010

+-----------------------------+-------+---------+---------+---------+---------+

| | | Group | Company |

+-----------------------------+-------+-------------------+-------------------+

| |Notes | 2010 | 2009 | 2010 | 2009 |

+-----------------------------+-------+---------+---------+---------+---------+

| | | $'000 | $'000 | $'000 | $'000 |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Cash flows from operating | | | | | |

| activities | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Cash generated from | 9 | 8,906 | 7,378 | 8,572 | 6,145 |

| operations | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Interest received | | 195 | 520 | 195 | 520 |

+-----------------------------+-------+---------+---------+---------+---------+

| Tax paid | | (2,188) | (202) | (966) | (464) |

+-----------------------------+-------+---------+---------+---------+---------+

| Net cash from operating | | 6,913 | 7,696 | 7,801 | 6,201 |

| activities | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Cash flows from investing | | | | | |

| activities | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Purchase of plant and | | (127) | (134) | (37) | (78) |

| equipment | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Capitalised intangible | | (521) | (588) | (518) | (583) |

| assets | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Net cash used in | | (648) | (722) | (555) | (661) |

| investing activities | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Cash flows from financing | | | | | |

| activities | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Dividends paid to company | 5 | (2,992) | (1,917) | (2,992) | (1,917) |

| shareholders | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Net cash used in | | (2,992) | (1,917) | (2,992) | (1,917) |

| financing activities | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Net increase in cash and | | 3,273 | 5,057 | 4,254 | 3,623 |

| cash equivalents | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Cash and cash equivalents | | 26,169 | 21,112 | 23,959 | 20,336 |

| at the start of the year | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

| Cash and cash equivalents | | 29,442 | 26,169 | 28,213 | 23,959 |

| at the end of the year | | | | | |

+-----------------------------+-------+---------+---------+---------+---------+

Notes to the Financial Statements

General Information

Craneware plc (the Company) is a public limited company incorporated in

Scotland. The Company has a primary listing on the AIM stock exchange.

Basis of preparation

The financial statements are prepared in accordance with International Financial

Reporting Standards, as adopted by the European Union (IFRS), IFRIC

interpretations and with those parts of the Companies Act 2006 applicable to

companies reporting under IFRS. The financial statements have been prepared

under the historic cost convention. A summary of the more important accounting

policies is set out below, together with an explanation of where changes have

been made to previous policies on the adoption of new accounting standards in

the year, if applicable.

The preliminary announcement for the year ended 30 June 2010 does not constitute

statutory accounts as defined in Section 435 of the UK Companies Act 2006.

PricewaterhouseCoopers LLP have audited the consolidated statutory accounts for

the Group for the years ended 30 June 2009 and 30 June 2010 and the reports were

unqualified and did not contain a statement under Section 498(2) or (3) of the

UK Companies Act 2006. The Group's consolidated statutory accounts for the year

ended 30 June 2009 have been filed with the Register of Companies. The Group's

Annual Report and Accounts for the year ended 30 June 2010 will be dispatched to

shareholders by the date that the final dividend is payable.

The preparation of financial statements in conformity with IFRS requires the use

of estimates and assumptions that affect the reported amounts of assets and

liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or actions, actual

results ultimately may differ from those estimates.

The Company and its subsidiary undertaking are referred to in this report as the

Group.

1. Selected principal accounting policies

The principal accounting policies adopted in the preparation of these accounts

are set out below. These policies have been consistently applied, unless

otherwise stated.

Reporting currency

The Directors consider that as the Group's revenues are primarily denominated in

US dollars the principal functional currency is the US dollar. The Group's

financial statements are therefore prepared in US dollars.

Currency Translation

Transactions denominated in foreign currencies are translated into US dollars at

the rate of exchange ruling at the date of the transaction. Monetary assets and

liabilities expressed in foreign currencies are translated into US dollars at

rates of exchange ruling at the balance sheet date $1.4961/GBP1 (2009 :

$1.6452/GBP1). Exchange gains or losses arising upon subsequent settlement of

the transactions and from translation at the balance sheet date, are included

within the related category of expense where separately identifiable, or in

general and administrative expenses.

Revenue recognition

The Group follows the principles of IAS 18, "Revenue Recognition", in

determining appropriate revenue recognition policies. In principle revenue is

recognised to the extent that it is probable that the economic benefits

associated with the transaction will flow into the Group.

Revenue comprises the value of software license sales, professional services

(included installation), support services and distribution agreements. Revenue

is recognised when (i) persuasive evidence of an arrangement exists; (ii)

delivery has occurred or services have been rendered; (iii) the sales price has

been fixed and determinable; and (iv) collectability is reasonably assured.

For software arrangements with multiple elements, revenue is recognised

dependent on whether vendor-specific objective evidence ("VSOE") of fair value

exists for each of the elements. VSOE is determined by reference to sales to

external customers made on a stand-alone basis. Where there is no VSOE revenue

is recognised rateably over the full term of each contract.

Revenue from standard license products which are not modified to meet the

specific requirements of each customer is recognised when the risks and rewards

of ownership of the product are transferred to the customer, which generally is

over the period of the underlying contract.

Revenue from professional services, including consulting, is recognised as the

applicable services are provided, and from consulting engagements when all

obligations under the consulting agreement have been fulfilled.

Software and distribution agreement with third parties are recognised in

accordance with the underlying contractual agreements. Where separate services

are delivered, revenue is recognised on delivery of the service.

The excess of amounts invoiced and future invoicing over revenue recognised is

included in deferred Income. If the amount of revenue recognised exceeds the

amounts invoiced the excess amount is included within accounts receivable.

Intangible Assets - Research and Development Expenditure

Expenditure associated with developing and maintaining the Group's software

products are recognised as incurred. Where, however, new product development

projects are technically feasible, production and sale is intended, a market

exists, expenditure can be measured reliably, and sufficient resources are

available to complete such projects, development expenditure is capitalised

until initial commercialisation of the product, and thereafter amortised on a

straight-line basis over its estimated useful life. Staff costs and specific

third party costs involved with the development of the software are included

within amounts capitalised.

Impairment Tests

The Group considers whether there is any indication that non-current assets are

impaired on an annual basis. If there is such an indication, the Group carries

out an impairment test by measuring the assets' recoverable amount, which is the

higher of the assets' fair value less costs to sell and their value in use. If

the recoverable amount is less than the carrying amount an impairment loss is

recognised.

Taxation

The charge for taxation is based on the profit for the period and takes into

account deferred taxation. Taxation is computed using the liability method.

Under this method, deferred tax assets and liabilities are determined based on

temporary differences between the financial reporting and tax bases of assets

and liabilities and are measured using enacted rates and laws that will be in

effect when the differences are expected to reverse. The deferred tax is not

accounted for if it arises from initial recognition of an asset or liability in

a transaction that at the time of the transaction affects neither accounting nor

taxable profit or loss. Deferred tax assets are recognised to the extent that

it is probable that future taxable profits will arise against which the

temporary differences will be utilised.

Deferred tax is provided on temporary differences arising on investments in

subsidiaries except where the timing of the reversal of the temporary difference

is controlled by the Group and it is probable that the temporary difference will

not reverse in the foreseeable future. Deferred tax assets and liabilities

arising in the same tax jurisdiction are offset.

In the UK and the US, the Group is entitled to a tax deduction for amounts

treated as compensation on exercise of certain employee share options under each

jurisdiction's tax rules. As explained under "Share-based payments" below, a

compensation expense is recorded in the Group's statement of comprehensive

income over the period from the grant date to the vesting date of the relevant

options. As there is a temporary difference between the accounting and tax

bases a deferred tax asset is recorded. The deferred tax asset arising is

calculated by comparing the estimated amount of tax deduction to be obtained in

the future (based on the Company's share price at the balance sheet date) with

the cumulative amount of the compensation expense recorded in the statement of

comprehensive income. If the amount of estimated future tax deduction exceeds

the cumulative amount of the remuneration expense at the statutory rate, the

excess is recorded directly in equity against retained earnings.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand, deposits held with banks and

short term highly liquid investments. For the purpose of the cash flow

statement, cash and cash equivalents comprise of cash on hand, deposits held

with banks and short term high liquid investments.

Share-Based Payments

The Group grants share options to certain employees. In accordance with IFRS 2,

"Share-Based Payments" equity-settled share-based payments are measured at fair

value at the date of grant. Fair value is measured by use of the Black-Scholes

pricing model as appropriately amended. The fair value determined at the date of

grant of the equity-settled share-based payments is expensed on a straight-line

basis over the vesting period, based on the Group's estimate of the number of

shares that will eventually vest.

The share-based payments charge is included in net operating expenses and is

also included in 'Other reserves'.

2. Critical accounting estimates and judgements

The preparation of financial statements in accordance with generally accepted

accounting principles requires the directors to make critical accounting

estimates and judgements that affect the amounts reported in the financial

statements and accompanying notes. The estimates and assumptions that have a

significant risk of causing material adjustment to the carrying value of assets

and liabilities within the next financial year are discussed below:-

· Provision for impairment of trade receivables:- the Group assesses trade

receivables for impairment which requires the directors to estimate the

likelihood of payment forfeiture by customers.

· Revenue recognition:- the Group assesses the economic benefit that will

flow from future milestone payments in relation to sub-licensing partnership

arrangements. This requires the directors to estimate the likelihood of the

Group, its partners, and sub-licensees meeting their respective commercial

milestones and commitments.

· Capitalisation of development expenditure:- the Group capitalises

development costs provided the conditions laid out previously have been met.

Consequently the directors require to continually assess the commercial

potential of each product in development and its useful life following launch.

· Provisions for income taxes:-the Group is subject to tax in the UK and US

and this requires the directors to regularly assess the applicability of its

transfer pricing policy.

· Share-based payments:-the Group requires to make a charge to reflect the

value of share-based equity-settled payments in the period. At each grant of

options and balance sheet date, the directors are required to consider whether

there has been a change in the fair value of share options due to factors

including number of expected participants.

3. Net operating expenses

+--------------------------------------------+--------+--------+

| | | |

| Net operating expenses are comprised of | | |

| the follows:- | | |

+--------------------------------------------+--------+--------+

| | 2010 | 2009 |

+--------------------------------------------+--------+--------+

| | $'000 | $'000 |

+--------------------------------------------+--------+--------+

| Sales and marketing expenses | 7,102 | 6,110 |

+--------------------------------------------+--------+--------+

| Client servicing | 4,037 | 4,017 |

+--------------------------------------------+--------+--------+

| Research and development | 3,785 | 2,960 |

+--------------------------------------------+--------+--------+

| Administrative expenses | 3,314 | 2,662 |

+--------------------------------------------+--------+--------+

| Share-based payments | 114 | 82 |

+--------------------------------------------+--------+--------+

| Depreciation of plant and equipment | 192 | 204 |

+--------------------------------------------+--------+--------+

| Amortisation of intangible assets | 253 | 176 |

+--------------------------------------------+--------+--------+

| Exchange (loss)/gain | (16) | 51 |

+--------------------------------------------+--------+--------+

| Net operating expenses | 18,781 | 16,262 |

+--------------------------------------------+--------+--------+

4. Tax on profit on ordinary activities

+--------------------------------------------+-------+-------+----------+

| | 2010 | 2009 | |

+--------------------------------------------+-------+-------+----------+

| | $'000 | $'000 | |

+--------------------------------------------+-------+-------+----------+

| Profit on ordinary activities before tax | 7,258 | 5,870 | |

+--------------------------------------------+-------+-------+----------+

| Current tax | | | |

+--------------------------------------------+-------+-------+----------+

| Corporation tax on profits of the year | 2,005 | 1,620 | |

+--------------------------------------------+-------+-------+----------+

| Foreign exchange on taxation in the year | 58 | 24 | |

+--------------------------------------------+-------+-------+----------+

| Adjustments for prior years | (257) | (543) | |

+--------------------------------------------+-------+-------+----------+

| Total current tax charge | 1,806 | 1,101 | |

+--------------------------------------------+-------+-------+----------+

| Deferred tax | | | |

+--------------------------------------------+-------+-------+----------+

| Origination & reversal of timing | (73) | 122 | |

| differences | | | |

+--------------------------------------------+-------+-------+----------+

| Adjustments for prior years | - | 199 | |

+--------------------------------------------+-------+-------+----------+

| Total deferred tax (credit)/charge | (73) | 321 | |

+--------------------------------------------+-------+-------+----------+

| | | | |

+--------------------------------------------+-------+-------+----------+

| Tax on profit on ordinary activities | 1,733 | 1,422 | |

+--------------------------------------------+-------+-------+----------+

| | | | |

+--------------------------------------------+-------+-------+----------+

| The difference between the current tax charge on ordinary | |

| activities for the year, reported in the consolidated | |

| statement of comprehensive income, and the current tax | |

| charge that would result from applying a relevant standard | |

| rate of tax to the profit on ordinary activities before | |

| tax, is explained as follows: | |

+ +----------+

| | |

+------------------------------------------------------------+--------------------------------------------+

| | | | |

+--------------------------------------------+-------+-------+----------+

| Profit on ordinary activities at the UK | 2,032 | 1,644 | |

| tax rate 28% (2009: 28%) | | | |

+--------------------------------------------+-------+-------+----------+

| Effects of | | | |

+--------------------------------------------+-------+-------+----------+

| Adjustment in respect of prior years | | | |

+--------------------------------------------+-------+-------+----------+

| Current tax | (257) | (543) | |

+--------------------------------------------+-------+-------+----------+

| Deferred tax | - | 199 | |

+--------------------------------------------+-------+-------+----------+

| State tax | 49 | 43 | |

+--------------------------------------------+-------+-------+----------+

| Additional US tax on profits 34% (2009: | 59 | 51 | |

| 34%) | | | |

+--------------------------------------------+-------+-------+----------+

| Foreign Exchange | (33) | 24 | |

+--------------------------------------------+-------+-------+----------+

| Expenses not deductible for tax purposes | (1) | 17 | |

+--------------------------------------------+-------+-------+----------+

| Tax deduction on share plan charges | (116) | (13) | |

+--------------------------------------------+-------+-------+----------+

| Total tax charge | 1,733 | 1,422 | |

+--------------------------------------------+-------+-------+----------+

5. Dividends

The dividends paid during the year were as follows:-

+--------------------------------------------+-------+-------+

| | 2010 | 2009 |

+--------------------------------------------+-------+-------+

| | $'000 | $'000 |

+--------------------------------------------+-------+-------+

| Final dividend, re 30 June 2009 - 4.76 | 1,220 | 1,172 |

| cents (2.9 pence)/share | | |

+--------------------------------------------+-------+-------+

| Interim dividend, re 30 June 2010 - 7.05 | 1,772 | 745 |

| cents (4.7 pence)/share | | |

+--------------------------------------------+-------+-------+

| Total dividends paid to company | 2,992 | 1,917 |

| shareholders in the year | | |

+--------------------------------------------+-------+-------+

The proposed final dividend is subject to approval by the shareholders at the

Annual General Meeting and has not been included as a liability in these

accounts.

6. Earnings per share

a) Basic

Basic earnings per share is calculated by dividing the profit attributable to

equity holders of the Company by the weighted average number of shares in issue

during the year.

+--------------------------------------------------+--------+--------+

| | 2010 | 2009 |

+--------------------------------------------------+--------+--------+

| Profit attributable to equity holders of the | 5,525 | 4,448 |

| Company ($'000) | | |

+--------------------------------------------------+--------+--------+

| Weighted average number of ordinary shares in | 25,315 | 25,187 |

| issue (thousands) | | |

+--------------------------------------------------+--------+--------+

| Basic earnings per share ($ per share) | 0.218 | 0.177 |

+--------------------------------------------------+--------+--------+

b) Diluted

For diluted earnings per share, the weighted average number of ordinary shares

calculated above is adjusted to assume conversion of all dilutive potential

ordinary shares. The Group has one category of dilutive potential ordinary

shares, being those share options granted to directors and employees under the

share option scheme.

+--------------------------------------------------+--------+--------+

| | 2010 | 2009 |

+--------------------------------------------------+--------+--------+

| Profit attributable to equity holders of the | 5,525 | 4,448 |

| Company ($'000) | | |

+--------------------------------------------------+--------+--------+

| Weighted average number of ordinary shares in | 25,315 | 25,187 |

| issue (thousands) | | |

+--------------------------------------------------+--------+--------+

| Adjustment for: | 1,005 | 1,007 |

| - Share options (thousands) | | |

+--------------------------------------------------+--------+--------+

| Weighted average number of ordinary shares for | 26,320 | 26,194 |

| diluted | | |

| earnings per share (thousands) | | |

+--------------------------------------------------+--------+--------+

| Diluted earnings per share ($ per share) | 0.210 | 0.170 |

+--------------------------------------------------+--------+--------+

7. Intangible assets

Research and development and computer software

+----------------+---------+----------+-------+---------+----------+-------+

| | Group | Company |

+----------------+----------------------------+----------------------------+

| | In | Computer | | In | Computer | |

| | Process | | | Process | | |

+----------------+---------+----------+-------+---------+----------+-------+

| | R & D | Software | Total | R & D | Software | Total |

+----------------+---------+----------+-------+---------+----------+-------+

| | $'000 | $'000 | $'000 | $'000 | $'000 | $'000 |

+----------------+---------+----------+-------+---------+----------+-------+

| Cost | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| At 1 July 2009 | 1,886 | 271 | 2,157 | 1,886 | 208 | 2,094 |

+----------------+---------+----------+-------+---------+----------+-------+

| Additions | 499 | 22 | 521 | 499 | 19 | 518 |

+----------------+---------+----------+-------+---------+----------+-------+

| At 30 June | 2,385 | 293 | 2,678 | 2,385 | 227 | 2,612 |

| 2010 | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| Amortisation | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| At 1 July 2009 | 725 | 226 | 951 | 725 | 172 | 897 |

+----------------+---------+----------+-------+---------+----------+-------+

| Charge for the | 219 | 34 | 253 | 219 | 29 | 248 |

| year | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| At 30 June | 944 | 260 | 1,204 | 944 | 201 | 1,145 |

| 2010 | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| NBV at 30 June | 1,441 | 33 | 1,474 | 1,441 | 26 | 1,467 |

| 2010 | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| Cost | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| At 1 July 2008 | 1,317 | 252 | 1,569 | 1,317 | 194 | 1,511 |

+----------------+---------+----------+-------+---------+----------+-------+

| Additions | 569 | 19 | 588 | 569 | 14 | 583 |

+----------------+---------+----------+-------+---------+----------+-------+

| At 30 June | 1,886 | 271 | 2,157 | 1,886 | 208 | 2,094 |

| 2009 | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| Amortisation | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| At 1 July 2008 | 599 | 176 | 775 | 599 | 127 | 726 |

+----------------+---------+----------+-------+---------+----------+-------+

| Charge for the | 126 | 50 | 176 | 126 | 44 | 170 |

| year | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| At 30 June | 725 | 226 | 951 | 725 | 171 | 896 |

| 2009 | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

| NBV at 30 June | 1,161 | 45 | 1,206 | 1,161 | 37 | 1,198 |

| 2009 | | | | | | |

+----------------+---------+----------+-------+---------+----------+-------+

8. Called up share capital

Authorised

+----------------------------+------------+-------+------------+-------+

| | 2010 | 2009 |

+----------------------------+--------------------+--------------------+

| | Number | $'000 | Number | $'000 |

+----------------------------+------------+-------+------------+-------+

| Equity share capital | | | | |

+----------------------------+------------+-------+------------+-------+

| Ordinary shares of 1p each | 50,000,000 | 1,014 | 50,000,000 | 1,014 |

+----------------------------+------------+-------+------------+-------+

Allotted called-up and fully paid

+----------------------------+------------+-------+------------+-------+

| | 2010 | 2009 |

+----------------------------+--------------------+--------------------+

| | Number | $'000 | Number | $'000 |

+----------------------------+------------+-------+------------+-------+

| Equity share capital | | | | |

+----------------------------+------------+-------+------------+-------+

| Ordinary shares of 1p each | 25,365,850 | 512 | 25,297,750 | 512 |

+----------------------------+------------+-------+------------+-------+

The movement in share capital during the year is represented as follows:

· 68,100 Ordinary Share options were exercised in the year.

9. Cash flow generated from operating activities

+----------------------------------+---------+-------+---------+-------+

| | | |

| Reconciliation of profit before tax to net | | |

| cash inflow from operating activities | | |

+----------------------------------------------------+---------+-------+

| | | | | |

+----------------------------------+---------+-------+---------+-------+

| | Group | Company |

+----------------------------------+-----------------+-----------------+

| | 2010 | 2009 | 2010 | 2009 |

+----------------------------------+---------+-------+---------+-------+

| | $'000 | $'000 | $'000 | $'000 |

+----------------------------------+---------+-------+---------+-------+

| Profit before tax | 7,258 | 5,870 | 6,280 | 5,012 |

+----------------------------------+---------+-------+---------+-------+

| Finance income | (195) | (520) | (195) | (520) |

+----------------------------------+---------+-------+---------+-------+

| Depreciation on plant and | 192 | 204 | 129 | 143 |

| equipment | | | | |

+----------------------------------+---------+-------+---------+-------+

| Amortisation on intangible | 253 | 176 | 248 | 170 |

| assets | | | | |

+----------------------------------+---------+-------+---------+-------+

| Share-based payments | 114 | 82 | 52 | 32 |

+----------------------------------+---------+-------+---------+-------+

| Movements in working capital: | | | | |

+----------------------------------+---------+-------+---------+-------+

| Increase in trade and other | (3,385) | (452) | (1,030) | (96) |

| receivables | | | | |

+----------------------------------+---------+-------+---------+-------+

| Increase in trade and other | 4,669 | 2,018 | 3,088 | 1,404 |

| payables | | | | |

+----------------------------------+---------+-------+---------+-------+

| Cash generated from operations | 8,906 | 7,378 | 8,572 | 6,145 |

+----------------------------------+---------+-------+---------+-------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BRGDCCGGBGGX

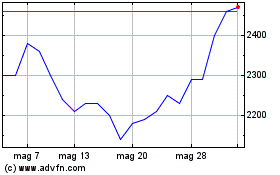

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024