TIDMCRW

RNS Number : 6339Y

Craneware plc

26 February 2013

Craneware plc

("Craneware", "the Group" or the "Company")

Interim Results

26 February 2013 - Craneware plc (AIM: CRW.L), the market leader

in automated revenue integrity solutions for the US healthcare

market, announces its unaudited results for the six months ended 31

December 2012.

Financial Highlights (US dollars)

-- Revenue increased 7% to $20.1m (H112: $18.8m)

-- Adjusted EBITDA(1) increased 15% to $5.4m (H112: $4.7m )

-- Profit before tax $4.5m (H112: $3.8m)

-- Adjusted basic EPS increased 18% to 13.2 cents per share (H112: 11.2 cents)

-- Cash at period end $28.6m (H112: $23.6m) from $28.8m at 30 June 2012

-- Proposed interim dividend of 5.2p (H112: 4.8p per share)

(1.) Adjusted EBITDA refers to earnings before interest, tax,

depreciation, amortisation, share based payments, released deferred

consideration and transaction related costs

Operational Highlights

-- 2012 Best in KLAS Awards: Software & Services

-- Particularly strong performance from InSight Audit

-- Supportive market environment

-- Good revenue visibility over the remainder of the year

Keith Neilson, CEO of Craneware commented:

"This has been a positive trading period for Craneware. Sales

activity is ahead of the same period last year and is now starting

to translate into revenue growth. The relevance of our product set

continues to strengthen in the evolving healthcare landscape with

the developments within the US healthcare market supportive of the

Group's long-term strategy and growth.""

For further information, please contact:

Craneware plc Peel Hunt Newgate Threadneedle

+44 (0)131 550 3100 +44 (0)20 7418 8900 +44 (0)20 7653 9850

Keith Neilson, CEO Dan Webster Caroline Evans-Jones

Craig Preston, CFO Richard Kauffer Fiona Conroy

Heather Armstrong

About Craneware

Craneware is the leader in automated revenue integrity solutions

that improve financial performance and mitigate risk for US

healthcare organisations. Founded in 1999, Craneware has

headquarters in Edinburgh, Scotland with offices in Atlanta,

Boston, Nashville and Phoenix employing more than 200 staff.

Craneware's market-driven, SaaS solutions help hospitals and other

healthcare providers more effectively price, charge, code and

retain earned revenue for patient care services and supplies. This

optimises reimbursement, increases operational efficiency and

minimises compliance risk. By partnering with Craneware, clients

achieve the visibility required to identify, address and prevent

revenue leakage. To learn more, visit craneware.com and

stoptheleakage.com

Chairman's Statement

Craneware enjoyed a more settled trading environment during the

six months to December 2012 compared to the corresponding period

last year. Revenues increased by 7% to $20.1m, adjusted EBITDA

increased by 15% to $5.4m and adjusted EPS increased by 18% to 13.2

cents. The Company continued to benefit from strong operational

cash flow, closing the period with a cash balance of $28.6m (31

December 2011: $23.6m). Visibility over revenue for FY13 has

increased to $39.7m (31 December 2011: $33.4m), providing the Board

with increased confidence in continued growth.

We believe the disruption to our market caused by the focus on

Electronic Health Records incentive payments has largely

dissipated, freeing up hospital resource to focus on other areas of

technology investment. This, combined with the ongoing focus of our

sales operation, has had a positive effect on sales activity and

execution.

New sales were secured across all sections of the customer base,

from individual hospitals through to integrated delivery networks

(IDNs). The increased sales activity noted when we published our

final results in September 2012 flowed through into an increase in

revenue during the period. I am pleased to report that sales

activity has remained high as we entered the second half of the

year, significantly ahead of activity in the same period in the

prior financial year.

Our vision is to be the partner healthcare providers rely on to

improve and sustain strong financial performance through revenue

integrity. With approximately a quarter of all US hospitals as

customers, our central position in this growing area of the US

healthcare market continues to be attractive to a wide range of

possible partners, providing us with potential additional future

channels to market.

While the Board remains cautious on timing, we are confident

that our comprehensive suite of revenue integrity solutions,

focused sales operation and large and clear market opportunity,

mean Craneware is well positioned to increase its market share.

I would like to take this opportunity to thank our staff for

their commitment and enthusiasm and our shareholders for their

continued support.

George Elliott

Chairman

26 February 2013

Operational Review

Introduction

Craneware's vision is to be the partner healthcare providers

rely on to improve and sustain strong financial performance through

revenue integrity. We provide the solutions for our clients to be

financially healthy so that they can continue to provide quality

care to their patients. Whilst incentive payments for the

implementation of Electronic Healthcare Records caused some

disruption to our market in the previous financial year, we are

confident that the growing fiscal and legislative pressures on US

hospitals means that revenue integrity is an area that hospitals

simply cannot afford to ignore.

Our strategy is to provide software solutions that help

customers at the points in their systems where clinical and

operational data transform into financial transactions. Our

solutions automate data normalisation, combining disparate data

sets while maintaining the localised context. This produces

valuable, actionable information and creates organisation-wide

visibility and accountability. We consistently receive feedback

from our customers that through the implementation of our software

they are able to rapidly identify significant amounts of dollars in

missed revenue, overspend or incorrect billing which could lead to

lost income and indeed fines.

Our focus during the first half of the year has been on

execution; seeking to grow the awareness of our solutions within

our market, while ensuring we have the correct products, processes

and people in place to drive the business forward.

Market Developments

The overall US healthcare market has seen some interesting

developments in recent months. The Supreme Court's ruling on 6

December 2012, upholding the Affordable Healthcare Act as

constitutional, sent a clear message that the changes to the

healthcare system and the financial pressures associated with it

are permanent.

At the same time, some of the cost-savings and efficiencies

introduced in recent years are now starting to have a demonstrable

effect, with the annual growth in Medicare spending now contained

within the government's cap of 1% of GDP. It appears that the US

healthcare market is beginning to embrace the changes forced upon

it, seeking means to control costs while maintaining high levels of

patient care.

A development that is expected to have a direct positive impact

on Craneware's market has been the possible extension from 2014

onwards of the look-back for the Recovery Audit Contractors from

three to five years. The administrative pressure already being

placed on hospitals by these types of audits is considerable, and

the extension by a further two years on the look-back period could

have significant repercussions on administrative teams. Craneware's

Audits and Denials solutions considerably ease these pressures and

once established as part of a hospital's good governance process

have been shown to be new Gatekeeper products for the remainder of

the Craneware solution set. This increases the number of routes

into any prospective customer.

The competitive landscape remains largely unchanged, with new

entrants to the market generally seeking to establish partnerships

or joint go-to-market strategies. Management believes Craneware has

the most extensive suite of revenue integrity solutions currently

available and is confident of its growing prominence within the US

healthcare market.

Sales and Marketing

We believe the structural changes made to our direct sales team

during the previous year are starting to have a material impact on

sales. Experienced Regional Vice Presidents oversee each of our

three geographical regions, and each has a team comprised of mixed

experience and skill sets. We have seen a good level of sales

activity across each of the three regions. Following thorough

internal and external training on our enlarged product set and

increased market opportunities presented by various US healthcare

reforms, we are confident that we have a sales team focused on

delivery and with the right tools to do so.

The average length of new customer contracts continues to be

in-line with our historical norms of approximately five years.

Where Craneware enters into new product contracts with its existing

customers, contracts are typically made co-terminus with the

customer's existing contracts, and as such the average length of

these contracts is greater than three years, in-line with our

expectations.

Whilst slightly below historic levels, renewal rates remain

high, at 94% by dollar value. We have experienced this level of

renewal previously and expect to seea return to over 100% by the

next reporting period.

The sales mix remained fairly constant through the period,

resulting in no change to the overall product attachment rate,

which remained steady at approximately 1.6 products per customer.

It was encouraging to note, however, a particularly strong close to

the period by InSight Audit, our solution for the management of the

audit process. The strength of InSight Audit's performance in the

latter months reinforces management's view that it has the

potential to be a Gatekeeper Product, similar to Chargemaster

Toolkit and Pharmacy ChargeLink, providing an additional entry

point to new customers.

Additional Routes to Market

Craneware continues to explore many opportunities to extend its

routes to market outside of direct sales to hospitals, working on a

number of major contract opportunities which all have the ability

to yield significant potential revenues. These potential contracts

follow the same revenue recognition methodology as an individual

hospital and group hospital contracts; although the sales approach

for each of these six different categories of deal is quite

different.

The six categories are IDN's & Large Hospital Systems,

Business Process Outsourcers/Consultants (BPO), Hardware Vendors,

Software Vendors, Group Purchasing Organisations (GPO's) and

Content Acquirers.

Craneware is working on opportunities in each of these areas,

however given the increasing overall size of Craneware's annual

revenue, the size of any deal required to be announced separately

to the market has also increased. Therefore only the very largest

of contracts will be announced individually in the future.

Awards

Craneware's solutions once again received industry recognition

in the period, with two of its solutions ranking first in two

separate revenue cycle categories in the annual "2012 Best in KLAS

Awards: Software & Services" report. KLAS, the leading source

of healthcare information technology vendor performance metrics,

determines its rankings based on the overall customer satisfaction

score for a vendor's products. KLAS rankings also are based on

direct, detailed feedback from healthcare providers across North

America.

Craneware's flagship product, Chargemaster Toolkit, was ranked

as the number one software in the "Revenue Cycle - Chargemaster

Management" market category for the seventh consecutive year, and

Craneware's Bill Analyzer solution ranked first in the "Revenue

Cycle - Other" category for the second year in a row.

Comments collected by KLAS during the evaluation included, "Most

of the time, people don't even know their chargemaster is dirty,

but looking into a [chargemaster management] system is worth the

time. In our first year using Chargemaster Toolkit, we easily made

over $1M," and "Craneware Bill Analyzer reviews our claims and

identifies areas where we could be billing differently ... In the

first year, we found $700,000 in net revenue that we had been

giving up."

Product Development

Product development continues to be focused on enhancements to

functionality of current products and the integration of those

products in new innovative combinations. The direction of the

product set moves consistently with the long-term strategic

positioning of Craneware as the revenue integrity partner of

choice. Integration, both within the solution set itself, and

externally with the Healthcare Information Systems, has also been a

focus, particularly with the EPIC patient accounting system to

ensure that all Craneware customers currently in the midst of the

replacement of their system are fully supported.

Financial Review

As announced in our trading statement on 21 January 2013, we are

reporting a 7% growth in revenues to $20.1m (H112: $18.8m) which

has resulted in a growth of our adjusted EBITDA(1) to $5.4m, this

being a 15% increase over the prior period (H112: $4.7m) .

As anticipated in our FY12 results, the increased levels of

sales activity we saw begin in H212 have started to contribute to

revenue growth in the latter half of this six month reporting

period. However, with the Group's annuity SaaS business model and

the resulting revenue recognition policies, a significant

proportion of license revenues generated from any new sale are

recognised in later periods.

At the end of each financial year, the Company reports its

'Three Year Visible Revenue' KPI which identifies the amount of

visible revenue either contracted or highly likely to be booked in

the next three year period.

At the end of the subsequent half year, the Company reports how

that metric, for the same three year period, has moved on, now that

the Company is 6 months into that period. This shows both how

renewals have flowed through and how sales of new products have

affected new contracted revenue across the three years within the 6

months. The total visible revenue for the three year period 1 July

2012 to 30 June 2015 has grown during this six month period to

$111.9m from $108.7m at 30 June 2012. This comprises $74.5m revenue

under contract, $26.6m renewal revenue and $10.8m Claimtrust legacy

revenue (at 30 June 2012: $59.9m, $38.0m and $10.8m

respectively).

'Revenue under contract', relates to revenues that are supported

by underlying contracts. 'Renewal Revenue'; at each reporting date,

we 'look forward' and calculate the amount of revenue which is

potentially available and could be recognised in each fiscal year

of the three year period but that requires an underlying contract

to be renewed. In calculating this, we assume a 100% dollar value

renewal level. As the renewals occur, the aggregated related

revenue for all of the three years, moves from 'Renewal revenues'

to 'revenue under contract'. The final element is 'Claimtrust

Legacy Revenue'. This relates to our February 2011 acquisition.

This is revenue that is not subject to long term contracts and is

usually invoiced on a monthly basis, but that we would expect to be

recurring in nature. With Craneware typically writing multi-year

contracts (which are included in 'revenue under contract'), and

having successfully completed the integration, we would not expect

to see this type of visible revenue grow in the future.

During the period we have seen our Dollar value renewal rate (as

referred to above) for the period, drop from its historical norms

of above 100% dollar value to 94%. However this modest dip only

relates to a very small number of hospitals not signing new

contracts prior to period end. We have witnessed this previously as

timing issues around period end and we do not believe this is

representative of a longer term trend. The financial effect of the

periods renewal rate is fully reflected in each of the years

forming our 'three year visible revenue' KPI above.

Within our operating expenses we have continued to invest as

appropriate for the future growth of the Group. However the

continued control over costs whilst continuing to leverage the

'cost base' acquired with the Claimtrust Inc acquisition in

February 2011, has resulted in net operating expenses increasing by

only $0.52m to $14.83m (H112: $14.31m). As a result our adjusted

EBITDA margin for the period is 26.8% as compared to 24.8% in the

same period in the prior year.

Ultimately the increase in EBITDA, as well as a small beneficial

effect from the reduction in corporation tax rates in the UK, has

resulted in the adjusted basic EPS increasing by 18% to $0.132 per

share (H112 : $0.112) and adjusted diluted EPS increasing to $0.131

(H112: $0.111).

The Group continues to maintain a strong Balance Sheet, with no

debt and significant cash reserves of $28.6m ($23.6m at 31 December

2011 and $28.8m at 30 June 2012). The cash levels reported are

after returning $2.5m to shareholders by way of dividends and tax

payments of $2m in the period. Consistent with prior years, the

combination of these payments and cash cycles in the run up to 31

December has resulted in the slight reduction in the cash balances.

Continued healthy cash collections since the period end ensures the

Group retains healthy cash reserves which in turn provides for

further future investment including potential 'bolt on'

acquisitions should such opportunities arise.

We continue to report the results (and hold the cash reserves)

of the Group in US Dollars, whilst having approximately twenty five

percent of our costs, being our UK employees and purchases,

denominated in Sterling. The average exchange rate for the Company

during the reporting period was $1.59/GBP1 which was comparable to

the corresponding period last year.

Dividend

The Board has resolved to pay an interim dividend of 5.2p (8.45

cents) per ordinary share in the Company on 12 April 2013 to those

shareholders on the register as at 15 March 2013 (FY12 Interim

dividend 4.8p). The ex-dividend date is 13 March 2013.

The interim dividend of 5.2p per share is capable of being paid

in US dollars subject to a shareholder having registered to receive

their dividend in US dollars under the Company's Dividend Currency

Election, or who has registered to do so by the close of business

on 15 March 2013. The exact amount to be paid will be calculated by

reference to the exchange rate to be announced on 15 March 2013.

The interim dividend referred to above in US dollars of 8.45 cents

is given as an example only using the Balance Sheet date exchange

rate of $1.6255/GBP1 and may differ from that finally

announced.

Outlook

This has been a positive trading period for Craneware. Sales

activity is ahead of the same period last year and is now starting

to translate into revenue growth. The relevance of our product set

continues to strengthen in the evolving healthcare landscape with

the developments within the US healthcare market supportive of the

Group's long-term strategy and growth.

Keith Neilson Craig Preston

Chief Executive Officer Chief Financial Officer

26 February 2013 26 February 2013

Craneware PLC

Interim Results FY13

Consolidated Statement of Comprehensive

Income

H1 2013 H1 2012 FY 2012

Notes $'000 $'000 $'000

------------------------------------------ ------- ----------- ----------- -----------

Revenue 20,131 18,754 41,067

Cost of sales (836) (658) (1,556)

----------- ----------- -----------

Gross profit 19,295 18,096 39,511

Net operating expenses (14,835) (14,312) (28,416)

----------- ----------- -----------

Operating profit 4,460 3,784 11,095

Analysed as:

Adjusted EBITDA(1) 5,392 4,655 11,932

Release deferred consideration

on business combination - - 954

Share-based payments (95) (68) (152)

Depreciation of plant and equipment (305) (276) (579)

Amortisation of intangible assets (532) (527) (1,060)

--------------------------------------------------- ----------- ----------- -----------

Finance income 54 37 107

----------- ----------- -----------

Profit before taxation 4,514 3,821 11.202

Tax charge on profit on ordinary

activities (1,241) (1,089) (2,309)

----------- ----------- -----------

Profit for the period attributable

to owners of the parent 3,273 2,732 8,893

--------------------------------------------------- ----------- ----------- -----------

Total comprehensive income attributable

to owners of the parent 3,273 2,732 8,893

--------------------------------------------------- ------- ----------- -----------

(1) Adjusted EBITDA is defined as operating profit before

released deferred consideration, share based payments, depreciation

and amortisation.

Earnings per share for the period attributable to equity holders

- Basic ($ per share) 1a 0.121 0.102 0.330

- *Adjusted Basic ($ per share)(2) 1a 0.132 0.112 0.316

- Diluted ($ per share) 1b 0.121 0.101 0.329

- *Adjusted Diluted ($ per share)(2) 1b 0.131 0.111 0.315

----------- -------- ----------

(2) Adjusted Earnings per share calculations allow for the

release of deferred consideration on the business combination

together with amortisation on acquired intangible assets to form a

better comparison with previous periods.

Craneware PLC

Interim Results FY13

Consolidated Statement of Changes in Equity

--------------------------------------------------------------------------------------------------

Retained

Share Capital Share Premium Other Reserves Earnings Total

$'000 $'000 $'000 $'000 $'000

--------------------------- -------------- -------------- --------------- ---------- --------

At 1 July 2011 536 15,239 302 16,328 32,405

Total comprehensive

income - profit for

the period - - - 2,732 2,732

Transactions with owners

Share-based payments - - 68 (498) (430)

Impact of share options

exercised 2 169 (155) 603 619

Dividend - - - (2,036) (2,036)

--------------------------- -------------- -------------- --------------- ---------- --------

At 31 December 2011 538 15,408 215 17,129 33,290

--------------------------- -------------- -------------- --------------- ---------- --------

Total comprehensive

income - profit for

the period

Transactions with owners - - - 6,160 6,160

Share-based payments - - 84 (40) 44

Impact of share options

exercised - - (90) 90 -

Dividend - - - (2,057) (2,057)

At 30 June 2012 538 15,408 209 21,282 37,437

--------------------------- -------------- -------------- --------------- ---------- --------

Total comprehensive

income - profit for

the period

Transactions with owners - - - 3,273 3,273

Share-based payments - - 95 52 147

Impact of share options

exercised - - (50) 50 -

Dividend - - - (2,482) (2,482)

At 31 December 2012 538 15,408 254 22,175 38,375

--------------------------- -------------- -------------- --------------- ---------- --------

Craneware PLC

Interim Results FY13

Consolidated Balance Sheet as at 31 December

2012

H1 2013 H1 2012 FY2012

Notes $'000 $'000 $'000

-------------------------------- ------- -------- -------- -------

ASSETS

Non-Current Assets

Plant and equipment 1,834 2,182 2,027

Intangible assets 15,481 17,449 16,010

Deferred Tax 1,673 269 1,470

18,988 19,900 19,507

-------- -------- -------

Current Assets

Trade and other receivables 13,195 12,933 12,560

Cash and cash equivalents 28,623 23,621 28,790

41,818 36,554 41,350

-------- -------- -------

Total Assets 60,806 56,454 60,857

-------------------------------- ------- -------- -------- -------

EQUITY AND LIABILITIES

Non-Current Liabilities

Contingent consideration - 954 -

Deferred income - 73 183

- 1,027 183

-------- -------- -------

Current Liabilities

Deferred income 15,999 15,740 15,766

Current tax liabilities 901 1,060 1,527

Trade and other payables 5,531 5,337 5,944

22,431 22,137 23,237

-------- -------- -------

Total Liabilities 22,431 23,164 23,420

-------- -------- -------

Equity

Called up share capital 2 538 538 538

Share premium account 15,408 15,408 15,408

Other reserves 254 215 209

Retained earnings 22,175 17,129 21,282

Total Equity 38,375 33,290 37,437

-------- -------- -------

Total Equity and Liabilities 60,806 56,454 60,857

-------------------------------- ------- -------- -------- -------

Craneware PLC

Interim Results FY13

Consolidated Statement of Cash Flow for the six months ended

31 December 2012

H1 2013 H1 2012 FY 2012

Notes $'000 $'000 $'000

----------------------------------------- ------ -------- -------- --------

Cash flows from operating activities

Cash generated from operations 3 4,396 2,501 10,602

Interest received 54 37 107

Tax paid (2,019) (689) (1,316)

----------------------------------------- ------ -------- -------- --------

Net cash from operating activities 2,431 1,849 9,393

Cash flows from investing activities

Purchase of plant and equipment (112) (291) (439)

Capitalised intangible assets (4) (248) (418)

----------------------------------------- ------ -------- -------- --------

Net cash used in investing activities (116) (539) (857)

Cash flows from financing activities

Dividends paid to company shareholders (2,482) (2,036) (4,093)

Proceeds from issuance of shares - 171 171

----------------------------------------- ------ -------- -------- --------

Net cash used in financing activities (2,482) (1,865) (3,922)

Net (decrease)/increase in cash

and cash equivalents (167) (555) 4,614

Cash and cash equivalents at the

start of the period 28,790 24,176 24,176

Cash and cash equivalents at the

end of the period 28,623 23,621 28,790

----------------------------------------- ------ -------- -------- --------

Craneware PLC

Interim Results FY13

Notes to the Financial Statements

1. Earnings per Share

(a) Basic

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

----------------------------------------------------------------------------

H1 2013 H1 2012 FY 2012

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,273 2,732 8,893

Weighted average number of ordinary

shares in issue (thousands) 26,992 26,905 26,946

Basic earnings per share ($ per share) 0.121 0.102 0.330

-------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,273 2,732 8,893

Release of deferred consideration on

business combination - - (954)

Amortisation of acquired intangibles

($'000) 287 287 574

-------- -------- --------

Adjusted Profit attributable to equity

holders ($'000) 3,560 3,019 8,513

-------- -------- --------

Weighted average number of ordinary

shares in issue (thousands) 26,992 26,905 26,946

Adjusted Basic earnings per share ($

per share) 0.132 0.112 0.316

-------- -------- --------

(b) Diluted

For diluted earnings per share, the weighted average number

of ordinary shares calculated above is adjusted to assume

conversion of all dilutive potential ordinary shares. The

Group has one category of dilutive potential ordinary shares,

being those granted to Directors and employees under the share

option scheme.

----------------------------------------------------------------------------

H1 2013 H1 2012 FY 2012

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,273 2,732 8,893

Weighted average number of ordinary

shares in issue (thousands) 26,992 26,905 26,946

Adjustments for: - share options (thousands) 91 170 84

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 27,083 27,075 27,030

Diluted earnings per share ($ per share) 0.121 0.101 0.329

-------- -------- --------

1. Earnings per Share (Cont.)

H1 2013 H1 2012 FY 2012

---------------------------------------------- -------- -------- --------

Profit attributable to equity holders

of the Company ($'000) 3,273 2,732 8,893

Release of deferred consideration on

business combination - - (954)

Amortisation of acquired intangibles

($'000) 287 287 574

Adjusted Profit attributable to equity

holders ($'000) 3,560 3,019 8,513

-------- -------- --------

Weighted average number of ordinary

shares in issue (thousands) 26,992 26,905 26,946

Adjustments for: - share options (thousands) 91 170 84

Weighted average number of ordinary

shares for diluted earnings per share

(thousands) 27,083 27,075 27,030

Adjusted Diluted earnings per share

($ per share) 0.131 0.111 0.315

-------- -------- --------

2. Called up share capital

H1 2013 H1 2012 FY 2012

Number $'000 Number $'000 Number $'000

---------------------------- ----------- ------ ----------- ------ ----------- ------

Authorised

Equity share capital

Ordinary shares of 1p

each 50,000,000 1,014 50,000,000 1,014 50,000,000 1,014

Allotted called-up and

fully paid

Equity share capital

Ordinary shares of 1p

each 26,998,408 538 26,987,018 538 26,991,891 538

3. Consolidated Cash Flow generated from operating

activities

Reconciliation of profit before taxation to

net cash inflow from operating activities:

H1 2013 H1 2012 FY 2012

$'000 $'000 $'000

------------------------------------- -------- -------- --------

Profit before taxation 4,514 3,821 11,202

Finance income (54) (37) (107)

Depreciation on plant and equipment 305 276 579

Amortisation on intangible assets 532 527 1,060

Share-based payments 95 68 152

Movements in working capital:

(Increase)/decrease in trade

and other receivables (787) 238 611

(Decrease)/increase in trade

and other payables (209) (2,392) (2,895)

Cash generated from operations 4,396 2,501 10,602

------------------------------------- -------- -------- --------

4. Basis of Preparation

The interim financial statements are unaudited and do not

constitute statutory accounts as defined in S435 of the Companies

Act 2006. These statements have been prepared applying accounting

policies that were applied in the preparation of the Group's

consolidated accounts for the year ended 30th June 2012. Those

accounts, with an unqualified audit report, have been delivered to

the Registrar of Companies.

5. Segmental Information

The Directors consider that the Group operates in one business

segment, being the creation of software sold entirely to the US

Healthcare Industry, and that there are therefore no additional

segmental disclosures to be made in these financial statements.

6. Significant Accounting Policies

The significant accounting policies adopted in the preparation

of these statements are set out below.

Reporting Currency

The Directors consider that as the Group's revenues are

primarily denominated in US dollars the principal functional

currency is the US dollar. The Group's financial statements are

therefore prepared in US dollars.

Currency Translation

Transactions denominated in foreign currencies are translated

into US dollars at the rate of exchange ruling at the date of the

transaction. Monetary assets and liabilities expressed in foreign

currencies are translated into US dollars at rates of exchange

ruling at the Balance Sheet date ($1.6255/GBP1). Exchange gains or

losses arising upon subsequent settlement of the transactions and

from translation at the Balance Sheet date, are included within the

related category of expense where separately identifiable, or in

general and administrative expenses.

Revenue Recognition

The Group follows the principles of IAS 18, "Revenue

Recognition", in determining appropriate revenue recognition

policies. In principle revenue is recognised to the extent that it

is probable that the economic benefits associated with the

transaction will flow into the Group.

Revenue is derived from sales of, and distribution agreements

relating to, software licenses and professional services (including

installation). Revenue is recognised when (i) persuasive evidence

of an arrangement exists; (ii) the customer has access and right to

use our software; (iii) the sales price can be reasonably measured;

and (iv) collectability is reasonably assured.

Revenue from standard licensed products which are not modified

to meet the specific requirements of each customer is recognised

from the point at which the customer has access and right to use

our software. This right to use software will be for the period

covered under contract and, as a result our annuity based revenue

model, recognises the licensed software revenue over the life of

this contract. This policy is consistent with the Company's

products providing customers with a service through the delivery

of, and access to, software solutions (Software-as-a-Service

("SaaS")), and results in revenue being recognised over the period

that these services are delivered to customers.

'White-labelling' or other 'Paid for development work' is

generally provided on a fixed price basis and as such revenue is

recognised based on the percentage completion or delivery of the

relevant project. Where percentage completion is used it is

estimated based on the total number of hours performed on the

project compared to the total number of hours expected to complete

the project. Where contracts underlying these projects contain

material obligations, revenue is deferred and only recognised when

all the obligations under the engagement have been fulfilled.

Revenue from all professional services is recognised as the

applicable services are provided. Where professional services

engagements contain material obligation, revenue is recognised when

all the obligations under the engagement have been fulfilled. Where

professional services engagements are provided on a fixed price

basis, revenue is recognised based on the percentage completion of

the relevant engagement. Percentage completion is estimated based

on the total number of hours performed on the project compared to

the total number of hours expected to complete the project.

Software and professional services sold via a distribution

agreement will normally follow the above recognition policies.

Should any contracts contain non-standard clauses, revenue

recognition will be in accordance with the underlying contractual

terms which will normally result in recognition of revenue being

deferred until all material obligations are satisfied.

The excess of amounts invoiced over revenue recognised are

included in deferred income. If the amount of revenue recognised

exceeds the amount invoiced the excess is included within accrued

income.

Business combinations

The acquisition of subsidiaries is accounted for using the

purchase method. The cost of the acquisition is measured at the

aggregate of the fair values, at the acquisition date, of assets

given, liabilities incurred or assumed, and the equity issued by

the Group. The consideration transferred includes the fair value of

any assets or liability resulting from a contingent consideration

and acquisition costs are expensed as incurred.

Any contingent consideration to be transferred by the Group is

recognised at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration that is

deemed to be an asset or liability is recognised in accordance with

IAS 39 in the Statement of Comprehensive Income. Contingent

consideration that is classified as equity is not re-measured and

its subsequent settlement is accounted for within equity.

Goodwill arising on the acquisition is recognised as an asset

and initially measured at cost, being the excess of fair value of

the consideration over the Group's assessment of the net fair value

of the identifiable assets and liabilities recognised.

If the Group's assessment of the net fair value of a

subsidiary's assets and liabilities had exceeded the fair value of

the consideration of the business combination then the excess

('negative goodwill') would be recognised in the Statement of

Comprehensive Income immediately. The fair value of the

identifiable assets and liabilities assumed on acquisition are

brought onto the Balance Sheet at their fair value at the date of

acquisition.

Intangible Assets

(a) Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the fair value of the identifiable assets

and liabilities of a subsidiary at the date of acquisition.

Goodwill is capitalised and recognised as a non-current asset in

accordance with IFRS 3 and is tested for impairment annually, or on

such occasions that events or changes in circumstances indicate

that the value might be impaired.

Goodwill is allocated to cash-generating units for the purpose

of impairment testing. The allocation is made to those

cash-generating units that are expected to benefit from the

business combination in which the goodwill arose.

(b) Proprietary software

Proprietary software acquired in a business combination is

recognised at fair value at the acquisition date. Proprietary

software has a finite life and is carried at cost less accumulated

amortisation. Amortisation is calculated using the straight-line

method to allocate the associated costs over their estimated useful

lives of 5 years.

(c) Contractual Customer relationships

Contractual customer relationships acquired in a business

combination are recognised at fair value at the acquisition date.

The contractual customer relations have a finite useful economic

life and are carried at cost less accumulated amortisation.

Amortisation is calculated using the straight-line method over the

expected life of the customer relationship which has been assessed

as 10 years.

(d) Research and Development Expenditure

Expenditure associated with developing and maintaining the

Group's software products are recognised as incurred. Where,

however, new product development projects are technically feasible,

production and sale is intended, a market exists, expenditure can

be measured reliably, and sufficient resources are available to

complete such projects, development expenditure is capitalised

until initial commercialisation of the product, and thereafter

amortised on a straight-line basis over its estimated useful life,

which has been assessed as 5 years. Staff costs and specific third

party costs involved with the development of the software are

included within amounts capitalised.

(e) Computer software

Costs associated with acquiring computer software and licensed

to-use technology are capitalised as incurred. They are amortised

on a straight-line basis over their useful economic life which is

typically 3 to 5 years.

Impairment of non-financial assets

At each reporting date the Group considers the carrying amount

of its tangible and intangible assets including goodwill to

determine whether there is any indication that those assets have

suffered an impairment loss. If there is such an indication, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any) through determining the

value in use of the cash generating unit that the asset relates to.

Where it is not possible to estimate the recoverable amount of an

individual asset, the Group estimates the recoverable amount of the

cash generating unit to which the asset belongs.

If the recoverable amount of an asset is estimated to be less

than its carrying amount, the impairment loss is recognised as an

expense.

Where an impairment loss subsequently reverses, the carrying

amount of the asset is increased to the revised estimate of its

recoverable amount, but so that the increased carrying amount does

not exceed the carrying amount that would have been determined had

no impairment loss been recognised for the asset. A reversal of an

impairment loss is recognised as income immediately. Impairment

losses relating to goodwill are not reversed.

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand, deposits held

with banks and short term highly liquid investments. For the

purpose of the Statement of Cash flow, cash and cash equivalents

comprise of cash on hand, deposits held with banks and short term

high liquid investments.

Share-Based Payments and Taxation Implications

The Group grants share options to certain employees. In

accordance with IFRS 2, "Share-Based Payments" equity-settled

share-based payments are measured at fair value at the date of

grant. Fair value is measured by use of the Black-Scholes pricing

model as appropriately amended. The fair value determined at the

date of grant of the equity-settled share-based payments is

expensed on a straight-line basis over the vesting period, based on

the Group's estimate of the number of shares that will eventually

vest. Non-market vesting conditions are included in assumptions

about the number of options that are expected to vest. At the end

of each reporting period, the entity revises its estimates of the

number of options that are expected to vest based on the non-market

vesting conditions. It recognises the impact of the revision to

original estimates, if any, in the Statement of Comprehensive

Income, with a corresponding adjustment to equity. When the options

are exercised the Company issues new shares. The proceeds received

net of any directly attributable transaction costs are credited to

share capital and share premium.

The share-based payments charge is included in net operating

expenses and is also included in 'Other reserves'.

In the UK and the US, the Group is entitled to a tax deduction

for amounts treated as compensation on exercise of certain employee

share options under each jurisdiction's tax rules. A compensation

expense is recorded in the Group's Statement of Comprehensive

Income over the period from the grant date to the vesting date of

the relevant options. As there is a temporary difference between

the accounting and tax bases a deferred tax asset is recorded. The

deferred tax asset arising is calculated by comparing the estimated

amount of tax deduction to be obtained in the future (based on the

Company's share price at the Balance Sheet date) with the

cumulative amount of the compensation expense recorded in the

Statement of Comprehensive Income. If the amount of estimated

future tax deduction exceeds the cumulative amount of the

remuneration expense at the statutory rate, the excess is recorded

directly in equity against retained earnings.

7. Availability of announcement and Half Yearly Financial

Report

Copies of this announcement are available on the Company's

website, www.craneware.com. Copies of the Interim Report will be

posted to shareholders, downloadable from the Company's website and

available from the registered office of the Company shortly.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UVSBRONAUUAR

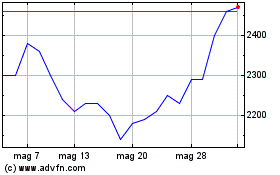

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Craneware (LSE:CRW)

Storico

Da Lug 2023 a Lug 2024