TIDMDLAR

RNS Number : 2770X

De La Rue PLC

19 December 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated by the

Market Abuse Regulation (EU) No.596/2014, as it forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018 ("MAR").

Upon the publication of this announcement, the inside information

is now considered to be in the public domain.

19 December 2023

De La Rue plc

2023/24 half year results

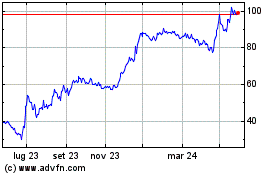

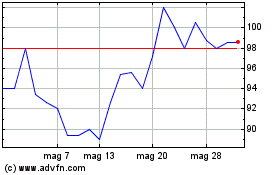

De La Rue plc (LSE: DLAR) ("De La Rue", the "Group" or the

"Company") announces its half year results for the six months ended

30 September 2023 (the "period", "H1 24" or "half-year"). The

comparative period was the six months ended 24 September 2022 ("H1

23").

Highlights

-- Adjusted operating profit of GBP7.9m (H1 23: GBP9.3m) ahead

of previous guidance of breakeven. IFRS operating loss narrowed to

GBP3.4m (H1 23: GBP12.6m).

-- Authentication revenue rose 5.7% to GBP48.1m (H1 23: GBP45.5m).

-- Currency revenue reduced 2.6% to GBP113.4m (H1 23: GBP116.4m).

-- Net debt of GBP82m (H1 23: GBP82.4m) in line with the October

2023 trading statement and ahead of previous guidance of GBP100m;

Operating cash inflow of GBP15.4m (H1 23: outflow of GBP2.8m).

-- Banking facilities extended to July 2025; RCF limit reduced to GBP235m (from GBP250m).

-- Pension situation improved and contributions reduced:

o Deficit per actuarial valuation now GBP78m (versus previous

remaining contributions of GBP84.7m)

o Deficit repair contributions moratorium continues for FY24;

thereafter contributions reduced to GBP8m annually from FY25-FY27,

saving GBP28m over that period; FY28-FY31 contributions then

increase to clear deficit by December 2030 (from March 2029)

-- Currency order book increased over 100% since September 2023

period end, to GBP219.8m, with very high win rate since beginning

of FY24, in a recovering market.

-- Multi-year Authentication contract extension secured on

improved terms; in latter stages of settling a further significant

GRS contract extension.

-- Authentication guidance of GBP100m revenue for FY24 reiterated.

-- The above underpins the Board's reiteration of full year

guidance: adjusted operating profit of early GBP20m range and net

debt in the mid GBP90m range.

Financial highlights

H1 24 H1 23 Change

GBPm GBPm %

-------------------------------- ------------ ----------- --------

Revenue 161.5 164.3 (1.7)

Authentication 48.1 45.5 5.7

Currency 113.4 116.4 (2.6)

Identity Solutions - 2.4 n/a

Gross profit 40.2 41.8 (3.8)

Adjusted operating profit*(1) 7.9 9.3 (15.1)

IFRS operating loss (3.4) (12.6) 73.0

Loss before taxation (16.8) (15.9) (5.7)

Adjusted basic EPS*(2) (p) (2.6)p 2.0p (230.0)

IFRS basic EPS (p) (6.2)p (12.6)p 50.8

H1 23 GBPm FY23 GBPm Change

%

-------------------------------- ------------ ----------- --------

Net debt(3) 82.0 82.4 (0.5)

-------------------------------- ------------ ----------- --------

Footnotes:

* These are non-IFRS measures. The definition and reconciliation

of adjusted operating profit and adjusted basic EPS can be found in

non-IFRS financial measures section of this Interim Statement.

(1.) Adjusted operating expenses and adjusted operating profit

excludes pre-tax exceptional items of GBP10.8m (H1 23: GBP21.4m)

and pre-tax amortisation of acquired intangible assets GBP0.5m (H1

23: GBP0.5m).

(2.) Adjusted basic EPS excludes post-tax exceptional items of

GBP6.7m (H1 23: GBP28.1m) and post-tax amortisation of acquired

intangible assets GBP0.4m (H1 23: GBP0.4m).

(3.) The definition of net debt can be found in note 8 to the

financial statements.

(4.) All of the above are reported for continuing

operations.

Clive Vacher, CEO of De La Rue, commented:

"De La Rue's robust performance in the first half reflects the

important actions that we have taken since 2020 to make the company

resilient to changing market conditions. These actions have allowed

us to navigate a downturn over the past 18 months, particularly in

Currency, and I am pleased that the market is now showing signs of

continuing recovery. We have doubled the Currency order book since

September 2023 and are exhibiting a high win rate, with more

opportunities in the pipeline.

"Authentication continues on its path to GBP100m in revenue for

the full financial year. We have secured a significant multi-year

contract extension, and we are in the late stages of securing

another contract extension in GRS. Our Australian passport

programme continues apace and is a significant driver of growth

this year.

"We continue to focus on the financial progress of the company.

In the half year, we demonstrated improved operating cash flow

versus H1 FY23 and, as announced in our October trading statement,

significantly improved net debt versus previous guidance. We have

extended our banking facilities to July 2025 and are comfortable to

reduce the size of facility.

"With a new pension deficit valuation of GBP78m, we have been

able to work with the Pension Trustee on an amended schedule of

contributions, that saves the company GBP28m cash contributions

between FY25 and FY27. The schedule now runs to December 2030, a

modest extension from March 2029, but still a number of years ahead

of scheme maturity.

"The progress reported today underpins the Board's full year

guidance of adjusted operating profit in the low GBP20m range, and

net debt in the mid GBP90m range."

Clive Whiley, Chairman of De La Rue, added:

"Upon my appointment as Chairman in May this year, it soon

became clear that De La Rue was struggling to balance conflicting

stakeholder objectives, alongside associated professional fees

which were suffocating the nascent recovery emanating from the

foundations laid by the Turnaround Plan initiated in 2020, Making a

continuation of the deterioration in the market rating almost

inevitable.

"Since then I have sought to provide aircover to allow the

reinforced executive management team to complete an in-depth review

of the fundamentals of De La Rue's business, designed to arm the

Board with the information necessary to gauge the core strategic

strengths of the Group, of which there are many.

"The interim results released this morning represent

demonstrable progress with adjusted operating profit ahead of

guidance, lower net debt, pension deficit repair contributions

reduced by GBP28m over the next three years, significantly enhanced

contract win rates and renewed confidence within the management

team.

"Accordingly, I would like to thank our core lenders, pension

trustees, shareholders and employees alike for their ongoing

support to enable us to complete this strategic review. The Board

is determined to utilise today's market update as a springboard to

optimise the underlying intrinsic value of the business, for the

benefit of all stakeholders, on which the company will provide an

update before 31 May 2024."

The person responsible for the release of this announcement on

behalf of De La Rue for the purposes of MAR is Jon Messent (Company

Secretary).

Enquiries:

De La Rue plc + 44 (0) 7990 337707

Clive Vacher Chief Executive Officer

Dean Moore Interim Chief Financial Officer

Louise Rich Head of Investor Relations

Brunswick + 44 (0) 207 404 5959

Stuart Donnelly

Ed Brown

A presentation to investors and analysts, including a live

webcast will be held today at 09:00 am and will be available via

our website at https://www.delarue.com or on

https://brrmedia.news/DLAR_HY . This will be available for playback

after the event.

About De La Rue

Established 210 years ago, De La Rue is trusted by governments,

central banks, and international brands, providing digital and

physical solutions that protect their supply chains and cash cycles

from counterfeiting and illicit trade.

With operations in five continents, customers in 140 countries

and solutions that include advanced track and trace software,

security document design, banknotes, brand protection labels, tax

stamps, security features and passport bio-data pages, De La Rue

brings unparalleled knowledge and expertise to its partnerships and

projects.

Our core focus areas are:

- Authentication: leveraging advanced digital software solutions

and security labels to protect revenues and reputations from the

impacts of illicit trade, counterfeiting, and identity theft.

- Currency: designing and manufacturing highly secure banknotes

and banknote components that are optimised for security,

manufacturability, cash cycle efficacy and public engagement.

The security and trust derived from our solutions pave the way

for robust economies and flourishing societies. This is underpinned

by a significant Environmental, Social, and Governance commitment

that is evidenced by accolades such as the ISO 14001 certification

and a consistent ranking in the top tier of the Financial Times

European Climate Leaders list.

De La Rue's shares are traded on the London Stock Exchange (LSE:

DLAR). De La Rue plc's LEI code is 213800DH741LZWIJXP78. For

further information please visit www.delarue.com.

Cautionary note regarding forward-looking statements

Certain statements contained in this document relate to the

future and constitute 'forward-looking statements'. These

forward-looking statements include all matters that are not

historical facts. In some cases, these forward-looking statements

can be identified by the use of forward-looking terminology,

including the terms "believes", "estimates", "anticipates",

"expects", "intends", "plans", "may", "will", "could", "shall",

"risk", "aims", "predicts", "continues", "assumes", "positioned" or

"should" or, in each case, their negative or other variations or

comparable terminology. They appear in a number of places

throughout this document and include statements regarding the

intentions, beliefs or current expectations of the Directors, De La

Rue or the Group concerning, amongst other things, the results of

operations, financial condition, liquidity, prospects, growth,

strategies and dividend policy of De La Rue and the industry in

which it operates.

By their nature, forward-looking statements are not guarantees

or predictions of future performance and involve known and unknown

risks, uncertainties, assumptions and other factors, many of which

are beyond the Group's control, and which may cause the Group's

actual results of operations, financial condition, liquidity,

dividend policy and the development of the industry and business

sectors in which the Group operates to differ materially from those

suggested by the forward-looking statements contained in this

document. In addition, even if the Group's actual results of

operations, financial condition and the development of the business

sectors in which it operates are consistent with the

forward-looking statements contained in this document, those

results or developments may not be indicative of results or

developments in subsequent periods.

Past performance cannot be relied upon as a guide to future

performance and should not be taken as a representation or

assurance that trends or activities underlying past performance

will continue in the future. Accordingly, readers of this document

are cautioned not to place undue reliance on these forward-looking

statements.

Other than as required by English law, none of the Company, its

Directors, officers, advisers or any other person gives any

representation, assurance or guarantee that the occurrence of the

events expressed or implied in any forward-looking statements in

this document will actually occur, in part or in whole.

Additionally, statements of the intentions of the Board and/or

Directors reflect the present intentions of the Board and/or

Directors, respectively, as at the date of this document, and may

be subject to change as the composition of the Company's Board of

Directors alters, or as circumstances require.

The forward-looking statements contained in this document speak

only as at the date of this document. Except as required by the

UK's Financial Conduct Authority, the London Stock Exchange or

applicable law (including as may be required by the UK Listing

Rules and/or the Disclosure Guidance and Transparency Rules), De La

Rue expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained in this document to reflect any change in the Group's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is

based.

BUSINESS UPDATE

De La Rue achieved an adjusted operating profit of GBP7.9m (H1

23: GBP9.3m) in the first half, ahead of guidance, helped by a

better-than-expected mix within Currency and strong sales coupled

with strong cost control in Authentication. Though adjusted

operating profit was lower than the comparative period last year,

the IFRS operating loss of GBP3.4m (H1 23: GBP12.6m) was much

reduced thanks to reduced exceptional charges.

The work we have done and continue to do, to reshape the

business and remove cost, has created more efficient and agile

operations. It has allowed us to begin to rebuild the order book in

Currency, winning a high proportion of the tenders for which we

have bid and to conclude a three-year contract renewal with an

important customer on improved terms within Authentication. At the

same time, we have seen an improved cash flow across the

business.

We have also announced today that we have secured an extension

to our banking facilities and improved terms for the schedule of

contributions to repair the deficit within the legacy defined

benefit pension scheme. These build on the 15-month pension deficit

repair moratorium and the banking covenant relaxation that we

announced at the time of our full year results and reduce cash

outflows through to the end of FY27 by an additional GBP28m. While

we have more to do, these actions put the business on a firmer

financial footing for the future.

FY24 to date has seen much activity across the business,

including further streamlining and improving operational

efficiency, seeking out new customers, extending relationships with

existing customers and the improvements to our financing situation

referenced above. We have restructured our UK sites, completed the

wind-down in Kenya and moved the expansion of our Malta operations

towards completion.

These have all required much hard work from employees across De

La Rue. I would like to thank the team for all their efforts during

the financial year so far, and for those yet to come as we work to

achieve our goals for the remainder of FY24 and beyond.

Pension scheme

In view of recent changes in interest rates and other actuarial

assumptions, we commissioned a fresh actuarial valuation of our

historic defined benefit pension scheme (the 'Scheme') as at

September 2023. This has resulted in the deficit being valued at

GBP78m, as compared with the outstanding total of future deficit

repair contributions previously agreed of GBP84.7m.

On 18 December 2023, we reached agreement with the Scheme

Trustee to pay deficit repair contributions in accordance with a

revised schedule. We will recommence deficit repair contributions

in July 2024 as previously agreed, but at a significantly lower

level, namely GBP8m per annum to the end of FY27, with the

outstanding amount thereafter spread over the period to December

2030, which is after the next periodic actuarial valuation is

due.

This revised deficit repair contribution schedule provides De La

Rue with a significantly improved cash flow profile, reducing cash

outflows by GBP28m over the period to the end of FY27. The actions

we have taken since 2020 in reprofiling the pension deficit repair

contributions will have saved the Group over GBP90m in cash

outflows by the end of FY27, while improving the safeguards to the

Scheme and its members with additional security and 'pari passu'

treatment with the banking facility providers.

Banking facilities

Today we also announce that we have reached agreement with our

banking syndicate so that our principal facilities now extend to

July 2025.

The extension has been granted with the same interest rate

schedule that was agreed in June 2023. The interest rates and

covenant limits remain unchanged, other than a downwards adjustment

in the liquidity headroom covenant to reflect the cancellation of

GBP15m of the revolving credit facility as explained below. Further

details of the revised banking arrangements can also be found

within the Financial Review below, under 'Banking facilities'.

Looking ahead, we are evaluating various options to refinance

our debt facilities for a longer horizon, allowing us to move away

from a repeated cycle of short-term facility extensions.

Net debt and cash

At the end of September 2023, our net debt stood at GBP82.0m

(FY23: GBP82.4m), significantly lower than our previous

guidance.

Our focus on strong control of working capital, reducing

inventory and seeking prompt payment from our customers generated

an operating cash inflow of GBP15.4m (H1 23: GBP2.8m outflow). This

was after taking account of the final GBP7.5m payment for

settlement of the termination of the Portals Paper agreement which

took place at the beginning of this financial year.

Our net debt position at the end of the first half also

benefitted from improving the matching of capital expenditure with

the timing of grant receipts in Malta. We will continue with these

and other initiatives in the second half and into FY25.

Our improved cash flow performance has enabled us to offer to

our bank syndicate the cancellation of [GBP15m] of the revolving

credit facility previously in place that is now surplus to our

requirements.

Authentication

Our Authentication division generated an adjusted operating

profit of GBP6.5m (H1 23: GBP4.9m) from revenue up 5.7% to GBP48.1m

(H1 23: GBP45.5m). The ID business saw a robust performance with

strong sales from the polycarbonate bio data page produced for the

new 'R series' Australian passport among others. These data pages

incorporate a range of security features in a technically advanced

highly secure, multi-layered polycarbonate plastic and allow

Australian citizens to benefit from one of the most advanced and

secure travel documents. Brand benefitted from the new customers

that we referenced in our full year results. Microsoft related

sales have stabilised in H1 24, but we have not yet seen any

significant recovery, reflecting the continued subdued state of PC

sales globally.

Authentication has recently seen the renewal of a three-year

contract with a key customer on improved terms. Negotiations on

another significant contract are in their later, detailed stage.

These build on the GRS contract extensions in the EU, Cameroon and

Sudan announced at the end of FY23, de-risking our future revenue

pipeline.

Recent additional investment in sales and marketing capability

is bearing fruit, with a number of leads being pursued in each area

of the business. In GRS the market continues to grow steadily, and

we are seeing several tenders or RFQ's for new contracts, together

with larger contract values to cover additional products to be

incorporated into existing schemes .

Currency

Our Currency division delivered an adjusted operating profit of

GBP1.4m (H1 23: GBP4.3m) in its traditionally weaker first half

from marginally lower revenue of GBP113.4m (H1 23: GBP116.4m)

compared with the same period last year. A mix of completed work

within banknotes with a higher margin than had been expected led to

an improved profit outturn versus expectations at the start of the

financial year.

While the industry-wide post pandemic downturn continued to

impact the business in the period, the division is now seeing some

recovery, albeit from a low base. While the overall market remains

unpredictable, our conversion rate of bids to orders since the

beginning of this financial year has been excellent. In FY24 to

date we have won substantial multi-year orders in Africa, the

Middle East and in Asia. The work we have done over the last few

years in making the business more competitive and agile, by for

example, replacing Portals as our sole provider of banknote paper

with a panel of suppliers and focusing on an efficient

manufacturing footprint, has helped us to attain this high

conversion rate.

At the same time market data continues to reflect an underlying

demand for fresh banknotes. Our latest view of the global growth of

cash in circulation is around 5% per annum, with growth in some of

our core markets increasing at a rate significantly ahead of

this.

At the end of September our total order book stood at GBP105.4m

(25 March 2023: GBP136.8m) and the 12-month order book at GBP65.8m

(25 March 2023: GBP131.7m). The timing of tenders has been such

that several significant orders have been closed recently. At

December, the total order book stood at GBP219.8m.

As well as focusing on winning tenders to print banknotes, we

also continue to seek opportunities to incorporate our security

features and SAFEGUARD(R) polymer substrate into the

specifications. Furthermore, our extensive security features

portfolio and polymer substrate provide opportunities to grow sales

to state printing works, which typically represent countries that

require a larger volume of banknotes.

Malta

The expansion of our Malta facilities is moving forward, with

the Authentication space due to be completed by end of this

financial year and the Currency facilities completed during

FY25.

When complete, the new facilities will substantially increase

our capacity within Authentication and add significantly to our

Currency capabilities within Malta.

Responsible business

Undertaking our business in an ethical and sustainable manner is

core to the De La Rue culture and underpins all that we do. We were

therefore delighted that our most recent annual assessment by

sustainability agency Ecovadis resulted in a 5% improvement in our

overall score, a rating in the 91(st) percentile and a silver

medal. De La Rue scored particularly highly in the theme area of

ethics.

Outlook

Within Currency, our order book for the remainder of FY24 is now

largely de-risked. Our operations team are now working hard to

fulfil these orders and deliver full year operating profit

expectations for the business. Authentication remains on track to

hit its GBP100m revenue target for the full year, though at an

operating profit level has a strong prior year comparative in the

second half to outperform.

We recognise that the outturn for H1 24 has been better from

both an operating profit and a net debt perspective than we set out

at the time of our full year results in June 2023. However, a

number of significant operational uncertainties still remain in

both divisions.

As a result, we reiterate the profit guidance previously given,

namely that we expect adjusted operating profit for FY24 to be in

the low GBP20m.

In relation to net debt, as we set out in our pre close

statement in early October, given the various initiatives in

relation to cash underway, we expect net debt for the full year

FY24 to be in the mid GBP90m range.

Clive Vacher

Chief Executive Officer

FINANCIAL REVIEW

To provide increased clarity on the underlying performance of

our business, we have reported gross profit and operating profit on

an IFRS and adjusted basis, together with adjusted EBITDA and

adjusted controllable operating profit (adjusted operating profit

before enabling function cost allocation), for both ongoing

operating divisions. Further details on non-IFRS financial measures

can be found later in this document.

100% of Group revenue for H1 24 of GBP161.5m (H1 23: GBP164.3m)

originated from our ongoing operating divisions of Currency and

Authentication.

Together Currency and Authentication delivered adjusted

operating profit of GBP7.9m (H1 23: profit GBP9.3m), a fall of

GBP1.4m (15.1%) period-on-period. This largely reflects lower

revenue from the Currency division, adverse mix and a slight

increase in operating expenses. The legacy Identity Solutions

business generated an adjusted operating result of GBPnil in the

current financial year with no remaining activity (H1 23: GBP0.1m

profit).

At an IFRS operating profit level, the Group saw a small net

loss of GBP3.4m, much less than the equivalent period last year,

which saw a loss of GBP12.6m after the exceptional cost of the

termination of the agreement with Portals Paper.

Authentication

The Authentication division leverages advanced digital software

solutions and security labels to protect revenues and reputations

from the impacts of illicit trade, counterfeiting, and identity

theft.

H1 24 H1 23 Change

GBPm GBPm

----------------------------------------- ------ ------ --------

Revenue 48.1 45.5 5.7%

Gross profit 17.9 15.7 14.0%

Adjusted controllable operating profit* 11.6 9.4 23.4%

Adjusted operating profit* 6.5 4.9 32.7%

Operating profit 5.8 3.9 48.7%

----------------------------------------- ------ ------ --------

% %

----------------------------------------- ------ ------ --------

Gross profit margin 37.2 34.5 270 bps

Adjusted controllable operating profit

margin* 24.1 20.7 340 bps

Adjusted operating profit margin* 13.5 10.8 270 bps

----------------------------------------- ------ ------ --------

* Non-IFRS measure

When compared with prior period, the most substantial increase

in H1 24 Authentication revenue was due to the increase in ID

sales, notably data pages for the Australian passport. Brand

benefitted from sales from new contracts announced at the full

year. Microsoft related sales faced a strong prior year comparative

in the first quarter. The monthly run rate has stabilised, but we

have not yet seen any significant recovery, reflecting the

continued subdued state of PC sales globally. The loss of revenue

in Kenya and from HMRC in FY23, together with a muted overall

performance in GRS, moderated overall sales growth in the

division.

Gross profit margin rose 270 basis points, when compared with

the prior period, reflecting the mix in sales and good

manufacturing yields. Exceptionally strong cost control led to no

increase in divisional operating expenses, which, combined with the

higher revenue, led to adjusted controllable operating profit

rising 23.4% to GBP11.6m (H1 23: GBP9.4m).

Adjusted operating profit was up 32.7% to GBP6.5m (H1 23:

GBP4.9m) despite the division being allocated a higher proportion

of central overheads, given its proportionally higher revenue for

the period. As most of the exceptional costs recorded in both this

period and in the comparative period last year related to the

Currency division rather than Authentication and amortisation was

at the same level as last year, most of the increase in profit fed

through to the IFRS operating profit level, which rose 48.7% to

GBP5.8m (H1 23: GBP3.9m).

Currency

The Currency division designs and manufactures highly secure

banknotes and banknote components that are optimised for security,

manufacturability, cash cycle efficacy and public engagement.

H1 24 H1 23 Change

GBPm GBPm

----------------------------------------- ------ ------- ----------

Revenue 113.4 116.4 (2.6)%

Gross profit 22.3 25.8 (13.6)%

Adjusted controllable operating profit* 14.1 15.7 (10.2)%

Adjusted operating profit* 1.4 4.3 (67.4)%

Operating loss (5.5) (16.5) 66.7%

----------------------------------------- ------ ------- ----------

% %

----------------------------------------- ------ ------- ----------

Gross profit margin 19.7 22.2 (250) bps

Adjusted controllable operating profit

margin* 12.4 13.5 (110) bps

Adjusted operating profit margin* 1.2 3.7 (250) bps

----------------------------------------- ------ ------- ----------

* Non-IFRS measure

Our Currency division remained profitable at the adjusted

operating profit level during its traditionally weaker first half,

delivering an adjusted operating profit of GBP1.4m (H1 23: GBP4.3m)

from marginally lower revenue of GBP113.4m (H1 23: GBP116.4m).

Revenue from banknotes was broadly flat on the comparative period

last year, security features revenue was marginally higher and

polymer was generally subdued.

Gross profit fell 13.6% to GBP22.3m (H1 23: GBP25.8m) with the

mix of sales adversely affecting margin when compared with the

prior period.

The ongoing remaining costs of the Gateshead and Kenya

facilities were reallocated to enabling function costs at the start

of FY24, which benefitted controllable operating costs within the

division. This, together with strong cost control, led adjusted

controllable operating profit to fall just 10.2% to GBP14.1m (H1

23: GBP15.7m).

GBP6.9m (H1 23: GBP20.8m) of exceptional costs of right sizing

the business for future operations led the division into an

operating loss of GBP5.5m (H1 23: loss of GBP16.5m) on an IFRS

basis. This included restructuring in the UK, together with some

further costs in relation to the wind down in Kenya. In the

equivalent period last year, a much larger divisional IFRS

operating loss was recorded, given that GBP16.8m relating to the

termination of the Portals Paper agreement was charged to the

division as an exceptional charge.

Identity solutions

As noted above, the legacy Identity Solutions business saw no

activity in H1 24 with an operating result of GBPnil (H1 23:

operating profit of GBP0.1m).

Enabling function costs

In H1 24 enabling function costs of GBP17.8m (H1 23: GBP15.9m)

rose by 11.9% and represented 11.0% of Group revenue (H1 23:

9.7%).

The rise in enabling function costs is mostly due to increased

professional fees together with the reallocation of the remaining

ongoing costs of the Gateshead and Kenya facilities into enabling

functions from the beginning of FY24. This allows for greater focus

in the central management of these projects. Most activity at

Gateshead has now ceased and we are working to relocate the

remaining functions as soon as practicable.

Exceptional items

Exceptional items during the period constituted a net charge of

GBP10.8m (H1 23: GBP21.4m) before tax.

Exceptional charges before tax included:

H1 H1 23

24

GBPm GBPm

---------------------------------------------------------- ------ ------

Site relocation and restructuring costs 7.9 2.1

Costs in relation to pension payment deferment and 3.0 -

banking refinancing

Credit loss provision/write back on Portals loan notes (0.3) 2.5

Pension underpin costs 0.2 -

Termination costs related to the Portals Paper agreement - 16.8

10.8 21.4

---------------------------------------------------------- ------ ------

GBP7.9m (H1 23: GBP2.1m) exceptional site relocation and

restructuring costs comprised:

- GBP6.5m (H1 23: GBPnil) charge for redundancy and legal fees

(GBP3.2m) (Currency and Authentication) and property, plant and

equipment impairments (GBP3.3m) (Currency) were made in relation to

restructuring initiatives in both divisions to right size the

divisions for future operations.

- A further GBP1.3m (H1 23: GBPnil) in relation to the wind down

of our operations in Kenya announced in January 2023. This included

redundancy charges of GBP0.2m, property, plant and equipment asset

impairments of GBP1.1m and other costs of GBP0.1m, offset by

GBP0.1m of proceeds from the sale of previously impaired

inventory.

- GBP0.1m (H1 23: GBP0.3m) of restructuring charges related to

the cessation of banknote production at our Gateshead facility

primarily relating to the costs, net of grant income received of

GBP0.1m, of relocating assets to different Group manufacturing

locations. This relocation of assets will continue into H2 24 as

the Group continues its expansion of the manufacturing facilities

in Malta.

- In addition, H1 23 included GBP1.8m of charges relating to

other cost out initiatives, including the initial Turnaround Plan

restructuring of our central enabling functions, selling and

commercial functions were also included within site relocation and

restructuring costs.

Costs associated with pension payment deferment and the banking

refinancing amounted to GBP3.0m (H1 23: GBPnil) in the period. This

included the following legal and professional advisor costs:

- GBP1.3m relating to amendments to the schedule of deficit

repair contributions as explained in 'Pension scheme' below.

- GBP1.7m relating to the amendment and restatement of the terms

of the revolving facility agreement on 29 June 2023, as detailed in

'Banking facilities' below.

Pension underpin costs of GBP0.2m (H1 23: GBPnil) relate to

legal fees, net of amounts recovered, incurred in the rectification

of certain discrepancies identified in the Scheme's rules. The

Directors do not consider this to have an impact on the UK defined

benefit pension liability at the current time, but they continue to

assess this.

During H1 24, a net credit loss provision release of GBP0.3m (H1

23: GBP2.5m charge) was reported on the loan notes held in Portals

International Limited where an unexpected cash repayment was

received on the loan notes from Portals International Limited

during the period.

Tax related to exceptional items amounted to a GBP4.1m tax

credit (H1 23: tax charge of GBP6.7m). Included within exceptional

tax items is a tax credit of GBP2.1m relating to the release of a

provision in relation to uncertain tax positions. This relates to

the expiry of an indemnity period in May 2023, following the Cash

Processing Solutions Limited business sale in May 2016.

The cash flow impact of exceptional items in H1 24 was a

GBP14.6m outflow (H1 23: GBP0.9m outflow) which included the final

GBP7.5m payments to Portals Paper Limited, GBP4.7m relating to site

relocation and restructuring costs, GBP2.5m of costs associated

with pension payment deferment and banking refinancing and GBP0.2m

relating to pension underpin costs, offset by the GBP0.3m received

in relation to Portals Loan notes (other financial assets).

Finance charge

The Group's net interest charge was GBP13.4m (H1 23: GBP3.3m).

This included interest income of GBP0.1m (H1 23: GBP0.6m), interest

expense of GBP12.2m (H1 23: GBP4.4m) and retirement benefit finance

expense of GBP1.3m (H1 23: income of GBP0.5m).

Interest income of GBP0.1m (H1 23: GBP0.6m) included interest

accrued on loan notes and preference shares held in the Portals

International Limited Group of GBPnil (H1 23: GBP0.5m). Interest

receivable on loan notes and preference shares is excluded from the

Group's covenant calculations.

Interest expense comprised:

H1 H1 23

24

GBPm GBPm

------------------------------------------------------ ----- ------

Bank loan interest 5.9 3.0

Lease liability interest 0.2 0.3

Charges relating to June 2023 debt modification 3.8 -

Other, including amortisation of finance arrangement

fees 2.3 1.1

12.2 4.4

------------------------------------------------------ ----- ------

The increase in bank loan interest paid in H1 24 was largely

attributable to the rises in Bank of England base rates. In H1 24

these moved from 4.25% to 5.25% over the period. By comparison in

H1 23 these moved from 0.75% to 2.25%.

The net charges relating to the debt modification of GBP3.8m (H1

23: GBPnil) relate to the changes in existing banking facilities,

treated as a non-substantial modification under IFRS 9 'Financial

Instruments'. The modification loss and its subsequent amortisation

are non-cash items. See note 4 for further information.

The IAS 19 related finance cost, which represents the difference

between the interest on pension liabilities and assets, was an

expense of GBP1.3m (H1 23: GBP0.5m income). The charge in the

period was due to the opening IAS 19 pension valuation in being a

deficit of GBP54.7m.

Taxation

The total tax credit in respect of continuing operations for the

first half was GBP5.6m (H1 23: tax charge GBP7.9m) and

comprised:

- GBP1.4m credit (H1 23: GBP1.3m charge) on adjusted loss after interest expense;

- GBP0.1m credit (H1 23: GBP0.1m credit) on the amortisation of acquired intangibles; and

- GBP4.1m credit (H1 23: GBP6.7m charge) on exceptional items,

which is described in more detail in under 'Exceptional items'

above.

Earnings per share

The basic weighted average number of shares for earnings per

share ('EPS') purposes was 195.6m (H1 23: 195.3m).

Adjusted basic loss per share was (2.6)p (H1 23: EPS of 2.0p),

reflecting the fall in adjusted basic earnings from GBP3.9m in H1

23 to a loss of GBP5.1m in H1 24.

IFRS basic loss per share from continuing operations was 6.2p

(H1 23: 12.6p) reflecting a basic loss of GBP12.2m (H1 23: loss of

GBP24.6m).

Cash flow

The conservation and generation of cash within the business has

been an area of stringent focus over the period. Net working

capital improved by GBP11.5m as we concentrated on reducing

inventory levels and on prompt payment from our customers. We

reduced our net capital expenditure outflow in Malta by seeking

timely receipt of associated grant income and kept careful control

over software development spend. This focus on strong cash control

is continuing in the second half.

More detail on the movements within our cash flows for the

period are set out below.

Cash flow from operating activities was a net cash inflow of

GBP15.4m (H1 23: GBP2.8m outflow), generated after adjusting the

GBP16.8m loss before tax (H1 23: GBP15.7m loss) for:

- GBP13.4m of net finance expense (H1 23: GBP4.0m)

- GBP9.0m of depreciation and amortisation (H1 23: GBP9.7m)

- GBP4.4m of asset impairment (H1 23: GBPnil)

- GBP2.8m decrease in provisions (H1 23: GBP0.7m decrease)

- GBP11.5m net working capital inflow (H1 23: GBP6.2m inflow) including:

o GBP9.6m decrease in inventory (H1 23: GBP2.5m increase);

o GBP20.8m decrease in trade and other receivable and contract

assets (H1 23: GBP10.8m increase) mainly due to timing of cash

collections on certain material customer contracts; and

o GBP18.9m decrease in trade and other payables and contract

liabilities (H1 23: GBP19.5m increase), due to the timing of

supplier payments and the final payment in relation to the Portals

termination agreement, paid just after the FY23 period end.

- tax payments of GBP1.2m (H1 23: GBP0.3m).

The cash outflow from investing activities of GBP2.2m (H1 23:

GBP7.4m outflow) included:

- capital expenditure on property, plant and equipment, after

cash receipts from grants, of GBP0.8m (H1 23: GBP2.5m), largely

relating to the construction of our expanded facility in Malta.

- capital expenditure on software intangibles and development

assets of GBP2.1m (H1 23: GBP5.3m).

- proceeds of GBP0.3m received from the partial settlement of Portals Loan notes.

The cash outflow from financing activities was GBP19.6m (H1 23:

inflow GBP11.0m), included:

- GBP7.0m net repayment of borrowings (H1 23: draw down of GBP16.5m),

- GBP8.3m (H1 23: GBP4.4m) of interest payments,

- GBP3.0m (H1 23: GBPnil) of debt issue cost payments relating

to the amendment of the banking facilities in June 2023, and

- GBP1.3m (H1 23: GBP1.1m) of IFRS 16 lease liability payments.

The net decrease in cash and cash equivalents in the period was

GBP6.4m (H1 23: GBP0.8 increase).

As a result of the cash flow items referred to, Group net debt

decreased from GBP82.4m at 25 March 2023 to GBP82.0m at 30

September 2023.

Net debt

The analysis below provides a reconciliation between the opening

and closing positions for liabilities arising from financing

activities together with movements in cash and cash

equivalents:

At 25 Cash Foreign At 30

March flow exchange September

2023 and other 2023

GBPm GBPm GBPm GBPm

--------------------------- -------- ------ ----------- -----------

Gross Borrowings (122.7) 7.0 - (115.7)

Cash and cash equivalents 40.3 (6.4) (0.2) 33.7

--------------------------- -------- ------ ----------- -----------

Net debt (82.4) 0.6 (0.2) (82.0)

--------------------------- -------- ------ ----------- -----------

Net debt is presented excluding unamortised pre-paid borrowing

fees of GBP4.7m (FY23: GBP5.0m), loss on debt modification of

GBP4.5m (FY23: GBP0.7m) and GBP12.2m (FY23: GBP13.3m) of lease

liabilities .

Banking facilities

On 29 June 2023 the Company signed a range of documents which

had the effect of amending and restating the terms of the revolving

facility agreement with its lending banks and their agents. These

documents are an amendment and restatement agreement with the

various lenders and the banks' agents and security agent, a

debenture between the Company, certain other Group companies and

the banks' security agent and inter-creditor agreement between the

creditors. As a result of these changes, the facilities are now

secured against material assets and shares within the Group.

Under the June amendment and restatement agreement, the banking

facilities expiration on the 1 January 2025 remained unchanged,

whilst there were also changes to:

- margins: with new interest rates introduced for net debt to EBITDA ratios over 2.5.

- changes in daily interest rates: to SONIA daily rates.

The following changes were made to the Group covenant financial

covenants and spread levels from 1 July 2023:

- EBIT/net interest payable more than or equal to 1.0 times, (3.0 times previously).

- Net debt/EBITDA less than or equal to 4.0 times until the Q4

2024 testing point, reducing to less than or equal to 3.6 times

from Q1 FY25 through to the end of that agreement, namely 1 January

2025 (3.0 times previously).

- Minimum Liquidity testing monthly, testing at each weekend

point on a 4-week historical basis and 13-week forward-looking

basis. The minimum liquidity was defined as "available cash and

undrawn RCF greater than or equal to GBP25m", although this reduced

to GBP20m if GBP5m or more of cash collateral was in place to

fulfil guarantee or bonding requirements (new test).

- Increases in spread rates on the leverage ratio as a result of the relaxation of levels:

Leverage (consolidated net debt to EBITDA) Margin (% per annum)

--------------------------------------------------- --------------------

Greater than 3.5:1 4.35

Greater than 3.0:1 and less than or equal to 3.5:1 4.15

Greater than 2.5:1 and less than or equal to 3.0:1 3.95

--------------------------------------------------- --------------------

The covenant tests use earlier accounting standards, excluding

adjustments for IFRS 16. Net debt for covenants excludes

unamortised pre-paid borrowing fees and the net loss on debt

modification.

Covenant test results as at 30 September 2023:

Test Requirement Actual at 30 September

2023

---------------------- ----------------------- -----------------------

EBIT to net interest More than or equal to

payable 1.0 2.16

Less than or equal to

Net debt to EBITDA 4.0 2.38

---------------------- ----------------------- -----------------------

Minimum liquidity at 30 September 2023 was in excess of the

GBP25m limit required under the covenant tests.

As explained above under 'Finance charges', the June 2023 change

in existing banking facilities is treated as a non-substantial

modification under IFRS 9 'Financial Instruments'.

At 30 September 2023 the Group had Bank facilities of GBP250.0m

(FY23: GBP275.0m) including an RCF cash drawn component of up to

GBP175.0m (FY23: GBP175.0m) and bond and guarantee facilities of a

maximum of GBP75.0m (FY23: GBP100.0m), which were due to mature on

1 January 2025.

The drawdowns on the RCF facility are typically rolled over on

terms of between one and three months. However, as the Group has

the intention and ability to continue to roll forward the drawdowns

under the facility, the amount borrowed has been presented as

long-term.

At 30 September 2023, the Group had a total of undrawn RCF

committed borrowing facilities, all maturing in more than one year,

of GBP60.0m (25 March 2023: GBP53.0m, all maturing in more than one

year). The amount of loans drawn on the GBP175.0m RCF cash

component was GBP115.0m as at 30 September 2023 (25 March 2023:

GBP112.0m). The accrued interest in relation to cash drawdowns

outstanding as at 30 September 2023 was GBP0.4m (25 March 2023:

GBP0.3m).

Guarantees of GBP46.0m (26 March 2023: GBP52.1m) were drawn at

30 September 2023 using the GBP75.0m guarantee facility. The bond

and guarantee facilities provide guarantees or bonds to participate

in tenders and function as back up to contracts, where the

customers require a guarantee as part of their procurement process.

In addition, the facilities underpin some advance payments from

customers. The Group considers the provision of such bonds to be in

its ordinary course of business.

On 18 December 2023 the Group entered into a new agreement with

its banking syndicate to extend its banking facilities to July

2025. From this date the Group will have Bank facilities of GBP235m

including an RCF cash drawn component of up to GBP160m (a reduction

of GBP15m) and bond and guarantee facilities of a maximum of

GBP75m. The covenant tests described above will continue to apply

to the facilities, other than the liquidity covenant where the

minimum headroom is now defined as "available cash and undrawn RCF

greater than or equal to GBP10m", to reflect the GBP15m reduction

in RCF. In addition an arrangement fee is due, equal to 1% of the

facility, which will reduce to 0.5% if the facility is refinanced

before 30 June 2024.

Pension scheme

The Company has not paid any deficit repair contributions to the

Scheme over the period to 30 September 2023. On 3 April 2023, the

Company and the Trustee agreed to defer the deficit repair

contribution due, payable on 5 April 2023, to 26 May 2023.

Subsequently, on 25 May 2023 the Company and the Trustee agreed to

defer the deficit contribution due on 26 May 2023 to 5 July 2023.

In June 2023, the Company and the Trustee agreed to defer all the

deficit repair contributions due to recommence from 5 July 2023 and

a new Recovery Plan was then agreed between the Company and the

Trustee which deferred all deficit repair contributions until July

2024. Under the Recovery Plan, the amount deferred, totalling

GBP18.75m, would be paid to the Scheme, from FY26 to FY29.

An actuarial valuation of the Scheme has been undertaken as at

30 September 2023. This showed a Scheme deficit of GBP78m. As a

result of this new valuation, on 18 December 2023, the Company and

the Scheme Trustee agreed a new schedule to fund the deficit. The

funding moratorium until July 2024 as previously agreed will be

retained, with the only payment being GBP1.25m due under the June

2023 Recovery Plan. This will be followed by deficit repair

contributions from the Company of GBP8m per annum to the end of

FY27, followed by higher contributions that at no time exceed

GBP16m per annum and which run until December 2030 or until the

Scheme becomes fully funded.

The next periodic actuarial valuation will be as at the end of

September 2026, with the Scheme Trustee undertaking to provide the

results of this valuation by January 2027, ahead of any increase in

contribution from GBP8m per annum.

The valuation of the Scheme on an IAS 19 basis at 30 September

2023 is a net liability of GBP60.5m (25 March 2023: net liability

of GBP54.7m).

The charge to the adjusted operating profit in respect of the

Scheme in the period was GBP0.6m (H1 23: GBP0.8m). Under IAS 19

there was a finance charge of GBP1.3m (H1 23: finance credit of

GBP0.5m) arising from the difference between the interest cost on

liabilities and the interest income on scheme assets.

Capital structure

At 30 September 2023 the Group had net assets of GBP4.2m (25

March 2023: GBP22.6m restated).

In the prior period (FY23) deferred tax assets were incorrectly

reported, being overstated by GBP12.4m. This has had an impact in

the second half of FY23 only and has no impact on H1 23 or earlier

reported periods. Neither does it have any cash impact on the

Group.

The prior year revision is a technical accounting point whereby

the Company has incorrectly treated a taxable timing difference as

a permanent timing difference, the error is in relation to external

interest expense which is restricted to 30% of EBITDA. The company

has claimed, and intends to continue to claim and carry forward,

the amounts arising from the interest restriction for use against

future profits.

Further information can be found in the Basis of Preparation

section below.

The movement during the period included:

GBPm

--------------------------------------------------------------- -------

Opening net assets - 25 March 2023 - as reported 35.0

Prior year revision (12.4)

--------------------------------------------------------------- -------

Opening net assets - 25 March 2023 - restated 22.6

Loss for the period (11.2)

Remeasurement loss on retirement benefit obligations (4.5)

Tax related to remeasurement of net defined benefit liability (1.7)

Other movements in other comprehensive income (1.0)

Foreign exchange movements (1.1)

Employee share scheme charges 0.8

Share capital issued 0.3

Closing net assets - 30 September 2023 4.2

--------------------------------------------------------------- -------

DIRECTORS' REPORT

Principal risks and uncertainties

Throughout its global operations De La Rue faces various risks,

both internal and external, which could have a material impact on

the Group's performance. The Group manages the risks inherent in

its operations in order to mitigate exposure to all forms of risks,

where practical, and to transfer risk to insurers where

applicable.

The Group analyses the risks that it faces under the following

broad headings: strategic risks (technological revolution, strategy

implementation, changes to the market environment and economic

conditions), operational risks, legal and regulatory, information

risks and financial risks (currency risk, credit risk, liquidity

risk, interest rate risk and commodity price risk).

The principal risks and uncertainties are reviewed and updated

at least quarterly. Currently we expect the key risks for the

remaining six months of the financial year to include:

- bribery and corruption;

- quality management and delivery failure;

- macroeconomic and geo-political environment;

- loss of a key site or process;

- sustainability and climate change;

- loss of key talent;

- breach of information security;

- supply chain failure;

- breach of security - product security;

- sanctions; and

- banking facilities.

The principal risks remain in line with the Annual Report and

Accounts for FY23, however, the Group continues to monitor and work

to mitigate headwinds in commodity and energy costs and challenges

in the supply chain.

The Group has not experienced any specific impact from the war

in Ukraine and the Israel-Hamas war, other than the global economic

conditions.

Going concern

Going concern assessments are included with the Basis of

Preparation section of these Interim Financial Statements. These

Interim Financial Statements do not contain the adjustments that

would result if the company was unable to continue as a going

concern.

A copy of the 2023 Annual Report is available at www.delarue.com

or on request from the Company's registered office at De La Rue

House, Jays Close, Viables, Basingstoke, Hampshire, RG22 4BS.

Related Party Transactions

Details of the related party transactions that have taken place

in the first six months of the current financial year are provided

in note 12 to the Condensed Consolidated Interim Financial

Statements. None of these have materially affected the financial

position or the performance of the Group during that period, and

there have been no changes during the first six months of the

financial year in the related party transactions described in the

last annual report that could materially affect the financial

position or performance of the Group.

Statement of Directors' responsibilities

The Directors confirm that, to the best of their knowledge:

- the Condensed Consolidated Interim Financial Statements, which

have been prepared in accordance with UK adopted IAS 34 'Interim

Financial Reporting', give a true and fair view of the assets,

liabilities, financial position and profit of the Company and the

undertakings included in the consolidation as a whole;

- the interim management report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

Condensed Consolidated Interim Financial Statements; and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that have taken place in the first

six months of the financial year and that have materially affected

the financial position or performance of the entity during that

period; and any changes during the first six months of the

financial year in the related party transactions described in the

last annual report that could materially affect the financial

position or performance of the entity.

The Board of Directors of De La Rue plc at 25 March 2023 and

their respective responsibilities can be found on pages 72 and 73

of the De La Rue plc Annual Report 2023. Since the year end there

have been the following changes to the Board:

- Kevin Loosemore, Non-Executive Chairman resigned - 1 May 2023

- Clive Whiley, Non-Executive Chairman appointed - 18 May 2023

- Catherine Ashton, Independent Non-Executive Director resigned - 12 June 2023

- Dean Moore, Independent Non-Executive Director appointed - 26

June 2023 and as Interim Chief Financial Officer - 4 August

2023

- Rob Harding, Chief Financial Officer resigned - 28 July 2023

- Margaret Rice-Jones, Independent Non-Executive Director resigned - 7 September 2023

- Brian Small, Independent Non-Executive Director appointed - 8 September 2023

For and on behalf of the Board

Clive Whiley

Chairman

19 December 2023

INDEPENT REVIEW REPORT TO DE LA RUE PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2023 which comprises the Group

condensed consolidated interim income statement, the Group

condensed consolidated interim statement of comprehensive

income/(loss), the Group condensed consolidated interim balance

sheet, the Group condensed consolidated interim statement of

changes in equity, the Group condensed consolidated interim

statement of cash flows, and the notes to the condensed

consolidated interim financial statements. We have read the other

information contained in the half yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2023 is not prepared, in all material respects, in

accordance with UK adopted International Accounting Standard 34 and

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements 2410 (UK) "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" (ISRE) issued by the Financial Reporting Council. A review

of interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures. A

review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Conclusions Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

Conclusion section of this report, nothing has come to our

attention to suggest that management have inappropriately adopted

the going concern basis of accounting or that management have

identified material uncertainties relating to going concern that

are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with this ISRE, however future events or conditions may

cause the entity to cease to continue as a going concern.

Responsibilities of the directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern (including the material uncertainty set out in Note 1) and

using the going concern basis of accounting unless the directors

either intend to liquidate the company or to cease operations, or

have no realistic alternative but to do so.

Auditor's Responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statements in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

This report is made solely to the company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK) "Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Financial

Reporting Council. To the fullest extent permitted by law, we do

not accept or assume responsibility to anyone other than the

company, for our work, for this report, or for the conclusions we

have formed.

Ernst & Young LLP

Reading

19 December 2023

GROUP CONDENSED CONSOLIDATED INTERIM INCOME STATEMENT -

UNAUDITED

FOR THE HALF YEARED 30 SEPTEMBER 2023

H1 24 H1 23

Note GBPm GBPm

---------------------------------------------------------- ----- -------- --------

Revenue from customer contracts 2 161.5 164.3

Cost of sales (121.3) (122.5)

---------------------------------------------------------- ----- -------- --------

Gross Profit 40.2 41.8

Adjusted operating expenses (32.3) (32.5)

---------------------------------------------------------- ----- -------- --------

Adjusted operating profit 7.9 9.3

Adjusted items(1) :

* Amortisation of acquired intangible assets (0.5) (0.5)

* Net exceptional items - expected credit loss 3 0.3 (2.5)

* Net exceptional items 3 (11.1) (18.9)

---------------------------------------------------------- ----- -------- --------

* Net exceptional items - Total 3 (10.8) (21.4)

Operating loss (3.4) (12.6)

Interest income 0.1 0.6

Interest expense (12.2) (4.4)

Net retirement benefit obligation finance

(charge)/income (1.3) 0.5

---------------------------------------------------------- ----- -------- --------

Net finance expense 4 (13.4) (3.3)

Loss before taxation from continuing

operations (16.8) (15.9)

Taxation 5 5.6 (7.9)

---------------------------------------------------------- ----- -------- --------

Loss for the period from continuing

operations (11.2) (23.8)

Profit from discontinued operations - 0.2

---------------------------------------------------------- ----- -------- --------

Loss for the period (11.2) (23.6)

---------------------------------------------------------- ----- -------- --------

Attributable to:

* Owners of the parent (12.2) (24.4)

* Non-controlling interests 11 1.0 0.8

---------------------------------------------------------- ----- -------- --------

Loss for the period (11.2) (23.6)

---------------------------------------------------------- ----- -------- --------

Earnings per ordinary share

Basic

Basic EPS continuing operations 6 (6.2)p (12.6)p

Basic EPS discontinued operations 6 - 0.1p

---------------------------------------------------------- ----- -------- --------

Total Basic earnings per share 6 (6.2)p (12.5)p

---------------------------------------------------------- ----- -------- --------

Diluted

Diluted EPS continuing operations 6 (6.2)p (12.6)p

Diluted EPS discontinued operations 6 - 0.1p

---------------------------------------------------------- ----- -------- --------

Total Diluted earnings per share 6 (6.2)p (12.5)p

---------------------------------------------------------- ----- -------- --------

(1) For adjusting items, the cash flow impact of exceptional

items can be found in note 3 and there was no cash flow impact for

the amortisation of acquired intangible assets.

GROUP CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME/(LOSS) - UNAUDITED

FOR THE HALF YEARED 30 SEPTEMBER 2023

H1 24 H1 23

GBPm GBPm

------------------------------------------------------ ------- -------

Loss for the financial period (11.2) (23.6)

Other comprehensive (expense)/income:

Items that are not reclassified subsequently

to income statement:

Re-measurement losses on retirement benefit

obligations (note 9) (4.5) (74.0)

Tax related to remeasurement of net defined

benefit liability (1.7) 16.9

------- -------

(6.2) (57.1)

Items that may be reclassified subsequently

to income statement:

Foreign currency translation difference for

foreign operations (1.8) 7.0

Foreign currency translation difference for

foreign operations - non-controlling interests 0.7 0.6

Change in fair value of cash flow hedges (1.2) (1.9)

Change in fair value of cash flow hedges transferred

to income statement (0.1) 0.8

Tax related to cash flow hedge movements 0.3 0.4

------- -------

(1.0) (0.7)

Other comprehensive loss for the period,

net of tax (8.3) (50.2)

------------------------------------------------------- ------- -------

Total comprehensive loss for the period (19.5) (73.8)

------------------------------------------------------- ------- -------

Total comprehensive income/(loss) for the

period attributable to:

Equity shareholders of the Company (20.1) (75.2)

Non-controlling interests 0.6 1.4

------------------------------------------------------- ------- -------

(19.5) (73.8)

------------------------------------------------------ ------- -------

GROUP CONDENSED CONSOLIDATED INTERIM BALANCE SHEET

AT 30 SEPTEMBER 2023

H1 24 FY 23

(unaudited) (audited)

Note restated*

GBPm GBPm

------------------------------------------- ------- --------------- -----------

ASSETS

Non-current assets

Property, plant and equipment 87.4 97.1

Intangible assets 38.4 39.3

Right-of use assets 11.1 12.1

Deferred tax assets 7.5 5.9

144.4 154.4

------------------------------------------- ------- --------------- -----------

Current assets

Inventories 39.9 49.3

Trade and other receivables 58.9 70.7

Contract assets 13.9 18.9

Current tax assets - 0.2

Derivative financial instruments 7 1.2 2.4

Cash and cash equivalents 33.7 40.3

------------------------------------------- ------- --------------- -----------

147.6 181.8

------------------------------------------- ------- --------------- -----------

Total assets 292.0 336.2

------------------------------------------- ------- --------------- -----------

LIABILITIES

Current liabilities

Trade and other payables (70.8) (92.1)

Current tax liabilities (19.2) (23.2)

Derivative financial liabilities 7 (2.6) (1.9)

Lease liabilities (3.0) (3.0)

Provisions for liabilities and charges 10 (3.2) (6.0)

------------------------------------------- ------- --------------- -----------

(98.8) (126.2)

------------------------------------------- ------- --------------- -----------

Non-current liabilities

Borrowings (115.5) (118.4)

Retirement benefit obligations 9 (60.5) (54.7)

Deferred tax liabilities (2.6) (2.8)

Lease liabilities (9.2) (10.3)

Other non-current liabilities (1.2) (1.2)

------------------------------------------- ------- --------------- -----------

(189.0) (187.4)

------------------------------------------- ------- --------------- -----------

Total liabilities (287.8) (313.6)

------------------------------------------- ------- --------------- -----------

Net assets 4.2 22.6

------------------------------------------- ------- --------------- -----------

EQUITY

Share capital 89.0 88.8

Share premium account 42.3 42.2

Capital redemption reserve 5.9 5.9

Hedge reserve (0.9) 0.1

Cumulative translation adjustment 7.4 9.2

Other reserves (83.8) (83.8)

Retained earnings (73.3) (55.7)

------------------------------------------- ------- --------------- -----------

Total equity attributable to shareholders

of the Company (13.4) 6.7

Non-controlling interests 11 17.6 15.9

------------------------------------------- ------- --------------- -----------

Total Equity 4.2 22.6

------------------------------------------- ------- --------------- -----------

*The Group Consolidated Balance Sheet for FY23 has been restated

as described in the Basis of preparation below.

GROUP CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN

EQUITY - UNAUDITED

FOR THE HALF YEARED 30 SEPTEMBER 2023

Attributable to equity shareholders Non- Total

controlling equity

interests

------------------------------------------------------------------------------

Share Share Capital Hedge Cumulative Other Retained

capital premium redemption reserve translation reserves reserves

account reserve adjustment

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------ -------- -------- ----------- -------- ------------ --------- ---------- ------------ ---------

Balance at 26

March

2022 88.8 42.2 5.9 (0.5) 4.2 (31.9) 35.1 18.0 161.8

(Loss)/profit for

the period - - - - - - (24.4) 0.8 (23.6)

Other

comprehensive

income for the

period,

net of tax - - - (0.7) 7.0 - (57.1) 0.6 (50.2)

------------------ -------- -------- ----------- -------- ------------ --------- ---------- ------------ ---------

Total

comprehensive

income - - - (0.7) 7.0 - (81.5) 1.4 (73.8)

Transactions with

owners of the

Company

recognised

directly

in equity:

Employee share

scheme

- value of

services

provided - - - - - - 1.0 - 1.0

Share capital

issued - 0.1 - - - - - - 0.1

Other - unclaimed

dividends - - - - - - 0.3 - 0.3

------------------ -------- -------- ----------- -------- ------------ --------- ---------- ------------ ---------

Balance at 24

September

2022 88.8 42.3 5.9 (1.2) 11.2 (31.9) (45.1) 19.4 89.4

------------------ -------- -------- ----------- -------- ------------ --------- ---------- ------------ ---------

Balance at 26

March

2022 88.8 42.2 5.9 (0.5) 4.2 (31.9) 35.1 18.0 161.8

Loss for the

period - - - - - - (55.9) (1.3) (57.2)

Other

comprehensive

income for the

year,

net of tax - as

reported - - - 0.6 5.0 - (76.2) - (70.6)

Prior year

revision - - - - - - (12.4) - (12.4)

Other

comprehensive

income for the

year,

net of tax -

restated - - - 0.6 5.0 - (88.6) - (83.0)

Total

comprehensive

income - - - 0.6 5.0 - (144.5) (1.3) (140.2)

Reclassification

between reserves - - - - - (51.9) 51.9 - -

Transactions with

owners of the

Company

recognised

directly

in equity:

Employee share

scheme

- value of

services

provided - - - - - - 1.9 - 1.9

Tax on income and

expenses

recognised

directly in

equity - - - - - - (0.5) - (0.5)

Dividends Paid - - - - - - - (0.8) (0.8)

Other - unclaimed

dividends - - - - - - 0.4 - 0.4

------------------ -------- -------- ----------- -------- ------------ --------- ---------- ------------ ---------

Balance at 25

March

2023 88.8 42.2 5.9 0.1 9.2 (83.8) (55.7) 15.9 22.6

------------------ -------- -------- ----------- -------- ------------ --------- ---------- ------------ ---------

(Loss)/profit for

the period - - - - - - (12.2) 1.0 (11.2)

Other

comprehensive

income for the

period,

net of tax - - - (1.0) (1.8) - (6.2) 0.7 (8.3)

------------------ -------- -------- ----------- -------- ------------ --------- ---------- ------------ ---------

Total

comprehensive

income - - - (1.0) (1.8) - (18.4) 1.7 (19.5)

Transactions with

owners of the

Company

recognised

directly

in equity:

Employee share

scheme

- value of

services

provided - - - - - - 0.8 - 0.8

Share capital

issued 0.2 0.1 - - - - - - 0.3

Balance at 30

September

2023 89.0 42.3 5.9 (0.9) 7.4 (83.8) (73.3) 17.6 4.2

------------------ -------- -------- ----------- -------- ------------ --------- ---------- ------------ ---------

GROUP CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN

EQUITY (Continued) - UNAUDITED

FOR THE HALF YEARED 30 SEPTEMBER 2023

Share premium account

This reserve arises from the issuance of shares for

consideration in excess of their nominal value.

Capital redemption reserve

This reserve represents the nominal value of shares redeemed by

the Company.

Hedge reserve

This reserve records the portion of any gain or loss on hedging

instruments that are determined to be effective cash flow hedges.

When the hedged transaction occurs, the gain or loss on the hedging

instrument is transferred out of equity to the income statement. If

a forecast transaction is no longer expected to occur, the gain or

loss on the related hedging instrument previously recognised in

equity is transferred to the income statement.

Cumulative translation adjustment ("CTA")

This reserve records cumulative exchange differences arising

from the translation of the financial statements of foreign

entities since transition to IFRS. Upon disposal of foreign

operations, the related accumulated exchange differences are

recycled to the income statement. This reserve also records the

effect of hedging net investments in foreign operations.

Other reserves

On 1 February 2000, the Company issued and credited as fully

paid 191,646,873 ordinary shares of 25p each and paid cash of

GBP103.7m to acquire the issued share capital of De La Rue plc (now

De La Rue Holdings Limited), following the approval of a High Court

Scheme of Arrangement. In exchange for every 20 ordinary shares in

De La Rue plc, shareholders received 17 ordinary shares plus 920p

in cash. The other reserve of GBP83.8m arose as a result of this

transaction and is a permanent adjustment to the consolidated

financial statements.

On 17 June 2020 the Group announced that it would issue new

ordinary shares via a "cash box" structure to raise gross proceeds

of GBP100m, in order to provide the Company and its management with

operational and financial flexibility to implement De La Rue's

turnaround plan, which was first announced by the Company earlier

in the year. The cashbox completed on 7 July 2020 and consisted of

a firm placing, placing and open offer. The Group issued 90.9m new

ordinary shares each with a nominal value of 44 152/175p, at a

price of 110p per share (giving gross proceeds of GBP100m). A "cash