TIDMENOG

RNS Number : 0745A

Energean PLC

18 January 2024

Energean plc

("Energean" or the "Company")

Trading Statement & Operational Update

London, 18 January 2024 - Energean plc (LSE: ENOG TASE: ) is

pleased to provide an update on recent operations and the Group's

trading performance in the 12-months to 31 December 2023 together

with guidance for 2024. This information is unaudited and subject

to further review. Energean will release its 2023 full year results

on 21 March 2024.

Mathios Rigas, Chief Executive Officer of Energean,

commented:

"2023 was the year we became the major independent gas producer

in the Mediterranean. Despite the challenging regional geopolitical

developments, we stabilised the production of the Energean Power

FPSO, which operated at 99% [1] uptime during Q4 2023, and we

produced at a maximum rate of 150 kboed from our 1 billion+ boe

pan-Mediterranean portfolio, with full year production in line with

our latest guidance.

"Energean has always focused on stable, long-term value creation

and delivery for all our stakeholders. We are making good progress

on the path to our near-term targets of 200 kboed, $1.75 billion

adjusted EBITDAX and leverage of c.1.5x. Our strong operational and

financial performance underpins our stated dividend policy.

"2024 shows significant potential; we are well advanced with our

core strategic projects across Israel, Egypt, Italy and Greece, and

have extended our footprint with a new gas development in Morocco.

As we continue to optimise our portfolio, we look forward to

enhancing our position as the leading independent gas-focused

exploration, development and production company in the region."

"I want to thank all our staff for their dedication and

commitment to Energean; it is their excellence, during a uniquely

challenging time, that has driven our success."

Operational Highlights

-- FY 2023 production of 123 kboed (83% gas) in line with latest

full year guidance of 120-130 kboed.

o Day-to-day production in Israel continues to be unimpacted by

the ongoing geopolitical developments.

o FPSO uptime (excluding planned shutdowns) was 99%(1) in Q4

2023.

-- NEA/NI (Egypt) project completed on time and on budget, with

the PY#1 and NI#1 wells brought online at the end of December 2023;

production in line with expectations.

-- New areas of development underway to expand and diversify the current business base:

o Phase 1 of the Katlan (Israel) Field Development Plan approved

by the Israeli Government[2]; Final Investment Decision ("FID")

expected upon finalisation of the Engineering, Procurement and

Construction ("EPC") terms, which are currently under

negotiation.

o New potential areas of growth in Italy following the

conclusion of the PITESAI review, which has opened up previously

frozen concessions in the Upper Adriatic and Sicilian Channel.

o Discussions initiated to merge the Abu Qir, NEA and NI (Egypt)

concessions to streamline the fiscal terms and extend the economic

life of the fields.

o Morocco farm-in expected to complete in the coming months;

appraisal well planned for 2024.

o Prinos Carbon Storage project progressing well and now

included within the European Commission's Projects of Common

Interest.

Corporate and Financial Highlights

-- Strong financial performance for the 12 months to 31 December

2023, following the first full year of production contribution from

Karish (Israel).

o Revenues of $1,419.4 million, a 93% increase (FY 2022: $737.1

million).

o Cost of Production per barrel (excluding royalties) of $6.5 ,

a 59% decrease (FY 2022: $15.9/boe).

o Adjusted EBITDAX of $925 million, a 119% increase (FY 2022:

$421.6 million).

-- Strong balance sheet maintained; ongoing deleveraging:

o 50% reduction in Group leverage to 3x (FY 2022: 6x).

o Group cash as of 31 December 2023 was $372 million, including

restricted amounts of $26 million Total liquidity was $607

million.

o No immediate debt maturities following Energean Israel's bond

refinancing in July 2023.

-- Q3 2023 dividend of 30 US$cents/share paid on 29 December 2023; total of 120 US$cents/share ($214million) returned to shareholders in 2023.

-- Scope 1 and 2 emissions intensity of approximately 9.4

kgCO2e/boe, a 41% reduction versus the 12 months ended 31 December

2022.

FY 2023 FY 2022 Increase

/ (Decrease)

%

Average working interest

production kboed 123 42 200%

----------- ------------------- ------------------ --------------

Sales and other revenues $ million 1,419 737 93%

----------- ------------------- ------------------ --------------

478 (of which 284 (of which

Cash Cost of Production $ million 185 is royalties) 46 is royalties) 68%

----------- ------------------- ------------------ --------------

10.6 (of 18.9 (of

which 4.1 which 3.0

Cash Cost of Production ($/boe) is royalties) is royalties) (44%)

----------- ------------------- ------------------ --------------

Adjusted EBITDAX[3] $ million 925 422 119%

----------- ------------------- ------------------ --------------

Development and production

expenditure $ million 566 729 (22%)

----------- ------------------- ------------------ --------------

Exploration expenditure $ million 57 140 (59%)

----------- ------------------- ------------------ --------------

Decommissioning expenditure $ million 19 9 110%

----------- ------------------- ------------------ --------------

31 December 31 December Increase

2023 2022 / (Decrease)

%

----------- ------------------- ------------------ --------------

Net Debt (including restricted

cash) $ million 2,849 2,518 13%

----------- ------------------- ------------------ --------------

Leverage (Net Debt / Adjusted

EBITDAX) 3x 6x (50%)

------------------- ------------------ --------------

Outlook

-- 2024 working interest production is expected to be between

155 - 175 kboed (weighted towards the second half of 2024), a

significant step up towards Energean's near-term targets.

o This range is primarily driven by Energean's gas demand

outlook for 2024 in Israel, which has been influenced by the coal

phase-out delays and warmer than average winter temperatures so

far.

-- Remaining growth projects expected to be brought online in 2024:

o Karish North first gas in Q1 2024; the second oil train will

be installed as soon as the security situation allows.

o Cassiopea first gas expected in the summer of 2024.

-- 2024 development and production capital expenditure expected to be $400-500 million

-- Results of the Orion-1x exploration well (Egypt).

-- Quarterly dividend payments intended to be declared in line

with previously communicated dividend policy.

Conference call

A webcast will be held today at 08:30 GMT / 10:30 Israel

Time.

Webcast: https://brrmedia.news/ENOG_JTU24

Dial-In: +44 (0) 33 0551 0200

Dial-in (Israel only): +972 (0) 3 376 1321

Confirmation code: Energean

The presentation slides will be made available on the website

shortly at www.energean.com .

Enquiries

For capital markets: ir@energean.com

Kyrah McKenzie, Investor Relations Manager Tel: +44 7921 210

862

For media: pblewer@energean.com

Paddy Blewer, Head of Corporate Communications Tel: +44 7765 250

857

Energean Operational Review

Production

In the 12 months to 31 December 2023, average working production

was 123 kboed (83% gas), within the latest guidance range of

120-130 kboed. Q4 2023 production averaged 135 kboed (83% gas).

In Israel, production averaged 485 mmscfd (5 bcm/yr equivalent)

in the fourth quarter, primarily as a result of the planned six-day

shutdown in early December to enable the hook-up of the Karish

North well and second gas export riser. The FPSO uptime during the

quarter was 99%(1) . Day-to-day production remains unimpacted as a

result of the ongoing geopolitical developments.

Portfolio-wide production in 2024 is expected to be 155-175

kboed. This range is primarily driven by Energean's gas demand

outlook for 2024 in Israel, which has been influenced by the coal

phase-out delays and warmer than average winter temperatures so

far.

Energean is actively seeking additional gas contracts, to

continue supporting the domestic demand, expanding to export in the

medium-term.

FY 2023 FY 2024 guidance

Kboed Kboed

Israel 87 115-130

(including 4.4 (including 5.7 -6.4

bcm of sales gas) bcm of sales gas)

--------------------- ---------------------

Egypt 25 (86% gas) 29-31

--------------------- ---------------------

Rest of portfolio 11 (34% gas) 11-14

--------------------- ---------------------

Total production 123 (83% gas) 155-175

--------------------- ---------------------

Development

Israel - Karish Growth Projects

Karish North is expected online in Q1 2024 and will utilise the

second gas export riser, which has been fully installed, once

onstream.

The second oil train will be will be installed as soon as the

security situation allows.

Israel - Katlan

Energean intends to develop the Katlan/Tanin area in a phased

development. Phase 1 includes the Athena, Zeus, Hera and Apollo

accumulations, for which the field development plan was approved by

the Israeli Government in December 2023. Energean expects to take

FID expected upon finalisation of EPC terms, which are currently

under negotiation.

Egypt

The NEA/NI development was completed in December 2023, with the

remaining two wells PY#1 and NI#1 brought online on 30 December

2023. Overall production from the fields is currently 72 mmscfd (13

kboed), in line with expectations.

An infill well (NAQPII#2) on the Abu Qir field began drilling in

December 2023 and was brought online in January 2024. Energean is

evaluating other infill and step-out exploration opportunities

around its Abu Qir hub.

Energean is working in partnership with the Egyptian authorities

to merge its three production concessions (Abu Qir, NEA and NI)

into a single concession. The resultant single concession is

expected to streamline the fiscal conditions and extend the

economic life of the fields.

At 31 December 2023, net receivables (after provision for bad

and doubtful debts) in Egypt were $149 million (30 September 2023:

$162 million), of which $101 million (30 September 2023: $119

million) was classified as overdue.

Italy

At Cassiopea (W.I. 40% non-operator), drilling operations began

in November 2023. First gas remains on track for the summer of

2024. Also in 2024 on the Cassiopea licence, Energean expects to

participate in two near-field drilling targets (Gemini and

Centauro) with its partner ENI (operator; 60%).

In December 2023, the Italian government introduced a new

framework to unlock previously frozen concessions as part of its

PITESAI review. Energean is subsequently focused on progressing

certain non-operated concessions in the Upper Adriatic and Sicilian

Channel, with the expectation to unlock additional reserves.

Greece

Energean's Prinos Carbon Storage ("CS") project in Greece has

been included by the European Commission as a Project of Common

Interest. Non-binding memorandum of understandings have been signed

for c.5 million tonnes per annum of storage and EUR 150 million of

grants have been committed. Energean is advancing the conversion of

its exploration licence into a storage permit.

Exploration

Egypt

Drilling operations are ongoing on the Orion-1X exploration well

(W.I. 19% subject to final government approvals expected shortly;

non-operator) located on the North East Hap'y Concession, offshore

Egypt.

Energean Corporate Review

Morocco country entry

As announced on 7 December 2023, Energean agreed to farm-in to

Chariot Limited ("Chariot", AIM:CHAR) acreage offshore Morocco,

which includes the 18 bcm (gross)[4] Anchois gas development and

significant exploration prospectivity. Approval by the Moroccan

Authorities is expected in the near-term, with closing of the

transaction expected shortly thereafter.

Energean (Operator) and Chariot plan to drill an appraisal well

on the Anchois field in 2024.

Kerogen convertible

As announced on 13 December 2023, Energean received a conversion

notice in respect of $50 million worth of convertible loan notes

from Kerogen Investments No. 38 Limited, resulting in the issuance

of 4,422,013 new ordinary shares ("New Ordinary Shares") at a

conversion price of GBP 8.3843 per New Ordinary Share. The New

Ordinary Shares were admitted for trading on the London and Tel

Aviv Stock Exchanges on 20 December 2023.

Dividend

In 2023, Energean returned a total of US$1.20/share to

shareholders (approximately $214 million), representing four

quarters of dividend payments.

In 2024, Energean intends to continue to pay quarterly dividends

to its shareholders in line with its previously communicated

dividend policy.

Net Zero progress

Energean's scope 1 and 2 emissions intensity in the 12 months to

31 December 2023 was estimated to be approximately 9.4 kgCO2e/boe,

a 41% reduction versus 31 December 2022 (16.0 kgCO2e/boe), in line

with guidance. FY 2024 emissions intensity are expected between

8.5-9.0 kgCO2e/boe.

2024 guidance

FY 2024

Production

------------

Israel (kboed) 115-130

------------

Egypt (kboed) 29-31

------------

Rest of portfolio (kboed) 11-14

------------

Total Production (kboed) 155-175

------------

Consolidated net debt ($ million) 2,800-2,900

------------

Cash Cost of Production (operating

costs plus royalties)

------------

Israel ($ million) 350-380

------------

Egypt ($ million) 30-40

------------

Rest of portfolio ($ million) 190-210

------------

Total Cash Cost of Production ($ million) 570-630

------------

Development and production capital

expenditure

------------

Israel ($ million) 150-200

------------

Egypt ($ million) 30-50

------------

Rest of portfolio ($ million) 220-250[5]

------------

Total development & production capital

expenditure ($ million) 400-500

------------

Exploration and appraisal expenditure

($ million) 130-170[6]

------------

Decommissioning expenditure ($ million) 40-50

------------

Forward looking statements

This announcement contains statements that are, or are deemed to

be, forward-looking statements. In some instances, forward-looking

statements can be identified by the use of terms such as

"projects", "forecasts", "on track", "anticipates", "expects",

"believes", "intends", "may", "will", or "should" or, in each case,

their negative or other variations or comparable terminology.

Forward-looking statements are subject to a number of known and

unknown risks and uncertainties that may cause actual results and

events to differ materially from those expressed in or implied by

such forward-looking statements, including, but not limited to:

general economic and business conditions; demand for the Company's

products and services; competitive factors in the industries in

which the Company operates; exchange rate fluctuations;

legislative, fiscal and regulatory developments; political risks;

terrorism, acts of war and pandemics; changes in law and legal

interpretations; and the impact of technological change.

Forward-looking statements speak only as of the date of such

statements and, except as required by applicable law, the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise. The information contained in this

announcement is subject to change without notice.

[1] Uptime is defined as the number of hours that the Energean

Power FPSO was operating; the Q4 2023 figure excludes the scheduled

6-day shutdown that occurred in December.

[2] Energean intends to develop the Katlan/Tanin area in a

phased development. Phase 1 includes the Athena, Zeus, Hera and

Apollo accumulations, for which the FDP has received government

approval.

[3] Adjusted EBITDAX is calculated as profit or loss for the

period, adjusted for discontinued operations, taxation,

depreciation and amortisation, share-based payment charge,

impairment of property, plant and equipment, other income and

expenses, net finance costs and exploration and evaluation

expenses.

[4] As per Chariot's latest competent persons report covering

the Anchois Field that has certified gross 2C contingent resources

of 18 bcm in the discovered gas sands

[5] Includes $20-25 million of expenditure on the Prinos Carbon

Storage project in Greece, which is expected to be covered by EU

grants

[6] Includes the Anchois appraisal well in Morocco

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRMMTMTBBTTI

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

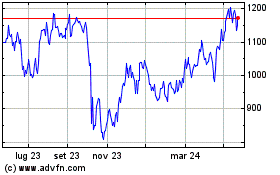

Grafico Azioni Energean (LSE:ENOG)

Storico

Da Dic 2024 a Gen 2025

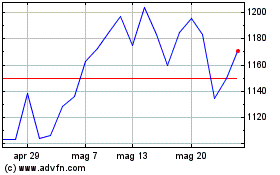

Grafico Azioni Energean (LSE:ENOG)

Storico

Da Gen 2024 a Gen 2025