Stobart Group Limited Pre-Close Trading Statement (2979Q)

29 Agosto 2014 - 8:01AM

UK Regulatory

TIDMSTOB

RNS Number : 2979Q

Stobart Group Limited

29 August 2014

29 August 2014

STOBART GROUP LIMITED

('Stobart' or 'the Group')

Pre-Close Trading Statement

Stobart Group, the infrastructure and support services group,

issues the following pre-close trading statement prior to the

announcement of the interim results for the six months to 31 August

2014, which is expected to be made on 23 October 2014.

Andrew Tinkler, Chief Executive Officer, said "We have seen

encouraging year on year growth in biomass tonnages supplied and

passenger numbers, which are key performance indicators in our

Energy and Aviation divisions respectively. Whilst the rate of

development against our plans in these growing businesses is hard

to predict accurately in the short term, the Board is satisfied

with the performance achieved to date and is confident of

delivering strong returns over the medium term. In the period to

date we have returned to shareholders GBP34.6m via share buybacks,

and GBP13.2m via dividends paid in July."

Following the partial realisation of the Transport &

Distribution business in April, the Group is now organised in five

divisions: Infrastructure, Energy, Aviation, Rail and Investments.

This is the first year of operation for our new divisions and it is

pleasing to be able to report satisfactory progress in all of

them.

In our Infrastructure division, we are targeting financial close

for investment in two large combined heat and power (CHP) energy

plants over the next six months. We have continued our strategy of

active property asset management and disposals, with the completion

of the sale of four properties in the period to date, realising

GBP12.7m of cash. Discussions are on-going around potential future

disposals and we are hoping to realise at least a similar level of

cash in the second half.

We have secured planning permission at our Carlisle Airport site

for an air/road freight distribution centre, which also opens up

potential opportunities for further development at the site

including passenger and air freight services. In addition, we have

secured planning permission for 100 residential houses at our

Chelford site.

In the Energy division, tonnages supplied are over 50% ahead

year on year in the period to 31 July 2014. However, profit per

tonne overall is lower as margins have been affected by a higher

proportion of exported products in readiness for UK plants coming

on stream, and transport profits are reduced year on year following

the ending of a contract on 28 February 2014. Looking forward, cost

management work undertaken in the first half is expected to benefit

the next six months. We have reorganised our processing sites to

allow more efficient supply of products to our customers. We

recently entered into a 12 year fuel supply contract for a combined

heat and power plant in Speyside, which is expected to be

commissioned in 2016. In addition we are at an advanced stage of

negotiation for a number of further significant potential supply

contracts with plants which are looking to reach financial close in

the near future.

In the Aviation division, passenger numbers are over 20% ahead

year on year in the period to 31 July 2014. The passenger-related

revenue per passenger has also grown by over 10% year on year. This

growth has directly benefited underlying EBITDA. We have also been

focussed on restructuring management and developing the airport's

systems to make the airport operation more efficient. For the

second year running the airport has topped the Which? airport

passenger satisfaction survey with an improved rating, but there is

still work to do in some areas. Based on known traffic, the

passenger numbers may be flat in the next six months but we are

actively working with operators to identify opportunities to bring

further traffic into that period. For example, we have recently

announced that SkyWork Airlines will be operating a twice daily new

route to Bern starting in October 2014, after transferring this

route from London City airport.

Stobart Air, of which we own 45%, has recorded increased

passenger numbers for 13 consecutive months up to July 2014, and we

are working with the airline's management to identify further

opportunities.

The Rail division has grown revenue from external customers by

around 40% in the period to 31 July 2014, securing a promising

level of work at respectable margins, through collaborations with

contractors to Network Rail. This has partially compensated for the

lower internal development work in the first half, but we expect

that internal work will pick up in the second half. There is also

strong interest for rail engineering work in the next six

months.

Within the Investments division, the Transport &

Distribution business including Eddie Stobart, of which we own 49%,

is performing in line with management's expectations, although our

recorded share of profit will be subject to transaction accounting

fair value adjustments. Growth continues in the aircraft leasing

business, of which we own 33%; the eighth aircraft has been

delivered and all aircraft are operational.

We have restructured the Energy and Aviation divisions,

involving some restructuring cost, and incurred exceptional finance

costs in connection with the early repayment of GBP168m of bank

debt in March and April 2014, which has reduced the on-going

interest costs significantly.

Enquiries:

Stobart Group +44 20 7851 9090

Andrew Tinkler, Chief Executive

Officer

Ben Whawell, Chief Financial

Officer

influence Associates +44 20 7287 9610

Stuart Dyble/James Andrew

END

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFSTTDITFIS

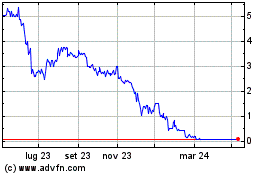

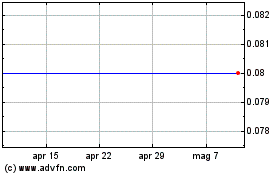

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Ago 2024 a Set 2024

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Set 2023 a Set 2024