The Group has net assets at the period end of GBP414.7m (28

February 2014: GBP461.1m). The reduction is principally due to the

purchase of own shares of GBP34.8m and dividend paid of GBP13.2m.

Net assets includes property assets and property related

investments with a total book value of GBP259.9m (28 February 2014:

GBP273.2m).

Net debt fell to GBP8.1m (28 February 2014: GBP127.9m). The

Group realised net cash (after fees) of GBP189.9m on the partial

disposal of the transport and distribution division including the

GBP13.7m licence premium from Eddie Stobart Limited. At the same

time the GBP100m variable rate loan with M&G Investment

Management Limited was fully repaid and the facility was

terminated.

In March, GBP68.1m of the restricted cash held at 28 February

2014 was used to repay a substantial proportion of the property

loan with GE Real Estate Finance Limited, plus payment of fees. At

the same time, the terms of the remaining debt were renegotiated

and the facility was reduced commensurately. Later in the period

this loan was further repaid out of proceeds from property

realisations, leaving GBP2.2m outstanding.

Separately disclosed finance costs of GBP8.1m include the early

repayment of fees payable in connection with the two substantial

repayments set out above, as well as write off of the debt issue

costs carried in relation to the amounts.

The gearing ratio (net debt/equity) was 2.0% (28 February 2014:

27.7%).

Brands

Following the partial disposal of the transport and distribution

division, the Group has retained ownership of the Stobart and Eddie

Stobart trademarks and designs which remain important and valuable

assets to the Group. Both Stobart Group and Eddie Stobart are

listed in Business Superbrands with Eddie Stobart brand ranked 45th

overall and first in the Supply Chain, Distribution, Freight &

Transport Services category. The Group has licensed the use of the

Eddie Stobart brand to Eddie Stobart Limited under a 15 year

licence agreement.

In September 2014 the Group welcomed more than 12,500 visitors

over two days to 'Stobart Fest' which took place at Carlisle

Airport. The Eddie Stobart Trucking Songs: Trucking All Over the

World went straight to number 1 on the compilations charts

demonstrating the potential influence of the brand, although the

royalties are modest.

Dividend and purchase of own shares

During the period, the Company purchased 26,403,000 of its own

shares for total consideration of GBP34,764,000. These shares are

held as treasury shares at the period end.

The Board has declared an unchanged interim dividend of 2.0p,

which will be paid on 5 December 2014 to shareholders on the

register as at 7 November 2014. When the interim dividend is paid

the Group will have returned an aggregate of GBP54.6m to

shareholders in the past 12 months.

Key risks and uncertainties

As with any business, risk assessment and the implementation of

mitigating actions and controls are vital to successfully achieving

the Group's strategy. The Board has overall responsibility for risk

management and internal control within the context of achieving the

Group's objectives. The key risks are set out in our 2014 Annual

Report.

Going concern

The directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. Accordingly, the interim financial statements

have been prepared on a going concern basis.

Directors' responsibility statement

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

The above statement of directors' responsibilities was approved

by the Board on 23 October 2014.

Iain Ferguson Andrew Tinkler Ben Whawell

Richard Butcher Andrew Wood John Garbutt

John Coombs

23 October 2014

Stobart Group Limited

Condensed Consolidated Income Statement

For the six months ended 31 August 2014

Restated

Six months Six months Year ended

ended 31 ended 31 28 February

August 2014 August 2013 2014

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 3 56,190 48,140 99,179

-------------- ------------- --------------

Operating expenses - Items related

to carrying value of investment

properties and assets held for

sale:

Gain in value of investment properties 652 546 4,223

Profit on disposal of investment

properties - 2,852 6,427

Loss on disposal of assets held

for sale (68) (100) (100)

Write-down in value of assets held

for sale - (650) (920)

Operating expenses - Other separately

disclosed items:

New business and new contract set (113) - -

up costs

Transaction costs - (416) (480)

Restructuring costs (952) (323) (1,905)

Impairment of property, plant and

equipment - - (12,970)

Amortisation of acquired intangibles (1,969) (111) (221)

Operating expenses - Other (54,409) (42,838) (92,417)

Share of post-tax profits of associates

and joint ventures 5 1,360 150 460

-------------- ------------- --------------

Operating profit 691 7,250 1,276

----------------------------------------- ------ -------------- ------------- --------------

Analysis of operating profit:

Operating profit 691 7,250 1,276

Add back:

Other separately disclosed items 3,034 850 15,576

Other separately disclosed items

included in share of profits of 1,893 - -

associates and joint ventures

-------------- ------------- --------------

Underlying operating profit 4 5,618 8,100 16,852

----------------------------------------- ------ -------------- ------------- --------------

Finance costs - Separately disclosed (8,096) - -

items

Finance costs - Other (1,459) (6,265) (12,098)

Finance income 258 245 635

(Loss)/profit before tax (8,606) 1,230 (10,187)

Tax 6 1,048 (1,684) (393)

Loss from continuing operations (7,558) (454) (10,580)

Discontinued operation

Profit from discontinued operation,

net of tax 7,622 9,404 21,929

-------------- ------------- --------------

Profit for the period 64 8,950 11,349

-------------- ------------- --------------

Restated

Six months Six months Year ended

ended 31 ended 31 28 February

August 2014 August 2013 2014

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Profit attributable to:

Owners of the Company 64 8,945 11,339

Non-controlling interests - 5 10

-------------- ------------- --------------

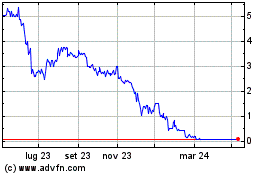

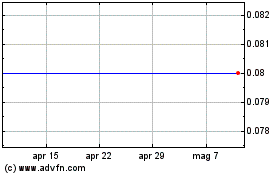

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Esken (LSE:ESKN)

Storico

Da Lug 2023 a Lug 2024