TIDMSTOB

RNS Number : 3481T

Stobart Group Limited

14 November 2019

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

14 November 2019

Stobart Group Limited

("Stobart" or the "Group")

Interim results for the six months ended 31 August 2019

Delivering strong strategic and operational performance in line

with expectations

Stobart Group Limited, the aviation and energy focused business,

today announces its interim results for the six months to 31 August

2019.

Warwick Brady, Chief Executive Officer, Stobart Group,

commented

"In London Southend Airport and Stobart Energy, the Group has

two businesses with immediate and considerable growth

opportunities.

"London Southend Airport continues to attract new airlines and

is on course to deliver our target of

5 million annual passengers at GBP8 EBITDA by February 2023. At

the same time, Stobart Energy is now set to become increasingly

cash generative.

"Both of these exciting growth businesses require further

investment in order to deliver their full potential. The Board has

undertaken an extensive review of the capital required to fund this

growth and taken the decision to suspend the dividend in order to

maximise the capital available for the further development of these

growth businesses. We are confident that, with the planned

strategic investment, we will deliver superior future returns."

31 August 31 August

2019 2018 % change

---------------------------------- ----------- ----------- ---------

Aviation

Passenger numbers 1,189,178 838,742 41.8%

Aviation revenue GBP26.4m GBP20.9m 25.8%

Underlying Aviation EBITDA(1) GBP4.1m GBP2.9m 43.0%

---------------------------------- ----------- ----------- ---------

Energy

Volume of waste managed 805,663 657,950 22.5%

Energy revenue GBP42.9m GBP29.9m 43.5%

Underlying Energy EBITDA(1) GBP11.7m GBP8.7m 35.4%

---------------------------------- ----------- ----------- ---------

Underlying EBITDA from the

two main operating divisions(1) GBP15.8m GBP11.6m 37.3%

---------------------------------- ----------- ----------- ---------

Revenue GBP93.1m GBP69.4m 34.1%

Underlying EBITDA(1) GBP12.1m GBP4.2m 187.1%

Loss for period (GBP20.9m) (GBP17.5m) (19.4%)

(1) Defined in glossary in note 15

Summary

Stobart Aviation:

-- Passenger numbers at London Southend Airport increased by

41.8% to 1.2 million, with circa 2.3 million passengers expected

for the year to February 2020.

-- Flybe/Virgin Connect announced yesterday that it is to open a

new base at London Southend that will involve two based aircraft

and a total of five aircraft serving 10 destinations. These

destinations are expected to attract circa 500,000 passengers

annually.

-- Underlying EBITDA per passenger increased by 3.0% to GBP3.55

(2018: GBP3.44). The commencement of operations with a global

logistics customer in October 2019 will make a significant

contribution to underlying EBITDA per passenger in the next

financial year.

-- Stobart Group will continue to invest in London Southend

Airport to deliver its target of welcoming 5 million passengers per

annum at GBP8 EBITDA per passenger in the year to February

2023.

Stobart Energy:

-- Volume of waste managed increased by 22.5% to 805,663 tonnes.

-- Underlying EBITDA increased 35.4% to GBP11.7m (2018:

GBP8.7m), reflecting the growing maturity of the business. Stobart

Energy is now set to become increasingly cash generative.

-- The Group will continue to invest in the business to maintain

its supply chain and infrastructure. The Group also intends to

explore commercial partnerships, collaborations and joint ventures

across the waste management and 'Energy from Waste' sector.

Financial:

-- Group revenue increased by 34.1% to GBP93.1m, driven, in

particular, by a strong performance in Stobart Energy.

-- Underlying EBITDA increased by 187.1% to GBP12.1m and loss

for the period increased by GBP3.4m to GBP20.9m.

-- Loss for the period includes an GBP8.5m non-cash impairment

of intangible assets in Stobart Rail & Civils, GBP3.7m non-cash

brand amortisation and GBP7.4m of new business and new contract

set-up costs.

Balance Sheet:

-- Stobart Group has evaluated the significant growth potential

within its aviation and energy businesses, and its available

sources of investment funding.

-- The Board continues to hold an GBP80m portfolio of

non-strategic infrastructure assets. However, the Board intends to

dispose of these assets at the right time and in such a way that

optimises the value to the Group.

-- The Board's intention is to restore the dividend at the point

at which the Group becomes significantly cash generative at an

operating level, subject to investment requirements to maximise

shareholder returns.

Enquiries:

Stobart Group Limited

Charlie Geller, Head of Communications Via Newgate Communications

Newgate Communications +44 203 757 6880

Giles Croot Stobart@newgatecommunications.com

Ian Silvera

Stobart Group Limited

("Stobart" or the "Group")

Interim Results for the six months ended 31 August 2019

Divisional Revenue Summary 31 August 31 August

2019 2018

GBPm GBPm

Aviation 26.4 20.9

Energy 42.9 29.9

Rail & Civils 29.4 22.6

Investments 2.1 2.0

Non-Strategic Infrastructure 1.3 1.1

Central costs and eliminations (9.0) (7.1)

---------- ----------

Revenue 93.1 69.4

---------- ----------

Divisional Continuing Profit Summary 31 August 31 August

2019 2018

GBPm GBPm

Aviation 4.1 2.9

Energy 11.7 8.7

----------

Underlying EBITDA from two main operating

divisions(1) 15.8 11.6

Rail & Civils (1.0) (4.8)

Investments 2.3 2.8

Non-Strategic Infrastructure (1.5) (1.1)

Central costs and eliminations (3.5) (4.3)

---------- ----------

Underlying EBITDA(1) 12.1 4.2

Non-underlying items (23.0) (6.9)

Gain on swaps 0.1 3.6

Depreciation (11.4) (7.6)

Impairment of loan notes - (2.5)

Finance costs (net) (4.5) (1.4)

Tax 3.2 1.5

---------- ----------

Loss for the period (23.5) (9.1)

---------- ----------

(1) Defined in glossary in note 15

Divisional Reviews

Stobart Group is focused on increasing the value of its

infrastructure assets in its core Aviation and Energy divisions.

The Group also has a Rail & Civils division, and holds a

portfolio of investments, including shareholdings in Connect

Airways and Eddie Stobart Logistics, and non-strategic

infrastructure assets.

Stobart Aviation

Stobart Aviation's principal asset is London Southend Airport.

The airport continues to grow rapidly with passenger numbers

increasing by 42% to 1,189,178 (2018: 838,742) in the period. The

Board expects to welcome circa 2.3 million passengers for the full

year, which would represent 164% growth since 2017. The Board

expects this rapid growth to continue as a result of its planned

investment programme, making the airport more attractive to

passengers and airlines alike.

London Southend Airport now offers flights to more than 40

destinations, and partners with airlines including easyJet, Ryanair

and Wizz Air. During the period, Stobart Group was part of the

Connect Airways consortium that received EU merger approval to take

management control of Flybe. Flybe is in the process of rebranding

to Virgin Connect and yesterday announced its plan to open a new

base at London Southend Airport that will involve two based

aircraft and a total of five aircraft serving 10 destinations.

These destinations are expected to attract circa 500,000 passengers

annually.

London Southend Airport continues to build its reputation for an

excellent passenger experience. A Which? Survey in October said the

Airport had the joint fastest security waiting time across UK

airports. Passengers can also enjoy a growing range of high street

brands in the departure lounge, including Dixons, WH Smith, Costa

Coffee and Giraffe STOP. As a result, London Southend Airport was

reported to be London's best performing airport in a Which? survey

for the sixth consecutive year in September.

Another part of the attraction of London Southend Airport is the

ease of access. This has improved even further in the period.

Passengers can now more easily connect to the first and last

flights following the introduction of early morning and late-night

trains as well as new bus services. The percentage of passengers

travelling to and from the airport by train from Central London has

increased to over 30%.

The increase in airline partnerships and passenger numbers in

2019 gives the Board confidence that the airport will welcome 5

million passengers in the year to February 2023 as planned. The

improved retail offering and revenue from train passengers and car

parking will help deliver the February 2023 EBITDA per passenger

target of GBP8. This target will be further helped by the

commencement of operations with a global logistics customer. That

customer is utilising existing hangarage on the north side of the

airport, away from the passenger operation. In October the Group

announced the agreement has created circa 200 jobs in the area and

will make a significant contribution to our EBITDA per passenger

target from the next financial year onward.

To ensure the customer experience keeps pace with expected

passenger growth, improvements will continue to be made to the

airport. The investment will help the airport meet its passenger

target by enhancing the attractiveness of the airport to airlines

and increasing the terminal capacity for customers. The investment

will also support the EBITDA per passenger target by allowing the

Group to capitalise on the revenue opportunities increased capacity

brings. For example, the Group plans to invest in new car parking,

and the building of a new hotel. The current hotel is reporting 93%

occupancy, higher than other similar hotels at other London

Airports.

Other plans include optimising the space within the departures

terminal and moving arrivals to a new purpose-built facility. This

means London Southend Airport can combine enhanced passenger flow

through check-in and security with an even greater retail offering.

This work is expected to be completed over the next three years,

with the pace of capital expenditure decisions made in reference to

the macro-economic environment. In the immediate term, Stobart

Group intends to introduce automated check-in facilities and the

latest security clearance technology for passenger baggage. This

will help maintain the Airport's reputation for being 'quick and

easy' and ensure the terminal capacity keeps pace with the

short-term increase in passenger numbers.

Stobart Aviation's other businesses have also performed well in

the period. Stobart Aviation Services now has over 400 employees

and 14 airline client contracts operating across five airports. It

has exceeded the targets set in its strategic plan for year one in

terms of both revenue and profitability.

Stobart Aviation's relationship with the Tees Valley Combined

Authority continues to develop. Durham Tees Valley Airport was

rebranded to Teesside International Airport in July and the airport

has seen a number of new airlines start or commit to starting

services.

At London Southend Airport, the Stobart Jet Centre appointed an

experienced new managing director, Fiona Langton. She is tasked

with increasing the centre's share of the London private jet

market, and also look to grow its presence in Cumbria and Teesside.

The pace of growth at Stobart Jet Centre is likely to be tempered

by the reduced availability of night time movements that are

instead being utilised by the airport's global logistics

customer.

Stobart Energy

As of October 2018, 29 out of the 30 energy recovery plants that

Stobart Energy supplies have now reached full contractual

operational volumes. As a result, the volume of waste managed by

Stobart Energy during the period increased by 147,713 tonnes to

805,663 tonnes - equivalent to a run rate of 1.7m tonnes per annum.

This represents a 22% increase on the same period last year.

The increase in the volume of waste managed, the consistent

energy recovery plants performance and a more efficient supply

chain led to a 35% increase in underlying EBITDA to GBP11.7m for

the period.

As these plants have now reached full commercial operations,

Stobart Energy will benefit from improved protections in terms of

contracted fuel supply that were not available during

commissioning. In addition, there will be much lower non-underlying

costs which previously related to pre-contract supply chain

challenges.

During the period Stobart Energy incurred significant costs in

an attempt to maintain the supply chain for the Tilbury Green Power

plant following an extended unplanned outage from the end of April

until the middle of October. Stobart Energy expects to recover the

financial impact of the unplanned outage via an exercise of

contractual take or pay provisions and insurance cover.

Stobart Energy has now reached the point at which the energy

recovery plants it supplies are operating for sustained periods on

a more consistent basis and accepting more contracted fuel. We

expect this in turn to ease the pressure on the wider supply chain

over the next 12 to 18 months, allowing Stobart Energy to realise

the value of the investment it has made to date in its supply

chain. In turn, this means margins are expected to improve,

allowing it to become increasingly cash generative, and deliver

strong and stable cashflows going forward.

A measure of how far Stobart Energy has evolved came through an

independent valuation of the energy business, which was received as

part of the vesting of the Stobart Energy Incentive Plan (SEIP).

The SEIP was an incentive plan put in place to fully align the

management of the energy business with shareholder interests by

benefitting from a significant increase in the value of the

division. For the purpose of determining the value of awards to

management under the SEIP, the Remuneration Committee appointed an

independent valuer to carry out a valuation of the energy business

on a consolidated basis. That independent valuation of the division

was an equity value of GBP237m as at 30 June 2019, compared to a

starting valuation of GBP100m as at 30 June 2016.

The Group is now looking to build on the progress made to date

by Stobart Energy. To deliver this progress, the Group will invest

in the division's fleet replacement programme, storage sites,

replacement mobile processing equipment and IT systems that it

requires. The Board believes there are opportunities for further

growth across the waste management and 'Energy from Waste' sectors.

As a result, it is studying opportunities to leverage its

operational experience through establishing commercial

partnerships, collaborations and joint ventures that will allow it

to grow the volume of waste that it manages.

Update on Capital Plans and Dividend

With the investment programme set out above, the Group's

aviation and energy businesses have a clear path to delivering

superior value for the Group's shareholders.

In recent years, Stobart's dividend has been largely funded from

the sale of assets rather than operational cash generation. The

Board believes that this practice is unsustainable and no longer in

the interest of shareholders. Whilst the Group continues to hold a

significant portfolio of non-strategic infrastructure assets, the

Board, will continue to sell assets in such a way that optimises

the value to the Group.

As a result, and in order to maximise this opportunity and

shareholder value over the medium term, the Board has taken the

decision to suspend the dividend, conserving GBP11m of cash in the

current period and GBP22m per annum that can now be invested in

these growth opportunities within the Group.

The Group has also commenced a process to obtain new long-term

debt to fund its growth programme and will provide a further update

as soon as it is in a position to do so.

Stobart Rail & Civils, Investments and Non-Strategic

Infrastructure

Stobart Group also has a portfolio of non-core businesses and

assets, from which the Board will aim to optimise shareholder value

over time.

Stobart Rail & Civils has been re-orientated to focus on

external works. This follows the appointment of a new management

team last year. That refreshed team has focused its attention and

investment on project delivery and contract management so that

works, such as that for Nexus on the Tyne and Weir Metro, are

consistently delivered profitably, on time and on budget.

Significant milestones were also reached on the design and

construction of the new maintenance facility at Newton Heath for

Arriva Northern Rail.

Stobart Rail & Civils has a clear pathway to reduce both its

exposure to legacy projects and contribution from internal works

and expects to complete all of its legacy projects by February

2023.

Network Rail has been slow to award work at the start of Control

Period 6 (CP6) which has impacted the whole industry. Stobart Rail

& Civils is now well positioned to improve its performance once

the CP6 issues are resolved. While the division is not material in

terms of delivering the Group's targets, the action undertaken to

de-risk and re-focus the business will allow management to realise

value from it in the future.

Another asset, Carlisle Lake District Airport was successfully

opened in July 2019 for commercial flights. It is becoming an

increasingly important business hub for the Cumbrian and Border

regions .

Other investments include stakes in Connect Airways and Eddie

Stobart Logistics. In July 2019, Connect Airways (in which Stobart

Group holds a 30% interest) received merger control clearance from

the European Commission for its acquisition of Flybe. With Connect

Airways taking over full management control of Flybe, the

leadership teams are focused on plans to grow its regional network,

while Stobart Air continues to expand its successful franchise

business.

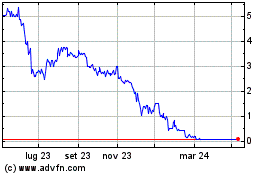

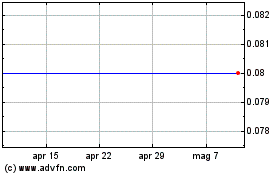

Stobart Group holds an 11.8% investment in Eddie Stobart

Logistics. The Company raised GBP53.1million of secured guaranteed

exchangeable bonds against its shareholding in Eddie Stobart

Logistics in May 2019. There are no changes to the status or term

of the bonds. That position was not affected by the decision made

by Eddie Stobart Logistics to suspend its dividend and shares, nor

is it impacted by a possible change of ownership. Despite recent

events, there remains considerable value in the Eddie Stobart brand

which continues to be owned by Stobart Group.

Financial Review

Revenue has increased by 34.1% to GBP93.1m (2018: GBP69.4m) in

the six months to 31 August 2019, driven by growth in the operating

divisions. Aviation has grown by 26.2% to GBP26.4m (2018:

GBP20.9m), with London Southend Airport (LSA) passenger numbers

increasing by 41.8% to 1,189,178 year-on-year. Revenue in Energy

has grown by 43.5% to GBP42.9m (2018: GBP29.9m) on the back of an

22.5% increase in tonnes to 805,663.

Underlying EBITDA has increased by 187.1% to GBP12.1m (2018:

GBP4.2m). Aviation has seen underlying EBITDA grow by 43.0% to

GBP4.1m (2018: GBP2.9m) on the back of increasing passenger numbers

through LSA. Energy has delivered a 35.4% increase in underlying

EBITDA to GBP11.7m (2018: GBP8.7m), as the volume of waste managed

increased in the period.

The loss before tax from continuing operations of GBP26.6m

(2018: GBP10.6m) includes a one-off impairment of intangible assets

relating to the Rail & Civils cash generating unit (GBP8.5m),

non-underlying new business and new contract set up costs in the

Aviation division (GBP5.7m), which are expected to be much lower in

the second half of the year, and an increased amortisation charge

in relation to our brand assets (GBP3.7m). A summary of divisional

profitability is set out on page 3 and further details of

divisional performance are set out in the Divisional Reviews

section.

Discontinued presentation on income statement

On 22 February 2019, the Group entered in to an agreement to

dispose of Propius Holdings Limited (Propius) to Connect Airways.

The results of the Propius business for the period are included

within discontinued operations. The prior period results have been

restated accordingly.

Swaps, Depreciation and Interest

The mark to market gain on swaps in the period was GBP0.1m

(2018: GBP3.6m). The current period movement is driven by the mark

to market valuations relating to diesel and US dollar swaps.

Depreciation has increased by GBP3.8m to GBP11.4m, with the

majority of this increase relating to additional processing site

assets and development at London Southend Airport.

Finance costs of GBP6.7m (2018: GBP2.0m) have increased largely

due to the transition to IFRS 16 and the payment of the Eddie

Stobart Logistics plc (ESL) dividend received to the exchangeable

bondholders. Finance income of GBP2.2m (2018: GBP0.6m) increased

due to interest receivable on loans made to Connect Airways and

Flybe, plus GBP0.5m unwind of fair value of the GBP25m 8% loan

notes with Connect Airways. The fair value is based on the present

value of the future cash flows, discounted at the estimated market

rate of interest.

Non-underlying items

31 August 2019 31 August 2018

GBP'000 GBP'000

-------------- --------------

New business and new contract set

up costs 7,367 3,324

Transaction costs - 112

Restructuring costs 552 -

Litigation and claims 330 1,575

Impairment 8,474 -

Share of post-tax losses of joint

venture 2,490 -

Amortisation 3,739 1,969

Total non-underlying items 22,952 6,980

-------------- --------------

We incurred new business and new contract set-up costs in the

Aviation division for new route development (GBP5.7m), the Energy

division relating to delayed commissioning of biomass plants

(GBP1.2m) and in the Non-Strategic Infrastructure division in

connection with Carlisle Lake District Airport development

(GBP0.5m).

Restructuring costs includes the removal of roles within the

Group, Aviation and Rail & Civils businesses. Litigation and

claims relate to the ongoing board dispute and trial costs,

including income received following cost orders. The impairment

charge relates to the write off of goodwill and other intangible

assets attributable to Rail & Civils.

Non-underlying share of post-tax losses of joint venture relate

to costs incurred by Connect Airways in acquiring Flybe, Stobart

Air and Propius. Amortisation relates to the Eddie Stobart brand

(GBP3.7m), which has doubled compared to the prior period,

following a review of the residual value. The charges in relation

to the non-cash amortisation of the brand is expected to continue

in future periods (see note 5 for further details).

Taxation

The tax credit is GBP3.2m (2018: GBP1.5m). This arises due to

the forecast utilisation of tax loss attributes arising in the

period and an accelerated unwind of the Group's deferred tax

liability relating to intangible assets (see note 7 for further

details).

Loss per share

Loss per share from underlying continuing operations(1) was

0.50p (2018: 0.89p). Total basic loss per share from continuing

operations was 6.40p (2018: 2.63p) (see note 8 for further

details).

(1) Defined in glossary in note 15

Dividends

31 August 2019 31 August 2018

-------------- --------------

Interim dividend (April) - 4.5p

Final dividend (July) 3.0p 4.5p

3.0p 9.0p

-------------- --------------

Total dividends paid (GBP'000) 11,125 31,256

-------------- --------------

A final dividend of 3.0p per share was paid on 31 July 2019.

Balance sheet

31 August 2019 28 February 2019

GBP'000 GBP'000

-------------- ----------------

Non-current assets 521,149 467,416

Current assets 89,187 79,736

-------------- ----------------

Total assets 610,336 547,152

Non-current liabilities (195,867) (137,722)

Current liabilities (170,293) (112,476)

Net assets 244,176 296,954

-------------- ----------------

The decrease in the net asset position of GBP52.8m principally

relates to the revaluation of ESL investment (GBP16.4m), dividends

paid (GBP11.1m) and the loss for the period (GBP20.9m).

Non-current assets have increased in the period, largely due to

the transition to IFRS 16. This increase was offset by a reduction

in other financial assets and amortisation, and write off, of

intangible assets.

Other financial assets represent the Groups investment in ESL

with a fair value at 31 August 2019 of GBP28.6m. Included in the

Condensed Consolidated Statement of Comprehensive Income is the

loss of GBP16.4m for the six months to 31 August 2019, following a

29.5p reduction in the ESL share price from 100.5p to 71.0p, prior

to the suspension in trading of ESL shares. Following this

suspension, management have made the judgement that the fair value

of this investment is lower than this share price on the date of

suspension, so have provided for a further 10% reduction in

value.

Current assets have increased by GBP9.5m, which primarily

relates to an increase in receivables, offset by a cash reduction

in the period. Non-current liabilities have increased by GBP58.1m,

principally driven by the increase in loans and borrowings,

following the transition to IFRS 16. See note 11 for further

details.

Current liabilities include the secured guaranteed exchangeable

bonds (Bonds) as in accordance with IAS 1 it is necessary for the

Bonds, issued on 3 May 2019, to be presented as a current liability

because the Group does not have an unconditional right to defer

settlement of the liability for at least 12 months after the

reporting period. The bondholders have an unconditional right to

require the group to settle the Bonds by giving the bondholders

shares in ESL at any time. The Group has no obligation to settle

the Bonds in cash within 12 months of the balance sheet date.

Debt and gearing

31 August 2019 28 February 2019

-------------- ----------------

Net debt:

- asset-backed finance GBP147.5m GBP97.5m

- IFRS 16 lease obligations GBP76.9m -

- cash (GBP7.7m) (GBP14.4m)

Total net debt GBP216.7m GBP83.1m

-------------- ----------------

Underlying EBITDA(1) /underlying

interest 3.1 2.1

Net debt/total assets 35.5% 15.2%

Gearing 88.7% 28.0%

-------------- ----------------

(1) Defined in glossary in note 15

In May 2019, the Group placed GBP53.1m of Bonds issued out of

its wholly owned subsidiary Stobart Finance plc. The Bonds have a

five-year maturity and are unconditionally and irrevocably

guaranteed by the Company and are exchangeable into ordinary shares

of one penny each in the capital of ESL.

On 1 March 2019, The Group adopted IFRS 16 which created lease

liabilities of GBP78.2m. These liabilities have replaced operating

lease charges in the Condensed Consolidated Income Statement for

nearly all leases held. See note 1 for further information and

details of the transition.

At 31 August 2019, the committed undrawn headroom of the RCF was

GBP29.0m (28 February 2019: GBP22.0m), and with cash balances of

GBP7.7m (28 February 2019: GBP14.4m), total headroom was GBP36.7m

(28 February 2019: GBP36.4m).

Cash flow

31 August 2019 31 August 2018

GBP'000 GBP'000

-------------- --------------

Operating cash flow (18,612) (18,143)

Investing activities (9,359) 24,308

Financing activities 21,264 (19,871)

-------------- --------------

Decrease in the period (6,707) (13,706)

Cash at beginning of period 14,432 43,108

Cash at end of period 7,725 29,402

-------------- --------------

There was an operating cash outflow in the period of GBP18.6m

(2018: GBP18.1m) principally relating to adverse working capital

movements in the Energy and Aviation divisions, which are expected

to improve in the second half. The working capital outflows are

principally related to increased receivable balances from new

business.

There was a cash outflow of GBP1.8m in relation to the UK Flybe

Franchise Operation (UKFFO) that is ceasing, but due to ongoing

commitments the Group will see the cash impact until February

2020.

Net cash outflows from investing activities include the purchase

of property, plant and equipment (PPE) totalling GBP13.0m,

principally relating to the development at London Southend

Airport.

Net cash inflows from financing activities include proceeds from

the issue of Bonds (GBP51.4m), repayment of finance leases

(GBP9.5m) and the net repayment of the RCF (GBP7.0m), in addition

to GBP11.1m of dividends paid.

Key Risks and Uncertainties

As with any business, risk assessment and the implementation of

mitigating actions and controls are vital to successfully achieving

the Group's strategy. The Board has overall responsibility for risk

management and internal control within the context of achieving the

Group's objectives. The key risks are set out in our statutory

accounts for the year ended 28 February 2019 and are broadly

unchanged.

Directors' Responsibility Statement

We confirm that to the best of our knowledge:

-- The condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU; and

-- The interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the statutory accounts for the year ended 28 February

2019 that could do so.

The above statement of Directors' responsibilities was approved

by the Board on

14 November 2019.

Lewis Girdwood

Director

14 November 2019

Condensed Consolidated Income Statement

For the six months ended 31 August 2019

Unaudited Unaudited

Six months ended 31 August Six months ended 31 August

2019 2018

Underlying Non-underlying Total Underlying Non-underlying Total

Continuing operations Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 3 93,131 - 93,131 69,429 - 69,429

----------- --------------- --------- ----------- --------------- ---------

Other operating income 194 - 194 2,248 - 2,248

Operating expenses (81,360) (8,249) (89,609) (66,873) (5,011) (71,884)

Share of post-tax

profits of associates

and joint ventures 140 (2,490) (2,350) (588) - (588)

----------- --------------- --------- ----------- --------------- ---------

EBITDA 12,105 (10,739) 1,366 4,216 (5,011) (795)

Gain on swaps 114 - 114 3,579 - 3,579

Depreciation (11,354) - (11,354) (7,552) - (7,552)

Amortisation 5 - (3,739) (3,739) - (1,969) (1,969)

Impairments 5 - (8,474) (8,474) - - -

----------- --------------- --------- ----------- --------------- ---------

Operating profit/(loss) 865 (22,952) (22,087) 243 (6,980) (6,737)

Impairment of loan

notes - - - (2,500) - (2,500)

Finance costs 6 (6,732) - (6,732) (2,032) - (2,032)

Finance income 6 2,186 - 2,186 654 - 654

----------- --------------- --------- ----------- --------------- ---------

Loss before tax (3,681) (22,952) (26,633) (3,635) (6,980) (10,615)

Tax 7 1,849 1,333 3,182 565 966 1,531

----------- --------------- --------- ----------- --------------- ---------

Loss for the period

from continuing operations (1,832) (21,619) (23,451) (3,070) (6,014) (9,084)

----------- --------------- ----------- ---------------

Discontinued operations

Profit/(loss) from

discontinued operations,

net of tax 2,567 (8,412)

--------- ---------

Loss for the period (20,884) (17,496)

--------- ---------

Loss per share expressed in pence per share - continuing operations

Basic 8 (6.40p) (2.63p)

Diluted 8 (6.40p) (2.63p)

Loss per share expressed in pence per share - total

Basic 8 (5.70p) (5.06p)

Diluted 8 (5.70p) (5.06p)

Condensed Consolidated Income Statement

For the six months ended 31 August 2019

Audited

Year ended 28 February

2019

Underlying Non-underlying Total

Continuing operations Notes GBP'000 GBP'000 GBP'000

Revenue 3 146,889 - 146,889

----------- --------------- ----------

Other operating income 1,310 - 1,310

Operating expenses (135,631) (17,135) (152,766)

Share of post-tax profits of associates

and joint ventures (1,740) - (1,740)

----------- --------------- ----------

EBITDA 10,828 (17,135) (6,307)

Loss on swaps (353) - (353)

Depreciation (16,305) - (16,305)

Amortisation 5 - (3,938) (3,938)

Impairments 5 - (7,800) (7,800)

----------- --------------- ----------

Operating loss (5,830) (28,873) (34,703)

Impairment of loan notes 5 (3,208) - (3,208)

Finance costs 6 (5,213) - (5,213)

Finance income 6 1,010 - 1,010

----------- --------------- ----------

Loss before tax (13,241) (28,873) (42,114)

Tax 7 (3,321) 2,791 (530)

----------- --------------- ----------

Loss for the period from continuing

operations (16,562) (26,082) (42,644)

----------- ---------------

Discontinued operations

Loss from discontinued operations,

net of tax (15,535)

----------

Loss for the period (58,179)

----------

Loss per share expressed in pence per share - continuing operations

Basic 8 (12.19p)

Diluted 8 (12.19p)

Loss per share expressed in pence per share - total

Basic 8 (16.64p)

Diluted 8 (16.64p)

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 31 August 2019

Six months Six months

ended ended Year ended

31 August 31 August 28 February

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss for the period (20,884) (17,496) (58,179)

Change in fair value of assets

classified as available-for-sale - (5,810) -

Discontinued operations, net of

tax, relating to exchange differences (1,212) 1,180 2,041

Tax on items relating to components

of other comprehensive income - 37 -

Other comprehensive (expense)/income

to be reclassified to profit or

loss in subsequent periods, net

of tax (1,212) (4,593) 2,041

------------- ------------- --------------

Re-measurement of defined benefit

plan (1,231) 1,103 (260)

Change in fair value of financial

assets classified as FVOCI (16,358) - (18,772)

Tax on items relating to components

of other comprehensive income/(expense) 273 (188) 45

Other comprehensive (expense)/income

not being reclassified to profit

or loss in subsequent periods,

net of tax (17,316) 915 (18,987)

Other comprehensive expense for

the period, net of tax (18,528) (3,678) (16,946)

------------- ------------- --------------

Total comprehensive expense for

the period (39,412) (21,174) (75,125)

------------- ------------- --------------

Condensed Consolidated Statement of Financial Position

For the six months ended 31 August 2019

31 August 28 February

2019 2019

Unaudited Audited

Notes GBP'000 GBP'000

Non-current assets

Property, plant and equipment 10 329,569 262,915

Investment in associates and joint

ventures 10,777 10,459

Other financial assets 28,560 44,918

Investment property 3,200 4,000

Intangible assets 88,268 100,482

Net investment in lease 13,763 -

Other receivables 47,012 44,642

---------- ------------

521,149 467,416

---------- ------------

Current assets

Inventories 22,740 22,559

Trade and other receivables 56,640 41,271

Cash and cash equivalents 11 7,725 14,432

Assets held for sale 2,082 1,474

89,187 79,736

---------- ------------

Total assets 610,336 547,152

---------- ------------

Non-current liabilities

Loans and borrowings 11 (156,016) (84,121)

Defined benefit pension scheme (4,006) (3,170)

Other liabilities (10,940) (11,096)

Deferred tax (10,021) (13,560)

Provisions (14,884) (25,775)

---------- ------------

(195,867) (137,722)

---------- ------------

Current liabilities

Trade and other payables (49,699) (53,648)

Loans and borrowings 11 (16,835) (13,433)

Exchangeable bonds* 11 (51,559) -

Corporation tax (12,412) (12,412)

Provisions (8,341) (5,438)

Liabilities held for sale (31,447) (27,545)

(170,293) (112,476)

---------- ------------

Total liabilities (366,160) (250,198)

---------- ------------

Net assets 244,176 296,954

---------- ------------

Capital and reserves

Issued share capital 37,082 37,082

Share premium 324,379 324,379

Foreign currency exchange reserve (732) 480

Reserve for own shares held by employee

benefit trust (8,759) (12,154)

Retained earnings (107,794) (52,833)

---------- ------------

Total Equity 244,176 296,954

---------- ------------

* In accordance with IAS 1 it is necessary for the secured

guaranteed exchangeable bonds (Bonds), issued on 3 May 2019, to be

presented as a current liability because the Group does not have an

unconditional right to defer settlement of the liability for at

least 12 months after the reporting period. The bondholders have an

unconditional right to require the group to settle the bonds by

giving the bondholders shares in Eddie Stobart Logistics plc (ESL)

at any time. The Group has no obligation to settle the Bonds in

cash within 12 months of the balance sheet date.

Condensed Consolidated Statement of Changes in Equity

For the six months ended 31 August 2019

For the six months ended 31 August 2019

Unaudited

Reserve

Foreign for own

Issued currency shares

share Share exchange held Retained Total

capital premium reserve by EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- --------- ---------- --------- ---------- ---------

Balance at 1 March

2019 37,082 324,379 480 (12,154) (52,833) 296,954

IFRS 16 transition

adjustment, net

of tax - - - - (2,846) (2,846)

---------------------- --------- --------- ---------- --------- ---------- ---------

Balance at 1 March

2019 (adjusted) 37,082 324,379 480 (12,154) (55,679) 294,108

---------------------- --------- --------- ---------- --------- ---------- ---------

Loss for the period - - - - (20,884) (20,884)

Other comprehensive

expense for the

period - - (1,212) - (17,316) (18,528)

---------------------- --------- --------- ---------- --------- ---------- ---------

Total comprehensive

expense for the

period - - (1,212) - (38,200) (39,412)

Employee benefit

trust - - - 3,395 (3,294) 101

Share-based payment

credit - - - - 420 420

Tax on share-based

payment credit - - - - 84 84

Dividends - - - - (11,125) (11,125)

---------------------- --------- --------- ---------- --------- ---------- ---------

Balance at 31 August

2019 37,082 324,379 (732) (8,759) (107,794) 244,176

---------------------- --------- --------- ---------- --------- ---------- ---------

For the six months ended 31 August 2018

Unaudited

Reserve

Foreign for own

Issued currency shares

share Share exchange held Retained Total

capital premium reserve by EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- --------- ---------- --------- ---------- ---------

Balance at 1 March

2018 35,434 301,326 (1,884) (330) 71,374 405,920

Loss for the period - - - - (17,496) (17,496)

Other comprehensive

income/(expense)

for the period - - 1,180 - (4,858) (3,678)

---------------------- --------- --------- ---------- --------- ---------- ---------

Total comprehensive

income/(expense)

for the period - - 1,180 - (22,354) (21,174)

Employee benefit

trust - - - (703) 238 (465)

Share-based payment

credit - - - - 674 674

Sale of treasury

shares - - - - (3,416) (3,416)

Dividends - - - - (31,256) (31,256)

---------------------- --------- --------- ---------- --------- ---------- ---------

Balance at 31 August

2018 35,434 301,326 (704) (1,033) 15,260 350,283

---------------------- --------- --------- ---------- --------- ---------- ---------

For the year ended 28 February 2019

Audited

Reserve

Foreign for own

Issued currency shares

share Share exchange held Retained Total

capital premium reserve by EBT earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------- --------- ---------- --------- ---------- ---------

Balance at 1 March

2018 35,434 301,326 (1,884) (330) 71,374 405,920

Loss for the period - - - - (58,179) (58,179)

Other comprehensive

income/(expense)

for the period - - 2,041 - (18,987) (16,946)

-------------------------- --------- --------- ---------- --------- ---------- ---------

Total comprehensive

income/(expense)

for the period - - 2,041 - (77,166) (75,125)

Issue of ordinary

shares 1,648 23,053 - - - 24,701

Employee benefit

trust - - - (11,824) 12,380 556

Reclassification

of exchange differences

on disposal of

subsidiaries - - 323 - - 323

Share-based payment

credit - - - - 714 714

Tax on share-based

payment credit - - - - (925) (925)

Purchase of treasury

shares - - - - (3,416) (3,416)

Dividends - - - - (52,516) (52,516)

IFRS 15 transition

adjustment, net

of tax - - - - (3,278) (3,278)

-------------------------- --------- --------- ---------- --------- ---------- ---------

Balance at 28 February

2019 37,082 324,379 480 (12,154) (52,833) 296,954

-------------------------- --------- --------- ---------- --------- ---------- ---------

Condensed Consolidated Statement of Cash Flows

For the six months ended 31 August 2019

Six months Six months Year ended

ended 31 ended 31 28 February

August 2019 August 2018 2019

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Cash used in continuing operations 13 (16,823) (417) (1,737)

Cash outflow from discontinued operations (1,789) (17,726) (11,059)

Income taxes paid - - -

------------- ------------- -------------

Net cash flow from operating activities (18,612) (18,143) (12,796)

------------- ------------- -------------

Purchase of property, plant and equipment

and investment property (13,031) (9,715) (23,731)

Purchase of property inventories - (1,829) (1,282)

Proceeds from the sale of property

inventories - 25,346 -

Proceeds from the sale of property,

plant and equipment and investment

property 2,731 3,888 8,501

Proceeds from disposal of asset held

for sale - - 6,217

Proceeds from sale and leaseback

(net of fees) - - 30,049

Cash disposed on sale of subsidiary

undertaking - - (3,728)

Non-underlying transaction costs - (112) -

Equity investment in associates and

joint ventures (2,667) - (1,500)

Net amounts repaid from/(advanced

to) joint ventures 2,938 - (143)

Interest received 670 12 57

Cash inflow/(outflow) from discontinued

operations - 6,718 (4,577)

------------- ------------- -------------

Net cash flow from investing activities (9,359) 24,308 9,863

------------- ------------- -------------

Dividend paid on ordinary shares (11,125) (31,256) (52,516)

Issue of ordinary shares less costs

of issue - - 24,702

Proceeds from issue of exchangeable

bonds 51,354 - -

Proceeds from grants 318 - 5,400

Repayment of capital element of finance

leases (8,168) (7,420) (14,382)

Repayment of IFRS 16 leases (1,306) - -

Net (repayment)/drawdown from revolving

credit facility (7,000) 23,609 17,572

Purchase of treasury shares (net

of costs) - (3,416) (3,416)

Interest paid (2,809) (1,722) (3,103)

Cash inflow from discontinued operations - 334 -

------------- ------------- -------------

Net cash flow from financing activities 21,264 (19,871) (25,743)

------------- ------------- -------------

Decrease in cash and cash equivalents (6,707) (13,706) (28,676)

Cash and cash equivalents at beginning

of period 14,432 43,108 43,108

------------- ------------- -------------

Cash and cash equivalents at end

of period 7,725 29,402 14,432

------------- ------------- -------------

1 Accounting policies of Stobart Group Limited

Corporate information

The condensed consolidated financial statements of the Group for

the six months ended 31 August 2019 were authorised for issue in

accordance with a resolution of the Directors on 14 November 2019.

Stobart Group Limited is a Guernsey registered company whose

ordinary shares are publicly traded on the London Stock Exchange.

The principal activities of the Group are described in note 3.

Basis of preparation

The condensed consolidated financial statements of the Group for

the six months ended 31 August 2019 have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU.

The condensed consolidated financial statements do not include

all the information and disclosures required in the annual

financial statements and should be read in conjunction with the

Group's annual financial statements as at 28 February 2019. Except

for the 28 February 2019 statutory comparatives, the financial

information set out herein is unaudited but has been reviewed by

the auditors, KPMG LLP, and their report to the Company is

attached.

The audited comparative financial information set out in these

interim consolidated financial statements does not constitute the

Group's statutory accounts for the year ended 28 February 2019 but

has been derived from those accounts. Statutory accounts for the

year ended 28 February 2019 have been published and KPMG LLP has

reported on those accounts. Their audit report was unqualified and

did not include a reference to any matters to which the auditors

drew attention by way of emphasis without qualifying their report.

The annual financial statements of the Group are prepared in

accordance with IFRSs as adopted by the EU.

Going concern

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. Accordingly, the interim financial statements

have been prepared on a going concern basis.

In arriving at this expectation, the Directors have reviewed the

cash flow forecasts of the Group, which cover a period of more than

12 months from the date of authorisation of these interim financial

statements, together with the projected covenant compliance of the

Group.

The Group, which has net assets of GBP244.2m, made a loss from

continuing operations of GBP23.5m and had negative working capital

of GBP15.2m and an operating cash outflow from continuing

operations of GBP16.8m during the period. The Group has a revolving

credit facility of GBP80.0m, which was drawn at GBP51.0m at 31

August 2019. The Group has cash balances of GBP7.7m and this,

together with the undrawn facility, results in total headroom of

GBP36.7m as at 31 August 2019.

The Directors have prepared forecasts through to February 2024,

together with sensitivity analysis on those forecasts including a

reasonable downturn in trading performance, the risk of some

provisions crystallising in the foreseeable future and the timing

of cash generated from asset disposals. The Directors have not

included potential areas of cash upside in the sensitivity

analysis.

The Group has other available actions should these transactions

not occur as expected, including reducing discretionary capital

expenditure assumed during the forecast period in order for the

Group to further invest in the growth divisions of Aviation and

Energy.

The Directors are satisfied that the Group has adequate

resources to fund its cash requirements for the foreseeable future.

The base and sensitised forecasts indicate that the Group will

continue to operate within the covenant requirements of the

revolving credit facility in the forecast period. The going concern

basis has been adopted and the financial statements do not include

any adjustments that would be necessary if this basis were

inappropriate.

Significant accounting policies and key estimates and

judgements

The accounting policies adopted in the preparation of the

interim consolidated financial statements are consistent with those

followed in the preparation of the Group's annual financial

statements for the year ended 28 February 2019. These accounting

policies are expected to be applied for the full year to 29

February 2020.

The estimates and judgements taken by the Directors in preparing

these interim financial statements are comparable with those

disclosed in the statutory accounts for the year ended 28 February

2019, except where stated.

The Group has initially adopted IFRS 16 Leases from 1 March

2019, which resulted in right-of-use assets of GBP60.9m, a net

investment of GBP14.0m, liabilities of GBP78.2m and GBP2.8m

adjustment to equity being recognised in the Condensed Consolidated

Statement of Financial Position. The right-of-use assets recognised

on transition were adjusted for any prepaid or accrued lease

expenses. The lease liability was calculated as the future lease

repayments, discounted at the incremental borrowing rate. The

weighted average incremental borrowing rate applied on transition

was 4.2%. The Group has a sub-lease on one of its property's and

has recognised a net investment for this particular property, with

the difference between the leases as lessee and lessor taken

directly to retained earnings. The Group applied the modified

retrospective approach and as such the comparative periods have not

been restated. The Group has applied the ongoing recognition

exemptions for short-term leases and low value leases and applied

the following practical expedients on transition:

-- Reliance on previous identification of a lease (as provided

by IAS 17) for all contracts that existed on 1 March 2019;

-- Reliance on previous assessments on whether leases are

onerous instead of performing an impairment review;

-- Accounting for operating leases with a remaining term of less

than 12 months from 1 March 2019 as short-term leases;

-- Exclusion of initial direct costs from the measurement of the

right-of-use asset at 1 March 2019; and

-- Use of hindsight in determining the lease term where there is

the option to extend the lease.

A reconciliation between operating lease commitments as lessee

under IAS 17 and finance lease liability recognised under IFRS 16

is outlined in the table below.

GBP'000

Operating lease commitments disclosed at 28 February

2019 139,679

Impact of discounting (71,627)

IFRS 16 lease liabilities not recognised in prior

period operating lease commitments 6,538

Increases in minimum lease commitment 3,926

Recognition exemption as less than 12 months of lease

term remaining at transition (286)

---------

IFRS 16 liability recognised at 1 March 2019 78,230

---------

IFRS 16 defines the lease term as the non-cancellable period of

a lease together with the options to extend or terminate a lease,

if it is reasonably certain that the option would be taken. The

Group makes a judgement as to whether it is reasonably certain that

the option will be taken when determining the length of the lease.

The Group considers factors such as the length of time before the

option is exercisable, operational requirements and any planned

future capital expenditure.

The following standards and amendments have an effective date

after the date of these financial statements:

Effective for accounting

periods commencing

Standard, amendment and interpretation on or after

IFRIC 23 Uncertainty over Income Tax

Treatments 1 January 2019

Amendments to IAS 28: Long-term Interests

in Associates and Joint Ventures 1 January 2019

Amendments to IAS 19: Plan Amendment,

Curtailment or Settlement 1 January 2019

Annual Improvements to IFRS Standards

2015-2017 Cycle 1 January 2019

Amendments to References to the Conceptual

Framework in IFRS Standards 1 January 2020

IFRS 17 Insurance Contracts 1 January 2021

Amendments to IAS 19 are not expected to have a material effect

on the defined benefit obligation disclosures, due to scheme rules

giving the Group and unconditional right to a refund if the scheme

is in surplus. The adoption of all other standards, amendments and

interpretations is not expected to have a material effect on the

net assets, results and disclosures of the Group.

Presentation of Condensed Consolidated Income Statement

The presentation of the Condensed Consolidated Income Statement

shows the underlying results and non-underlying results in separate

columns. Non-underlying items are income and expenses, which

because of their nature, infrequency or occurrence, or the events

giving rise to them, merit separate presentation to allow

shareholders to better understand the financial performance for the

period. Non-underlying items includes the Group's share of

non-underlying profits of associates and joint ventures. Underlying

operating profit and underlying profit before tax are non-GAAP

measures which comprise operating profit and profit before tax

respectively before non-underlying items. The columnar format is

considered to be the clearest method of presentation of this

information.

Non-GAAP measures are used as they are considered to be both

useful and necessary. They are used for internal performance

analysis; the presentation of these measures facilitates

comparability with other companies, although management's measures

may not be calculated in the same way as similarly titled measures

reported by other companies.

The post-tax results of discontinued operations along with any

gain or loss recognised on the measurement to fair value less costs

to sell or on the disposal of the assets or disposal groups

constituting the discontinued operation are disclosed as a single

amount in the Condensed Consolidated Income Statement. The

comparative period results are restated accordingly.

2 Seasonality of operations

There is a material effect of seasonality in both of our largest

operating divisions. In the Aviation division there are higher

seasonal sales in summer, and this is partly offset by higher

seasonal sales in winter in the Energy division.

3 Segmental information

The reporting segments are Stobart Aviation, Stobart Energy,

Stobart Rail & Civils, Stobart Investments and Non-Strategic

Infrastructure.

The Stobart Aviation segment specialises in the operation of

commercial airports. The Stobart Energy segment specialises in the

supply of sustainable biomass for the generation of renewable

energy.

The Stobart Rail & Civils segment specialises in delivering

internal and external civil engineering development projects

including rail network operations. The Stobart Investments segment

holds a non-controlling interest in a transport and distribution

business, a regional airline business and a baggage handling

business. The Non-Strategic Infrastructure segment specialises in

management, development and realisation of non-strategic property

assets.

The Executive Directors are regarded as the Chief Operating

Decision Maker. The Directors monitor the results of each business

unit separately for the purposes of making decisions about resource

allocation and performance assessment. The main segmental profit

measure is underlying EBITDA, which is calculated as profit/(loss)

before tax, interest, depreciation, amortisation, swaps and

non-underlying items. Income taxes and certain central costs are

managed on a Group basis and are not allocated to operating

segments

Period ended Rail Non-Strategic Adjustments

31 August 2019 Aviation Energy & Civils Investments Infrastructure and eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External 26,307 42,883 18,375 2,127 1,170 2,269 93,131

Internal 65 - 11,019 - 142 (11,226) -

--------- -------- ---------- ------------ ---------------- ------------------ ---------

Statutory revenue 26,372 42,883 29,394 2,127 1,312 (8,957) 93,131

--------- -------- ---------- ------------ ---------------- ------------------ ---------

Underlying

EBITDA 4,110 11,748 (967) 2,267 (1,454) (3,599) 12,105

Non-underlying

items (5,784) (1,166) (84) (2,490) (532) (683) (10,739)

Swaps - - - - - 114 114

Depreciation (3,653) (4,442) (1,370) - (1,016) (873) (11,354)

Amortisation - (22) - - - (3,717) (3,739)

Impairments - - (8,474) - - - (8,474)

Net interest (581) (585) (95) (479) (255) (2,551) (4,546)

--------- -------- ---------- ------------ ---------------- ------------------ ---------

(Loss)/profit

before tax (5,908) 5,533 (10,990) (702) (3,257) (11,309) (26,633)

--------- -------- ---------- ------------ ---------------- ------------------ ---------

Period ended Rail Non-Strategic Adjustments

31 August 2018 Aviation Energy & Civils Investments Infrastructure and eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External 20,895 29,877 12,729 1,967 1,039 2,922 69,429

Internal 66 - 9,895 - 38 (9,999) -

--------- -------- ---------- ------------ ---------------- ------------------ ---------

Statutory revenue 20,961 29,877 22,624 1,967 1,077 (7,077) 69,429

--------- -------- ---------- ------------ ---------------- ------------------ ---------

Underlying

EBITDA 2,875 8,677 (4,840) 2,823 (1,054) (4,265) 4,216

Non-underlying

items (310) (2,170) - - (844) (1,687) (5,011)

Swaps - - - - - 3,579 3,579

Depreciation (2,803) (3,168) (1,114) - (348) (119) (7,552)

Amortisation - (111) - - - (1,858) (1,969)

Impairment

of loan notes - - - - (2,500) - (2,500)

Net interest (131) (366) (116) - (170) (595) (1,378)

--------- -------- ---------- ------------ ---------------- ------------------ ---------

(Loss)/profit

before tax (369) 2,862 (6,070) 2,823 (4,916) (4,945) (10,615)

--------- -------- ---------- ------------ ---------------- ------------------ ---------

Inter-segment revenues are eliminated on consolidation. Included

in adjustments and eliminations underlying EBITDA are central costs

of GBP3,476,000 (2018: GBP4,199,000) and intragroup profits

eliminated of GBP123,000 (2018: GBP66,000).

4 Discontinued operations

On 22 February 2019, the Group entered into an agreement to

dispose of Propius Holdings Limited (Propius) to Connect Airways.

The results of Propius have been reported on a single line, net of

tax on the face of the Condensed Consolidated Income Statement and

the assets and liabilities of Propius are presented as held for

sale in the Condensed Consolidated Statement of Financial Position.

The Condensed Consolidated Income Statement for the period ended 31

August 2018 has been restated on the same basis and also includes

the results of the operations of Everdeal Holdings Limited

(Everdeal) and the UK Flybe Franchise Operation (UKFFO) and the

profit on disposal of Everdeal as explained in the statutory

financial statements for the year ended 28 February 2019.

5 Non-underlying items

Non-underlying items included in the Condensed Consolidated

Income Statement comprise the items set out and described

below.

Six months Six months Year ended

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

New business and new contract

set-up costs 7,367 3,324 11,551

Transaction costs - 112 -

Restructuring costs 552 - 391

Litigation and claims 330 1,575 5,193

Share of post-tax losses of

joint venture 2,490 - -

Non-underlying items within

EBITDA 10,739 5,011 17,135

Amortisation 3,739 1,969 3,938

Impairments 8,474 - 7,800

----------- ----------- -----------

Total non-underlying items 22,952 6,980 28,873

----------- ----------- -----------

New business and new contract set-up costs comprise costs of

investing in major new business areas or major new contracts to

commence or accelerate development of our business presence. These

costs include new contract set-up costs at London Southend Airport

in the Aviation division and pre-contract costs and excess costs

incurred due to delays in customer plants becoming operational in

the Energy division.

Transaction costs comprise costs of making investments or costs

of financing transactions that are not permitted to be debited to

the cost of investment or as issue costs. Restructuring costs,

including the removal of some roles, have occurred within Group,

Aviation and Rail.

The charge for litigation and claims includes the cost of a High

Court dispute with a former Director, offset by any costs that have

been recovered. Contingent assets relating to any outstanding

claims are not recognised unless recovery is considered virtually

certain, in accordance with accounting standards.

Non-underlying share of post-tax losses of joint venture relates

to costs incurred by Connect Airways in acquiring Flybe, Stobart

Air and Propius.

Amortisation of acquired intangibles comprises the amortisation

of intangible assets including those identified as fair value

adjustments in acquisition accounting. The charge in the year is

principally in connection with amortisation of the Eddie Stobart

brand (GBP3.7m), which has doubled compared to last half year,

following a review of the residual value.

The impairment charge relates to the write off of goodwill and

intangible assets attributable to Rail & Civils.

6 Finance costs and income

Six months Six months

2019 2018

Unaudited Unaudited

GBP'000 GBP'000

Bank loans 1,292 822

Interest on defined benefit pension scheme 40 47

Finance charges payable under finance leases

and hire purchase agreements 746 640

Interest on IFRS 16 leases 1,306 -

Amortisation of deferred issue costs 182 146

ESL dividend passed to exchangeable bondholders 1,985 -

Other interest 525 377

Foreign exchange losses 656 -

Total finance costs 6,732 2,032

----------- -----------

Six months Six months

2019 2018

Unaudited Unaudited

GBP'000 GBP'000

Bank interest receivable 12 18

Interest receivable from associates and

joint ventures 2,174 -

Foreign exchange gains - 636

----------- -----------

Total finance income 2,186 654

----------- -----------

7 Taxation

Taxation on profit on ordinary activities

Total tax in the Condensed Six months Six months Year ended

Consolidated Income Statement 2019 2018 2019

from continuing and discontinued

operations

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Current income tax:

UK corporation tax - - -

Overseas corporation tax (22) - 1,268

Adjustments in respect of prior

years - 1,015 3,016

Total current tax (22) 1,015 4,284

----------- ----------- -----------

Deferred tax:

Origination and reversal of

temporary differences (2,021) (1,388) (1,872)

Impact of change in rate - - -

Adjustment in respect of prior

years (1,083) (947) (826)

----------- ----------- -----------

Total deferred tax (3,104) (2,335) (2,698)

----------- ----------- -----------

Total (credit)/charge in the

income statement from continuing

and discontinued operations (3,126) (1,320) 1,586

----------- ----------- -----------

Included in the above tax credits are total current tax credit

on continuing operations of GBPnil

(2018: GBP1,015,000 charge) and a total deferred tax credit on

continuing operations of GBP3,182,000 (2018: GBP2,546,000) giving a

total tax credit on continuing operations in the Condensed

Consolidated Income Statement of GBP3,182,000 (2018:

GBP1,531,000).

The GBP3,182,000 credit on continuing operations in the period

is allocated as GBP1,849,000 underlying and GBP1,333,000

non-underlying.

Reductions in the UK corporation tax rate from 20% to 19%

(effective from 1 April 2017) and a further reduction to 17%

(effective from 1 April 2020) have been announced and were

substantively enacted at the Condensed Consolidated Statement of

Financial Position date. As such, the deferred tax

assets/liabilities as at 31 August 2019 have been

recognised/provided at 17%.

8 Loss per share

The following table reflects the income and share data used in

the basic and diluted earnings per share calculations:

Six months Six months Year ended

2019 2018 2019

Unaudited Unaudited Audited

Numerator GBP'000 GBP'000 GBP'000

Loss used for basic and diluted

earnings (20,884) (17,496) (58,179)

Denominator Number Number Number

Weighted average number of shares

used in basic EPS 366,331,503 345,974,719 349,698,911

Effects of employee share options - - -

------------ ------------ ------------

Weighted average number of shares

used in diluted EPS 366,331,503 345,974,719 349,698,911

------------ ------------ ------------

Own shares held and therefore

excluded from weighted average

number 4,490,212 8,354,112 6,798,847

------------ ------------ ------------

The following table reflects the income used in the basic and

diluted underlying earnings per share calculations. The denominator

is consistent with the disclosed data in the table above.

Six months Six months Year ended

2019 2018 2019

Unaudited Unaudited Audited

Numerator GBP'000 GBP'000 GBP'000

Underlying profit/(loss) used

for basic and diluted earnings 735 (10,969) (31,054)

Underlying earnings/(loss) per

share

Basic 0.20p (3.17p) (8.88p)

Diluted 0.20p (3.17p) (8.88p)

----------- ----------- -----------

9 Dividends

A final dividend of 3.0p (2018: 4.5p) per share totalling

GBP11,125,000 (2018: GBP15,628,000) was declared on 29 May 2019 and

was paid on 31 July 2019.

10 Property, plant and equipment

Additions and disposals

During the six months ended 31 August 2019, the Group acquired

or developed property, plant and equipment assets with a cost of

GBP19,708,000 (2018: GBP18,681,000). This included development work

at London Southend Airport. Property, plant and equipment assets

with a book value of GBP2,537,000 (2018: GBP3,446,000) were

disposed of by the Group during the six months ended 31 August

2019, resulting in a profit of GBP194,000 (2018: GBP442,000).

Capital commitments

At 31 August 2019, the Group had capital commitments of

GBP4,875,000 (2018: GBP946,000), principally relating to

replacement truck and trailers in the Energy fleet.

11 Analysis of net debt

31 August 28 February

2019 2019

Unaudited Audited

Loans and borrowings GBP'000 GBP'000

Non-current

Fixed rate:

* Obligations under finance leases and hire purchase

contracts 14,697 20,668

Variable rate:

* Obligations under finance leases and hire purchase

contracts 16,578 5,886

* Bank loans 50,667 57,567

---------- ------------

81,942 84,121

---------- ------------

Current

Fixed rate:

* Obligations under finance leases and hire purchase

contracts 8,079 6,663

51,559 -

* Exchangeable bonds*

Variable rate:

* Obligations under finance leases and hire purchase

contracts 5,882 6,770

---------- ------------

65,520 13,433

---------- ------------

Total loans and borrowings (excluding IFRS

16) 147,462 97,554

Cash 7,725 14,432

---------- ------------

Comparable net debt (excluding IFRS 16) 139,737 83,122

Non-current

74,074 -

* IFRS 16 lease obligations

Current

2,874 -

* IFRS 16 lease obligations

---------- ------------

Net debt 216,685 83,122

---------- ------------

* In accordance with IAS 1 it is necessary for the secured

guaranteed exchangeable bonds (Bonds), issued on 3 May 2019, to be

presented as a current liability because the Group does not have an

unconditional right to defer settlement of the liability for at

least 12 months after the reporting period. The bondholders have an

unconditional right to require the group to settle the bonds by

giving the bondholders shares in Eddie Stobart Logistics plc (ESL)

at any time. The Group has no obligation to settle the Bonds in

cash within 12 months of the balance sheet date.

The obligations under finance leases and hire purchase contracts

are taken out with various lenders at fixed or variable interest

rates prevailing at the inception of the contracts. During the

period, GBP13,343,000 (Feb 2019: GBP14,178,000) of new finance

leases were taken out, GBP8,168,000 (Feb 2019: GBP14,382,000)

repayments made, and GBP74,000 (Feb 2019: GBP142,000) of unwind of

discount.

The GBP80,000,000 variable rate committed revolving credit

facility, with a facility end date of January 2022, was drawn at

GBP51,000,000 (Feb 2019: GBP58,000,000) at the period end.

The Group was in compliance with all financial covenants

throughout both the current and prior periods.

12 Fair values

Financial assets and liabilities

The carrying amounts of the following financial assets and

financial liabilities are a reasonable approximation of their fair

value: cash and cash equivalents, financial assets at fair value

through other comprehensive income, investments in associates and

joint ventures, trade and other receivables, trade and other

payables, derivative financial assets/liabilities.

The book value and fair values of the remaining financial

liabilities are as follows:

Book Value Fair Value

31 August 31 August

2019 2019

Unaudited Unaudited

GBP'000 GBP'000

Financial Liabilities

Bank loans 50,667 50,667

Exchangeable bonds 51,559 51,559

Finance leases and hire purchase arrangements 122,184 120,838

Book Value Fair Value

28 February 28 February

2019 2019

Audited Audited

GBP'000 GBP'000

Financial Liabilities

Bank loans 57,567 57,567

Finance leases and hire purchase arrangements 39,987 38,858

The fair values of loans and borrowings have been calculated by

discounting the expected future cash flows at prevailing interest

rates. The fair value of the exchangeable bonds includes a

derivative instrument, valued using an option pricing model, and a

debt component where the fair value has been calculated by

discounting the expected future cashflows at prevailing interest

rates.

Fair Value Hierarchy

The fair value hierarchy is explained in the statutory accounts

for the year ended 28 February 2019.

Financial Assets measured at Fair Value

Total Level 1 Level 2 Level 3

GBP'000 GBP'000 GBP'000 GBP'000

As at 31 August

2019

Other financial

assets 31,733 - 31,733 -

Swaps 357 - 357 -

As at 28 February

2019

Other financial

assets 44,918 44,918 - -

Swaps 248 - 248 -

During the six months ended 31 August 2019, there was one

transfer from Level 1 to Level 2 fair value measurements, and no

transfers into and out of Level 3 fair value measurements. The

transfer classified as other financial assets relates to the

Group's investment in ESL shares and arose due to the suspension of

trading in their shares on 23 August 2019 resulting in no

observable price at 31 August 2019. The valuation method at the

period end used the price on the date of suspension and applied a

reduction of 10%, due to the RNS information released regarding the

dividend. This is a judgement taken by management and once the

trading in ESL shares is permitted, the valuation will return to

level 1 and be based on the actively traded share price. A movement

of 1p in the ESL share price changes the investment value by

GBP447,000.

13 Cash used in operations

Six months Six months Year ended

ended 31 ended 31 28 February

August August 2018 2019

2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss before tax (26,633) (10,615) (42,114)

Adjustments to reconcile loss before tax to net cash flows:

Loss in value of investment properties 879 - 715

Realised profit on sale of property,

plant and equipment and investment

properties (194) (443) (584)

Share of post-tax profits of associates

and joint ventures accounted for