TIDMIPU

LEGAL ENTITY IDENTIFIER: 549300K1D1P23R8U4U50

Invesco Perpetual UK Smaller Companies Investment Trust plc

Half-Yearly Financial Report for the Six Months to 31 July 2023

The following text is extracted from the Half-Yearly Financial Report for the

Six Months to 31 July 2023. All page numbers below refer to the Half-Yearly

Financial Report which will be made available on the Company's website.

Investment Objective

The Company is an investment trust whose investment objective is to achieve long

-term total returns for shareholders primarily by investment in a broad cross

-section of small to medium sized UK quoted companies.

Financial Information and Performance Statistics

Total Return Statistics Six Months to 31 July Year Ended

(with dividends

reinvested) 2023 31 January

2023

Net asset value(1)(2) -6.9% -17.5%

Share price(1)(2) -5.4% -17.0%

Benchmark Index (2)(3) -4.2% -12.4%

Capital Statistics

At At

31 July 31 January

Period End Date 2023 2023 Change

Total shareholders' funds (£'000) 159,378 174,915 -8.9%

Net asset value per share (`NAV') 471.16p 517.09p -8.9%

Share price(2) 416.50p 451.00p -7.6%

Discount(1) (11.6)% (12.8)%

Gearing(1):

- gross gearing nil nil

- net cash 0.4% 2.9%

Maximum authorised gearing 9.4% 8.6%

Six Six

months months

ended ended

31 July 31 July

2023 2022

Return and dividend per ordinary share

Return(1)

- revenue 8.17p 6.74p

- capital (43.56)p (80.21)p

- Total (35.39)p (73.47)p

First interim dividend 3.85p 3.75p

Notes:

(1)Alternative Performance Measures (`APM'). See pages 16 and 17 for the

explanation and calculation of APMs. Further details are provided in the

Glossary of Terms and Alternative Performance Measures in the Company's 2023

Annual Financial Report.

(2)Source: Refinitiv.

(3)The Benchmark Index of the Company is the Numis Smaller Companies + AIM

(excluding Investment Companies) Index with dividends reinvested.

CHAIRMAN'S STATEMENT

Highlights

· Discount to NAV has narrowed from 12.8% to 11.6% during the period

· Discount has further narrowed to 8.9% as at 9 October 2023

· First interim dividend increased to 3.85p (2022: 3.75p), maintaining the

target dividend yield of 4%

· Revenue per ordinary share up to 8.17p (2022: 6.74p) during the period

Dear Shareholders,

I am pleased to succeed JaneLewis as the Company's new Chairman. Having served

on the Board for nine years, Jane retired at the conclusion of the AGM held in

June 2023. Iwould like to take this opportunity to thank Jane for all her hard

work and service to the Company. Her vast knowledge and experience of the

investment trust industry proved invaluable to the Board over that time. I would

also like to welcome Simon Longfellow to the Board. As previously announced,

Simon was appointed as a Non-Executive Director of the Company with effect from

1 July 2023 and has specialist experience of marketing investment trusts and

communicating effectively with Shareholders. The Board has now settled back to

its normal number of fourDirectors.

Performance

In common with many companies investing in the smaller companies sector, it has

been a difficult six months. The increasing interest rate environment has led to

the highest rates the UK has experienced for 15 years which has proven

challenging for markets in general and smaller companies in particular. Fears

about the cost of living crisis and the UK dipping into recession have weighed

heavily on sentiment. There is hope that interest rates might have peaked and

that the UK may avoid recession, though growth is still weak.

Your Company's net asset value (`NAV') return was -6.9% compared to -4.2% for

the benchmark index (in each case measured on a total return basis).

The Company's share price fell from 451.00p to 416.50p during the six months to

31 July 2023, a decrease of 7.6% (a 5.4% decrease on a total return basis), and

the discount to net asset value ended the period narrower at 11.6%, having been

12.8% as at 31 January 2023.

It is particularly pleasing to report an increase in revenue per share for the

period to 8.17p (2022: 6.74p). This reflects the robust dividend flow from the

portfolio.

Since the Company's half-year end to 9 October 2023, the latest practical date

before publication of this interim report, the Company's NAV total return is

-9.1%, the share price total return is -6.2%, whilst the benchmark index total

return is -8.7%. As at 9 October 2023, the discount has narrowed further to

8.9%.

Dividends

The Company's dividend policy is to target a dividend yield of 4% of the year

end share price paid from income earned within the portfolio and enhanced, as

necessary, through the use of realised capital profits.

In accordance with this policy, on 20 July 2023 the Board declared a first

interim dividend of 3.85p for the year ending 31 January 2024, which was paid on

1 September 2023 to shareholders on the register on 4 August 2023 (2022: 3.75p).

The expected timetable for the remaining dividend payments is as follows: the

second and third interim dividends are payable in December 2023 and March 2024

respectively, with the final dividend payable in June 2024, following its

approval by shareholders at the Company's Annual General Meeting.

Shareholders who hold shares on the main register and are residents of the UK,

Channel Islands and Isle of Man, have the opportunity to reinvest their dividend

via the Dividend Reinvestment Plan (`DRIP'). Shareholders will need to submit an

election by the 17 November 2023. Further information can be found in the

leaflet included with this report and on the Company's webpage:

www.invesco.co.uk/ipukscit.

Outlook

It is hoped that interest rates and inflation have now peaked; while it is too

early to declare new shoots of growth, there are some positive indicators such

as the easing of wage inflation. The worst may now be behind us and there is

certainly a widespread belief that UK equities are good value. Our portfolio

managers comment more about this in relation to UKsmaller companies in their

report.

Bridget Guerin

Chairman

10 October 2023

PORTFOLIO MANAGERS' REPORT

Q What were the key influences on the market over the period?

A Inflation and the central banks response to inflation were the dominant

features of the period under review. The Bank of England raised rates

significantly, from 3.5% to 5.25%, with the hope that the increased cost of

borrowing would reduce demand and moderate price increases. Although inflation

has begun to moderate, it typically takes around a year for higher rates to take

effect, suggesting this has so far been a minor factor. In fact, many economists

calculate that the increased income from consumer savings currently outweighs

the negative impact from higher mortgage rates. More importantly, many of the

factors that drove inflation to multi-decade highs, such as energy prices, and

the supply chain disruption that we saw after the pandemic, have finally begun

to normalise.

Another notable feature of the half year was a bout of Artificial Intelligence

(`AI') exuberance. This was prompted by the launch of the latest version of AI

software ChatGPT. Whilst various forms of machine learning have been in use for

the last decade, ChatGPT captured the imagination of investors due to its

ability to produce written output with a realistic human like quality. The

software analyses vast amounts of written online content and uses the

information to predict the order in which to place words to create coherent

text. Whilst it is a very useful tool, its lack of any actual intelligence makes

it prone to regurgitating false information in a highly convincing way. As with

all popular stock market trends, investment banks created various instruments

("baskets" of stocks) to allow investors to play this theme. This negatively

impacted the shares of a number of companies, which rightly or wrongly, were

deemed to be potential victims of this new technology. Whilst we see AI as an

important tool for driving productivity, we were surprised by the market

volatility created by this phenomenon.

The much-heralded UK recession is yet to materialise. Although the level of

growth in the UK economy is anaemic, we continue to benefit from full employment

and a higher level of consumer savings than we have seen for some time. So

contrary to the endless news headlines about the "cost of living crisis", the

consumer discretionary sector was by far the strongest performing area within

the UK smaller companies sector, with leisure stocks performing particularly

well.

Q How did the portfolio perform over the period?

A The Net Asset Value total return for the portfolio over the period was -6.9%,

which was an underperformance versus the benchmark index, the Numis Smaller

Companies + AIM (excluding Investment Companies), which returned -4.2% on the

same basis. The share price total return was -5.4%, reflecting the narrowing of

the discount from 12.8% at last financial year end to 11.6% at the end of this

period.

Q Which stocks contributed to and detracted from performance?

A The best performing stocks over the period included: Infrastructure products

business, Hill & Smith (+27%), which is benefitting from increased spending on

infrastructure, particularly in the US, where the company generates most of its

profits. Gresham House (+42%), is a fund management business focused on ethical

investing. The company received a takeover approach at a significant premium to

its share price. Pubs businesses, Young & Co's Brewery (+32%) and Mitchells &

Butlers (+40%), both recovered significantly after a period of underperformance.

The shares had suffered due to high energy prices and wage inflation

substantially reducing profits. However, consumer spending has remained far more

resilient than many had expected, and with energyprices now moderating, the

stockshave recovered much of the lostground. Software and services company,

FDTechnologies (+31%), had a good period after it announced strong sales figures

for its innovative data software. Historically it was mostly used within the

financial sector, but the company is now gaining new customers across a variety

of verticals, which has substantially increased the addressable market for its

product.

In a difficult period for markets, inevitably there were some poorly performing

holdings: Oil and Gas company, Jadestone Energy (-73%), suffered from reduced

production due to some maintenance issues at its main oil field. The profit

shortfall meant the business had to issue shares at a discount to bolster its

cash position. Whilst the stock appears good value it has been blighted by a

number of missteps, so we are currently reviewing the holding. Keywords Studios

(-38%), which provides outsourced services to the computer games industry, was

caught up in the bout of AIexuberance which gripped the market following the

release of the latest version of ChatGPT. Some commentators believe that its

revenue could be negatively impacted by generative AI. However, the company

already uses AI as a productivity tool in a number of areas of its business, so

we believe the fears are misplaced. We think it is an excellent business and

used the share price weakness to add to the holding. Software and services

business, Learning Technologies (-46%), was also impacted by short selling due

to fears about the impact of AI. Again, we do not believe the business will be

significantly affected. However, lower business confidence in the US did lead to

a reduction in earnings estimates toward the end of the period. Whilst this is

disappointing, we believe the company still has substantial growth potential and

we have retained our holding. Videndum (-40%), which manufactures products used

in the TV, film and photographic industries has seen its earnings expectations

eroded due to the strikes called by script writers and actors in the US. The

strikes will ultimately be resolved, and profits will recover, so we have

retained our holding.

Q What is the current portfolio strategy?

A Our investment philosophy remains unchanged. The current portfolio is

comprised of around 70 stocks with the sector weightings being determined by

where we are finding attractive companies at a given time, rather than by

allocating assets according to a "top down" view of the economy. We continue to

seek growing businesses, which have the potential to be significantly larger in

the medium term. These tend to be companies that either have great products or

services, that can enable them to take market share from their competitors, or

companies that are exposed to higher growth niches within the UK economy or

overseas. We prefer to invest in cash generative businesses that can fund their

own expansion, although we are willing to back strong management teams by

providing additional capital to invest for growth.

The sustainability of returns and profit margins is vital for the long-term

success of a company. The assessment of the position of a business within its

supply chain and a clear understanding of how work is won and priced are key to

determining if a company has "pricing power", which is particularly important in

the current inflationary environment. It is also important to determine which

businesses possess unique capabilities, in the form of intellectual property,

specialist know-how or a scale advantage in their chosen market. We conduct

around 300 company meetings and site visits a year, and these areas are a

particular focus for us on such occasions.

The current uncertainty over the timing and pace of economic recovery has led us

to manage the portfolio using a "barbell" strategy. Around half the portfolio is

invested in businesses with more defensive characteristics. These companies

either benefit from long term contracts or are exposed to more stable, less

economically sensitive end markets. These characteristics provide a greater

degree of resilience and earnings visibility in the current environment.

However, it should be noted that this sort of certainty comes at a price, with

these stocks typically trading at a valuation premium to the market. The other

half of the portfolio is invested in more cyclical, economically sensitive

stocks. In some cases, these businesses are experiencing more difficult trading,

however, we believe they can still be attractive investments where this is

reflected in the valuation. When economic conditions improve it is possible to

make strong returns from these stocks, as both earnings and the multiple

investors willing to pay for those earnings, start to recover.

Q What are the major holdings in the portfolio?

A The 5 largest holdings in the portfolio at the end of the period were:

·4imprint (4.4% of the portfolio) sells promotional materials such as pens, bags

and clothing which are printed with company logos. The business gathers orders

through online and catalogue marketing, which are then routed to their suppliers

who print and dispatch the products to customers. As a result of outsourcing

manufacture, the business has a relatively low capital requirement and can focus

on marketing and customer service. Continual reinvestment of revenue into

marketing campaigns has enabled the business to generate an enviable long term

growth record whilst maintaining margins.

·JTC (3.3% of the portfolio) is a financial administration business providing

services to real estate and private equity funds, multinational companies, and

high net worth individuals. The business has a strong culture, a reputation for

quality and has augmented its organic growth with acquisitions. Margins and

returns on capital are strong and the business benefits from long term

contracts, giving it excellent earnings visibility.

·Hill & Smith (3.2% of the portfolio) is a supplier of products and services

into the infrastructure sectors in the UK and US. Its proprietary steel and

composite products are used in the rail, roads, water, and energy sectors. The

business also provides galvanizing services to protect steel structures, and

leases temporary road barriers and security products. The company generates good

margins and benefits from exposure to growing infrastructure investment,

particularly in the US.

·CVS (3.1% of the portfolio) is a leading veterinary services business, which

owns over 500 vet surgeries and specialist centres, predominantly in the UK. The

scale of the business gives it purchasing power, allowing it to generate a

higher margin than individual surgeries. The business has been a leading

consolidator of the UK market and have recently entered continental Europe and

Australia. The company is relatively immune to the economic cycle, and with ever

more being spent on the wellbeing of the nation's pets, it can continue to grow

for many years to come.

The recent announcement of a Competition and Markets Authority consultation on

the sector has negatively impacted its share price. However, there are already

restrictions on the number of vets any business can have in a given area in

order to ensure a competitive market, and we do not believe the business is

generating excessive profits. Whilst prices for veterinary services have risen

over the last few years, the increases have only been in-line with wage

inflation in the sector.

·Advanced Medical Solutions (2.7% of the portfolio) produces a range of

proprietary wound care and wound closure products such as sutures, medical

adhesives, antimicrobial dressings and surgical devices. The company should

benefit from the backlog of medical procedures following the pandemic and has an

exciting pipeline of innovative products which should drive longer term growth.

Q What were the new holdings added over the period?

A New stocks that we added to the portfolio in the period include:

·Tatton Asset Management (`Tatton') creates model portfolios which it sells via

independent financial advisors (`IFAs') in the UK. The outsourcing of investment

decisions by IFAs to businesses such as Tatton has increased significantly over

the last decade due to an increasing burden of regulation on IFAs. Tatton has a

range of model portfolios, made up of both active and passive funds, that

correspond with a variety of risk categories for clients. The service has one of

the lowest fee structures in the industry, a good long-term performance record

and a strong reputation within the IFA sector. The business is growing strongly,

and with a highly scalable business model, it achieves an enviable level of

profitability.

·Niox is a medical diagnostic business with technology that can more accurately

diagnose and monitor asthma. The company is the world leader in fractional

exhaled nitric oxide (`FeNO') testing, which measures exhaled Nitric Oxide as a

diagnostic marker for asthma. FeNO testing is significantly more accurate than

traditional methods of testing. The product is approved by the National

Institute for Health and Care Excellence in the UK and is reimbursable in all

its major markets. We believe the business can substantially grow its installed

base of devices, and this should drive a high level of recurring test kit

revenue.

Q What is the Portfolio Managers' approach to gearing?

A Gearing decisions are taken after reviewing a variety of metrics including

valuations, earnings momentum, market momentum, bond spreads and a range of

economic indicators. After analysing this data, we concluded that the Company

should not be geared at this point. We will continue to monitor these factors

and look to gear the Company when the indicators turn more positive.

Q How does ESG factor in the investment process?

A Environment, Social and Governance (`ESG') issues are increasingly a focus for

many investors and analysis of these factors has always been a core part of our

investment process. Invesco has significant resources focussed on ESG, both at a

group and individual team level. Our proprietary ESGintel system draws in

company specific data from a broad range of sources and enables ESG related

metrics to be quantified. This provides fund managers with a clear overview of

areas of concern, allowing targeted engagement with businesses to bring about

positive change.

Environmental liabilities, socially dubious business practises and poor

corporate governance, can have a significant impact on share prices. We assess

environmental risks within a business, and analyse the steps being taken to

reduce its environmental impact. We like businesses with strong cultures and

engaged employees, and avoid businesses, which, whilst acting within the law,

run the risk of a public backlash, or being constrained by newlegislation. We

believe that governance, board structure and incentivisation, are byfar the most

important factors within ESGin determining shareholder returns. Theimportance of

businesses being managed by good quality people, with appropriate

incentivisation should not be underestimated. Therefore, we proactively consult

with all the businesses we own on these matters and vote against resolutions

where standards fall short of our expectations.

Q What is the dividend policy of the Company?

A The Company pays out all the income earned within the portfolio and enhances

it using a small amount of realised capital profits to target a dividend yield

of 4.0% based on the year end share price. This provides shareholders with an

attractive and consistent yield whilst allowing us to target businesses that we

believe will deliver the best total return, without having to compromise on

quality to hit an income target.

Q What are your expectations for the year ahead?

A The current level of economic growth in the UK is lacklustre, and we are just

beginning to feel the lagged effects of the steep increase in the Bank of

England base rate, so the prognosis for the coming year appears gloomy. However,

we are not currently in recession and the most recent data suggests that wages

are growing again in real terms for the first time in a couple of years. We are

also in the fortunate position of having full employment and healthy consumer

balance sheets (in aggregate) which should feed through to confidence over time.

We are hopeful that inflation should continueto decline over coming months. The

supply chain tightness that drove the initial wave of inflation following the

pandemic has largely normalised, and energy prices have now significantly fallen

year on year. Conversations with companies suggest that it is now much easier to

find staff than it was a year ago and this is beginning to feed through to wage

settlements. So hopefully the worst of the cost of living crisis is now behind

us, and we are near the peak of the current interest rate cycle.

The value within the UK smaller companies market is very apparent to us. Whether

we compare current valuations to history, or to other international markets, the

sector looks anomalously cheap. Over time this should attract increased interest

from the investment community, but in the meantime we have seen a surge in

takeover activity from both corporate and private equity buyers looking to

exploit the "knock-down" prices of UK equities. Whilst the economic backdrop is

underwhelming we continue to see opportunities to buy undervalued shares in

companies with excellent long term growth potential. So, after a difficult

couple of years, we are optimistic of better returns over the coming year.

Jonathan Brown & Robin West

Portfolio Managers

10 October 2023

PRINCIPAL RISKS AND UNCERTAINTIES

The Directors confirm that they have carried out a robust assessment of the

emerging and principal risks facing the Company, including those that would

threaten its business model, future performance, solvency or liquidity. Most of

these risks are market related and are similar to those of other investment

trusts investing primarily in listed markets. The Audit Committee reviews the

Company's risk control summary at each meeting, and as part of this process,

gives consideration to identify emerging risks. Emerging risks, such as evolving

cyber threat, geo-political tension and climate related risks, have been

considered during the period as part of the Directors' assessment.

+--------------+---------------------------------------------------------------+

|Principal Risk|Mitigating Procedures and Controls |

|Description | |

+--------------+---------------------------------------------------------------+

|Market | |

|(Economic) | |

|Risk | |

+--------------+---------------------------------------------------------------+

|Factors such |The Directors have assessed the market impact of the ongoing |

|as |uncertainty from the conflict in Ukraine and the resulting |

|fluctuations |sanctions imposed on Russia through regular discussions with |

|in stock |the Portfolio Managers and the Corporate Broker. The Company's |

|markets, |current portfolio consists of companies listed on the main UK |

|interest rates|equity market and those listed on AIM. The Company does not |

|and exchange |have direct investments in Russia or hold stocks with |

|rates are not |significant links to Russia. To a limited extent, futures can |

|under the |be used to mitigate against market (economic) risk, as can the |

|control of the|judicious holding of cash or other very liquid assets. Futures |

|Board or the |are not currently being used. |

|Portfolio | |

|Managers, but | |

|may give rise | |

|to high levels| |

|of volatility | |

|in the share | |

|prices of | |

|investee | |

|companies, as | |

|well as | |

|affecting the | |

|Company's own | |

|share price | |

|and the | |

|discount to | |

|its NAV. The | |

|risk could be | |

|triggered by | |

|unfavourable | |

|developments | |

|globally | |

|and/or in one | |

|or more | |

|regions, | |

|contemporary | |

|examples being| |

|the market | |

|uncertainty in| |

|relation to | |

|ongoing | |

|invasion of | |

|Ukraine by | |

|Russia. | |

+--------------+---------------------------------------------------------------+

|Investment | |

|Risk | |

+--------------+---------------------------------------------------------------+

|The Company |The Portfolio Managers' approach to investment is one of |

|invests in |individual stock selection. Investment risk is mitigated via |

|small and |the stock selection process, together with the slow build-up of|

|medium-sized |holdings rather than the purchase of large positions outright. |

|companies |This allows the Portfolio Managers, cautiously, to observe more|

|traded on the |data points from a company before adding to a position. The |

|London Stock |overall portfolio is well diversified by company and sector. |

|Exchange or on|The weighting of an investment in the portfolio tends to be |

|AIM. By their |loosely aligned with the market capitalisation of that company.|

|nature, these |This means that the largest holdings will often be amongst the |

|are generally |larger of the smaller companies available. The Portfolio |

|considered |Managers are relatively risk averse, look for lower volatility |

|riskier than |in the portfolio and seek to outperform in more challenging |

|their larger |markets. The Portfolio Managers remain cognisant at all times |

|counterparts |of the potential liquidity of the portfolio. There can be no |

|and their |guarantee that the Company's strategy and business model will |

|share prices |be successful in achieving its investment objective. The Board |

|can be more |monitors the performance of the Company, giving due |

|volatile, with|consideration to how the Manager has incorporated ESG |

|lower |considerations including climate change into their investment |

|liquidity. In |process. The Board also has guidelines in place to ensure that |

|addition, as |the Portfolio Managers adhere to the approved investment |

|smaller |policy. The continuation of the Manager's mandate is reviewed |

|companies may |annually. |

|not generally | |

|have the | |

|financial | |

|strength, | |

|diversity and | |

|resources of | |

|larger | |

|companies, | |

|they may find | |

|it more | |

|difficult to | |

|overcome | |

|periods of | |

|economic | |

|slowdown or | |

|recession. | |

| | |

|Furthermore, | |

|the risk of | |

|climate change| |

|and matters | |

|concerning ESG| |

|could affect | |

|the valuation | |

|of companies | |

|held in the | |

|portfolio. | |

+--------------+---------------------------------------------------------------+

|Shareholders' | |

|Risk | |

+--------------+---------------------------------------------------------------+

|The value of |The Board reviews regularly the Company's investment objective |

|an investment |and strategy to ensure that it remains relevant, as well as |

|in the Company|reviewing the composition of the shareholder register, peer |

|may go down as|group performance on both a share price and NAV basis, and the |

|well as up and|Company's share price discount to NAV per share. The Board and |

|an investor |the Portfolio Managers maintain an active dialogue with the aim|

|may not get |of ensuring that the market rating of the Company's shares |

|back the |reflects the underlying NAV; both share buy back and issuance |

|amount |facilities are in place to help the management of this process.|

|invested. | |

+--------------+---------------------------------------------------------------+

|Reliance on | |

|the Manager | |

|and other | |

|Third-Party | |

|Service | |

|Providers | |

+--------------+---------------------------------------------------------------+

|The Company |Third-party service providers are subject to ongoing monitoring|

|has no |by the Manager and the Board. |

|employees and | |

|comprises non |The Manager reviews the performance of all third-party |

|-executive |providers regularly through formal and informal meetings. |

|directors | |

|only. The |The Audit Committee reviews regularly the performance and |

|Company is |internal controls of the Manager and all third-party providers |

|therefore |through audited service organisation control reports, together |

|reliant upon |with updates on information security, the results of which are |

|the |reported to the Board. |

|performance of| |

|third-party |The Manager's business continuity plans are reviewed on an |

|service |ongoing basis and the Directors are satisfied that the Manager |

|providers for |has in place robust plans and infrastructure to minimise the |

|its executive |impact on its operations so that the Company can continue to |

|function and |trade, meet regulatory obligations, report and meet shareholder|

|service |requirements. The Board receives regular update reports from |

|provisions. |the Manager and third-party service providers on business |

|The Company's |continuity processes and has been provided with assurance from |

|operational |them all insofar as possible that measures are in place for |

|structure |them to continue to provide contracted services to the Company.|

|means that all| |

|cyber risk | |

|(information | |

|and physical | |

|security) | |

|arises at its | |

|third-party | |

|service | |

|providers, | |

|including | |

|fraud, | |

|sabotage or | |

|crime against | |

|the Company. | |

|The Company's | |

|operational | |

|capability | |

|relies upon | |

|the ability of| |

|its third | |

|-party service| |

|providers to | |

|continue | |

|working | |

|throughout the| |

|disruption | |

|caused by a | |

|major event | |

|such as the | |

|Covid-19 | |

|pandemic. | |

|Failure by any| |

|service | |

|provider to | |

|carry out its | |

|obligations to| |

|the Company in| |

|accordance | |

|with the terms| |

|of its | |

|appointment | |

|could have a | |

|materially | |

|detrimental | |

|impact on the | |

|operation of | |

|the Company | |

|and could | |

|affect the | |

|ability of the| |

|Company to | |

|successfully | |

|pursue its | |

|investment | |

|policy. The | |

|Company's main| |

|service | |

|providers, of | |

|which the | |

|Manager is the| |

|principal | |

|provider, are | |

|listed on page| |

|18. The | |

|Manager may be| |

|exposed to | |

|reputational | |

|risks. In | |

|particular, | |

|the Manager | |

|may be exposed| |

|to the risk | |

|that | |

|litigation, | |

|misconduct, | |

|operational | |

|failures, | |

|negative | |

|publicity and | |

|press | |

|speculation, | |

|whether or not| |

|it is valid, | |

|will harm its | |

|reputation. | |

|Damage to the | |

|reputation of | |

|the Manager | |

|could | |

|potentially | |

|result in | |

|counterparties| |

|and third | |

|parties being | |

|unwilling to | |

|deal with the | |

|Manager and by| |

|extension the | |

|Company, which| |

|carries the | |

|Manager's | |

|name. This | |

|could have an | |

|adverse impact| |

|on the ability| |

|of the Company| |

|to pursue its | |

|investment | |

|policy | |

|successfully. | |

+--------------+---------------------------------------------------------------+

|Regulatory | |

|Risk | |

+--------------+---------------------------------------------------------------+

|The Company is|The Manager reviews the level of compliance with tax and other |

|subject to |financial regulatory requirements on a regular basis. The Board|

|various laws |regularly considers all risks, the measures in place to control|

|and |them and the possibility of any other risks that could arise. |

|regulations by|The Manager's Compliance and Internal Audit team produce annual|

|virtue of its |reports for review by the Company's Audit Committee. Further |

|status as an |details of risks and risk management policies as they relate to|

|investment |the financial assets and liabilities of the Company are |

|trust, its |detailed in note 16 of the Company's 2023 Annual Financial |

|listing on the|Report. |

|London Stock | |

|Exchange and | |

|being an | |

|Alternative | |

|Investment | |

|Fund under the| |

|UK AIFMD | |

|regime. A loss| |

|of investment | |

|trust status | |

|could lead to | |

|the Company | |

|being subject | |

|to corporation| |

|tax on the | |

|chargeable | |

|capital gains | |

|arising on the| |

|sale of its | |

|investments. | |

|Other control | |

|failures, | |

|either by the | |

|Manager or any| |

|other of the | |

|Company's | |

|service | |

|providers, | |

|could result | |

|in operational| |

|or | |

|reputational | |

|problems, | |

|erroneous | |

|disclosures or| |

|loss of assets| |

|through fraud,| |

|as well as | |

|breaches of | |

|regulations. | |

+--------------+---------------------------------------------------------------+

In the view of the Board, these principal risks and uncertainties are as much

applicable to the remaining six months of the financial year as they were to the

six months under review.

THIRTY LARGEST INVESTMENTS

at 31 July 2023

Ordinary shares unless stated otherwise

Market

Value

£'000

% of

Portfolio

Company Sector

4imprint Media 6,967 4.4

JTC Investment Banking 5,206 3.3

and Brokerage

Services

Hill & Smith Industrial Metals 5,072 3.2

and Mining

CVSAIM Consumer Services 4,865 3.1

Advanced Medical Medical Equipment 4,240 2.7

SolutionsAIM and Services

Hollywood Bowl Travel and Leisure 4,092 2.6

Chemring Aerospace and 3,937 2.5

Defence

Energean Oil, Gas and Coal 3,869 2.4

Serco Industrial Support 3,642 2.3

Services

Alfa Financial Software and 3,592 2.3

Software Computer Services

Top Ten Holdings 45,482 28.8

Hilton Food Food Producers 3,577 2.2

AJ Bell Investment Banking 3,485 2.2

and Brokerage

Services

Brooks Investment Banking 3,456 2.2

MacdonaldAIM and Brokerage

Services

Coats General Industrials 3,308 2.1

discoverIE Electronic and 3,031 1.9

Electrical Equipment

Young & Co's Travel and Leisure 2,945 1.8

Brewery - Non

-VotingAIM

Ricardo Construction and 2,869 1.8

Materials

Gresham HouseAIM Closed End 2,789 1.8

Investments

Keywords Leisure Goods 2,735 1.7

StudiosAIM

Johnson ServiceAIM Industrial Support 2,686 1.7

Services

Top Twenty 76,363 48.2

Holdings

Essentra Industrial Support 2,677 1.7

Services

Kainos Software and 2,676 1.7

Computer Services

Volution Construction and 2,612 1.6

Materials

Alpha Financial Industrial Support 2,524 1.6

Markets Services

ConsultingAIM

Churchill ChinaAIM Household Goods and 2,448 1.5

Home Construction

Marshalls Construction and 2,398 1.5

Materials

Aptitude Software Software and 2,343 1.5

Computer Services

RWSAIM Industrial Support 2,301 1.5

Services

Auction Technology Software and 2,283 1.4

Computer Services

Genuit Construction and 2,264 1.4

Materials

Top Thirty 100,889 63.6

Holdings

Other Investments 57,828 36.4

(40)

Total Investments:

70

(31 January 2023: 158,717 100.0

70)

AIMInvestments quoted on AIM.

GOVERNANCE

Going Concern

The financial statements have been prepared on a going concern basis. The

portfolio of investments is comprised entirely of quoted securities and the

ongoing charges are around 1% of net assets. As at 9 October 2023, the Company

has drawn down £3.4m of its bank overdraft borrowing facilities, with a further

£11.6m available for investment opportunities within prescribed limits as set by

the Board.

The Directors consider this is the appropriate basis, as the Company has

adequate resources to continue in operational existence for the foreseeable

future, being taken as at least 12 months after signing the balance sheet. In

considering this, the Directors took into account the diversified portfolio of

readily realisable securities which can be used to meet funding commitments, and

the ability of the Company to meet all of its liabilities, including any bank

overdraft, and ongoing expenses as they fall due.

Related Party Transactions and Transactions with the Manager

Note 20 of the Company's 2023 Annual Financial Report gives details of related

party transactions and transactions with the Manager. This report is available

on the Company's section of the Manager's website at www.invesco.co.uk/ipukscit.

Directors' Responsibility Statement in respect of the preparation of the Half

-Yearly Financial Report

The Directors are responsible for preparing the Half-Yearly Financial Report

using accounting policies consistent with applicable law and International

Financial Reporting Standards.

The Directors confirm that to the best of their knowledge:

-the condensed set of financial statements contained within the Half-Yearly

Financial Report have been prepared in accordance with the International

Accounting Standards 34 `Interim Financial Reporting';

-the interim management report includes a fair review of the information

required by 4.2.7R and 4.2.8R of the UKLA's Disclosure Guidance and Transparency

Rules; and

-the interim management report includes a fair review of the information

required on related party transactions.

The Half-Yearly Financial Report has not been audited or reviewed by the

Company's auditor.

Signed on behalf of the Board of Directors.

Bridget Guerin

Chairman

10 October 2023

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

For the For the

six six

months months

ended ended

31 July 31 July

2023 2022

Revenue Capital Total Revenue Capital Total

Notes £'000 £'000 £'000 £'000 £'000 £'000

Loss on - (14,695) (14,695) - (26,494) (26,494)

investments

held

at fair

value

Income 2 3,074 491 3,565 2,584 - 2,584

3,074 (14,204) (11,130) 2,584 (26,494) (23,910)

Investment 3 (92) (523) (615) (111) (631) (742)

management

fee

Other (217) (1) (218) (192) (3) (195)

expenses

Loss before 2,765 (14,728) (11,963) 2,281 (27,128) (24,847)

finance

costs

and

taxation

Finance 3 (1) (8) (9) (1) (4) (5)

costs

Loss before 2,764 (14,736) (11,972) 2,280 (27,132) (24,852)

taxation

Taxation 4 - - - - - -

Loss after 2,764 (14,736) (11,972) 2,280 (27,132) (24,852)

taxation

Return per 8.17p (43.56)p (35.39)p 6.74p (80.21)p (73.47)p

ordinary

share

Weighted

average

number of

ordinary

shares

in issue

during

the period

33,826,929 33,826,929

The total columns of this statement represent the Company's statement of

comprehensive income, prepared in accordance with UK-adopted international

accounting standards. The loss after taxation is the total comprehensive loss.

The supplementary revenue and capital columns are both prepared in accordance

with the Statement of Recommended Practice issued by the Association of

Investment Companies. All items in the above statement derive from continuing

operations of the Company. No operations were acquired or discontinued in the

period.

CONDENSED STATEMENT OF CHANGES IN EQUITY

Capital

Share Share Redemption Capital Revenue

Capital Premium Reserve Reserve Reserve Total

Notes £'000 £'000 £'000 £'000 £'000 £'000

For the six

months

ended 31 July

2023

At 31 January 10,642 22,366 3,386 137,004 1,517 174,915

2023

Total - - - (14,736) 2,764 (11,972)

comprehensive

loss for the

period

Dividends 5 - - - (2,048) (1,517) (3,565)

paid

At 31 July 10,642 22,366 3,386 120,220 2,764 159,378

2023

For the six

months

ended 31 July

2022

At 31 January 10,642 22,366 3,386 184,089 270 220,753

2022

Total - - - (27,132) 2,280 (24,852)

comprehensive

loss for the

period

Dividends 5 - - - (4,906) (270) (5,176)

paid

At 31 July 10,642 22,366 3,386 152,051 2,280 190,725

2022

CONDENSED BALANCE SHEET

Registered number 2129187

At At

31 July 31 January

2023 2023

£'000 £'000

Notes

Non-current assets

Investments held at fair 158,717 172,643

value through profit or

loss

Current assets

Amounts due from brokers - 48

Overseas withholding tax 30 31

recoverable

Income tax recoverable 4 4

Prepayments and accrued 238 317

income

Cash and cash equivalents 614 5,055

886 5,455

Total assets 159,603 178,098

Current liabilities

Amounts due to brokers (53) (2,974)

Accruals (172) (209)

Total assets less current (225) (3,183)

liabilities

Net assets 159,378 174,915

Capital and reserves

Share capital 10,642 10,642

Share premium 22,366 22,366

Capital redemption reserve 3,386 3,386

Capital reserve 120,220 137,004

Revenue reserve 2,764 1,517

Total shareholders' funds 159,378 174,915

Net asset value per 471.16p 517.09p

ordinary share

Number of ordinary shares 6 33,826,929 33,826,929

in issue at the period end

CONDENSED CASH FLOW STATEMENT

Six months Six months

ended 31 July ended 31 July

2023 2022

£'000 £'000

Notes

Cash flow from operating activities

Loss before finance costs and taxation (11,963) (24,847)

Adjustments for:

Purchases of investments (9,562) (26,326)

Sales of investments 5,920 32,746

(3,642) 6,420

Loss on investments held at fair value 14,695 26,494

Decrease/(increase) in receivables 80 (71)

Decrease in payables (37) (39)

Net cash (outflow)/inflow from (867) 7,957

operating activities

Cash flow from financing activities

Finance cost paid (9) (5)

Dividends paid 5 (3,565) (5,176)

Net cash outflow from financing (3,574) (5,181)

activities

Net (decrease)/increase in cash and (4,441) 2,776

cash equivalents

Cash and cash equivalents at start of 5,055 1,530

the period

Cash and cash equivalents at the end of 614 4,306

the period

Reconciliation of cash and cash

equivalents to the Balance Sheet is as

follows:

Cash held at custodian 44 61

Invesco Liquidity Funds plc - Sterling, 570 4,245

money market fund

Cash and cash equivalents 614 4,306

Cash flow from operating activities

includes:

Dividends received 3,649 2,516

Interest received 2 -

As the Company did not have any long term debt at both the current and prior

period ends, no reconciliation of the financial liabilities is presented.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

1.Basis of Preparation

The condensed financial statements have been prepared using the same accounting

policies as those adopted in the Company's 2023 Annual Financial Report. They

have been prepared on a historical cost basis, in accordance with the applicable

UK-adopted international accounting standards and, where possible, in accordance

with the Statement of Recommended Practice for Financial Statements of

Investment Trust Companies and Venture Capital Trusts, updated by the

Association of Investment Companies in July 2022 (AIC SORP).

2.Income

Six months Six months

ended 31 July ended 31 July

2023 2022

£'000 £'000

Income from investments:

UK dividends

- ordinary 2,561 2,249

- special 409 210

Overseas dividends 102 125

3,072 2,584

Other income:

Deposit interest 2 -

3,074 2,584

Special dividends of £491,000 were recognised in capital during the period (31

July 2022: £nil).

Overseas dividends include dividends received on UK listed investments where the

investee company is domiciled outside of the UK.

3.Management Fee and Finance Costs

The investment management fee and finance costs are allocated 15% to revenue and

85% to capital.

A base management fee is payable monthly in arrears and is calculated at the

rate of 0.75% (31 July 2022: 0.75%) per annum by reference to the Company's

gross funds under management.

4.Taxation and Investment Trust Status

No tax liability arises on capital gains because the Company has been accepted

by HMRC as an approved investment trust and it is the intention of the Directors

to conduct the affairs of the Company so that it continues to satisfy the

conditions for this approval.

5. Dividends paid on Ordinary Shares

Six months ended Six months ended

31 July 2023 31 July 2022

Rate £'000 Rate £'000

Third interim (prior year) 3.75p 1,269 3.75p 1,269

Final (prior year) 6.79p 2,296 11.55p 3,907

Total 10.54p 3,565 15.30p 5,176

The first interim dividend of 3.85p per ordinary share (31 July 2022: 3.75p) was

paid on 1 September 2023 to shareholders on the register on 4August 2023.

6.Share Capital, including Movements

Share capital represents the total number of shares in issue, including treasury

shares.

Six months Year ended

ended 31 July 31 January

2023 2023

Share capital:

Ordinary shares of 20p each (£'000) 6,765 6,765

Treasury shares of 20p each (£'000) 3,877 3,877

10,642 10,642

Number of ordinary shares in issue: 33,826,929 33,826,929

Number of shares held in treasury: 19,382,155 19,382,155

Total 53,209,084 53,209,084

7.Classification Under Fair Value Hierarchy

Note 16 of the Company's 2023 Annual Financial Report sets out the basis of

classification.

As at 31 July 2023, all of the Company's portfolio was composed of quoted (Level

1) investments.

In the prior year, Berry Starquest Limited was a dormant subsidiary and was the

only Level 3 investment valued at £100 as at 31 January 2023. The subsidiary was

dissolved on 28 February 2023.

8.Status of Half-Yearly Financial Report

The financial information contained in this Half-Yearly Financial Report, which

has not been reviewed or audited by an independent auditor, does not constitute

statutory accounts within the meaning of section 434 of the Companies Act 2006.

The financial information for the half years ended 31 July 2022 and 31 July 2023

has not been audited. The figures and financial information for the year ended

31January 2023 are extracted and abridged from the latest audited accounts and

do not constitute the statutory accounts for that year. Those accounts have been

delivered to the Registrar of Companies and included the Independent Auditor's

Report, which was unqualified.

The Half-Yearly Financial Report for the Six Months to 31 July 2023 will be

available to shareholders, and copies may be obtained during normal business

hours from the Company's Registered Office, from its correspondence address, 43

-45 Portman Square, London W1H 6LY, and via www.invesco.co.uk/ipukscit.

A copy of the Half-Yearly Financial Report will be submitted shortly to the

National Storage Mechanism ("NSM") and will be available for inspection at the

NSM, which is situated at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

By order of the Board

Invesco Asset Management Limited

Company Secretary

10 October 2023

GLOSSARY OF TERMS AND ALTERNATIVE PERFORMANCE MEASURES

Alternative Performance Measure (APM)

An APM is a measure of performance or financial position that is not defined in

applicable accounting standards and cannot be directly derived from the

financial statements. The calculations shown in the corresponding tables are for

the six months ended 31 July 2023 and the year ended 31 January 2023. The APMs

listed here are widely used in reporting within the investment company sector

and consequently aid comparability.

Benchmark (or Benchmark Index)

A market index, which averages the performance of companies in any sector,

giving a good indication of any rises or falls in the market. The benchmark

index used in these accounts is the Numis Smaller Companies + AIM (excluding

Investment Companies) Index with dividends reinvested.

(Discount)/Premium (APM)

Discount is a measure of the amount by which the mid-market price of an

investment company share is lower than the underlying net asset value (`NAV') of

that share. Conversely, premium is a measure of the amount by which the mid

-market price of an investment company share is higher than the underlying net

asset value of that share. In this Half-Yearly Financial Report the discount is

expressed as a percentage of the net asset value per share and is calculated

according to the formula set out below. If the shares are trading at a premium

the result of the below calculation will be positive and if they are trading at

a discount it will be negative.

31 July 31 January

2023 2023

Share price a 416.50p 451.00p

Net asset value per share b 471.16p 517.09p

Discount c = (a-b)/b (11.6)% (12.8)%

Gearing (APM)

The gearing percentage reflects the amount of borrowings that a company has

invested. This figure indicates the extra amount by which net assets, or

shareholders' funds, would move if the value of a company's investments were to

rise or fall. A positive percentage indicates the extent to which net assets are

geared; a nil gearing percentage, or `nil', shows a company is ungeared. A

negative percentage indicates that a company is not fully invested and is

holding net cash as described below.

There are several methods of calculating gearing and the following has been used

in this report:

Gross Gearing (APM)

This reflects the amount of gross borrowings in use by a company and takes no

account of any cash balances. It is based on gross borrowings as a percentage of

net assets. As at 31 July 2023 the Company had no gross borrowings (31 January

2023: £nil).

31 July 31 January

2023 2023

£'000 £'000

Bank overdraft facility - -

Gross borrowings a - -

Net asset value b 159,378 174,915

Gross gearing c = a/b nil nil

Net Gearing or Net Cash (APM)

Net gearing reflects the amount of net borrowings invested, i.e. borrowings less

cash and cash equivalents (incl. investments in money market funds). It is based

on net borrowings as a percentage of net assets. Net cash reflects the net

exposure to cash and cash equivalents, as a percentage of net assets, after any

offset against total borrowings.

31 July 31 January

2023 2023

£'000 £'000

Bank overdraft facility - -

Less: cash and cash equivalents 614 5,055

Net cash a 614 5,055

Net asset value b 159,378 174,915

Net cash c = a/b 0.4% 2.9%

Maximum Authorised Gearing

This reflects the maximum authorised borrowings of the Company taking into

account both any gearing limits laid down in the investment policy and the

maximum borrowings laid down in covenants under any borrowing facility and is

calculated as follows:

31 July 31 January

2023 2023

£'000 £'000

Maximum authorised borrowings as laid

down in:

Investment policy:

- lower of 30% of net asset value; a = 30% x e 47,813 52,475

and

- £25m b 25,000 25,000

Bank overdraft facility covenants: c 15,000 15,000

lower of 30% of net asset value and

£15m

Maximum authorised borrowings (d = d 15,000 15,000

lower of a, b and c)

Net asset value e 159,378 174,915

Maximum authorised gearing f = d/e 9.4% 8.6%

Net Asset Value (`NAV')

Also described as shareholders' funds, the NAV is the value of total assets less

liabilities. Liabilities for this purpose include current and long-term

liabilities. The NAV per share is calculated by dividing the net assets by the

number of ordinary shares in issue (excluding shares held in treasury). For

accounting purposes assets are valued at fair (usually market) value and

liabilities are valued at par (their repayment - often nominal - value).

Return

The return generated in a period from the investments including the increase and

decrease in the value of investments over time and the income received.

Total Return

Total return is the theoretical return to shareholders that measures the

combined effect of any dividends paid together with the rise or fall in the

share price or NAV. In this Half-Yearly Financial Report these return figures

have been sourced from Refinitiv who calculate returns on an industry

comparative basis.

Net Asset Value Total Return (APM)

Total return on net asset value per share, assuming dividends paid by the

Company were reinvested into the shares of the Company at the NAV per share at

the time the shares were quoted ex-dividend.

Share Price Total Return (APM)

Total return to shareholders, on a mid-market price basis, assuming all

dividends received were reinvested, without transaction costs, into the shares

of the Company at the time the shares were quoted ex-dividend.

Net Asset Share

Six months ended 31 July 2023 Value Price

As at 31 July 2023 471.16p 416.50p

As at 31 January 2023 517.09p 451.00p

Change in period a -8.9% -7.6%

Impact of dividend reinvestments(1) b 2.0% 2.2%

Total return for the period c = a+b -6.9% -5.4%

Net Asset Share

Year Ended 31 January 2023 Value Price

As at 31 January 2023 517.09p 451.00p

As at 31 January 2022 652.60p 570.00p

Change in year a -20.8% -20.9%

Impact of dividend reinvestments(1) b 3.3% 3.9%

Total return for the year c = a+b -17.5% -17.0%

(1)Total dividends paid during the six months to 31 July 2023 of 10.54p (31

January 2023: 22.80p) reinvested at the NAV or share price on the ex-dividend

date. NAV or share price falls subsequent to the reinvestment date consequently

further reduce the returns, vice versa if the NAV or share price rises.

Benchmark Index

Total return on the benchmark index is on a mid-market value basis, assuming all

dividends received were reinvested, without transaction costs, into the shares

of the underlying companies at the time the shares were quoted ex-dividend.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

October 11, 2023 02:00 ET (06:00 GMT)

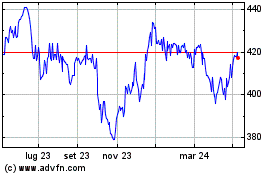

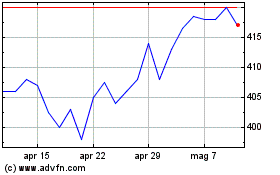

Grafico Azioni Invesco Perpetual Uk Sma... (LSE:IPU)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Invesco Perpetual Uk Sma... (LSE:IPU)

Storico

Da Mag 2023 a Mag 2024