TIDMIRON

RNS Number : 6718M

Ironveld PLC

18 September 2023

Ironveld Plc

("Ironveld" or the "Company")

Operations Update

Ironveld plc ("Ironveld" or the "Company"), the AIM quoted

mining development company, is pleased to provide an update on

recent activities.

Operational and Financial Update Highlights

-- Newly installed power generation at Rustenburg smelter now supplying two furnaces as planned;

-- Ironveld secured a cash generative short term contract from a

third party to undertake metals processing;

-- Third furnace refurbishment now due to commence in October;

-- Directors have provided working capital support for the

Company with a facility of up to GBP500,000 to maintain flexibility

of funding;

-- Encouraging market conditions for near-term High Purity Iron

and future iron powders products; and

-- Burnstar Technologies Pty Ltd. ("Burnstar") Liquified Natural

Gas ("LNG") to hydrogen project on track.

Ironveld Smelting Operations

During July and August, activities at Ironveld Smelting's

Rustenburg facilities focused on ensuring that the two refurbished

furnaces as well as the Argon Oxygen Decarburization ("AOD")

Convertor and the Granulator could operate successfully. Although

the refurbished plant operated as planned without any material

issues, it became clear that further electrical power supply would

be required to run all equipment simultaneously to optimum levels.

To resolve this problem, additional generators were ordered and

then fully installed earlier this month. Whilst this resulted in a

short delay in the anticipated level of activity from the first two

furnaces, the additional power is now capable of operating all

equipment as planned on a full-time basis, which is expected to

continue going forward. Final works and commissioning of the third

planned furnace at the smelter had been placed on hold pending the

arrival of the additional generators and this is now expected to

start in October.

Environmentally Friendly and Economical Energy Solution

The use of generators at the site has always formed part of

Ironveld's short-term solution to remain off-grid, allowing it to

avoid the daily 'load shedding' imposed by the state electricity

provider, ESKOM. As previously announced, Ironveld has contracted

for installation of a full solar-LNG hybrid system at its

Rustenburg site to provide all power requirements on a materially

cheaper basis than both diesel generators and grid power which is

expected to be installed during Q1 2024.

In addition, all works are proceeding as planned with respect to

the BurnStar LNG to hydrogen project which is presently on track

for commissioning around the end of 2023, followed by commencement

of supply during Q1 2024. This may enable Ironveld to use hydrogen

as a reductant in the smelting process, thereby further enhancing

the Company's 'green metals' credentials.

Third-party Smelting Contract Demonstrates Capabilities of

On-site Team and Equipment

In August, whilst waiting for the installation of the additional

generators and seeking to utilise the power available at the time,

the smelter was able to successfully process a test quantity of

third-party metal product to generate revenue. This is expected to

lead to an additional cash generative fixed term and quantity

contract in the short term whilst the customer conducts maintenance

on its own facilities. The outcome has been to demonstrate not only

the flexibility of the production team at the smelter, but also the

Company's ability to generate value from its on-site equipment. In

due course, the fourth furnace at the smelter is also expected to

be brought into production and may become available for third party

contracts.

The refurbished Granulator at the smelter performed

significantly above expectations during this recent processing. The

plant was able to consistently generate a minus two-millimetre

final product, which based on current feedback, should lead to an

increased number of customers for the Company's High Purity Iron

product.

Ironveld Mining's IPace DMS Magnetite Joint Venture

Progressing

As announced on 1 September 2023, an amendment to the structure

of the IPace DMS Magnetite Joint Venture ("JV") has been signed

with Sable Exploration and Mining ("SEAM"), bringing in SEAM as

funding partner. SEAM has already advanced funding as envisaged by

the agreements. At the mine site, ground works and civil works for

the DMS Magnetite JV are progressing well and all processing

equipment is expected to be installed in approximately four weeks,

with first product sales around two to four weeks after that.

General mining activities to provide the smelter with necessary

ore have enabled stockpiles to be created at both sites.

High Purity Iron Powders Opportunity

Ironveld's Board has been very encouraged by recent

conversations with potential customers for its planned iron powders

products. At present there is no production of water atomised iron

powders in the southern hemisphere and, once production of these

powders commences, Ironveld will enable local customers to avoid

importing these critical materials. The Company has a fully costed

capital investment programme of approximately ZAR 80 million

(approximately GBP3.4 million) to upgrade the Rustenburg production

facilities and is considering a number of ways to best finance this

expansion without further recourse to shareholders.

Additive Manufacturing Research reported earlier this week that

metal 3D printing markets had grown 16 per cent year-on-year and

Ironveld's planned iron powders will feed into this growing market.

For example, the aerospace industry, including Airbus and Boeing,

is increasingly using metal 3D printing for parts, and last month

Apple announced that it would be using 3D printers to make the

chassis for some of the upcoming Apple Watch Series 9 models. The

new manufacturing process that Apple is testing will use less

material than the large slabs of metal that are needed for

traditional computer numerical control manufacturing, as well as

cutting down on the time that it takes to make new devices.

Direct Funding Discussions

As announced on 30 March 2023, the Company reported that it was

aware that Grosvenor Resources (Pty) Limited ("Grosvenor") was in

talks with potential funders to facilitate its investment

transactions. An institution introduced by Grosvenor is now in

direct funding discussions with the Company and the Company will

provide a further update when appropriate.

Working Capital Loan Facility

As a result of the short delay in reaching full production

capacity at the Rustenburg smelter complex and the additional

diesel generator costs as explained above, the Company's operating

expenditure has been higher than anticipated at the time of the

February 2023 placing. In order to ensure that the Company has a

sufficient working capital buffer until the expected receipt of

increased product sales from the recently installed additional

on-site power, Ironveld has entered into working capital loan

facility agreements (the "Facility") with certain Directors, being

Peter Cox, Giles Clarke and Nick Harrison, together with Tracarta

Limited (in which John Wardle has a beneficial interest). The

Facility consists of a maximum of GBP500,000 in order to provide

the Company with flexibility in meeting ongoing operating costs

over the coming months.

The key terms or the agreements are as follows:

-- Interest on funds drawn at 11% per annum;

-- Arrangement fee of 2.5% of the Facility value;

-- Term of six months;

-- Repayment of any funds drawn down plus interest immediately

upon receipt of funds drawn down from any replacement institutional

debt facility or conversion at the issue price in the event of any

future equity placing during the loan term; and

-- There are no warrants immediately awarded in connection with

the Facility however, conditional upon a replacement institutional

debt facility being drawn down during the loan term, 62,500,000

warrants (in total) will be issued to the lenders exercisable at

0.80p per share. The exercise price represents a 162.3% premium to

the closing mid price per Ironveld share of 0.305p on 15 September

2023.

Martin Eales, Chief Executive Officer, commented:

"We are extremely pleased to have the processing plant up and

running effectively and efficiently again. It was not without great

deliberation that we decided to pause certain activities but,

ultimately, the decision to do this and install additional

generators, until such time as the solar hybrid facility is

commissioned, was the correct one.

"Positive discussions with potential iron powder customers are

progressing well. In addition, the Company in engaged in

preliminary discussions with direct funders, introduced by

Grosvenor, which could see the Company further accelerate its

activities.

"Ironveld is edging closer to a fully operational smelting

plant, with the planned three furnaces nearing full operational

status before the end of the year. The sheer size of the mine site,

and the vast amounts high grade ore there, together with our

ability to process and sell the product, means the upside potential

is enormous.

"Notwithstanding the terms of the Facility being provided by the

Directors and Tracarta, at present the Company has no intention of

seeking new equity capital, and it will give us an important

financial buffer as we continue the commissioning and production

process.

"We look forward to sharing further positive updates during the

remainder of the year."

Change of Name of Nominated Adviser

The Company also announces that its Nominated Adviser and Joint

Broker has changed its name to Cavendish Capital Markets Limited

("Cavendish") following completion of its own corporate merger.

Related Party Transaction

The Facility participation by Giles Clarke, Nick Harrison, Peter

Cox and John Wardle, all Directors of the Company, constitutes a

related party transaction pursuant to Rule 13 of the AIM Rules for

Companies. The Company's independent Directors (being Martin Eales

and Malebo Ratlhagane) consider, having consulted with the

Company's nominated adviser, Cavendish, that the terms of the

Facility are fair and reasonable insofar as the Company's

shareholders are concerned.

For further information, please contact:

Ironveld plc c/o BlytheRay

Martin Eales, Chief Executive Officer +44 20 7138 3204

Cavendish (Nomad and Broker)

Christopher Raggett / Charlie Beeson / George

Dollemore +44 20 7220 0500

Turner Pope (Joint Broker)

Andrew Thacker / James Pope +44 20 3657 0050

BlytheRay

Tim Blythe / Megan Ray +44 20 7138 3204

NOTES TO EDITORS

Ironveld (IRON.LN) is the owner of Mining Rights over

approximately 28 kilometres of outcropping Bushveld magnetite with

a SAMREC compliant ore resource of some 56 million tons of ore

grading 1.12% V2O5, 68.6% Fe2O3 and 14.7% TiO2.

In 2022 Ironveld agreed to acquire and refurbish a smelter

facility in Rustenburg, South Africa, in which it can process its

magnetite ore into the marketable products of high purity iron,

titanium slag and vanadium slag. This transaction became

unconditional in March 2023.

Ironveld is an AIM traded company. For further information on

Ironveld please refer to www.ironveld.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKNSFDSDEFA

(END) Dow Jones Newswires

September 18, 2023 02:00 ET (06:00 GMT)

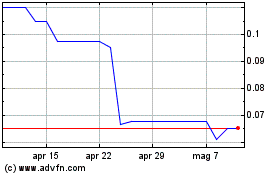

Grafico Azioni Ironveld (LSE:IRON)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Ironveld (LSE:IRON)

Storico

Da Dic 2023 a Dic 2024