TIDMJMI

RNS Number : 0514U

JPMorgan UK Smaller Cos IT PLC

23 March 2023

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN UK SMALLER COMPANIES INVESTMENT TRUST PLC

UNAUDITED HALF YEAR RESULTS FOR THE SIX MONTHSED

31ST JANUARY 2023

Legal Entity Identifier: 549300PXALXKUMU9JM18

Information disclosed in accordance with DTR 4.2.2

CHAIRMAN'S STATEMENT

Investment Performance

The half year saw a continuation of the unpleasant cocktail of

challenges faced in the prior period. Equity markets continued to

grapple with rising interest rates, high inflation, the threat of

recession, supply chain constraints, a significant tightening of

liquidity and further geopolitical headwinds from heightened

tensions between the US and China and in Ukraine. Just at the point

that global investors began to sense a relative improvement in the

economic outlook and markets began to recover, the UK temporarily

suffered from a spectacular own goal due to domestic political

machinations. The poorly considered and communicated economic

policy of the short lived Truss premiership had a significant

negative impact on domestic equity and debt markets but which

thankfully recovered by the end of our reporting period following

the appointment of Rishi Sunak as prime minister.

With continued market volatility, the Company's total return on

net assets (with net dividends reinvested) over the six months to

31st January 2023 was -1.2%, which was marginally behind the Numis

Smaller Companies plus AIM (excluding Investment Companies) Index

which returned -0.4%. However, the return to shareholders for the

reporting period was +0.4% which reflects a narrowing of the share

price discount to net asset value from 11.0% at the start of the

financial year to 9.8% at the end of the half year. Despite the

difficult challenges faced by UK smaller companies over recent

years, over the longer term performance remains strong with the

Company being up 202.8% over the past ten years, some 56.4% ahead

of the benchmark. Further details can be found in the Half Year

Report.

Since the end of the reporting period, markets have fallen due

to concerns in the banking sector. From 31st January 2023 to 21st

March 2023, the Company's total return on net assets was -6.6%,

marginally underperforming the Company's benchmark index which

declined by -6.0% as at 21st March 2023. Over the same period, the

Company delivered a return to ordinary shareholders of -10.7% as

the discount widened.

In their report, the Investment Managers provide a review of the

Company's performance for the period and the outlook for the

remainder of the year.

Loan Facility and Gearing

During the reporting period, the Company continued to utilise

its revolving credit facility to maintain a meaningful but modest

level of gearing. As noted in the previous Annual Report, on 1st

October 2021 the Board renewed and increased the borrowing facility

with Scotiabank to GBP50 million for a period of 24 months. There

is a further option to increase borrowings to GBP60 million subject

to certain conditions. As at 31st January 2023, GBP21 million was

drawn on the loan facility. Since the end of the reporting period

an additional GBP5 million was drawn down. The current facility

matures on 1st October 2023 and the Board will review the Company's

borrowing requirements in advance of this date.

The Company has maintained a fairly constant level of gearing,

with the Board giving the Investment Managers flexibility to adjust

the gearing tactically within a range set by the Board of 10% net

cash to 15% geared in normal markets. During the reporting period,

the Company's gearing ranged from 4.0% to 8.7%, ending the half

year at 7.6% as the Investment Managers took advantage of perceived

attractive valuations. As at 21st March 2023 the Company's gearing

was 6.9%, with total borrowings of GBP26 million.

Share Repurchases and Issuance

During the six months to 31st January 2023, the Company did not

repurchase or issue any shares. However, the Board's objective

remains to act in the best interests of shareholders by using the

repurchase and allotment authorities to manage imbalances between

the supply and demand of the Company's shares with the intention of

reducing the volatility of the discount or premium in normal market

conditions. As at the end of the reporting period there were

79,611,410 shares in issue (including 1,559,741 shares held in

Treasury).

Board Succession

Having completed nine years of service as a Director, Frances

Davies retired from the Board at the Annual General Meeting (AGM)

in December 2022. Frances was also Chairman of the Remuneration

Committee and Senior Independent Director. Following her retirement

Alice Ryder took over these roles. Katrina Hart was also formally

appointed at the AGM and is proving to be a valuable addition to

the Board.

Being a Board of four, the Directors are mindful that the size

of the Board may need to be increased in light of new regulations.

In accordance with the FCA's new policy on diversity, the Board

currently complies with the gender recommendation and is committed

to increasing diversity and inclusion over time.

Outlook

Following a period of optimism that inflation might fall back

significantly towards the end of 2023 and that interest rate rises

were coming to an end, markets have become nervous over the path of

interest rates. More recently UK and global equities have fallen

and government bond yields have risen suggesting that, despite the

significant rise in interest rates over the past year, economic

activity remains unexpectedly robust and investors are again

growing concerned about inflation and monetary policy. Whatever the

eventual outcome it seems likely that markets will be influenced by

key data and policy announcements as investor sentiment is likely

being driven by hopes of a more supportive US policy rather than

improving fundamentals. Recent developments in the banking sector

have raised concerns over the solvency of several banks and whether

this is potentially a systemic problem. However, central and

commercial banks have acted decisively in unison to contain the

issue and a by-product of this maybe a more dovish approach to

interest rates. In this environment volatility is likely to

remain.

However, as the managers comment in their outlook, despite being

cautious on the timing of interest rate reductions and the short

term path of the economy, they find reasons to be more optimistic.

This more encouraging view is primarily built upon the attractive

valuation on which UK smaller companies currently stand. Whilst

these are difficult markets to navigate, experience points to

opportunity for patient investors.

Andrew Impey

Chairman 23rd March 2023

INVESTMENT MANAGERS' REPORT

Performance and Market Background

The first half of the Company's financial year endured a bleak

backdrop. The atrocious war in Ukraine raged on, energy prices and

inflation remained uncomfortably high, interest rates rose swiftly

and there was a growing threat of recession in 2023 in much of the

developed world. While public sector strike action grew in the UK

in response to the stark cost of living increase over the year,

towards the end of the period there were a few positives of note.

China backed down on its zero-Covid policy; inflation appeared to

have peaked in the US, UK and Europe; recessionary risks in Europe

and the UK began to diminish; and in the UK the new Prime Minister,

Rishi Sunak, calmed markets and investors after the disastrous Liz

Truss mini budget in September.

Against this backdrop, the Numis Smaller Companies plus AIM

(excluding Investment Companies) Index was effectively flat at

-0.4% for the six months (although it is notable that this hid

significant declines at the start of the period, followed by a

rebound as markets looked to life beyond peak inflation). The

Company was marginally behind and produced a total return on net

asset value of -1.2% in the period, while the total return to

shareholders was +0.4%.

Portfolio

Among the positive contributors to performance in the six months

were Ashtead Technology, Bank of Georgia, Dunelm and Hollywood

Bowl. We have owned Ashtead Technology (subsea rental equipment)

since its IPO at the end of 2021 and it continued to produce

impressive results and see growing demand, while Bank of Georgia

benefitted from the strength of the Georgian economy, which is

currently among the strongest globally. Both Dunelm (the homewares

retailer) and Hollywood Bowl (a bowling company) enjoyed a rerating

following strong figures which demonstrated the strength of their

appeal to consumers. On the negative side, the main detractors

included Serica Energy, the North Sea gas producer, following the

Government's extra tax levy on North Sea oil and gas producers, the

housebuilder Vistry, on concerns over the housing market, and not

owning Micro Focus, which hurt performance on a relative basis as

it received a bid at a very significant premium.

We continued to make changes to the portfolio to adapt to the

fast-changing economic outlook. New additions included: the book

publisher, Bloomsbury, purchased due to the quality of its

portfolio and long-term track record of earnings upgrades; the high

street card retailer, Card Factory, purchased on indications that

the business has successfully turned around following a more

challenging period; the price comparison website,

Moneysupermarket.Com, on valuation grounds; and Zoo Digital, which

provides localisation services such as dubbing to the film industry

and is benefitting from the proliferation of video content

globally.

Outlook

It is very easy to paint a dark and gloomy picture of the UK

economy and to make a direct read across to the UK stockmarket.

However, markets (and investors) are pre-emptive and looking out to

the next 12 to 18 months provides reasons to be more

optimistic.

In line with most economists, we expect a mild recession in the

UK in 2023 at worst, or minimal growth at best. The most recent

composite UK Purchasing Managers Index (PMI) data was a positive

surprise at 53, where anything over 50 signals expansion. We

believe inflation has peaked in the UK, and while we expect it to

remain elevated, we do foresee a significant decline from the

current 10.1% over the course of this year. In part this is due to

gas prices, which are substantially lower than the peak in 2022,

although still high versus history. After ten increases since

December 2021, interest rates at 4% have substantially normalised

and are much closer to peak. Current market expectations are for a

first cut of 25bp in the second half of 2023, but we think that is

likely to be premature and we do not expect them to come down any

time soon. Consumer confidence remains very weak - headlines,

strikes, utility bills and potential house price declines are all

playing a part - but has picked up significantly this February. The

unemployment rate remains very low at 3.7% and there are still over

a million job vacancies. Freight rates have fallen significantly,

and it appears that supply chains are beginning to function more

normally, aided by the re-opening of China.

This leads us to valuations. The environment is going to remain

extremely difficult for businesses and consumers to navigate this

year - but a lot of this is already reflected in valuations. While

the stockmarket has rallied off its low in October, the Numis

Smaller Companies plus AIM (excluding Investment Companies) Index

is on a similar P/E ratio to the FTSE 100 of under 11x, despite

growing faster. The Company's portfolio has a lower forecast P/E of

10.5x and on our favoured free cashflow yield metric the portfolio

is undeniably attractive on an historic free cashflow yield of

6.8%. As we have said before, acquirors of UK businesses recognise

this. M&A continued in 2022 despite the economic backdrop; we

have already seen a number of bids in the small cap arena in 2023

and we strongly believe this trend will continue this year while

valuations remain so compelling on any sensible timeframe.

Georgina Brittain

Katen Patel

Portfolio Managers 23rd March 2023

INTERIM MANAGEMENT REPORT

The Company is required to make the following disclosures in its

half year report:

Principal and Emerging Risks and Uncertainties

The principal risks and uncertainties faced by the Company have

not changed significantly and fall into the following broad

categories: strategic and performance risk; discount/premium;

smaller company investment and market; political and economic

(including the continuing war in Ukraine and the heightened

political tensions between the US and China); investment management

team; accounting, legal and regulatory; cybercrime; global

pandemics; and climate change. Information on each of these areas

is given in the Strategic Report within the Annual Report and

Financial Statements for the year ended 31st July 2022 and in the

view of the Board, these principal and emerging risks and

uncertainties are as applicable to the remaining six months of the

financial year as they were to the period under review.

Related Parties Transactions

During the first six months of the current financial year, no

transactions with related parties have taken place which have

materially affected the financial position or the performance of

the Company during the period.

Going Concern

The Directors believe, having considered the Company's

investment objectives, risk management policies, capital management

policies and procedures, nature of the portfolio (including its

liquidity) and expenditure projections, that the Company has

adequate resources, an appropriate financial structure and suitable

management arrangements in place to continue in operational

existence for the foreseeable future and more specifically, that

there are no material uncertainties pertaining to the Company that

would prevent its ability to continue in such operational existence

for at least 12 months from the date of the approval of this half

year financial report. For these reasons, they consider there is

reasonable evidence to continue to adopt the going concern basis in

preparing the financial statements.

Directors' Responsibilities

The Board of Directors confirms that, to the best of its

knowledge:

(i) the condensed set of financial statements contained within

the half year financial report has been prepared in accordance with

FRS 104 'Interim Financial Reporting' and gives a true and fair

view of the state of affairs of the Company and of the assets,

liabilities, financial position and net return of the Company, as

at 31st January 2023, as required by the UK Listing Authority

Disclosure and Transparency Rules 4.2.4R; and

(ii) the half year management report includes a fair review of

the information required by 4.2.7R and 4.2.8R of the UK Listing

Authority Disclosure and Transparency Rules.

In order to provide these confirmations, and in preparing these

financial statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business;

and the Directors confirm that they have done so.

For and on behalf of the Board

Andrew Impey

Chairman 23rd March 2023

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

31st January 2023 31st January 2022 31st July 2022

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ---------- --------- -------- ---------- ---------- ---------- ---------- ---------- -----------

Losses on

investments

held at fair

value

through

profit or loss - (4,427) (4,427) - (32,407) (32,407) - (85,781) (85,781)

Net foreign

currency

gains/(losses) - 3 3 - 1 1 - (2) (2)

Income from

investments 2,848 - 2,848 3,609 - 3,609 8,101 - 8,101

Interest

receivable

and

similar income 67 - 67 4 - 4 50 - 50

---------------- ---------- --------- -------- ---------- ---------- ---------- ---------- ---------- -----------

Gross

return/(loss) 2,915 (4,424) (1,509) 3,613 (32,406) (28,793) 8,151 (85,783) (77,632)

Management fee (289) (674) (963) (406) (948) (1,354) (748) (1,744) (2,492)

Other

administrative

expenses (288) - (288) (259) - (259) (566) - (566)

---------------- ---------- --------- -------- ---------- ---------- ---------- ---------- ---------- -----------

Net

return/(loss)

before

finance costs

and taxation 2,338 (5,098) (2,760) 2,948 (33,354) (30,406) 6,837 (87,527) (80,690)

Finance costs (140) (327) (467) (78) (183) (261) (180) (419) (599)

---------------- ---------- --------- -------- ---------- ---------- ---------- ---------- ---------- -----------

Net

return/(loss)

before

taxation 2,198 (5,425) (3,227) 2,870 (33,537) (30,667) 6,657 (87,946) (81,289)

Taxation (15) - (15) (18) - (18) (106) - (106)

---------------- ---------- --------- -------- ---------- ---------- ---------- ---------- ---------- -----------

Net

return/(loss)

after

taxation 2,183 (5,425) (3,242) 2,852 (33,537) (30,685) 6,551 (87,946) (81,395)

---------------- ---------- --------- -------- ---------- ---------- ---------- ---------- ---------- -----------

Return/(loss)

per share

(note

3) 2.80p (6.95)p (4.15)p 3.65p (42.97)p (39.32)p 8.39p (112.68)p (104.29)p

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or

discontinued in the period.

The 'Total' column of this statement is the profit and loss

account of the Company and the 'Revenue' and 'Capital' columns

represent supplementary information prepared under guidance

issued by the Association of Investment Companies.

The net return after taxation represents the profit for the

period or loss and also the total comprehensive income.

CONDENSED STATEMENT OF CHANGES IN EQUITY

Called Capital

up

share Share redemption Capital Revenue

capital premium reserve reserves(1) reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- -------- ----------- ------------ ----------- ---------

Six months ended 31st January

2023 (Unaudited)

At 31st July 2022 3,981 25,895 2,903 220,248 7,420 260,447

Net (loss)/return after taxation - - - (5,425) 2,183 (3,242)

Dividend paid in the period

(note 4) - - - - (5,386) (5,386)

---------------------------------- -------- -------- ----------- ------------ ----------- ---------

At 31st January 2023 3,981 25,895 2,903 214,823 4,217 251,819

---------------------------------- -------- -------- ----------- ------------ ----------- ---------

Six months ended 31st January

2022 (Unaudited)

At 31st July 2021 3,981 25,895 2,903 308,194 5,318 346,291

Net (loss)/return after taxation - - - (33,537) 2,852 (30,685)

Dividend paid in the period

(note 4) - - - - (4,449) (4,449)

---------------------------------- -------- -------- ----------- ------------ ----------- ---------

At 31st January 2022 3,981 25,895 2,903 274,657 3,721 311,157

---------------------------------- -------- -------- ----------- ------------ ----------- ---------

Year ended 31st July 2022

(Audited)

At 31st July 2021 3,981 25,895 2,903 308,194 5,318 346,291

Net (loss)/return after taxation - - - (87,946) 6,551 (81,395)

Dividend paid in the period

(note 4) - - - - (4,449) (4,449)

---------------------------------- -------- -------- ----------- ------------ ----------- ---------

At 31st July 2022 3,981 25,895 2,903 220,248 7,420 260,447

---------------------------------- -------- -------- ----------- ------------ ----------- ---------

(1) This reserve forms the distributable reserve of the Company

and may be used to fund distribution of profits to

shareholders.

CONDENSED STATEMENT OF FINANCIAL POSITION

(Unaudited) (Unaudited) (Audited)

At 31st At 31st At 31st

January January July

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ------------ ----------

Fixed assets

Investments held at fair value through profit

or loss 271,061 340,828 275,604

----------------------------------------------- ------------ ------------ ----------

Current assets

Debtors 647 1,512 1,476

Cash and cash equivalents 2,345 8,941 9,650

----------------------------------------------- ------------ ------------ ----------

2,992 10,453 11,126

Current liabilities

Creditors: amounts falling due within one

year (22,234) (124) (1,283)

----------------------------------------------- ------------ ------------ ----------

Net current (liabilities)/assets (19,242) 10,329 9,843

----------------------------------------------- ------------ ------------ ----------

Total assets less current liabilities 251,819 351,157 285,447

----------------------------------------------- ------------ ------------ ----------

Creditors: amounts falling due after one

year - (40,000) (25,000)

----------------------------------------------- ------------ ------------ ----------

Net assets 251,819 311,157 260,447

----------------------------------------------- ------------ ------------ ----------

Capital and reserves

Called up share capital 3,981 3,981 3,981

Share premium 25,895 25,895 25,895

Capital redemption reserve 2,903 2,903 2,903

Capital reserves 214,823 274,657 220,248

Revenue reserve 4,217 3,721 7,420

----------------------------------------------- ------------ ------------ ----------

Total shareholders' funds 251,819 311,157 260,447

----------------------------------------------- ------------ ------------ ----------

Net asset value per share (note 5) 322.6p 398.7p 333.7p

CONDENSED STATEMENT OF CASH FLOWS

(Unaudited) (Unaudited) (Audited)

Six months Six months Year ended

ended ended

31st January 31st January 31st July

2023 2022 2022

GBP'000 GBP'000 GBP'000

--------------------------------------------------- ------------- ------------- -----------

Net cash outflow from operations before

dividends and

interest (note 6) (1,288) (1,674) (3,018)

Dividends received 3,417 3,385 7,419

Interest received 77 4 40

Interest paid (409) (265) (604)

--------------------------------------------------- ------------- ------------- -----------

Net cash inflow from operating activities 1,797 1,450 3,837

--------------------------------------------------- ------------- ------------- -----------

Purchases of investments (43,844) (38,883) (105,409)

Sales of investments 44,132 42,776 122,651

Settlement of foreign currency contracts - - (4)

--------------------------------------------------- ------------- ------------- -----------

Net cash inflow from investing activities 288 3,893 17,238

--------------------------------------------------- ------------- ------------- -----------

Dividend paid (5,386) (4,449) (4,449)

Litigation expense - (31) (52)

Repayment of bank loans (4,000) (3,000) (18,000)

Drawdown of bank loans - 8,000 8,000

--------------------------------------------------- ------------- ------------- -----------

Net cash (outflow)/inflow from financing

activities (9,386) 520 (14,501)

--------------------------------------------------- ------------- ------------- -----------

(Decrease)/increase in cash and cash equivalents (7,301) 5,863 6,574

--------------------------------------------------- ------------- ------------- -----------

Cash and cash equivalents at start of period/year 9,650 3,077 3,077

Exchange movements (4) 1 (1)

--------------------------------------------------- ------------- ------------- -----------

Cash and cash equivalents at end of period/year 2,345 8,941 9,650

--------------------------------------------------- ------------- ------------- -----------

Cash and cash equivalents consist of:

Cash and short term deposits 346 278 294

Cash held in JPMorgan Sterling Liquidity

Fund 1,999 8,663 9,356

--------------------------------------------------- ------------- ------------- -----------

Total 2,345 8,941 9,650

--------------------------------------------------- ------------- ------------- -----------

RECONCILIATION OF NET DEBT

As at Other As at

31st July non-cash 31st January

2022 Cash flows charges 2023

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ---------- ----------- --------- -------------

Cash and cash equivalents

Cash 294 56 (4) 346

Cash equivalents 9,356 (7,357) - 1,999

-------------------------------- ---------- ----------- --------- -------------

9,650 (7,301) (4) 2,345

Borrowings

Debt due in less than one year (25,000) 4,000 - (21,000)

-------------------------------- ---------- ----------- --------- -------------

Total (15,350) (3,301) (4) (18,655)

-------------------------------- ---------- ----------- --------- -------------

NOTES TO THE FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 31ST JANUARY 2023

1. Financial statements

The information contained within the condensed financial

statements in this Half Year Report has not been audited or

reviewed by the Company's auditors.

The figures and financial information for the year ended 31st

July 2022 are extracted from the latest published financial

statements of the Company and do not constitute statutory accounts

for that year. Those financial statements have been delivered to

the Registrar of Companies and including the report of the auditors

which was unqualified and did not contain a statement under either

section 498(2) or 498(3) of the Companies Act 2006.

2. Accounting policies

The financial statements have been prepared in accordance with

the Companies Act 2006, FRS 102 'The Financial Reporting Standard

applicable in the UK and Republic of Ireland' of the United Kingdom

Generally Accepted Accounting Practice ('UK GAAP') and with the

Statement of Recommended Practice 'Financial Statements of

Investment Trust Companies and Venture Capital Trusts' (the revised

'SORP') issued by the Association of Investment Companies in July

2022.

FRS 104, 'Interim Financial Reporting', issued by the Financial

Reporting Council ('FRC') in March 2015 has been applied in

preparing this condensed set of financial statements for the six

months ended 31st January 2023.

All of the Company's operations are of a continuing nature.

The accounting policies applied to this condensed set of

financial statements are consistent with those applied in the

financial statements for the year ended 31st July 2022.

3. Return/(loss) per share

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

31st January 31st January 31st July

2023 2022 2022

GBP'000 GBP'000 GBP'000

---------------------------- ----------------- ----------------- -----------

Return per share is based

on the following:

Revenue return 2,183 2,852 6,551

Capital loss (5,425) (33,537) (87,946)

---------------------------- ----------------- ----------------- -----------

Total loss (3,242) (30,685) (81,395)

---------------------------- ----------------- ----------------- -----------

Weighted average number of

shares in issue 78,051,669 78,051,669 78,051,669

Revenue return per share 2.80p 3.65p 8.39p

Capital loss per share (6.95)p (42.97)p (112.68)p

---------------------------- ----------------- ----------------- -----------

Total loss per share (4.15)p (39.32)p (104.29)p

---------------------------- ----------------- ----------------- -----------

4. Dividends paid

(Unaudited) (Unaudited) (Audited)

Six months Six months Year ended

ended ended

31st January 31st January 31st July

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------- ------------- ------------- -----------

2022 final dividend of 6.9p

(2021: 5.7p) 5,386 4,449 4,449

----------------------------- ------------- ------------- -----------

All dividends paid in the period have been funded from the

revenue reserve.

The Company will normally declare one final dividend for the

year ending 31st July 2023, therefore no interim dividend has been

declared in respect of the six months ended 31st January 2023

(2022: nil).

5. Net asset value per share

(Unaudited) (Unaudited) (Audited)

Six months Six months ended Year ended

ended

31st January 31st January 31st July

2023 2022 2022

--------------------------- ------------- ----------------- -----------

Net assets (GBP'000) 251,819 311,157 260,447

Number of shares in issue 78,051,669 78,051,669 78,051,669

--------------------------- ------------- ----------------- -----------

Net asset value per share 322.6p 398.7p 333.7p

--------------------------- ------------- ----------------- -----------

6. Reconciliation of net loss before finance costs and taxation

to net cash outflow from operations before dividends and

interest

(Unaudited) (Unaudited) (Audited)

Six months Six months Year ended

ended ended

31st January 31st January 31st July

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------------- ------------- ------------- -----------

Net loss before finance costs

and taxation (2,760) (30,406) (80,690)

Add: capital loss before finance

costs and

taxation 5,098 33,354 87,527

Scrip dividends received as

income (27) (145) (145)

Decrease/(increase) in accrued

income and

other debtors 598 (103) (440)

(Decrease)/increase in accrued

expenses (21) (19) 36

Management fee charged to capital (674) (948) (1,744)

Tax on unfranked investment

income (15) (18) (106)

Dividends received (3,417) (3,385) (7,419)

Interest received (77) (4) (40)

Realised loss on foreign exchange

transactions 7 - 3

----------------------------------- ------------- ------------- -----------

Net cash outflow from operations

before dividends and interest

(1,288) (1,674) (3,018)

----------------------------------- ------------- ------------- -----------

7. Fair valuation of investments

The fair value hierarchy disclosures required by FRS 102 are

given below:

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

31st January 2023 31st January 2022 31st July 2022

Assets Liabilities Assets Liabilities Assets Liabilities

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- -------- ------------ -------- ------------ ---------- ------------

Level 1 271,061 - 340,828 - 275,604 -

---------- -------- ------------ -------- ------------ ---------- ------------

Total 271,061 - 340,828 - 275,604 -

---------- -------- ------------ -------- ------------ ---------- ------------

JPMORGAN FUNDS LIMITED

23rd March 2023

For further information, please contact:

Lucy Dina

For and on behalf of

JPMorgan Funds Limited

020 7742 4000

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

JPMORGAN ASSET MANAGEMENT (UK) LIMITED

S

A copy of the Half Year Report will shortly be submitted to the

FCA's National Storage Mechanism and will be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The Half Year Report will also shortly be available on the

Company's website at www.jpmuksmallercompanies.co.uk where up to

date information on the Company, including daily NAV and share

prices, factsheets and portfolio information can also be found.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LXLFLXXLEBBE

(END) Dow Jones Newswires

March 23, 2023 08:57 ET (12:57 GMT)

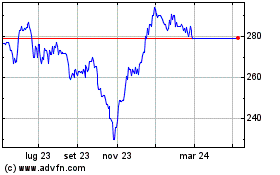

Grafico Azioni Jpmorgan Uk Smaller Comp... (LSE:JMI)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Jpmorgan Uk Smaller Comp... (LSE:JMI)

Storico

Da Feb 2024 a Feb 2025