Final Results

OCTOPUS TITAN VCT PLC

Annual report and financial statements for the year

ended 31 December 2023

Octopus Titan VCT plc (‘Titan’ and ‘the

Company’) today announces the final results for the year to 31

December 2023 as below.

Titan’s mission is to invest in the people,

ideas and industries that will change the world.

Octopus Titan VCT plc is managed by Octopus AIF

Management Limited (the ‘Manager’), who has delegated investment

management to Octopus Investments Limited (‘Octopus’ or ‘Portfolio

Manager’) via its investment team Octopus Ventures.

Key financials

|

|

2023 |

2022 |

|

Net assets (£’000) |

£993,744 |

£1,051,760 |

|

Loss after tax (£’000) |

£(149,499) |

£(319,215) |

|

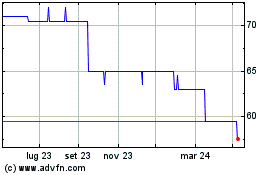

NAV per share |

62.4p |

76.9p |

|

Total value per share1 |

164.4p |

173.9p |

|

Total return per share2 |

(9.5)p |

(23.8)p |

|

Total return per share %3 |

(12.4)% |

(22.5)% |

|

Dividends paid in the year |

5.0p |

5.0p |

|

Dividend yield %4 |

6.5% |

4.7% |

|

Dividend declared |

1.9p |

3.0p |

- Total value per share is an alternative performance measure,

calculated as NAV plus cumulative dividends paid since launch, as

described in the glossary of terms.

- Total return per share is an alternative performance measure,

calculated as movement in NAV per share in the period plus

dividends paid in the period, as described in the glossary of

terms.

- Total return % is an alternative performance measure,

calculated as total return/opening NAV, as described in the

glossary of terms.

- Dividend yield is an alternative performance measure,

calculated as dividends paid/opening NAV, as described in the

glossary of terms.

Chair’s statement

Titan’s total return for the year to 31 December

2023 was -12.4% with net assets at the end of the period totalling

£1.0 billion.

Highlights

- Titan’s latest fundraise: £107

million

- 10-year cumulative return:

+28%

- Dividends paid in 2023: 5p

The Net Asset Value (NAV) per share at 31

December 2023 was 62.4p which, adjusting for dividends paid in the

year, represents a net decrease of 9.5p per share from 31 December

2022 or a total return of -12.4%. This decline reflects the

widespread impact of the ongoing difficult global macro environment

and associated impact on capital availability for our portfolio

companies. With funding conditions being more challenging, many

portfolio companies have prioritised extending cash runways instead

of growth, looking to either achieve profitability or delay

fundraising until more favourable market conditions return. In

spite of this, the underlying portfolio has shown great resilience

and we have seen an overall increase in revenue generated when

comparing against the prior year. Despite the decrease in NAV, the

10-year tax-free annual compound return for shareholders is 2.5%.

The total value (NAV plus cumulative dividends paid per share since

launch) at the end of the period was 164.4p (31 December 2022:

173.9p).

In the 12 months to 31 December 2023, we

utilised £216 million of our cash resources, comprising £98 million

in new and follow-on investments, £58 million in dividends (net of

the Dividend Reinvestment Scheme), £32 million in share buybacks

and £28 million in annual investment management fees and other

running costs. The cash and corporate bond balance of £203 million

at 31 December 2023 represented 20% of net assets at that date,

compared to 17% at 31 December 2022.

Performance incentive fees

As the 2023 total return has been negative, and net assets have

declined since 31 December 2021, no performance fee is payable. To

remind you, the performance fee is calculated as 20% on net gains

above the high water mark (the highest total return as at previous

year ends), which is currently set as 197.7p as at 31 December

2021.

Dividends

Shareholders will recall that in the half-year report, the Company

announced a revised dividend policy targeting a dividend of 5% of

the opening NAV per financial year supplemented by special

dividends when appropriate. This revised policy aligns more closely

with the Company’s long term sustainability goals.

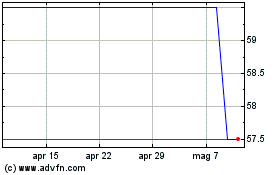

Following careful consideration, I am pleased to

confirm that on 14 March 2024 the Board declared a second interim

dividend of 1.9p per share in respect of the year ending 31

December 2023. This will be paid on 24 May 2024 to shareholders on

the register as at 5 May 2024, which equates to 3% of the Company’s

opening NAV as at 1 January 2024. Dividends of 5p were paid during

the year which represents a tax-free yield of 6.5% on the NAV at 31

December 2022, equivalent to 9.8% for a higher rate tax payer. If

you are one of the 25% of shareholders who take advantage of the

Dividend Reinvestment Scheme (DRIS), your dividend will be

receivable in Titan shares.

Since inception, we have now paid 102p in tax

free dividends per share, excluding the recently declared

dividend.

Fundraise and buybacks

We were pleased to raise over £237 million in the fundraise which

closed on 5 April 2023 and on 19 October 2023, we launched a new

offer to raise up to £125 million. The new offer was closed on 5

April 2024 having raised £107 million. We would like to take this

opportunity to welcome all new shareholders and thank all existing

shareholders for their continued support. This is a lower fundraise

than in recent years but still represents the largest VCT fundraise

in the market for the 2023/24 tax year. We were pleased that in the

November Autumn Statement the Chancellor announced that the VCT

sunset clause will be extended, meaning VCT relief will be

available to subscribers for shares issued before April 2035,

rather than April 2025.

During the period, Titan repurchased 47 million

shares for £32 million (representing 3.0% of the net asset value as

at 31 December 2022). The Board has continued to buy back shares

from shareholders at no greater than a 5% discount to NAV per

share. Whilst the Board will seek authority to continue to be able

to buy back up to 14.99% of Titan’s shares, the Directors intend

that this authority will only be used for a maximum of 5% of the

share capital annually.

Board of Directors

I am pleased to announce that Julie Nahid Rahman was appointed to

the Board on 1 August 2023. Julie brings to the Board a wealth of

experience drawn from her long career in private equity, executive

search and strategy consulting.

As part of the Board’s succession planning, I am

also pleased to announce that on 19 April 2024, Rupert Dickinson

was appointed to the Board with effect from 1 May 2024. Rupert has

over 20 years’ experience in the wealth and investment management

industries. We look forward to benefiting from his and Julie’s

extensive experience.

Portfolio Manager

Malcolm Ferguson, Octopus’ lead fund manager for Titan, has

resigned and Jo Oliver has been appointed as Adviser to the Board

on fund and strategy on an interim basis. Jo brings 15 years of

experience with Octopus Ventures and the Company, having previously

been the lead fund manager for Titan from November 2014 to June

2022. Since 2022, Jo has remained part of the Octopus Ventures

investment team, as a Partner, on a part-time basis. Malcolm will

continue to take an active role as lead fund manager of Titan until

30 April 2024, with Jo then taking on the interim role overseeing

the fund management of the Company while a process is undertaken to

find a permanent replacement. The Board welcomes the breadth of

experience Jo brings to Titan in this interim period. I would like

to take this opportunity to thank Malcolm for his contribution to

the Company and wish him well for the future.

AGM and shareholder event

The AGM will take place on 11 June 2024 from 12pm noon and will be

held at the offices of Octopus Investments Limited, 33 Holborn,

London, EC1N 2HT. Full details of the business to be conducted at

the AGM are given in the Notice of AGM.

Shareholders’ views are important, and the Board

encourages shareholders to vote on the resolutions within the

Notice of AGM using the proxy form, or electronically at

www.investorcentre.co.uk/eproxy. The Board has carefully considered

the business to be approved at the AGM and recommends shareholders

to vote in favour of all the resolutions being proposed, as the

Board will be doing.

In addition to the AGM, we are also pleased to

offer shareholders the opportunity to attend an online shareholder

webinar on 3 June 2024 at 2pm, to ensure we can respond to any

questions you may have for either the Portfolio Manager or Titan

Board prior to the proxy forms needing to be completed. For details

of how to sign up please see octopustitanvct.com. Alternatively,

shareholders are also invited to send any questions they may have

via email to TitanAGM@octopusinvestments.com.

Outlook

The decline in Titan’s NAV reflects the difficult environment in

which its portfolio companies are operating. Multiple factors have

had an influence, including the slowing of growth across the

portfolio as companies optimised for efficiency and profitability

(where possible). Slowing growth has meant that the uplifts in

value in certain portfolio companies have been insufficient in this

period to offset some of the headwinds. There were also

company-specific performance issues with companies encountering

tougher trading conditions, reducing growth in revenue. This led to

under-performance against expectations which translated to lower

valuation multiples. Some portfolio companies attempted to raise

and were unfortunately unsuccessful, leading several to be placed

into administration or accept acquisition offers on unfavourable

terms; more can be read on these disposals in the Portfolio

Manager’s review. Others had to complete funding rounds at lower

valuations or structured in a way which negatively impacted some

existing shareholders as they were on more dilutive terms. This

reflects the increased cost of capital for investors because of

higher interest rates.

When periods are more challenging, it is crucial

that the portfolio companies’ management teams are supported as

they are a key determining factor to a company’s success. The

Octopus Ventures team sets itself apart as it looks to add value

beyond just investment. It is actively involved in its portfolio

companies, with a people and talent manager assigned to each area

of focus, and a team member typically taking a seat on the board.

Both offer tailored advice, work shops and strategy sessions

relevant to the businesses’ stage and sector. Regular board

reporting allows the Octopus Ventures team to closely assess a

company’s progress and focussed sessions are internally led to

assess trajectory and future planning. These review points are

especially important at times when the ability to source further

investment is more limited and means introductions to contacts and

alternative investment sources can be made at the opportune

time.

2023 has been another challenging year and, with

the UK officially entering a recession in February 2024 and the

expectation that interest rates will not start to fall until the

end of 2024, it is unlikely that recovery will be near term.

Analysis from Atomico’s “State of European Tech 23 in 2023”, shows

investments in the European technology ecosystem dropped to half

the levels seen in 2021, when investment volumes surpassed $100

billion for the first time, and a 28% decline from 2022¹. This

reduction is driven by many later-stage companies delaying

fundraising, coupled with investors deploying funds at a

significantly slower pace during periods of economic uncertainty

and declining valuations. In line with this, the exit landscape has

also been subdued since its peak during the final quarter of 2021,

which has made it difficult to realise value in Titan’s

portfolio.

However, there are signs of recovery and reasons

to be optimistic about the future outlook. The Standard and Poor’s

500 (S&P 500) is a stock market index tracking the stock

performance of 500 of the largest companies listed on stock

exchanges in the US. This closed on 31 December 2023 with a 24%

increase over the prior year, showing a renewed appetite for public

equities. This positive trend was mirrored in the valuation

multiples of technology companies, where signs of stabilisation and

recovery were evident2. These factors fuel optimism in

the market. Furthermore, Titan’s portfolio remains well funded with

circa 48% of the portfolio NAV being comprised of companies not

expecting to need further funding. This figure rises to 88% when

including those companies with more than 12 months’ cash runway.

The lower valuation environment also provides more attractive

opportunities to invest and add to the portfolio, which we believe

will provide the foundations for positive long‑term shareholder

returns. Despite the decline in Titan’s performance, the Board

believes that the Company is well placed, with its diverse

portfolio spanning different sectors, business models and stages to

navigate the challenges and our long-term view of early-stage

venture capital remains positive.

VCTs have long provided a compelling opportunity

for UK investors to provide funding for businesses in a

tax-efficient way, and we look forward to Titan continuing to do so

in the coming year. I would like to conclude by thanking both the

Board and the Octopus team on behalf of all shareholders for their

hard work.

Tom Leader

Chair

- Atomico, State of European Tech – December 23 – p.38

- Bessemer Index

Portfolio Manager’s review

At Octopus, our focus is on managing your

investments and providing open communication. Our annual and half

year updates are designed to keep you informed about the progress

of your investment.

Focus on performance

The NAV of 62.4p per share at 31 December 2023 represents a

decrease in NAV of 9.5p per share versus a NAV of 76.9p per share

as at 31 December 2022, after adding back dividends paid during the

year of 5p (2022: 5p) per share, a decrease of 12.4% in the

year.

The performance over the five years to 31

December 2023 is shown below:

|

|

Period ended |

Year ended |

Year ended |

Year ended |

Year ended |

|

|

31 December |

31 December |

31 December |

31 December |

31 December |

|

|

20191 |

2020 |

2021 |

2022 |

2023 |

|

NAV, p |

95.2 |

97.0 |

105.7 |

76.9 |

62.4 |

|

Cumulative dividends paid, p |

76.0 |

81.0 |

92.0 |

97.0 |

102.0 |

|

Total Value, p |

171.2 |

178.0 |

197.7 |

173.9 |

164.4 |

|

Total return |

7.6% |

7.1% |

20.3% |

(22.5)% |

(12.4)% |

|

Dividend yield |

5.4% |

5.3% |

11.3% |

4.7% |

6.5% |

|

Equivalent dividend yield for a higher rate tax payer |

8.0% |

7.8% |

16.8% |

7.0% |

9.8% |

- The period to December 2019 was 14 months.

The decrease in valuation over 2023 has been

driven by the downward valuation movements across 80 companies

which saw a collective decrease in valuation of £189 million. The

businesses that contributed most significantly to this were

ManyPets, Orbex and Elvie. These three valuation movements account

for 42% of the total decline in the reporting period. ManyPets has

been implementing changes to drive higher efficiency and target

profitability in the short term at the expense of growth. The

company has also needed to drive significant price increases in

response to high vet fee inflation thereby hurting customer

retention figures, further impacting growth. Comparable companies

with lower growth rates tend to attract lower valuation multiples

and this has impacted the holding value of ManyPets, which, given

the size of the holding, has driven a meaningful downward movement.

Orbex has seen a decline in value due to the technical risk

surrounding it successfully launching a rocket later in 2024, a

significant milestone for the business for it to secure further

funding. Elvie’s decline in value is due to a need to raise further

funding, which will occur at significantly dilutive terms given

challenging trading as a result of consumer confidence declining,

increased competition and some product launch delays.

Octopus Ventures believes that many of the

companies which have seen decreased valuations in the year have the

potential to overcome the issues they face and get their growth

plans back on track. Octopus Ventures will continue to work with

them to help them realise their ambitions. In some cases, the

support offered could include further funding, to ensure a business

has the capital it needs to execute on its strategy.

Conversely, 38 companies saw an increase in

valuation in the period, delivering a collective increase in

valuation of £57 million. These valuation increases reflect

businesses which have successfully concluded further funding

rounds, grown revenues or met certain important milestones. Notable

strong performers in the portfolio include Pelago, Vitesse and

Skin+Me. Pelago has grown strongly and successfully concluded a

further funding round in 2023, while Vitesse and Skin+Me have both

shown impressive capital efficient growth. These strong performers

demonstrate that there are opportunities available for companies to

thrive, and Titan’s diverse portfolio allows different routes for

each company to succeed in their market.

The gain on Titan’s uninvested cash reserves was

£12.9 million in the year to 31 December 2023 (31 December 2022:

loss of £12.6 million), primarily driven by fair value movements in

the corporate bond portfolio and returns on money market funds. The

Board’s objective for these investments is to generate sufficient

returns through the cycle to cover costs, at limited risk to

capital.

Titan total value growth from

inception

Despite the reduction in NAV in the year, the total value has seen

a significant increase since the end of Titan’s first year (31

October 2008), from 89.9p to 164.4p at 31 December 2023. This

represents an increase of 83% in value since Titan’s first full

year including 102p of dividends paid since inception. Since Titan

launched, a total of over £506 million has been distributed back to

shareholders in the form of tax-free dividends. This includes

dividends reinvested as part of the DRIS.

Disposals

One full profitable disposal completed in the year with iSize being

acquired by Sony Interactive Entertainment in November 2023. In the

year, Titan also received deferred proceeds from the sale of

WaveOptics (to SNAP Inc in 2021), Conversocial (to Verint Systems

Inc in 2021), Glofox (to ABC Fitness Solutions in 2022), Digital

Shadows (to ReliaQuest in 2022) and Skew (to Coinbase in 2021).

Liquidation proceeds were also received in the reporting period

when Third Eye was dissolved. In 2023, these disposals, deferred

and liquidation proceeds have returned £46 million to Titan in

cash, shares and/or deferred amounts.

In January 2023, Arena Flowers (the UK’s number

one rated ethical flower delivery company) acquired and merged with

portfolio company Patch. As a result, Titan now holds shares in the

combined business. The businesses are highly complementary, and the

growth potential and synergies create opportunities to deliver

value to the stakeholders of the enlarged group.

There have been three disposals made at a loss:

Commazero was acquired by Weavr (Paystratus Group Limited);

Chronext sold to a Swiss investment group; and ByMiles was acquired

by Direct Line Group. In aggregate, these losses generated

negligible proceeds compared to an investment cost of £16

million.

Unfortunately, Troglo (trading as LVNDR) was

placed into administration having been unsuccessful in securing

further funding and having explored and exhausted all available

options. In the year, Third Eye and Phasor Solutions were fully

dissolved having been placed into administration in previous

reporting periods.

The underperformance of a portfolio company is

always disappointing for Octopus and shareholders alike, but it’s a

key characteristic of a venture capital portfolio, and we believe

the successful disposals will continue to significantly outweigh

the losses over the medium to long term.

In these more demanding periods, it is

especially important that we are an active investor, offering more

than just financial support. We have our in-house people and talent

team who lend their expertise and knowledge to support our

portfolio companies with both their recruitment and team

structuring. They also help build strong foundations to grow and

develop the business with robust processes and policies being

established early on and providing platforms and tools to help them

succeed. It is typical for a member of the Octopus Ventures team to

join the Board of a portfolio company to provide ongoing, tailored

support, including introducing companies to key contacts to partner

with on the next stage on their growth journey.

|

|

Period ended 31 December 20191 |

Year ended 31 December 2020 |

Year ended 31 December 2021 |

Year ended 31 December 2022 |

Year ended 31 December 2023 |

Total |

|

Dividends (£'000) |

33,187 |

46,037 |

101,976 |

49,596 |

58,210 |

289,006 |

|

Disposal proceeds2 (£'000) |

26,334 |

23,915 |

221,504 |

62,213 |

45,637 |

379,603 |

- The period to December 2019 was 14 months.

- This table includes cash and retention proceeds received within

the period.

New and follow-on

investments

Titan completed 22 new investments and made 18 follow-on

investments in 2023. Together, these totalled £98 million (made up

of £54 million into new companies and £44 million invested into the

existing portfolio). This compares with 31 new investments and 33

follow-on investments in 2022, together totalling £157 million.

This slowing of investment rate is a result of a reduced volume of

founders seeking funding as they look to reduce reliance on further

funding, or take steps to make their existing capital go further.

The total value of the portfolio as at 31 December 2023 is £791

million.

Below are some examples of our new investments.

For a full list of investments which completed in the year, please

refer to the appendix.

- Awell Health

automates routine clinical tasks, synchronising data between

systems and driving seamless coordination between care teams and

patients.

- Cellvoyant is an

artificial intelligence (AI) first biotechnology company creating

novel stem cell-based therapies for chronic diseases.

- Colonia

Technologies is a B2B marketplace for commercial vehicle

sharing.

- Go Autonomous is a

SaaS solution that automates over 50% B2B revenue generation that

is conducted through unstructured communication channels (primarily

email).

- HelloSelf offers a

digital, personalised psychological therapy and coaching

platform.

- Metris Energy has

created a platform that allows landlords of multi-unit buildings to

monetise modular renewable energy projects through a single billing

platform to charge tenants.

- Onibi is creating

an online game called Jam Land. It is a mobile-first, 3D game,

focused on exploration, creation and social. Based in an ocean

world governed by physics, with islands, flying structures and

creatures; and built for short game play loops.

- Pencil Biosciences

is a gene editing technology platform.

- Perci Health is

the first digital and comprehensive cancer survivorship

clinic.

- Remofirst is an

Employer of Record (EOR) and compliance platform that allows

companies to hire and pay employees globally.1

- Vypercore is

developing a new processor design which allows memory usage to be

managed more efficiently and securely by moving memory allocation

from software to hardware.

- Investment completed in 2024.

Q&A

Where does Octopus Ventures source its investments

from?

The team receive inbound approaches from entrepreneurs across all

stages of development and sectors. We engage with thousands of

companies seeking investment and go on to invest in less than 1% of

these. We also proactively research the best-in-class founders and

businesses which are looking to fundraise within our seven areas of

focus and reach out to the teams to learn more and understand if

they meet our investment criteria. In-line with our female

diversity pledge we have launched different initiatives to help

drive engagement with female entrepreneurs to ensure we offer an

equal opportunity to assess female founded and led businesses.

Sometimes we can meet a business which may not be right for our

investment at that point in time, but we offer the company

constructive feedback and give guidance on milestones so that they

can come back to us and we can reassess in the future. As well as

entrepreneurs we haven’t worked with before, a great endorsement of

our reputation is founders we have previously partnered with often

returning to us to back their next businesses.

How does Octopus Ventures assess

potential investments?

After reviewing pitch materials and having an introductory call

with a business, if we feel the opportunity is truly pioneering and

led by an incredible management team, we invite them to pitch to

our investment team – allowing the company to tell us their story

and to ask any questions. If positive, we will then spend time

evaluating in more detail the key elements of the company ranging

from team and hiring plans, product and technology, financials,

sales pipeline and competitive landscape among other matters. In

parallel, we will frequently speak to partners, customers and

relevant third parties to help us asses the opportunity. The final

step in our process is to invite the management team to a final

pitch to our Investment Committee, made up of senior investment

professionals within the Octopus Ventures team. Following that

meeting, if we have built sufficient conviction in the team and

opportunity, we will put forward terms upon which we will invest in

the business. Once terms are agreed, we will complete confirmatory

due diligence alongside Director checks and negotiation of the

investment legal documents, which govern how we will work with the

company post-investment.

What are the timeframes around

making an investment?

We would expect a typical investment process to take around three

months from initial meeting to completion of the investment, but we

are often in contact with a management team for months if not years

before making our initial investment. An existing relationship

prior to investment allows both parties to ensure there is a good

fit, ahead of working together, in many instances this can span

many years. We recognise that fundraising is a necessity for

early-stage companies, and that it puts a huge strain on a business

which is typically short on resource and time. As a result, we are

always focused on trying to make the investment process as smooth

and frictionless as possible whilst ensuring due process is

followed.

How does Octopus Ventures monitor

Titan’s portfolio companies?

Our typical investment horizon is seven to ten years, and

early-stage companies will often need several rounds of funding and

support before an exit. So, we don’t just make an investment, but

we also actively participate in the company’s growth plans.

Usually, someone from Octopus Ventures sits on the board of the

companies in which we invest, allowing them to play a prominent

role in the company’s ongoing development and share their expertise

and learnings. In addition, we focus on two core value-add

initiatives – firstly, we work hard to help the founders raise

their next funding round, through investor introductions and

fundraising advice. Secondly, we understand that, as with many

companies, the quality of the team can make or break a young

business, so we support this with a dedicated in-house people and

talent team. Their contributions range from establishing

best-in-class recruitment processes, to finding appropriate coaches

for the senior leadership team, to selectively supporting

recruitment efforts for key roles.

Valuations

Titan’s unquoted portfolio companies are valued in accordance with

UK GAAP accounting standards and the International Private Equity

and Venture Capital (IPEV) valuation guidelines. This means we

value the portfolio at Fair Value, which is the price we expect

people would be willing to buy or sell an asset for, assuming they

had all the information available we do; are knowledgeable parties

with no pre-existing relationship; and that the transaction is

carried out under the normal course of business.

The table below illustrates the split of

valuation methodology (shown as a percentage of portfolio value and

number of companies). ‘External price’ includes valuations based on

funding rounds that typically completed by the year end or shortly

after the year end, and exits of companies where terms have been

issued with an acquirer. ‘External price’ also includes quoted

holdings, which are held at their quoted price as at the valuation

date. ‘Multiples’ is predominantly used for valuations that are

based on a multiple of revenues for portfolio companies. Where

there is uncertainty around the potential outcomes available to a

company, a probability-weighted ‘scenario analysis’ is

considered.

|

Valuation methodology |

By value |

By number of companies |

|

Multiples |

58% |

41 |

|

External price |

26% |

45 |

|

Scenario analysis |

16% |

38 |

|

Write-off |

- |

22 |

Portfolio case studies

Ibex

ibex-ai.com

Trusted cancer diagnostics for all

- Used everyday at health systems,

hospitals and laboratories in the US, UK, Europe, Asia and

Australia

- Partnerships with industry leaders

such as AstraZeneca, Philips and Roche

- $55 million raised in Series C

funding round in 2023

Ibex is transforming cancer diagnostics with

artificial intelligence (AI). The company was founded in 2016 with

the aim to ensure that every patient can receive accurate, timely

and personalised cancer diagnosis. Its AI platform (named Galen) is

deployed worldwide, supporting pathologists and providers with AI

insights that help improve the quality and accuracy of diagnosis

and drive better efficiencies with optimised lab workflows. Galen

helps pathologists detect and grade breast, prostate, and gastric

cancer. Galen is integrated with third-party digital pathology

software solutions, scanning platforms and laboratory information

systems, its workflows deliver automated high-quality insights that

enhance patient safety, increase physician confidence and boost

productivity.

Octopus investment dates:

March 2021: Series B

July 2023: Series C

Neat

neat.eu

Provides insurance solutions for everyday products and services

- 700 merchants worked with

- 25 products offered

Neat is a subscription-based insurance platform

that gives merchants the ability to provide lifetime insurance

bundles to customers at highly competitive rates. The platform is

simple and scalable, allowing seamless integration without

technical expertise. Its application allows them to offer this high

value-added service to their customers with tailored offers. Neat

combines technology with human integrations to efficiently cover

its clients. Its mission is to promote more sustainable consumption

through its services as protecting products extends their lifespan

and therefore reduces their environmental impact, promoting repair

and reconditioning.

Octopus investment dates:

November 2022: Seed

CoMind

comind.io

The future of neurotechnology is non-invasive

- 150,000+ users screened and had

their brain health managed

- $20 million raised in Series A

funding round in 2023

CoMind’s mission is to redefine how the brain is

measured and treated to optimise patient outcomes across the care

continuum. It is creating a ground-breaking neuromonitoring device

designed to continuously measure cerebral physiological signals

non-invasively, many of which are inaccessible today. This simple,

non-invasive measurement at the patient’s bedside will enable

better diagnostics and treatment for complex neurological

conditions.

Octopus investment dates:

April 2021: Seed+

November 2023: Series A

Lapse

lapse.com

“Friends not followers”

- September 2023 the top ranked app

in the US across all categories

- $30 million raised in Series A

funding round in 2023

Lapse is an app inspired by film photography;

users take photos using a retro image filter allowing close friends

to view their private photo journal. Lapse was built in reaction to

social media companies creating platforms where people can feel

compelled to curate their lives for strangers rather than for

sharing memories. It launched in 2021 and is available on iOS in

the US, Canada and the UK. It is still in early access stage,

meaning potential users must be invited by users already on the

platform to ensure that everyone has a great experience, allowing

the app to develop and refine based on user experience and

feedback.

Octopus investment dates:

December 2021: Seed

December 2021: Series A

We are disappointed to report a net decrease in

the value of the portfolio of £132 million since 31 December 2022,

excluding additions and disposals. This represents a decline of 16%

on the value of the portfolio at the start of the year. Here, we

set out the cost and valuation of the top 20 holdings, which

account for 56% of the value of the portfolio.

|

|

Portfolio: |

Investment cost: |

Total valuation including cost: |

|

1 |

Skin+Me |

£11.5m |

£48.5m |

|

2 |

ManyPets |

£10.0m |

£47.1m |

|

3 |

Amplience |

£13.6m |

£41.8m |

|

4 |

Permutive |

£19.0m |

£41.2m |

|

5 |

Pelago1 |

£17.9m |

£38.6m |

|

6 |

Vitesse |

£10.1m |

£26.6m |

|

7 |

Elliptic |

£9.9m |

£19.0m |

|

8 |

vHive |

£8.0m |

£18.9m |

|

9 |

Token |

£12.6m |

£17.1m |

|

10 |

XYZ |

£15.3m |

£15.5m |

|

11 |

Orbex |

£10.3m |

£15.3m |

|

12 |

Big Health |

£12.9m |

£14.4m |

|

13 |

Legl |

£7.3m |

£13.8m |

|

14 |

Iovox |

£7.2m |

£13.5m |

|

15 |

Ometria |

£11.5m |

£13.2m |

|

16 |

Ibex |

£11.8m |

£12.5m |

|

17 |

KatKin |

£8.2m |

£12.0m |

|

18 |

Lapse |

£8.0m |

£11.8m |

|

19 |

Sofar |

£11.5m |

£11.7m |

|

20 |

Automata |

£12.3m |

£11.7m |

- Digital Therapeutics, Inc.,

formerly Quit Genius, has rebranded as Pelago.

Top 10 investments in

detail1

1

Skin+Me

www.skinandme.com

Skin+Me offers direct-to-consumer, personalised

skincare.

|

Initial investment date: |

September 2019 |

|

Investment cost: |

£11.5m |

|

|

(2022: £11.5m) |

|

Valuation: |

£48.5m |

|

|

(2022: £32.9m) |

|

Last submitted accounts: |

31 August 2022 |

|

Turnover: |

Not available2 |

|

Loss before tax: |

£(10.6)m |

|

|

(2022: £(5.5)m) |

|

Net assets: |

£(9.1)m |

|

|

(2022: £0.3m) |

|

Valuation methodology: |

Multiple |

2

ManyPets

www.manypets.com

An award-winning insurtech company with a

specific focus on providing better pet insurance for everyone.

|

Initial investment date: |

October 2016 |

|

Investment cost: |

£10.0m |

|

|

(2022: £10.0m) |

|

Valuation: |

£47.1m |

|

|

(2022: £102.7m) |

|

Last submitted accounts: |

31 March 2023 |

|

Turnover: |

£32.8m |

|

|

(2022: £42.4m) |

|

Loss before tax: |

£(41.8)m |

|

|

(2022: £(31.9)m) |

|

Net assets: |

£(25.7)m |

|

|

(2022: £12.6m) |

|

Valuation methodology: |

Multiple |

3

Amplience

www.amplience.com

Amplience is a leading headless content

management system, which powers retailers’ digital channels.

|

Initial investment date: |

December 2010 |

|

Investment cost: |

£13.6m |

|

|

(2022: £13.6m) |

|

Valuation: |

£41.8m |

|

|

(2022: £38.7m) |

|

Last submitted accounts: |

30 June 2023 |

|

Turnover: |

£14.9m |

|

|

(2022: £13.4m) |

|

Loss before tax: |

£(8.1)m |

|

|

(2022: £(7.8)m) |

|

Net assets: |

£(17.4)m |

|

|

(2022: £(12.1)m) |

|

Valuation methodology: |

Multiple |

4

Permutive

www.permutive.com

Permutive’s publisher data platform gives its

customers an in-the-moment view of everyone on their site.

|

Initial investment date: |

May 2015 |

|

Investment cost: |

£19.0m |

|

|

(2022: £19.0m) |

|

Valuation: |

£41.2m |

|

|

(2022: £38.5m) |

|

Last submitted accounts: |

31 January 2023 |

|

Turnover: |

£9.8m |

|

|

(2022: £7.1m) |

|

Loss before tax: |

£(19.3)m |

|

|

(2022: £(9.6)m) |

|

Net assets: |

£(40.2)m |

|

|

(2022: £(23.3)m |

|

Valuation methodology: |

Multiple |

5

Pelago

www.pelagohealth.com

A digital health solution for managing substance

use disorders.

|

Initial investment date: |

January 2020 |

|

Investment cost: |

£17.9m |

|

|

(2022: £12.8m) |

|

Valuation: |

£38.6m |

|

|

(2022: £33.5m) |

|

Last submitted accounts: |

Not available2 |

|

Turnover: |

Not available2 |

|

Loss before tax: |

Not available2 |

|

Net assets: |

Not available2 |

|

Valuation methodology: |

Last round |

6

Vitesse

www.vitessepsp.com

A settlement and liquidity management platform

to hold funds and deliver international payments globally, using

domestic, in-country processing.

|

Initial investment date: |

June 2020 |

|

Investment cost: |

£10.1m |

|

|

(2022: £7.1m) |

|

Valuation: |

£26.6m |

|

|

(2022: £12.3m) |

|

Last submitted accounts: |

31 March 2023 |

|

Consolidated turnover: |

£11.2m |

|

|

(2022: £4.8m) |

|

Consolidated loss before tax: |

£(5.7)m |

|

|

(2022: £(4.5)m) |

|

Net assets: |

£16.2m |

|

|

(2022: £8.1m) |

|

Valuation methodology: |

Multiple |

7

Elliptic

www.elliptic.co

A digital currency custodial and physical

storage offering.

|

Initial investment date: |

July 2014 |

|

Investment cost: |

£9.9m |

|

|

(2022: £7.7m) |

|

Valuation: |

£19.0m |

|

|

(2022: £15.9m) |

|

Last submitted accounts: |

31 March 2023 |

|

Consolidated turnover: |

£9.6m |

|

|

(2022: £6.1m) |

|

Consolidated loss before tax: |

£(27.1)m |

|

|

(2022: £(15.0)m) |

|

Net assets: |

£10.6m |

|

|

(2022: £36.8m) |

|

Valuation methodology: |

Multiple |

8

vHive Tech Ltd

www.vhive.ai

vHive enables businesses to deploy autonomous

drone hives to digitise their field assets and operations.

|

Initial investment date: |

May 2019 |

|

Investment cost: |

£8.0m |

|

|

(2022: £8.0m) |

|

Valuation: |

£18.9m |

|

|

(2022: £19.7m) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

$6.4m |

|

|

(2022: $2.4m) |

|

Consolidated loss before tax: |

$(3.5)m |

|

|

(2022: $(3.0)m) |

|

Consolidated net assets: |

$28.2m |

|

|

(2022: $2.3m) |

|

Valuation methodology: |

Multiple |

9

Token

www.token.io

A leading open banking solution, focused on

payments.

|

Initial investment date: |

March 2017 |

|

Investment cost: |

£12.6m |

|

|

(2022: £12.6m) |

|

Valuation: |

£17.1m |

|

|

(2022: £18.3m) |

|

Last submitted group accounts: |

31 December 2022 |

|

Turnover: |

Not available2 |

|

Loss before tax: |

Not available2 |

|

Net assets: |

£0.7m |

|

|

(2022: £0.5m) |

|

Valuation methodology: |

Multiple |

10

XYZ Reality

www.xyzreality.com

Has developed a cloud-based engineering grade

augmented reality (AR) software platform and hardware for the

construction industry.

|

Initial investment date: |

June 2021 |

|

Investment cost: |

£15.3m |

|

|

(2022: £8.5m) |

|

Valuation: |

£15.5m |

|

|

(2022: £8.5m) |

|

Last submitted group accounts: |

31 March 2023 |

|

Turnover: |

£2.7m |

|

|

(2022: £1.1m) |

|

Loss before tax: |

£(8.2)m |

|

|

(2022: £(5.6)m) |

|

Net assets: |

£8.2m |

|

|

(2022: £15.9m) |

|

Valuation methodology: |

Last round |

1. These are numbers per latest public filings.

Latest figures have not been disclosed.

2. Information not publicly available.

Outlook

The decline in Titan’s NAV is disappointing and looking ahead in

2024, there remain headwinds which need to be navigated, notably

around the lack of capital, especially at the later stages for

driving growth. We have seen the impact on our portfolio companies

with their growth slowing, leading to slower valuation

appreciation. This has limited their ability to raise follow-on

funding at attractive terms or achieve successful exits at

appealing valuations. Both the funding and exit environment have

been subdued as businesses look to preserve cash and focus on

achieving profitability. According to Pitchbook (a provider of

private markets data), European funding in 2023 fell to roughly €57

billion, down from €105 billion in 2022 and VC firms raised €16

billion compared to €28 billion a year ago1.

We do not anticipate an end to the slowdown in

the near term, but green shoots of recovery are evident, with

public markets starting to rally and investor interest starting to

return in some markets. We also believe more challenging periods,

such as these, can create opportunities for great investments to be

made and it can increase our ability to build meaningful strategic

stakes in existing portfolio companies where we believe there is

real opportunity for value growth over the coming years.

As stated in the Chair’s Statement, Malcolm

Ferguson, Octopus’ lead Fund Manager for Titan, has resigned and Jo

Oliver has assumed the role, on an interim basis, until a full-time

lead Fund Manager has been appointed. Malcolm has been a great

asset to the Company and we wish him the best in his new role. Jo

was previously in this role for the period 2014-2022 and has worked

in the team for 15 years. He will work alongside the 30 investment

professionals focusing on Titan offering almost 300 years of

collective investment experience supported by 25 operations team

members.

Titan is well placed in this environment with

its evergreen structure as it can take a long-term view. With the

support of its shareholders, Titan can be patient and support

companies throughout their growth journey and back management teams

as they seize the right opportunities at the right time. As we

continue to meet with extraordinary entrepreneurs and invest in

truly disruptive innovation, Titan is well placed to take advantage

of and navigate these difficult times.

1. Pitchbook Report - total VC market data, not

just technology.

Risks and risk management

The Board assesses the risks faced by Titan and,

as a board, reviews the mitigating controls and actions, and

monitors the effectiveness of these controls and actions.

Emerging and principal risks, and

risk management

Emerging risks

The Board has considered emerging risks. The

Board seeks to mitigate emerging risks and those noted below by

setting policy, regular review of performance and monitoring

progress and compliance. In the mitigation and management of these

risks, the Board applies the principles detailed in the Financial

Reporting Council’s Guidance on Risk Management, Internal Control

and Related Financial and Business Reporting.

The following are some of the potential emerging risks

management and the Board are currently monitoring:

- adverse changes in global macroeconomic environment;

- challenging market conditions for private company fundraising

and exits;

- geo-political instability; and

- climate change.

Principal risks

|

Risk |

Mitigation |

Change |

|

Investment performance: |

|

|

|

The focus of Titan’s investments is into unquoted, small and

medium‑sized VCT qualifying companies which, by their nature,

entail a higher level of risk and shorter cash runway than

investments in larger quoted companies. |

Octopus has significant experience and a strong track record of

investing in early-stage unquoted companies, and appropriate due

diligence is undertaken on every new investment. A member of the

Octopus Ventures team is appointed to the board of a portfolio

company using a risk-based approach, considering the size of the

company within the Titan portfolio and the engagement levels of

other investors. Regular board reports are prepared by the

portfolio company’s management and examined by the Manager. This

arrangement, in conjunction with its portfolio talent team’s active

involvement, allows Titan to play a prominent role when necessary

in a portfolio company’s ongoing development and strategy. This

included the impact of the Silicon Valley Bank collapse in the last

year, and the ongoing impact of geopolitical uncertainty on

portfolio companies. The overall risk in the portfolio is mitigated

by maintaining a wide spread of holdings in terms of financing

stage, age, industry sector and business models. The Board reviews

the investment portfolio with the Portfolio Manager on a regular

basis. The Portfolio Manager is incentivised via a performance

incentive fee for exceeding certain performance hurdles. The Board

and Octopus are reviewing the fee structure.

|

Increased exposures reflected in the previous period remain due to

the difficult macro environment and challenging trading conditions

for some portfolio companies continuing. |

|

Risk |

Mitigation |

Change |

|

VCT qualifying status: |

|

|

|

Titan is required at all times to observe the conditions for the

maintenance of approved VCT status. The loss of such approval could

lead to Titan and its investors losing access to the various tax

benefits associated with VCT status and investment. |

Octopus tracks Titan’s qualifying status regularly throughout the

year, and reviews this at key points including investment

realisation. This status is reported to the Board at each Board

meeting. The Board has also engaged external independent advisers

to undertake an independent VCT status monitoring role.

|

Decreased exposures reflected in the previous period remain. VCT

status monitoring by independent advisers continues to reduce the

risk of an issue causing a loss of VCT status. |

|

Risk |

Mitigation |

Change |

|

Loss of key people: |

|

|

|

The loss of key investment staff by the Portfolio Manager could

lead to poor fund management and/or performance due to lack of

continuity or understanding of Titan. |

The Portfolio Manager has a broad team experienced in and focused

on early-stage investing. This mitigates the risk of any one

individual with the required skill set and knowledge of venture

capital investing, and the portfolio specifically, leaving. Key

investment staff are also incentivised via the performance

incentive fee.

|

Loss of the lead fund manager and increased exposures reflected in

the previous period remain due to the absence of a performance fee

and reduced levels of capital raising compared to previous

periods. |

|

Risk |

Mitigation |

Change |

|

Operational: |

|

|

The Board is reliant on the Portfolio Manager to manage investments

effectively, and manage the services of a number of third parties,

in particular the registrar, depositary and tax advisers. A failure

of the systems or controls at Octopus or third-party providers

could lead to an inability to provide accurate reporting and

accounting and to ensure adherence to VCT rules.

|

The Board reviews the system of internal controls, both financial

and non-financial, operated by Octopus (to the extent the latter

are relevant to Titan’s internal controls). These include controls

designed to make sure that Titan’s assets are safeguarded and that

proper accounting records are maintained.

|

No overall change in risk exposure on balance. |

|

Risk |

Mitigation |

Change |

|

Information security: |

|

|

|

A loss of key data could result in a data breach and fines. The

Board is reliant on Octopus and third parties to take appropriate

measures to prevent a loss of confidential customer

information. |

Annual due diligence is conducted on third parties which includes a

review of their controls for information security. Octopus has a

dedicated information security team and a third party is engaged to

provide continual protection in this area. A security framework is

in place to help prevent malicious events.

|

No overall change on balance, although cyber threat remains a

significant risk area faced by all service providers. |

|

Risk |

Mitigation |

Change |

|

Economic: |

|

|

Events such as an economic recession and movement in interest rates

could adversely affect some smaller companies’ valuations, as they

may be more vulnerable to changes in trading conditions or the

sectors in which they operate. This could result in a reduction in

the value of Titan’s assets.

|

Titan invests in a diverse portfolio of companies, across a range

of sectors, which helps to mitigate against the impact on any one

sector. Titan also maintains adequate liquidity to make sure it can

continue to provide follow‑on investment to those portfolio

companies which require it and which is supported by the individual

investment case.

|

Increased exposures reflected in the previous period remain as

economic uncertainty persists through high inflation, high interest

rates and other economic factors. |

|

Risk |

Mitigation |

Change |

|

Legislative: |

|

|

|

A change to the VCT regulations could adversely impact Titan by

restricting the companies Titan can invest in under its current

strategy. Similarly, changes to VCT tax reliefs for investors could

make VCTs less attractive and impact Titan’s ability to raise

further funds. |

The Portfolio Manager engages with HM Treasury and industry bodies

to demonstrate the positive benefits of VCTs in terms of growing

early-stage companies, creating jobs and increasing tax revenue,

and to help shape any change to VCT legislation.

|

Risk exposure has continued to reduce since the previous period

following the extension of the sunset clause to 2035 being

agreed. |

|

Risk |

Mitigation |

Change |

|

Liquidity: |

|

|

|

The risk that Titan’s available cash will not be sufficient to meet

its financial obligations. Titan invests in smaller unquoted

companies, which are inherently illiquid as there is no readily

available market for these shares. Therefore, these may be

difficult to realise for their fair market value at short

notice. |

Titan’s liquidity risk is managed on a continuing basis by Octopus

in accordance with policies and procedures agreed by the Board.

Titan’s overall liquidity risks are monitored on a quarterly basis

by the Board, with frequent budgeting and close monitoring of

available cash resources. Titan maintains sufficient investments in

cash and readily realisable securities to meet its financial

obligations. At 31 December 2023, these investments were valued at

£199,841,000 (2022: £162,945,000), which represents 20% (2022: 17%)

of the net assets of Titan. The Board also review the cash runway

in the portfolio.

|

Risk exposure has continued to increase, reflecting economic

uncertainty, the impact on fundraising and the risk of disposal

failures. |

|

Risk |

Mitigation |

Change |

|

Valuation: |

|

|

|

The portfolio investments are valued in accordance with

International Private Equity and Venture Capital (IPEV) valuation

guidelines. This means companies are valued at fair value. As the

portfolio comprises smaller unquoted companies, establishing fair

value can be difficult due to the lack of a readily available

market for the shares of such companies and the potentially limited

number of external reference points. |

Valuations of portfolio companies are performed by appropriately

experienced staff, with detailed knowledge of both the portfolio

company and the market it operates in. These valuations are then

subject to review and approval by Octopus’ Valuation Committee,

comprised of staff who are independent of Octopus Ventures with

relevant knowledge of unquoted company valuations, as well as

Titan’s Board of Directors.

|

Risk exposure remains unchanged from the previous period due to

economic uncertainty within valuation modelling. |

|

Risk |

Mitigation |

Change |

|

Foreign currency exposure: |

|

|

|

Investments held and revenues generated in other currencies may not

generate the expected level of returns due to changes in foreign

exchange rates. |

Octopus and the Board regularly review the exposure to foreign

currency movement to make sure the level of risk is appropriately

managed. Investments are primarily made in GBP, EUR and USD so

exposure is limited to a small number of currencies. On realisation

of investments held in foreign currencies, cash is translated to

GBP shortly after receiving the proceeds to limit the amount of

time exposed to foreign currency fluctuations.

|

Risk exposure has not changed since the previous period. |

Viability statement

In accordance with the FRC UK Corporate

Governance Code published in 2018 and provision 36 of the AIC Code

of Corporate Governance, the Directors have assessed the prospects

of Titan over a period of five years, consistent with the expected

investment hold period of a VCT investor. A fundraising was

launched on 19 October 2023 and closed on 5 April 2024, raising

£107 million. Under VCT rules, subscribing investors are required

to hold their investment for a five-year period in order to benefit

from the associated tax reliefs. The Board regularly considers

strategy, including investor demand for Titan’s shares, and a

five-year period is considered to be a reasonable time horizon for

this.

The Board carried out a robust assessment of the

emerging and principal risks facing Titan and its current position,

including risks which may adversely impact its business model,

future performance, solvency or liquidity, and focused on the major

factors which affect the economic, regulatory and political

environment. Particular consideration was given to Titan’s reliance

on, and close working relationship with, the Portfolio Manager. The

principal risks faced by Titan and the procedures in place to

monitor and mitigate them are set out above.

The Board has carried out robust stress testing

of cash flows which included assessing the resilience of portfolio

companies, including the requirement for any future financial

support and the ability to pay dividends, and buybacks.

The Board has additionally considered the

ability of Titan to comply with the ongoing conditions to make sure

it maintains its VCT qualifying status under its current investment

policy.

Based on this assessment the Board confirms that

it has a reasonable expectation that Titan will be able to continue

in operation and meet its liabilities as they fall due over the

five-year period to 31 December 2028. The Board is mindful of the

ongoing risks and will continue to make sure that appropriate

safeguards are in place, in addition to monitoring the cash flow

forecasts to ensure Titan has sufficient liquidity.

Directors’ responsibilities statement

The Directors are responsible for preparing the

Strategic Report, the Directors’ Report, the Directors’

Remuneration Report and the financial statements in accordance with

applicable law and regulations. They are also responsible for

ensuring that the annual report and financial statements include

information required by the Listing Rules of the Financial Conduct

Authority.

Company law requires the Directors to prepare

financial statements for each financial year. Under that law the

Directors have elected to prepare the financial statements in

accordance with United Kingdom Generally Accepted Accounting

Practice (GAAP), including Financial Reporting Standard 102 – ‘The

Financial Reporting Standard Applicable in the United Kingdom and

Republic of Ireland’ (FRS 102), (United Kingdom accounting

standards and applicable law). Under company law the Directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs and profit

or loss of the Company for that period. In preparing these

financial statements, the Directors are required to:

- select suitable accounting policies

and then apply them consistently;

- make judgements and accounting

estimates that are reasonable and prudent;

- state whether applicable UK

Accounting Standards have been followed, subject to any material

departures disclosed and explained in the financial

statements;

- prepare the financial statements on

the going concern basis unless it is inappropriate to presume that

the Company will continue in business; and

- prepare a Strategic Report,

Directors’ Report and Directors’ Remuneration Report which comply

with the requirements of the Companies Act 2006.

The Directors are responsible for keeping

adequate accounting records that are sufficient to show and explain

the Company’s transactions and disclose with reasonable accuracy at

any time the financial position of the Company and enable them to

ensure that the financial statements comply with the Companies Act

2006. They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

Insofar as each of the Directors is aware:

- there is no relevant audit

information of which the Company’s auditor is unaware; and

- the Directors have taken all steps

that they ought to have taken to make themselves aware of any

relevant audit information and to establish that the auditor is

aware of that information.

The Directors are responsible for preparing the

annual report and financial statements in accordance with

applicable law and regulations. Having taken advice from the Audit

Committee, the Directors are of the opinion that this report as a

whole provides the necessary information to assess the Company’s

performance, business model and strategy and is fair, balanced and

understandable.

The Directors are responsible for the

maintenance and integrity of the corporate and financial

information included on the Company’s website. Legislation in the

United Kingdom governing the preparation and dissemination of

financial statements may differ from legislation in other

jurisdictions.

The Directors confirm that, to the best of their

knowledge:

- the financial statements, prepared

in accordance with United Kingdom Generally Accepted Accounting

Practice, including FRS 102, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company; and

- the annual report and financial

statements (including the Strategic Report), give a fair review of

the development and performance of the business and the position of

the Company, together with a description of the principal risks and

uncertainties that it faces.

On behalf of the Board

Tom Leader

Chair

Income statement

|

|

|

Year to 31 December 2023 |

Year to 31 December 2022 |

|

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

(Loss)/gain on disposal of fixed asset investments |

|

— |

(1,870) |

(1,870) |

— |

66 |

66 |

|

Gain on disposal of current asset investments |

|

— |

355 |

355 |

— |

— |

— |

|

Loss on valuation of fixed asset investments |

|

— |

(131,655) |

(131,655) |

— |

(284,465) |

(284,465) |

|

Gain/(loss) on valuation of current asset investments |

|

— |

8,098 |

8,098 |

— |

(12,682) |

(12,682) |

|

Investment income |

|

4,467 |

— |

4,467 |

864 |

— |

864 |

|

Investment management fee |

|

(1,054) |

(20,028) |

(21,082) |

(1,125) |

(21,383) |

(22,508) |

|

Other expenses |

|

(6,264) |

— |

(6,264) |

(7,060) |

— |

(7,060) |

|

Foreign exchange translation |

|

— |

(1,548) |

(1,548) |

— |

6,570 |

6,570 |

|

Loss before tax |

|

(2,851) |

(146,648) |

(149,499) |

(7,321) |

(311,894) |

(319,215) |

|

Tax |

|

— |

— |

— |

— |

— |

— |

|

Loss after tax |

|

(2,851) |

(146,648) |

(149,499) |

(7,321) |

(311,894) |

(319,215) |

|

Loss per share – basic and diluted |

|

(0.2)p |

(9.7)p |

(9.9)p |

(0.6)p |

(24.0)p |

(24.6)p |

- The ‘Total’ column of this statement is the profit and loss

account of Titan; the supplementary revenue return and capital

return columns have been prepared under guidance published by the

Association of Investment Companies.

- All revenue and capital items in the above statement derive

from continuing operations.

- Titan has only one class of business and derives its income

from investments made in shares and securities and from bank and

money market funds.

Titan has no other comprehensive income for the period.

The accompanying notes form an integral part of the financial

statements.

Balance sheet

|

|

|

As at 31 December 2023 |

As at 31 December 2022 |

|

|

|

£’000 |

£’000 |

£’000 |

£’000 |

|

Fixed asset investments |

|

|

790,819 |

|

827,449 |

|

Current assets: |

|

|

|

|

|

|

Money market funds |

|

91,172 |

|

58,701 |

|

|

Corporate bonds |

|

108,669 |

|

104,244 |

|

|

Applications cash1 |

|

17,842 |

|

23,299 |

|

|

Cash at bank |

|

2,970 |

|

16,120 |

|

|

Debtors |

|

1,802 |

|

47,374 |

|

|

|

|

|

222,455 |

|

249,738 |

|

Current liabilities |

|

(19,530) |

|

(25,427) |

|

|

Net current assets |

|

|

202,925 |

|

224,311 |

|

|

|

|

|

|

|

|

Net assets |

|

|

993,744 |

|

1,051,760 |

|

|

|

|

|

|

|

|

Share capital |

|

|

1,594 |

|

1,368 |

|

Share premium |

|

|

45,780 |

|

92,896 |

|

Capital redemption reserve |

|

|

74 |

|

27 |

|

Special distributable reserve |

|

|

1,025,614 |

|

887,288 |

|

Capital reserve realised |

|

|

(89,570) |

|

(53,430) |

|

Capital reserve unrealised |

|

|

51,674 |

|

160,634 |

|

Revenue reserve |

|

|

(41,422) |

|

(37,023) |

|

|

|

|

|

|

|

|

Total equity shareholders’ funds |

|

|

993,744 |

|

1,051,760 |

|

|

|

|

|

|

|

|

NAV per share |

|

|

62.4p |

|

76.9p |

- Funds raised from investors since Titan opened for new

investment which have not been allotted as at year end.

The accompanying notes form an integral part of the financial

statements.

The statements were approved by the Directors and authorised for

issue on 24 April 2024 and are signed on their behalf by:

Tom Leader

Chair

Company Number 06397765

Statement of changes in equity

|

|

|

|

Capital |

Special |

Capital |

Capital |

|

|

|

|

Share |

Share |

redemption |

distributable |

reserve |

reserve |

Revenue |

|

|

|

capital |

premium |

reserve |

reserve1 |

realised1 |

unrealised |

reserve1 |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1 January 2023 |

1,368 |

92,896 |

27 |

887,288 |

(53,430) |

160,634 |

(37,023) |

1,051,760 |

|

Comprehensive income for the year: |

|

|

|

|

|

|

|

|

|

Management fees allocated as capital expenditure |

— |

— |

— |

— |

(20,028) |

— |

— |

(20,028) |

|

Current year loss on disposal of fixed asset investments |

— |

— |

— |

— |

(1,870) |

— |

— |

(1,870) |

|

Current year gain on disposal of current asset investments |

— |

— |

— |

— |

355 |

— |

— |

355 |

|

Loss on fair value of fixed asset investments |

— |

— |

— |

— |

— |

(131,655) |

— |

(131,655) |

|

Gain on fair value of current asset investments |

— |

— |

— |

— |

— |

8,098 |

— |

8,098 |

|

Loss after tax |

— |

— |

— |

— |

— |

— |

(2,851) |

(2,851) |

|

Foreign exchange translation |

— |

— |

— |

— |

— |

— |

(1,548) |

(1,548) |

|

Total comprehensive income for the year |

— |

— |

— |

— |

(21,543) |

(123,557) |

(4,399) |

(149,499) |

|

Contributions by and distributions

to owners: |

|

|

|

|

|

|

|

|

|

Share issue (includes DRIS) |

273 |

207,132 |

— |

— |

— |

— |

— |

207,405 |

|

Share issue costs |

— |

(5,737) |

— |

— |

— |

— |

— |

(5,737) |

|

Repurchase of own shares |

(47) |

— |

47 |

(32,422) |

— |

— |

— |

(32,422) |

|

Dividends paid (includes DRIS) |

— |

— |

— |

(77,763) |

— |

— |

— |

(77,763) |

|

Total contributions by and distributions to owners |

226 |

201,395 |

47 |

(110,185) |

— |

— |

— |

91,483 |

|

Other movements: |

|

|

|

|

|

|

|

|

|

Share premium cancellation |

— |

(248,511) |

— |

248,511 |

— |

— |

— |

— |

|

Prior year current asset losses now realised |

— |

— |

— |

— |

(355) |

355 |

— |

— |

|

Transfer between reserves |

— |

— |

— |

— |

(14,242) |

14,242 |

— |

— |

|

Total other movements |

— |

(248,511) |

— |

248,511 |

(14,597) |

14,597 |

— |

— |

|

Balance as at 31 December 2023 |

1,594 |

45,780 |

74 |

1,025,614 |

(89,570) |

51,674 |

(41,422) |

993,744 |

- Reserves are available for distribution, subject to the

restrictions.

The accompanying notes form an integral part of the financial

statements.

|

|

|

|

Capital |

Special |

Capital |

Capital |

|

|

|

|

Share |

Share |

redemption |

distributable |

reserve |

reserve |

Revenue |

|

|

|

capital |

premium |

reserve |

reserve1 |

realised1 |

unrealised |

reserve1 |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1 January 2022 |

129,850 |

201,163 |

9,759 |

642,873 |

(14,122) |

439,790 |

(36,272) |

1,373,041 |

|

Comprehensive income for the year: |

|

|

|

|

|

|

|

|

|

Management fees allocated as capital expenditure |

— |

— |

— |

— |

(21,383) |

— |

— |

(21,383) |

|

Current year gain on disposal of fixed asset investments |

— |

— |

— |

— |

66 |

— |

— |

66 |

|

Loss on fair value of fixed asset investments |

— |

— |

— |

— |

— |

(284,465) |

— |

(284,465) |

|

Loss on fair value of current asset investments |

— |

— |

— |

— |

— |

(12,682) |

— |

(12,682) |

|

Loss after tax |

— |

— |

— |

— |

— |

— |

(7,321) |

(7,321) |

|

Foreign exchange translation |

— |

— |

— |

— |

— |

— |

6,570 |

6,570 |

|

Total comprehensive income for the year |

— |

— |

— |

— |

(21,317) |

(297,147) |

(751) |

(319,215) |

|