TIDMRC2

RNS Number : 2559C

Reconstruction Capital II Ltd

09 June 2023

9 June 2023

Reconstruction Capital II Limited

Annual Report and Audited Financial Statements

for the year ended 31 December 2022

Reconstruction Capital II Limited ("RC2", the "Company" or the

"Group"), a closed-end investment company incorporated in the

Cayman Islands admitted to trading on the AIM market of the London

Stock Exchange, today announces its results for the year ended 31

December 2022.

Copies of the Company's annual report will today be posted to

shareholders. The annual report is also available to view on the

Company's website http://www.reconstructioncapital2.com .

Financial highlights

-- The audited net asset value as at 31 December 2022 was

EUR0.1757 per share (EUR0.1971 per share as at 31 December 2021), a

10.9% decrease over the year;

-- The Directors do not recommend the payment of a dividend.

Operational highlights

Private Equity Programme

At the end of December 2022, the investments held under the

Private Equity Programme had a total fair value of EUR23.97m, 8.6%

below the 2021 valuation of EUR26.24m. The valuations of Policolor,

Mamaia and Telecredit were all performed by independent valuers.

The valuations of the Company's investments in Reconstruction

Capital Plc ("RC") and The Romanian Investment Fund Limited ("RIF")

were also based on their audited net asset values, but these were

in turn based on the same valuation of their main underlying asset,

Policolor SA, as adopted by the Company.

In 2022, the outbreak of war across the border in Ukraine

triggered a global energy and food crisis, adding fuel to

inflationary pressures which were already building up as the world

transited out of Covid-induced economic repression, resulting in

rising interest rates, and disrupted supply chains, and the erosion

of the purchasing power of households and businesses. Mainly due to

these difficult circumstances, Policolor fell short of its budgeted

targets, whilst Mamaia and Telecredit were able to shrug off the

economic headwinds and beat their budgets. The changes in the

valuations above reflect future expectations for these businesses,

in the light of their trading performance in 2022.

Based on unaudited figures for 2022, the Policolor Group managed

to generate a 7.4% year-on-year increase in sales, from EUR 79.4m

in 2021 to EUR 85.3m in 2022, helped by the resins division whose

sales were 24.1% above 2021. However, the Group's gross margin

shrank from 28.8% in 2021 to 24.5%, mainly due to the Coatings

division not having the pricing power to enable it to implement

price increases sufficiently quickly to compensate for the steep

increase in raw material and energy prices. Mainly due to this, in

spite of significant cost savings in administration and logistics

costs, the Group's recurring EBITDA of EUR2.6m was 37.6% lower

year-on-year and 56.2% below budget.

Based on unaudited figures for 2022, Mamaia Resort Hotels

achieved record results, with operating revenues of EUR 4.0m, 29.5%

above budget and 32.4% above 2021, driven by a higher occupancy

rate as the Hotel managed to secure more group occupancy contracts

in the off-season. The Hotel's EBITDA was EUR 0.7m, 77.3% above

budget and 72.1% higher year-on-year.

Based on unaudited figures for 2022, Telecredit had another

high-growth year. In 2022, the Company

deployed EUR 28.5m in financing products to small and

medium-sized enterprises, generating Operating profit before

depreciation and interest expenses of EUR 0.7m, 78% higher than

2021 and 48% above budget.

Related parties' interests

As at 31 December 2022, 39,030,555 of the Company's shares were

held by Ion Florescu, 42,726,319 shares were owned by Portadrix

Investments Limited, which is wholly-owned by The Florescu Family

Trust, and 105,985 shares were owned by New Europe Capital SRL,

which is the adviser to the Company and is 84% owned by Ion

Florescu. Mr Florescu and interests related to him own in aggregate

81,862,859 shares representing 60.26% of the current issued share

capital of the Company.

For further information, please contact:

Reconstruction Capital II Limited Cornelia Oancea / Luca Nicolae

Tel: +40 21 3167680

Grant Thornton UK LLP (Nominated Adviser)

Philip Secrett / George Grainger

Tel: +44 (0) 20 7383 5100

finnCap Limited (Broker) William Marle / Giles Rolls Tel: +44 20

7220 0500

ADVISER'S REPORT

For the year ended 31 December 2022

On 31 December 2022, Reconstruction Capital II Limited ("RC2" or

the "Company") had a total audited net asset value ("NAV") of

EUR23.8m, or EUR0.1757 per share. The NAV per share fell by 10.9%

over the course of the year.

Private Equity Programme

At the end of December 2022, the investments held under the

Private Equity Programme had a total fair value of EUR23.97m, 8.6%

below the 2021 valuation of EUR26.24m. The valuations of Policolor,

Mamaia and Telecredit were all performed by independent valuers.

The valuations of the Company's investments in Reconstruction

Capital Plc ("RC") and The Romanian Investment Fund Limited ("RIF")

were also based on their audited net asset values, but these were

in turn based on the same valuation of their main underlying asset,

Policolor SA, as adopted by the Company.

2022 2021

EUR EUR

Policolor S.A 14,080,000 17,000,000

Mamaia Hotel Resorts SRL ("Mamaia") 4,814,247 4,076,986

Telecredit IFN S.A. ("Telecredit") 3,255,500 1,895,500

The Romanian Investment Fund Limited 1,180,103 1,719,419

Reconstruction Capital Plc 644,777 1,544,540

-------------- --------------

23,974,627 26,236,445

-------------- --------------

The above valuations are based on assumptions that applied as of

31 December 2022.

In 2022, the outbreak of war across the border in Ukraine

triggered a global energy and food crisis, adding fuel to

inflationary pressures which were already building up as the world

transited out of Covid-induced economic repression, resulting in

rising interest rates, and disrupted supply chains, and the erosion

of the purchasing power of households and businesses. Mainly due to

these difficult circumstances, Policolor fell short of its budgeted

targets, whilst Mamaia and Telecredit were able to shrug off the

economic headwinds and beat their budgets. The changes in the

valuations above reflect future expectations for these businesses,

in the light of their trading performance in 2022.

Based on unaudited figures for 2022, the Policolor Group managed

to generate a 7.4% year-on-year increase in sales, from EUR 79.4m

in 2021 to EUR 85.3m in 2022, helped by the resins division whose

sales were 24.1% above 2021. However, the Group's gross margin

shrank from 28.8% in 2021 to 24.5%, mainly due to the Coatings

division not having the pricing power to enable it to implement

price increases sufficiently quickly to compensate for the steep

increase in raw material and energy prices. Mainly due to this, in

spite of significant cost savings in administration and logistics

costs, the Group's recurring EBITDA of EUR2.6m was 37.6% lower

year-on-year and 56.2% below budget.

Based on unaudited figures for 2022, Mamaia Resort Hotels

achieved record results, with operating revenues of EUR 4.0m, 29.5%

above budget and 32.4% above 2021, driven by a higher occupancy

rate as the Hotel managed to secure more group occupancy contracts

in the off-season. The Hotel's EBITDA was EUR 0.7m, 77.3% above

budget and 72.1% higher year-on-year.

Based on unaudited figures for 2022, Telecredit had another

high-growth year. In 2022, the Company

deployed EUR 28.5m in financing products to small and

medium-sized enterprises, generating Operating profit before

depreciation and interest expenses of EUR 0.7m, 78% higher than

2021 and 48% above budget.

Apart from the shareholdings in RC and RIF, the other private

equity investments are held through two Cyprus-based wholly-owned

subsidiaries, RC2 (Cyprus) Limited and Glasro Holdings Limited,

which are not consolidated in the present financial statements, in

accordance with IFRS. The Assets at Fair Value shown in the present

financial statements, which amount to EUR24.10m, reflects the

valuations of the underlying private equity holdings outlined in

the above table, plus cash and cash equivalents of EUR0.14m, and

net sundry liabilities of EUR-0.01m, held by these intermediary

holding companies.

Economic Overview

Both the Romanian and Bulgarian economies reported an increase

in GDP in 2022 of 4.8% and 3.4%, respectively, despite the Russian

invasion of Ukraine. The invasion added fuel to already rising

prices, with

inflation reaching 16.4% in Romania and 16.9% in Bulgaria at the

end of 2022. In spite of the economic headwinds, the European

Commission has forecast economic growth of 2.5% in Romania and 1.4%

in

Bulgaria in 2023.

INVESTMENT POLICY

Investment Objective and Policy of the Company

At a general shareholder meeting on 21 February 2018, the

investment objective of the Company was changed so that it now aims

to achieve capital appreciation and/or to generate investment

income returns through the acquisition of real estate assets in

Romania, including the development of such assets, and/or the

acquisition of significant or controlling stakes in companies

established in, or operating predominantly in Romania, primarily in

the real estate sector. Any new private equity investment in

companies operating in sectors other than real estate is limited to

25% of the Company's total assets at the time of effecting the

investment. However, the Company may continue to make follow-on

investments in existing portfolio companies (which include

Policolor SA, Mamaia Resort Hotels SRL and Telecredit SA IFN)

without any such limitation.

Gearing

The Company may borrow up to a maximum level of 30% of its gross

assets (as defined in its articles).

Distribution Policy

The Company's investment objective is focused principally on the

provision of capital growth. For further details of the Company's

distribution policy, please refer to the Admission Document on the

Company's website.

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2022

2022 2021

EUR EUR

Investment income

Fair value loss on financial assets

at fair value through

profit or loss (2,615,823) 2,774,875

Interest income 518,085 3,197,478

-------------- --------------

Net investment income/(loss) (2,097,738) 5,972,353

-------------- --------------

Expenses

Operating expenses (844,981) (725,459)

Net financial (expense)/income (871) (11,595)

-------------- --------------

Total expenses (845,852) (737,054)

-------------- --------------

Profit/(loss) for the year (2,943,590) 5,235,299

-------------- --------------

Other comprehensive income - -

-------------- --------------

Total comprehensive income/(loss)

for the year attributable to owners (2,943,590) 5,235,299

-------------- --------------

Gain/(loss) Per Share

Basic and diluted gain/(loss) per

share (0.0217) 0.0385

STATEMENT OF FINANCIAL POSITION

As at 31 December 2022

2022 2021

EUR EUR

ASSETS

Non-current assets

Financial assets at fair value through

profit or loss 24,104,083 26,971,821

-------------- --------------

Total non-current assets 24,104,083 26,971,821

-------------- --------------

Current assets

Trade and other receivables 15,492 6,027

Cash and cash equivalents 73,337 11,301

-------------- --------------

Total current assets 88,829 17,328

-------------- --------------

TOTAL ASSETS 24,192,912 26,989,149

-------------- --------------

LIABILITIES

Current liabilities

Trade and other payables 124,485 205,685

Total current liabilities 124,485 205,685

-------------- --------------

Non-current liabilities

Borrowings 250,833 -

-------------- --------------

TOTAL LIABILITIES 375,318 205,685

-------------- --------------

NET ASSETS 23,817,594 26,783,464

-------------- --------------

EQUITY AND RESERVES

Share capital 1,355,784 1,358,569

Share premium 109,187,284 109,206,779

Accumulated deficit (86,725,474) (83,781,884)

-------------- --------------

TOTAL EQUITY 23,817,594 26,783,464

-------------- --------------

Net Asset Value per share

Basic and diluted net asset value

per share 0.1757 0.1971

STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2022

Share Accumulated

Share capital premium deficit Total

EUR EUR EUR EUR

Balance at 1 January 2021 1,358,569 109,206,779 (89,235,299) 21,548,165

Profit for the year - -

Other comprehensive income - - 5,235,299 5,235,299

---------------- ----------- ------------ --------------

Total comprehensive loss

for the

year - - 5,235,299 5,235,299

---------------- ----------- ------------ --------------

Balance at 31 December 2021 1,358,569 109,206,779 (83,781,884) 26,783,464

---------------- ----------- ------------ --------------

Loss for the year - - (2,943,590) (2,943,590)

---------------- ----------- ------------ --------------

Total comprehensive loss

for the year - - (2,943,590) (2,943,590)

---------------- ----------- ------------ --------------

Repurchase and cancellation

of own shares (2,785) (19,495) - (22,280)

---------------- ----------- ------------ --------------

Transactions with owners (2,785) (19,495) (22,280)

---------------- ----------- ------------ --------------

Balance at 31 December 2022 1,355,784 109,187,284 (86,725,474) 23,817,594

---------------- ----------- ------------ --------------

STATEMENT OF CASH FLOWS

For the year ended 31 December 2022

2022 2021

EUR EUR

Cash flows from operating activities

Profit/(loss) for the year (2,943,590) 5,235,299

Adjustments for:

Fair value loss on financial assets

at fair value through profit or loss 2,615,823 (2,774,875)

Interest income (518,085) (3,197,478)

Interest expense 833 11,035

Net (loss)/gain on foreign exchange 6 (44)

-------------- --------------

Net cash outflow before changes in

working capital (845,013) (726,063)

(Increase)/decrease in trade and other

receivables (9,465) 7,573

(Decrease)/increase in trade and other

payables (81,200) 113,902

Purchase of financial assets - (210,000)

Repayments of financial assets 770,000 1,210,085

-------------- --------------

Net cash generated from/(used in) operating

activities (165,678) 395,497

Cash flows from financing activities

Proceeds from borrowings 250,000 250,000

Repayments of loans - (650,000)

Interest paid - (17,313)

-------------- --------------

Payments to purchase own shares (22,280) -

-------------- --------------

Net cash generated from/(used in) financing

activities 227,720 (417,313)

-------------- --------------

Net decrease in cash and cash equivalents

before currency adjustment 62,042 (21,816)

Effects of exchange rate differences

on cash and cash equivalents (6) 44

-------------- --------------

Net decrease in cash and cash equivalents

after currency adjustment 62,036 (21,772)

Cash and cash equivalents at the beginning

of the year 11,301 33,073

-------------- --------------

Cash and cash equivalents at the end

of the year 73,337 11,301

-------------- --------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GIGDLXDGDGXC

(END) Dow Jones Newswires

June 09, 2023 07:03 ET (11:03 GMT)

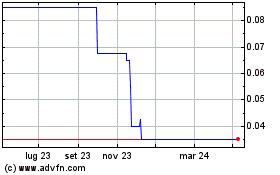

Grafico Azioni Reconstruction Capital Ii (LSE:RC2)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Reconstruction Capital Ii (LSE:RC2)

Storico

Da Mag 2023 a Mag 2024