TIDMRTN

RNS Number : 0783S

Restaurant Group PLC

12 July 2022

The Restaurant Group plc

The Restaurant Group plc ("Group" or "TRG")

Acquisition of Barburrito, early debt facility repayment and

purchase of interest rate caps

TRG provides an update today for:

-- The acquisition of Barburrito Group Ltd ("Barburrito") for

GBP7m, representing a next 12 months ("NTM") run-rate EBITDA

multiple of 4.4x

-- Choosing to make an early repayment of GBP44m of term-loan facilities

-- The purchase of interest rate caps on GBP125m of debt

Acquisition of Barburrito

Background: Barburrito is an award-winning Mexican style

fast-casual restaurant chain, focused on serving fast, fresh and

healthy Mexican food. The business currently operates across 16

sites in high-footfall locations across a range of formats (i.e.

shopping centres, city centres and transport hubs).

Strategic and financial rationale: The Barburrito proposition is

well aligned with key consumer trends including healthy eating,

convenience, customisable cuisine and offers high quality products

at attractive prices with an average spend per customer of

c.GBP10.

The strength and established nature of the proposition and its

alignment to these key consumer trends has resulted in an

impressive trading performance as laid out in the table below:

YTD FY22 Like-for-like ("LFL") sales (%) vs. 2019

comparables

Q1(*) Q2(**) YTD(***) YTD outperformance

to date vs Coffer

Peach restaurant

tracker

Barburrito +22% +18% +20% +14%

-------------------

* Q1 refers to the 13 weeks to 03 April 2022 and includes the

benefit from VAT being at 12.5%. This boosted LFL sales for the

restaurant and pub sector by approximately 5 to 6%.

**Q2 refers to the 12-week period to 26 June 2022, with VAT at

20%.

***YTD refers to the 25-week period to 26 June 2022.

Barburrito's strong current trading gives us confidence in its

ability to align with and extend TRG's track record of market

outperformance.

The sites have historically generated strong returns on invested

capital(1) in excess of 30% and TRG believes there is significant

scope to further develop and expand the brand, particularly in the

south of England, where there is limited presence. The initial

expansion plan would be to double the existing estate over the next

four years.

Barburrito will be integrated into TRG's Leisure &

Concessions division, with the key operational team from Barburrito

retained. The Leisure & Concessions team is very familiar with

the business having operated two sites previously as franchises in

UK airports.

Transaction overview: The total consideration of GBP7m will be

paid entirely in cash by TRG and represents a 4.4x run-rate EBITDA

multiple. The transaction has been done on a debt-free and

cash-free basis. TRG is acquiring the business from its existing

shareholders(2) .

For the period ended 26 September 2021, Barburrito's profit

before tax was GBP1.7m and as at 26 September 2021 its gross assets

were GBP3.9m. The profit before tax ("PBT") figure for the period

benefitted from significant temporary government support (i.e. VAT

reduction and property grants).

The 16 existing sites are expected to contribute Adjusted(3)

company level EBITDA and PBT of c.GBP1.6m and c.GBP0.8m

respectively to TRG over the next 12 months.

Update on early debt facility repayment and interest rate

caps

Given the Group's significant cash headroom and confidence in

the underlying cash generation across our businesses, TRG chose to

repay a further GBP44m of its term loan in June 2022, thereby

reducing its total available debt facilities to GBP361m. The debt

facilities currently comprise a GBP241m term loan and a GBP120m RCF

facility which is undrawn. The Group currently has cash headroom(4)

in excess of GBP190m against these facilities.

To manage the risk of interest rate increases on its debt

facilities, TRG purchased interest rate caps as follows:

-- On GBP125m of debt limiting the SONIA base rate to 0.75% for

a total cost of GBP2.2m from November 2022 to November 2025;

and

-- On GBP100m of debt limiting the SONIA base rate to 0.75% for

a total cost of GBP0.9m from November 2025 to November 2026. These

caps significantly reduce the impact of interest rate changes on

our debt over the next four years

As a result of the GBP44m early repayment of the term-loan, the

Group maintains its previous guidance for the expected P&L

interest charge (pre-IFRS 16) for FY22 at between GBP24 and GBP25m,

despite the significant increase in the SONIA base rates that have

come into effect and possible further interest rate increases to

come. The purchase of the interest rate caps provides further

protection for TRG over the next four years.

Notice of results

TRG's next update is scheduled to be the interim results

announcement on 8 September 2022.

(1) Return on invested capital (ROIC) defined by outlet EBITDA

for the twelve months to March 2020/initial capex invested

(2) Existing shareholders comprise "Abbeyway Commercial (3)

Limited, Morgan Davies, Stephen Herring, Graham Turner & Neil

Lidguard"

(3) Pre IFRS 16 Adjustment and exceptional charges

(4) Cash headroom position as at 29 May 2022. Current facilities

subject to minimum liquidity covenant of GBP40m.

Enquiries:

The Restaurant Group plc

Andy Hornby, Chief Executive

Officer

Kirk Davis, Chief Financial

Officer

Umer Usman, Investor Relations 020 3117 5001

MHP Communications

Oliver Hughes

Simon Hockridge 020 3128 8789/8742

Notes:

1. The Restaurant Group plc operates approximately 400

restaurants and pub restaurants throughout the UK as at 12 July

2022. Its principal trading brands are Wagamama, Frankie &

Benny's and Brunning & Price. It also operates a multi-brand

Concessions business which trades principally in UK airports. In

addition, the Wagamama business has a 20% stake in a JV operating

five Wagamama restaurants in the US and over 50 franchise

restaurants operating across a number of territories.

2. Statements made in this announcement that look forward in

time or that express management's beliefs, expectations or

estimates regarding future occurrences are "forward-looking

statements" statements and reflect the Group's current expectations

concerning future events. Actual results may differ materially from

current expectations or historical results.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCQFLFFLDLBBBK

(END) Dow Jones Newswires

July 12, 2022 02:00 ET (06:00 GMT)

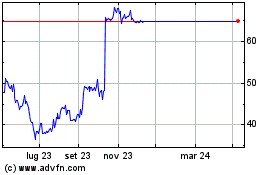

Grafico Azioni Restaurant (LSE:RTN)

Storico

Da Apr 2024 a Mag 2024

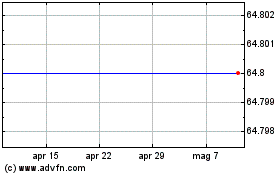

Grafico Azioni Restaurant (LSE:RTN)

Storico

Da Mag 2023 a Mag 2024