TIDMSAIN

RNS Number : 7961H

Scottish American Investment Co PLC

01 August 2023

RNS Announcement

The Scottish American Investment Company P.L.C. (SAINTS)

Legal Entity Identifier: 549300NF03XVC5IFB447

Regulated Information Classification: Interim Financial

Report.

The following is the unaudited Interim Financial Report for the

six months to 30 June 2023 which was approved by the Board on 31

July 2023.

Results for the six months to 30 June 2023 and appointment of

Deputy Manager

Results

3/4 SAINTS' assets have delivered a strong positive return over

the first six months of 2023, broadly keeping pace with equities.

SAINTS' net asset value total return (borrowings at fair value) was

7.8% over the first six months of 2023, whilst global equities*

returned 7.9% over the same period.

3/4 Over the past five years the Company has outperformed both

global equities and its sector, delivering a net asset value total

return (borrowings at fair value) of 73.0% against the market's*

total return of 56.7% and the sector's unweighted average net asset

value total return of 50.0%.

3/4 The Company has declared a second interim dividend of 3.45p.

3/4 SAINTS' revenues per share over the period were 7.64p

compared to 7.78p for the equivalent period last year. The

reduction in the Company's revenues is principally due to exchange

rate movements and property sales, with the Company's equity

holdings generally continuing to show dividend growth in local

currency terms, helped by the Managers' emphasis on

dependability.

3/4 SAINTS' global equity portfolio outperformed global equities

over the period despite the narrow leadership in equity

markets.

3/4 Despite a rising interest rate environment SAINTS' bond

investments delivered a positive total return, as to a lesser

extent did property. SAINTS' infrastructure equities fell back

slightly.

3/4 To satisfy market demand the Company issued GBP7.7m of

shares over the period at a premium to Net Asset Value.

3/4 The Board and the Managers are optimistic about SAINTS' long term prospects for growth.

* FTSE All-World Index (in sterling terms)

Source: Morningstar/Baillie Gifford and relevant underlying

service providers. See disclaimer at end of this announcement.

Appointment of Deputy Manager

3/4 The Board is pleased to announce the appointment of Ross

Mathison as Deputy Manager of SAINTS with immediate effect. Ross is

an investment manager in Baillie Gifford's Global Income Growth

team. This appointment reflects his close involvement in the

management of SAINTS and Baillie Gifford's team based approach.

Pausing to look back: the long term case for dividend growth

rather than yield

With SAINTS celebrating its 150th anniversary this year, we have

been pausing to look back. Baillie Gifford was appointed investment

manager by the Board in 2004. Financial markets were recovering

from the dot com crash, the UK was still in the EU, and China was

on its way to becoming a major driver of global growth after

joining the World Trade Organisation in 2001.

As managers we inherited a portfolio which had focused on

preserving yield, and which had become heavily skewed towards the

UK: almost 70% of the equity portfolio was invested in

London-listed stocks. We began a gradual process of moving the

portfolio in a different direction. Focusing on growth rather than

yield. And more expansive in terms of embracing investment

opportunities globally.

At the time, SAINTS' competitors could essentially be regarded

as the peer group of UK Equity Income funds. So, what happened

next? The accompanying chart shows the income and capital growth

delivered by SAINTS since 2004, compared with 26 such funds which

are still going today. Of these 26, we were particularly interested

in the 20 funds which, back in 2004, yielded more than 4%. These

yield-focused funds had an average dividend yield of 4.7%, which

was approximately a quarter higher than SAINTS' yield in 2004,

which was 3.8%.

The results can be seen in the chart. Despite its lower starting

yield, SAINTS shareholders have received, over the period, more

income than investments in the average high-yielding fund. Not by a

wide margin, but a little bit more, despite starting at a

significantly lower yield. The growth in dividends from SAINTS has

surpassed the gap in starting yield, to the point that over the

entire period, total income from SAINTS has been a little

higher.

More strikingly, there is a stark difference in capital growth.

SAINTS' shareholders have seen their capital grow by many multiples

of the higher-yielding, UK-focused funds. An investment of

GBP10,000 in 2004 delivered GBP24,000 of capital growth at SAINTS,

compared with GBP5,300 for those yield-seeking funds.

Adding both income and capital growth, SAINTS' shareholders have

seen their initial investment grow by 4.6x, whereas an investor in

the average higher-yielding UK income fund would have seen their

initial investment grow by 2.8x.

http://www.rns-pdf.londonstockexchange.com/rns/7961H_1-2023-7-31.pdf

We draw three conclusions from these numbers:

-- A focus on dividend growth, rather than yield, does not mean

shareholders receive less income than high-yielding strategies,

over the long-term.

-- These outcomes give credence to our belief that investing in

companies that can compound their dividends relentlessly higher

over long periods of time - the SAINTS approach - results in much

higher capital growth. Relentless compounding of dividends requires

relentless compounding of earnings. And relentless compounding of

earnings drives share price appreciation, resulting in capital

growth.

-- It shows the benefits of investing globally. Of course, many

UK-listed companies are global businesses, tapping into growth in

other parts of the world. But the much wider universe of global

opportunities provides much better odds of finding those relentless

compounders of earnings and dividends.

Note that we have assumed, in our calculations, that investors

were choosing to receive and consume their income, rather than

reinvesting it into new shares of SAINTS (or their UK income fund).

If we crunched these numbers again, but assumed reinvestment of

dividends into new shares, we suspect the gap in outcomes would be

even wider: given SAINTS' much stronger capital growth. We know

that many SAINTS shareholders reinvest their dividends into new

SAINTS shares.

Long-term compounders

Around 2013, Baillie Gifford expanded the team managing SAINTS.

This gave us the resource to search the world for even more of the

dividend compounders we seek. It also gave us an opportunity to

stop and think about our investment approach. We decided to

double-down. SAINTS leaned further into growth, and away from

higher-yielding equities.

Looking back on the companies that were owned within the

portfolio in 2013 - many of which are still held today - we can see

several examples of the growth stocks that have underpinned SAINTS'

income and capital growth. The table below shows the ten

best-performing holdings that we have held continuously for the

past decade. (There have been other strong performers purchased

since 2013, but here we are focussing on decade-long

performance):

cumulative cagr cagr

Total return cagr cagr cagr cagr pa to cagr Total return Total return

Company GBP Sales EPS PE Share price Div addition local GBP

================ ============== ======= ===== ===== ============= ============== ============== ==============

Apple 1820% 10% 14% 12% 28% 2% 32% 34%

Microsoft 1312% 10% 13% 11% 25% 1% 28% 30%

TSMC 715% 16% 20% (1%) 18% 1% 28% 30%

Analog Devices 545% 16% 20% 1% 18% 2% 18% 20%

Partners Group 466% 15% 14% (1%) 13% 2% 16% 19%

Atlas Copco 403% 8% 9% 7% 16% 3% 21% 18%

McDonald's 373% (2%) 7% 4% 12% 2% 15% 17%

Rio Tinto 281% 3% 6% 1% 7% 4% 14% 14%

Pepsi 260% 3% 5% 3% 8% 2% 12% 14%

UPS 234% 6% 11% (3%) 8% 2% 11% 13%

---------------- -------------- ------- ----- ----- ------------- -------------- -------------- --------------

Source: Bloomberg and Baillie Gifford. Period 30 June 2013 to 30

June 2023

Some of the returns here are extraordinary. Investments such as

Apple, Microsoft, TSMC, Analog Devices, Partners Group and Atlas

Copco have all delivered share price appreciation better than 15%

per annum, in local currency terms. After we add dividends into the

equation, total returns have been even higher: 20 or 30% per annum

in some cases. That means $1,000 invested ten years ago is worth

about $11,800 today, in the example of Microsoft.

The foundation-stone beneath the total returns of these

companies has been their strong revenue and earnings growth. By

focusing on companies that we have judged likely to compound their

earnings relentlessly higher at attractive rates - some 20% per

annum in the case of TSMC and Analog Devices for example - we have

found that share price appreciation has broadly followed. Sometimes

this capital growth has been turbo-charged by expansion in the PE

multiple, for example in the case of Apple. But the more important

thing has been not to over-pay, risking PE compression that offsets

the earnings growth. This way, the earnings growth has been more

likely to translate into share price and capital growth.

Looking back today, in 2023, we believe more strongly than ever

in our approach: focusing on growing companies that pay resilient

dividends which should compound relentlessly away alongside their

profit growth, all in the pursuit of strong income and capital

growth for SAINTS shareholders. By looking globally for these

companies, rather than narrowing our horizons to the particular

island on which we happen to be based, we dramatically raise our

odds of finding the next Atlas Copcos and Apples of the world. Over

the long-term, we believe the laws of compounding make this

approach highly likely to deliver better results than a

value-oriented, yield-based approach to investing.

Interim Management Report

Market commentary

Markets went down, up and occasionally sideways in the first

half of 2023. It might be tempting to dismiss this as the usual

gyrations of share prices and sentiment. But there are longer-term

forces at play in recent market movements, which are worth

commenting on here to help SAINTS shareholders understand what is

happening.

The world economy is currently in a period of transition. The

2010s were an environment of low inflation and low interest rates.

During the recent past we have seen inflation spike to levels not

seen for many years, and central banks including the Bank of

England attempt to wrestle inflation under control by continuously

raising short-term borrowing rates. This has had, and will continue

to have, knock-on effects in the broader economy. At times the

market has plunged into despondency about the potential for

recession, whilst at other times it has been euphoric about the

prospect of inflation peaking and interest rates stabilising.

But what does it all mean for SAINTS' investments? Our belief is

that the companies in the equity portfolio are much better-placed

to continue growing their earnings and dividends than the average

company in the stock market, despite the challenges that come with

higher inflation and higher interest rates. For one thing, SAINTS'

holdings have notably low levels of debt. This means that while

other companies may struggle mightily in the next few years as they

roll over their debt at significantly higher interest rates, this

is unlikely to be much of a drag on profit growth for the companies

in SAINTS' portfolio. Indeed some of SAINTS' holdings, such as

Netease and Cognex, have net cash balance sheets and will see their

earnings rise as they earn higher rates of interest.

We can also observe that SAINTS' holdings earn unusually high

returns on equity, compared with the average company. This is

essentially a reflection of the strong value they offer to their

customers, which in turn helps them to pass on cost inflation where

appropriate. We have seen this play out in some of their financial

results since the start of the year. For example Coca-Cola recently

reported revenue growth of 11% year over year.

These are some of the factors that give us confidence that, in

this brave new world of higher interest rates, the impact on growth

across SAINTS' equity portfolio will, hopefully, be relatively

muted. Of course if economies fall into recession, growth may slow

a little. But even then we might be hopeful that nominal growth in

their dividends would continue. The typical SAINTS holding pays out

perhaps half of its earnings as dividends. This means that even if

these earnings fall, there is a large cushion that allows SAINTS'

companies to look through the cycle and increase their dividends.

We saw this during the past six months at TSMC, which despite

forecasting a decline in sales of 10% this year due to the

semiconductor cycle, said it foresees strong growth in its business

in the medium-term and announced an increase in its dividend of

9%.

Performance

Over the first half of 2023, the equity portfolio delivered

positive returns of approximately 8%, broadly in line with global

equity markets. Interestingly, three of the top five contributors

to performance were industrial companies: Watsco (the US

distributor of air conditioning equipment), Fastenal (the US

distributor of industrial parts) and French-listed Schneider

Electric (automation and power management equipment).

"Interestingly" because, as mentioned above, investors have been

worrying about the impact of rapidly rising interest rates on the

economy and the risks of recession. But the results published by

these companies have been far more resilient than the market

anticipated.

Apart from these industrial names, Novo Nordisk was another

strong contributor to performance over the past 6 months, on the

back of excellent operational performance. Sales for Q1 2023,

announced in May, were 25% higher than the previous year as its

appetite suppressants continue to see rapidly rising demand from

patients who are battling obesity.

Two Chinese holdings were the main drag on performance:

furniture manufacturer Man Wah and sportswear company Anta Sports.

Both published muted results in the period, affected by a

disappointing rebound in the Chinese economy so far this year

following the end of the strict lockdown policy last December. Our

view is that in both cases their long-term growth prospects have

not been markedly impacted, simply delayed, and their balance

sheets and cash-flows remain very healthy.

Beyond the equity portfolio, we saw solid performance from

SAINTS' investments in property, infrastructure equities, and

bonds. These are funded out of SAINTS' prudent borrowings with an

average cost of 3%.

Perhaps most notable was the property portfolio, managed by

OLIM, which delivered a positive contribution to performance over

the period as rental income more than offset a decline in capital

values. The latest valuation, conducted externally by Savills,

resulted in a handful of the properties being modestly marked down

due to rising interest rates and falling market values for

commercial property across the UK. But if we look at the 12

properties which were owned by SAINTS at the start of the year, and

compare their values with the latest market valuation at 30 June

2023, we see that in aggregate their total value fell by only 2.4%,

from GBP66.75m to GBP65.15m. This is a notable performance in a

very difficult market for commercial property. If we add the two

new properties purchased during the past six months (a hotel in

Ringwood and an Aldi supermarket in Gosport) the total property

portfolio has grown from GBP66.75m to GBP79.55m. Their rental

income comfortably beats the cost of SAINTS' modest borrowings.

Investments and divestments

Two new equity holdings were added to the portfolio in the first

half of the year: Coloplast and Eurofins.

Coloplast is a Danish-listed leading manufacturer of ostomy,

incontinence, urology and wound care products, with significant

European and global market shares. Its product engineering

strengths in adhesives technology, combined with a mindset of

continuous innovation, have enabled the company to develop

profitable niche positions in markets with good prospects of

continued compounding in earnings and dividends.

French-listed Eurofins Scientific is a laboratory business

focused on a wide variety of testing related to food and the

environment. Structural growth drivers of its business include

expanding regulation and increased penetration of testing in

developing countries. What makes us particularly enthusiastic about

Eurofins is the distinctive vision of its founder, CEO and largest

shareholder, Gilles Martin, who is resolutely focused on the

long-term. Over the past three decades, the company has invested

relentlessly in an industry-leading, internally developed

technology platform and created a large global network of labs. We

expect the combination of these two factors to provide solid

foundations for growth and increasing returns on capital in the

next decade and beyond.

So far this year, we have divested from four equity holdings:

National Instruments, Silicon Motion, Linea Directa, and Cullen

Frost.

National Instruments is an American manufacturer of hardware and

software for lab researchers which has received a takeover bid at a

price of $53 per share. We believe that the offer price is

attractive and represents a healthy return on the fund's book cost,

so we sold our position.

Silicon Motion, likewise, received a takeover offer. As we had

received the final dividend and there was still uncertainty over

the Chinese regulators' willingness to approve the deal, we decided

to divest our position and put the capital to work in new

ideas.

We invested in Linea Directa, a Spanish motor insurance company,

only two years ago. However, the shares have proven to be highly

illiquid, which meant we struggled to make this into the size of

holding we envisaged. With no plan in sight to help improve

liquidity, we decided to divest the holding.

Following a string of runs at US regional banks earlier this

year, we decided that the risk facing Cullen Frost had turned

unfavourably asymmetric, and we divested the holding to preserve

capital.

ESG

We believe that investing sustainably is critical if we are to

achieve our long-term objectives of delivering a dependable income

and growing income and capital in real terms over the long term. In

addition to the regular monitoring of our holdings and scoring

potential new portfolio candidates using our Impact Ambition and

Trust framework, our ESG analyst delved deep into two particular

issues over the past few months: water management in Chile, and

palm oil.

The water management report was to help us assess our investment

in Albemarle, the world's largest lithium producer, and the

potential risks to its growth prospects from water management

around its operations in Chile. For a few weeks our analyst became

a hydrogeologist, talking to academics, experts and NGOs to try and

assess the impact of the company's practices in one of the world's

most arid regions. His conclusion was that whilst lithium mining

has some impact, the reduced water availability that has been

observed in Chile in the past few years is more likely to be a

function of the 13-year drought currently underway in the country,

combined with much-larger water consumption by copper mining and

agriculture. We will use this research to encourage Albemarle to

expand their efforts to reduce water use and expand the monitoring

of their impact on water in the area.

Palm oil, and the deforestation sometimes associated with its

production, is another important issue with potential implications

for our investments. Palm oil is in some ways a victim of its own

success, with a broadening range of uses leading to global

production rising fivefold over the past thirty years and making it

the most used vegetable oil in the world. Advocates of palm oil

point to the fact that it represents 36% of food oil globally but

takes up less than 9% of land dedicated to that food oil

production. Critics counter that not all land is created equal and

palm oil production often replaces tropical forest with high carbon

stock and richer biodiversity. Several of SAINTS' investments

including Procter & Gamble, L'Oréal and PepsiCo are significant

users of palm oil so we need to understand this particular

issue.

Our research has highlighted a few important points. Much

progress has been made in terms of sustainability certification and

many companies are now dedicating resources to ensure their palm

oil is grown sustainably. On the other hand, a large number of

small independent suppliers, combined with a lot of intermediary

processing steps, make traceability and transparency very

challenging, and a key area for companies to address. This has

helped us to have more informed discussions with our companies -

indeed we raised it with Procter & Gamble while visiting them

in Cincinnati last month - and this has helped us to establish a

set of measures and policies we expect our holdings to adopt, if

they have not already done so.

Outlook

After reflecting back on the occasion of SAINTS' 150th, we take

several lessons forward. One is the rewards from focusing on

long-term dividend growth rather than short-term dividend yield.

Another is the expansion of opportunities afforded by a global

portfolio. A third is the exceptional returns that outstanding

companies can generate for SAINTS shareholders.

This year, as every year, the gyrations of markets and economies

creates a great deal of uncertainty and speculation. But for the

long-term investor in great companies, faced with opportunities

such as Coloplast or Eurofins or indeed any of the investments

within SAINTS' portfolio, we see the potential for many years of

continued resilient income together with attractive growth in

capital.

We are proud to be managers of SAINTS, and the trust put in us

by the Board. We hope that in the decade ahead, as in the nearly

two-decades past, we can continue to earn that trust by delivering

attractive returns to SAINTS shareholders.

Baillie Gifford & Co

31 July 2023

See disclaimer at the end of this announcement.

Past performance is not a guide to future performance .

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of Financial Statements has been prepared

in accordance with FRS 104 'Interim Financial Reporting';

b) the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (indication of important events during the first six months,

their impact on the Financial Statements and a description of

principal risks and uncertainties for the remaining six months of

the year); and

c) the Interim Financial Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.8R (disclosure of related party transactions and changes

therein).

By order of the Board

Lord Macpherson of Earl's Court

Chairman

31 July 2023

Income Statement (unaudited)

For the six months ended For the six months ended For the year ended

30 June 2023 30 June 2022 31 December 2022 (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

Gains on sales of

investments -

securities - 17,939 17,939 - 1,586 1,586 - 12,200 12,200

Gains on sales of

investments - property - - - - 607 607 - 2,042 2,042

Changes in fair value

of investments -

securities - 38,544 38,544 - (105,210) (105,210) - (92,291) (92,291)

Changes in fair value

of investments -

property - (2,167) (2,167) - 1,543 1,543 - (7,156) (7,156)

Currency (losses)/gains - (39) (39) - 71 71 - 192 192

Income - dividends and

interest 14,493 - 14,493 14,486 - 14,486 25,488 - 25,488

Income - rent and other 2,348 - 2,348 2,412 - 2,412 4,555 - 4,555

Management fees (note

3) (514) (1,542) (2,056) (494) (1,481) (1,975) (980) (2,940) (3,920)

Other administrative

expenses (634) - (634) (574) - (574) (1,257) - (1,257)

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

Net return before

finance costs and

taxation 15,693 52,735 68,428 15,830 (102,884) (87,054) 27,806 (87,953) (60,147)

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

Finance costs of

borrowings (354) (1,061) (1,415) (565) (1,695) (2,260) (921) (2,763) (3,684)

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

Net return on ordinary

activities before

taxation 15,339 51,674 67,013 15,265 (104,579) (89,314) 26,885 (90,716) (63,831)

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

Tax on ordinary

activities (1,811) 506 (1,305) (1,562) 429 (1,133) (2,540) 790 (1,750)

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

Net return on ordinary

activities after

taxation 13,528 52,180 65,708 13,703 (104,150) (90,447) 24,345 (89,926) (65,581)

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

Net return per ordinary

share (note 4) 7.64p 29.46p 37.10p 7.78p (59.16p) (51.38p) 13.82p (51.04p) (37.22p)

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

Note:

Dividends paid and

payable per share

(note 5) 6.75p 6.65p 13.82p

======================= ======== ======== ======== ======== ========= ========= ========= ========== ========

The accompanying notes below are an integral part of the

Financial Statements.

The total column of this statement is the profit and loss

account of the Company. The supplementary revenue and capital

columns are prepared under guidance published by the Association of

Investment Companies.

All revenue and capital items in the above statements derive

from continuing operations.

A Statement of Comprehensive Income is not required as all gains

and losses of the Company have been reflected in the above

statement.

Balance Sheet (unaudited)

At 31 December

At 30 June 2022

2023 (audited)

GBP'000 GBP'000

---------------------------------------------- ----------- --------------

Non-current assets

Investments - securities 919,024 869,837

Investments - property 79,550 66,750

---------------------------------------------- ----------- --------------

998,574 936,587

---------------------------------------------- ----------- --------------

Current assets

Debtors 3,886 3,213

Cash and deposits 2,682 4,184

---------------------------------------------- ----------- --------------

6,568 7,397

---------------------------------------------- ----------- --------------

Creditors

Amounts falling due within one year:

Other creditors and accruals (2,654) (2,596)

---------------------------------------------- ----------- --------------

Net current assets 3,914 4,801

---------------------------------------------- ----------- --------------

Total assets less current liabilities 1,002,488 941,388

---------------------------------------------- ----------- --------------

Creditors

Amounts falling due after more than one year:

Loan notes (note 7) (94,721) (94,714)

---------------------------------------------- ----------- --------------

Net assets 907,767 846,674

---------------------------------------------- ----------- --------------

Capital and reserves

Share capital 44,551 44,188

Share premium account 185,559 178,189

Capital redemption reserve 22,781 22,781

Capital reserve 635,994 583,814

Revenue reserve 18,882 17,702

---------------------------------------------- ----------- --------------

Shareholders' funds 907,767 846,674

---------------------------------------------- ----------- --------------

Net asset value per ordinary share * 509.4p 479.0p

---------------------------------------------- ----------- --------------

Ordinary shares in issue (note 8) 178,205,943 176,750,943

---------------------------------------------- ----------- --------------

* See Glossary of Terms and Alternative Performance Measures at

the end of this announcement.

The accompanying notes below are an integral part of the

Financial Statements.

Statement of Changes in Equity (unaudited)

For the six months ended 30 June 2023

Share Capital Capital

premium redemption reserve Revenue Shareholders'

Share capital account reserve * reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================================== =============== ======== =========== ========= ========= ===============

Shareholders' funds at 1 January

2023 44,188 178,189 22,781 583,814 17,702 846,674

Shares issued 363 7,370 - - - 7,733

Net return on ordinary activities

after taxation - - - 52,180 13,528 65,708

Dividends paid (note 5) - - - - (12,348) (12,348)

================================== =============== ======== =========== ========= ========= ===============

Shareholders' funds at 30 June

2023 44,551 185,559 22,781 635,994 18,882 907,767

================================== =============== ======== =========== ========= ========= ===============

For the six months ended 30 June 2022

Share Capital Capital

premium redemption reserve Revenue Shareholders'

Share capital account reserve * reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================================== =============== ======== =========== ========= ========= ===============

Shareholders' funds at 1 January

2022 43,900 172,576 22,781 673,740 17,188 930,185

Shares issued 175 3,434 - - - 3,609

Net return on ordinary activities

after taxation - - - (104,150) 13,703 (90,447)

Dividends paid (note 5) - - - - (11,666) (11,666)

================================== =============== ======== =========== ========= ========= ===============

Shareholders' funds at 30 June

2022 44,075 176,010 22,781 569,590 19,225 831,681

================================== =============== ======== =========== ========= ========= ===============

* The Capital Reserve balance at 30 June 2023 includes

investment holding gains of GBP317,109,000 (30 June 2022 - gains of

GBP276,512,000).

The accompanying notes below are an integral part of the

Financial Statements.

Cash Flow Statement (unaudited)

Six months Six months

to to

30 June 30 June

2023 2022

GBP'000 GBP'000

-------------------------------------------------- ---------- ----------

Cash flows from operating activities

Net return on ordinary activities before taxation 67,013 (89,314)

Net (gains)/losses on investments - securities (56,483) 103,624

Net losses/(gains) on investments - property 2,167 (2,150)

Currency losses/(gains) 39 (71)

Finance costs of borrowings 1,415 2,260

Overseas withholding tax (1,291) (1,140)

Changes in debtors (687) (130)

Changes in creditors 73 571

Other non-cash changes 80 120

-------------------------------------------------- ---------- ----------

Cash from operations 12,326 13,770

Interest paid (1,422) (3,368)

-------------------------------------------------- ---------- ----------

Net cash inflow from operating activities 10,904 10,402

-------------------------------------------------- ---------- ----------

Cash flows from investing activities

Acquisitions of investments - securities (68,321) (38,252)

Acquisitions of investments - property (14,967) (8,239)

Disposals of investments - securities 75,535 36,174

Disposals of investments - property - 3,589

-------------------------------------------------- ---------- ----------

Net cash outflow from investing activities (7,753) (6,728)

-------------------------------------------------- ---------- ----------

Cash flows from financing activities

Equity dividends paid (12,348) (11,666)

Shares issued 7,734 3,609

Loan notes drawn down - 80,000

Debenture stock repaid - (80,000)

Costs of issuance of debt - (16)

-------------------------------------------------- ---------- ----------

Net cash outflow from financing activities (4,614) (8,073)

-------------------------------------------------- ---------- ----------

Decrease in cash and cash equivalents (1,463) (4,399)

Exchange movements (39) 71

Cash and cash equivalents at start of period * 4,184 11,263

-------------------------------------------------- ---------- ----------

Cash and cash equivalents at end of period * 2,682 6,935

-------------------------------------------------- ---------- ----------

* Cash and cash equivalents represent cash at bank and short

term money market deposits repayable on demand.

The accompanying notes below are an integral part of the

Financial Statements.

Performance Attribution for the Six Months to 30 June 2023

(unaudited)

Average allocation Average allocation Total return Total return

SAINTS Benchmark SAINTS Benchmark

Portfolio breakdown % % % %

========================= ======================= ===================== ===================== ============

Global Equities 94.5 100.0 8.5 7.9

Infrastructure Equities 2.8 (0.8)

Bonds 4.5 4.5

Direct Property 8.1 0.2

Deposits 0.7 -

Borrowings at book value (10.6) 1.5

========================= ======================= ===================== ===================== ============

Portfolio Total Return (borrowings at book value) 7.9

Other items * (0.1)

========================================================================= ===================== ============

Fund Total Return (borrowings at book value) 7.8

============

Adjustment for change in fair value of borrowings -

========================================================================= ===================== ============

Fund Total Return (borrowings at fair value) 7.8

========================================================================= ===================== ============

The above returns are calculated on a total returns basis with

net income reinvested.

Source: Baillie Gifford and relevant underlying index

providers.

* Includes Baillie Gifford and OLIM management fees.

See disclaimer at the end of this announcement.

Past performance is not a guide to future performance .

Twenty Largest Equity Holdings at 30 June 2023 (unaudited)

Value % of total

Name Business GBP'000 assets *

=================================== ====================================== ======== ==========

Novo Nordisk Pharmaceutical company 36,801 3.7

Distributes air conditioning, heating

Watsco and refrigeration equipment 34,254 3.4

Microsoft Computer software 34,063 3.4

Distribution and sales of industrial

Fastenal supplies 29,800 3.0

Procter & Gamble Household product manufacturer 27,738 2.8

Taiwan Semiconductor Manufacturing Semiconductor manufacturer 26,589 2.7

Apple Consumer technology 25,509 2.5

Pepsico Snack and beverage company 25,383 2.5

United Parcel Service Courier services 24,616 2.5

Sonic Healthcare Laboratory testing 22,501 2.2

Analog Devices Integrated circuits 22,433 2.2

Roche Pharmaceuticals and diagnostics 21,973 2.2

Atlas Copco Engineering 21,836 2.2

Deutsche Boerse Securities exchange owner/operator 21,172 2.1

Schneider Electric Electrical power products 20,854 2.1

Coca Cola Beverage company 18,608 1.8

Experian Credit scoring and marketing services 18,294 1.8

Nestlé Food producer 17,802 1.8

Edenred Voucher programme outsourcer 17,665 1.8

Information services and solutions

Wolters Kluwer provider 17,255 1.7

=================================== ====================================== ======== ==========

485,146 48.4

=========================================================================== ======== ==========

* Before deduction of borrowings.

Notes to the Condensed Financial Statements (unaudited)

1 The condensed Financial Statements for the six months to 30

June 2023 comprise the statements set out above together with the

related notes below. They have been prepared in accordance with FRS

104 'Interim Financial Reporting' and the AIC's Statement of

Recommended Practice issued in November 2014 and updated in July

2022 with consequential amendments and have not been audited or

reviewed by the Auditor pursuant to the Auditing Practices Board

Guidance 'Review of Interim Financial Information'. The Financial

Statements for the six months to 30 June 2023 have been prepared on

the basis of the same accounting policies as set out in the

Company's Annual Report and Financial Statements at 31 December

2022.

Going Concern

The Directors have considered the nature of the Company's

principal risks and uncertainties, as set out on the inside front

cover, together with its current position. The Board has, in

particular, considered macroeconomic and geopolitical concerns,

including the Russia-Ukraine conflict, increased inflation and

interest rates but does not believe the Company's going concern

status is affected. In addition, the Company's investment objective

and policy, its assets and liabilities and projected income and

expenditure, together with the Company's dividend policy, have been

taken into consideration and it is the Directors' opinion that the

Company has adequate resources to continue in operational existence

for the foreseeable future. The Company's assets, the majority of

which are investments in quoted securities which are readily

realisable, exceed its liabilities significantly. All borrowings

require the prior approval of the Board. Gearing levels and

compliance with borrowing covenants are reviewed by the Board on a

regular basis. The Company has no short term borrowings. The

redemption dates for the Company's loan notes are June 2036, April

2045 and April 2049. Accordingly, the Directors consider it

appropriate to adopt the going concern basis of accounting in

preparing these Financial Statements and confirm that they are not

aware of any material uncertainties which may affect the Company's

ability to continue to do so over a period of at least twelve

months from the date of approval of these Financial Statements.

2 The financial information contained within this Interim

Financial Report does not constitute statutory accounts as defined

in sections 434 to 436 of the Companies Act 2006. The financial

information for the year ended 31 December 2022 has been extracted

from the statutory accounts which have been filed with the

Registrar of Companies. The Auditor's Report on those accounts was

not qualified, and did not contain statements under sections 498(2)

or (3) of the Companies Act 2006.

3 Baillie Gifford & Co Limited, a wholly owned subsidiary of

Baillie Gifford & Co, has been appointed by the Company as its

Alternative Investment Fund Manager (AIFM) and Company Secretary.

The investment management function has been delegated to Baillie

Gifford & Co. The management agreement can be terminated on six

months' notice. The annual management fee, calculated quarterly, is

0.45% on the first GBP500m of total assets and 0.35% on the

remaining total assets, where 'total assets' is defined as the

total value of the assets held, excluding the value of the property

portfolio, less all liabilities (other than any liability in the

form of debt intended for investment purposes).

As AIFM, Baillie Gifford & Co Limited has delegated the

management of the property portfolio to OLIM Property Limited. OLIM

receives an annual fee from SAINTS of 0.5% of the value of the

property portfolio, subject to a minimum quarterly fee of GBP6,250.

The agreement can be terminated on three months' notice.

4 Net Return per Ordinary Share

Six months Six months

to 30 June to 30 June

2023 2022

GBP'000 GBP'000

===================================================== ================ ================

Revenue return on ordinary activities after taxation 13,528 13,703

Capital return on ordinary activities after taxation 52,180 (104,150)

===================================================== ================ ================

Total net return 65,708 (90,447)

===================================================== ================ ================

Weighted average number of ordinary shares in issue 177,095,723 176,051,800

===================================================== ================ ================

5 Dividends

Six months Six months

to 30 June to 30 June

2023 2022

GBP'000 GBP'000

===================================================== ================ ================

Amounts recognised as distributions in the period:

Previous year's final of 3.67p (2022 - 3.375p), paid

13 April 2023 6,487 5,937

First interim of 3.30p (2022 - 3.25p), paid 22 June

2023 5,861 5,730

===================================================== ================ ================

12,348 11,667

===================================================== ================ ================

Amounts paid and payable in respect of the period:

First interim of 3.30p (2022 - 3.25p), paid 22 June

2023 5,861 5,730

Second interim of 3.45p (2022 - 3.40p) 6,148 5,994

===================================================== ================ ================

12,009 11,724

===================================================== ================ ================

The second interim dividend was declared after the period end

date and therefore has not been included as a liability in the

Balance Sheet.

It is payable on 20 September 2023 to shareholders on the

register at the close of business on 11 August 2023. The

ex-dividend date is 10 August 2023. The Company's Registrar offers

a Dividend Reinvestment Plan and the final date for elections for

this dividend is 30 August 2023.

6 Fair Value Hierarchy

The fair value hierarchy used to analyse the basis on which the

fair values of financial instruments held at fair value through the

profit or loss account are measured is described below. Fair value

measurements are categorised on the basis of the lowest level input

that is significant to the fair value measurement.

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

An analysis of the Company's financial asset investments based

on the fair value hierarchy described above is shown below.

As at 30 June 2023 Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

================================== ======== ======== ======== ================

Securities

Listed equities 880,897 - - 880,897

Bonds - 38,127 - 38,127

Property

Freehold - - 79,550 79,550

================================== ======== ======== ======== ================

Total financial asset investments 880,897 38,127 79,550 998,574

================================== ======== ======== ======== ================

As at 31 December 2022 Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

================================== ======== ======== ======== ================

Securities

Listed equities 826,397 - - 826,397

Bonds - 43,440 - 43,440

Property

Freehold - - 66,750 66,750

================================== ======== ======== ======== ================

Total financial asset investments 826,397 43,440 66,750 936,587

================================== ======== ======== ======== ================

There have been no transfers between levels of the fair value

hierarchy during the period. The fair value of listed investments

is bid value or, in the case of holdings on certain recognised

overseas exchanges, last traded price. They are categorised as

Level 1 if they are valued using unadjusted quoted prices for

identical instruments in an active market and Level 2 if they do

not meet all these criteria but are, nonetheless, valued using

market data. The fair value of unlisted investments is determined

using valuation techniques, determined by the Directors, based upon

observable and/or non-observable data such as latest dealing

prices, stockbroker valuations, net asset values and other

information, as appropriate. The Company's holdings in unlisted

investments are categorised as Level 3 as the valuation techniques

applied include the use of non-observable data.

7 At 30 June 2023, the book value of the borrowings was

GBP94,721,000 (31 December 2022 - GBP94,714,000) and the fair value

was GBP62,760,000 (31 December 2022 - GBP65,549,000). The debt

comprises long-term private placement loan notes: GBP15 million

with a coupon of 2.23% issued during 2021 and GBP80 million with a

coupon of 3.12% issued to refinance the 8% Debenture Stock which

matured on 10 April 2022.

8 At 30 June 2023, the Company had the authority to buy back

26,494,966 ordinary shares and to issue 16,220,094 ordinary shares

without application of pre-emption rights in accordance with the

authorities granted at the AGM in April 2023. During the six months

to 30 June 2023, 1,455,000 (31 December 2022 - 1,150,000) shares

were issued at a premium to net asset value raising proceeds of

GBP7,733,000 (31 December 2022 - GBP5,901,000). No shares were

bought back (31 December 2022 - nil).

9 Related Party Transactions

There have been no transactions with related parties during the

first six months of the current financial year that have materially

affected the financial position or the performance of the Company

during that period and there have been no changes in the related

party transactions described in the last Annual Report and

Financial Statements that could have had such an effect on the

Company during that period.

10 The Interim Financial Report will be available on the SAINTS

page of the Managers' website: saints-it.com ++ on or around 15

August 2023.

Principal Risks and Uncertainties

The principal risks facing the Company are financial risk,

investment strategy risk, climate and governance risk, regulatory

risk, custody and depositary risk, operational risk, discount risk,

leverage risk, political risk, cyber security risk and emerging

risks. An explanation of these risks and how they are managed is

set out on pages 8 to 10 of the Company's Annual Report and

Financial Statements for the year to 31 December 2022 which is

available on the Company's website: saints-it.com.

The principal risks and uncertainties have not changed since the

date of that report.

Glossary of Terms and Alternative Performance Measures (APM)

Total Assets

Total assets less current liabilities, before deduction of all

borrowings.

Net Asset Value

Net Asset Value (NAV) is the value of total assets less

liabilities (including borrowings). The NAV per share is calculated

by dividing this amount by the number of ordinary shares in

issue.

Net Asset Value (Borrowings at Book Value)

Borrowings are valued at adjusted net issue proceeds. Book value

approximates amortised cost.

Net Asset Value (Borrowings at Fair Value) (APM)

Borrowings are valued at an estimate of their market worth.

30 June 31 December

2023 2022

=============================================== =============== ===============

Shareholders' funds (borrowings at book value) GBP907,767,000 GBP846,674,000

Add: book value of borrowings GBP94,721,000 GBP94,714,000

Less: fair value of borrowings (GBP62,760,000) (GBP65,549,000)

=============================================== =============== ===============

Shareholders' funds (borrowings at fair value) GBP939,728,000 GBP875,839,000

=============================================== =============== ===============

Shares in issue 178,205,943 176,750,943

=============================================== =============== ===============

Net Asset Value per ordinary share (borrowings

at fair value) 527.3p 495.5p

=============================================== =============== ===============

Discount/Premium (APM)

As stockmarkets and share prices vary, an investment trust's

share price is rarely the same as its NAV. When the share price is

lower than the NAV per share it is said to be trading at a

discount. The size of the discount is calculated by subtracting the

share price from the NAV per share and is usually expressed as a

percentage of the NAV per share. If the share price is higher than

the NAV per share, this situation is called a premium .

30 June 30 June 31 December 31 December

2023 2023 2022 2022

NAV (book) NAV (fair) NAV (book) NAV (fair)

Closing NAV per share 509.4p 527.3p 479.0p 495.5p

Closing share price 522.0p 522.0p 508.0p 508.0p

====================== =========== =========== =========== ===========

Premium/(discount) 2.5% (1.0%) 6.1% 2.5%

====================== =========== =========== =========== ===========

Total Return (APM)

The total return is the return to shareholders after reinvesting

the net dividend on the date that the share price goes

ex-dividend.

30 June 30 June 30 June 31 December 31 December 31 December

2023 2023 2023 2022 2022 2022

NAV (book) NAV (fair) share price NAV (book) NAV (fair) share price

Opening NAV per

share/share price (a) 479.0p 495.5p 508.0p 529.7p 528.4p 541.0p

Closing NAV per

share/share price (b) 509.4p 527.3p 522.0p 479.0p 495.5p 508.0p

Dividend adjustment

factor * (c) 1.013742 1.012896 1.013027 1.027330 1.026941 1.027687

Adjusted closing

NAV per share/share

price (d = b x c) 516.4p 534.1p 528.8p 492.1p 508.8p 522.1p

===================== =============== =========== =========== ============ =========== =========== ============

Total return (d ÷ a)-1 7.8% 7.8% 4.1% (7.1%) (3.7%) (3.5%)

===================== =============== =========== =========== ============ =========== =========== ============

* The dividend adjustment factor is calculated on the assumption

that the dividends paid out by the Company are reinvested into the

shares of the Company at the cum income NAV/share price, as

appropriate, at the ex-dividend date.

Ongoing Charges (APM)

The total expenses (excluding borrowing costs) incurred by the

Company as a percentage of the average net asset value (with

borrowings at fair value). The ongoing charges have been calculated

on the basis prescribed by the Association of Investment

Companies.

Performance Attribution (APM)

Analysis of how the Company achieved its performance relative to

its benchmark.

Gearing (APM)

At its simplest, gearing is borrowing. Just like any other

public company, an investment trust can borrow money to invest in

additional investments for its portfolio. The effect of the

borrowing on the shareholders' assets is called 'gearing'. If the

Company's assets grow, the shareholders' assets grow

proportionately more because the debt remains the same. But if the

value of the Company's assets falls, the situation is reversed.

Gearing can therefore enhance performance in rising markets but can

adversely impact performance in falling markets.

Gearing represents borrowings at book less cash and cash

equivalents expressed as a percentage of shareholders' funds.

Potential gearing is the Company's borrowings expressed as a

percentage of shareholders' funds.

Equity gearing is the Company's borrowings adjusted for cash,

bonds and property expressed as a percentage of shareholders' funds

.

Leverage (APM)

For the purposes of the Alternative Investment Fund Managers

(AIFM) Directive, leverage is any method which increases the

Company's exposure, including the borrowing of cash and the use of

derivatives. It is expressed as a ratio between the Company's

exposure and its net asset value and can be calculated on a gross

and a commitment method. Under the gross method, exposure

represents the sum of the Company's positions after the deduction

of sterling cash balances, without taking into account any hedging

and netting arrangements. Under the commitment method, exposure is

calculated without the deduction of sterling cash balances and

after certain hedging and netting positions are offset against each

other.

Active Share (APM)

Active share, a measure of how actively a portfolio is managed,

is the percentage of the listed equity portfolio that differs from

its comparative index. It is calculated by deducting from 100 the

percentage of the portfolio that overlaps with the comparative

index. An active share of 100 indicates no overlap with the index

and an active share of zero indicates a portfolio that tracks the

index.

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

SAINTS' objective is to deliver real dividend growth by

increasing capital and growing income. Its policy is to invest

mainly in equity markets, but other investments may be held from

time to time including bonds, property and other asset classes.

Baillie Gifford & Co Limited, a wholly owned subsidiary of

Baillie Gifford & Co, is appointed as investment managers and

secretaries to SAINTS. Baillie Gifford & Co, the Edinburgh

based fund management group has around GBP235 billion under

management and advice as at 31 July 2023.

Past performance is not a guide to future performance. SAINTS is

a listed UK company. As a result, the value of its shares and any

income from those shares is not guaranteed and could go down as

well as up. You may not get back the amount you invested. As SAINTS

invests in overseas securities, changes in the rates of exchange

may also cause the value of your investment (and any income it may

pay) to go down or up. You can find up to date performance

information about SAINTS on the SAINTS page of the Managers'

website saints-it.com . Neither the contents of the Company's

website nor the contents of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this announcement.

For further information please contact:

James Budden, Baillie Gifford & Co

Tel: 0131 275 2000

Jonathan Atkins, Four Communications

Tel: 0203 920 0555 or 07872 495396

Third Party Data Provider Disclaimer

No third party data provider ('Provider') makes any warranty,

express or implied, as to the accuracy, completeness or timeliness

of the data contained herewith nor as to the results to be obtained

by recipients of the data. No Provider shall in any way be liable

to any recipient of the data for any inaccuracies, errors or

omissions in the index data included in this document, regardless

of cause, or for any damages (whether direct or indirect) resulting

therefrom.

No Provider has any obligation to update, modify or amend the

data or to otherwise notify a recipient thereof in the event that

any matter stated herein changes or subsequently becomes

inaccurate.

Without limiting the foregoing, no Provider shall have any

liability whatsoever to you, whether in contract (including under

an indemnity), in tort (including negligence), under a warranty,

under statute or otherwise, in respect of any loss or damage

suffered by you as a result of or in connection with any opinions,

recommendations, forecasts, judgements, or any other conclusions,

or any course of action determined, by you or any third party,

whether or not based on the content, information or materials

contained herein.

Sustainable Finance Disclosure Regulation ('SFDR')

Sustainable Finance Disclosure Regulation ('SFDR')

The EU Sustainable Finance Disclosure Regulation ('SFDR') does

not have a direct impact in the UK due to Brexit, however, it

applies to third-country products marketed in the EU. As The

Scottish American Investment Company P.L.C. is marketed in the EU

by the AIFM, BG & Co Limited, via the National Private

Placement Regime (NPPR) the following disclosures have been

provided to comply with the high-level requirements of SFDR.

The AIFM has adopted Baillie Gifford & Co's Governance and

Sustainable Principles and Guidelines as its policy on integration

of sustainability risks in investment decisions.

Baillie Gifford & Co's approach to investment is based on

identifying and holding high quality growth businesses that enjoy

sustainable competitive advantages in their marketplace. To do this

it looks beyond current financial performance, undertaking

proprietary research to build an in-depth knowledge of an

individual company and a view on its long-term prospects. This

includes the consideration of sustainability factors

(environmental, social and/or governance matters) which it believes

will positively or negatively influence the financial returns of an

investment.

More detail on the Managers' approach to sustainability can be

found in the Governance and Sustainability Principles and

Guidelines document, available publicly on the Baillie Gifford

website (bailliegifford.com).

Taxonomy Regulation

The Taxonomy Regulation establishes an EU-wide framework of

criteria for environmentally sustainable economic activities in

respect of six environmental objectives. It builds on the

disclosure requirements under SFDR by introducing additional

disclosure obligations in respect of Alternative Investment Funds

that invest in an economic activity that contributes to an

environmental objective. The Company does not commit to make

sustainable investments as defined under SFDR. As such, the

underlying investments do not take into account the EU criteria for

environmentally sustainable economic activities.

- ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKDBKABKDFON

(END) Dow Jones Newswires

August 01, 2023 02:00 ET (06:00 GMT)

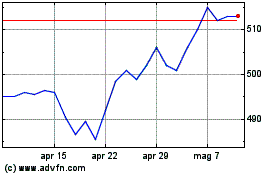

Grafico Azioni Scottish American Invest... (LSE:SAIN)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Scottish American Invest... (LSE:SAIN)

Storico

Da Nov 2023 a Nov 2024