TIDMSEED

RNS Number : 3630U

Seed Innovations Limited

22 November 2023

Seed Innovations Ltd / AIM: SEED / Sector: Closed End

Investments

22 November 2023

SEED Innovations Limited ("SEED" or the "Company")

Interim Results

SEED Innovations Ltd, the AIM quoted company providing

shareholders with exposure to early-stage health, wellness, and

medical cannabis companies to which, in normal circumstances, they

have limited access to, is pleased to announce its interim results

for the six months ended 30 September 2023.

A copy of this announcement and the Interim Results will be

available on the Company's website : www.seedinnovations.co .

HIGHLIGHTS

-- Divestment of holding in Leap Gaming for EUR5.8 million

payable in two tranches. The first tranche of EUR3 million (GBP2.7

million) was received on completion of the deal with the balance

due in April 2024.

-- Partial sale in Avextra AG ("Avextra"), a German based,

European vertically integrated medical cannabis company, generated

gross proceeds of GBP2.45 million (EUR2.9 million), a 62% (1.6x)

return on SEED's original investment in 2021 and 2023.

-- SEED remains a supportive shareholder in Avextra with 2,242

units representing approximately 3% of Avextra on a fully diluted

basis.

-- The net asset value of the Company at 30 September 2023 was

GBP14,611,908 equal to net assets of 6.87 pence per Ordinary Share

- approximately 2.75 times the current share price.

-- On 19 September 2023, the Company announced its intention to

buy back a maximum of 21,500,000 of its own shares in a bid to

increase net asset value and liquidity in its shares.

-- Strong cash and cash receivables of GBP7.1 million as at 30

September 2023 - making it well position to capitalise on

investment opportunities.

The Company remains well positioned to benefit from the

long-term potential of the medical cannabis industry, and other

emerging growth markets, despite recent worldwide geopolitical and

economic events.

Commenting on the interim results, CEO, Ed McDermott said:

"The Company's share price has faced a challenging period amid

persistent unfavourable macro conditions. Despite this,

operationally, we have continued to demonstrate our ability to

identify, invest and generate liquidity events. A testament to this

was our recent partial exit from Avextra at a 1.6x return on SEED's

original investment. The Leap sale, and partial sale of Avextra

have contributed to our strong cash position of GBP7.1 million,

which remains higher than our market capitalisation. Our invested

NAV also in isolation is higher than our market capitalisation.

"We believe we are significantly undervalued and that the

Company's shares, currently trading at approximately a 64% discount

to net asset value, represent an attractive investment opportunity.

To this end, and to increase liquidity and return value to

shareholders, we have, as announced and underway, decided to

buy-back up to 21,500,000 of our own shares. Alongside, we have

also committed to increasing our visibility and accessibility to

investors, via several interactive investor events, which we hope

will increase the understanding of SEED and highlight its potential

to increase shareholder value."

For further information on the Company please visit: www.seedinnovations.com or contact:

Ed McDermott SEED Innovations E: info@seedinnovations.co

Lance de Jersey Ltd

James Biddle Beaumont Cornish T: (0)20 7628 3396

Roland Cornish Limited,

Nomad

----------------------- -------------------------------

Isabella Pierre Shard Capital Partners T: (0)20 7186 9927

Damon Heath LLP

Broker

----------------------- -------------------------------

Ana Ribeiro St Brides Partners E: seed@stbridespartners.co.uk

Isabelle Morris Ltd,

Financial PR

----------------------- -------------------------------

CHAIRMAN'S STATEMENT

FOR THE PERIODED 30 SEPTEMBER 2023

There have been several positive developments for SEED

Innovations during this reporting period. Perhaps the most

significant is the Company's divestment of holdings in two investee

companies at premiums to our original investment, resulting in a

strong current cash balance of GBP2.19 million at 30 September 2023

and over GBP4.3 million at the time of publishing these interim

reports. This puts the Company in the enviable position of having

significant levels of cash to deploy in investments that the board

feel have the potential of increasing shareholder value. That said,

the macro-economic instability continues to play a major role in

stock market volatility and whilst we are seeing some signs of a

more positive sentiment, we have some way to go before we see

stable investor activity, particularly in small caps.

In April we received the first tranche of the Leap Gaming sale

proceeds, with the balance due in April 2024. In September, we went

on to sell just over half of our holding in Avextra AG at a premium

of 62% (1.6x) return on SEED's original investment in 2021 and

2022, which yielded EUR2.9 million (GBP2.45 million). With cash and

receivables at period end of GBP7.1 million, we are in investment

mode and have strong potential deal flow. While there are many

challenges in early stage investing in depressed markets such as

these, there are also opportunities. I remain convinced that our

board's extensive experience and access to these opportunities have

the potential to create further value.

Despite a recent, and frustrating, contraction in our share

price, I was encouraged to see the price rise to around 4.15p in

late September on the back of positive news. Investors can see the

Company is undervalued, with its market capitalisation below the

combined total of cash and future contracted receivables, let alone

Net Asset Value ("NAV"). While the stock price remains volatile, I

am hopeful that this will stabilise, along with the markets, and

consistently improve. This should be helped with the continuation

of a share buy-back programme launched on 2 October, the aim of

which is to provide liquidity for those investors wishing to exit

their investment, as well as reducing the number of shares in issue

and so increasing the NAV per share for those shareholders who

remain with us.

Broader fundraising challenges and limited liquidity across the

UK market have exerted significant pressure on our own stock price

but by extension, have cast a shadow over the endeavours of a few

of our portfolio companies, most recently Northern Leaf and OTO.

These tough circumstances have, regrettably, negatively impacted

the carrying value of these investments, leading to necessary

write-downs. We remain vigilant in navigating these complexities,

and while these adjustments are reflective of the current broader

economic climate, we are committed to steering our investments

toward sustainable growth and resilience in the face of such market

turbulence.

I'd like to thank our shareholders, many of whom, like me, have

been on this journey for many years. It is gratifying that we have

been able to report new significant entrants to our share register

as well as others who have increased their holdings. We continue to

work to improve communication with our shareholders and potential

investors through broadening the use of social media as well as

streaming our shareholder meetings, and I look forward to welcoming

shareholders to our first London investor event later this

month.

With ever increasing access to potentially interesting

investments, we are confident that the coming months will present

SEED with multiple opportunities, offering avenues for growth and

attractive investment prospects. The evolving landscape holds the

promise of cultivating long-term value, and we are committed to

capitalising on these opportunities to ensure our continued

success.

Ian Burns

Chairman

22 November 2023

REPORT OF THE CHIEF EXECUTIVE OFFICER

FOR THE PERIODED 30 SEPTEMBER 2023

The interim period under review continued to be one with a

number of headwinds including much stock market volatility, and

macro- economic factors remain a significant challenge for SEED. We

are not isolated in this with the small cap sector in general

coming under immense pressure. That said, the last six months has

seen a number of developments for us, with SEED's financial

position strengthen significantly following the sale of Leap Gaming

to IMG Arena US, LLC, and the realisation of a little over half of

our investment in Avextra.

In April, SEED received the first tranche of sale proceeds from

the sale of Leap, being EUR3 million (GBP2.7 million), the balance

being due in April 2024. Pleasingly we then realised half of our

investment in Avextra at a premium of 62% (1.6x) return on SEED's

original investment, yielding EUR2.9 million (GBP2.45 million),

repaying the majority of our initial investment and leaving most of

the balance of our holding as potential pure upside.

In other portfolio developments, I was delighted to see Clean

Food Group raise c.GBP2.3 million in August, in which we invested

GBP216,000. Their raise was supported by industrial food

specialists Doehler Group and Alianza Team along with AIM listed

Agronomics Limited.

As a result of an increased level of cash available, and a

strong potential deal flow, SEED remains confident that the current

environment will offer opportunities to invest and in turn, create

long-lasting value for investors. We are talking, and listening, to

our shareholders about how best to utilise the cash on hand

generated by the recent exits and options considered include the

buyback of shares, a special dividend, and the reinvestment into

new investments.

The strength of our balance sheet and the knowledge that we are

actively looking for investments has attracted a lot of investment

opportunities, through our own network and pleasingly beyond it.

However, quality is key and it is critical that, in a market where

valuations continue to fall, we ensure the deployment of funds at

the optimum time for our shareholders. I am confident that the

right investment(s) will present themselves and we are able to move

quickly on any favourably priced opportunities with the potential

for excellent long-term value. For that reason, the board have

concluded, at this time, to focus on new investment opportunities

and using a portion of the monies received so far to undertake a

share buy-back programme, the aim of which is to provide liquidity

for those investors wishing to exit their investment, as well as

reducing the number of shares in issue increasing the NAV per share

in the future. Whilst we haven't elected to pay a 'special

dividend' at this point, it is something that will remain under

consideration and may be an option when future cash receipts occur,

particularly after significant realisations of investments.

I am frustrated by our stock price which has been variable

during the period under review. Positive news flow has resulted in

buying of our shares at a price, that at points (for example in

late September), has been at a stark contrast to the general,

muted, market sentiment. That said, positive news is not always

translating into a strengthening share price so in the coming

months we will be looking at additional approaches to shareholder

engagement with the aim to enlarging our shareholder base and

increasing liquidity, as well as keeping SEED in the forefront of

the minds of investors trading stocks. Sadly, we cannot manufacture

news when there is none and are sometimes constrained by

restrictions imposed by our investee companies in terms of the

timing of announcements (particularly when we are "inside" in

relation to their own news and developments). At our Annual General

Meeting in September 2023, we spoke of our intention of holding an

in-person investor event over Winter 2023/24 and this is scheduled

for 29 November 2023. It will be an excellent opportunity for

shareholders to meet the board and some of our existing investee

companies.

I remain confident of SEED's future and with cash and cash

receivables at period end of GBP7.1 million, we are well placed to

deploy realised funds into new investments over the next year as

well as continuing with the recently commenced share buy-back

programme. We are seeking to increase shareholder engagement and

more general market engagement via new initiatives and look forward

to meeting more of our investors in person in due course.

Ed McDermott CEO

22 November 2023

INVESTMENT REPORT

The following brings a summary of the portfolio of investments

held by the Company, together with select updates on the underlying

investee companies, into a single report for ease of reference of

shareholders rather than spreading over the Chairman's and CEO

Reports as previously.

The net asset value of the Company at 30 September 2023 was

GBP14,611,908. (31 March 2023: GBP16,032,000), equal to net assets

of 6.87p per Ordinary Share (31 March 2023: 7.54p per Ordinary

Share).

The table below lists the Company's holdings at 30 September

2023, with comparatives as at 31 March 2023.

Prior results as at Interim results as at

31 March 2023 30 September 2023

-------------------- ----------------

Holding Valuation Holding Valuation % of Nav

Holding Category (GBP000's) (GBP000's)

-------------------- ---------------- --------------------- -------------- ------------ -------------- ----------

Juvenescence 128,205

Limited Biotech 128,205 shares 2,556 shares 2,595 17.8%

---------------- --------------------- -------------- ------------ -------------- ----------

Biotech/

Avextra AG Cannabis 5,142 shares 4,436 2,242 shares 1,940 13.3%

---------------- --------------------- -------------- ------------ -------------- ----------

Clean Food Group 7,161,336

Ltd ("CFG") Biotech 5,850,000 shares 965 shares 1,182 8.1%

---------------- --------------------- -------------- ------------ -------------- ----------

Little Green

Pharma Biotech/ 7,324,796

("LGP") Cannabis 7,324,796 shares 715 shares 636 4.4%

---------------- --------------------- -------------- ------------ -------------- ----------

Inveniam Capital 86,810

Partners, Fintech 86,810 shares 596 shares 605 4.1%

---------------- --------------------- -------------- ------------ -------------- ----------

Inc.

-------------- ------------ -------------- ----------

Biotech/ 1,236,331

Northern Leaf Ltd Cannabis 1,236,331 shares 960 shares 444 3.0%

---------------- --------------------- -------------- ------------ -------------- ----------

Portage Biotech 37,623

Inc. Biotech 37,623 shares 94 shares 65 0.4%

---------------- --------------------- -------------- ------------ -------------- ----------

OTO International CBD SWB shares 71,502

Ltd Wellness (excl loan) 423 shares 38 0.3%

---------------- --------------------- -------------- ------------ -------------- ----------

(South West Brands)

-------------- ------------ -------------- ----------

Leap Gaming Gaming Shares & Loan 5,106 Sold - 0.0%

---------------- --------------------- -------------- ------------ -------------- ----------

Total Investment

Value 15,851 7,505 51.4%

-------------- ------------ -------------- ----------

Cash and receivables,

net of payables

and accruals 181 7,107 48.6%

-------------- ------------ -------------- ----------

Net Asset Value 16,032 14,612

-------------- ------------ -------------- ----------

The movement in the portfolio value of negative GBP1.4 million

is attributable to the negative revaluations of Northern Leaf and

OTO (due to raising funds at discounted prices) and the further

decline in the market price of listed investments Little Green

Pharma and Portage. Gains have been seen in the valuation of

Avextra and due to favorable FX movements.

This report is separated by liquidity profile of the underlying

investments, from those liquid investments which could more easily

be realised to cash by virtue of their own public markets listings,

toward those longer term investments which are less liquid and so

likely to take a longer time and more planning and work to get to a

position for sale via a liquidity event or M&A activity.

LIQUID INVESTMENTS

Portage Biotech, Inc ('Portage')

NASDAQ listed Portage (Ticker: PRTG) is an emerging

biotechnology company developing an immunotherapy-focused pipeline

to treat a broad range of cancers. Its focus is to combine its own

technology with already proven immune-boosting PD1 agents and to

this end, Portage has a pipeline of products targeted for clinical

testing and a growing roster of notable partnerships.

Portage is valued at its trading price on the NASDAQ exchange.

Despite positive analysts targets, market price has continued to

remain depressed well below these levels and is unlikely to be

helped by additional fundraising by Portage at these prices. SEED's

holding is however, a residual balance left after prior profitable

sales of this stock. The holding is in no way material to SEEDs

position and will likely be exited in the future, albeit we are

loathe to realise a loss unnecessarily at this point.

Portage's activity within the period was steady, this

included;

-- The Portage team participated in a panel discussion at both

the Cantor Global Healthcare Conference, the BIO International

Conference, and the at the American Society of Clinical Oncology

(ASCO) Annual Meeting;

-- Portage entered into a clinical trial collaboration agreement

with Merck (known as MSD outside the US and Canada) to evaluate

Portage's next-generation adenosine antagonists in combination with

KEYTRUDA(R) (pembrolizumab), Merck's anti- PD-1 (programmed death

receptor-1) therapy, for patients with solid tumours;

-- In late June Portage announced that it had dosed the first

patient in its Phase 1a trial, ADPORT-601 (NCT04969315). The trial

is evaluating Portage's adenosine 2A receptor (A2AR) antagonist

candidate, PORT-6, in patients with solid tumours including

prostate cancer, and renal and non-small cell lung cancer;

-- It has updated interim data from the Phase 1 portion of the

trial evaluating its lead invariant natural killer T cell (iNKT)

engager, PORT-2 (IMM60), alone and in combination with KEYTRUDA(R)

(pembrolizumab) in patients with advanced melanoma and metastatic

non-small cell lung cancer (NSCLC) presented in a poster

presentation at the 2023 ASCO Annual Meeting.

PRE-LIQUIDITY INVESTMENTS

Being investee companies with a communicated intent to pursue a

liquidity event such as a market listing, or M&A transaction,

in the near to medium term.

Juvenescence Ltd ('Juvenescence')

Juvenescence is a life sciences company developing therapies and

consumer products to modify and support heathy aging focused on

improving and extending human lifespans. By utilising a coalition

of best scientists, physicians, and investors across its four

divisions, it aims to create cutting-edge therapies and products

that disrupt the thinking and behaviour around ageing. Juvenescence

has a broad portfolio of products in development and is driving

innovation amongst two divisions: JuvTherapeutics - Focused on

traditional prescription medicines to modify aging and prevent

diseases, and JuvLife- Consumer products that manage aging and help

increase health span.

Juvenescence has announced a move to a more conventional

"pharma" like development structure which it believes will position

it for a liquidity event in the future as development of its JuvRX

portfolio of pharma solutions progresses. It seems unlikely however

that such a liquidity event will be seen before 2025 at the

earliest.

Despite the sector-wide valuation challenges faced by many life

sciences companies Juvenescence has seen progress its JuvRx Core

Programs, including; Oral PAI-1 Inhibitor (MDI), GDF-15 and follow

on mAbs (BYOMass), Oral CD38 inhibitor (Napa), Oral Therapeutic,

Ketone Ester (Selah), Oral Plasmalogens (Pelagic) that all programs

that continue to progress and hit key milestones enroute to the

clinic.

Northern Leaf Ltd ('Northern Leaf')

Northern Leaf is focused on becoming a key player in the

European medical cannabis supply chain, having already built a

secure operational facility in Jersey. Northern Leaf is leading the

development of a new industry for the British Isles, using

state-of-the-art tracking systems and robust policies and

procedures to ensure the highest levels of quality from seed to

sale.

Significant milestones were reached by Northern Leaf despite

challenging market conditions, including several major

accreditations including the Good Manufacturing Practice (GMP)

accreditation by the UK's Medicines and Healthcare Products

Regulatory Agency for its flower product as an active

pharmaceutical ingredient as well as being accredited with the Good

Agricultural and Collecting Practice by Control Union Medical

Cannabis Standard (IMC- G.A.P) for its cultivation facility in

Jersey.

In our final results for March 2023, the Company reported the

conversion of its 2-year GBP600,000 Convertible Loan Note as part

of an equity raise of c.GBP3 million, resulting in SEED holding

1,236,331 preference shares in Northern Leaf, representing 2.2% of

the enlarged equity of Northern Leaf and with a carrying value of

GBP960,000 based upon the price of that raise and with Northern

Leaf targeting an IPO for later this year.

Unfortunately, poor public market conditions including one of

the hardest markets in memory for initial public offerings, have

worked against Northern Leaf's ambitions thus far and whilst work

on an IPO continues, if successful, it will likely be at a lower

price than that at of the last equity raise. As a result, we have

reduced our carrying valuation by a little over half to GBP443,000

to reflect either the risk of an IPO at a lower price or indeed of

a listing not progressing and the resultant pressures of raising

further private funding. This said SEED is encouraged by the drive

and determination of Northern Leaf's management to be successful in

this endeavour and wish them well in their continued work to secure

ongoing funding for the further development of the business as it

transitions into a revenue generating cannabis production

company.

LONGER TERM INVESTMENTS

Being typically early-stage investments and often in the value

creation phase of development, working toward initial sales and/or

profitability. Some positions may have been held for some years

already, with no communicated plans for a public market liquidity

event, nor publicised plans for a sale by M&A. Where progress

in development has been achieved or further upside within an

acceptable timeframe now seems unlikely, SEED may be working with

the investee company to identify a route to a liquidity event, or

may independently find a purchaser for just its own holding in the

investee company.

Clean Food Group Limited ('CFG')

CFG was co-founded by CEO Alex Neves and Co-Chairman (and SEED

CEO) Ed McDermott in 2021, with the goal of becoming the leading

independent UK cultivated food ingredients business. CFG is a

British based food Technology Company which aims to become the

leading independent UK cultivated food business. CFG is developing

a sustainable yeast technology that produces cultivated,

sustainable alternatives to palm oil and soy protein, two

ingredients in food and cosmetics with currently massive and still

growing demand and negative environmental impact. CFG has gathered

a knowledgeable board of directors and an experienced advisory team

which is familiar with biotechnology, life sciences and high-growth

industries.

Since the last reporting period, SEED has invested a further

GBP216,000 in CFG's latest funding round. This raised monies at the

same carrying price per share as was used to value the holding in

March 2023. Other investors and industrial food specialists are

supporting CFG including AIM listed Agronomics, Doehler Group and

Alianza Team. We are confident that the global food industry will

continue to look to invest in healthier and more sustainable food

choices for future generations and CFG will continue to prosper as

a result.

OTO International Limited ('OTO')

OTO is an omni-channel premium wellness brand, whose positioning

as the premium wellness brand of choice has enabled the business to

build three diversified and robust revenue streams (including

retail, spa and e-commerce) across multiple territories including

the UK, USA, Japan and Europe consisting of an exciting and

uniquely positioned portfolio of brands in fast growing consumer

sectors, with products perfectly positioned to take a market share

across beauty, female wellness, personal care and spa.

SEED received a shareholding in OTO of 71,502 shares (1.4% of

OTO) being payment in kind from the sale of South West Brands

('SWB', in which SEED was previously invested) to OTO in April

2023. Following their purchase of SWB, OTO has sadly experienced

some funding issues, resulting in a significant write-down of

carrying value to c.GBP38,000 now. SEED also continues to hold a

loan with SWB / OTO which is now reflected in "Receivables" in

these financial statements.

Inveniam Capital Partners ('Inveniam')

Inveniam is a private fintech company which built Inveniam.io, a

powerful technology platform that utilises big data, AI and

blockchain technology to provide surety of data and

high-functioning use of that data in a distributed data ecosystem.

Inveniam has built Inveniam.io, the data operating system for

delivering access, transparency, and trust in the value and

performance of private market assets.

SEED's investment in Inveniam came about following the failure

of legacy investment Factom and is non-core in relation to the

current investment strategy. As such, it is a position that we will

seek to exit when possible and to this end look forward to a future

improvement in the fortunes of US Tech investing and positive

developments at Inveniam.

Avextra AG (formally Eurox Group GmbH) ('Avextra')

Avextra is a German-based, vertically integrated medical

cannabis company focused on intensifying its investment in

pharmaceutical development internationally while maintaining the

highest European pharmaceutical quality standards to expand its

Avextra-branded pharmaceutical products.

Within the reporting period Avextra successfully exported EU-GMP

standardised cannabis extracts manufactured at its German facility

to its distribution partner in Italy, increasing Avextra's European

footprint and validating its extract focused business strategy.

SEED has been able to negotiate the exit of 56% of our position

in Avextra during the period, realizing EUR2.9 million in cash.

This represented an exit at slightly (2%) above our March 2023

carrying value per share. Given the total invested in Avextra

historically stood at EUR3.17 million, SEED has substantially

recovered our cost of investment thus far, leaving the majority of

the GBP1.94 million carrying value as potential profit to be

realized in the future.

The Board proposes to invest in companies to which, in normal

circumstances, individual investors may have limited access.

Investments sought will be in sectors which have, or have the

potential for, significant intellectual property, principally in

the wellness and life sciences sectors (including biotech,

longevity of life and pharmaceuticals) along with aligned

technology sectors (including artificial intelligence and digital

delivery). Equally the Board will consider investments in

established industries where the business is applying new

technologies and/or 'know-how' to enhance its offering or taking

established business models or products to new markets. In keeping

with its desire to provide its shareholders with access to

investments they may otherwise not be able to participate in, the

Board also intends to apply a portion of the portfolio to

opportunistic investments which may, by exception, fall outside the

above criteria but represent good potential for short term returns.

Such investments will be limited at 15% of the Company's NAV and

would typically be in fundraisings by listed companies or as part

of an IPO.

Initially the geographical focus will be North America and

Europe but investments may also be considered in other regions to

the extent that the Board considers that valuable opportunities

exist and positive returns can be achieved.

INVESTING POLICY

In selecting investment opportunities, the Board will focus on

businesses, assets and/or projects that are available at attractive

valuations and hold opportunities to unlock embedded value. In line

with the existing portfolio it is expected that investments will be

in SMEs with sub GBP100m valuations but with the potential for

significant growth. Where appropriate, the Board may seek to invest

in businesses where it may influence the business at a board level,

add its expertise to the management of the business, and utilise

its industry relationships and access to finance. The extent that

the Company will be a passive or active shareholder will depend on

the interest held and the maturity of the investee company.

The Company's interests in a proposed investment and/or

acquisition will range from minority positions to full ownership

and will comprise multiple investments. The proposed investments

may be in either quoted or unquoted companies; are likely to be

made by direct acquisitions or investments; and may be in

companies, partnerships, earn-in joint ventures, debt or other loan

structures, joint ventures or direct or indirect interests in

assets or businesses.

The Company will pursue a balanced portfolio of an even mixture

of early stage, pre-liquidity event and liquid investments which it

will aim to hold within the portfolio for 2-4 years, 6-24 months

and up to 12 months respectively. Whilst the target is to have the

portfolio split fairly evenly between the different stages of

liquidity there will be no set criteria for which the Company will

hold an investment and the proportion of the portfolio which will

be represented by each investment type.

There is no limit on the number of projects into which the

Company may invest. The Directors intend to mitigate risk by

appropriate due diligence and transaction analysis. The Board

considers that as investments are made, and new promising

investment opportunities arise, further funding of the Company may

also be required.

Where the Company builds a portfolio of related assets it is

possible that there may be cross holdings between such assets. The

Company does not currently intend to fund any investments with debt

or other borrowings but may do so if appropriate. Investments are

expected to be mainly in the form of equity, with debt potentially

being raised later to fund the development of such assets.

Investments in later stage assets are more likely to include an

element of debt to equity gearing. The Board may also offer new

Ordinary Shares by way of consideration as well as or in lieu of

cash, thereby helping to preserve the Company's cash for working

capital and as a reserve against unforeseen contingencies

including, for example, delays in collecting accounts receivable,

unexpected changes in the economic environment and operational

problems.

The Board will conduct initial due diligence appraisals of

potential businesses or projects and, where it believes that

further investigation is warranted, it intends to appoint

appropriately qualified persons to assist. The Board believes it

has a broad range of contacts through which it is likely to

identify various opportunities which may prove suitable.

The Board believes its expertise will enable it to determine

quickly which opportunities could be viable and so progress quickly

to formal due diligence. The Company will not have a separate

investment manager. The Board proposes to carry out a comprehensive

and thorough project review process in which all material aspects

of a potential project or business will be subject to rigorous due

diligence, as appropriate. Due to the nature of the sectors in

which the Company is focused it is unlikely that cash returns will

be made in the short to medium term on the majority of its

portfolio; rather the Company expects a focus on capital returns

over the medium to long term.

The Directors are responsible for preparing these unaudited

condensed half-yearly financial statements, which have not been

reviewed or audited by the Company's independent auditors, and are

required to:

-- prepare the unaudited half-yearly financial statements in

accordance with International Accounting Standard 34: Interim

Financial Reporting;

-- include a fair review of important events that have occurred

during the period, and their impact on the unaudited half-yearly

financial statements, together with a description of the principal

risks and uncertainties of the Company for the remaining six months

of the financial year as detailed in the Chairman's Statement;

and

-- include a fair review of related party transactions that have

taken place during the six-month period which have had a material

effect on the financial position or performance of the Company,

together with disclosure of any changes in related party

transactions from the last annual financial statements which have

had a material effect on the financial position of the Company in

the current period.

CONDENSED HALF-YEARLY STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 SEPTEMBER 2023

01 April 01 April 2022

2023 to to

30 September 30 September

2023 2022

(unaudited) (unaudited)

Notes GBP'000 GBP'000

Net realised gain / (loss) on disposal

of financial assets at fair value through

profit and loss 5 1,112 4

Net unrealised (loss)/gain on revaluation

of financial assets at fair value

through profit and loss 5 (2,148) (3,536)

Interest income on financial assets at

fair value through profit and loss - 41

Total investment (loss)/income (1,036) (3,491)

Other income

43 -

Bank Interest income Arrangement fee - 9

Total other income 43 9

Expenses

Directors' remuneration and expenses 12 (179) (173)

Recognition of Directors share based expense 12 - (16)

Legal and professional fees (85) (40)

Other Expenses (91) (80)

Administration fees Adviser and broker's

fees (20) (24)

(35) (46)

Total expenses (410) (379)

Net (loss)/profit before losses and gains

on foreign currency exchange (1,403) (3,861)

Net foreign currency exchange gains/(loss) (17) 72

Total comprehensive (loss)/gain for the

period (1,420) (3,789)

(Loss)/earnings per Ordinary share -

basic and diluted 7 (0.67p) (1.78p)

The Company has no recognised gains or losses other than those

included in the results above.

All the items in the above statement are derived from continuing

operations.

CONDENSED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2023

30 September 31 March

2023 2023

(unaudited)

Notes GBP'000 GBP'000

Non-current assets

Financial assets at fair value through

profit or loss 5 7,504 16,019

7,504 16,019

Current assets

Cash and cash equivalents Other

receivables 2,185 30

4,951 50

7,136 80

Total assets 14,640 16,099

Current liabilities

Payables and accruals (28) (67)

(28) (67)

Net assets 14,612 16,032

Financed by

Share capital 11 2,127 2,127

Other distributable reserve 12,485 13,905

14,612 16,032

Net assets per Ordinary share -

basic and diluted 10 6.87 7.54

CONDENSED HALF-YEARLY STATEMENT OF CHANGES IN EQUITY

AS AT 30 SEPTEMBER 2023

Employee Other

Share Capital share option distributable Total

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 31 March 2023 2,127 - 13,905 16,032

Total comprehensive income for the year - - (1,420) (1,420)

--------------- ------------- -------------- --------

Balance as at 30 September 2023 2,127 - 12,485 14,612

--------------- ------------- -------------- --------

Balance as at 31 March 2022 2,127 212 18,122 20,461

Total comprehensive loss for the year - - (3,788) (3,788)

Employee share scheme - value of employee

services - 16 - 16

--------------- ------------- -------------- --------

Balance as at 30 September 2022 2,127 228 14,334 16,689

--------------- ------------- -------------- --------

CONDENSED HALF-YEARLY STATEMENT OF CASHFLOWS

FOR THE PERIODED 30 SEPTEMBER 2023

01 April 2023 to 01 April 2022

to

30 September 2023 30 September 2022

(unaudited) (unaudited)

GBP'000 GBP'000

Notes

Cash flows from operating activities

Total comprehensive (loss)/income for

the year (1,420) (3,788)

Adjustments for:

Unrealised loss/(gain) on fair value adjustments

on financial assets at 2,148 3,536

FVTPL

Realised loss/(gain) on disposal of financial

assets at FVTPL (1,112) (4)

Foreign exchange movement 17 (72)

Directors' share based payment expense - 16

Finance income - (37)

Changes in working capital:

(Increase)/decrease in other receivables

and prepayments (4,901) 27

Decrease in other payables and accruals (39) (23)

Net cash outflow from operating activities (5,306) (345)

Cash flows from investing activities

Acquisition of financial assets at fair

value through profit or loss 5 (216) (439)

Disposal of financial assets at fair value

through profit or loss 5 7,695 150

Net cash inflow/(outflow) from investing

activities 7,479 (289)

(Decrease)/Increase in cash and cash

equivalents 2,172 (634)

Cash and cash equivalents brought forward 30 922

(Decrease)/Increase in cash and cash equivalents 2,172 - 634

Foreign exchange movement (17) 72

Cash and cash equivalents carried forward 2,185 360

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIODED 30 SEPTEMBER 2023

1. General Information

SEED Innovations Limited (the "Company") is an authorised

closed-ended investment scheme. The Company is domiciled and

incorporated as a limited liability company in Guernsey. The

registered office of the Company is PO Box 343, Obsidian House, La

Rue D'Aval, Vale, GY6 8LB.

The Company's objective is set out in its Investing Policy which

can be found at https://seedinnovations.co/about/investing-policy

and as detailed on pages 10 to 11 of these financial

statements.

The Company's Ordinary Shares are quoted on AIM, a market

operated by the London Stock Exchange and is authorised as a

Closed- ended investment scheme by the Guernsey Financial Services

Commission (the "GFSC") under Section 8 of the Protection of

Investors (Bailiwick of Guernsey) Law, 2020 and the Authorised

Closed-Ended Investment Schemes Guidance and Rules 2021.

2. Statement of Compliance

These condensed half-yearly financial statements, which have not

been independently reviewed or audited by the Company auditors,

have been prepared in accordance with International Accounting

Standard 34: Interim Financial Reporting. They do not include all

of the information required for full annual financial statements

and should be read in conjunction with the audited financial

statements for the year ended 31 March 2023.

The unaudited condensed half-yearly financial statements were

approved by the Board of Directors on 22 November 2023.

3. Significant Accounting Policies

These unaudited condensed half-yearly financial statements have

adopted the same accounting policies as the last audited financial

statements, which were prepared in accordance with International

Financial Reporting Standards ("IFRS"), issued by the International

Accounting Standards Board, interpretations issued by the IFRS

Interpretations Committee and applicable legal and regulatory

requirements of Guernsey Law and reflect the accounting policies as

disclosed in the Company's last audited financial statements, which

have been adopted and applied consistently.

The Company has adopted all revisions and amendments to IFRS

issued by the IASB, which may be relevant to and effective for the

Company's financial statements for the annual period beginning 1

April 2023. No new standards or interpretations adopted during the

period had an impact on the reported financial position or

performance of the Company.

4. Critical Accounting Estimates and Judgements

The preparation of financial statements in conformity with IFRS

requires the Board to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. The

estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates.

The Board makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal the related actual results.

The Directors believe that the underlying assumptions are

appropriate and that the financial statements are fairly presented.

Estimates and assumptions that have a significant risk of causing a

material adjustment to the carrying amounts of assets and

liabilities within the next financial year are outlined below:

Judgements

Going concern

After making reasonable enquiries, and assessing all data

relating to the Company's liquidity, the directors have a

reasonable expectation that the Company has adequate resources to

continue in operational existence for the foreseeable future and do

not consider there to be any threat to the going concern status of

the Company. For this reason, they continue to adopt the going

concern basis in preparing the financial statements.

Assessment as an investment entity

In determining the Company meeting the definition of an

investment entity in accordance with IFRS 10, it has considered the

following:

o the Company has raised the commitments from a number of

investors in order to raise capital to invest and to provide

investor management services with respect to these private equity

investments;

o the Company intends to generate capital and income returns

from its investments which will, in turn, be distributed to the

investors; and

o the Company evaluates its investment performance on a fair

value basis, in accordance with the policies set out in these

financial statements.

Although the Company met all three defining criteria, management

has also assessed the business purpose of the Company, the

investment strategies for the private equity investments, the

nature of any earnings from the private equity investments and the

fair value model. Management made this assessment in order to

determine whether any additional areas of judgement exist with

respect to the typical characteristics of an investment entity

versus those of the Company. Management have therefore concluded

that from the assessments made, the Company meets the criteria of

an investment entity within IFRS 10.

Part of the assessment in relation to meeting the business

purpose aspects of the IFRS 10 criteria also requires consideration

of exit strategies. Given that the Company does not intend to hold

investments indefinitely, management have determined that the

Company's investment plans support its business purpose as an

investment entity.

The Board has also concluded that the Company meets the

additional characteristics of an investment entity, in that: it

holds more than one investment; the investments will predominantly

be in the form of equities, derivatives and similar securities; it

has more than one investor and the majority of its investors are

not related parties.

Estimates and assumptions

Fair value of securities not quoted in an active market.

The Company may value positions by using its own models or

commissioning valuation reports from professional third-party

valuers. The models used in either case are based on valuation

methods and techniques generally recognised as standard within the

industry and in accordance with International Private Equity and

Venture Capital Valuation (IPEV) Guidelines. The inputs into these

models are primarily revenue or earnings multiples and discounted

cash flows. The inputs in the revenue or earnings multiple models

include observable data, such as the earnings multiples of

comparable companies to the relevant portfolio company, and

unobservable data, such as forecast earnings for the portfolio

company. In discounted cash flow models, unobservable inputs are

the projected cash flows of the relevant portfolio company and the

risk premium for liquidity and credit risk that are incorporated

into the discount rate. In some instances, the cost of an

investment is the best measure of fair value in the absence of

further information. Models are calibrated by back-testing to

actual results/exit prices achieved to ensure that outputs are

reliable, where possible.

Models use observable data, to the extent practicable. However,

areas such as credit risk (both own and counterparty), volatilities

and correlations require management to make estimates. Changes in

assumptions about these factors could affect the reported fair

value of financial instruments. The sensitivity to unobservable

inputs is based on management's expectation of reasonable possible

shifts in these inputs, taking into consideration historical

volatility and estimations of future market movements.

The determination of what constitutes 'observable' requires

significant judgement by the Company. The Company considers

observable data to be market data that is readily available,

regularly distributed or updated, reliable and verifiable, not

proprietary, and provided by independent sources that are actively

involved in the relevant market.

4. Investments designated at fair value through profit or loss

A reconciliation of the opening and closing balances of assets

designated at fair value through profit or loss classified as Level

1 is shown below:

30 September 2023 31 March 2023

GBP'000 GBP'000

Fair value of investments brought

forward 811 2,632

Purchases during the year - -

Disposals proceeds during the year - (104)

Realised gains/(losses) on disposals - 4

Net unrealised change in fair value (108) (1,721)

Fair value of investments carried

forward 703 811

A reconciliation of the opening and closing balances of assets

designated at fair value through profit or loss classified as Level

3 is shown below:

30 September 2023 31 March 2023

GBP'000 GBP'000

Fair value of investments brought forward 15,208 16,892

Purchases during the period/year 216 443

Disposals proceeds during the period/year (7,695) (54)

Capitalised interest on loan - 102

Realised gains/(losses) on disposals 1,112 (840)

Net unrealised change in fair value (2,040) (1,335)

Fair value of investments carried forward 6,801 15,208

During the period there were no transfers

between the levels.

The valuations used to determine fair values are validated and

periodically reviewed by experienced personnel, in most cases this

validation and review is undertaken by members of the Board,

however professional third-party valuation firms are used for some

valuations and the Company also has access to a network of industry

experts by virtue of the personal networks of the directors and

substantial shareholders. The valuations prepared by the Company or

received from third parties are in accordance with the

International Private Equity and Venture Capital Valuation

Guidelines. The valuations, when relevant, are based on a mixture

of:

-- Market approach (utilising EBITDA or Revenue multiples,

industry value benchmarks and available market prices

approaches);

-- Income approach (utilising Discounted Cash Flow, Replacement

Cost and Net Asset approaches);

-- Price of a recent transaction when transaction price/cost is

considered indicative of fair value; and

-- Proposed sale price.

5. Segmental Information

In accordance with IFRS 8: Operating Segments, it is mandatory

for the Company to present and disclose segmental information based

on the internal reports that are regularly reviewed by the Board in

order to assess each segment's performance and to allocate

resources to them.

Operating segments are reported in a manner consistent with the

internal reporting used by the chief operating decision-maker. The

chief operating decision-maker, who is responsible for allocating

resources and assessing performance of the operating segments, has

been identified as the Board as a whole. The board is responsible

for the Company's entire portfolio and considers the business to

have a single operating segment. Asset allocation decisions are

based on a single, integrated investment strategy, and the

Company's performance is evaluated on an overall basis.

6. (Loss)/Earnings per Ordinary Share

The loss per Ordinary Share of -0.67p (30 September 2022: -1.78p

loss per ordinary share) is based on the loss for the period of

GBP1,420,000 (30 September 2022: loss GBP3,789,000) and on a

weighted average number of 212,747,395 Ordinary Shares in issue

during the year (30 September 2022: 212,747,395 Ordinary

Shares).

7. Dividends

The Directors do not propose an interim dividend for the period

ended 30 September 2023 (30 September 2022: GBPNil).

8. Tax effects of other comprehensive income

The Income Tax Authority of Guernsey has granted the Company

exemption from Guernsey income tax under the Income Tax (Exempt

Bodies) (Guernsey) (Amendment) Ordinance, 2012 and the income of

the Company may be distributed or accumulated without deduction of

Guernsey income tax. Exemption under the above mentioned Ordinance

entails payment by the Company of an annual fee of GBP1,200 for

each year in which the exemption is claimed. It should be noted,

however, that interest and dividend income accruing from the

Company's investments may be subject to withholding tax in the

country of origin.

There were no tax effects arising from the other comprehensive

income disclosed in the Statement of Comprehensive Income (30

September 2022: GBPNil).

9. Net Assets per Ordinary Share

The net asset value per Ordinary Share is based on the net

assets attributable to equity shareholders of GBP14,612,000 (31

March 2023:

GBP16,032,000) and on 212,747,395 Ordinary Shares (31 March

2023: 212,747,395 Ordinary Shares) in issue at the end of the

period.

10. Share Capital, Warrants, Options, Treasury shares and Other distributable reserves

30 September 31 March 2023

2023

GBP'000 GBP'000

Authorized:

1,910,000,000 Ordinary Shares of 1p

(2022: 1,910,000,000 Ordinary Shares) 19,100 19,100

100,000,000 Deferred Shares of 0.9p

(2022: 100,000,000 Deferred Shares) 900 900

20,000 20,000

Allotted, called up and fully paid:

212,747,395 Ordinary Shares of 1p

(2022: 212,747,395 Ordinary Shares) (i) 2,127 2,127

Nil Deferred Shares of 0.9p (ii) - -

Treasury Shares:

2,472,446 Treasury Shares of 1p

(2022: 2,472,446) (iii) 25 25

(i) Ordinary Shares

There was no issue of shares during the period ended 30

September 2023 (31 March 2023: Nil).

(ii) Deferred Shares

There was no issue of shares during the period ended 30

September 2023 (31 March 2023: Nil).

(iii) Directors' Authority to Allot Shares

The Directors are generally and unconditionally authorised to

exercise all the powers of the Company to allot relevant

securities. The Directors may determine up to a maximum aggregate

nominal amount of 100% of the issued share capital during the

period until the following Annual General Meeting. The Guernsey

Companies Law does not limit the power of Directors to issue shares

or impose any pre-emption rights on the issue of new shares.

(iv) Shares held in Treasury

There were no changes to the number of Shares held in Treasury

during the period.

11. Related Parties

Ian Burns

Mr Burns is the legal and beneficial owner of Smoke Rise

Holdings Limited, which held 1,674,024 (0.79%) Ordinary Shares

(2022: 1,374,024 (0.65%)) in the Company at 31 March 2023 and the

date of signing this report.

Mr Burns is entitled to an annual remuneration of GBP36,000.

Ed McDermott

Mr McDermott held 4,680,000 (2.2%) Ordinary Shares (2022: Nil)

in the Company at 31 March 2023 and at the date of signing this

report.

Mr McDermott is entitled to an annual remuneration of GBP160,000

(2022: GBP160,000). Mr McDermott was paid no performance bonus in

2023 (2022: Nil) relating to work undertaken in the year ended 31

March 2023.

Lance De Jersey

Mr De Jersey, Finance Director of the Company held 400,000

ordinary shares in the Company as at 31 March 2023 and at the date

of signing of this report.

Mr De Jersey is entitled annual remuneration of GBP106,000

(2022: GBP106,000) and was paid no performance bonus in 2023 (2022:

Nil) relating to work undertaken in the year ended 31 March

2023.

Luke Cairns

Mr Cairns is entitled to an annual remuneration

of GBP36,000.

Alfredo Pascual

Mr Pascual is entitled to an annual remuneration

of EUR106,000 per annum.

30 September 2023 30 September

2022

Directors' Directors'

Remuneration Remuneration

GBP'000 GBP'000

Ian Burns 18 18

Ed McDermott 81 80

Lance De Jersey 53 57

Luke Cairns 18 18

Alfredo Pascual 9 -

179 173

12. Capital Management Policy and Procedures

The Company's capital structure is derived solely from the issue

of Ordinary Shares.

The Company does not currently intend to fund any investments

through debt or other borrowings but may do so if appropriate.

Investments in early stage assets are expected to be mainly in the

form of equity, with debt potentially being raised later to fund

the development of such assets. Investments in later stage assets

are more likely to include an element of debt to equity gearing.

The Company may also offer new Ordinary Shares as consideration as

well as cash, thereby helping to preserve the Company's cash for

working capital and as a reserve against unforeseen contingencies

including, for example, delays in collecting accounts receivable,

unexpected changes in the economic environment and operational

problems.

The Board monitors and reviews the structure of the Company's

capital on an ad hoc basis. This review includes:

-- The need to obtain funds for new investments, as and when they arise;

-- The current and future levels of gearing;

-- The need to buy back Ordinary Shares for cancellation or to

be held in treasury, which takes account of the difference between

the net asset value per Ordinary Share and the Ordinary Share

price;

-- The current and future dividend policy; and

-- The current and future return of capital policy.

The Company is not subject to any externally imposed capital

requirements.

13. Events after the Financial Reporting Date

On 29 September 2023 the Company announced the commencement of a

share repurchase programme of Ordinary Shares for up to a maximum

of 21,500,000 shares and GBP850,000 commencing on 2 October 2023

and ending not later than 29 February 2024. Share purchases will

take place in open market transactions and may be made from time to

time depending on market conditions, share price, trading volume

and other factors. The Company has appointed Shard Capital Partners

LLP to manage the programme and make market purchases of Ordinary

Shares on its behalf, independently of the Company.

As at the date of signing of the financial statements the

Company had purchased 6,485,000 total number of shares at a volume

weighted average price of GBP 0.0325.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZMZMDZDGFZM

(END) Dow Jones Newswires

November 22, 2023 09:29 ET (14:29 GMT)

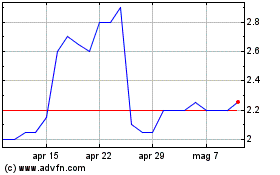

Grafico Azioni Seed Innovations (LSE:SEED)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Seed Innovations (LSE:SEED)

Storico

Da Mag 2023 a Mag 2024