Shell plc

Shell announces commencement of a share

buyback programme

October 31, 2024

Shell plc (the ‘Company’) today announces the

commencement of a $3.5 billion share buyback programme covering an

aggregate contract term of approximately three months (the

‘programme’). The purpose of the programme is to reduce the issued

share capital of the Company. All shares repurchased as part of the

programme will be cancelled. It is intended that, subject to market

conditions, the programme will be completed prior to the Company’s

Q4 2024 results announcement, scheduled for January 30, 2025.

The Company has entered into an arrangement with

a single broker consisting of two irrevocable, non-discretionary

contracts, to enable the purchase of ordinary shares on both London

market exchanges (the London Stock Exchange and/or on BATS and/or

on Chi-X) (pursuant to one ‘London contract’) and Netherlands

exchanges (Euronext Amsterdam and/or on CBOE Europe DXE and/or on

Turquoise Europe) (pursuant to one ‘Netherlands contract’) for a

period up to and including January 24, 2025. The aggregate maximum

consideration for the purchase of ordinary shares under the London

contract is $2.1 billion and the maximum consideration for the

purchase of ordinary shares under the Netherlands contract is $1.4

billion. Purchases under the London contract will be carried out in

accordance with the Company’s authority1 to repurchase shares

on-market and will be effected within certain contractually agreed

parameters. Purchases under the Netherlands contract will be

carried out in accordance with the Company’s authority1 to

repurchase shares off-market pursuant to the off-market share

buyback contract approved by its shareholders and the parameters

set out therein.

The maximum number of ordinary shares which may

be purchased or committed to be purchased by the Company under the

programme (across both contracts) is 525,000,000, which is the

maximum number remaining as of the date of this announcement

pursuant to the relevant authorities granted by shareholders at the

Company's 2024 Annual General Meeting1.

The broker will make its trading decisions in

relation to the Company's securities independently of the

Company.

The programme will be conducted in accordance

with Chapter 9 of the UK Listing Rules, Article 5 of the Market

Abuse Regulation 596/2014/EU dealing with buy-back programmes (‘EU

MAR’) and EU MAR as “onshored” into UK law from the end of the

Brexit transition period (at 11:00 pm on 31 December 2020) through

the European Union (Withdrawal) Act 2018 (as amended by the

European Union (Withdrawal Agreement) Act 2020), and as amended,

supplemented, restated, novated, substituted or replaced including

by relevant statutory instruments (including, The Market Abuse

(Amendment) (EU Exit) Regulations (SI 2019/310)), from time to time

and the Commission Delegated Regulation (EU) 2016/1052 (the ‘EU MAR

Delegated Regulation’) and the EU MAR Delegated Regulation as

“onshored” into UK law from the end of the Brexit transition period

(at 11:00 pm on 31 December 2020) through the European Union

(Withdrawal) Act 2018 (as amended by the European Union (Withdrawal

Agreement) Act 2020), and as amended, supplemented, restated,

novated, substituted or replaced, including by relevant statutory

instruments (including, The Market Abuse (Amendment) (EU Exit)

Regulations (SI 2019/310)), from time to time.

1 The existing shareholder authorities to buy

back shares granted at the Company's 2024 Annual General Meeting

will expire at the earlier of the close of business on August 20,

2025, and the end of the date of the Company's 2025 Annual General

Meeting. The Company expects to seek renewal of shareholder

authority to buy back shares at subsequent Annual General

Meetings.

Enquiries

Media International: +44 (0) 207 934 5550

Media Americas: +1 832 337 4355

Cautionary Note

The companies in which Shell plc directly and

indirectly owns investments are separate legal entities. In this

announcement “Shell”, “Shell Group” and “Group” are sometimes used

for convenience where references are made to Shell plc and its

subsidiaries in general. Likewise, the words “we”, “us” and “our”

are also used to refer to Shell plc and its subsidiaries in general

or to those who work for them. These terms are also used where no

useful purpose is served by identifying the particular entity or

entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell

companies” as used in this announcement refer to entities over

which Shell plc either directly or indirectly has control. The term

“joint venture”, “joint operations”, “joint arrangements”, and

“associates” may also be used to refer to a commercial arrangement

in which Shell has a direct or indirect ownership interest with one

or more parties. The term “Shell interest” is used for

convenience to indicate the direct and/or indirect ownership

interest held by Shell in an entity or unincorporated joint

arrangement, after exclusion of all third-party interest.

Forward-Looking Statements

This announcement contains forward-looking

statements (within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995) concerning the financial condition,

results of operations and businesses of Shell. All statements other

than statements of historical fact are, or may be deemed to be,

forward-looking statements. Forward-looking statements are

statements of future expectations that are based on management’s

current expectations and assumptions and involve known and unknown

risks and uncertainties that could cause actual results,

performance or events to differ materially from those expressed or

implied in these statements. Forward-looking statements include,

among other things, statements concerning the potential exposure of

Shell to market risks and statements expressing management’s

expectations, beliefs, estimates, forecasts, projections and

assumptions. These forward-looking statements are identified by

their use of terms and phrases such as “aim”; “ambition”;

‘‘anticipate’’; ‘‘believe’’; “commit”; “commitment”; ‘‘could’’;

‘‘estimate’’; ‘‘expect’’; ‘‘goals’’; ‘‘intend’’; ‘‘may’’;

“milestones”; ‘‘objectives’’; ‘‘outlook’’; ‘‘plan’’; ‘‘probably’’;

‘‘project’’; ‘‘risks’’; “schedule”; ‘‘seek’’; ‘‘should’’;

‘‘target’’; ‘‘will’’; “would” and similar terms and phrases. There

are a number of factors that could affect the future operations of

Shell and could cause those results to differ materially from those

expressed in the forward-looking statements included in this

announcement, including (without limitation): (a) price

fluctuations in crude oil and natural gas; (b) changes in demand

for Shell’s products; (c) currency fluctuations; (d) drilling and

production results; (e) reserves estimates; (f) loss of market

share and industry competition; (g) environmental and physical

risks; (h) risks associated with the identification of suitable

potential acquisition properties and targets, and successful

negotiation and completion of such transactions; (i) the risk of

doing business in developing countries and countries subject to

international sanctions; (j) legislative, judicial, fiscal and

regulatory developments including regulatory measures addressing

climate change; (k) economic and financial market conditions in

various countries and regions; (l) political risks, including the

risks of expropriation and renegotiation of the terms of contracts

with governmental entities, delays or advancements in the approval

of projects and delays in the reimbursement for shared costs; (m)

risks associated with the impact of pandemics, such as the COVID-19

(coronavirus) outbreak, regional conflicts, such as the

Russia-Ukraine war, and a significant cybersecurity breach; and (n)

changes in trading conditions. No assurance is provided that future

dividend payments will match or exceed previous dividend payments.

All forward-looking statements contained in this announcement are

expressly qualified in their entirety by the cautionary statements

contained or referred to in this section. Readers should not place

undue reliance on forward-looking statements. Additional risk

factors that may affect future results are contained in Shell plc’s

Form 20-F for the year ended December 31, 2023 (available at

www.shell.com/investors/news-and-filings/sec-filings.html and

www.sec.gov). These risk factors also expressly qualify all

forward-looking statements contained in this announcement and

should be considered by the reader. Each forward-looking

statement speaks only as of the date of this announcement, October

31, 2024. Neither Shell plc nor any of its subsidiaries undertake

any obligation to publicly update or revise any forward-looking

statement as a result of new information, future events or other

information. In light of these risks, results could differ

materially from those stated, implied or inferred from the

forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon

Intensity” (NCI), which includes Shell’s carbon emissions from the

production of our energy products, our suppliers’ carbon emissions

in supplying energy for that production and our customers’ carbon

emissions associated with their use of the energy products we sell.

Shell’s NCI also includes the emissions associated with the

production and use of energy products produced by others which

Shell purchases for resale. Shell only controls its own emissions.

The use of the terms Shell’s “Net Carbon Intensity” or NCI are for

convenience only and not intended to suggest these emissions are

those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a

ten-year period and are updated every year. They reflect the

current economic environment and what we can reasonably expect to

see over the next ten years. Accordingly, they reflect our Scope 1,

Scope 2 and NCI targets over the next ten years. However, Shell’s

operating plans cannot reflect our 2050 net-zero emissions target,

as this target is currently outside our planning period. In the

future, as society moves towards net-zero emissions, we expect

Shell’s operating plans to reflect this movement. However, if

society is not net zero in 2050, as of today, there would be

significant risk that Shell may not meet this target.

Forward-Looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP

measures such as cash capital expenditure and divestments. We are

unable to provide a reconciliation of these forward-looking

non-GAAP measures to the most comparable GAAP financial measures

because certain information needed to reconcile those non-GAAP

measures to the most comparable GAAP financial measures is

dependent on future events some of which are outside the control of

Shell, such as oil and gas prices, interest rates and exchange

rates. Moreover, estimating such GAAP measures with the required

precision necessary to provide a meaningful reconciliation is

extremely difficult and could not be accomplished without

unreasonable effort. Non-GAAP measures in respect of future periods

which cannot be reconciled to the most comparable GAAP financial

measure are calculated in a manner which is consistent with the

accounting policies applied in Shell plc’s consolidated financial

statements.

The contents of websites referred to in this announcement do not

form part of this announcement.

We may have used certain terms, such as resources, in this

announcement that the United States Securities and Exchange

Commission (SEC) strictly prohibits us from including in our

filings with the SEC. Investors are urged to consider closely the

disclosure in our Form 20-F, File No 1-32575, available on the SEC

website www.sec.gov.

LEI number of Shell plc: 21380068P1DRHMJ8KU70

Classification: Acquisition or disposal of the issuer’s own

shares.

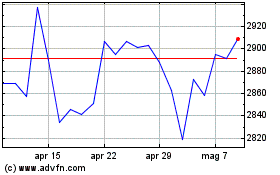

Grafico Azioni Shell (LSE:SHEL)

Storico

Da Nov 2024 a Dic 2024

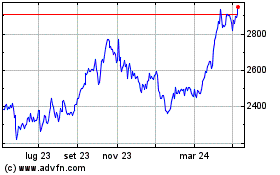

Grafico Azioni Shell (LSE:SHEL)

Storico

Da Dic 2023 a Dic 2024