Citigroup Global Markets Limited Form 8.5 (EPT/RI) - Amendments

08 Luglio 2024 - 11:08AM

RNS Regulatory News

RNS Number : 5018V

Citigroup Global Markets Limited

08 July 2024

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

FERRPMLTMTMMMAI

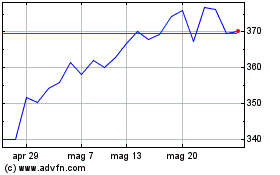

Grafico Azioni Smith (ds) (LSE:SMDS)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Smith (ds) (LSE:SMDS)

Storico

Da Nov 2023 a Nov 2024