TIDMSPR

RNS Number : 5589W

Springfield Properties PLC

13 December 2023

13 December 2023

Springfield Properties plc

("Springfield", the "Company", the "Group" or the "Springfield

Group")

Trading Update

Trading in line with management expectations - on track to meet

debt reduction target

Springfield Properties plc (AIM: SPR), a leading housebuilder in

Scotland focused on delivering private and affordable housing,

provides the following update on trading for the six months ended

30 November 2023.

-- Trading in H1 2024 has been in line with management expectations

o Demand in private housing remained stable but subdued

o Recommenced signing new affordable-only housing contracts,

with c. GBP24.0m of new contracts entered into

-- Two profitable land sales agreed in H1 2024 for a total of

GBP9.3m with funds to be received by the end of the financial year,

and confident of signing other agreements in the near term

-- Net bank debt at 30 November 2023 of c. GBP94.0m (not

including the c. GBP8.8m outstanding proceeds from recent land

sales) and on track to meet target of reducing net bank debt to c.

GBP55.0m by 31 May 2024 (31 May 2023: GBP61.8m)

-- Build cost inflation continues to reduce - expected to be c.

4% for H1 2024 - and there is greater availability of materials and

labour

-- Confident of meeting market expectations for FY 2024

Focus on debt reduction

As noted in the Group's final results announcement of 20

September 2023, the Board adopted a strategy focusing on reducing

debt to be in a stronger position for when normalised market demand

returns. A key element of this is the active pursuit of land sales

to accelerate cash realisation from its large land bank and without

impacting the Group's development pipeline. During the period, the

Group entered into two agreements for profitable sales of land for

a total consideration of GBP9.3m, and is confident of signing other

such agreements in the near term.

The Group continues to carefully manage working capital by

commencing to build private homes when they are reserved and

maintaining tight control over costs across the Group. Build cost

inflation has also continued to reduce as anticipated , and is

expected to be c. 4% for H1 2024.

The Group's net bank debt was c. GBP94.0m as at 30 November

2023. This figure does not include the c. GBP8.8m of outstanding

proceeds from contracted land sales to be received by the end of

the financial year, with additional profitable sales expected in H2

2024. The Group remains on track to meet its target of reducing net

bank debt to c. GBP55.0m by 31 May 2024 (31 May 2023:

GBP61.8m).

The increase in net bank debt over the six-month period

primarily reflects GBP11.0m in scheduled deferred payments relating

to the Group's acquisitions of Tulloch Homes and Mactaggart &

Mickel Homes and GBP6.0m in contracted payments for land. It also

reflects the usual working capital cycle, with work-in-progress at

the end of the first half for delivery in the second half of the

year.

The Board also notes that the GBP18.0m additional term loan that

the Group secured in September 2023 to provide extra surety against

the challenging market backdrop has not been utilised.

Private housing performance

In private housing, reservation rates remained stable, but

subdued, throughout the period and to date. Demand compared with

the prior year period continued to be impacted by high interest

rates, mortgage affordability and reduced homebuyer confidence,

resulting in lower completions and reservations than in H1

2023.

The selling prices in private housing remained stable, supported

by the established reputation of the high quality and higher

specification housing of the Group's brands.

Affordable housing performance

The Group continues to be encouraged by the demand that it is

receiving in affordable housing having recommenced engaging with

providers during the period. As previously announced, since 31 May

2023 the Group has signed affordable housing contracts totalling c.

GBP24.0m for delivery in the second half of the year and beyond,

and it is in advanced negotiations regarding further contracts that

it expects to be awarded in H2 2024. The Group has maintained its

approach of only pursuing new affordable housing contracts that

have a 12-18 month delivery timeframe, which bring lower pricing

risk.

Summary & Outlook

The Group expects results for the first half of 2024 to be in

line with management expectations. While there remains uncertainty

in the near-term market, the Group is confident of meeting market

expectations for the year to 31 May 2024, with growth anticipated

in H2 over H1 across the business, in line with usual seasonality,

and with a significant contribution from land sales.

Looking further ahead, the Board is encouraged by the early

indications of a return in homebuyer confidence, with inflation

reducing and the Bank of England holding interest rates for two

consecutive months. Build cost inflation continues to moderate and

there is greater availability of materials and subcontractors. The

interest that the Group is receiving in its land bank - and at

attractive valuations - reflects the market preparing for an upturn

in trading conditions.

The fundamentals of the business and of the housing market in

Scotland remain strong. There is an undersupply of housing across

all tenures, which is becoming more acute - as evidenced by three

local authorities, including Edinburgh and Glasgow Councils,

recently declaring housing emergencies. The Group offers high

quality, energy efficient homes in popular locations across the

country and it has an excellent track record of delivering

developments exclusively dedicated to affordable housing. This is

further supported by the Group having one of the largest land banks

in Scotland, with c. 6,500 owned plots and strategic options over a

further 3,255 acres, equating to c. 33,000 plots as at 30 November

2023. This includes a strong landholding in the Highlands region,

where new housing is recognised as a key infrastructure requirement

to support the creation of the Inverness and Cromarty Firth Green

Freeport, which is due to bring GBP3.0bn of investment and c.

10,000 new jobs into the region.

In addition, the decisive actions that the Group has taken

during the current year put it in a stronger position to deliver

future growth as more favourable economic and trading conditions

return.

Accordingly, the Board remains confident in the Group's

prospects and in its ability to generate shareholder value.

The Group will provide further details in its interim results

announcement, which is expected to be announced in February

2024.

Enquiries

Springfield Properties

Sandy Adam, Chairman

Innes Smith, Chief Executive Officer

Iain Logan, Chief Financial Officer +44 1343 552550

-----------------

Singer Capital Markets

-----------------

Shaun Dobson, James Moat, Oliver Platts

(Investment Banking) +44 20 7496 3000

-----------------

Gracechurch Group

-----------------

Harry Chathli, Claire Norbury +44 20 4582 3500

-----------------

Analyst Research

Equity Development and Progressive Equity produce freely

available research on Springfield Properties plc, including

financial forecasts. This is available to view and download

here:

https://www.thespringfieldgroup.co.uk/news/updates-and-analyst-reports

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFIIFLLFLIV

(END) Dow Jones Newswires

December 13, 2023 02:00 ET (07:00 GMT)

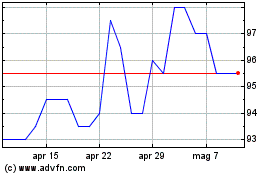

Grafico Azioni Springfield Properties (LSE:SPR)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Springfield Properties (LSE:SPR)

Storico

Da Nov 2023 a Nov 2024