TIDMSURE

RNS Number : 0050H

Sure Ventures PLC

24 July 2023

Sure Ventures plc

Annual Report and Audited Financial Statements

For the year ended 31 March 2023

Company Number: 10829500

Table of Contents

1 Investment Objective, Policy and Performance Summary 1

2 Chairman's

Statement..........................................................................

3

3 Investment Manager's Report.............................................................. 7

4 Strategic

Report.................................................................................

12

Business Review 13

Principal Risks and Uncertainties 15

Key Performance Indicators 7

Promoting the Success of the Company

5 Directors' Report 9

Board of Directors

Statutory Information 21

Corporate Governance Statement 5

Report of the Audit Committee 32

Statement of Directors' Responsibilities 5

Directors' Remuneration Report 6

6 Independent Auditor's Report............................................................ 39

7 Financial Statements 6

Income Statement 7

Statement of Financial Position 8

Statement of Changes in Equity 9

Statement of Cash Flows 50

Notes to the Financial Statements 1

8 Alternative Performance Measures (APMs)

9 Glossary

10 Shareholders' Information 8

Directors, Portfolio Manager and Advisers 69

11 Investment Policy 70

1 Investment Objective, Policy and Performance Summary

Investment Objective

The investment objective of the Company is to achieve capital

growth for investors.

Investment Policy

The Company's Investment Policy can be found at page 70 of this

Annual Report.

Performance Summary

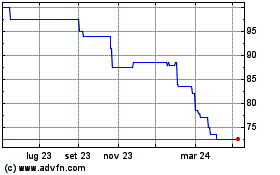

31 March 2023 31 March 2022

Number of ordinary shares in

issue 6,646,472 6,013,225

Market capitalisation

- Ordinary shares (in sterling) 6,314,148 6,133,500

Net asset value ("NAV") attributable

to ordinary shareholders

- Ordinary shares GBP 7,963,207 GBP 7,751,596

NAV per share attributable

to ordinary shareholders

- Ordinary shares (in sterling) 119.81p 128.91p

Ordinary share price (bid price)

in sterling 95.00p 102.00p

Ordinary share price deficit

to NAV

in sterling (20.71%) (20.87%)

Investments held at fair value

through profit and loss GBP 8,196,153 GBP 7,516,667

Cash and cash equivalents GBP 36,697 GBP282,178

Dividend History

There were no dividends paid during the period (2022 -

None).

Listing Information

The Company's shares are admitted to trading on the Specialist

Fund Segment (SFS) of the London Stock Exchange.

The ISIN number for the GBP shares is GB00BYWYZ460, Ticker:

SURE.

Website

The Company's website address is http://www.sureventuresplc.com

.

2 Chairman's Statement

Chairman's Statement

Dear Shareholders.

On behalf of my fellow directors, I am delighted to present the

annual results of Sure Ventures plc (the 'Company') for the year

ended 31 March 2023.

FINANCIAL PERFORMANCE

The Company's performance for the year to 31 March 2023 returned

a net asset value ('NAV') total return per

share of - 7.06 % (31 March 2022 : +40.03%), broadly in line with expectations.

The performance remains largely unchanged throughout the current

financial year, from the impressive full year results to 31 March

2022, due to limited changes in valuation of the underlying

portfolio of unlisted investee companies.

Since the Company's incorporation in 2017, through its indirect

AIFM-managed investments funds and direct investments, it has

created a balanced, and now seasoned portfolio of exciting

early-stage technology companies in sectors that are developing at

an incredibly fast pace.

The pandemic highlighted the need for virtual communication and

the Company's investments have benefited from that. Now, in the

current economic environment of higher inflation and higher

interest rates, the Company is deriving further benefit from the

increasing need for corporate cost savings. Accordingly, investment

in new technologies is a good area to find those cost savings, a

prime example is artificial intelligence (AI) in the workplace.

Goldman Sachs estimates that up to 300m full time jobs worldwide

could be exposed by generative AI. The launch of ChatGPT in 2022

was one of the most pivotal innovations in the technology space for

years and has contributed to the huge rally in AI focused tech

stocks in the first half of 2023.

At the time of writing, Apple has just announced the

long-awaited release of its Augmented Reality (AR)/Virtual Reality

(VR) immersive spatial computing headset, Apple Vision Pro. The

headset allows the real world to merge seamlessly with the digital

world. It has the potential to change the AR/VR landscape and could

propel AR/VR into the mainstream of everyday use by consumers. UBS

has predicted that the new headset will generate USD 6 b illion for

Apple in the coming year, which in turn, the Company believes will

have a meaningful impact on the AR/VR focused investee companies

within the portfolio.

The Company is confident that its carefully constructed

portfolio is extremely well positioned to reali s e further gains

in all its chosen investment themes of AI, AR, VR, internet of

things (IoT) and cybersecurity.

During the year however, there were limited net movements in the

portfolio valuation among the private companies except for a

further funding round for CameraMatics. The indirect listed holding

in ENGAGE XR PLC and the direct listed holding of Let's Explore

Group PLC (formerly known as Immotion Group PLC ) underperformed,

largely due to market sentiment heading into the year end. In the

past two months both these listed companies have begun to recover.

Meanwhile, Smarttech247 listed on the AIM market in December 2022

and was trading over 15% higher as at the year end.

The sale of Buymie was concluded during the year and its value

has been written down to zero as a prudent approach to the

transaction. This investment represents the first investment write

down of the Company, which is inevitable when considering the

nature of the early-stage technology startup investment strategy,

and the phase in the investment cycle that the Company is

positioned currently.

The Company had invested NDRC@Arclabs. This was an "accelerator"

investment and is a vehicle for identifying potential investments

for the Company. This has now come to its natural end which means

the investment has been written down to zero.

The investment portfolio for Fund I (as further defined below)

is now complete, and no new investments will be made, with the

remaining capital allocated to follow-on rounds of the fourteen

investee companies in the portfolio. By contrast, Fund II (also

defined below) is in the early stages of investment origination,

and to date investments have been made in just two companies.

In the period to 31 March 2023 the Company's NAV attributable to

shareholders grew by GBP220k to GBP7.9 6 m through a combination of

NAV performance and new subscriptions.

In common with the current market trend of listed trusts, the

Company's share price now trades at a discount to its last

published NAV, currently around 20%. However, in June 2022 and

January 2023 the Company was able to validate its share price by

raising new subscriptions through private placements at the

mid-market share price.

PORTFOLIO UPDATE - FUND I

The Company's first fund investment was in Sure Valley Ventures

Sub-Fund of Suir Valley Fund ICAV ('Fund I'). Its holdings comprise

25.9% of Fund I (out of a total of EUR27m) and the commitment to

this percentage ensures the Company's investments in Fund I are not

diluted. The Company has made a total commitment of EUR7m,

increasing its initial commitment from EUR4.5m in September

2019.

The Company holds direct investments outside of Fund I. Let's

Explore Group PLC , a listed immersive VR entertainment group and

VividQ Limited, that is a privately owned deep technology company

pioneering the application of holography in augmented reality AR

and VR. The Fund I portfolio also includes two listed entities;

i) ENGAGE XR Holdings PLC (formerly VR Education Holdings PLC )

(ENGAGE) a developer of VR software and immersive experiences with

a specific focus on education

ii) Smarttech247, a security managed detection and response

company and market leader in security operations utilizing AI and

cybersecurity cloud technologies.

As at the year end, the Company has a further eleven privately

held companies in the AR, VR, IoT and AI space. The Company has,

with its investment in Artomatix concluded its first successful

portfolio company exit in 2019 for x5 return of the original

investment.

During the year, Fund I concluded its final portfolio investment

in Everyangle, a Dublin-based AI business utilizing CCTV cameras

and computer vision applications to simplify complex visual data

and transform it into crystal clear, actionable insights, enabling

its customers to reduce losses and improve efficiencies.

The year also featured an EUR3m equity financing round from

existing investors for CameraMatics that closed in Q4 and resulted

in a significant uplift in valuation of 83%, making it one of the

top two holdings of Fund I by valuation, behind Getvisibility which

continues to perform very well.

As previously mentioned, the first write downs since inception

occurred in the year for Buymie and NDRC@Arclabs. Buymie was

acquired in the year and the Company has taken the prudent approach

to the transaction to write the investment down to zero. The

investment in NDRC was an incubator and accelerator programme that

has finished and is the rationale behind writing off the full value

of this investment.

Smarttech247 listed on the AIM market in December 2022 which

valued the company at GBP37m, giving an uplift to the Q3 NAV and

its stock price has since traded higher post IPO.

The Company's other listed investment holdings, Let's Explore

Group and ENGAGE, had a mixed year with both share prices trading

lower into the year end. However, the holdings in both companies

have been reduced to levels that are less impactful of the

Company's NAV, creating lower volatility through dilution of these

holdings.

PORTFOLIO UPDATE - FUND II

In March 2022 the Company announced its commitment of GBP5m to

the Sure Valley Ventures Enterprise Capital Fund. This is a GBP85m

first close launch of a total GBP95m UK software technology fund,

investing in AR, VR and the Metaverse, including AI, IoT and

Cybersecurity in investee companies throughout the UK (Fund II).

The British Business Bank is the GBP50m cornerstone investor

through its Enterprise Capital Funds programme and it is envisaged

that investment in up to 25 software companies will be made during

the investment period.

As at the year end, the first portfolio Fund II investments had

been made in Retinize, a Belfast-based creative tech company

developing an Animotive software, harnessing VR technology to

transform the 3D animation production process. An investment in

Jaid was also made which is an innovative technology company

providing AI-powered human communications solutions. As at the year

end 5% of total commitments had been drawn and the pipeline for new

investments remains extremely healthy.

Further information on the investment portfolio is provided in

the report of the Investment Manager which follows this

statement.

COMMITMENTS AND FUNDING

As previously mentioned, in 2019 the Company announced an

increase in subscription to Fund I of EUR2.5m taking its total

commitment to EUR7m, thereby increasing its share in the Fund from

21.6% to 25.9%. This commitment was made shortly before the Fund

closed to new subscribers validating the Company's belief that the

Fund I portfolio is at a mature stage with several investee

companies preparing for further funding rounds. There is potential

here for further uplifts to occur from initial valuations. Limited

new funding rounds occurred in this financial year however others

are still at the negotiation stage and the Company expects further

positive Fund I uplifts to occur in the coming quarters.

The Company's commitment to Fund II is GBP5m over the duration

of the Fund's investment period and the forecast capital calls

throughout the investment period was a key consideration prior to

agreeing to the Company's commitment to Fund II.

The Company believes that it will have sufficient access to

funding to meet its remaining commitments to Fund I and to its

anticipated commitments to Fund II over the terms of each Funds'

investment cycle, through a combination of available cash and

liquid investments, anticipated subscriptions and access to loans

and equity subscription facilities.

INVESTMENT ENVIRONMENT

The Company is excited by the constituent investments of Fund I

and the potential of these investee businesses to deliver higher

valuations this year and negotiated exits over the next one to two

years. The pace of change in the technology shows no signs of

abating. The Company has a carefully constructed, diverse portfolio

with exposure to some of the most in-demand areas of technology.

The Investment Manager is ahead of target to reap the rewards of

being an early mover in these areas. The initial investments

identified for Fund II, and the varied deal pipeline that has been

identified is also particularly pleasing.

DIVID

During the year to 31 March 2023, the Company has not declared a

dividend (31 March 2022: GBPNil). Pursuant to the Company's

dividend policy the directors intend to manage the Company's

affairs to achieve shareholder returns through capital growth

rather than income. The Company does not expect to receive a

material amount of dividends or other income from its direct or

indirect investments. It should not be expected that the Company

will pay a significant annual dividend, if any.

GEARING

The Company may deploy gearing of up to 20% of net asset value

(calculated at the time of borrowing) to seek to enhance returns

and for the purposes of liquidity, capital flexibility and

efficient portfolio management. The Company's gearing is expected

to primarily comprise bank borrowings but may include the use of

derivative instruments and such other methods as the Board may

determine. During the period to 31 March 2023 the Company had

borrowings of GBP200,000 drawn from a GBP1,000,000 loan facility

provided by Shard Merchant Capital Limited (31 March 2022:

GBPNil).

The Board will continue to review the Company's borrowing, in

conjunction with the Investment Manager on a regular basis pursuant

with the Company's overall cash management and investment strategy.

The Board would look to extinguish borrowing should it receive a

premium from the sales of any of its portfolio investments. There

is always a good probability that this will happen, and this

justifies the use of leverage.

CAPITAL RAISING

On 31 May 2022, the Company announced a placing of 441,860

ordinary shares that were admitted to trading on the Specialist

Fund Segment of the London Stock Exchange and a further placing of

191,387 ordinary shares announced on 12 January 2023, under the

existing ISIN: GB00BYWYZ460, taking the total shares in admission

as at 31 March 2023 to 6,646,472.

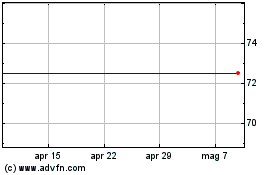

Post year end, on 5 May 2023, the Company announced a further

placing of 200,000 ordinary shares that were admitted to trading on

the Specialist Fund Segment of the London Stock Exchange on or

around 12 May 2023, under the existing ISIN: GB00BYWYZ460, taking

the total shares in admission to 6,846,472.

The Investment Manager's Report following this Statement gives

further detail on the affairs of the Company. The Board is

confident of the long-term prospects for the Company in pursuit of

its investment objectives.

OUTLOOK

The portfolio construction of Fund I is now complete and is at

the realization stage with several companies attracting interest

from potential suitors. Others continue to prepare for follow-on

funding rounds with the potential of higher valuations. Fund II is

at the early stage of the investment cycle and the investment team

is encouraged not only with the quality of its first investments,

but with the deal pipeline that has developed.

The year's performance was a steady, consolidation year, in what

has been a challenging economic environment of higher inflation and

higher interest rates, against a backdrop of continued conflict in

Ukraine. Notwithstanding the recent rally in AI-related equities,

these factors have influenced sentiment in public and private

markets which in turn has impacted private market deal activity and

fundraising ability across all markets. However, the Company is

confident it is well placed to benefit from the surge of interest

in AI, AR/VR, and its other chosen verticals, and that its pursuit

of portfolio exits will provide investors with rewards for their

commitment to this longer-term investment strategy.

Perry Wilson

Chairman

11 July 2023

3 Investment Manager's Report

Investment Manager's Report

THE COMPANY

Sure Ventures plc (the "Company") was established to enable

investors to gain access to early-stage technology companies in the

four exciting and expansive market verticals of augmented reality

and virtual reality (AR/VR), artificial intelligence (AI),

Cybersecurity and the Internet of Things (IoT).

The Company gains access to deal flow ordinarily reserved for

venture capital funds and ultra-high net worth angel investors,

establishing a diversified software-centric portfolio with a clear

strategy. Listing the fund on the London Stock Exchange offers

investors:

-- Relative liquidity

-- A quoted share price

-- A high level of corporate governance.

It is often too expensive, too risky and too labour-intensive

for investors to build a portfolio of this nature themselves. We

are leveraging the diverse skillsets of an experienced management

team who have the industry network to gain access to quality deal

flow, the expertise to complete extensive due diligence in target

markets and the entrepreneurial skills to help these companies to

mature successfully. Those investing in the Company will get

exposure to Sure Valley Ventures which in turn makes direct

investments in the above sectors in the UK and Ireland.

Augmented Reality & Virtual Reality

The Immersive Technologies market has had a significant growth

boost during the COVID-19 pandemic, with people looking for new

ways to connect and entertain themselves. In 2021, the Global AR/VR

market was valued at USD 11.83 billion. By 2030, it is projected to

reach USD 139.5 billion, registering a Compound Annual Growth Rate

(CAGR) of 30%. There are a number of factors driving the growth of

the AR/VR market. One is the growth of the mobile gaming industry.

Mobile gaming is a major driver of AR/VR adoption, as it allows

users to experience immersive games and experiences without having

to purchase expensive hardware. Another factor driving the growth

of the AR/VR market is the increase in internet connectivity. As

internet speeds and availability improve, AR/VR applications become

more feasible. This is leading to increased adoption of AR/VR in a

variety of industries, including education, healthcare, and

manufacturing.

The increasing use of consumer electronic devices is also

driving the growth of the AR/VR market. As more and more people own

smartphones, tablets, and other devices that can be used to access

AR/VR content, the market for AR/VR headsets and other hardware is

expected to grow.

Some recent developments in the AR/VR market include:

-- Meta has had great success with its Quest 2 VR headset and

plans to launch a new high-end metaverse headset in Q2 2023.

-- Apple announced its Vision Pro headset on June 5, 2023. The

Apple Vision Pro is a very powerful mixed reality headset with a

sleek design, eye and hand tracking and sharp micro-OLED displays.

This device offers immersive video watching, serious multitasking,

lots of games and reimagined FaceTime calls. The Apple Vision Pro

is so ambitious Apple does not call it a VR or AR headset. It is a

spatial computer that Apple is calling the "most advanced personal

electronics device ever." The Vision Pro headset is expected to be

released in early 2024 with a price of USD 3,500.

-- Microsoft unveiled fresh, immersive features for its

Microsoft Mesh-powered Team platform, it announced at its Build

2023 event in June 2023. With the update, users can add immersive

experiences to private previews on the platform, leading to greater

engagement while attending meetings. Teams users can now connect in

immersive spaces with realistic interactivity. Meeting attendees

can now walk over to groups, wave to others, and similar

activities.

-- Google is working on a new AR headset called Project Iris

which is expected to be release in 2024.

These developments are expected to help accelerate growth in the

AR/VR market even further.

In addition, the AR/VR market is expected to be further boosted

by the development of the metaverse. The metaverse is a virtual

world that is created by the convergence of AR, VR, and other

technologies. It is expected to be a major driver of growth in the

AR/VR market, as it will provide a new platform for gaming,

entertainment, education, and work.

The metaverse is still in its early stages of development, but

it has the potential to be a major disruptive force in the tech

industry. As it continues to develop, it is likely to have a

significant impact on the AR/VR market.

Internet of Things

The Internet of Things (IoT) market is expected to grow

significantly in the coming years. According to a report by Allied

Market Research, the global IoT market size was valued at USD

544.38 billion in 2022 and is projected to reach USD 3,352.97

billion by 2030, exhibiting a CAGR of 26.1% during the forecast

period (2023-2030). The growth of the IoT market is being driven by

a number of factors, including the increasing demand for connected

devices, the growth of the cloud computing market, and the

development of new IoT technologies. The increasing demand for

connected devices is one of the key drivers of the IoT market.

Connected devices are used in a variety of applications, including

smart homes, smart cities, and industrial automation. The growth of

the cloud computing market is also contributing to the growth of

the IoT market. Cloud computing provides a platform for storing and

processing data from IoT devices. Furthermore, the development of

new IoT technologies is also contributing to the growth of the

market. These new technologies include 5G, artificial intelligence,

and machine learning. 5G will enable faster and more reliable

connections between IoT devices. Artificial intelligence and

machine learning will be used to analyze data from IoT devices and

make predictions.

Cybersecurity

The global artificial intelligence (AI) in cybersecurity market

size was evaluated at USD 17.4 billion in 2022 and is expected to

hit around USD 102.78 billion by 2032, growing at a CAGR of 19.43%

between 2023 and 2032. The growth of the cyber security market is

being driven by a number of factors, including the increasing

number of cyber-attacks, the growing adoption of cloud computing,

and the increasing use of IoT devices. Cyber-attacks are becoming

more sophisticated and targeted, and they are causing significant

financial and reputational damage to organizations. The growing

adoption of cloud computing is also contributing to the growth of

the cyber security market. Cloud computing provides a new attack

surface for cyber criminals, and it is important for organizations

to have the right security measures in place to protect their data.

The increasing use of IoT devices is also contributing to the

growth of the market. IoT devices are often connected to the

internet, which makes them vulnerable to cyber attacks. It is

important for organizations to secure their IoT devices to protect

their data and systems. The future prediction for growth of the

cyber security market is very positive. The market is expected to

continue to grow at a significant rate in the coming years. This

growth will be driven by the increasing number of cyber-attacks,

the growing adoption of cloud computing, and the increasing use of

IoT devices.

Artificial Intelligence

The global artificial intelligence market size was valued at USD

428.00 billion in 2022. The market is projected to grow from USD

515.31 billion in 2023 to USD 2,025.12 billion by 2030, exhibiting

a CAG of 21.6% during the forecast period. Artificial intelligence

is the simulation of human intelligence processes using various

machines by means of creating intelligent software and hardware

capable of replicating human behavior such as learning and

problem-solving. The report covers Al-based solutions such as AWS

Chatbots, OpenAl Codex, and Azure Al, and others. The global market

is set to grow drastically with the surge in artificial

intelligence applications, increased number of relevant

partnerships and collaborations, rise in small-scale Al providers,

changing complexities of business structure, and hyper-personalized

service demands. Additionally, government initiatives and

investments in Al technologies for enterprises and end users create

benefits.

The benefit of investing in companies in these four key sectors

at a Seed stage are that:

Sure Valley Ventures can invest in these companies at attractive

valuations of between GBP2 to GBP8m and get up to 20% of the

company for initial investment amounts of between GBP0.75m to

GBP1.25m.

-- The investment sectors (AR/VR, IoT, AI, and Cybersecurity)

have massive growth potential ahead of them which creates a

tailwind behind the companies that are creating these new

markets.

-- These sectors are also ones that have the potential of

creating the next big European Companies and build on Europe's

existing technology strengths.

-- These companies have the potential to get to exponential

growth and of achieving an IPO or being acquired by one of the

Silicon Valley giants who are all investing in these sectors.

-- The Sure Valley Ventures Platform and Network can help

fast-track the development of these companies across the chasm to

the Series A investment round, which in turn increases the

potential for an outsized return and also reduces the risk of the

failure of a portfolio company.

In summary, Sure Ventures plc can gain exposure to all of these

benefits through its participation in the Sure Valley Ventures

Funds, as further outlined below.

PORTFOLIO BREAKDOWN

On 6 February 2018, the Company entered into a EUR4.5m

commitment to Sure Valley Ventures ("Fund I"), the sole sub-fund of

Suir Valley Funds ICAV and its investment was equalised into Fund I

at that date. On 31 August 2019 a further EUR2.5m was committed to

Fund I, taking the total investment in Sure Valley Ventures to

EUR7m. The first drawdown was made on 5 March 2018 and as at 31

March 2023, a total of EUR6,309,394 had been drawn down against

this commitment.

On 26 April 2019, the Company made a direct investment of

GBP500,000 into VividQ Limited, a deep tech start-up with world

leading expertise in 3D holography. VividQ Limited completed an

additional funding round in May 2021 which saw the valuation of

this investment rise to GBP794k, representing a 59% unrealised

gain. This investment represents the second direct investment of

the Company, alongside Let's Explore Group PLC (formerly Immotion

Group PLC), which was announced on 24 April 2018.

On 25 February 2022, Sure Ventures plc committed to invest GBP5m

into the second fund of Sure Valley Ventures ("Fund II"). Fund II

completed an GBP85m first close of a GBP95m UK software technology

fund, which aims to increase the supply of equity capital to

high-potential, early-stage UK companies. The first drawdown was

made on 23 February 2022 and as at 31 March 2023, a total of

GBP250,000 had been drawn down against this commitment.

As detailed in the Statement of Financial Position included in

the following financial statements, these two Sure Valley Ventures

Fund investments alongside the two direct investments, represent

the entire portfolio of Sure Ventures plc as at 31 March 2023.

On 31 May 2022, the Company announced a placing of 441,860

ordinary shares, followed by a further placing of 191,387 ordinary

shares, announced on 12 January 2023. The ordinary shares were

admitted to trading on the Specialist Fund Segment of the London

Stock Exchange on 10 June 2022 and 18 January 2023 respectively,

under the existing ISIN: GB00BYWYZ460, taking the total shares in

admission as at 31 March 2023 to 6,646,472.

SUIR VALLEY FUNDS ICAV

Suir Valley Funds ICAV (the "ICAV") is a close-ended Irish

collective asset-management vehicle with segregated liability

between sub-funds incorporated in Ireland pursuant to the Irish

Collective Asset-management Vehicles Act 2015 and constituted as an

umbrella fund insofar as the share capital of the ICAV is divided

into different series with each series representing a portfolio of

assets comprising a separate sub-fund.

The ICAV was registered on 18 October 2016 and authorised by the

Central Bank of Ireland as a qualifying investor alternative

investment fund ("QIAIF") on 10 January 2017. The initial sub-fund

of the ICAV is Sure Valley Ventures, or Fund I, which had an

initial closing date of 1 March 2017. Fund I invests in a broad

range of software companies with a focus on companies in the AR/VR,

AI and IoT sectors.

As at 31 March 2023, Fund I had commitments totalling EUR27m and

had made seventeen direct investments into companies spanning the

AR/VR, AI and IoT sectors. One of these investments was sold in

2019, giving Fund I its first realised gain on exit of around 5X

return on investment. On 12 March 2018, Immersive VR Education

Limited, Fund I's first investment, completed a flotation on the

London Stock Exchange (AIM) and the Dublin Stock Exchange (ESM).

The public company is now called ENGAGE XR Holdings PLC - ticker

EXR (Formally VR Education Holdings PLC - VRE). EXR was the first

software company to list on the ESM since that market's inception.

In July 2020, following an improvement in share price, Fund I

decided to sell sufficient shares to recover its initial

investment. This resulted in a realised gain of EUR73k being

payable to Sure Ventures plc, along with its share of the initial

investment, and some Escrow funds from the aforementioned exit. The

final Escrow payment from the sale was settled in July 2021, seeing

another EUR151k flowing to the plc. Total distributions from Fund I

to the plc as at 31 March 2023 was EUR1,759,630.

SURE VALLEY VENTURES ENTERPRISE CAPITAL LP

Sure Valley Ventures Enterprise Capital Fund LP is a close-ended

UK based GP/LP Fund which completed its first close on 1 March

2022. The total commitments for this first close were GBP85m. The

British Business Bank are the cornerstone investor of this Fund,

committing GBP50m of the initial GBP85m, with Sure Ventures plc

committing a total of GBP5m.

Fund II has a similar investment strategy to the first Fund,

being a seed capital investor in high growth software companies

that are focused on bringing a disruptive innovation to market. It

plans to invest into 25 software companies from across the UK

through its new fund. As well as being based in London, Dublin, and

Cambridge, the Sure Valley team has recently opened an office in

Manchester to help access deals in the significant and exciting

innovation clusters that have developed around creative

technologies in the North of England and in the Metaverse and AI

opportunities in cities such as Manchester, Leeds, Sheffield and

Newcastle.

As at 31 March 2023, the Fund had drawn down a total of GBP4.25m

and has made its first two investments into a Belfast based company

called Retinize, for an amount of GBP1m and a London based company

called Jaid t/a Opsmatix Limited for GBP1m with the option to

invest a further GBP350k. The total invested capital to date for

Sure Ventures plc was GBP250,000.

PERFORMANCE

In the year to 31 March 2023, the Company's performance remained

strong, as it returned a net asset value of GBP1.20/unit,

representing a 7.06% decline from the audited March 2022 NAV of

GBP1.29p. The NAV remains largely unchanged as a result of minimal

fluctuations in valuation of any of the portfolio companies from

year end, against a backdrop of the usual cost base. The two direct

investments have had mixed results, with Let's Explore Group PLC

(formerly Immotion Group PLC), closing the year at 3.6p, down from

4.7p at the year-end; indicative of a tough few months in the

public markets and wider economy. VividQ remains unchanged, having

closed a new funding round to give Sure Ventures plc an unrealised

gain of 59% on its initial holding in the previous financial year.

Given the lack of revenue to support the ongoing operational costs

of the plc, these unrealised gains are key to maintaining a steady

NAV, until the point that we see more exits and realised gains.

FUTURE INVESTMENT OUTLOOK

Fund I has achieved one very positive realised gain, recovered

its full investment in its listed portfolio company, as well as

seeing a number of unrealised gains across the portfolio. The

portfolio of current investments is continuing to mature, with more

companies completing series A funding rounds, which has started to

provide the NAV growth that was set out to achieve from inception.

As the investment period of this Fund has now closed, there are no

more new investments to be made, with all remaining capital being

allocated to follow-on funding of existing investments, as these

companies continue to grow and provide the Fund with opportunities

to exit.

We remain confident in the future outlook of the Company for the

next financial year, particularly with the launch of the new

Enterprise Capital Fund, whilst also reserving the right to make

further direct investments provided there is sufficient working

capital to do so.

Shard Capital AIFM LLP

Investment Manager

10 May 2023

4 Strategic Report

Business Review

The strategic report on pages 12 to 18 has been prepared to help

shareholders assess how the Company operates and how it has

performed. The strategic report has been prepared in accordance

with the requirements of Section 414 A-D of the Companies Act 2006

(the "Act") and best practice. The business review section of the

strategic report discloses the Company's risks and uncertainties as

identified by the board, the key performance indicators used by the

board to measure the Company's performance, the strategies used to

implement the Company's objectives, the Company's environmental,

social and ethical policy and the Company's future

developments.

PrincipaL activity

The Company carries on business as an investment trust and its

principal activity is to invest in companies in accordance with the

Company's investment policy with a view to achieving its investment

objective.

Strategic and investment policy

Investment Policy

The Company's Investment Policy can be found at page 70 of this

Annual Report.

Future developments

While the future performance of the Company is dependent, to a

large degree, on the performance of the Fund which, in turn, is

subject to many external factors, the board's intention is that the

Company will continue to pursue its stated investment objective as

outlined on page 2. The Company's future developments and outlook

are discussed in more detail in the Chairman's Statement on page 4

and the Investment Manager's Report on pages 7 to 11.

Premium/Discount management

The board closely monitors the premium or discount at which the

Company's ordinary shares trade in relation to the Company's

underlying net asset value and takes action accordingly. Throughout

the period under review the Company's ordinary shares traded at

discount to its underlying net asset value. The board is of the

view that an increase of the Company's ordinary shares in issue

provides benefits to shareholders, including a reduction in the

Company's administrative expenses on a per share basis and

increased liquidity in the Company's shares.

Whilst the board believes that it is in the shareholders' best

interests to prevent the Company's shares trading at a discount to

net asset value as shareholders will be unable to realise the full

value of their investments, the current trend is for listed

investment trusts to trade at a discount to net asset value.

Notwithstanding this current discount to net asset value, the

Company may from time to time acquire its own shares, should there

be sufficient liquidity to do so.

Corporate and operational structure

Operational and portfolio management

The Company has outsourced its operations and portfolio

management to various service providers as detailed below:

-- Shard Capital AIFM LLP is appointed as the Company's manager

(the "Manager" or "Investment Manager") and Alternative Investment

Fund Manager ("AIFM") for the purposes of the Alternative

Investment Fund Managers Directive ("AIFMD");

-- Apex Fund Services (Ireland) Limited is appointed to act as the Company's administrator;

-- Apex Secretaries LLP is appointed as the Company's secretary.

-- INDOS Financial Limited is appointed as the Company's depositary;

-- Computershare Investor Services PLC is appointed as the Company's share registrar;

-- Shard Capital Partners LLP is appointed to act as the Company's placing agent; and

-- PKF Littlejohn LLP is appointed to act as the Company's auditors.

Alternative Investment Fund Managers Directive

In accordance with the AIFMD, the Company has appointed Shard

Capital AIFM LLP to act as the Company's AIFM for the purposes of

the AIFMD. The AIFM ensures that the Company's assets are valued

appropriately in accordance with the relevant regulations and

guidance. In addition, the Company has appointed INDOS Financial

Limited as depositary, to provide depositary services to the

Company as required by the AIFMD.

Donations

The Company made no political or charitable donations during the

period under review to organisations either within or outside the

EU (2022: none).

Environment, human rights, employee, social and community

issues

The Company is required by law to provide details of

environmental matters (including impact of the Company's business

on the environment), employee, human rights, social and community

issues (including information about any policies it has in relation

to these matters and the effectiveness of those policies). The

Company does not have any employees and the board comprises

non-executive directors. As an investment trust, its activities do

not have a direct impact on the environment. The Company aims to

minimise any detrimental effect that its actions may have by

adhering to applicable social legislation, and as a result does not

maintain specific policies in relation to these matters.

The Company has no operations and therefore no greenhouse gas

emissions to report nor does it have responsibility for any other

emissions producing sources under the Companies Act 2006 (Strategic

Report and Directors' Report) Regulations 2013, including those

within its underlying investment portfolio. However, the Company

believes that high standards of corporate social responsibility

such as the recycling of paper waste will support its strategy and

make good business sense.

In carrying out its investment activities and in relationships

with suppliers, the Company aims to conduct itself responsibly,

ethically and fairly.

Modern slavery

Due to the nature of the Company's business, the board does not

consider the Company to be directly within the scope of modern

slavery regulations. The board considers the Company's supply

chains, being with professional service providers within the UK or

the EU to be low risk in relation to this matter.

Anti-bribery and corruption

It is the Company's policy to conduct its business in an ethical

manner. The Company takes a zero tolerance approach to bribery and

corruption and is committed to acting professionally, fairly and

with integrity in its business dealings.

Principal Risks and Uncertainties

The board has carried out a robust assessment of its risks and

controls as detailed below. The day-to-day risk management

functions of the Company have been delegated to Shard Capital AIFM

LLP (the "Manager"), which reports to the board.

OperationaL Risks

Third Party Service Providers

The Company has no employees and the directors have all been

appointed on a non-executive basis. Whilst the Company has taken

all reasonable steps to establish and maintain adequate procedures,

systems and controls to enable it to comply with its obligations,

the Company is reliant upon the performance of third-party service

providers for its executive function. In particular, the Manager,

Depositary, Administrator and Registrar amongst others, will be

performing services which are integral to the day-to-day operation,

including IT, of the Company.

The termination of service provision by any service provider, or

failure by any service provider to carry out its obligations to the

Company, or to carry out its obligations to the Company in

accordance with the terms of its appointment, could have a material

adverse effect on the Company's operations and its ability to meet

its investment objective.

Mitigation

Day-to-day oversight of third-party service providers is

exercised by the Manager and reported to the board on a quarterly

basis. As appropriate to the function being undertaken, each of the

service providers is subject to regular performance and compliance

monitoring. The performance of Shard Capital AIFM LLP in its duties

to the Company is subject to ongoing review by the board on a

quarterly basis as well as formal annual review by the Company's

management engagement committee.

The appointment of each service provider is governed by

agreements which contain the ability to terminate each of these

counterparties with limited notice should they continually or

materially breach any of their obligations to the Company.

Reliance on key individuals

The Company will rely on key individuals at the Manager to

identify and select investment opportunities and to manage the

day-to-day affairs of the Company. There can be no assurance as to

the continued service of these key individuals at the Manager. The

departure of key individuals from the Manager without adequate

replacement may have a material adverse effect on the Company's

business prospects and results of operations. Accordingly, the

ability of the Company to achieve its investment objective depends

heavily on the experience of the Manager's team, and more generally

on the ability of the Manager to attract and retain suitable

staff.

Mitigation

The interests of the Manager are closely aligned with the

performance of the Company through the management and performance

fee structures in place and direct investment by certain key

individuals of the Manager. Furthermore, investment decisions are

made by a team of professionals, mitigating the impact loss of any

single key professional within the Manager's organisation. The

performance of the Manager in its duties to the Company is subject

to ongoing review by the board as well as formal annual review by

the management engagement committee.

Fluctuations in the market price of Issue Shares

The market price of the issued shares may fluctuate widely in

response to different factors and there can be no assurance that

the issued shares will be repurchased by the Company even if they

trade materially below their net asset value. Similarly, the shares

may trade at a premium to net asset value whereby the shares can

trade on the open market at a price that is higher than the value

of the underlying assets. There can be no assurance, express or

implied, that shareholders will receive back the amount of their

investment in the issued shares.

Mitigation

The Manager and the board closely monitor the level of discount

or premium at which the shares trade on the open market. Subject to

shareholders' approval, and compliance with the relevant companies

legislation, the Company may purchase the shares in the market with

the intention of enhancing the net asset value per ordinary share,

however there can be no assurance that any purchases will take

place or that any purchases will have the effect of narrowing any

discount to net asset value at which the ordinary shares may trade.

When the shares trade at a premium the Company may issue shares to

reduce the premium at which shares trade. As at 31 March 2023 the

shares were trading at a discount to net asset value.

Investments

Achievement of the Investment Objective

There can be no assurance that the Manager will continue to be

successful in implementing the Company's investment objective.

Mitigation

The Company's investment decisions are delegated to the Manager.

Performance of the Company against its investment objectives is

closely monitored on an ongoing basis by the Manager and the board

and is reviewed in detail at each board meeting. Any action

required to mitigate underperformance is taken as deemed

appropriate by the Manager.

Borrowing

The Company may use borrowings in connection with its investment

activities including, where the Manager believes that it is in the

interests of shareholders to do so, for the purposes of seeking to

enhance investment returns. Such borrowings may subject the Company

to interest rate risk and additional losses if the value of its

investments falls. Whilst the use of borrowings should enhance the

net asset value of the issued shares when the value of the

Company's underlying assets is rising, it will have the opposite

effect where the underlying asset value is falling. In addition, in

the event that the Company's income falls for whatever reason, the

use of borrowings will increase the impact of such a fall on the

Company's return and accordingly will have an adverse effect on the

Company's ability to pay dividends to shareholders.

Mitigation

The Manager and the board closely monitor the level of gearing

of the Company. The Company has a maximum limitation on borrowings

of 20% of net asset value (calculated at the time of borrowing)

which the Manager may affect at its discretion. During the year

ended 31 March 2019 the Company entered into a loan facility

agreement of GBP1,000,000 with Shard Merchant Capital Limited.

During the year the Company drew down GBP200,000 of this amount

(see note 11 for further details).

Liquidity of Investments

The Company expects to have a material level of exposure to

unquoted companies that are aligned with the Company's strategy and

that present opportunities to enhance the Company's return on its

investments. Such investments, by their nature, involve a higher

degree of valuation and performance uncertainties and liquidity

risks than investments in listed and quoted securities and they may

be more difficult to realise. The illiquidity of such investments

may make it difficult for the Company to sell them if the need

arises and may result in the Company realising significantly less

than the value at which it had previously recorded such

investments. Investments in unlisted equity securities, by their

nature, involve a higher degree of valuation and performance

uncertainties and liquidity risks than investments in listed

securities and therefore may be more difficult to realise.

Mitigation

The Company has established investment restrictions on the

extent to which it can invest up to 15% of net asset value in a

single investment. However, this restriction does not apply to

investments in the Fund or any Further Funds or collective

investment vehicles managed by third parties. Compliance with these

restrictions is monitored by the Manager and by the board on an

ongoing basis.

Regulations

Tax

Any changes in the Company's tax status or in taxation

legislation could affect the value of investments held by the

Company, affect the Company's ability to provide returns to

shareholders and affect the tax treatment for shareholders of their

investments in the Company.

Mitigation

The Company intends at all times to conduct its affairs so as to

enable it to qualify as an investment trust for the purposes of

Chapter 4 of Part 24 of the Corporation Tax Act 2010. Both the

board and the Manager are aware of the requirements which are to be

fulfilled in any accounting period for the Company to maintain its

investment trust status. Adherence to the conditions required to

satisfy the investment trust criteria are monitored by the

compliance function of the Manager and reviewed by the board on a

regular basis.

Breach of applicable legislative obligations

The Company and its third-party service providers are subject to

various legislation and regulations, including, but not limited to

The Data Protection Act 2018 and the General Data Protection

Regulation. Any breach of applicable legislative obligations could

have a negative impact on the Company and impact returns to

shareholders.

Mitigation

The Company engages only with third party service providers

which hold the appropriate regulatory approvals for the function

they are to perform, and can demonstrate that they can adhere to

the regulatory standards required of them. Each appointment is

governed by agreements which contain the ability to terminate each

of these counterparties with limited notice should they continually

or materially breach any of their legislative obligations, or their

obligations to the Company more broadly. Additionally, each of the

counterparties is subject to regular performance and compliance

monitoring by the Manager, as appropriate to their function, to

ensure that they are acting in accordance with applicable

regulations and are aware of any upcoming regulatory changes which

may affect the Company. Performance of third party service

providers is reported to the board on a quarterly basis, whilst the

performance of the Manager in its duties to the Company is subject

to ongoing review by the board on a quarterly basis as well as

formal annual review by the management engagement committee.

Key Performance Indicators

The board monitors success in implementing the Company's

strategy against a range of key performance indicators ("KPIs"),

which are viewed as significant measures of success over the longer

term. Although performance relative to the KPIs is also monitored

over shorter periods, it is success over the long term that is

viewed as more important, given the inherent volatility of

short-term investment returns. The principal KPIs are set out

below:

KPI Performance

Year ended 31 Year ended 31

March 2023 March 2022

--------------------- ---------------------

Movement in net asset value Decreased by Increased by

per ordinary share 7.06% 40.03%

--------------------- ---------------------

Premium/discount (after deducting Traded at a discount Traded at a discount

borrowings at fair value) of 20.71% at of 20.87% at

the year end the year end

--------------------- ---------------------

Movement in the share price Decreased by Decreased by

6.86% 2.9%

--------------------- ---------------------

The Company does not currently follow any benchmark. Similarly,

Sure Valley Ventures (the "Fund") does not follow any benchmark.

Accordingly, the portfolio of investments held by the Company and

Sure Valley Ventures will not mirror the stocks and weightings that

constitute any particular index or indices, which may lead to the

Company's shares failing to follow either the direction or extent

of any moves in the financial markets generally (which may or may

not be to the advantage of shareholders).

Promoting the success of the Company

Under Section 172 of the Companies Act 2006, the board has a

duty to promote the long-term success of the Company for the

benefit of its shareholders as a whole and, in doing so, have

regard to the likely consequences of its decisions in the long-term

upon the Company's other stakeholders and the environment.

The Company's objective is to achieve capital growth for

investors through exposure to early stage technology companies,

with a focus on software-centric businesses in its chosen target

markets.

The board believes that the values of integrity, accountability

and transparency form the basis of the Company's corporate culture

and promote good standards of governance.

The board has identified the Company's main stakeholders to be

its shareholders, Investment Manager and other key service

providers. The board seeks to understand the priorities of its

stakeholders and engages with them through the communication and

governance processes that it has put in place.

Shareholders

The board believes that transparent communication with

shareholders is important. In addition to the Annual Report and the

half-yearly report, the Company publishes quarterly portfolio

updates which are available on the Company's website together with

other information that the board believes shareholders will find

useful. The board welcomes feedback from shareholders and the

Investment Manager provides such feedback to the board on a regular

basis.

During the year, the Company issued 633,247 new ordinary shares

in response to investor demand. The board believes that share

issues are in the interests of shareholders as a whole as they

provide additional finance for investment opportunities, enable the

Company's fixed costs to be spread over a wider base and provide a

source of liquidity in the Company's shares.

Investment Manager

The Investment Manager has a fundamental role in promoting the

long-term success of the Company. The board regularly reviews the

performance of the investment portfolio at quarterly board meetings

and performs a formal annual evaluation of the performance of the

Investment Manager. This contact enables constructive regular

dialogue between the Investment Manager and the board.

Other key service providers

The board believes that strong relationships with its other key

service providers (Company Secretary, Administrator, Depositary and

Registrar) are also important for the long-term success of the

Company. There is regular contact between the board and the

Company's other key service providers. The board performs an annual

review of the services provided by the Company Secretary,

Administrator, Depositary and Registrar to ensure that these are in

line with the Company's requirements.

Environmental, Social and Governance ("ESG")

The board and the Investment Manager recognise the importance of

the impact of the Company's decisions and ESG factors are

integrated in the investment process.

Approval

The Strategic Report was approved by the board of directors on

11 July 2023 and signed on its behalf by:

Perry Wilson

Chairman

5 Directors' Report

Bo a rd of Directors

Perry Wilson

Chairman of the board and the management engagement committee

and a member of the audit committee.

Perry Wilson (Chairman) (independent)

Perry Wilson is a financial services professional with over 25

years' experience in investment banking and fund management,

responsible for running portfolio risk positions in global markets.

He started his career in accountancy before joining the asset

trading group at Lazard in 1987, focusing on illiquid credit and

structured products and going on to become a director of the

bank.

In 2003 Mr Wilson joined Argo Capital as executive director, an

AIM listed alternative investment fund management firm and was part

of a small team of portfolio managers that oversaw the group's

fiftyfold AUM growth to USD 1.3bn at it's height. After leaving

Argo in 2010 Mr Wilson joined Integra Capital to implement a liquid

credit strategy before setting up a fixed income sales and trading

operation for a Central Asian investment bank, Visor Capital in

2013.

Since 2015 Mr Wilson has been on the board of a number of UK and

offshore financial services firms and investment funds, as

independent non-executive director, and also acted as chair of

trustees for a UK pension plan, providing corporate governance and

oversight utilising his extensive financial markets background and

experience.

St. John Agnew

St. John Agnew

St. John trained as a solicitor and was an in-house Commercial

and Banking Counsel for TSB Bank. His responsibilities included

drafting and negotiating legal documentation in relation to all

Bank lending and commercial arrangements. This included many types

of commercial contracts and involved a close working relationship

with the technology team who required advice on a steady flow of

technology contracts.

He became an Investment Manager in 2000 and set up a fund in the

Cayman Islands in 2004 based on Technical Analysis which he

successfully operated and closed in late 2007. He continues to

advise on investment and is currently an Investment Manager

registered with Credo Capital with his own private clients.

St. John has also served as Trustee on a Pension fund for a

Charity and, using his legal and investment knowledge, he helped to

restructure the board to allow it to recognise and meet its

extensive ongoing Pension obligations. He is also currently a

non-executive director of a food company, The Big Prawn Company,

where he uses his knowledge and experience to help guide this

company.

gareth burchell

Gareth Burchell

Gareth Burchell began his career in the insurance industry and

spent three years at RBS Insurance prior to beginning his career in

investment advice and management. Mr. Burchell is currently Head of

Shard Capital Stockbrokers and chairs an investment committee that

specialises in providing funding for both listed and unlisted small

companies. Mr Burchell has had a focus on the small cap arena for

15 years and he and his team have provided GBP100m+ of funding to

300+ companies. He has an in-depth knowledge of the UK listing

process of various small cap exchanges.

Statutory information

Board members, and directors' and officers' insurance

The names and biographical details of the board members who

served on the board as at the year end can be found on page 20.

During the year under review the Company's directors' and

officers' liability insurance for its directors and officers as

permitted by section 233 of the Companies Act 2006 was covered and

maintained by Shard Capital AIFM LLP.

Status of the Company

The Company is an investment company within the meaning of

section 833 of the Companies Act 2006.

The Company operates as an investment trust in accordance with

Chapter 4 of Part 24 of the Corporation Tax Act 2010 and the

Investment Trust (Approved Company) (Tax) Regulations 2011. The

Company has obtained its initial approval as an investment trust

from HM Revenue & Customs. In the opinion of the directors, the

Company has conducted its affairs since its initial approval as an

investment trust in order that it is able to maintain its status as

an investment trust.

The Company is an externally managed closed-ended investment

company with an unlimited life and has no employees.

Internal controls and risk management

Details of the Company's principal risks and uncertainties can

be found in the Strategic Report on pages 12 to 18 inclusive of

details of the Company's internal controls. Details of the

Company's application of hedging arrangements, if any, are set out

on page 72, the Investment Policy section of these financial

statements.

Share capital - voting and dividend

As at 31 March 2023, the Company had 6,646,472 (2022: 6,013,225)

ordinary shares in issue. There are no other classes of shares in

issue and no shares are held in treasury.

The maximum number of shares which can be admitted to trading on

the LSE without the publication of a prospectus is 20% of the

ordinary shares in issue on a rolling 12 month basis at the time of

admission of the shares.

During the year under review a total of 633,247 (2022: 662,500)

ordinary shares were issued as detailed below:

Date Shares issued Price paid per Discount to net

share (pence) asset value (%)

(1)

============== ===============

May 2022 441,860 107.5 16.6%

========== ============== =============== =================

Jan 2023 191,387 104.5 13.2%

========== ============== =============== =================

(1) Last published NAV at time of issue

As at 31 March 2023 there were 6,646,472 ordinary shares of 1p

in issue. Since the year end a further 200,000 ordinary shares have

been issued.

The ordinary shares carry the right to receive dividends and

have one voting right per ordinary share. There are no shares which

carry specific rights with regard to the control of the Company.

The shares are freely transferable. There are no restrictions or

agreements between shareholders on the voting rights of any of the

ordinary shares or the transfer of shares.

The Company has been incorporated with an unlimited life.

On a winding up or a return of capital by the Company, the

ordinary shareholders are entitled to the capital of the

Company.

No final dividend is being recommended. The Company's policy is

to pay dividends, if any, on an annual basis, as set out in the

Company's prospectus dated 17 November 2017 and the supplementary

prospectus dated 2 January 2018 (the "Prospectus"). There were no

dividends paid in respect of the year ended 31 March 2023 (2022 -

None).

The Company will pay out such dividends as are required for it

to maintain its investment trust status.

Substantial share interests

The Company has received the following notification in

accordance with the Disclosure and Transparency Rule 5.1.2R of an

interest in the voting rights attaching to the Company's issued

share capital.

The Company received a notification on 8 March 2021 that Pires

Investments plc had acquired an interest in 1,500,000 ordinary

shares in the Company, representing 22.57% of the Company's

ordinary shares in issue at 31 March 2023.

Independent auditor

The Company's independent auditor, PKF Littlejohn LLP ("PKF"),

was appointed by the members on 16 April 2018 and has expressed its

willingness to continue to act as the Company's auditor for the

forthcoming financial year. The audit committee has carefully

considered the auditor's appointment, as required in accordance

with its terms of reference, and, having regard to its

effectiveness and the services it has provided the Company during

the period under review, has recommended to the board that the

independent auditor be appointed at the forthcoming Annual General

Meeting ("AGM"). At the AGM resolutions will be proposed for the

appointment of the independent auditor and to authorise the

directors to agree its remuneration for the forthcoming financial

year. In reaching its decision, the audit committee considered the

points detailed on pages 32 to 34 of the Audit Committee's

report.

Audit information

As r equi r e d b y section 4 1 8 o f t h e C om p ani e s A c t

2 0 06, t h e directors wh o he l d offi ce a t t h e d a te o f t

hi s repor t each confir m that , s o far as the y are awar e ,

there is no rele vant aud i t information o f w hich the C om p an

y 's au d itor is un aware a n d e ac h director ha s t a k e n al

l t h e s t ep s r e qui r e d o f a director to ma k e t h e m s

elve s a w a r e o f a n y r e l ev a n t a u d i t i n f o r m a t

io n a n d t o e s t ablish tha t t h e C om p an y ' s audi t o r

is awa re of that info r ma t ion.

Articles of Association

An y amendmen t s to t h e C om p an y ' s ar t icle s of a s so

cia t io n mus t b e mad e b y spe cia l r e s ol u t ion.

Going concern

The directors have reviewed the financial projections of the

Company from the date of this report, which shows that the Company

will be able to generate sufficient cash flows in order to meet its

liabilities as they fall due. Accordingly, the directors are

satisfied that the going concern basis remains appropriate for the

preparation of the financial statements. The Company also has

detailed policies and processes for managing the risks, set out in

the Investment Policy on pages 71 to 72.

Viability statement

In accordance with the revised Association of Investment

Companies Code of Corporate Governance published in February 2019

and revised UK Corporate Governance Code, published by the

Financial Reporting Council in July 2018, the directors have

assessed the prospects of the Company over a three-year period

ending March 2026. The board believes this period to be appropriate

taking into account the current trading position and the potential

impact of the principal risks that could affect the viability of

the Company. At 31 March 2023, the Company's cash less liabilities

amounted to (GBP235,186) which may pose a potential risk to the

viability of the Company.

Analysis to assess viability has focused on the risks in

delivery of the growth of the business and a series of projections

have been considered changing funding levels and the performance of

the assets acquired.

The analysis demonstrates that, the Company would be able to

withstand the impact of the risks identified. Based on the robust

assessment of the principal risks, prospects and viability of the

Company, the board confirms that they have reasonable expectation

that the Company will be able to continue in operation and meet its

liabilities as they fall due over the three-year period ending

March 2026.

Management and administration

Company Secretary

Apex Secretaries LLP (the "Company Secretary") is the company

secretary of the Company.

Administrator

Apex Fund Services (Ireland) Ltd (the "Administrator"), is the

administrator of the Company. The Administrator provides the

day-to-day administration of the Company. The Administrator is also

responsible for the Company's general administrative functions,

such as the calculation of the net asset value and maintenance of

the Company's accounting records.

Under the terms of the administration agreement, the

Administrator is entitled to an annual administration fee equal to

the greater of: (i) EUR28,000 per annum; and (ii) an amount equal

to 0.08% of the portion of NAV up to and including EUR100 million,

0.06% of the portion of NAV between EUR100 million and EUR200

million and 0.05% of the portion of NAV above EUR200 million

(exclusive of VAT and out of pocket expenses). The Administrator is

also entitled to reimbursement of all reasonable out of pocket

expenses incurred by it in connection with the performance of its

duties. The administration agreement can be terminated by either

party by providing 90 days' written notice.

Manager

Shard Capital AIFM LLP (the "Manager"), a UK-based company

authorised and regulated by the Financial Conduct Authority, is the

Company's manager and alternative investment fund manager ("AIFM")

for the purposes of the Alternative Investment Fund Managers

Directive ("AIFMD"). The Manager is responsible for the

discretionary management of the Company's assets and ensures that

these are valued appropriately in accordance with the relevant

regulations and guidance.

Under the terms of the management agreement, the Manager is

entitled to a management fee and a performance fee together with

reimbursement of reasonable expenses incurred by it in the

performance of its duties. From the period from first admission,

the management fee payable was based on 1.25% of the NAV. The

Manager is also entitled to receive a performance fee equal to 15%

of any excess returns over a high watermark, subject to achieving a

hurdle rate of 8% in respect of each performance period. Further

details on the management fee and the performance fee can be found

in Note 4 to the financial statements. The management agreement can

be terminated by either party providing twelve months' written

notice.

Depositary

The Company's depositary is INDOS Financial Limited (the

"Depositary"), a company authorised and regulated by the Financial

Conduct Authority. Under the terms of the depositary services

agreement the Depositary is entitled to a monthly depositary fee

equal to the greater of: (i) GBP2,000 and GBP2,917 per month

(depending on the activity of the Company); and (ii) an amount

equal to 1/12 of 0.03% of NAV (exclusive of VAT and out of pocket

expenses). The depositary services agreement can be terminated by

either party by providing 90 days' written notice.

Change of control

There are no agreements which the Company is party to that might

be affected by a change of control of the Company.

Subsequent events

Following the year end, Sure Ventures plc raised gross proceeds

of GBP200,000 by way of a private placing. The ordinary shares were

issued at 100p per share, representing the closing mid-price on 5

May 2023.

Future developments

Indications of likely future developments in the business of the

Company are set out in the Strategic Report on pages 12 to 18.

By order of the board

Apex Secretaries LLP

Company Secretary

Date: 11 July 2023

Corporate Governance Statement

The corporate governance statement explains how the board has

sought to protect shareholders' interests by protecting and

enhancing shareholder value. The directors are ultimately

responsible for the stewardship of the Company and this section

explains how they have fulfilled their corporate governance

responsibilities. This corporate governance statement forms part of

the directors' report.

As set out in the Prospectus, the Company's Specialist Fund

Segment securities are not admitted to the Official List of the UK

Listing Authority. Therefore the Company has not been required to

satisfy the eligibility criteria for admission to listing on the

Official List and is not required to comply with the Financial

Conduct Authority's Listing Rules. The board is committed to high

standards of corporate governance and have adopted the UK Corporate

Governance Code (the "UK Code") published by the Financial

Reporting Council ("FRC"). The Disclosure Guidance and Transparency

Rules ("DTR") require companies to disclose how they have applied

the principles and provisions of the UK Code. A copy of the UK Code

is available from the website of the Financial Reporting Council at

https://www.frc.org.uk/directors/corporate-governance-and-stewardship/uk-corporate-governance-code

.

The Association of Investment Companies ("AIC") has published

its own Code on Corporate Governance (the "AIC Code"). The FRC has

confirmed that AIC member companies who report against the AIC Code

will be meeting their obligations in relation to the UK Code and

the associated disclosure requirements of the DTR. The AIC Code is

available from the AIC's website at www.theaic.co.uk.

The board has considered the principles and provisions of the

AIC Code. The AIC Code addresses the principles and provisions set

out in the UK Code, as well as setting out additional principles

and provisions on issues that are of specific relevance to the

Company.

The board considers that voluntarily reporting against the

principles and provisions of the AIC Code, which has been endorsed

by the Financial Reporting Council, provides more relevant

information to shareholders.

Statement of compliance

The Company has complied with the recommendations of the AIC

Code and the relevant provisions of the UK Code, except as set out

below.

The UK Code includes provisions relating to:

-- The role of the chief executive;

-- Executive directors' remuneration;

-- The appointment of a senior independent director; and

-- The need for an internal audit function.

The board considers these provisions are not relevant to the

Company, being an externally managed investment company with no

executive directors. In particular, all of the Company's day-to-day

management and administrative functions are outsourced to third

parties. As a result, the Company has no executive directors,

employees or internal operations. The Company has therefore not

reported further in respect of these provisions.

In addition, the board does not, at present, consider that

separate nomination and remuneration committees would be

appropriate given the board's size, being three members in total.

Currently, decisions concerning the board's remuneration,