TIDMTAN

RNS Number : 9914W

Tanfield Group PLC

24 August 2022

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement via a Regulatory Information Service ("RIS"), this

inside information is now considered to be in the public domain

Tanfield Group Plc

("Tanfield" or the "Company")

Snorkel Investment & Loan Subscription Update

The Board of Tanfield (the "Board") is pleased to update the

market on its investment in Snorkel International Holdings LLC

("Snorkel"), the aerial work platform business, as well as with

respect to additional loan subscriptions.

Investment Background

-- Tanfield is a 49% shareholder in the equity of Snorkel

following the joint venture between the Company and Xtreme

Manufacturing LLC ("Xtreme") (the "Contemplated Transaction"), a

company owned by Don Ahern of Ahern Rentals Inc, relating to

Snorkel, in October 2013.

-- T he Snorkel investment is valued at GBP19.1m. The outcome of

the US and UK Proceedings referenced below could have an impact on

this valuation.

-- On 22 October 2019, the Company announced that it had

received a Summons and Complaint, filed in Nevada (the "US

Proceedings") by subsidiaries of Xtreme, relating to the

Contemplated Transaction .

-- On 24 October 2019, the Company announced it had become

necessary to issue and serve a claim in the English High Court

against Ward Hadaway (the "UK Proceedings"), the solicitor acting

for the Company at the time of the Contemplated Transaction, in

order to fully protect the Company's rights pending the outcome of

the US Proceedings.

-- On 26 February 2021, Ward Hadaway was granted permission to

join Foulston Siefkin, Tanfield's US based law firm who were

retained in 2013 to draft the documents governed by US law relating

to the Contemplated Transaction, into the UK Proceedings. As a

result, the Company amended its claim to include Foulston Siefkin

as a second defendant.

Highlights

-- In the second quarter of 2022, Snorkel achieved further sales

growth as it continued to recover following the global COVID-19

pandemic. Sales for the quarter increased to US$46.8m, compared to

US$40.3m for the second quarter of 2021, an increase of 16.3%. This

resulted in sales for the first 6 months of 2022 being US$88.6m,

compared to US$71.7m for the same period in 2021, an increase of

23.5%.

-- Despite the increase in sales, the EBITDA for the second

quarter of 2022 was a loss of US$4.3m, compared to a profit of

US$0.2m for the second quarter of 2021. Likewise, the EBITDA loss

for the first six months of 2022 increased to US$7.8m, compared to

US$2.5m for the same period in 2021.

Business Update

Tanfield is a 49% shareholder in the equity of Snorkel following

the joint venture between the Company and Xtreme, a company owned

by Don Ahern of Ahern Rentals Inc, relating to Snorkel, in October

2013 .

Snorkel continues to recover from the impact of the global

COVID-19 pandemic, which impacted its ability to operate as normal,

and has seen sales for the second quarter of 2022 increase to

US$46.8m, compared to US$40.3m for the second quarter of 2021, an

increase of 16.3%. This resulted in sales for the first 6 months of

2022 being US$88.6m, compared to US$71.7m for the same period in

2021, an increase of 23.5%.

Despite the increase in sales, the EBITDA for the second quarter

of 2022 was a loss of US$4.3m, compared to a profit of US$0.2m for

the same period in 2021. Likewise, the EBITDA loss for the first

six months of 2022 increased to US$7.8m, compared to US$2.5m for

the same period in 2021. The Board once again note that the gross

profit margin has reduced even further to 2.8% for the second

quarter of 2022, compared to 8.9% for the second quarter of 2021

and the already low level of 4.1% in Q1 2022. The Board is unaware

of the reason for the continuing reduction to the gross profit

margin and continues to believe that it is not in line with the

industry averages. Work to investigate this is ongoing.

To highlight the dramatic change in recent years, at the height

of the pandemic in Q2 2020, Snorkel achieved sales of only US$16.8m

and reported an EBITDA loss of US$4.3m. 2 years later in Q2 2022,

Snorkel sales have increased by almost 179% to US$46.8m compared to

Q2 2020, yet the reported EBITDA in both periods is a loss of

around US$4.3m. To put this further into context, in Q2 2017

Snorkel achieved a slightly lower level of sales at US$44.9m and

yet in that quarter reported an EBITDA profit of US$1.0m, some

US$5.3m higher than the loss reported in Q2 2022.

Below is a summary of the consolidated financial statement for

the second quarter of 2022, including comparative figures for the

previous 5 years:

US$000's Q2 2022 Q2 2021 Q2 2020 Q2 2019 Q2 2018 Q2 2017

Net sales 46,848 40,286 16,818 60,848 51,766 44,870

Cost of goods sold 45,521 36,720 16,852 52,951 45,108 39,084

Gross profit 1,327 3,566 (34) 7,897 6,658 5,786

-------- -------- -------- -------- -------- --------

Gross profit margin 2.8% 8.9% (0.2%) 13.0% 12.9% 12.9%

Selling, general, admin

&

currency costs 5,592 3,414 4,218 5,926 5,211 4,761

EBITDA (4,265) 152 (4,252) 1,971 1,447 1,025

-------- -------- -------- -------- -------- --------

Below is a summary of the consolidated financial statement for

the first six months of 2022, including comparative figures for the

previous 5 years:

US$000's H1 2022 H1 2021 H1 2020 H1 2019 H1 2018 H1 2017

Net sales 88,554 71,717 60,242 112,452 96,302 79,749

Cost of goods sold 85,514 66,126 56,598 98,682 84,033 69,181

Gross profit 3,040 5,591 3,643 13,770 12,269 10,569

-------- -------- -------- -------- -------- --------

Gross profit margin 3.4% 7.8% 6.0% 12.2% 12.7% 13.3%

Selling, general, admin

&

currency costs 10,784 8,069 9,546 12,754 11,480 9,164

EBITDA (7,744) (2,478) (6,212) 1,016 789 1,404

-------- -------- -------- -------- -------- --------

The Board is not able to determine if or when Snorkel's sales

might return to pre-pandemic levels. However, it views the ongoing

increase to sales as a positive development and is not aware of any

reason why this improving trend should not continue.

Loan Subscription

Further to the update on 24 May 2022, in which the Company

announced that the first loan note instrument (the "First Loan") of

up to GBP700,000 had subscriptions totalling GBP625,000, the second

loan note instrument (the "Second Loan") of up to GBP1m had

subscriptions totalling GBP950,000, and the third loan note

instrument (the "Third Loan") of up to GBP2m had subscriptions

totalling GBP950,000, the Board is pleased to announce that a

number of existing shareholders have collectively subscribed to a

further GBP300,000 of the Third Loan.

This constitutes a related party transaction under Rule 13 of

the AIM Rules as a result of OTK Holding A/S, which hold

approximately 14% of the issued shares of the Company, subscribing

to a further GBP135,000 of the Third Loan. The Third Loan is

unsecured and carries annual interest of 10% which is to accrue and

is repayable on the earlier of (i) 28 February 2025 or (ii) receipt

of funds relating to either the US or UK Proceedings. Should

repayment take place prior to 28 February 2025, a 20% early

redemption premium shall apply. The Directors of the Company,

having consulted with WH Ireland Limited, the Company's nominated

adviser, consider the terms of the transaction to be fair and

reasonable in so far as shareholders are concerned .

The Third Loan will be used to provide ongoing working capital

funding, including costs related to the US and UK Proceedings.

The Board believe that further subscriptions to the Third Loan

may be necessary to ensure that the Company continues to protect

its investment in Snorkel. Following discussions with the existing

shareholders, if further subscriptions were required, the Board are

of the opinion that further funding will be made available.

Legal Proceedings

The US Proceedings are continuing, with a jury trial currently

expected to take place around the summer of 2023. The UK

Proceedings are also continuing, with a trial scheduled for

November 2022. The Board continue to believe that a positive

outcome to either or both proceedings is possible. So far as it is

necessary, the Company will continue to vigorously defend and

advance its position in both proceedings, whilst continuing to seek

advice.

Further updates will be provided to Shareholders as and when

appropriate.

For further information:

Tanfield Group Plc 020 7220 1666

Daryn Robinson

WH Ireland Limited - Nominated Advisor / Broker

James Joyce / Megan Liddell 020 7220 1666

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFFFSITFIVFIF

(END) Dow Jones Newswires

August 24, 2022 02:00 ET (06:00 GMT)

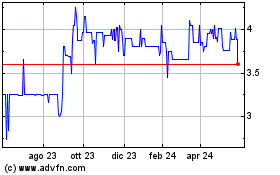

Grafico Azioni Tanfield (LSE:TAN)

Storico

Da Nov 2024 a Dic 2024

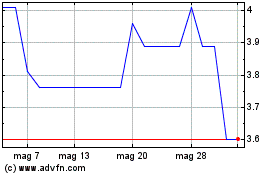

Grafico Azioni Tanfield (LSE:TAN)

Storico

Da Dic 2023 a Dic 2024