TIDMTGA

RNS Number : 5302W

Thungela Resources Limited

13 December 2023

Thungela Resources Limited

(Incorporated in the Republic of South Africa)

(Registration number: 2021/303811/06)

JSE share code: TGA

LSE share code: TGA

ISIN: ZAE000296554

('Thungela' or the 'Company' and together with its affiliates,

the 'Group')

Chief Financial Officer's Pre-Close Statement

for the financial year ending 31 December 2023

Operational agility sees Thungela confirm its full year 2023

guidance despite continued rail challenges, while also achieving

higher than expected production at Ensham

Dear Stakeholder

As we approach the end of 2023, we are proud to report that we

have demonstrated resilience in the face of external challenges,

made substantial progress in executing our strategic objectives,

and continued to live up to our purpose - to responsibly create

value together for a shared future.

Based on the Group's performance for the period 1 January 2023

to 30 November 2023 ("the year to date"(1) ), we are set to achieve

the full-year guidance metrics as outlined in our 2023 interim

results released in August 2023.

The followin g are the key insights into our performance for the

year to date and our expectations for the financial year ending 31

December 2023.

-- Energy demand reduced in Europe, China and much of Asia

following the milder 2023 Northern Hemisphere winter. This

reduction in demand was further exacerbated by already high coal

and gas stock levels in key import hubs. Inventory levels in the

main coal supply hubs increased due to the low demand in Europe,

with more producers shifting their focus to the Asian-Pacific

market. Energy prices, including the price of coal, remain volatile

and susceptible to ongoing geopolitical tensions.

-- Benchmark coal prices softened markedly in 2023 following the

record levels observed in 2022. The Richards Bay Benchmark coal

price(2) has averaged USD122.88/tonne for the year to date,

compared to USD270.87/tonne for FY 2022. The Newcastle Benchmark

coal price(3) has averaged USD175.15/tonne for the year to date,

compared to USD360.19/tonne for FY 2022.

-- Discount to the Richards Bay Benchmark coal price has been

approximately 15% for the year to date, compared to 15% for FY 2022

and 18% for H1 2023. Discounts in the second half of the year

narrowed as prices retracted. The average realised export price for

product sold ex-Richards Bay Coal Terminal ("RBCT") for the year to

date is USD104.85/tonne, compared to USD229.21/tonne for FY

2022.

-- The premium achieved by Ensham to the Newcastle Benchmark

coal price has been approximately 10.4% from completion of the

acquisition on 31 August 2023 through to 30 November 2023. This

premium is due primarily to the composition of the Ensham sales

book which includes volumes sold at fixed prices. The average

realised price for product from Ensham is USD153.44/tonne for the

same period.

--

-- Export saleable production relating to our South African

operations is expected to be 12.1Mt for FY 2023, marginally higher

than the mid-point of the guidance range of 11.5Mt to 12.5Mt issued

in August 2023. The removal of three underground sections in

response to poor rail performance resulted in a decrease of 7.6%

compared to the prior year (FY 2022: 13.1Mt).

-- Export saleable production at Ensham(4) for FY 2023 is

expected to be 2.9Mt (on a 100% basis), higher than the expectation

of 2.7Mt that prevailed upon completion of the acquisition - this

increase is primarily due to an enhanced focus on productivity. The

attributable export saleable production from Ensham for the Group

in FY 2023 is expected to be 0.8Mt - this represents 85% of the

total production for the four months from completion of the

acquisition to the end of the year (refer to Annexure A).

-- FOB cost per export tonne excluding royalties for the South

African operations for FY 2023 is expected to be at the low end of

the revised guidance range of R1,120 to R1,200/tonne issued in

August 2023 - this is due to higher-than-expected domestic revenue

offsets and a positive movement in the non-cash rehabilitation

provisions. Including royalties, the FOB cost per export tonne is

expected to be at the low end of the revised guidance range of

R1,170 to R1,250/tonne.

-- FOB cost per export tonn e excluding royalties at Ensham(5)

is expected to be approximately R1,947/tonne for the period from

completion through to the end of the year (refer to Annexure A).

Including royalties, the FOB cost per export tonne is expected to

be R2,342/tonne.

-- Export equity sales for the South African operations are

expected to be relatively stable year-on-year with 12.1Mt for FY

2023, compared to 12.2Mt in FY 2022.

-- Export equity sales for Ensham(4) are expected to be 3.0Mt

for FY 2023. The Group expects to recognise 1.2Mt of sales,

representing 100% of the sales in the four months following

completion of the transaction (refer to Annexure A).

-- Capital expenditure for the South African operations for FY

2023 is expected to be R3.0 billion, at the lower end of the

guidance range. This consists of R1.4 billion relating to

sustaining capital and R1.6 billion relating to expansionary

capital for the Elders and Zibulo North Shaft projects.

-- Capital expenditure at Ensham for FY 2023 is expected to be

R1.0 billion (on a 100% basis) - this relates to sustaining capex

only. The Group is expected to recognise R0.3 billion which

represents the attributable capital expenditure incurred in the

period from completion through to the end of the year on an 85%

basis (refer to Annexure A).

-- The Group had a net cash position of R10.5 billion on 30

November 2023 . In December 2023 we received the Ensham economic

benefit deed payment of R0.8 billion. We also expect to pay R2.1

billion in taxes and royalties in South Africa in December 2023.

Taking into account these movements, as well as expected cash

generation from operations and capital spend for December, net cash

is expected to be approximately R9.6 billion at the end of

2023.

Managing the impact of continued poor rail performance

The inconsistent and poor Transnet rail performance continued to

weigh heavily on the South African coal mining industry and indeed

on the Group's results in the second half of the year. The

annualised industry run rate dropped from 48.0Mtpa in H1 2023 to

45.9Mtpa in the second half of the year through to the end of

November 2023. This results in an annualised run rate of 47.0Mtpa

for the year to date, below the 50.3Mt railed in 2022.

The deterioration in the second half of the year has been

primarily attributable to an increase in security related issues as

well as locomotive failures. The coal industry, including Thungela,

continues to work closely with Transnet to remedy the security

situation and has been supporting Transnet through additional

security coverage since November 2023. A sustainable solution is

dependent on the procurement of spares for the locomotives supplied

by the Chinese locomotive supplier CRRC, either directly from CRRC,

or from alternative suppliers. Thungela and the coal industry

recognises the need for urgent intervention and RBCT (on behalf of

the industry) has placed orders with alternative suppliers for

critical locomotive spares. Transnet is also in the process of

procuring locomotive spares from alternative equipment

manufacturers.

In response to the continued rail underperformance, we curtailed

production at three underground sections earlier this year and

instituted free-on-truck sales in order to better manage stockpile

capacity at our operations. We continued to truck coal from our

operations to nearby sidings, allowing for further rail loading

options and reducing the risk of train cancellations. The wider

distribution pattern and our rapid load-out terminals are physical

infrastructure advantages which allow us to benefit from additional

trains when TFR experiences problems on certain sections elsewhere

on the line. As a result, the Group expects to rail 12.0Mt in

2023.

Update on the Ensham acquisition

Earlier this year, we announced the acquisition of the Ensham

thermal coal mine in Queensland Australia, marking a significant

milestone on our journey to geographic diversification, and we

successfully completed the transaction on 31 August 2023.

It was imperative that the acquisition be value accretive for

shareholders and the transaction was structured to enable Thungela

to benefit from the economics of the Ensham Business from the

lock-box date of 1 January 2023 through to completion. We are

pleased to report that the Group has received R0.8 billion in cash

through this mechanism, higher than initial estimates. Together

with the final closing adjustments, this results in a reduction in

the purchase price of the Ensham Business from the initial R4.1

billion, to approximately R3.2 billion.

The acquisition substantially increases Thungela's coal resource

base and provides access to new markets, notably Japan, as well as

exposure to the Newcastle Benchmark coal price. The Ensham sales

book consists of volumes sold against the Newcastle Benchmark coal

price, the Japanese Reference Price as well as fixed price

contracts with large utilities.

Thungela assumed control of the operations on 1 September 2023,

resulting in an enhanced focus on productivity. W e are confident

that the mine should produce 2.9Mt (on a 100% basis) in 2023,

higher than our initial expectation of 2.7Mt at the time of

completion of the transaction. The integration of Ensham into the

Group has progressed well and we completed the transition of all

services from the previous owner on 30 November 2023. Key areas of

judgement in relation to the acquisition of the Ensham Business,

and the impact thereof on the financial results for the year, are

in the process of being finalised.

Commitment to capital allocation framework and shareholder

returns

In South Africa we also continue to make good progress on the

Elders and Zibulo North Shaft projects which are on track with

regard to both the expected completion schedule and total expected

spend. By the end of 2023 we expect to have spent a total of R1.6

billion on the two projects, with a further R2.8 billion expected

to be spent in future to complete the projects.

While agile operational performance has allowed the Group to

navigate challenging rail and price headwinds this year, a degree

of caution pertaining to balance sheet flexibility remains

appropriate as softening coal prices have put the Group on a lower

cash generation trajectory.

Disciplined capital allocation remains a cornerstone of

Thungela's strategy, and our capital allocation strategy continues

to be informed by the funding requirements for our projects as well

as the continued uncertainty relating to rail performance.

Accordingly, the board considers it appropriate to maintain a cash

buffer of R5 billion as well as to continue to reserve the cash

required for the ongoing execution of the Elders and Zibulo North

Shaft projects.

The board also reaffirms that it is committed to shareholder

returns in accordance with Thungela's stated dividend policy, which

is to target a minimum payout of 30% of adjusted operating free

cash flow(6) , and the Group's capital allocation framework which

prioritises the return of capital to shareholders while maintaining

balance sheet flexibility.

Our disciplined capital allocation approach, agility and

enhanced resilience have served us well in 2023, enabling us to

execute on our strategic priorities, adapt to changing market

conditions and ensure that we are able to continue to create

superior returns for our shareholders in the long-term.

Deon Smith

Chief Financial Officer

Annexure A: Ensham accounting treatment

As a result of the acquisition, Thungela, through its subsidiary

Sungela Holdings, obtained an 85% interest in the Ensham Business,

with the remaining 15% owned by LX International, through its

subsidiary Bowen Investment (Australia).

Thungela holds a 75% interest in Sungela Holdings, with the

remaining 25% held by Audley Energy and Mayfair Corporations Group

(the co-investors). The co-investors purchase of equity in Sungela

Holdings was funded through a mezzanine loan provided by Thungela,

which is repayable in February 2025. The co-investors are required

to apply 90% of any distributions from Sungela Holdings towards

repayment of the loan.

The results of the Ensham Business have been included in the

Thungela Group results from the date the Group obtained operational

control, being 1 September 2023. The contractual agreements

governing the Ensham Business result in Thungela recognising 85% of

the results of the mine on a line-by-line basis, including saleable

production. Thungela is responsible for marketing all coal produced

by the Ensham Business, and thus sales volumes are recognised at

100%. Attributable metrics from Ensham represent the Group's 85%

interest therein, other than sales metrics which are at 100%. The

incremental costs relating to the 15% of sales volumes are

recognised as coal purchased from our joint venture partner within

operating costs. The results of the Thungela Group for the year

ended 31 December 2022 will not be updated to reflect the results

of the Ensham Business before the date we obtained control

thereof.

Annexure B: Operational performance

Table 1: Export saleable production by operation

Export saleable 2022 2023 % change

production Actual Forecast(7)

Mt

(a) (b) (b-a)/a

South Africa

------------------------- ------- ------------

Underground 9.7 9.0 -7%

------------------------- ------- ------------

Zibulo 4.3 4.2 -2%

------------------------- ------- ------------

Greenside 2.6 1.9 -27%

------------------------- ------- ------------

Goedehoop(8) 2.8 2.9 4%

------------------------- ------- ------------

Opencast 3.4 3.1 -9%

------------------------- ------- ------------

Khwezela 1.6 1.6 -

------------------------- ------- ------------

Mafube 1.8 1.5 -17%

------------------------- ------- ------------

Australia

------------------------- ------- ------------

Ensham (85%) 0.0 0.8 -

------------------------- ------- ------------

TOTAL 13.1 12.9 -2%

------------------------- ------- ------------

Table 2: Export sales by segment

Export sales 2022 2023 % change

Mt Actual Forecast(7)

South Africa 12.2 12.1 1%

--------------- ------- ------------

Underground 8.8 9.3 6%

--------------- ------- ------------

Opencast 3.4 2.8 -18%

--------------- ------- ------------

Australia

--------------- ------- ------------

Ensham (100%) 0.0 1.2 -

--------------- ------- ------------

Export sales 0.0 1.0 -

--------------- ------- ------------

Domestic sales 0.0 0.2 -

--------------- ------- ------------

TOTAL 12.2 13.3 9%

--------------- ------- ------------

Footnotes

1. All references to "year to date" refer to the period from 1

January 2023 to 30 November 2023 (FY 2023). FY 2022 refers to the

period from 1 January 2022 to 31 December 2022.

2. Richards Bay Benchmark price reference for 6,000kcal/kg

thermal coal exported from the Richards Bay Coal Terminal.

3. Newcastle Benchmark price reference for 6,000kcal/kg coal

exported from Newcastle, Australia. The NEWC Index is the main

price reference for physical coal contracts in Asia and is the

settlement price for a significant volume of index-linked

contracts.

4. Production at Ensham is crushed and screened before being

sold into either the export or Australian domestic market. Sales

into the Australian domestic market are at export parity prices

and, as a result, all production at Ensham is considered to be

export saleable production.

5. Based on an average ZAR/AUD exchange rate of R12.05:AUD1.00

for the four months from the completion of the acquisition.

6. Adjusted operating free cash flow is net cash flows from

operating activities less sustaining capex.

7. Based on the latest available management forecasts. Final figures may differ by +/- 5%.

8. Export saleable production for Goedehoop includes

approximately 715kt (2022: 372kt) attributable to the Nasonti

operation.

Review of Pre-Close Statement

The information in this Pre-Close Statement is the

responsibility of the directors of Thungela and has not been

reviewed or reported on by the Group's independent external

auditor.

A trading statemen t will be released once the Company has

reasonable certainty on the expected ranges for EPS and HEPS and to

the extent required by the JSE Listing Requirements.

Investor Call Details

A conference call and audio webinar relating to the details of

this announcement will be held at 13:00 SAST on Wednesday, 13

December 2023. A recording of the audio webinar will be made

available on the Thungela website from 17:00 SAST on the same date

- www.thungela.com/investors.

Conference Call registration:

https://services.choruscall.za.com/DiamondPassRegistration/register?confirmationNumber=2089702&linkSecurityString=57bdebc4a

Audio webinar registration:

https://themediaframe.com/mediaframe/webcast.html?webcastid=g3bZvNrt

Disclaimer

This announcement includes forward-looking statements. All

statements other than statements of historical facts contained in

this announcement, including, without limitation, those regarding

Thungela's financial position, business, acquisition and divestment

strategy, dividend policy, plans and objectives of management for

future operations (including development plans and objectives

relating to Thungela's products, production forecasts and Reserve

and Resource positions), are, or may be deemed to be,

forward-looking statements. By their nature, such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Thungela or industry results to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. The Group

assumes no responsibility to update forward-looking statements in

this announcement except as may be required by law.

The information contained in this announcement is deemed by the

Company to constitute inside information as stipulated under the

market abuse regulation (EU) no. 596/2014 as amended by the market

abuse (amendment) (UK mar) regulations 2019. Upon the publication

of this announcement via the regulatory information service, this

inside information is now considered to be in the public

domain.

Investor Relations

Ryan Africa

Email: ryan.africa@thungela.com

Shreshini Singh

Email: shreshini.singh@thungela.com

Media Contacts

Hulisani Rasivhaga

Email: hulisani.rasivhaga@thungela.com

UK Financial adviser and corporate broker

Liberum Capital Limited

Tel: +44 20 3100 2000

Sponsor

Rand Merchant Bank

(a division of FirstRand Bank Limited)

Rosebank

13 December 2023

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDKZMMZDZFGFZM

(END) Dow Jones Newswires

December 13, 2023 02:34 ET (07:34 GMT)

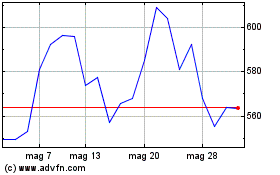

Grafico Azioni Thungela Resources (LSE:TGA)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Thungela Resources (LSE:TGA)

Storico

Da Nov 2023 a Nov 2024