TIDMTRP

RNS Number : 0699X

Tower Resources PLC

18 December 2023

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO

OR FROM THE UNITED STATES, CANADA, AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A BREACH OF THE RELEVANT SECURITIES LAWS OF SUCH

JURISDICTION.

This announcement does not constitute a prospectus or offering

memorandum or an offer in respect of any securities and is not

intended to provide the basis for any decision in respect of Tower

Resources PLC or other evaluation of any securities of Tower

Resources PLC or any other entity and should not be considered as a

recommendation that any investor should subscribe for or purchase

any such securities.

18 December 2023

Tower Resources plc

("Tower" or the "Company")

Completion of Subscription and Director's Dealings

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM listed oil and gas company with its focus on Africa, is

pleased to announce that, further to the Company's announcement

earlier today outlining the proposed subscription (the

"Subscription") for 3,000,000,000 new Ordinary Shares (the

"Subscription Shares"), the Company has successfully placed

3,000,000,000 new Ordinary Shares and raised gross proceeds

totalling GBP600,000 at a Subscription Price of 0.02 pence per

share. The Subscription Price of 0.02 pence per share represented a

13% discount to the closing bid price of the Company's shares on 15

December 2023.

Pursuant to the Subscription, Jeremy Asher, Chairman and CEO,

has entered into an Agreement (the "Subscription Agreement") to

subscribe for 400,000,000 new Ordinary Shares in the Subscription

for GBP80,000 as detailed below.

The participation of Jeremy Asher (the "Director Related Party")

constitutes a related party transaction in accordance with AIM Rule

13. Accordingly, Paula Brancato and Mark Enfield, the Director's

independent of the Subscription consider, having consulted with the

Company's Nominated Adviser, SP Angel Corporate Finance LLP, that

the terms of the Director Related Party participation in the

Subscription is fair and reasonable insofar as the Company's

shareholders are concerned.

The following table sets out the Directors' shareholdings and

percentage interests in the issued share capital of the Company

following completion of the subscription.

Holding prior Number Immediately following Admission

to the announcement of Subscription of the Subscription shares

of Proposed Subscription Shares acquired

pursuant

to the Subscription

Number of % of Number of Number of % of issued % of fully

Ordinary issued Ordinary Ordinary share diluted

Shares share Shares Shares capital share capital

capital

--------------- ----------- --------------------- -------------- ------------ --------------

Jeremy Asher(*) 611,603,608 6.46 400,000,000 1,011,603,608 8.11 7.18

--------------- ----------- --------------------- -------------- ------------ --------------

Mark Enfield(#) 1,877,546 0.02 - 1,877,546 0.02 0.01(--)

--------------- ----------- --------------------- -------------- ------------ --------------

Paula Brancato(#) - - - - - -

--------------- ----------- --------------------- -------------- ------------ --------------

* Includes shares held directly and via Agile Energy Ltd and

Pegasus Petroleum Ltd which are owned by the Asher Family Trust of

which Jeremy Asher is a lifetime beneficiary

(#) Independent Director

(--) This figure describes the ratio of shares held immediately

after admission to the fully diluted share capital; in the event

that Mr Asher and Mr Enfield exercised all warrants and options

they hold and continued to hold those additional shares after

exercise, then their respective shareholdings after full exercise

as a percentage of fully diluted capital would be 12.7% and 0.7%

respectively.

Share Capital Following the Subscription

Application has been made for the Subscription Shares to be

admitted to trading on AIM. It is expected that Admission of the

Shares will become effective and that dealings will commence by

8.00 a.m. on or around 10 January 2024.

Following admission of the Shares, the Company's enlarged issued

share capital will comprise 12,467,459,075 Ordinary Shares of 0.001

pence each with voting rights in the Company. This figure may be

used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in the interest in, the share

capital of the Company under the FCA's Disclosure and Transparency

Rules.

Warrants and Options in Issue

Following the issue of Broker Warrants the total number of

Warrants and Options in issue is 1,615,088,147 equating to 11.5% of

the Company's enlarged share capital assuming full exercise of all

warrants and share options.

IMPORTANT NOTICE

This announcement does not constitute or form part of any offer

or invitation to purchase, or otherwise acquire, subscribe for,

sell, otherwise dispose of or issue, or any solicitation of any

offer to sell, otherwise dispose of, issue, purchase, otherwise

acquire or subscribe for, any security in the capital of the

Company in any jurisdiction.

The information contained in this announcement is not to be

released, published, distributed or transmitted by any means or

media, directly or indirectly, in whole or in part, in or into the

United States or to any US Person. This announcement does not

constitute an offer to sell, or a solicitation of an offer to buy,

securities in the United States or to any US Person. Securities may

not be offered or sold in the United States absent: (i)

registration under the Securities Act; or (ii) an available

exemption from registration under the Securities Act. The

securities mentioned herein have not been, and will not be,

registered under the Securities Act and will not be offered to the

public in the United States.

This announcement does not constitute an offer to buy or to

subscribe for, or the solicitation of an offer to buy or subscribe

for, Ordinary Shares in the capital of the Company or any other

security in any jurisdiction in which such offer or solicitation is

unlawful. The securities mentioned herein have not been, and the

Ordinary Shares will not be, qualified for sale under the laws of

any of Canada, Australia, the Republic of South Africa or Japan and

may not be offered or sold in Canada, Australia, the Republic of

South Africa or Japan or to any national, resident or citizen of

Canada, Australia, the Republic of South Africa or Japan. Neither

this announcement nor any copy of it may be sent to or taken into

the United States, Canada, Australia, the Republic of South Africa

or Japan. In addition, the securities to which this announcement

relates must not be marketed into any jurisdiction where to do so

would be unlawful.

Note regarding forward-looking statements

This announcement contains certain forward-looking statements

relating to the Company's future prospects, developments and

business strategies. Forward-looking statements are identified by

their use of terms and phrases such as "targets" "estimates",

"envisages", "believes", "expects", "aims", "intends", "plans",

"will", "may", "anticipates", "would", "could" or similar

expressions or the negative of those, variations or comparable

expressions, including references to assumptions.

The forward-looking statements in this announcement are based on

current expectations and are subject to risks and uncertainties

which could cause actual results to differ materially from those

expressed or implied by those statements. These forward-looking

statements relate only to the position as at the date of this

announcement. Neither the Directors nor the Company undertake any

obligation to update forward looking statements, other than as

required by the AIM Rules for Companies or by the rules of any

other applicable securities regulatory authority, whether as a

result of the information, future events or otherwise. You are

advised to read this announcement and the information incorporated

by reference herein, in its entirety. The events described in the

forward-looking statements made in this announcement may not

occur.

Neither the content of the Company's website (or any other

website) nor any website accessible by hyperlinks on the Company's

website (or any other website) is incorporated in, or forms part

of, this announcement.

Any person receiving this announcement is advised to exercise

caution in relation to the Placing. If in any doubt about any of

the contents of this announcement, independent professional advice

should be obtained.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Contacts:

Tower Resources plc

Jeremy Asher

Chairman & CEO

Andrew Matharu

VP - Corporate Affairs +44 20 7157 9625

BlytheRay

Financial PR

Tim Blythe

Megan Ray +44 20 7138 3208

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint

Broker

Stuart Gledhill

Kasia Brzozowska +44 20 3470 0470

Axis Capital Markets Limited

Joint Broker

Lewis Jones

Ben Tadd +44 203 026 2689

Novum Securities Ltd

Joint Broker

Jon Bellis

Colin Rowbury +44 20 7399 9400

Panmure Gordon (UK) Limited

Joint Broker

John Prior

Hugh Rich +44 20 7886 2500

About Tower Resources

Tower Resources plc is an AIM listed energy company building a

balanced portfolio of energy opportunities in Africa across the

exploration and production cycle in oil and gas and beyond. The

Company's current focus is on advancing its operations in Cameroon

to deliver cash flow through short-cycle development and rapid

production with long term upside, and de-risking attractive

exploration licenses through acquiring 3D seismic data in the

emerging oil and gas provinces of Namibia and South Africa, where

world-class discoveries have recently been made.

Tower's strategy is centred around stable jurisdictions that the

Company knows well and that offer excellent fiscal terms. Through

its Directors, staff and strategic relationship with EPI Group,

Tower has access to decades of expertise and experience in Cameroon

and Namibia, and its joint venture with New Age builds on years of

experience in South Africa.

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM:

MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY ASSOCIATED WITH

THEM

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Jeremy Asher

--------------------------------- ------------------------------------------

2. Reason for the notification

-----------------------------------------------------------------------------

a) Position/status: Chairman and Chief

Executive Officer

--------------------------------- ------------------------------------------

b) Initial notification/Amendment: Initial notification

--------------------------------- ------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------------

a) Name: Tower Resources PLC

--------------------------------- ------------------------------------------

b) LEI: 2138002J9VH6PN7P2B09

--------------------------------- ------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------------

a) Description of the financial Ordinary Shares of

instrument, type of instrument: 0.001 pence each

Identification code: GB00BZ6D6J81

--------------------------------- ------------------------------------------

b) Nature of the transaction: Subscription shares

--------------------------------- ------------------------------------------

c) Price(s) and volume(s): Price(s) Volume(s)

0.02 pence 400,000,000

------------

--------------------------------- ------------------------------------------

d) Aggregated information: Single transaction

Aggregated volume: as in 4 c) above Price(s) Volume(s)

Price: 0.02 pence 400,000,000

--------------------------------- ------------------------------------------

e) Date of the transaction: 18 December 2023

07:15 GMT

--------------------------------- ------------------------------------------

f) Place of the transaction: Outside a trading

venue

--------------------------------- ------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIDGBDDXUBDGXR

(END) Dow Jones Newswires

December 18, 2023 02:30 ET (07:30 GMT)

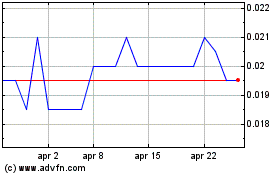

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Nov 2023 a Nov 2024