TIDMTWD

RNS Number : 0123M

Trackwise Designs PLC

09 January 2023

TRACKWISE DESIGNS PLC

("Trackwise", the "Company" or the "Group")

Board Changes

The Board of Trackwise Designs plc (AIM: TWD), a leading

manufacturer of specialist products using printed circuit

technology, is pleased to confirm, following the General Meeting to

approve the Fundraising, held on Friday 6 January 2023, the

appointment of Andrew Lapping and Chris Pennison to the Board of

the Company, as Non-Executive Chairman and Non-Executive Director

respectively, with effect from 8:00 a.m. on 9 January 2023.

As announced on 14 December 2022, and included in the Circular

to Shareholders dated 15 December 2022, in order to maintain Board

numbers and also to control the cost base, Susan McErlain and Ian

Griffiths will step down from the Board at the same time. Charles

Cattaneo intends to step down from the Board at the end of January

2023. Given the forthcoming departure of Charles Cattaneo, the

Company is commencing a recruitment process for an additional new

non-executive director.

Andrew Lapping, incoming Chairman of Trackwise, commented:

"Today marks a fresh start for the Group after a very tough

recent period.

I am delighted to take on the challenge of helping to lead

Trackwise with my former Hyperdrive CEO Chris Pennison as we join

the Trackwise Board. We bring industry experience to the Group with

a track record of transitioning smart technology into a

commercially viable and successful product.

Prior to our participation in the Fundraising, Chris and I

undertook significant referencing of the sales pipeline and the

core technology. As a result, we believe there is significant

potential for Trackwise and its IHT technology in the EV

market.

Whilst I recognise that the Fundraising has been difficult for

existing shareholders, I would urge all to get behind us as we look

to exploit the Company's world-class IP and production

facilities.

I want to close by reassuring all stakeholders that Trackwise

has enormous potential but to realise its true value, we have to

think and act smart in a very dynamic and rapidly expanding

market."

Definitions

All capitalised terms used in this announcement and not

otherwise defined shall have the meanings given to them in the

Circular.

Enquiries

Trackwise Designs plc +44 (0)1684 299 930

Philip Johnston, CEO www.trackwise.co.uk

Paul Cook, CFO

finnCap Ltd +44 (0)20 7220 0500

NOMAD and Broker

Ed Frisby/Fergus Sullivan - Corporate

Finance

Andrew Burdis/Barney Hayward - ECM

Alma PR +44 (0)20 3405 0205

Financial PR and IR

David Ison/Caroline Forde/Josh Royston/Kieran

Breheny

Notes to editors

Trackwise is a UK-based manufacturer of specialist products

using printed circuit technology.

The full suite includes: Improved Harness Technology(TM) ("IHT")

and Advanced PCBs - Microwave and Radio Frequency ("RF"), Short

Flex, Flex Rigid and Rigid Multilayer products.

IHT uses a proprietary, patented process that Trackwise has

developed to manufacture multilayer flexible printed circuits of

unlimited length. While the technology has many applications, the

directors expect that one of its primary uses will be to replace

traditional wire harnesses in a variety of industries.

The Company operates from three sites, located in Tewkesbury,

Stonehouse and Stevenage. It serves customers in Europe and North

America.

Trackwise Designs plc was admitted to trading on AIM in 2018

with the ticker TWD. For additional information please visit

www.trackwise.co.uk

Regulatory disclosures

INFORMATION REQUIRED UNDER RULE 17 AND SCHEDULE 2, PARAGRAPH (G)

OF THE AIM RULES FOR COMPANIES ("AIM RULES")

Full name: Andrew Christopher Lapping

Age: 59

Shareholding in the Andrew Lapping, and Chris Pennison,

Company: represent a number of underlying

new investors who, including Andrew

and Chris, have acquired in the

Placing a total of 130,000,000

New Ordinary Shares, via Hamilton

Capital Partners LLP; included

within this number is Andrew's

beneficial interest in 7,500,000

New Ordinary Shares. On Admission,

the aggregate of these New Ordinary

Shares will represent approximately

25.3 per cent. of the Company's

enlarged issued share capital.

In addition, on Admission, all

those investing in the Fundraising

will hold Warrants to subscribe

for 1 additional Ordinary Share

for each Warrant held in the ratio

of 1 Warrant for every 2 New Ordinary

Shares issued to those subscribers.

Andrew's beneficial interest in

Warrants will be 3,750,000 Warrants,

held via Hamilton Capital Partners

LLP. Andrew is a LLP Designated

Member of Hamilton Capital Partners

LLP.

Current directorships and/or Historic directorships

partnerships: and/or partnerships (within

the last five years):

24 Camphill Avenue LLP B L Developments Limited

Exchangelaw (No229) Limited Bamburgh First Property

Fibre Broadband Company LLP

Ltd BDL Select Hotels Limited

Gemini Print Southern Limited BDL Select Operations Limited

Gemini Print UK Limited Blackford Media LLP

Glasgow Renovation Homes Brookfields Park Syndicate

(No.2) LLP LLP

Glasgow Renovation Homes Crosshill Developments LLP

LLP Davidsons Mains Investments

Glasgow Renovation Homes LLP

No.3 LLP Duckhouse Gallery Limited

Hamilton Capital Partners Glasgow South Orbital (Hamilton)

LLP Limited

HCP HASI LLP Grace Darling Holidays Limited

HCP High Yield Carried Interest GSO Hamilton Cip Limited

No3 LLP Hamcap Redheughs LLP

HCP High Yield No3 Limited Hamilton Hindley Properties

Hindley Capital Ltd Ltd

Hindley Circuits Limited Hamilton Road Developments

Hindley Edinburgh Limited LLP

Hindley Prospect Hill Limited Hamilton Springburn Ltd

Hindley Residential Lettings Hamiltongold LLP

Ltd HCP 1 (Glasgow 2) Limited

Keepers Cottage LLP HCP 1 (Glasgow) Limited

Northern Edge Limited HCP Carried Interest LLP

Solway Capital Investments HCP Carried Interest No

Plc 2 LLP

The Hamilton Portfolio (Care HCP Durham 2 Ltd

Homes) Limited HCP Durham Ltd

The Hamilton Portfolio Partnership HCP General Partner Limited

LLP HCP General Partner No 2

Yellowfin Limited Limited

HCP High Yield No2 LLP

HCP High Yield No3.5 Limited

HCP Redheughs LLP

Hindley Cedar (Glasgow)

Homes LLP

Hindley Cedar Homes Limited

Hindley Cedar Property LLP

Hindley Communications Ltd

Hindley Fibre Limited

Hindley Glasgow Limited

Hindley Glasgow South LLP

Hindley Prem 2 LLP

Hindley Refurbthat LLP

Hindley West Embankment

Properties Limited

Hyperdrive Innovation Holdings

Limited

Hyperdrive Innovation Ltd

Hyperdrive Technologies

Ltd

Maybury Media LLP

Motherwell Football And

Athletic Club Limited (The)

Oak Hotels LLP

Paten & Co Limited

Paten Hotels Limited

Peak Income Partnership

(Balliol) Ltd

Peak Income Partnership

(Boldon) Ltd

Peak Income Partnership

LLP

Princes Street Suites Limited

Refurbthat Holdings Limited

Riverside Dyce LLP

Silver Travel Advisor Limited

Space 2001 Limited

St James Media LLP

TAL SE Land Development

Partnership LLP

The Hamilton Portfolio Limited

All the following disclosures relate to appointments where

Andrew Lapping was an investor and either a non executive director,

or a limited liability partnership (LLP) designated member.

On 12 April 2005, Andrew Lapping was appointed as a LLP

designated member of Barrance Farm LLP. Barrance Farm LLP went into

creditors' voluntary liquidation on 17 June 2014. The members'

statement of affairs dated 22 September 2014 showed an estimated

deficiency as regards creditors of GBP742,236. Under the

liquidation, no dividend was declared to creditors as the funds

realised were distributed, used or allocated for defraying the

expenses of the administration. Barrance Farm LLP was subsequently

dissolved on 24 December 2014.

On 17 December 1999, Andrew Lapping was appointed as a director

of Buzzsoft Limited and subsequently resigned as a director on 18

September 2001. Buzzsoft Limited went into creditors' voluntary

liquidation on 20 June 2002. The directors' statement of affairs

dated 1 February 2007 showed an estimated deficiency as regards

creditors of GBPnil. Buzzsoft Limited was subsequently dissolved on

16 May 2007.

On 1 January 2000, Andrew Lapping was appointed as a director of

Collingwood Developments Limited. Collingwood Developments Limited

went into administration on 11 June 2004 and subsequently went into

creditors' voluntary liquidation on 8 June 2006. Under the

liquidation, a dividend of 55 pence in the pound was paid to

unsecured creditors. Collingwood Developments Limited was

subsequently dissolved on 25 November 2016.

On 17 February 2003, Andrew Lapping was appointed as a director

of Container Store Limited. Container Store Limited went into

administration on 30 August 2005. Container Store Limited had no

realizable assets or creditors and accordingly the administration

was automatically ended on 29 August 2006. Container Store Limited

was subsequently dissolved on 8 June 2007.

On 12 December 2005, Andrew Lapping was appointed as a LLP

designated member of Coopersknowe Developments LLP. Coopersknowe

Developments LLP went into administration on 9 January 2009. The

members' statement of affairs dated 6 February 2009 showed an

estimated deficiency as regards creditors of GBP773,123.

Coopersknowe Developments LLP was subsequently dissolved on 14

April 2013.

On 1 March 2005, Andrew Lapping was appointed as a director of

Frasers Hamilton (Shrubhill) Limited. Frasers Hamilton (Shrubhill)

Limited went into administration on 10 September 2012. The

directors' statement of affairs dated 10 October 2012 showed an

estimated deficiency as regards creditors of GBP16,896,000. Frasers

Hamilton (Shrubhill) Limited was subsequently dissolved on 1

December 2014.

On 27 July 2007, Andrew Lapping was appointed as a LLP

designated member of Hamilton Road Developments LLP. Hamilton Road

Developments LLP went into administration on 28 October 2015. The

members' statement of affairs dated 13 November 2015 showed an

estimated deficiency as regards creditors of GBP478,284. Hamilton

Road Developments LLP was subsequently dissolved on 27 January

2021.

On 29 March 1999, Andrew Lapping was appointed as a director of

Motherwell Football And Athletic Club Limited (The) and

subsequently resigned as a director on 20 June 2012. Motherwell

Football And Athletic Club Limited (The) went into administration

on 25 April 2002 and was subsequently discharged from

administration on 20 April 2004. On 17 March 2004 Motherwell

Football And Athletic Club Limited (The) approved a corporate

voluntary arrangement (CVA) and the CVA was subsequently completed

on 27 April 2012. Under the CVA, a dividend of 23 pence in the

pound was paid to unsecured creditors. The company remains on the

Register of Companies.

On 25 August 2005, Andrew Lapping was appointed as a director of

Reston Developments Limited. Reston Developments Limited went into

administration on 20 December 2012. The directors' statement of

affairs dated 11 February 2013 showed an estimated deficiency as

regards creditors of GBP1,632,740. Reston Developments Limited was

subsequently dissolved on 28 November 2015.

On 6 March 2000, Andrew Lapping was appointed as a director of

Room 2 Limited and subsequently resigned as a director on 22 July

2005. Room 2 Limited went into administration on 30 August 2005 and

subsequently went into creditors voluntary liquidation on 30 August

2006. Under the liquidation, a dividend of 100 pence in the pound

was paid to preferential creditors and a dividend of 1.57 pence in

the pound was paid to unsecured creditors. Room 2 Limited was

subsequently dissolved on 10 December 2019.

On 5 August 2003, Andrew Lapping was appointed as a director of

SOE Development Limited. SOE Development Limited went into

administration on 19 April 2005 and subsequently went into

creditors' voluntary liquidation on 3 April 2006. The directors'

statement of affairs dated 4 May 2010 showed an estimated

deficiency as regards creditors of GBPnil. SOE Development Limited

was subsequently dissolved on 11 August 2010.

On 9 January 2009, Andrew Lapping was appointed as a director of

TAL CPT 2 Limited. TAL CPT 2 Limited went into creditors' voluntary

liquidation on 10 May 2011. The directors' statement of affairs

dated 8 February 2013 showed an estimated deficiency as regards

creditors of GBP414. Under the liquidation, no dividend was

declared to creditors as the funds realised were distributed, used

or allocated for defraying the expenses of the administration. TAL

CPT 2 Limited was subsequently dissolved on 19 May 2013.

On 3 April 2007, Andrew Lapping was appointed as a director of

TAL CPT Hub Company Limited. TAL CPT Hub Company Limited went into

creditors' voluntary liquidation on 27 October 2011. The directors'

statement of affairs dated 29 April 2014 showed an estimated

deficiency as regards creditors of GBP854,761. Under the

liquidation, GBP43,633 was returned to shareholders. TAL CPT Hub

Company Limited was subsequently dissolved on 1 August 2014.

On 9 January 2009, Andrew Lapping was appointed as a director of

TAL CPT Limited. TAL CPT Limited went into creditors' voluntary

liquidation on 10 May 2011. The directors' statement of affairs

dated 8 February 2013 showed an estimated deficiency as regards

creditors of GBP525,319. Under the liquidation, no dividend was

declared to creditors as the funds realised were distributed, used

or allocated for defraying the expenses of the administration. TAL

CPT Limited was subsequently dissolved on 19 May 2013.

On 19 February 2009, Andrew Lapping was appointed as a director

of TAL CPT Management Limited. TAL CPT Management Limited went into

creditors' voluntary liquidation on 8 May 2012. TAL CPT Management

Limited was subsequently dissolved on 17 August 2013.

On 23 January 2004, Andrew Lapping was appointed as a director

of Vis Entertainment Limited and subsequently resigned as a

director on 17 June 2004. Vis Entertainment Limited went into

administration on 7 April 2005 and subsequently went into

creditors' voluntary liquidation on 20 March 2007. The directors'

statement of affairs dated 7 April 2005 showed an unknown estimated

deficiency as regards creditors. Under the liquidation, no dividend

was declared to creditors as the funds realised were distributed,

used or allocated for defraying the expenses of the administration.

Vis Entertainment Limited was subsequently dissolved on 29 July

2014.

On 18 December 2007, Andrew Lapping was appointed as a director

of Yellowfin Limited. Yellowfin Limited went into administration on

26 August 2009 and subsequently went into compulsory liquidation on

20 August 2010. The directors' statement of affairs dated 26 August

2009 showed an estimated deficiency as regards creditors of

GBP8,535,823. Under the administration, a distribution of 100 pence

in the pound was paid to preferential creditors equivalent to

GBP3,202. No distribution was made to unsecured creditors under the

administration. Under the liquidation, a prescribed part

distribution of 0.0005 pence in the pound was set aside for

unsecured creditors equivalent to GBP3,949. The Company was

subsequently issued with a court order for winding up, following

the cessation of the appointment of the administrator, on 1

February 2011. Mr Lapping is still shown as a director on the

Register of Companies however he no longer has any involvement in

the company.

Full name: Christopher Roy Pennison

Age: 55

Shareholding in the Andrew Lapping, and Chris Pennison,

Company: represent a number of underlying

new investors who, including Andrew

and Chris, have acquired in the

Placing a total of 130,000,000

New Ordinary Shares, via Hamilton

Capital Partners LLP; included

within this number is Chris's

beneficial interest in 2,500,000

New Ordinary Shares. On Admission,

the aggregate of these New Ordinary

Shares will represent approximately

25.3 per cent. of the Company's

enlarged issued share capital.

In addition, on Admission, all

those investing in the Fundraising

will hold Warrants to subscribe

for 1 additional Ordinary Share

for each Warrant held in the ratio

of 1 Warrant for every 2 New Ordinary

Shares issued to those subscribers.

Chris's beneficial interest in

Warrants will be 1,250,000 Warrants.

Current directorships and/or Historic directorships

partnerships: and/or partnerships (within

the last five years):

Avid Electric Vehicles Limited Academy 360

Avid Innovation Limited HamiltonGold LLP

Avid Technology Group Limited Hyperdrive Innovation Holdings

Avid Technology Limited Limited

Avid Vehicles (Projects) Hyperdrive Innovation Ltd

Limited Hyperdrive Technologies

Collingwood Solutions Limited Ltd

DFV Management Services The Laidlaw Schools Trust

Ltd

Gemini Print Southern Limited

Gemini Print UK Limited

Glasgow Renovation Homes

(No2) LLP

Glasgow Renovation Homes

No.3 LLP

Hindley Circuits Limited

Hyperdrive Innovation Holdings

Limited

Hyperdrive Innovation Ltd

Hyperdrive Technologies

Ltd

Irridian Industrial Electronics

Limited

Turntide Drives Limited

Turntide Transport Limited

On 16 August 2004, Chris Pennison was appointed as a director of

James Ross & Son (Newcastle) Limited. James Ross & Son

(Newcastle) Limited went into administration on 15 February 2007

and subsequently went into creditors' voluntary liquidation on 16

August 2007. The directors' statement of affairs dated 2 April 2007

showed an estimated deficiency as regards creditors of

GBP1,454,794.40. The return of final meeting dated 17 November 2010

showed, under the liquidation, a preferential dividend of GBP37,184

equivalent to 100 pence in the pound and an unsecured dividend of

GBP442,031 equivalent to 23.76 pence in the pound was paid to

creditors. James Ross & Son (Newcastle) Limited was

subsequently dissolved on 22 February 2011.

There is no further information disclosable in respect of Andrew

Lapping and Chris Pennison pursuant to Rule 17 and Schedule 2,

paragraph (g) of the AIM Rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOABPMTTMTJMBPJ

(END) Dow Jones Newswires

January 09, 2023 02:00 ET (07:00 GMT)

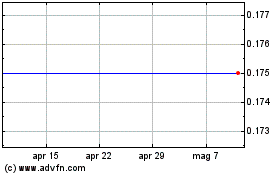

Grafico Azioni Trackwise Designs (LSE:TWD)

Storico

Da Mag 2024 a Giu 2024

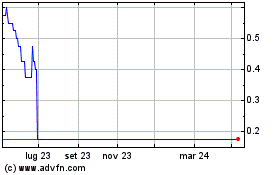

Grafico Azioni Trackwise Designs (LSE:TWD)

Storico

Da Giu 2023 a Giu 2024