Results of General Meeting, Capital Reorganisation & Total Voting Rights

29 Febbraio 2024 - 1:36PM

UK Regulatory

Results of General Meeting, Capital Reorganisation & Total

Voting Rights

Vast Resources plc / Ticker: VAST / Index: AIM /

Sector: Mining

29 February 2024

Vast Resources plc

(‘Vast’ or the ‘Company’)

Results of General Meeting, Capital

Reorganisation

& Total Voting Rights

Vast Resources plc, the AIM-listed mining

company, announces that at the Company’s General Meeting held

earlier today, all resolutions were passed and as such, the capital

reorganisation set out in the Notice of General meeting will be

completed. The proxy results for the resolutions are set out

below:

- Resolution 1: 84.10% in favour

- Resolution 2: 86.15% in favour

- Resolution 3: 85.89% in favour

Application has been made for the 928,607,357

new ordinary shares (‘New Ordinary Shares’) to be admitted to

trading on AIM (‘Admission’). It is expected that Admission will

become effective and dealing will commence in respect of the New

Ordinary Shares on 1 March 2024. The ISIN Code for the New Ordinary

Shares will be GB00BQ7WTT20 and the SEDOL will be BQ7WTT2.

Total Voting Rights

As result of the passing of the Resolutions, and

as announced on 14 February 2024, the number of ordinary shares in

issue has been reduced by a factor of six and as from Admission

will stand at 928,607,357 ordinary shares of 0.1p each. This figure

may then be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in Vast under the FCA’s Disclosure and

Transparency Rules.

Market Abuse Regulation (MAR)

Disclosure

Certain information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 as it forms part of UK Domestic Law by virtue of the

European Union (Withdrawal) Act 2018 (“UK MAR”) until the release

of this announcement.

**ENDS**

For further information, visit

www.vastplc.com or please contact:

Vast

Resources plc

Andrew Prelea (CEO)

|

www.vastplc.com

+44 (0) 20 7846 0974 |

Beaumont

Cornish – Financial & Nominated Advisor

Roland Cornish

James Biddle

|

www.beaumontcornish.com

+44 (0) 20 7628 3396 |

Shore

Capital Stockbrokers Limited – Joint Broker

Toby Gibbs / James Thomas (Corporate Advisory)

|

www.shorecapmarkets.co.uk

+44 (0) 20 7408 4050 |

Axis

Capital Markets Limited – Joint Broker

Richard Hutchinson

|

www.axcap247.com

+44 (0) 20 3206 0320 |

St Brides

Partners Limited

Susie Geliher |

www.stbridespartners.co.uk

+44 (0) 20 7236 1177 |

ABOUT VAST RESOURCES PLC

Vast Resources plc is a United Kingdom AIM

listed mining company with mines and projects in Romania,

Tajikistan, and Zimbabwe.

In Romania, the Company is focused on the rapid

advancement of high-quality projects by recommencing production at

previously producing mines.

The Company's Romanian portfolio includes 100%

interest in Vast Baita Plai SA which owns 100% of the producing

Baita Plai Polymetallic Mine, located in the Apuseni Mountains,

Transylvania, an area which hosts Romania's largest polymetallic

mines. The mine has a JORC compliant Reserve & Resource Report

which underpins the initial mine production life of approximately

3-4 years with an in-situ total mineral resource of 15,695 tonnes

copper equivalent with a further 1.8M-3M tonnes exploration target.

The Company is now working on confirming an enlarged exploration

target of up to 5.8M tonnes.

The Company also owns the Manaila Polymetallic

Mine in Romania, which the Company is looking to bring back into

production following a period of care and maintenance. The Company

has also been granted the Manaila Carlibaba Extended Exploitation

Licence that will allow the Company to re-examine the exploitation

of the mineral resources within the larger Manaila Carlibaba

licence area.

Vast has an interest in a joint venture company

which provides exposure to a near term revenue opportunity from the

Takob Mine processing facility in Tajikistan. The Takob Mine

opportunity, which is 100% financed, will provide Vast with a 12.25

percent royalty over all sales of non-ferrous concentrate and any

other metals produced. Vast has also been contractually appointed

to manage and develop the Aprelevka Gold Mines located along the

Tien Shan Belt that extends through Central Asia, currently

producing approximately 11,600 oz of gold and 116,000 oz of silver

per annum. It is the intention to increase production closer to

historical peak production of 27,000 oz gold and 250,000 oz silver.

Vast will be entitled to a 4.9% effective interest in the mines

with the option to acquire equity in the future.

The Company retains a continued presence in

Zimbabwe in respect of the Historic claims.

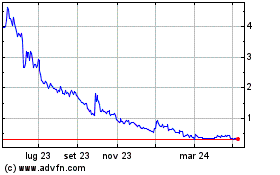

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Dic 2024 a Gen 2025

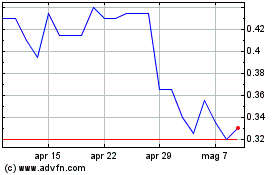

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Gen 2024 a Gen 2025