Tajikistan – Aprelevka Update

Vast Resources plc / Ticker: VAST / Index: AIM /

Sector: Mining

11 June 2024

Vast Resources plc

(‘Vast’ or the ‘Company’)

Tajikistan – Aprelevka

Update

Production Update

The Company wishes to update its report on gold

production at the four Aprelevka mines for May 2024 given in the

announcement of 4 June 2024 where the production had been estimated

based on a calculation of throughput and grade. Following

completion of the smelting, the actual production for May 2024

showed an increase from 933oz as had been estimated to 1,059oz –

significantly higher than the April production of 805oz and March

production of 643oz.

Formin Reports on mines at

Aprelevka

The Company is pleased to announce that further

to the announcement of 15 May 2024, which gave details of an update

resource report by Formin on the mine with the specific name

Aprelevka, Formin has now provided Gulf International Minerals Ltd

‘(Gulf’) with updated Resource Reports based on the SRK produced

wireframes, collated historic data and the 2019-2022 drilling

results on the other three active mines in the Aprelevka group,

namely Burgunda, Ikkizelon and Kyzylcheku (the ‘Reports’). The full

Reports can be found on the Company’s website using the links set

out in an Appendix to this announcement. The Reports include

updated NAEN code-compliant MREs. Russia is a member of CRIRSCO

(Committee for Mineral Reserves International Reporting Standards),

as are 14 other countries including Australasia, Canada, Europe,

South Africa and the USA. However, these national/regional codes

are not identical and the Russian code, NAEN, is neither directly

comparable with other codes that are frequently used to calculate

reserves and resources such as JORC nor is it commonly used by AIM

companies. Accordingly, caution should be taken in interpreting

these NAEN resources if used for investment purposes. The Company’s

mineral reporting standard remains JORC, and it remains committed

to reporting MREs under JORC.

As outlined in the announcement of 19 October

2023, the Company will manage the mining and development activities

of the mines in the Aprelevka group referenced above for a 5-year

period. In consideration, Vast will be entitled to a 10% share of

the earnings before interest, tax and depreciation that Gulf

receives from its 49% interest in Aprelevka. Vast will also have

the right at any time from 1 January 2025 until the end of the

5-year management period (i) to convert its earnings share

entitlement into a 10% equity interest in Gulf and (ii) to acquire

up to 20% of the share capital of Gulf at market value at the time

of acquisition, market value to be determined by the auditors in

default of an agreement between the parties.

The financing required to carry out the present

intended development at the mines will be arranged by Gulf

International Minerals ltd, under regular banking terms and

conditions repayable in priority to any dividends being paid by

Aprelevka. The Operator of Aprelevka is the local management team

in conjunction with Vast Resources PLC who is designated under its

management agreement to engage third party contractors to undertake

the day-to-day activities of the mining operation.

The following is the text of the Executive

Summary of the Report on Burgunda:

“Introduction

Formin SA. has been requested by Gulf

International Minerals Ltd, hereinafter also referred to as the

“Company” or the “Client”) to prepare a digitization of historical

data, provide a 3D geological model and an resource evaluation, for

Burgunda Mine located in the Northern part of Tajikistan.

Property Description

The Burgunda project consists of an open pit

operation and a nearby insitu leaching project. The deposit is

located near the border with Uzbekistan and appropriately 20km west

of Uzbek city of Almalyk. It lies almost 90km by paved, rutted, and

unpaved road northnorthwest of the Kansai Mill.

Ore description and Resource estimation

The ore is represented by two main quartz veins

with a high grade of gold and silver.

The resource estimate results are presented

below:

|

|

|

|

|

Average Value |

Material Content |

|

|

Resource classification |

Ore |

Density |

Mass |

Au |

Ag |

Au |

Ag |

|

|

|

|

g/cm³ |

t |

g/t |

g/t |

t |

t |

|

Measured

|

Vein 1 |

2.80 |

2,201.92 |

1.36 |

8.36 |

0.00 |

0.02 |

|

|

Vein 3 |

2.80 |

10.953.60 |

10.14 |

19.32 |

0.11 |

0.21 |

|

|

Total |

2.80 |

13,155.52 |

8.67 |

17.49 |

0.11 |

0.23 |

|

Indicated

|

Vein 1 |

2.80 |

31,913.28 |

2.12 |

19.31 |

0.07 |

0.62 |

|

|

Vein 3 |

2.80 |

19,120.64 |

11.36 |

18.81 |

0.22 |

0.36 |

|

|

Total |

2.80 |

51,033.92 |

5.58 |

19.12 |

0.29 |

0.98 |

|

Inferred

|

Vein 1 |

2.80 |

100,027.20 |

2.45 |

15.15 |

0.25 |

1.52 |

|

|

Vein 3 |

2.80 |

46,220.16 |

11.47 |

19.64 |

0.53 |

0.91 |

|

|

Total |

2.80 |

146,247.36 |

5.30 |

16.57 |

0.78 |

2.42 |

|

Total

|

Vein 1 |

2.80 |

134,142.40 |

2.35 |

16.03 |

0.32 |

2.15 |

|

|

Vein 3 |

2.80 |

76,294.40 |

11.25 |

19.38 |

0.86 |

1.48 |

|

|

Total |

2.80 |

210,436.80 |

5.58 |

17.25 |

1.17 |

3.63 |

“ |

The following is the text of the Executive

Summary of the Report on Ikkizelon:

“Introduction

Formin SA. has been requested by Gulf

International Minerals Ltd, hereinafter also referred to as the

“Company” or the “Client”) to prepare a digitization of historical

data, provide a 3D geological model and an resource evaluation, for

Ikkizelon Mine located in the Northern part of Tajikistan.

Property Description

The Ikkizelon gold vein deposit occupies an area

of 0.7km2 extending in a south-eastern direction between

the headwaters of Shakarbulak, Shorbulak and Kuruk in the central

part of the Kalkanat Mountains. The area belongs to the Matchinsk

region of Khujand province.

Ore description and Resource estimation

The ore is represented by 14 main quartz veins

with a high grade of gold and silver.

The resource estimate results are presented

below

|

|

|

|

Average Value |

Material Content |

|

|

Resource class |

Density |

Mass |

Au |

Ag |

Au |

Ag |

|

|

|

g/cm³ |

t |

g/t |

g/t |

t |

t |

|

|

Measured |

2.80 |

127,939.32 |

10.12 |

23.82 |

1.29 |

3.05 |

|

|

Indicated |

2.80 |

130,005.13 |

9.45 |

25.60 |

1.23 |

3.33 |

|

|

Inferred |

2.80 |

146,026.42 |

7.14 |

20.46 |

1.04 |

2.99 |

|

|

Total |

2.80 |

403,970.86 |

8.83 |

23.18 |

3.57 |

9.36 |

“ |

The following is the text of the Executive

Summary of the Report on Kyzylcheku.

“Introduction

FORMIN S.A. has been requested by GULF

INTERNATIONAL MINERALS LTD, hereinafter also referred to as the

“Company” or the “Client”) to prepare a the digitization of

historical data, provide a 3D geological model and an resource

evaluation, for Kyzylcheku Mine located in the Northern part of

Tajikistan.

Property Description

The Kizil Cheku deposit is situated in the

headwaters of the Aktash-sai (Aktash stream) on the southern slopes

of the Kuramin Ridge, 13 km east of the Kansai concentrator at an

elevation of 1,450 m. It is accessible by a good all-season dirt

road from Kansai.

Ore description and Resource estimation

The ore is represented by six main quartz veins

with a high grade of gold and silver.

The resource estimate results are presented

below:

|

|

|

|

Average Value |

Material Content |

|

|

Resource class |

Density |

Mass |

Au |

Ag |

Au |

Ag |

|

|

|

g/cm³ |

t |

g/t |

g/t |

t |

t |

|

|

Measured |

2.80 |

201,734.87 |

1.34 |

103.47 |

0.27 |

20.89 |

|

|

Indicated |

2.80 |

300,191.65 |

1.34 |

105.49 |

0.40 |

31.67 |

|

|

Inferred |

2.80 |

245,906.86 |

1.44 |

120.80 |

0.35 |

29.71 |

|

|

Total |

2.80 |

747,833.38 |

1.38 |

110.01 |

1.03 |

82.27 |

“ |

Total Vast attributable value including Aprelevka as

announced on 15 May 2024

| Vast

Attributable Value |

Ore |

Au oz |

Ag oz |

|

Measured |

77,496 |

9,263 |

98,773 |

|

Indicated |

60,108 |

6,896 |

91,972 |

|

Inferred |

81,970 |

9,879 |

116,117 |

|

Total |

219,573 |

26,070 |

306,846 |

Qualified Person

Vlad Andrei Negru, who has signed the report on

behalf of Formin, is a 'Certified Person' from the National Agency

for Mineral Resource in Romania. He is a geologist with

more than 12 years' experience in Mineral Resource

estimation. He has worked for a large number of projects in

Romanian and also as an SRK consultant. Mr Negru consents to

the inclusion of his name in this announcement in the form and

context to which it appears.

**ENDS**

For further information, visit

www.vastplc.com or please contact:

Vast

Resources plc

Andrew Prelea (CEO)

|

www.vastplc.com

+44 (0) 20 7846 0974 |

Beaumont

Cornish – Financial & Nominated Advisor

Roland Cornish

James Biddle

|

www.beaumontcornish.com

+44 (0) 20 7628 3396 |

Shore

Capital Stockbrokers Limited – Joint Broker

Toby Gibbs / James Thomas (Corporate Advisory)

|

www.shorecapmarkets.co.uk

+44 (0) 20 7408 4050 |

Axis

Capital Markets Limited – Joint Broker

Richard Hutchinson

|

www.axcap247.com

+44 (0) 20 3206 0320 |

St Brides

Partners Limited

Susie Geliher |

www.stbridespartners.co.uk

+44 (0) 20 7236 1177 |

ABOUT VAST RESOURCES PLC

Vast Resources plc is a United Kingdom AIM

listed mining company with mines and projects in Romania,

Tajikistan, and Zimbabwe.

In Romania, the Company is focused on the rapid

advancement of high-quality projects by recommencing production at

previously producing mines.

The Company's Romanian portfolio includes 100%

interest in Vast Baita Plai SA which owns 100% of the producing

Baita Plai Polymetallic Mine, located in the Apuseni Mountains,

Transylvania, an area which hosts Romania's largest polymetallic

mines. The mine has a JORC compliant Reserve & Resource Report

which underpins the initial mine production life of approximately

3-4 years with an in-situ total mineral resource of 15,695 tonnes

copper equivalent with a further 1.8M-3M tonnes exploration target.

The Company is now working on confirming an enlarged exploration

target of up to 5.8M tonnes.

The Company also owns the Manaila Polymetallic

Mine in Romania, which the Company is looking to bring back into

production following a period of care and maintenance. The Company

has also been granted the Manaila Carlibaba Extended Exploitation

Licence that will allow the Company to re-examine the exploitation

of the mineral resources within the larger Manaila Carlibaba

licence area.

The Company retains a continued presence in

Zimbabwe.

Vast has an interest in a joint venture company

which provides exposure to a near term revenue opportunity from the

Takob Mine processing facility in Tajikistan. The Takob Mine

opportunity, which is 100% financed, will provide Vast with a 12.25

percent royalty over all sales of non-ferrous concentrate and any

other metals produced.

Also in Tajikistan, Vast has been contracted to

develop and manage the Aprelevka gold mines on behalf of its owner

Gulf International Minerals Ltd (“Gulf”) under which Vast is

entitled, inter alia, to 10% of the earnings that Gulf receives

from its 49% interest in Aprelevka in joint venture with the

government of Tajikistan. Aprelevka holds four active operational

mining licences located along the Tien Shan Belt that extends

through Central Asia, currently producing approximately 11,600oz of

gold and 116,000 oz of silver per annum. It is the intention of the

Company to assist in increasing Aprelevka’s production from these

four mines closer to the historical peak production rates of

approximately 27,000oz of gold and 250,000oz of silver per year

from the operational mines.

Beaumont Cornish Ltd

Beaumont Cornish Limited (“Beaumont Cornish”) is

the Company’s Nominated Adviser and is authorised and regulated by

the FCA. Beaumont Cornish’s responsibilities as the Company’s

Nominated Adviser, including a responsibility to advise and guide

the Company on its responsibilities under the AIM Rules for

Companies and AIM Rules for Nominated Advisers, are owed solely to

the London Stock Exchange. Beaumont Cornish is not acting for and

will not be responsible to any other persons for providing

protections afforded to customers of Beaumont Cornish nor for

advising them in relation to the proposed arrangements described in

this announcement or any matter referred to in it.

Glossary

CRIRSCO

(JORC/CIM/PERC/NAEN)

|

Resource |

Measured |

Indicated |

Inferred |

Exploration Potential or Exploration Target |

|

Reserve |

Proven |

Probable |

|

|

|

Russian State Classification |

Reserve |

A, B and C1 |

B, C1 and C2 |

C2 and P1 |

P2 and P3 |

The following is a summary of technical

terms:

|

Ag |

Silver |

|

Au |

Gold |

|

Cu |

Copper |

|

Pb |

Lead |

|

Zn |

Zinc |

|

Mo |

Molybdenum |

|

Bi |

Bismuth |

|

W |

Wolfram (Tungsten) |

|

Cut-off |

The cut-off grade is the lowest grade, or quality, of mineralised

material that qualifies as economically mineable and available in a

given deposit. May be defined on the basis of economic evaluation,

or on physical or chemical attributes that define an acceptable

product specification; |

|

Economic composite |

This classifies drill data into ore and waste categories and takes

into account grade thresholds, mining dimensions and allowable

dilution. It is primarily an input into modelling the geometry of

mineralisation rather than grade. |

|

Grade |

Grade(s) means the quantity of ore or metal in a specified quantity

of rock |

|

Mineral Resource |

A 'Mineral Resource' is a concentration or occurrence of solid

material of economic interest in or on the Earth's crust in such

form, grade (or quality), and quantity that there are reasonable

prospects for eventual economic extraction. The location, quantity,

grade (or quality), continuity and other geological characteristics

of a Mineral Resource are known, estimated or interpreted from

specific geological evidence and knowledge, including sampling.

Mineral Resources are sub-divided, in order of increasing

geological confidence, into Inferred, Indicated and Measured

categories. |

|

Inferred Mineral Resource |

An 'Inferred Mineral Resource' is that part of a Mineral Resource

for which quantity and grade (or quality) are estimated on the

basis of limited geological evidence and sampling. Geological

evidence is sufficient to imply but not verify geological and grade

(or quality) continuity. It is based on exploration, sampling and

testing information gathered through appropriate techniques from

locations such as outcrops, trenches, pits, workings and drill

holes. |

|

Indicated Mineral Resource |

An 'Indicated Mineral Resource' is that part of a Mineral Resource

for which quantity, grade (or quality), densities, shape and

physical characteristics are estimated with sufficient confidence

to allow the application of Modifying Factors in sufficient detail

to support mine planning and evaluation of the economic viability

of the deposit. |

|

Exploration Target |

An Exploration Target is a statement or estimate of the exploration

potential of a mineral deposit in a defined geological setting

where the statement or estimate, quoted as a range of tonnes and a

range of grade (or quality), relates to mineralisation for which

there has been insufficient exploration to estimate a Mineral

Resource. |

|

Mineral Reserve |

An ‘Ore Reserve’ is economically minable part of a Measured and/or

Indicated Mineral Resource. It includes diluting materials and

allowances for losses, which may occur when the material is mined

or extracted and is defined by studies at Pre-Feasibility level as

appropriate that include application of Modifying Factors. Such

studies demonstrate that, at the time of reporting, extraction

could be reasonably justified. |

|

JORC Code |

Australasian Institute of Mining and Metallurgy Joint Ore Reserves

Committee code on mineral resources and ore reserves |

|

NAEN Code |

Russian Code for the Public Reporting of Exploration Results,

Mineral Resources and Mineral Reserves |

|

Mineralisation |

Process of formation and concentration of elements and their

chemical compounds within a mass or body of rock |

APPENDIX

TECHNICAL PROGRAM FOR BURGUNDA

MINE

PROJECT EXPLOITATION LICENCE

Prepared by Formin SA

Project Location:

Latitude N40°45’39.3” and Longitude E69°29’21.5”

Northern Tajikistan

Prepared for:

GULF INTERNATIONAL MINERALS LTD

For the full report, follow this link:

https://www.vastplc.com/wp-content/uploads/2024/06/burgunda-report.pdf

TECHNICAL PROGRAM FOR IKKIZELON

MINE

PROJECT EXPLOITATION LICENCE

Prepared by Formin SA

Project Location:

Latitude N40°41’55” and Longitude E69°26’55”

Northern Tajikistan

Prepared for:

GULF INTERNATIONAL MINERALS LTD

For the full report, follow this link:

https://www.vastplc.com/wp-content/uploads/2024/06/ikkizelon-report.pdf

TECHNICAL PROGRAM FOR KYZYLCHEKU

MINE

PROJECT EXPLOITATION LICENCE

Prepared by Formin SA

Project Location:

Latitude N40°31.05’9” and Longitude E69°48’39.5”

Northern Tajikistan

Prepared for:

GULF INTERNATIONAL MINERALS LTD

For the full report, follow this link:

https://www.vastplc.com/wp-content/uploads/2024/06/kyzylcheku.pdf

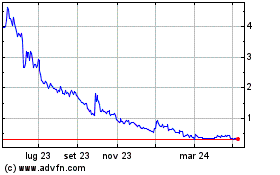

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Gen 2025 a Feb 2025

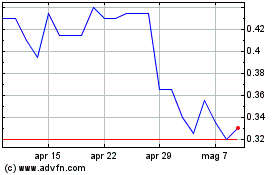

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Feb 2024 a Feb 2025