Update regarding Debt Funding from A & T Investments SARL

27 Giugno 2024 - 9:00AM

UK Regulatory

Update regarding Debt Funding from A & T Investments SARL

Vast Resources plc / Ticker: VAST / Index: AIM /

Sector: Mining

27 June 2024

Vast Resources plc

(‘Vast’ or the ‘Company’)

Update regarding Debt Funding from A

& T Investments SARL (“Alpha”)(the “Debt

Facility”)

Vast Resources plc, the AIM-listed mining

company, announces that it has received a Notice of Acceleration

and Enforcement in relation to the Debt Facility (the “Notice”).

The Notice given is to the effect that if the outstanding debt of

$5,820,000 (the “Debt”) is not repaid in full by 26 September 2024

it will then enforce the security given to Alpha by a third party

which party would in turn have recourse to Vast. At the time the

third party security was provided, the asset was valued at more

than the debt due to Alpha. The Notice also declares that the Debt

be immediately due and payable by Vast and is thereby demanded.

Alpha has informed the Company in subsequent

conversations that the Notice has been given to protect their

technical position concerning the enforcement of the third party

security and is not given with the purpose of causing damage to the

Company. Alpha furthermore is in negotiation with the Company on

further debt standstill arrangements.

The Company remains confident that it will be

able to repay Alpha in full by 26 September 2024 out of the

expected restructuring finance as referred to in the Company’s

announcement of 29 April 2024 when this can be implemented.

The Company will update the market with further

details in due course.

**ENDS**

For further information, visit

www.vastplc.com or please contact:

Vast

Resources plc

Andrew Prelea (CEO)

|

www.vastplc.com

+44 (0) 20 7846 0974 |

Beaumont

Cornish – Financial & Nominated Advisor

Roland Cornish

James Biddle

|

www.beaumontcornish.com

+44 (0) 20 7628 3396 |

Shore

Capital Stockbrokers Limited – Joint Broker

Toby Gibbs / James Thomas (Corporate Advisory)

|

www.shorecapmarkets.co.uk

+44 (0) 20 7408 4050 |

Axis

Capital Markets Limited – Joint Broker

Richard Hutchinson

|

www.axcap247.com

+44 (0) 20 3206 0320 |

St Brides

Partners Limited

Susie Geliher |

www.stbridespartners.co.uk

+44 (0) 20 7236 1177

|

Nominated Adviser

Beaumont Cornish Limited (“Beaumont Cornish”) is the Company’s

Nominated Adviser and is authorised and regulated by the FCA.

Beaumont Cornish’s responsibilities as the Company’s Nominated

Adviser, including a responsibility to advise and guide the Company

on its responsibilities under the AIM Rules for Companies and AIM

Rules for Nominated Advisers, are owed solely to the London Stock

Exchange. Beaumont Cornish is not acting for and will not be

responsible to any other persons for providing protections afforded

to customers of Beaumont Cornish nor for advising them in relation

to the proposed arrangements described in this announcement or any

matter referred to in it.

ABOUT VAST RESOURCES PLC

Vast Resources plc is a United Kingdom AIM

listed mining company with mines and projects in Romania,

Tajikistan, and Zimbabwe.

In Romania, the Company is focused on the rapid

advancement of high-quality projects by recommencing production at

previously producing mines.

The Company's Romanian portfolio includes 100%

interest in Vast Baita Plai SA which owns 100% of the producing

Baita Plai Polymetallic Mine, located in the Apuseni Mountains,

Transylvania, an area which hosts Romania's largest polymetallic

mines. The mine has a JORC compliant Reserve & Resource Report

which underpins the initial mine production life of approximately

3-4 years with an in-situ total mineral resource of 15,695 tonnes

copper equivalent with a further 1.8M-3M tonnes exploration target.

The Company is now working on confirming an enlarged exploration

target of up to 5.8M tonnes.

The Company also owns the Manaila Polymetallic

Mine in Romania, which the Company is looking to bring back into

production following a period of care and maintenance. The Company

has also been granted the Manaila Carlibaba Extended Exploitation

Licence that will allow the Company to re-examine the exploitation

of the mineral resources within the larger Manaila Carlibaba

licence area.

The Company retains a continued presence in

Zimbabwe.

Vast has an interest in a joint venture company

which provides exposure to a near term revenue opportunity from the

Takob Mine processing facility in Tajikistan. The Takob Mine

opportunity, which is 100% financed, will provide Vast with a 12.25

percent royalty over all sales of non-ferrous concentrate and any

other metals produced.

Also in Tajikistan, Vast has been contracted to

develop and manage the Aprelevka gold mines on behalf of its owner

Gulf International Minerals Ltd (“Gulf”) under which Vast is

entitled, inter alia, to 10% of the earnings that Gulf receives

from its 49% interest in Aprelevka in joint venture with the

government of Tajikistan. Aprelevka holds four active operational

mining licences located along the Tien Shan Belt that extends

through Central Asia, currently producing approximately 11,600oz of

gold and 116,000 oz of silver per annum. It is the intention of the

Company to assist in increasing Aprelevka’s production from these

four mines closer to the historical peak production rates of

approximately 27,000oz of gold and 250,000oz of silver per year

from the operational mines.

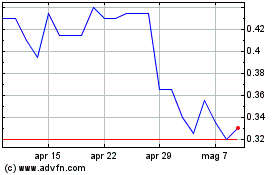

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Gen 2025 a Feb 2025

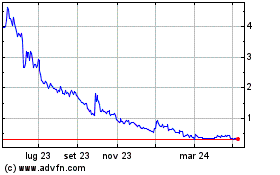

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Feb 2024 a Feb 2025