Interim Management Statement

06 Maggio 2008 - 9:00AM

UK Regulatory

Bovis Homes Group PLC

Bovis Homes Group PLC

Interim Management Statement

Tuesday 6 May 2008

Bovis Homes Group PLC is holding its Annual General Meeting at 11:30am on 9 May

2008 at the New Connaught Rooms, 61-65 Great Queen Street, London. In advance of

the AGM, this interim management statement comments on the financial performance

of the Group for the period from 1 January 2008 to the date of this statement

and on the outlook for the current financial year.

At the time of its preliminary results announcement for the year ended 31

December 2007, issued on 10 March 2008, the Group commented that the short term

outlook for the housing market in 2008 remained uncertain, with a reduced

availability of mortgage finance adversely impacting the housing market, and

reducing consumer confidence.

More recently, conditions in the housing market have deteriorated sharply. Well

publicised negative developments in the mortgage market have continued apace,

with a large number of mortgage products being withdrawn, mortgage interest

rates and fees being increased and more substantial deposits being required by a

range of different lenders. This, together with a general reduction in the

quantum of mortgage finance availability, has contributed to a much reduced

volume of mortgages being approved, such that the British Bankers Association

has reported a 46% decline in the number of mortgage approvals for house

purchases in March 2008 compared to March 2007. Combined with ongoing adverse

press speculation about the housing market, this is making homebuyers markedly

more cautious.

As a result, the Group's reservation levels since the date of the preliminary

results announcement have been disappointing. Reservations achieved to date for

2008 total 1,382 homes as compared to 1,979 reservations at the same time in

2007, a decrease of 30%. Housing gross margins for private reservations achieved

to date in 2008 have been maintained at high levels. However, if the recent more

difficult conditions in the housing market persist, and the level of

reservations, allied with the increase in cancellation rates, seen in recent

weeks does not improve, the Group will not be able to achieve a volume of legal

completions in 2008 that falls within the range of the Board's expectations at

the time of the preliminary results announcement.

In light of the recent market deterioration, the Board now expects that the

Group's results for the first half of the year to 30 June 2008 will be

significantly lower than it had previously anticipated and that with ongoing

market uncertainties, the outlook for the remainder of 2008 is difficult to

predict.

The timing of any improvement in the housing market is uncertain and, therefore,

the Group is positioning itself to allow it to trade across a range of differing

market outcomes. Whilst the Group continues to seek to maximise sales values in

those locations where market conditions remain orderly, sales prices have been

and will be adjusted, where appropriate, to reflect local market conditions. A

number of measures are being put into place to manage cash flows in relation to

land, construction work in progress and overheads. The Group anticipates opening

a number of new sales outlets over the next few months, with investment being

cautiously controlled, again based on local market conditions. This will

increase the Group's opportunities for reservations from these new sales outlets

and should allow returns to be achieved as early as possible on consented land

owned by the Group.

Whilst the short term trading environment remains unfavourable, the Group

continues to work on sustaining a high quality land bank to underpin future

profitable growth through strategic conversion, and the number of plots in its

land bank has increased since 1 January 2008. The Group has achieved residential

planning consent on circa 5,400 plots of strategic land, circa 3,200 plots of

which are now owned and included in the consented land bank. The remaining 2,200

plots are held under long term option by the Group. The consented land bank now

stands at circa 14,000 plots, with approximately 50% of this land bank

originating as strategic land. Notably, residential planning consent has been

achieved during 2008 on the Group's major strategic investments at Filton, north

Bristol, and Wellingborough. These two sites provide the Group with high quality

land in good locations.

The Group has bilateral committed loan facilities totalling �220 million which

do not mature until 2010. Net borrowings currently stand at circa �92 million,

which is in line with the Group's expectations as it approaches its normal

first-half year borrowing peak in May.

The Board continues to act in the long term interests of its shareholders.

Whilst acknowledging that short term profits are adversely affected by current

market conditions, the Group's long term investment strategy in land for

housebuilding will assist the Group in delivering sustained good medium and long

term performance. The underlying shortage of houses in the United Kingdom, as

evidenced by the Government's ambition to deliver three million new homes by

2020, will underpin housing market activity in the future. With modest gearing

and a strong consented land bank, Bovis Homes remains well positioned to benefit

from improved housing market conditions when they arise.

Conference Call for analysts

Please note that Malcolm Harris, Chief Executive, David Ritchie, Group Managing

Director and Neil Cooper, Group Finance Director of Bovis Homes will host a

conference call at 09:00am today, Tuesday 6 May 2008, to discuss this statement.

To access the call please dial 020 8515 2301 and ask for the Bovis Homes Interim

Management Statement conference call. Please dial in 5 minutes prior to the

start of the conference call to allow time for registration.

For further information, please contact:

Bovis Homes Group PLC

Tel: 020 7321 5010

Malcolm Harris, Chief Executive

David Ritchie, Group Managing Director

Neil Cooper, Group Finance Director

Shared Value Limited

Tel: 020 7321 5010

Andrew Best

Emily Bruning

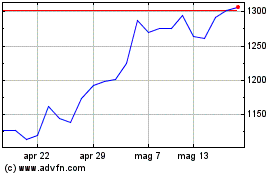

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

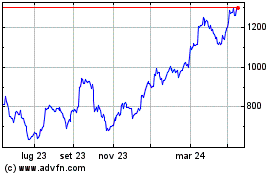

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024