Trading Statement

09 Luglio 2008 - 8:00AM

UK Regulatory

Bovis Homes Group PLC

Bovis Homes Group PLC

Trading Update

9 July 2008

Overview

The Group is today providing a trading update covering the six month period

ended 30 June 2008 ahead of reporting its interim results on Tuesday 26 August

2008.

Against the worst market backdrop that the Group has seen for many years, the

Group has achieved a good quality of profit on those private homes it has sold

but has achieved significantly lower volumes of legal completions, largely

arising through a severe reduction in mortgage availability caused by the

'credit crunch'. As previously advised, half year profit will be adversely

impacted by this sharp reduction in volume.

Sales & margins

For the six months ended 30 June 2008, the Group has legally completed the sale

of 851 homes, as compared to 1,256 homes legally completed in the comparable

period, a reduction of 32%. Within these totals, around 27% of homes legally

completed were social and partnership homes as compared to the first six months

of 2007 in which 13% were social and partnership homes.

For private homes, the Group has achieved an average net sales price of

�196,500, as compared to �204,500 in the first six months of 2007, principally

due to a shift in the private selling mix towards smaller properties in the

first half of 2008. Overall, including social and partnership homes, the average

sales price achieved by the Group for the six months ended 30 June 2008 was

�167,500 compared with �189,600 in the first half of 2007.

In line with the Group's aim to sustain good quality profits on those homes

sold, the Group's underlying housing gross margins on private home legal

completions held up well in the first half of 2008, only decreasing by

approximately 2% compared to the first half of 2007.

However, the overall dilution in the Group's housing gross margin will be

greater, reflecting the higher proportion of social and partnership homes in the

mix together with a number of other factors: these include the impact of

increased planning fees expensed on progression of strategic land opportunities,

which the Group continues to charge to housing profit as incurred, appropriate

provisioning in respect of semi-fixed site management costs incurred during a

period of lower build and sales activity in the first half of 2008, and

impairment provisions in respect of unsold part exchange properties. As a

result, the Group is expecting to deliver an overall gross housing profit margin

of approximately 26% for the half year, a decline of some 6% against the

comparable period.

Whilst the Group continues to work towards generating land sales profit during

2008, it acknowledges that there are fewer organisations actively buying in the

current land market. During the first half year, the Group expects a

contribution of approximately �2 million from land sales, net of option costs.

Balance Sheet

As at 30 June 2008, the Group had net debt of �94 million, with gearing

anticipated to be approximately 13% at the half year end. Average net debt for

the first half of 2008 was approximately �81 million, and the Group now

anticipates that average net debt for the year as a whole will be in the range

�110 million to �120 million. The Group has bilateral committed loan facilities

of �220 million which do not mature until 2010.

The Group has previously indicated that it is taking steps to manage its cash

flows including, in particular, careful control of its investment in housing

work in progress. It has been successful in the first half of 2008 in converting

strategic land, having obtained outline planning consent for both Wellingborough

and Filton during 2008. It anticipates holding around 14,000 plots of consented

land at 30 June 2008, of which approximately 58% has been converted from the

strategic land bank. Within this total will be 2,200 plots at Filton and 900

plots at Wellingborough. The balance of the plots with consent at Wellingborough

(2,200 plots) remain controlled under a call option which can be exercised by

the Group in the future. The pace of significant investment in these major and

important projects remains under the control of the Group and is being adjusted

in light of market conditions. With regard to land opportunities, the Group will

evaluate these as they arise, but will exercise significant caution in this area

for at least the remainder of 2008, as it has done in the recent past, with only

11% of the plots in the half year land bank purchased in the consented land

market since the start of 2007.

Having regard both to its carrying cost of inventory, and to reliable estimates

at the balance sheet date of sales prices given prevailing market conditions,

the Board does not presently anticipate making any material inventory provisions

or write-downs at this half year. This position will be reviewed prior to

publication of the Group's interim accounts, and again prior to the end of the

trading year.

Cost reduction measures

Further to the Group's comment in its interim management statement of 6 May 2008

regarding actions taken to manage its overhead costs, the Group is closing its

Eastern regional office, transferring control of its operation in this area to

its existing Central and South East offices. It is also amalgamating a number of

key functions of its Northern region with its Central region. These, together

with other cost saving measures, will be largely in place from the end of July

2008. The Group has carefully assessed its actions in these areas to ensure that

it is not unduly compromising its capacity to grow when market conditions

improve. The new structure will retain a good geographic coverage with regional

offices in the South East, South West, Midlands and North West of England.

Notwithstanding these changes, the Group is maintaining capability to identify

and appraise strategic land in all of its existing areas of operations.

The Group expects total staff numbers, both office and site-based, to be reduced

by around 40% compared to those employed at the start of the year and

anticipates the annualised saving from these actions plus other cost saving

initiatives to be around 20% of its general overhead cost base. The Group will

be charging a one-off restructuring charge of around �2 million in its first

half year results as a result of these actions.

Outlook and dividends

Looking forward to the full year, the Group's reservation levels since its

previous statement on 6 May 2008 have continued to be notably lower than the

previous year. Cumulative sales achieved to 30 June 2008 for 2008 legal

completion stood at 1,482 homes as compared to 2,282 homes at the same point

last year, a 35% decline year over year. The Group anticipates private home

sales volumes to continue at prevailing levels for the balance of the selling

period for 2008, and is continuing to seek further opportunities in social

housing.

The Group continues to assess its pricing strategy very carefully and in the

light of house price indices showing falls in house prices, and a general

backdrop of adverse media speculation, the Group is being pragmatic in the

application of its pricing strategies at present, dealing assertively where

appropriate to maintain a competitive net pricing stance. Given the speed of

emerging trends in the market at present, it is difficult to estimate with any

certainty the likely net pricing of the Group over the second half of 2008, but

any further market falls would likely reduce both the Group's achievable net

pricing and gross margins.

In setting out its dividend policy, the Board has consistently made clear that

the payment of anticipated dividends would be dependent on the prevailing

business environment. Given the lack of liquidity in financial markets and

fragile consumer confidence, which have created a high degree of uncertainty in

the housing market, the Board considers a reduction in dividend at this time to

be a balanced position to take for long term shareholder value. It therefore

intends to declare an interim dividend for 2008 of 5p per share which the Board

recognises to be a substantial reduction from the 20p per share previously

anticipated to be paid at this stage. In line with recent practice, the final

dividend is anticipated to be at the same level as the interim dividend, but a

final decision on this will be made in early 2009.

The Group has been investing on a long term basis for many years and in doing so

has been able to purchase a large proportion of its residential land through

conversion of its strategic land investments. Allied to this, the Group has a

well designed product range targeted towards mid market housing and has

developed good expertise in the social and partnership housing sector. Having

taken action this year through restructuring and cost control to mitigate the

impact from current housing market conditions, the Group will be able to exploit

its strong asset base as and when the housing market returns to more normal

conditions.

Conference Call for Analysts and Investors

David Ritchie, Chief Executive and Neil Cooper, Group Finance Director of Bovis

Homes will host a conference call at 11:00am today, Wednesday 9 July 2008, to

discuss the interim trading update.

To access the call, please dial 020 7190 1595. Please dial in 5 minutes prior to

the start of the conference call to allow time for registration. A recording of

the conference call will be available until midnight on 16th July 2008,

accessible on 020 7190 5901, passcode: 139925#.

Enquiries: Bovis Homes Group PLC

David Ritchie, Chief Executive

Neil Cooper, Group Finance Director

Tel: 01474 876200 - after 9am

Shared Value Limited

Emily Bruning

Tel: 0207 321 5027

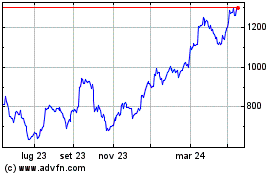

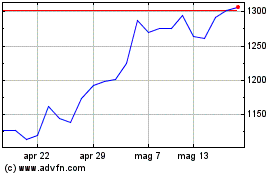

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024