RNS Number : 9473B

Bovis Homes Group PLC

26 August 2008

BOVIS HOMES GROUP PLC

HALF-YEARLY FINANCIAL REPORT

for the six months ended 30 June 2008

Issued 26 August 2008

The Board of Bovis Homes Group PLC today announces its interim results for 2008.

* Revenue generated of �149.3 million (2007 H1: �259.9 million)

* Adjusted profit before tax* of �11.7 million (2007 H1: �58.4 million)

* Adjusted earnings per share* of 7.1p (2007 H1: 34.2p)

* Interim dividend declared of 5p per share, reflective of challenging market conditions

* Gross margin of 26.3% (2007 H1: 32.6%) with adjusted operating margin at 10.0%* (2007 H1: 22.5%), significantly impacted by loss

of scale benefits on general overhead

* Restructuring undertaken with an anticipated 20% (circa �10 million) reduction in general overhead cost base on annualised basis

* 3,735 land plots successfully converted from strategic land in the first half of 2008 leading to consented land bank at 30 June

2008 of 14,294 plots (31 December 2007: 11,413 plots)

* Strategic landholdings of 20,982 potential plots (31 December 2007: 24,868 potential plots)

* Net debt of �93 million, 13% geared, with �220 million of total bank facilities in place until 2010

* No land write-downs required as at 30 June 2008

* 2008 figures adjusted for restructuring cost of �2.2 million (2007: �nil).

Commenting on the results, David Ritchie, Chief Executive of Bovis Homes Group PLC said: "The Group has taken decisive action in

response to the toughest period of trading it has experienced in its time as a public company. It has largely avoided new investments in

consented land, has reduced production levels and has restructured to cut operating costs. Having done so, the Group is well positioned to

deal with prevailing market conditions. The Group has a high quality land bank, largely sourced strategically, which has not required

write-downs in the half year and gearing remained low at 13%. The underlying profitability of private homes sales remained good in the first

half year with average sales price and gross margin reduced by just 4% and 2% respectively.

The Group's strategic land successes in the first half of 2008 have reduced the average plot cost of the consented land bank as a whole,

essential in supporting future profitability during a period when the outlook for house prices is highly uncertain.

The Group considers that the current difficult trading environment will continue for the foreseeable future with continued poor mortgage

liquidity limiting housing market activity. Actions continue to be taken to conserve cash and a realistic approach is being taken in respect

of achievable net prices for the Group's available homes to facilitate delivery of required volumes for the remainder of 2008."

Certain statements in this press release are forward looking statements. Forward looking statements involve evaluating a number of

risks, uncertainties or assumptions that could cause actual results to differ materially from those expressed or implied by those

statements. Forward looking statements regarding past trends, results or activities should not be taken as a representation that such

trends, results or activities will continue in the future. Undue reliance should not be placed on forward looking statements.

Enquiries:

David Ritchie, Chief Executive

Neil Cooper, Group Finance Director

Bovis Homes Group PLC

Tel: 020 7321 5010

Results issued by:

Andrew Best / Emily Bruning

Shared Value Limited

Tel: 020 7321 5022 / 5027

Interim Management Report

These interim results for the six months ended 30 June 2008 have been delivered against the backdrop of the worst market the Group has

traded in for many years. The Group has sought to deliver a good quality of profit on the private homes it legally completed during the

first half of 2008, however a reduction in the volume of private homes legally completed has led to a much reduced level of absolute profit.

The Group gross margin has reduced, reflecting this lower private volume combined with an increase in the proportion of social and

partnership homes legally completed. Combined with an overhead base largely fixed in the short term, albeit 7% below the previous year, the

operating profit margin of the Group was sharply down on the prior year.

The Group has not only taken steps to reduce its overhead cost base but also to ensure that it conserves cash. It has reduced production

levels, is largely avoiding new land commitments and has acted quickly in reducing its cost base. Notwithstanding the fact that gearing, at

13%, remained relatively low at the half year, this level of gearing is likely to increase in the current challenging market, with average

net debt for the year as a whole expected to be in the range �110-�120 million. The Group has also announced that it intends to pay an

interim dividend for 2008 of 5p net per share, a substantial reduction from the 20p per share previously anticipated to be paid at this

stage.

The Group has been cautious in recent years in regard to investing in land with residential planning consent in place, given prevailing

costs. This caution has been allied with a focus on delivery of planning consent on strategic land already owned or controlled by the Group.

Success in conversion of this strategic land has been significant in recent years, leading to a position where the majority of the Group's

current consented land bank, some 58%, has been converted from the Group's strategic land bank. This long term activity has assisted the

Group in maintaining a low cost land bank on which it can develop new homes in the future, and it remains a key strategic priority for the

Group going forward.

Market conditions

The UK housing market has been badly impacted during 2008 as mortgage availability has reduced, following financial market turmoil in

the second half of 2007. As an example, according to the Bank of England, seasonally adjusted house purchase mortgage approvals in June

2008 were down by 68% against the prior year. As the vast majority of potential customers in the market require mortgage finance, this has

had a negative impact on the Group's levels of reservations and legal completions. Further exacerbating this impact has been a rise in

mortgage interest rates, despite a falling trend in the Bank of England base rate, and a reduction in loan-to-value ratios, both of which

impact critically on the ability of first-time buyers to proceed, given their general lack of equity. As first time buyers represent the

first rung on the ladder for housing chains, this is a particularly damaging development for the market.

This impact is clearly evident in market statistics. Firstly, transaction volumes across the market have declined. The latest government

data suggests that completed residential property transactions in England and Wales in June were 45% below the prior year. Secondly,

sentiment is now poor, as evidenced by a number of consumer confidence surveys. Accordingly, Nationwide and Halifax house price indices

suggest that market pricing is now falling as a result of reducing demand and falling confidence, and it is likely to take some time for

these conditions to stabilise or improve.

Results

The Group generated �149.3 million of revenue in the first half of 2008, a fall of 43% versus the comparable period (2007: �259.9

million). Housing revenue fell by 40%, contributed to by a 32% reduction in legal completions from 1,256 homes legally completed in 2007 to

851 homes legally completed in 2008. Of the Group's legal completions in 2008, 624 (73%) were of private homes and 227 (27%) were of social

and partnership homes. These proportions are as compared to 87% and 13% respectively over the same period in 2007. Private homes legal

completions fell by 43%, and social and partnership homes legal completions grew by 38%, albeit from a much smaller base.

In the first half of 2008, the Group delivered a private home average sales price of �196,700, some 4% lower than the average sales price

delivered for private homes in the first half of 2007 of �204,500. With the average size of private homes legally completed falling from

1,021 square feet to 964 square feet as a result of an increase in the selling mix of smaller homes, the underlying average sales price per

square foot for private homes increased by around 2%. The social and partnership homes average sales price for the first half of 2008 was

�87,800, a 3% decline on the previous year (2007: �90,400). In total, the Group's average sales price for the first half of 2008, at

�167,600, was 12% lower than that of the previous year (2007: �189,600), primarily from the impact of social housing increasing in the

selling mix from 13% to 27%.

Land sales reduced substantially compared to the prior year, with revenue of �4.9 million, and profits, less option costs, of �2.1 million,

as compared to revenue of �19.1 million and profits, less option costs, of �8.6 million in the first half of 2007. Given uncertainties on

house pricing, the land market has been subdued in the first half of the year.

The Group's underlying private housing margins fell by approximately 2%. Allied with other factors, including an increase in the

proportion of social and partnership homes sold which generate lower profit margins, reduced scale economies in semi-fixed site management

charges and cost increases in strategic planning fees and part-exchange provisions, the gross profit margin fell to 26.3% in the first half

of 2008 (2007: 32.6%).

Whilst overhead costs fell by 7% to �24.4 million, the impact of lower revenues, taken together with the gross margin decline, has been to

sharply reduce the operating margin, which was 10.0% for the half year before taking into account a �2.2 million one-off restructuring

charge incurred as a result of the cost reduction programme undertaken by the Group during the half (8.5% including this charge). This is as

compared to 22.5% in 2007 for the comparable period.

Following this cost reduction programme, the Group's Eastern regional office has been closed and a number of key functions of its Northern

region have been amalgamated with its Central region. Total staff numbers, both office and site-based, have been reduced by around 40%

compared to those employed at the start of the year. The Group anticipates the annualised saving in respect of general overheads from these

actions to be around 20% of its general overhead cost base (circa �10 million). Savings have also been made to direct site based costs and

the Group has reduced the level of subcontract labour working on its sites.

For the six months ended 30 June 2008 the Group achieved a pre-tax profit of �11.7 million before restructuring costs (�9.5 million after

restructuring costs) as compared to �58.4 million in the same period in 2007. Basic earnings per share has decreased in the half year from

34.2p in 2007 to 7.1p in 2008 before restructuring charges (5.7p after restructuring charges).

Dividends

The interim dividend of the Company will amount to 5p net per share, compared to the 17.5p interim dividend declared and paid for 2007.

This dividend will be paid on 21 November 2008 to holders of ordinary shares on the register at the close of business on 26 September 2008.

The Group recognises that it had previously indicated an intention to pay 20p per share at this time, dependent on the prevailing business

environment. In light of current difficult trading conditions, the Board considers this reduction to be a prudent action to take. The Board

intends to offer a scrip dividend alternative, pursuant to which the shareholders may elect to receive the whole or part of their dividend

in new ordinary shares credited as fully paid instead of cash, for the 2008 interim dividend.

Borrowings and financing

As at 30 June 2008, the Group had net debt of �93 million, representing gearing of 13%. The Group's average net borrowings for the first

half year were �81 million, and the Group now anticipates that average net debt for the year as a whole will be in the range �110 - �120

million. The Group has bilateral committed facilities of �220 million in place which do not mature until early 2010 and it will be

discussing its longer term banking arrangements with its bankers well ahead of that maturity.

This first half average borrowing position gave rise to total financing charges of �3.2 million, substantially higher than the

comparable period at �0.1 million. Of this total financing charge, cash interest expenses were �2.4 million (2007: �1.9 million income) and

�1.3 million (2007: �2.4 million) related to non-cash imputed interest expenses arising from land creditors, a reduction on the prior year

as the Group has seen a decline in the level of land creditors held on the balance sheet as at 30 June 2008 versus June 2007. The Group

also generated �0.5 million of non-cash pension financing interest income in the first half of 2008, as compared to �0.4 million income in

the first half of 2007.

Land

The Group has been successful in the first half of 2008 in converting strategic land, having obtained outline planning consent for both

Wellingborough and Filton. As a result, the Group's controlled and consented landbank has risen from 11,413 plots at the end of 2007 to

14,294 plots at the end of June 2008, of which approximately 58% was converted from the strategic land bank, and only 11% has been acquired

in the consented market since the start of 2007. Within this total are 2,200 plots at Filton and 900 plots at Wellingborough, both owned and

paid for. The balance of the plots with consent at Wellingborough remain controlled under a call option which can be exercised by the Group

in the future. The pace of material investment in these major and important projects remains under the control of the Group and is being

adjusted in light of market conditions.

The strategic land bank at 30 June 2008 stood at 20,982 potential plots as compared to 24,868 potential plots held at the start of the

year. This reduction is primarily due to the successful conversion of 3,735 plots into the consented land bank. The Group continues to

maintain a suitable organisational infrastructure to enable it to replenish this strategic land bank, which represents a key source of value

for the Group.

Having regard both to its carrying costs of land, and to reliable estimates at the balance sheet date of sales prices given prevailing

market conditions, no land provisions or write-downs have been necessary in this half year.

Pensions

As at 30 June 2008, the Group's actuary estimated that the Group's defined benefits pension scheme had moved from a surplus of �1.0m at

the end of 2007 to a deficit of �1.5 million. The main driver of this adverse movement has been the impact of poor investment conditions in

the equity markets reducing the value of the scheme's assets. This was partially offset by favourable changes in actuarial assumptions

applied to estimates of the Group's liabilities arising principally from increases in bond yields.

Principal risks and uncertainties

In a manner consistent with the Disclosure and Transparency Rules, the Board has formally identified a number of principal risks and

uncertainties that may impact the business, reporting on this in full in its 2007 Annual report and accounts. The purpose of doing so is to

ensure that the Group is able to arrange its affairs such that it can avoid the risk, or mitigate the impact of the risk occurring. A number

of these risks relate to the Group's day to day operations, such as the risk of accidents occurring as a result of breaches of health and

safety standards or of environmental damage arising. Other risks and uncertainties are inherent in the activity of speculative housebuilding

and are principally commercial in nature, such as the risk of trading worsening as a result of fast moving developments in credit markets.

Notwithstanding the tougher trading environment at present, the Board has continued to ensure that operational risks remain a key focus of

management throughout the business: in particular in regard to risks that may result in injury or harm to individuals or to the environment.

It continues to manage these risks robustly and in a proactive manner.

More widely, the present trading environment gives rise to a number of material uncertainties which necessarily carry risk with them,

and which may have a material impact on the Group's performance over the next six months of the year. The more significant of these include

the volume of mortgage finance being made available, the direction and speed of national house price changes and the relative levels of

consumer confidence. The Group has outlined above a number of the activities it has taken, such as its overhead reduction programme, a

reduction in discretional purchasing and a reduction in dividend, which it regards as prudent given historically high levels of uncertainty

in the marketplace at present. It continues to monitor marketplace developments very carefully, to enable it to react accordingly, in

particular in terms of its cashflow.

Cumulative reservations

Cumulative sales achieved to 30 June 2008 for 2008 legal completion stood at 1,482 homes as compared to 2,282 homes at the same point in

2007 which represented a 35% decline in volume. Within this, the Group held 687 reservations for social and partnership homes (2007: 661

reservations) and 795 reservations for private homes (2007: 1,621 reservations).

Prospects

Looking forward to the full year, the Group's reservation levels since 30 June 2008 have continued to be notably lower than the previous

year. Cumulative sales achieved to 22 August 2008 for 2008 legal completion stood at 1,574 homes as compared to 2,592 homes at the same

point last year, a 39% decline year over year.

The Group anticipates private home sales volumes continuing at the current absolute level for the remainder of 2008. In response to current

market uncertainties, the Group is committed to competitive net pricing such that it can achieve volume delivery. Given current sentiment,

this is likely to further reduce private sales prices and profit margins achievable on incremental reservations over the remainder of 2008.

The Group has consistently invested on a long term basis enabling it to purchase a large proportion of its residential land through

conversion of its strategic land investments. Allied to this, the Group has a well designed product range focused towards low-rise,

mid-market housing, and has developed good expertise in the social and partnership housing sector. Having restructured the business to help

mitigate the impact from current housing market conditions, the Group will be able to exploit its strong asset base as and when the market

returns to more normal conditions.

Malcolm Harris

Chairman

Bovis Homes Group PLC

Group income statement

For the six months ended 30 Six months ended 30 Six months ended 30 Year ended

June 2008 (unaudited) June 2008 June 2007 31 Dec 2007

�000 �000 �000

Revenue 149,288 259,931 555,702

Cost of sales (109,965 ) (175,301 ) (382,659 )

Gross profit 39,323 84,630 173,043

Administrative expenses before (24,356 ) (26,116 ) (48,653 )

restructuring costs

Restructuring costs (2,248 ) - -

Operating profit before 12,719 58,514 124,390

financing costs

Financial income 608 3,258 6,158

Financial expenses (3,823 ) (3,363 ) (6,962 )

Net financing costs (3,215 ) (105 ) (804 )

Profit before tax 9,504 58,409 123,586

Income tax expense (2,616 ) (17,361 ) (36,727 )

Profit for the period 6,888 41,048 86,859

attributable to equity holders

of the parent

Earnings per share

Basic 5.7p 34.2p 72.4p

Diluted 5.7p 34.1p 72.2p

Dividend per share charged in

period

2007 final paid May 2008 17.5p - -

2007 interim paid November - - 17.5p

2007

2006 final paid May 2007 - 20.0p 20.0p

17.5p 20.0p 37.5p

Bovis Homes Group PLC

Group balance sheet

At 30 June 2008 (unaudited) 30 June 2008 30 June 2007 31 Dec 2007

�000 �000 �000

Assets

Goodwill 9,176 - 9,176

Property, plant and equipment 13,915 14,581 14,451

Available for sale financial 3,789 - 1,085

assets

Investments 22 22 22

Deferred tax assets 3,761 3,187 3,233

Trade and other receivables 6,222 2,734 2,589

Retirement benefit asset - 2,830 1,010

Total non-current assets 36,885 23,354 31,566

Inventories 887,893 745,898 870,550

Trade and other receivables 34,082 42,378 52,725

Cash 4,006 132,829 346

Total current assets 925,981 921,105 923,621

Total assets 962,866 944,459 955,187

Equity

Issued capital 60,482 60,376 60,415

Share premium 157,054 156,290 156,734

Hedge reserve - 4 -

Retained earnings 489,403 483,121 506,594

Total equity attributable to 706,939 699,791 723,743

equity holders of the parent

Liabilities

Bank loans 25,000 24,995 25,000

Trade and other payables 28,891 35,358 28,816

Retirement benefit obligations 1,530 - -

Provisions 562 2,004 1,463

Total non-current liabilities 55,983 62,357 55,279

Bank overdraft 1,015 - 3,588

Bank loans 71,383 - 16,000

Trade and other payables 125,353 165,480 142,291

Provisions 728 - 500

Tax liabilities 1,465 16,831 13,786

Total current liabilities 199,944 182,311 176,165

Total liabilities 255,927 244,668 231,444

Total equity and liabilities 962,866 944,459 955,187

These condensed consolidated interim financial statements were approved by the Board of directors

on 22 August 2008

Bovis Homes Group PLC

Group statement of cash flows

For the six months ended 30 Six months ended Six months ended Year ended

June 2008

(unaudited) 30 June 2008 30 June 2007 31 Dec 2007

�000 �000 �000

Cash flows from operating

activities

Profit for the period 6,888 41,048 86,859

Depreciation 644 698 1,421

Financial income (608 ) (3,258 ) (6,158 )

Financial expenses 3,823 3,363 6,962

Profit on sale of property, (33 ) (1 ) (43 )

plant and equipment

Equity-settled share-based (402 ) (319 ) 133

payment expenses

Income tax expense 2,616 17,361 36,727

Available for sale financial (2,704 ) - (1,085 )*

assets

Other non cash items 147 - 996

Operating profit before 10,371 58,892 125,812

changes in working capital and

provisions

Decrease/(increase) in trade 14,993 (19,962 ) (28,736 )

and other receivables

(Increase)/decrease in (17,488 ) 12,180 (42,195 )

inventories

Decrease in trade and other (18,206 ) (2,998 ) (39,519 )

payables

Decrease in provisions and (673 ) (1,760 ) (6,301 )

employee benefits

Cash generated from operations (11,003 ) 46,352 9,061

Interest paid (2,564 ) (2,475 ) (4,812 )

Income taxes paid (14,942 ) (18,257 ) (39,052 )

Net cash from operating (28,509 ) 25,620 (34,803 )

activities

Cash flows from investing

activities

Interest received 78 2,960 5,420

Acquisition of property, plant (143 ) (520 ) (879 )

and equipment

Proceeds from sale of plant 68 20 106

and equipment

Acquisition of subsidiary net - - (73,304 )

of cash acquired

Net cash from investing 3 2,460 (68,657 )

activities

Cash flows from financing

activities

Dividends paid (21,031 ) (23,976 ) (44,990 )

Proceeds from the issue of 387 884 1,367

share capital

Drawdown/(repayment) of 55,383 (15,000 ) 1,000

borrowings

Net cash from financing 34,739 (38,092 ) (42,623 )

activities

Net increase/(decrease) in 6,233 (10,012 ) (146,083 )

cash and cash equivalents

Cash and cash equivalents at (3,242 ) 142,841 142,841

the start of period

Cash and cash equivalents at 2,991 132,829 (3,242 )

the end of period

*Previously reported as a component of trade and other receivable movement Bovis Homes Group PLC

Group statement of recognised income and expense

For the six months ended 30 Six months ended Six months ended Year ended

June 2008

(unaudited) 30 June 2008 30 June 2007 31 Dec 2007

�000 �000 �000

Revaluation of available for (17 ) - -

sale financial assets

Deferred tax on revaluation of 5 - -

available for sale financial

assets

Effective portion of changes - 165 160

in fair value of interest rate

cash flow hedges

Deferred tax on changes in - (49 ) (48 )

fair value of interest rate

cash flow hedges

Actuarial (loss)/gain on (3,100 ) 5,770 3,750

defined benefit pension scheme

Deferred tax on actuarial 868 (1,886 ) (1,325 )

movements on defined benefit

pension scheme

Deferred tax on other employee (402 ) (471 ) (790 )

benefits

Net income recognised directly (2,646 ) 3,529 1,747

in equity

Profit for the period 6,888 41,048 86,859

Total recognised income and 4,242 44,577 88,606

expense for the period

attributable to equity holders

of the parent

Notes to the accounts

1 Basis of preparation

Bovis Homes Group PLC ('the Company') is a company domiciled in the United Kingdom. The condensed consolidated interim financial

statements of the Company for the six months ended 30 June 2008 comprise the Company and its subsidiaries (together referred to as 'the

Group') and the Group's interest in associates.

The condensed consolidated interim financial statements were authorised for issue by the directors on 22 August 2008. The financial

statements are unaudited but have been reviewed by KPMG Audit Plc.

The condensed interim financial statements have been prepared in accordance with IAS34 'Interim Financial Reporting' as endorsed by the

EU. As required by the Disclosure and Transparency Rules of the Financial Services Authority, the condensed consolidated interim financial

statements have been prepared applying the accounting policies and presentation that were applied in the preparation of the Company's

published consolidated financial statements for the year ended 31 December 2007, which were prepared in accordance with IFRSs as adopted by

the EU.

As the Group's main operation is that of a housebuilder and it operates entirely within the United Kingdom, there are no separate

segments, either business or geographic, to disclose.

In common with the rest of the UK housebuilding industry, activity occurs year-round, but there are two principal selling seasons: spring

and autumn. As these fall into two separate half years, the seasonality of the business is not pronounced, although it is biased towards

the second half of the year under normal trading conditions.

The condensed interim financial statements do not constitute statutory accounts within the meaning of Section 240 of the Companies Act

1985. The figures for the half years ended 30 June 2008 and 30 June 2007 are unaudited. The comparative figures for the financial year

ended 31 December 2007 are not the Company's statutory accounts for that financial year. Those accounts have been reported on by the

Company's auditors and delivered to the Registrar of Companies. The report of the auditors was (i) unqualified, (ii) did not include a

reference to any matters to which the auditors drew attention by way of emphasis without qualifying their report, and (iii) did not contain

a statement under section 237 (2) or (3) of the Companies Act 1985.

2 Earnings per share

Basic earnings per ordinary share for the six months ended 30 June 2008 is calculated on profit after tax of �6,888,000 (six months

ended 30 June 2007: �41,048,000; year ended 31 December 2007: �86,859,000) over the weighted average of 120,194,838 (six months ended 30

June 2007: 119,880,594; year ended 31 December 2007: 119,984,811) ordinary shares in issue during the period. For presentation purposes, an

earnings per share statistic has been disclosed in the interim management report after adjusting for restructuring costs incurred in the

year. This adjustment was made by adding an additional �1,619,000 to the Group's profit after tax, being the Group's 2008 restructuring

charge of �2,248,000 tax-effected at 28%.

Diluted earnings per ordinary share is calculated on profit after tax of �6,888,000 (six months ended 30 June 2007: �41,048,000; year

ended 31 December 2007: �86,859,000) over the diluted weighted average of 120,298,768 (six months ended 30 June 2007: 120,229,838; year

ended 31 December 2007: 120,244,911) ordinary shares potentially in issue during the period. The average number of shares is diluted in

reference to the average number of potential ordinary shares held under option during the period. This dilutive effect amounts to the number

of ordinary shares which would be purchased using the aggregate difference in value between the market value of shares and the share option

exercise price. The market value of shares has been calculated using the average ordinary share price during the period. Only share options

which have met their cumulative performance criteria have been included in the dilution calculation.

3 Dividends

The following dividends per qualifying ordinary share were paid by the Group.

(unaudited) Six months ended Six months ended Year ended

30 June 2008 30 June 2007 31 Dec 2007

May 2008: 17.5p (May 2007: 21,031 23,976 23,976

20.0p)

November 2007: 17.5p - - 21,014

21,031 23,976 44,990

An interim dividend in respect of 2008 of 5.0p per share, amounting to a total dividend of �6,048,000 based on the shares in issue as at

30 June 2008, was declared by the Board on 22 August 2008. This interim dividend will be paid on 21 November 2008 to shareholders on the

register at the close of business on 26 September 2008. This dividend has not been recognised as a liability at the balance sheet date.

4 Income taxes

Current tax

Current tax expense for the interim periods presented is the expected tax payable on the taxable income for the period, calculated using

a corporation tax rate of 30% up to 5 April 2008, and 28% thereafter, adjusted to take account of deferred taxation movements.

Current tax for current and prior periods is classified as a current liability to the extent that it is unpaid. Amounts paid in excess

of amounts owed are classified as a current asset.

Deferred tax

The amount of deferred tax provided is based on the expected manner of realisation or settlement of the carrying amount of assets and

liabilities using tax rates enacted or substantively enacted at the balance sheet date.

5 Related party transactions

Transactions between fellow subsidiaries, which are related parties, during the first half of 2008 have been eliminated on consolidation, as

have transactions between the Company and its subsidiaries during this period. The Group's associates are disclosed in the Group's Annual

report and accounts 2007.

Transactions between the Group and key management personnel in the first half of 2008 were limited to those relating to remuneration,

previously disclosed as part of the Group's Report on directors remuneration published with the Group's Annual report and accounts 2007. No

material change has occurred in these arrangements in the first half of 2008.

Mr Malcolm Harris, a Group Director, is a non-executive Director of the National House Builders Council (NHBC), and the House Builders

Federation. The Group trades in the normal course of business, on an arms-length basis, with the NHBC for provision of a number of

building-related services, most materially for provision of warranties on new homes sold and for performance bonding on infrastructure

obligations. The Group pays subscription fees and fees for research as required to the House Builders Federation.

Total net payments were as follows:

(unaudited) Six months ended Six months ended

30 June 2008 30 June 2007

�000's �000's

NHBC 813 1,298

HBF 57 58

There have been no related party transactions in the first six months of the current financial year which have materially affected the

financial performance or position of the Group, and which have not been disclosed.

6 Reconciliation of net cash flow to net (debt)/cash

(unaudited) Six months ended Six months ended Year ended

30 June 2008 30 June 2007 31 Dec 2007

�000 �000 �000

Net increase/(decrease) in

cash and cash equivalents 6,233 (10,012 ) (146,083 )

(Drawdown)/Repayment of (55,383 ) 15,000 (1,000 )

borrowings

Fair value adjustments to - 165 160

interest rate swaps

Net (debt)/cash at start of (44,242 ) 102,681 102,681

period

Net (debt)/cash at end of (93,392 ) 107,834 (44,242 )

period

Analysis of net (debt)/cash:

Cash 4,006 132,829 346

Bank overdraft (1,015 ) - (3,588 )

Bank loans (96,383 ) (25,000 ) (41,000 )

Fair value of interest rate - 5 -

swaps

Net (debt)/cash (93,392 ) 107,834 (44,242 )

7 Group statement of changes in equity

(unaudited) Total Issued Share Hedge Total

retained capital premium reserve

earnings

For the six months ended30 �000 �000 �000 �000 �000

June 2008

Balance at 1 January 2007 462,162 60,288 155,494 (112 ) 677,832

Total recognised income and 44,461 - - 116 44,577

expense

Issue of share capital - 88 796 - 884

Share based payments 474 - - - 474

Dividends paid to shareholders (23,976 ) - - - (23,976 )

Balance at 30 June 2007 483,121 60,376 156,290 4 699,791

Balance at 1 January 2007 462,162 60,288 155,494 (112 ) 677,832

Total recognised income and 88,494 - - 112 88,606

expense

Issue of share capital - 127 1,240 - 1,367

Share based payments 928 - - - 928

Dividends paid to shareholders (44,990 ) - - - (44,990 )

Balance at 31 December 2007 506,594 60,415 156,734 - 723,743

Balance at 1 January 2008 506,594 60,415 156,734 - 723,743

Total recognised income and 4,242 - - - 4,242

expense

Issue of share capital - 67 320 - 387

Share based payments (402 ) - - - (402 )

Dividends paid to shareholders (21,031 ) - - - (21,031 )

Balance at 30 June 2008 489,403 60,482 157,054 - 706,939

8 Circulation to shareholders

The interim report will be sent to shareholders. Further copies will be available on request from the Company Secretary, Bovis Homes

Group PLC, The Manor House, North Ash Road, New Ash Green, Longfield, Kent DA3 8HQ.

Further information on Bovis Homes Group PLC can be found on the Group's corporate website www.bovishomes.co.uk/plc including the

analyst presentation document which will be presented at the Group's results meeting on 26 August 2008.

Statement of Directors* responsibility

We confirm to the best of our knowledge:

* The condensed set of financial statements has been prepared in accordance with IAS34 Interim Financial Reporting as adopted by the

EU;

* The interim management report includes a fair review of the information required by:

(a) DTR 4.2.7.R of the Disclosure and Transparency Rules, being an indication of important events that have occurred during the first six

months of the financial year and their impact on the condensed set of financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year; and

(b) DTR 4.2.8.R of the Disclosure and Transparency Rules, being related party transactions that have taken place in the first six months of

the current financial year and that have materially affected the financial position or performance of the entity during that period; and any

changes in the related party transaction described in the last annual report that could do so.

For and on behalf of the Board,

David Ritchie Neil Cooper

Chief Executive Finance Director

22 August 2008

Independent review report by KPMG Audit Plc to Bovis Homes Group PLC

Introduction

We have been instructed by the Company to review the condensed set of financial statements in the half-yearly financial report for the six

months ended 30 June 2008 which comprises the Group income statement, Group balance sheet, Group statement of cash flows, Group statement of

recognised income and expense and the related explanatory notes. We have read the other information contained in the half-yearly financial

report and considered whether it contains any apparent misstatements or material inconsistencies with the information in the condensed set

of financial statements.

This report is made solely to the Company in accordance with the terms of our engagement to assist the Company in meeting the requirements

of the Disclosure and Transparency Rules (*the DTR*) of the UK*s Financial Services Authority (*the UK FSA*). Our review has been undertaken

so that we might state to the Company those matters we are required to state to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility to anyone other than the Company for our review work, for this report, or

for the conclusions we have reached.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been approved by, the directors. The directors are responsible for

preparing the half-yearly financial report in accordance with the DTR of the UK FSA.

As disclosed in note 1, the annual financial statements of the Group are prepared in accordance with IFRSs as adopted by the EU. The

condensed set of financial statements included in this half-yearly financial report has been prepared in accordance with IAS 34 Interim

Financial Reporting as adopted by the EU.

Our responsibility

Our responsibility is to express to the Company a conclusion on the condensed set of financial statements in the half-yearly financial

report based on our review.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410 Review of Interim Financial

Information Performed by the Independent Auditor of the Entity issued by the Auditing Practices Board for use in the UK. A review of interim

financial information consists of making enquiries, principally of persons responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International

Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the

half-yearly financial report for the six months ended 30 June 2008 is not prepared, in all material respects, in accordance with IAS 34 as

adopted by the EU and the DTR of the UK FSA.

KPMG Audit Plc

Chartered Accountants

London

22 August 2008

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KLLFLVVBZBBF

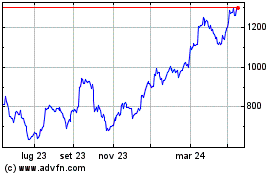

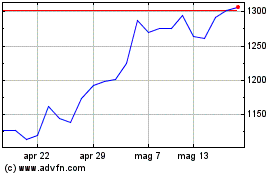

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024