FOCUS: Some UK House Builders May Follow Property Cos In Rts Issues

17 Febbraio 2009 - 9:26AM

Dow Jones News

Some of the U.K.'s house builders could follow commercial

property companies and seek additional capital to shore up their

balance sheets as their covenants are in danger of being

breached.

The near-certainty of large land write-downs and questions about

capitalizing of deferred tax assets have raised the issue of

whether house builders can remain within loan-to-value

covenants.

Persimmon PLC (PSN.LN) is the most likely to ask for capital to

deal with its GBP600 million debt, analysts say. It is currently

renegotiating a debt refinancing as its covenants are expected to

be breached this year, according to analysts.

"A rights issue would be in keeping with management style as

Persimmon had five rights issues between 1986 and 1996," said

Liberum Capital analyst Charlie Campbell.

He added that a rights issue would be an appropriate way for

management to broaden its options, as its choices currently are

constrained by the need to pay down debt.

A Persimmon spokesman was not immediately available for comment.

The company is due to announce full-year results March 3.

A rights issue won't mean that Persimmon will be able to end its

debt-refinancing negotiations. "We believe that Persimmon's holders

would not be happy if the rights issue is seen as an alternative to

debt refinancing, and would expect Persimmon to succeed in

refinancing the debt before raising new equity," said Campbell.

He said that other house builders are unlikely to come to the

market in the short term. Berkeley Group PLC (BKG.LN) and Bellway

PLC (BWY.LN) have access to cash or bank debt and don't need to tap

markets for cash.

Redrow PLC (RDW.LN), Taylor Wimpey PLC (TW.LN) and Barratt

Developments PLC (BDEV.LN) do not have sufficiently high

capitalization to support rights issues, while it is too early for

Bovis Homes PLC (BVS.LN), Campbell said.

But Barratt, which, according to analysts, could remain in

compliance with covenants, doesn't have to be close to a breach to

tap into the market preemptively.

"Rather than be pushed by a covenant breach into an emergency

equity issue, we consider it is logical for Barratt to tap the

market preemptively as covenants are expected to be breached this

year," said KBC Peel Hunt analyst Robin Hardy.

A spokeswoman for Barratt Developments declined to comment.

The general sentiment among analysts and investors is that that

companies should not put off seeking more capital as cash reserves

might run out quickly.

Analysts believe that the U.K. property companies will be

fighting for capital this year, and the sooner companies ask for

extra capital the better.

According to KBC Peel Hunt, Barratt doesn't have to ask for

much. "Even a fairly modest equity issue would transform the

finances, lessen the risk profile and set Barratt up far better for

the eventual recovery," Hardy added.

Barratt has been trying to cut its debt and, according to

analysts. Barratt's debt stood at GBP1.42 billion at the half year

to Dec. 31.

But Hardy warned that even after another 18 months of aggressive

debt reduction, Barratt will still have debts of around GBP700

million to GBP900 million at June, 2010, before any new

capital-raising.

The company warned in January that it will have to make further

write-downs and expects no recovery in the housing market as long

as poor buyer confidence and restricted access to mortgage

financing continue to impact housing sales.

Last week, commercial property companies Hammerson PLC (HMSO.LN)

and British Land Co. PLC (BLND.LN) announced rights issues of

GBP584.2 million and GBP740 million, respectively. Land Securities

PLC (LAND.LN) Monday confirmed it is considering a rights issue.

Analysts believe the company will ask the market for up to GBP750

million in coming weeks.

Company Web site: www.barratthomes.co.uk

www.persimmonhomes.com

-By Anita Likus, Dow Jones Newswires; +44 20 7842 9407; anita.likus@dowjones.com

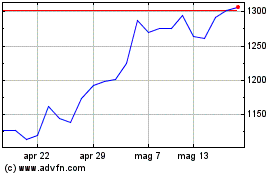

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

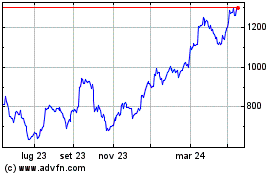

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024