UK Property Cos Raise More Than GBP1 Billion In Sign Of Confidence

23 Settembre 2009 - 12:13PM

Dow Jones News

U.K. property companies announced plans Wednesday to raise more

than GBP1 billion to strengthen their balance sheets and to build

war chests to fund acquisitions in the strongest indication yet

that confidence is returning to the real-estate sector.

House builders Barratt Developments PLC (BDEV.LN) and Redrow PLC

(RDW.LN) disclosed plans to raise more than GBP900 million through

rights issues and placements, while Liberty International PLC

(LII.LN), the country's largest industrial real-estate investment

trust, said it would raise about GBP310 million through an issue of

new shares.

The capital hikes are the latest in a burgeoning trend that has

seen similar moves earlier this year by house builders Taylor

Wimpey PLC (TW.LN), Bovis Homes Group PLC (BVS.LN), Berkeley Group

Holdings PLC BKG.LN) and Bellway PLC BWY.LN).

House builders have been struggling for more than a year with

the worst housing market conditions in decades. Mortgage financing

evaporated in the banking crisis, reducing the number of buyers to

a trickle and forcing house prices lower. As a result of falling

prices, the companies had to take write-downs on the value of land

and work in progress, and put developments on hold.

But signs continue to emerge to suggest that conditions in the

real-sector have eased.

Barratt Developments and Redrow, for example, both have reported

house prices had risen in the past few months, visitor numbers at

sales sites had increased and sales were up. "We have definitely

seen the market stabilize during the calendar year 2009," Redrow

Chairman Steve Morgan said.

U.K. house prices in August rose for the third time in four

months, while the annual rate of decline continued to ease, Lloyds

Banking Group PLC (LYG) said earlier this month. Its Halifax house

price index was up 0.8% from July, but down 10.1% from August,

2008.

"Demand for housing has increased since the start of the year

due to better affordability and low interest rates," said Martin

Ellis, Halifax's housing economist. "This, together with low levels

of property available for sale, has boosted house prices over the

last few months."

Still, gross mortgage lending in August was 13% lower than in

July, the Council of Mortgage Lenders said last week. "Underlying

lending levels appear to have stabilized during the summer, with

stronger lending for house purchase balanced by lower levels of

remortgaging," the CML said.

Those signs of stability have given executives the confidence to

prepare for growth. "We believe this is the right time to refinance

and recapitalize the business," Barratt Developments Chief

Executive Mark Clare said.

Barratt Developments announced a fully underwritten placing and

1.3-for-1 rights issue to raise gross proceeds of GBP720.5 million.

Clare said some of that would be spent to buy land this year in

order to maintain a land bank equivalent to at least

three-and-a-half years' work.

Barratt Developments on Wednesday reported a net loss for the 12

months to June 30 of GBP468.6 million, compared with a net profit

last year of GBP86.4 million, due to an "intensely difficult year"

in the U.K. housing market.

Redrow announced a rights issue to raise GBP156 million.

Proceeds from the rights issue will be used to reduce overall

levels of gearing by repaying and canceling up to GBP135 million

drawn under an existing syndicated facility agreement. It also

announced the proposed GBP15 million acquisition of the Harrow

Estates business, which focuses on identifying and acquiring brown

field land.

Redrow Chairman Morgan said the marketplace had shrunk in the

past seven or eight years but remained competitive. "The country's

need for new homes is greater than it has ever been," he said.

Industrial landlord Liberty International said it would issue

new ordinary shares representing around 9.9% of its total capital,

worth about GBP310 million, so that it can resume investment in its

prime U.K. regional shopping centers and central London assets.

Company Web sites: www.barratthomes.co.uk; www.redrow.co.uk;

www.liberty-international.co.uk

-By Jonathan Buck, Dow Jones Newswires; +44 (0)207 842 8237;

jonathan.buck@dowjones.com

(Michael Carolan and Digby Larner contributed to this

article.)

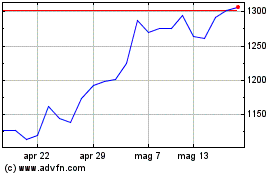

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

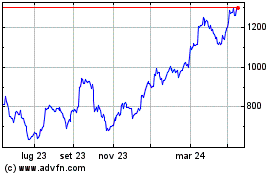

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024