UPDATE: Bovis Homes Enters Land Market With Cash,New Facility

15 Gennaio 2010 - 12:30PM

Dow Jones News

U.K. house builder Bovis Homes Group PLC (BVS.LN) Friday said it

plans to be "quite assertive" in the land market in 2010 following

a quiet year for construction, but said it expects 2010 to be

another subdued year for sales as mortgage approval volumes slowly

rise.

Bovis said it has now has credit approval, subject to

documentation, for a replacement GBP150 million syndicated facility

which would mature in September 2013 and be more affordable than

the current deal. Bovis said that this facility, added to its net

cash of GBP113 million, would allow it to be an attractive land

buyer in the market.

The company, which spent 2009 selling stock with little building

work going on, said it re-entered the residential land market in

the latter part of 2009, and has already acquired four sites with

terms agreed in principle on a further 15 sites.

Speaking to Dow Jones Newswires, Chief Executive David Ritchie

said it was Bovis' ambition to entice land vendors with more

guaranteed cash up front. Housebuilders don't usually pay

landowners cash up front, instead deferring payments over a period

of time; Bovis still plans to defer some payments to land vendors,

who have been reluctant to sell their land at current, lower

prices.

He added on a conference call with analysts that Bovis'

overheads would have to increase as it replaces the land buying

team it laid off in 2008 and hires specialist technical support. It

will also look to bring back bonuses.

Bovis said it expects 2009 pretax profit before exceptional

items to be in line with the board's expectations, but it didn't

say what these were. However on the conference call Finance

Director Neil Cooper said the most recent market figure was around

GBP7 million.

The company said that at the end of 2009 it had net cash of

GBP113 million compared with net debt of GBP108 million a year

earlier. The end figure was considerably above the GBP90.6 million

estimate from analysts at Panmure Gordon, who kept their "buy"

rating following the update.

Bovis said it legally completed the sale of 1,803 homes in 2009,

similar to the 1,817 in 2008. Of these, 1,527 were private homes--a

25% rise on 2008--although the average sale price of these houses

fell to GBP165,500 from GBP181,000.

At the end of 2009, the company's sales order book for 2010

totaled 643 homes for delivery--some 218 homes more than at the

same time a year earlier.

At 1051 GMT, shares were down 12.4 pence, or 2.7%, at 441.7

pence, while the wider FTSE All-Share was up 0.4%.

Bovis will post its 2009 results March 8.

Company Web site: www.bovishomes.co.uk

-By Rachael Gormley, Dow Jones Newswires; 44-20-7842-9308;

rachael.gormley@dowjones.com

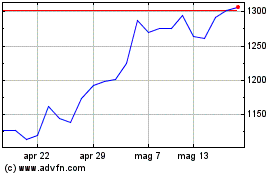

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

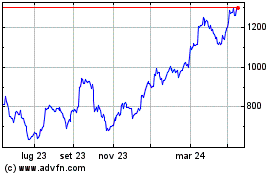

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024