Half Yearly Report -3-

23 Agosto 2010 - 8:00AM

UK Regulatory

level of customer service being delivered by the Group.

Principal risks and uncertainties

In a manner consistent with the Disclosure and Transparency Rules, the Board has

formally identified a number of principal risks and uncertainties that may

impact the business, reporting on these in full in its 2009 annual report and

accounts. The purpose of so doing is to ensure that the Group is able to

arrange its affairs such that it can avoid the risk or mitigate the impact of

the risk occurring. A number of these risks relate to the Group's day to day

operations, such as the risk of accidents occurring as a result of breaches of

health & safety standards or of environmental damage arising.

Other risks and uncertainties are inherent in the activity of speculative

housebuilding and are principally commercial in nature. During the worsening

trading environment, the Group reviewed and reassessed the likelihood and impact

of risk occurring in this changing business environment. Having done so, the

Group identified that the principal commercial risks of the business fell into a

number of categories, principally market driven risks around the ability to

deliver sales pricing and sales volume, legislative risks posed by planning and

legislation changes and liquidity risks given the difficulties in financial

markets.

Given the strong investment in new consented land over the last six months,

together with the Group's expectations of further investment in the near term,

the risks associated with delivering future sales volumes have lessened. The

housing market has remained stable in terms of transactional activity and the

ability of the Group to trade from an increased number of sales outlets in

future periods will assist in achieving the targeted sales volumes.

Mortgage availability has improved during the first half of 2010 although still

constrained relative to the period prior to the housing market downturn, and

house prices have stabilised with small improvements within the new homes

market, with the south of England stronger than the Midlands and the north of

England.

Recent changes to the planning environment have increased the levels of

uncertainty around obtaining residential planning consents. The Government has

been swift to announce its planned changes to the planning system and there

appears a heightened risk that a period of hiatus will arise as local planning

authorities react to the changing rules by slowing decision making. There is

now a risk that certain areas of the country will see limited positive decisions

for planning consent for new homes until new planning legislation is released in

2011. The strategy of the Group, implemented in the second half of 2009, to

invest significantly in land which already has a residential planning consent

will ensure that the Group has a strong pipeline of consented land on which to

develop during the next few years without being significantly impacted by the

aforementioned risks to planning. Many of the Group's long term interests in

strategic land remain strong contenders for planning consent, although the

timing of such consents may be delayed by virtue of the current planning system

changes.

Cumulative sales

Cumulative sales achieved to 30 June 2010 for 2010 legal completion stood at

1,474 homes as compared to 1,364 homes at the same point last year. Within

these totals, private sales stood at 1,150 homes in 2010 compared to 1,086 homes

in 2009, reflecting a 6% increase. In the first half of the year, the Group

achieved a net private sales rate per site per week of 0.42 reservations, ahead

of the comparable net private sales rate achieved in the first half of 2009 of

0.39 reservations per site per week.

Prospects

Cumulative sales achieved to 20 August 2010 for 2010 legal completion stood at

1,637 homes as compared to 1,519 homes at the same point last year, an 8%

increase year over year. Within this total, private sales now stand at 1,313

homes, up 5% on the 1,250 home sales achieved to the same point last year.

Based on the assumption that current housing market conditions prevail, the

Group is targeting the legal completion of c1,600 private homes during 2010 as

compared to 1,527 private home legal completions in 2009, representing an

increase of 5%.

The Group has traded well through the housing market downturn and is strongly

positioned to exploit opportunities to expand the Group based on investment at a

low point in the housing market cycle. 2010 will be a year of improved profit

performance and strong land acquisition, both of which will enable the Group to

demonstrate that it has added shareholder value in a tough operating

environment. The Group will continue to use its strong balance sheet position

to invest in cost effective consented land opportunities in the near term with

the aim of increasing its land bank of consented plots. This strategy will

increase the output capacity of the Group through holding a larger land bank

across an increased number of housing sites. This new land has been acquired

based on acquisition appraisals which achieve returns in line with the Group's

hurdle rates using current sales prices. Therefore, based on current market

conditions, these new sites will provide the Group the potential to improve

profit margins and investment returns over the coming years as these new sites

begin to deliver legal completions. The combination of increased volume from a

greater number of sites with improved margins will contribute strongly to the

profit growth of the Group, without reliance on a general housing market

recovery.

Bovis Homes Group PLC

Group income statement

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| For the six months ended 30 | Six months ended 30 June | Six months ended 30 June | Year ended 31 December 2009 |

| June 2010 | 2010 | 2009 | |

+---------------------------------+-------------------------------------------+--------------------------------------------+-----------------------------------------------+

| (unaudited) | Before | | Exceptional | | Total | | Before | | Exceptional | | Total | | Before | | Exceptional | | Total | |

| | exceptional | | items | | | | exceptional | | items | | | | exceptional | | items | | | |

| | | | | | | | items | | | | | | items | | | | | |

| | items | | | | | | | | | | | | | | | | | |

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| | GBP000 | | GBP000 | | GBP000 | | GBP000 | | GBP000 | | GBP000 | | GBP000 | | GBP000 | | GBP000 | |

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| | | | | | | | | | | | | | | | | | | |

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Revenue | 115,623 | | - | | 115,623 | | 122,611 | | - | | 122,611 | | 281,505 | | - | | 281,505 | |

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Cost of sales | (96,806 | )| - | | (96,806 | )| (102,849 | )| (9,843 | )| (112,692 | )| (236,339 | )| 1,471 | | (234,868 | )|

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Gross profit/(loss) | 18,817 | | - | | 18,817 | | 19,762 | | (9,843 | )| 9,919 | | 45,166 | | 1,471 | | 46,637 | |

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Administrative expenses | (13,997 | )| - | | (13,997 | )| (12,582 | )| - | | (12,582 | )| (27,769 | )| - | | (27,769 | )|

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Operating profit/(loss) before | 4,820 | | - | | 4,820 | | 7,180 | | (9,843 | )| (2,663 | )| 17,397 | | 1,471 | | 18,868 | |

| financing costs | | | | | | | | | | | | | | | | | | |

+---------------------------------+-------------+-+-------------+-+---------+-+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Financial income | 1,363 | | - | | 1,363 | | 764 | | - | | 764 | | 2,304 | | - | | 2,304 | |

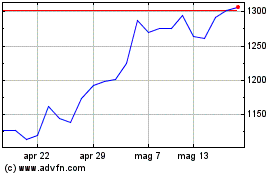

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

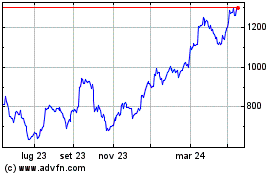

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024