Bovis Homes To Declare A Dividend For 2010, Legal Completions +5% To 1,901

14 Gennaio 2011 - 8:49AM

Dow Jones News

Bovis Homes Group PLC (BVS.LN), a U.K. home builder announced

Friday for the year ended December 31, 2010, that due success with

its growth strategy and confidence in its further delivery, the

Group will declare a dividend for 2010.

MAIN FACTS:

-In line with management expectations, the Group legally

completed 1,901 homes in 2010 (2009: 1,803 homes), an increase of

5%.

-The Group's average sales price in 2010 was GBP160 700, 4%

higher than the equivalent of GBP154,600 in 2009.

-This increase was driven by growth in the Group's average

private sales price in 2010 to GBP172,400 from GBP165,500 in

2009.

-Improved sales prices during the year combined with the benefit

of build cost savings primarily on second half legal completions

have increased the gross margin.

-With overheads in line with expectations, the Group expects the

operating profit margin for 2010 to be at least 7%.

-Given the Group's strong performance, it is anticipated that

the profit for 2010 will be ahead of consensus expectations as at

the date of this trading update.

-At January 1, 2011, the Group held a forward sales order book

for 2011 delivery of 420 homes.

-The forward sales position at the start of 2010 was 643 homes,

including a non recurring sale of 215 homes sold to a joint venture

in which the Group holds a 50% stake.

-The Group has achieved its target of substantially matching

production with legal completion volumes in 2010.

-As at December 31, 2010, the Group held housing work in

progress equivalent to 1,093 homes (2009: 986 homes).

-This will facilitate the early legal completion of homes

reserved in the first half of 2011 and will support the overall

growth aspirations of the Group for the year.

-The cash position of the Group as at December 31, 2010 remained

strong, with net cash of GBP52 million, having started 2010 with

GBP113 million of net cash.

-The overall cash outflow was contributed to by payments during

the year of GBP138 million relating to land investment, with strong

operating cash inflows pre-land expenditure of GBP93 million.

-The Group has outlined its growth strategy to acquire good

quality residential land which will provide an increase in sales

outlets to support volume growth, and based on current market

conditions will deliver growth in profits and improved financial

returns.

-The Group has been successful in 2010 in acquiring consented

land, adding 3,700 plots to the land bank at a cost of GBP203

million and with a gross profit potential of GBP181 million.

-Furthermore, the Group has terms agreed for the acquisition of

an additional c.2,500 plots.

-The Group continues to expect trading conditions in 2011 to be

subdued relative to historical levels, with ongoing economic

uncertainty.

-Mortgage approval volumes remain weak, with mortgage providers

requiring high levels of deposit, particularly from first time

buyers.

-The Group is confident of its ability to deliver on its growth

strategy, which will add significantly to future shareholder

value.

-Shares closed Thursday at 425.50 pence

-By Zechariah Hemans, Dow Jones Newswires; 44-20-7842-9411;

zechariah.hemans@dowjones.com

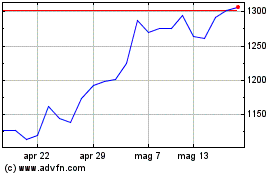

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

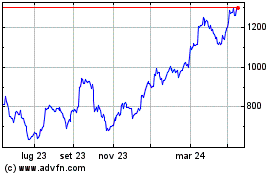

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024