Bovis Homes Group PLC Clarification Statement (0455D)

24 Marzo 2014 - 5:47PM

UK Regulatory

TIDMBVS

RNS Number : 0455D

Bovis Homes Group PLC

24 March 2014

24 March 2014

Clarification Statement

The "Private Rental Sector Deals" announcement released earlier

today at 7am under RNS No 9743C via RNS Reach distribution circuit,

has been re-released for transparency purposes.

The announcement is unchanged and is reproduced in full

below.

Bovis Homes Group PLC

SUCCESS IN SECURING RETURN ENHANCING PRIVATE RENTAL SECTOR

DEALS

Bovis Homes Group PLC today announces that contracts have been

signed for two separate private rental sector (PRS)

transactions.

Demonstrating strong innovation to drive growth and shareholder

returns, the Group has signed contracts with two separate

investors, one of which is accessing funding through the

Government's Build to Rent Scheme, to sell new homes under two PRS

transactions across a range of sites already owned by the

Group.

The two transactions involve circa 510 homes with a total

revenue of approximately GBP80 million, of which circa 250 homes

are expected to legally complete in 2014 with the remainder in

2015. These homes will be delivered over and above the Group's

prevailing private sales, accelerating the development on each of

the sites included without sales risk, with an average housing

profit margin which is not expected to dilute the Group's

anticipated operating margin in 2014 and 2015. The strong profit

delivery combined with the acceleration of capital turn enabled by

these transactions will act as a further positive contributor to

increasing the Group's return on capital employed in both 2014 and

2015.

The first transaction for circa 190 homes is focused on the

south, particularly on larger sites where the Group may have

considered selling land phases to enhance capital turn and where

the PRS transaction, as an alternative to such land sales, delivers

stronger returns. In respect of this transaction, the Group will

partner with the investor and invest approximately GBP1 million for

an approximately 27% equity stake in the PRS investing entity and

will also advance GBP4 million as a secured loan. The second

transaction involves the delivery of circa 320 new homes on sites

mainly in the midlands and north, enabling the Group to accelerate

trading through some of its older sites, some of which are written

down.

Positive impact on returns

Assuming current market conditions continue, the strong private

sales position of the Group combined with the additional volume

arising from the PRS transactions should enable the Group to

deliver a strong increase in total reservations during 2014. The

Group now aims to deliver between 3,650 and 3,850 legal completions

in 2014 (including circa 250 PRS homes) with a further enhanced

forward order book for 2015 which will include the balancing circa

250 PRS homes. With a clear focus on controlling the capital

employed of the Group, capital turn is now expected to increase to

around 0.9 in 2014. As a result, return on capital employed is

expected to increase strongly to approximately 15% in 2014 (2013:

10.4%) with further progress anticipated thereafter.

Commenting, David Ritchie, Chief Executive said:

'We are delighted to have agreed these two Private Rental Sector

deals which will provide the opportunity to deliver over 500

additional new homes during 2014 and 2015. Through achieving this,

Bovis Homes is accelerating delivery across a number of its

existing housing sites and enhancing shareholder returns.'

- ENDS -

Enquiries: David Ritchie, Chief Executive

Jonathan Hill, Group Finance Director

Tel: +44 (0)1474 876200

Reg Hoare, James White and Giles Robinson

MHP Communications

Tel: +44 (0)20 3128 8100

This information is provided by RNS

The company news service from the London Stock Exchange

END

CNTJIMFTMBITBMI

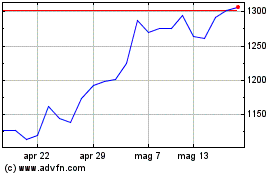

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

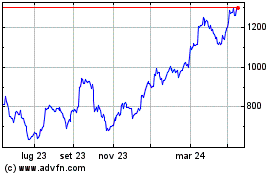

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024