Verity Group PLC - Disposal, etc

04 Settembre 1997 - 5:59PM

UK Regulatory

RNS No 4968w

VERITY GROUP PLC

4th September 1997

VERITY GROUP PLC

Disposal of Wharfedale International Limited

("Wharfedale") and Quad Electroacoustics Limited ("Quad")

Verity Group Plc ("Verity" or the "Company") announces

that it has entered into a conditional agreement with

Pointfield Limited ("Pointfield") and Pointfield's parent

company, IAG Limited ("IAG"), for the sale to Pointfield

of Wharfedale and Quad (the "Transaction"). However,

the Company will effectively retain a 40 per cent interest

in Wharfedale and Quad through a 40 per cent shareholding

in Pointfield. The effective 60 per cent holding in

Wharfedale and Quad is being sold for a consideration of

#5.8 million in cash and loan notes as described below.

Pointfield is currently dormant. IAG will subscribe #4.8

million in cash (#2.2 million on completion and the

balance in stages so as to enable Pointfield to meet its

obligations under the term loan note referred to below)

and hold 60 per cent of the ordinary share capital of

Pointfield.

The sale of the shares in Wharfedale and Quad to

Pointfield will be for a nominal consideration but

Pointfield will also purchase from the Company at par the

benefit of #8.0 million of loan notes to be issued by

Wharfedale and Quad prior to completion, evidencing inter

company indebtedness of the same amount currently owed by

Wharfedale and Quad to the Company. The consideration for

the sale of the loan notes is to be satisfied as to #3.2

million by the allotment to the Company of 40 per cent of

the ordinary share capital of Pointfield, as to #2.2

million in cash and as to #2.6 million by the issue to the

Company of a term loan note. The term loan note is to

carry a coupon of 8% per annum and is repayable in the sum

of #800,000 on 30 November 1997, #800,000 on 31 December

1997, #500,000 12 months following completion and #500,000

21 months following completion.

Under the terms of an option agreement to be entered into

at completion by the Company and IAG, the Directors expect

that the Company's interest in Pointfield will reduce to

approximately 20 per cent within two years of completion

and will be eliminated entirely within five years of

completion. Under the option agreement IAG is required to

purchase within a period of two years from completion

approximately 50 per cent of the shares in Pointfield

allotted to Verity for a cash consideration based on a

premium of 20 per cent over the value attributed to such

shares on allotment, such premium falling to nil in the

event that IAG purchases those shares within the first 14

months following completion. Further, between three and

five years following completion, Verity can require IAG to

purchase, and IAG can require Verity to sell, the

remaining shares in Pointfield held by Verity for a cash

consideration based on the higher of the value attributed

to such shares on allotment, or a value calculated by

reference to four times the consolidated profits of

Pointfield in the financial year prior to the financial

year in which such shares are purchased.

The obligations of Pointfield and IAG under the term loan

note and option agreement respectively will be secured by

a second charge over the shares held by Pointfield in

Wharfedale and Quad and the shares held by IAG in

Pointfield, to rank behind charges to be granted in favour

of the new bankers to Wharfedale and Quad.

In view of the size of the disposal of Wharfedale and Quad

the Transaction is conditional, inter alia, upon

shareholder approval.

Information on Wharfedale and Quad

Wharfedale is a manufacturer of loudspeakers, marketing

mainly to the mid-price sector of the market through

specialist hi-fi retailers and several of the larger high

street chains. Quad designs, manufactures and distributes

premium quality hi-fi products, including amplifiers,

tuners, CD players and loudspeakers. Its products are

sold into the consumer and professional audio markets

worldwide.

For the year ended 30 June 1996, Wharfedale and Quad

contributed combined profits before taxation of #1.2

million to the group comprising Verity and its

subsidiaries (the "Group") on turnover of #14.6 million.

At 30 June 1996 Wharfedale and Quad had combined net

assets of #4.3 million (excluding outstanding inter

company indebtedness totalling #8.7 million).

The combined profit referred to above, however, includes

the results attributable to certain parts of Wharfedale

and Quad's business which have been disposed of, or

retained by the Company, do not form part of the

transaction.

Reasons for the Transaction

The rapidly growing interest in NXT flat panel speaker

technology ("NXT") from potential licensees in recent

months and the increasing number of applications being

developed by existing licensees have led the Directors to

re-focus Verity's strategy. The Directors are now

convinced that Verity's future lies primarily in the

development and exploitation of its NXT and related

technologies. The Directors have therefore decided to

commit Verity's full resources to developing both NXT and

Mission, its premium speaker brand. In addition to

developing its own application of NXT, the Mission

business will continue to strengthen its worldwide

distribution and marketing network.

The position of Premier Percussion Limited is currently

under review and shareholders will be informed of

progress.

In the circumstances and in order to ensure that Verity's

full management and financial resources can be devoted to

these businesses, the Directors have decided that it is in

the best interests of Verity and its shareholders that

Wharfedale and Quad be sold. The disposal of Wharfedale

and Quad will generate net cash which the Directors intend

to employ in meeting the future funding requirements

associated with the continued development of NXT.

Current Trading

Since 27 September 1996, Verity has launched NXT in

Europe, Japan and the USA. Licence agreements have been

signed with NEC, Samsung and Peerless Fabrikkerne A/S and

the Directors expect that further licences will be signed

with major international companies during the next month.

Since 30 June 1996, Verity has increasingly concentrated

its management, engineering, marketing and financial

resources on NXT. As indicated at the time of the interim

results, this has adversely impacted on the trading

results of Verity's non-NXT businesses for the year ended

30 June 1997, and in particular on Wharfedale and Quad.

In addition, the increased strength of sterling in 1997

has led to reduced profitability in all of Verity's

manufacturing businesses.

An explanatory circular, incorporating further details of

the Transaction and notice of an extraordinary general

meeting of Verity, will be sent to shareholders of the

Company as soon as possible.

It is expected that the preliminary announcement of the

Group's results for the year ended 30 June 1997 will be

made by the end of the first week in October.

For further information, please contact:

Verity Group Plc

Peter Thoms, Corporate Affairs Director 01480 451777

Ludgate Communications

Richard Hews 0171 253 2252

END

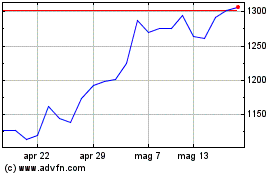

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

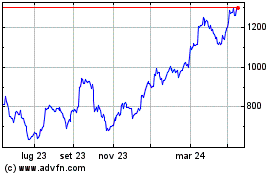

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024