RNS No 6884w

BOVIS HOMES GROUP PLC

19th March 1998

BOVIS HOMES GROUP PLC

PRELIMINARY RESULTS

FOR THE YEAR ENDED 31 DECEMBER 1997

Issued 19 March 1998

Following a successful flotation in December 1997, the Board of Bovis

Homes Group PLC today announced its maiden preliminary results for 1997 as a

separately quoted company.

Pre tax profit increased 60% to #37.3 million (1996:#23.3 million)

Operating margin increased to 15.4% (1996: 11.0 %)

Return on average capital employed increased to 18.8% (1996:12.5%)

Adjusted earnings per share increased by 40% to 22.8p (1996: 16.3p)

Unit completions increased 4.1% to 2,556 (1996: 2,456)

Plots held with planning consent increased 15.6% to 8,296 (1996: 7,178)

Year end net short term deposits of #27.9 million

Commenting on the results, Malcolm Harris, the Chief Executive of Bovis Homes

Group PLC said:

"Following the solid performance in 1997, the first two months' trading

results of 1998 were encouraging with margin improvements across all

sectors of the business. Land purchases have been in line with

expectations."

An extract from the full text from the Chairman's statement, the Chief

Executive's Operational Review and the Financial Review follow:

Enquires:

Malcolm Harris, Chief Executive

Bovis Homes Group PLC

Tel: 0171 329 0096 on Thursday 19th March until 2.30 p.m. only

Tel: 01474 872427 thereafter

Results issued by Julian Bosdet & Henry Harrison-Topham

Shandwick Consultants Ltd

Tel: 0171 329 0096

Extract from the Chairman's Statement

This is my first statement to shareholders since the flotation of the

Company last December. I am therefore particularly pleased to be able to

report favourably on an outstanding year for the Group, which benefited from

the implementation of strategic changes within the Group, against a background

of improved market conditions.

Results

For the year ended 31 December 1997 pre tax profit amounted to #37.3 million,

an increase of 60% over the pro forma result for the previous year. Our

published result compares with our forecast of #37.1 million made at the time

of the flotation.

Unit completions increased by 4% and stringent cost containment and

construction efficiencies together with selling price improvements saw

margins improve.

Adjusted earnings per share of 22.8p showed an increase of 40% over the

previous year, assuming issued share capital of 112.8 million shares for both

years.

Dividend Policy

As indicated in the flotation prospectus, the Board is not recommending

payment of a final dividend for the 1997 financial year. In the absence of

unforeseen circumstances, the first dividend declared by the Board as an

independently quoted company, will be the interim dividend for the year

ending 31 December 1998, which it expects to pay in November 1998, followed by

a final dividend in May 1999.

Market Conditions

The market for the Group's range of houses and locations remained strong

throughout 1997. The consequences of the General Election in May and the new

Government's first budget in July were largely neutral to the housing market.

Increases in interest rates since then have perhaps dampened some of the

optimism seen earlier in the year, but current indicators do not appear to

suggest further major increases. Indeed strong economic performance, coupled

with low inflation and relatively stable interest rates, has resulted in

housing being more affordable today than for many years.

Strategy

The Company is focused on maximising shareholder value by achieving a superior

return on capital employed and consistent growth in profits and earnings per

share. This will be achieved by:

Skilfull investment in short, medium and long term land holdings, either

directly held or on option.

Continuous improvement to the design of our range of homes.

Improved management of development and construction to enhance profitability.

The management of risk by diversity of product range and spread of locations.

Growth across each of the regions and Retirement Homes to deliver further

economies of scale.

We have the land with planning consent, the strategic landholdings, the

financial resources and the management expertise to achieve these objectives.

Looking Forward

The immediate economic scenario is reassuringly stable. Land prices, however,

are increasing and there is fierce competition for the best locations. These

conditions emphasise the virtues of maintaining a strategic land bank. Demand

for new houses remains good in the areas in which we have a presence.

The Group is very strong financially, backed by the availability of good

banking facilities. Management continues to maintain tight cost and overhead

controls.

The Board is therefore confident that the Group will continue to prosper.

Sir Nigel Mobbs

Chairman

Chief Executive's Operational Review

Bovis Homes' operating margin in 1997 was 15.4%, one of the highest in the

industry. The Group's core strength lies in its management at all levels

throughout the organisation, and I am pleased to be able to report that

management's combined efforts culminated in all regions and our Retirement

Homes operation producing significant improvements in profitability. As

mentioned in the Chairman's report, strong cost controls, coupled with

construction efficiencies, contributed towards margin enhancement last year

and further improvements are expected in 1998. Our focus is upon growth in

profits as opposed to volume increases at the expense of margin, with a clear

emphasis on improvements to the return on shareholders funds.

The Market

Southern England sustained strong demand and increased selling prices; the

Midlands, North and South West experienced a steady market with improvements

in demand and selling prices in the second half of the year.

The increase in average sales price per square foot achieved, net of

incentives and trade-in costs, was 3.9% over 1996.

Average building costs were contained through tight cost control and value-

engineering and showed a small reduction in cost per square foot compared with

the previous year.

Overheads were further reduced by #0.8 million from 1996 to 1997 despite an

increase of 4% in unit completions.

Product Mix and Average Selling Price

The average selling price has increased from #90,100 in 1996 to #92,600 in

1997. The analysis of product mix, related average selling prices and

regional unit completion profile are shown below.

Product Mix Analysis - 1997

House type Unit Average

completions selling price

in 1997 in 1997

% #

One and two bedrooms 477 19 65,4000

Three bedrooms 761 30 73,400

Four bedrooms 841 33 118,000

Five or more bedrooms 103 4 177,700

Social Housing 202 8 53,000

Retirement (Note) 172 6 124,200

________ _______ _________

Total: 2,556 100 92,600

________ _______ _________

Note: Of total unit completions, 146 were sales made by the Retirement Homes

operation. The balance of the retirement units sold comprises sales,

by the three regions, of homes for the elderly which do not have

very sheltered housing facilities.

Regional Unit Completion Profile

Year ended Year ended

31 December 1997 31 December 1996

Unit Unit

completions % completions %

South East 1,104 43 1,030 42

South West 677 26 528 21

Central 629 25 755 31

_______ ___ _____ ____

Total three regions 2,410 94 2,313 94

_______ ___ _____ ____

Retirement Homes 146 6 143 6

operation

_______ ___ ______ ____

Total: 2,556 100 2,456 100

_______ ___ ________ ____

All regions have increased unit completions with the exception of Central

which has been replanning many of its sites to accommodate new products.

The Bovis Homes product range is principally targeted to compete against the

second-hand market. Our policy is to offer a superior dwelling both in terms

of design and specification. Where we compete directly with other new homes,

we aim to differentiate our dwellings in terms of elevational treatment,

internal layout and specification. We believe that our product mix and

geographic spread, will enable us to be reasonably resilient to any major

economic changes.

The introduction of a very wide range of products based upon standardised plan

forms and construction methods, with resultant economies of scale, allows us

to tailor the final product to meet local needs in terms of both external

design and internal specification whilst retaining high quality standards and

cost control. The introduction of this method of working over the past two

years has substantially improved the overall profitability of the business.

We have a policy of continuous product improvement, the objective of which is

to ensure that we are competitive in all sectors of the market in which we

operate. We also consistently review all of our internal processes to

increase quality with an objective of reducing unit cost.

Congratulations are in order to Jim Ditheridge and his colleagues in receiving

a Housebuilder of the Year award in recognition of the very high quality of

product and service offered by Retirement Homes, which specialises in very

sheltered housing.

Our social housing operation is an important part of the business that we are

committed to long term, with the expectation that it will substantially

increase its contribution towards the Group's overall performance in the

coming years.

Land and Planning

Consented Land Bank at 31 December 1997

Plots held with planning consent for immediate development increased from

7,178 plots at the start of the year to 8,296 plots at 31 December 1997,

representing 3.25 years' land supply based upon 1997 sales. Our average plot

cost as at 31 December 1997 was #18,600 (20.1% of 1997 average selling price)

compared with our average plot cost as at 31 December 1996 of #19,600 (21.8%

of 1996 average selling price).

Consented Land Bank at 31 December 1997

Analysis by Region & Retirement Homes

Plots of consented land

Total %

South East 3,013 36

South West 2,351 29

Central 2,572 31

Retirement Homes 360 4

_____ ____

Total: 8,296 100

_____ ____

Strategic Land Bank at 31 December 1997

Bovis Homes usually acquires its strategic land under option exercisable when

outline planning consent has been achieved.

Strategic land held at 31 December 1997 of over 2,200 acres had potential for

more than 13,000 plots. This included approximately 1,300 acres with

prospects for approximately 8,300 plots, which are in areas designated for

development within draft or adopted development plans by local, county or

unitary planning authorities, including a number of plots with planning

permission.

Strategic Land Bank at 31 December 1997

Analysis by Region & Retirement Homes

Potential Plots

In

"Growth

Total % locations" %

South East 7,730 59 6,326 76

South West 2,570 20 678 8

Central 2,664 21 1,254 15

Retirement Homes 43 - 43 1

_______ ___ ______ _____

Total: 13,007 100 8,301 100

_______ ___ ______ _____

"Growth locations": areas designated for development within draft or adopted

development plans by local, county or unitary planning authorities.

Land successfully converted from strategic to consented land provided 24% of

the Group's unit completions during 1997, contributing 32% of the

Group's profit and was particularly important in the South East region

operation where our largest strategic interests are held.

The Government is, understandably, focusing upon the optimum use of brown

land. 30% of the Group's production was based upon previously used land in

1997 and this is expected to rise to approximately 35% of production in 1998.

We have a very able land management team, including qualified town planners,

and I believe that we can provide sufficient land at an acceptable purchase

price to meet the Group's requirements.

As quoted by other housebuilders, we have also experienced delays in many

areas in obtaining detailed planning consent. Although there is some

frustration and a belief that the system can be improved, due to the strength

of the Group's total landholdings this problem is not expected to impede the

business's overall performance.

Health & Safety

Bovis Homes promotes all aspects of safety throughout its operations in the

interests of employees, subcontractors and visitors to its sites and premises.

The Company views this as an essential element in the success of the business

and this was recognised in 1997 with major awards from both the Royal Society

for the Prevention of Accidents and the British Safety Council.

Outlook for 1998

Our objective of expanding the business with a greater coverage of the major

conurbations in the North of England, is proceeding well. Building costs

overall are being contained notwithstanding the recent cement price increase.

Despite stiff competition for prime development land our skilled management

team has been acquiring sites in the right locations and at prices acceptable

to the Group and if this continues through the year it will result in us

maintaining a strong land bank with consent, as well as adding further

important strategic land holdings.

Malcolm Harris

Chief Executive

Financial Review

Introduction

1997 has seen the fundamental restructuring of the capital and financing of

the Group. On 9 December 1997 the Company ceased to be a wholly owned

subsidiary of P&O following a placing by Hambros Bank Limited, and its

shares were admitted to the Official List of the London Stock Exchange.

A total of 112,538,532 new and existing ordinary shares were sold under the

placing, and a further 259,500 were issued to directors, all at the placing

price of #2 per ordinary share. The proceeds of the issue of new ordinary

shares received by the Company were used to repay loans outstanding to the

P&O Group. The proceeds arising from the placing of the 24,729,060 existing

ordinary shares were received directly by P&O.

In anticipation of the placing Bovis Homes Limited, the principal subsidiary

of the Company, on 3 November 1997, entered into a series of bilateral

committed revolving loan facilities and uncommitted bonding facilities with

Barclays Bank PLC, Midland Bank plc, Royal Bank of Scotland plc, Den Danske

Bank and West Deutsche Landesbank. The aggregate amounts of the committed

facilities and the uncommitted bonding facilities are #100 million and #55

million respectively. These facilities mature on 2 November 2002, and,

together with new overdraft and money market facilities totalling #20 million,

are available to Bovis Homes Limited to provide finance for the general

corporate purposes of the Group.

Corporate Structure

During 1996 the business and trade of the Group was conducted through the

Company and its subsidiary companies, and Partkestrel Limited

("Partkestrel"), all wholly owned subsidiaries of P&O. On 31 December 1996 the

assets and trade of Partkestrel were transferred to a subsidiary of the

Company whilst the ownership of the shares remained with P&O. In consequence

it is appropriate to show the aggregate of the accounts of Bovis Homes Group

PLC and Partkestrel as pro forma figures for 1996, so as to provide a fair

comparison against 1997 consolidated figures. The pro forma figures have

been shown in addition to the 1996 consolidated figures for Bovis Homes Group

PLC and its subsidiary and associated companies, which are required under the

Companies Act 1985, and have been used as comparative figures throughout this

review.

Review of Results

The Group achieved an operating profit of #38.3 million, representing an

improvement of 30% over the previous year (#29.4 million). This was based on

2,556 unit completions (2,456) at an average selling price of #92,600

(#90,100). Turnover however was lower at #248.9 million, compared with

#267.5 million in 1996, due to a significantly lower level of land sales

and other income.

An improvement in gross margin and a reduction in administration expenses,

combined to enhance the operating margin to 15.4% (11.0%). The gross margin

has benefited in 1997 from the Company's procurement policies, a greater

proportion of value-engineered products coupled with more efficient site

layouts, as well as more favourable market conditions. Administration

expenses, which include sales and marketing costs have reduced from

#21.1 million to #20.3 million. This continued improvement follows on from

the re-organisation in 1995 and 1996, and the continuous review of the

Group's operations to identify and implement further improvements.

Interest payable less interest receivable amounted to #1.0 million compared

with #6.1 million in 1996. The sharp reduction being due to the positive

cash flow over the last two years.

Profit before tax was #37.3 million (#23.3 million) and profit after tax was

#25.7 million (#18.4 million). The effective tax charge at 31.1%

benefited from a relatively small amount of losses brought forward in a

subsidiary company, compared with the previous year.

A dividend amounting to #29.0 million was paid to P&O on 2 October 1997.

Review of the Balance Sheet

Net assets at 31 December 1997 amounted to #208.7 million.

Stocks and work in progress at year end amounting to #243.7 million, are #7.1

million lower than at 31 December 1996. Within these figures the land bank

has been increased by #12.5 million to #162.6 million, whilst the book value

of part exchange properties and other housing stocks has reduced by

#8.9 million to #17.3 million and housing work in progress and raw materials

have reduced by #10.7 million to #63.1 million. Creditors payable under and

over one year, excluding interest free financing from P&O Group companies,

amounted to #86.2 million (#80.6 million). They included deferred land

payments of #38.0 million compared with #34.1 million at the end of 1996,

reflecting the Group's policy to defer land payments on new acquisitions

whenever possible, to maximise the return on capital employed within the

business.

The capital funding of the business has changed substantially during

the year as explained in the introduction. At the commencement of the year

the Group had interest free funding of #165.5 million from the P&O Group, plus

interest bearing finance of #7.4 million. At the close of the year the

Company was funded by issued share capital and share premium totalling

#188.5 million and was holding net short term deposits of #27.9 million.

Cash Flow

Net cash flow from operating activities of #51.6 million was enhanced by a

reduction in stocks and work in progress and an increase in creditors. A

dividend of #29.0 million was paid to P&O in October and the proceeds of the

issue of new ordinary shares were applied in repaying the outstanding interest

free loan due to P&O.

At 31 December 1997 #30.0 million of surplus cash resources were on deposit

with the money market at maturities ranging between 2 days and 12 days after

31 December 1997. There was also a bank overdraft of #2.1 million. This put

the Group in a strong financial position as it went forward into 1998.

Ron Walford

Finance Director

Group Profit and Loss Account

for the year ended 31 December 1997

Pro forma

1997 1996 1996

#000 #000 #000

Turnover - continuing

operations 248,878 267,508 250,711

Cost of sales (190,350) (217,074) (204,044)

_______ ________ ________

Gross profit 58,528 50,434 46,667

Administrative expenses (20,270) (21,069) (21,069)

_______ _________ ________

Operating profit -

continuing operations 38,258 29,365 25,598

Interest receivable and

similar income 322 56 56

Interest payable and similar

charges (1,243) (6,169) (6,169)

_______ _______ _______

Profit on ordinary

activities before taxation 37,337 23,252 19,485

Taxation on profit on

ordinary activities (11,600) (4,840) (4,626)

________ _______ _______

Profit on ordinary

activities after taxation 25,737 18,412 14,859

Dividend paid (29,000) - -

Transfer from reserves 3,263 - -

________ ________ _______

Retained profit for the

financial year - 18,412 14,859

________ ________ ________

Basic earnings per ordinary

share #2.71 - #758.11

________ _______ ________

Adjusted earnings per

ordinary share* 22.8p 16.3p 13.2p

________ ________ ________

* Adjusted earnings per share is calculated on the basis of the 112.8

million shares in issue on flotation as if they had been in issue throughout

the two years ended 31 December 1997. The proceeds of the issue were applied

in repaying an interest free loan due to P&O, hence no adjustment has been

made to earnings in respect of interest. The Board believes that adjusted

earnings per share is the most appropriate basis for comparing earnings per

share throughout the period.

In both the current and preceding financial period there was no material

difference between the historical profits and losses and those reported in the

profit and loss account.

Group Balance Sheet

at 31 December 1997

Pro forma

1997 1996 1996

#000 #000 #000

Fixed assets

Tangible assets 9,588 8,193 8,193

Investments 24 41 41

_______ ________ ________

9,612 8,234 8,234

_______ ________ ________

Current assets

Stocks and work in progress 243,696 250,812 250,812

Debtors due within one year 8,090 7,243 7,243

Debtors due after more than one year 3,597 3,319 3,319

Cash and short term deposits 29,988 - -

_______ ________ _________

285,371 261,374 261,374

Creditors: amounts falling due within

one year (73,355) (68,666) (68,666)

Interest free loan due to P&O and

subsidiaries - (148,850) (165,492)

_______ ________ ________

(73,355) (217,516) (234,158)

Net current assets 212,016 43,858 27,216

_______ ________ ________

Total assets less current liabilities 221,628 52,092 35,450

Creditors: amounts falling due after

more than one year (12,886) (11,956) (11,956)

________ ________ ________

Net assets 208,742 40,136 23,494

_______ _________ ________

Capital and reserves

Called up share capital 56,399 23,010 10

Share premium 132,103 - -

Revaluation reserve 884 865 865

Profit and loss account 19,356 16,261 22,619

_______ ______ ______

Equity shareholders' funds 208,742 40,136 23,494

_______ _______ _______

Group Cash Flow Statement

for the year ended 31 December 1997

Pro forma

1997 1996 1996

#000 #000 #000

Net cash flow from operating activities 51,580 97,956 78,172

Returns on investments and servicing of

finance:

Interest received 322 56 56

Interest paid (1,506) (7,684) (7,684)

______ _______ _______

(1,184) (7,628) (7,628)

______ _______ _______

Taxation (paid)/received (6,707) 7,141 7,200

Capital expenditure and financial

investment

Sale of tangible fixed assets 506 408 408

Purchase of tangible fixed assets (2,897) (1,087) (1,087)

_______ _______ _______

(2,391) (679) (679)

_______ _______ _______

Dividend paid (29,000) - -

________ _______ _______

Cash inflow before management of liquid

resources and financing 12,298 96,790 77,065

Management of liquid resources

Amount placed on short term deposits (29,988) - -

Financing

Issue of ordinary share capital 188,492 - -

Repayment of P&O loans (169,492) (90,200) (70,475)

________ ________ ________

Increase in cash 1,310 6,590 6,590

________ ________ ________

Group Statement of Total Recognised Gains and Losses

for the year ended 31 December 1997

Pro forma

1997 1996 1996

#000 #000 #000

Profit for financial year 25,737 18,412 14,859

Unrealised surplus on the

revaluation of property - 151 151

______ ______ ______

Total recognised gains relating

to the year 25,737 18,563 15,010

______ ______ ______

Group Reconciliation of Movements in Shareholders' Funds

for the year ended 31 December 1997

Pro forma

1997 1996 1996

#000 #000 #000

Opening shareholders' funds 23,494 21,573 8,484

Disposal of revalued property 19 - -

Issue of share capital 188,492 - -

Total recognised gains and losses

for the year 25,737 18,563 15,010

Dividend (29,000) - -

_______ ______ ______

Closing shareholders' funds 208,742 40,136 23,494

_______ ______ ______

Notes to the Accounts

1 Basis of Preparation

The pro forma information contained herein in respect of the year ended 31

December 1996 is based on a combination of the accounts of all the

companies and businesses now operated by Bovis Homes Group PLC which

comprised Bovis Homes Group PLC and subsidiary and associated undertakings

together with Partkestrel Limited ("Partkestrel") a wholly owned

subsidiary of P&O. On 31 December 1996 the assets of Partkestrel were

acquired by a subsidiary of Bovis Homes Group PLC for consideration

settled through an intercompany account with P&O. From 1 January 1997 the

trade relating to those assets was included in the consolidated accounts

of Bovis Homes Group PLC. Following flotation flotation on 9 December

1997 Partkestrel remained a wholly owned subsidiary of P&O.

2 Taxation

The effective corporation tax rates payable for the years ended 31

December 1997 and 1996 have been reduced by brought forward tax losses and

in the case of 1996 by tax credits in respect of earlier years.

3 Dividends

On 2 October 1997 an ordinary dividend of #29.0 million was paid by the

Company to P&O.

4 Earnings per ordinary share

Basic earnings per ordinary share for the year ended 31 December 1997 is

calculated on the weighted average of 9,495,586 ordinary shares in issue

during the year. Basic earnings per ordinary share for the year ended

31 December 1996 is calculated on the weighted average of 19,600 ordinary

shares in issue during the year which reflects the adjustment from #1

shares to 50p shares.

Adjusted earnings per share is calculated on the basis of the 112.8

million shares in issue on flotation as if they had been in issue

throughout the two years ended 31 December 1997. The proceeds of the issue

were applied in repaying an interest free loan due to P&O, hence no

adjustment has been made to earnings in respect of interest. The Board

believes that adjusted earnings per share is the most appropriate basis

for comparing earnings per share throughout the period.

The issue of shares under Share Option Schemes does not give rise to a

material dilution of earnings.

5 Called Up Share Capital

On 3 November 1997 the Company (then called Bovis Homes Investments

Limited) sub-divided its existing called up share capital of 9,800 #1

ordinary shares into 39,200 ordinary shares of 25p each and

issued 49,418,920 new ordinary shares of 25p each to P&O for #12.4

million. On 3 December 1997 the entire authorised share capital was

consolidated into shares of 50p each. With effect from 9 December 1997

the authorised share capital was increased to 150,000,000 ordinary shares

of 50p each, and an additional 88,068,972 ordinary shares were issued at

#2 each, increasing the issued share capital to 112,798,032 ordinary

shares of 50p each.

6 Reconciliation of operating profit to operating cash flows

Pro forma

1997 1996 1996

#000 #000 #000

Operating profit 38,258 29,365 25,598

Depreciation 1,139 1,188 1,188

Profit on disposal of tangible fixed

assets (124) (98) (98)

Decrease in stocks 7,116 50,430 34,413

Decrease in debtors 1,952 1,145 1,145

Increase in creditors 3,239 15,926 15,926

______ ______ ______

Net cash inflow from operating activities 51,580 97,956 78,172

______ ______ ______

7 Change of Name

On 4 November 1997 the Company (then known as Bovis Homes Investments

Limited) re-registered as a public limited company and changed its name to

Bovis Homes Group PLC.

8 Non-statutory Accounts

The financial information set out above does not constitute the Company's

statutory accounts for the years ended 31 December 1997 or 1996, but is

derived from those accounts. Statutory accounts for the Company for 1996

have been delivered to the Registrar of Companies and those for 1997 will

be delivered following the company's Annual General Meeting. The

auditors have reported on those accounts: their reports were unqualified

and did not contain statements under section 237(2) or (3) of the

Companies Act 1985.

END

FR JPMMBLLABTFP

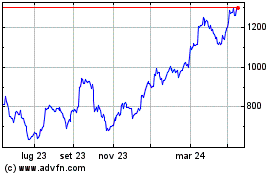

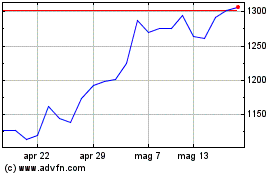

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024