Bovis Homes Group PLC AGM Statement (9468O)

23 Maggio 2018 - 8:01AM

UK Regulatory

TIDMBVS

RNS Number : 9468O

Bovis Homes Group PLC

23 May 2018

23 May 2018

BOVIS HOMES GROUP PLC

Trading statement for the period covering 1 January 2018 to

date

Bovis Homes Group PLC is holding its Annual General Meeting

("AGM") at 2:00pm today in Tunbridge Wells. This statement comments

on the Group's current trading and outlook for the financial

year.

Greg Fitzgerald, Chief Executive commented:

"Market conditions remain robust and we are on track to deliver

another controlled period end. Our HBF customer satisfaction score

continues to trend well above 80% and with our exciting new housing

range launched in April, we are well placed to meet our customers'

needs and increase output, whilst optimising price and driving

profitability."

Current trading

Customer satisfaction remains a key priority for the Group and

following our focus on customer service in 2017 through investment

and training, the Group's HBF Customer Satisfaction score (1

October 2017 to date) continues to trend at well above 80%, a 4

star rating, with 3 of our regions trending at 5 star (90% and

above).

Total sales for the year are in line with our expectations and

pricing is strong. Our average private sales rate per site per week

for the year to date is up 6% to 0.52 (2017: 0.49). This rate

excludes the sale of 275 units to Heylo Housing Association to be

completed in 2018.

We have opened 12 new developments in the year and are operating

from an average of 84 active sites. As planned, we have 11 new

sites launching in the coming months, and expect our average active

sites number to increase in the second half.

We are making good progress with our four major margin

initiatives covering price optimisation, specification review, cost

reduction and the launch of our new housing range. In particular,

our focus on driving prices across all our product whilst

delivering high levels of customer service, has seen positive

movements in pricing for the year to date.

We are delighted to have launched our new housing range for both

private and affordable homes, The Phoenix Collection, in late

April. This market leading range will deliver exciting, high

quality new homes as well as drive further price optimisation and a

reduction in our costs. We have already identified more than 50% of

the private units in our owned land bank to be replanned, and

expect our first completions from the new range from Spring

2019.

Our discussions regarding joint ventures and the reduction of

our investment at our larger sites at Sherford, near Plymouth and

Wellingborough are progressing well, and we are on track to deliver

a total of at least GBP180 million of additional cash into the

business by December 2018.

Dividends

Subject to shareholder approval at today's AGM a final dividend

of 32.5p per share (2016: 30.0p per share) will be paid on 25 May

2018, giving a total dividend for 2017 of 47.5p per share (2016:

45.0p per share).

Outlook

Market fundamentals remain strong. We continue to see good

levels of demand for new homes across all our operating regions

with underlying pricing remaining firm.

The Group is making clear progress towards its medium term

targets including a 23.5% gross margin and 25% return on capital

employed. In the first 5 months we have seen positive results from

our margin initiatives which represent further margin potential for

the Group in the medium term.

Certain statements in this press release are forward looking

statements. Forward looking statements involve evaluating a number

of risks, uncertainties or assumptions that could cause actual

results to differ materially from those expressed or implied by

those statements. Forward looking statements regarding past trends,

results or activities should not be taken as a representative on

that such trends, results or activities will continue in the

future. Undue reliance should not be placed on forward looking

statements.

For further information please contact:

Bovis Homes Group PLC 01474 876219

Earl Sibley, Group Finance

Director 07811 988617

Susie Bell, Head of IR

Maitland

Neil Bennett

James McFarlane 020 7379 5151

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

AGMATMPTMBBTBJP

(END) Dow Jones Newswires

May 23, 2018 02:01 ET (06:01 GMT)

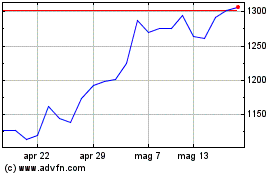

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

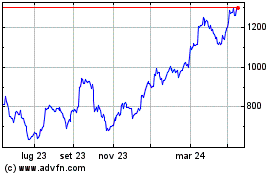

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024