TIDMVTY

RNS Number : 2957Q

Vistry Group PLC

18 June 2020

THIS ANNOUNCEMENT (INCLUDING THE APPIX) AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL.

THE FOLLOWING ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A

PROSPECTUS OR A PROSPECTUS EQUIVALENT DOCUMENT. THE COMPANY EXPECTS

TO PUBLISH LATER TODAY THE CIRCULAR IN CONNECTION WITH THE BONUS

ISSUE SHARES. ANY VOTING DECISION BY SHAREHOLDERS IN CONNECTION

WITH THE BONUS ISSUE SHOULD BE MADE ON THE BASIS OF THE INFORMATION

CONTAINED IN THE CIRCULAR.

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

18 June 2020

For immediate release

Vistry Group PLC

Proposed Bonus Issue

Publication of Circular and Notice of General Meeting

1 Bonus Issue

As set out in the Company's announcement dated 15 May 2020, the

Company today confirms that, rather than pay the expected Second

Interim Dividend, it will return value by way of a bonus issue

through the issue of 4,369,992 Shares valued at GBP60 million based

on a share price of GBP13.73, being the closing Share price of the

Company on 27 December 2019 (the "Bonus Issue" and the "Bonus Issue

Shares") to Shareholders on the Company's register of members as at

6.00 p.m. on 27 December 2019 (the "Qualifying Shareholders") (the

"Bonus Issue Record Time"). The Bonus Issue is conditional on

shareholder approval being obtained at a general meeting to be held

at the Company's Head Office at 11 Tower View, Kings Hill, West

Malling, Kent ME19 4UY on 14 July 2020 at 12.00 noon (or any

adjournment thereof) (the "General Meeting").

The Company is expected to capitalise a sum of GBP2,184,996 from

its retained profits to pay up in full 4,369,992 Shares. The

Qualifying Shareholders are expected to receive:

for every 1 Share held at the Bonus Issue Record Time,

0.02945974 Bonus Issue Shares

The Bonus Issue Shares will be issued to Qualifying Shareholders

in lieu of the expected Second Interim Dividend. If a Qualifying

Shareholder believes they have a market claim, please contact the

counterparty and settle bi-laterally.

Applications will be made to the FCA and to the London Stock

Exchange for admission of the Bonus Issue Shares to the listing on

the premium listing segment of the UK Official List in accordance

with the Listing Rules and to trading on the Main Market (the

"Admission"). It is currently expected that Admission of the Bonus

Issue Shares will become effective at 8.00 a.m. on 15 July

2020.

The Company announces the dates and times given in the table

below in connection with the Bonus Issue, which are indicative only

and are based on the Company's current expectations and are subject

to change. If any dates and/or times in this expected timetable

change, the revised dates and/or times will be notified to

Shareholders by announcement through a Regulatory Information

Service. All times shown are London times unless otherwise

stated.

EVENT TIME AND/OR DATE

Ex-dividend date for the Bonus 8.00 a.m. on 24 December

Issue Shares 2019

Bonus Issue Record Time 6.00 p.m. on 27 December

2019

Announcement of the Bonus Issue 15 May 2020

Publication of the Circular, 18 June 2020

the Notice of General Meeting

and the Form of Proxy

Latest time and date for receipt 12.00 noon on 10 July

of the Form of Proxy (or appointing 2020

a proxy electronically or submitting

a proxy via CREST) for the General

Meeting

Voting Record Time(1) 10.00 p.m. on 10 July

2020

General Meeting 12.00 noon on 14 July

2020

Admission and commencement of by 8.00 a.m. on 15 July

dealings in the Bonus Issue 2020

Shares on the premium segment

of the Official List and the

Main Market of the London Stock

Exchange

CREST accounts of Shareholders on or soon after 8.00

holding in uncertificated form a.m. on 15 July 2020

credited with the Bonus Issue

Shares

Despatch of share certificates within 14 days of Admission

for the Bonus Issue Shares to

Shareholders holding in certificated

form

CREST accounts credited with within 14 days of Admission

any cash due in relation to

the sale of fractional entitlements

Despatch of cheques for any within 14 days of Admission

cash in relation to the sale

of fractional entitlements

Notes:

(1) Entitlement to vote at the General Meeting by appointing

a proxy, and the number of votes which may be cast at

the General Meeting, will be determined by reference

to the Company's register of members at 10.00 p.m. on

10 July 2020 or, if the meeting is adjourned, not later

than 48 hours before the time appointed for the adjourned

meeting (as the case may be). In each case, changes

to the register of members after the relevant deadline

shall be disregarded.

(2) All events in the above timetable following the

holding of the General Meeting are conditional on the

passing of the Resolutions at such meeting.

2 Publication of Circular and Notice of General Meeting

The Company further announces that a shareholder circular

seeking approval of the Bonus Issue (the "Circular"), the Notice of

General Meeting and the Form of Proxy will be posted to

Shareholders today. The Circular is not required to be approved by

the FCA under the Listing Rules.

The Shareholder's attention is drawn to the section headed

"COVID-19 and impact on the General Meeting" in the Chairman's

Letter in the Circular. In view of the restrictions introduced by

the UK Government in response to COVID-19, in particular current UK

Government prohibitions on public gatherings and guidance on social

distancing, Shareholders are asked not to attend the General

Meeting in person and, in the interests of safety, any attempted

entry to the General Meeting will be refused. As further detailed

in the Circular, Shareholders are strongly encouraged instead to

appoint the Chairman of the meeting as their proxy and provide

voting instructions to the proxy in advance of the General

Meeting.

The Circular and the Notice of General Meeting have been

published on the Company's website at

https://www.vistrygroup.co.uk/2020. A copy of the Circular and the

Notice of General Meeting have been submitted to the National

Storage Mechanism and will be available for viewing at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

For further information please contact:

Vistry Group PLC

Earl Sibley, Chief Financial Officer

Susie Bell, Head of Investor Relations 01675 437160

Powerscourt (PR Adviser to Vistry Group PLC)

Justin Griffiths

Nick Dibden +44 (0)20 7250

Victoria Heslop 1446

IMPORTANT NOTICE

This Announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer,

invitation or solicitation to purchase, otherwise acquire,

subscribe for, sell, otherwise dispose of or issue any securities,

or the solicitation of any vote or approval in connection with the

Bonus Issue or otherwise, in any jurisdiction in which such offer,

invitation or solicitation is unlawful.

Vistry Group PLC urges Shareholders to read the Circular once

published carefully because it contains important information in

relation to the Bonus Issue.

Any vote in respect of Resolutions to be proposed at the General

Meeting to approve the Bonus Issue and related matters should be

made only on the basis of the information contained in the

Circular.

This Announcement is not a prospectus or prospectus equivalent

documents.

The Bonus Issue will be subject to the applicable requirements

of the London Stock Exchange and the FCA.

ADDITIONAL INFORMATION FOR US SHAREHOLDERS

The Bonus Issue Shares have not been and will not be registered

under the US Securities Act or under the securities laws of any

state or other jurisdiction of the United States and may not be

offered or sold within the United States, except pursuant to an

applicable exemption from, or in a transaction not subject to, the

registration requirements of the US Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States.

The Bonus Issue Shares have not been approved or disapproved by

the US Securities and Exchange Commission, any state securities

commission in the United States or any other US regulatory

authority, nor have any of the foregoing authorities passed upon or

endorsed the merits of the offering of the Bonus Issue Shares or

the accuracy or adequacy of this Announcement. Any representation

to the contrary is a criminal offence in the United States.

OVERSEAS SHAREHOLDERS

The Bonus Issue Shares have not been, and will not be,

registered under the applicable securities laws of any jurisdiction

outside the United Kingdom. Accordingly, the Bonus Issue Shares may

not be offered, sold, delivered or otherwise transferred, directly

or indirectly, in, into or from any such jurisdiction, or to, or

for, the account or benefit of citizens or residents of any such

jurisdiction, except pursuant to an applicable exemption from, or

in a transaction not subject to, applicable securities laws of

those jurisdictions or as otherwise permitted under the applicable

securities laws of those jurisdictions. Shareholders outside the

United Kingdom are required by the Company to inform themselves

about and observe any restrictions on the offer, sale or transfer

of the Bonus Issue Shares.

No action has been taken by the Company to obtain any approval,

authorisation or exemption to permit the allotment or issue of the

Bonus Issue Shares or the possession or distribution of this

Announcement (or any other publicity material relating to the Bonus

Issue Shares) in any jurisdiction other than the United

Kingdom.

Unless otherwise determined by the Company or required by and

permitted by applicable law and regulation, the Bonus Issue will

not be implemented and documentation relating to the Bonus Issue

shall not be made available, directly or indirectly, in, into or

from an excluded territory where to do so would violate the laws of

that jurisdiction (an "Excluded Territory") and no person may vote

their Shares with respect to the Bonus Issue at the General

Meeting, or execute and deliver the Form of Proxy appointing

another to vote at the General Meeting on their behalf, by any use,

means, instrumentality or form within an Excluded Territory or any

other jurisdiction if to do so would constitute a violation of the

laws of that jurisdiction. Accordingly, copies of this Announcement

are not being, and must not be, directly or indirectly, mailed or

otherwise forwarded, distributed or sent in, into or from any

Excluded Territory and persons with access to this Announcement and

any other documents relating to the Bonus Issue (including

custodians, nominees and trustees) must not mail or otherwise

forward, distribute or send them in, into or from any Excluded

Territory. Persons who are not resident in the United Kingdom or

who are subject to the laws and/or regulations of another

jurisdiction should inform themselves of, and should observe, any

applicable requirements.

It is the responsibility of each person into whose possession

this Announcement comes to satisfy themselves as to the full

observance of the laws and regulations of the relevant jurisdiction

in connection with the distribution of this Announcement and the

issuance of the Bonus Issue Shares and to obtain any governmental,

exchange control or other consents which may be required, to comply

with other formalities which are required to be observed and to pay

any issue, transfer or other taxes due in such jurisdiction. To the

fullest extent permitted by applicable law, the Company, the Board

and all other persons involved in the Bonus Issue disclaim any

responsibility or liability for the failure to satisfy any such

laws, regulations or requirements by any person.

APPENDIX - DEFINITIONS

The following words and expressions shall have the following

meanings in this Announcement unless the context otherwise

requires:

"Admission" the admission of the Bonus Issue Shares

to listing on the premium listing segment

of the UK Official List in accordance

with the UK Listing Rules and to trading

on the Main Market for listed securities

in accordance with the UK Admission

and Disclosure Standards;

"Bonus Issue" up to GBP60 million (based on a share

price of GBP13.73 as at 27 December

2019) of capital of the Company expected

to be returned to the Qualifying Shareholders

by issuing the Bonus Issue Shares at

Admission;

"Bonus Issue Record Time" 6.00 p.m. on 27 December 2020;

"Bonus Issue Shares" 4,369,992 Shares of GBP0.50 each in

the capital of the Company;

"Circular" the document published on 18 June 2020

as a circular prepared in accordance

with the Listing Rules;

"CREST" the relevant system (as defined in the

CREST Regulations) in respect of which

Euroclear UK & Ireland Limited is the

Operator (as defined in such Regulations)

in accordance with which securities

may be held and transferred in uncertificated

form;

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001/3755), as amended;

"Directors" or "Board" the board comprising the executive directors

and non-executive directors of the Company

as at the date of this Announcement;

"Euroclear" Euroclear UK and Ireland Limited, incorporated

in England and Wales with registered

number 02878738;

"FCA" the UK Financial Conduct Authority acting

in its capacity as the competent authority

for the purposes of Part VI of the FSMA;

"Form of Proxy" the form of proxy accompanying the Circular

for use by Shareholders in relation

to the General Meeting;

"FSMA" the Financial Services and Markets Act

2000, as amended;

"General Meeting" the general meeting of the Company to

be held at the Company's Head Office

at 11 Tower View, Kings Hill, West Malling,

Kent ME19 4UY on 14 July 2020 at 12.00

noon (or any adjournment thereof), notice

of which is set out at the end of the

Circular;

"Listing Rules" the listing rules and regulations made

by the FCA under Part VI of the FSMA,

as amended;

"Main Market" the main market of the London Stock

Exchange;

"Notice of General Meeting" the notice set out at the end of the

Circular giving Shareholders notice

of the General Meeting;

"Official List" the official list of the FCA;

"Qualifying Shareholders" Shareholders who are on the register

of members on the Bonus Issue Record

Time;

"Regulatory Information any of the services authorised by the

Service" FCA from time to time for the purpose

of disseminating regulatory announcements;

"Resolutions" means the Shareholder ordinary resolutions

of Vistry Group PLC necessary to approve,

effect and implement the Bonus Issue,

including, without limitation, to: (i)

authorise the Directors to capitalise

a sum of up to GBP2,184,996 and apply

such sums by way of a Bonus Issue to

the Shareholders; and (ii) grant authority

to the Directors to allot the Bonus

Issue Shares (and any amendment(s) thereof);

"Second Interim Dividend" the second interim dividend payment

of 41.0 pence per Share totalling GBP60

million, which was previously intended

to be paid on 29 May 2020 to Qualifying

Shareholders;

"Shareholders" the holders of the Shares in the capital

of the Company;

"Shares" the ordinary shares of GBP0.50 each

in the capital of the Company;

"United Kingdom" or "UK" the United Kingdom of Great Britain

and Northern Ireland;

"United States" or "US" the United States of America, its territories

and possessions, any state of the United

States and the District of Columbia;

"US Securities Act" the US Securities Act of 1933, and the

rules and regulations promulgated thereunder,

as amended;

"Vistry Group PLC" or Vistry Group PLC, a public limited company

"Company" incorporated in England and Wales with

registered number 00306718, whose registered

office is 11 Tower View, Kings Hill,

West Malling, Kent, ME19 4UY, United

Kingdom; and

"Voting Record Time" 10 July 2020 at 10.00 p.m., or, if the

General Meeting is adjourned, not later

than 48 hours before the time appointed

for the adjourned meeting.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBRGDLCDBDGGR

(END) Dow Jones Newswires

June 18, 2020 02:00 ET (06:00 GMT)

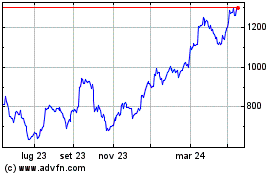

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

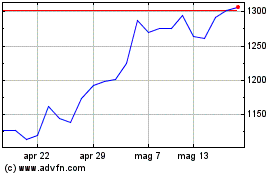

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024