RNS No 0561k

BOVIS HOMES GROUP PLC

15th March 1999

BOVIS HOMES GROUP PLC

PRELIMINARY RESULTS

FOR THE YEAR ENDED 31 DECEMBER 1998

The Board of Bovis Homes Group PLC today announced its preliminary results

for 1998.

* Pre tax profit increased 20.6% to #45.0 million (1997: #37.3 million)

* Adjusted earnings per share increased by 21.0% to 27.6p (1997: 22.8p)

* Operating margin increased by 25% to 19.3% (1997: 15.4%)

* Return on average capital employed increased to 20.2% (1997: 18.8%)

* Plots with planning consent increased to 9,466 plots (4.1 years' supply

on 1998 completions)

* Strategic land holdings of 16,445 potential plots (1997: 13,007

potential plots)

* Final dividend of 6.67p net per ordinary share making 10.0p for the

year (2.76 times covered)

* Year end net borrowings of #6.8 million (3% gearing)

Commenting on the results, Malcolm Harris, the Chief Executive of Bovis

Homes Group PLC said:

"The objectives set for 1998 relating to profit and minimum return upon

capital employed were achieved with a strong investment in land providing an

excellent base to expand the business. The first two months of the current

year were most encouraging, with both reservations and selling prices ahead of

the same period last year. Barring major unforeseen economic changes, we

anticipate another successful year."

Enquiries: Malcolm Harris, Chief Executive

Bovis Homes Group PLC

Tel: 0171 329 0096 on Monday 15 March

Tel: 01474 872427 thereafter

Chairman's Statement

In its first full year as an independent public company, Bovis Homes

has succeeded in producing an excellent set of results as well as enhancing

its land bank. Shareholders have seen earnings growth of 21.0% with adjusted

earnings per share increasing from 22.8p in 1997 to 27.6p in 1998.

Results

Profit before tax for the year ended 31 December 1998 amounted to #45.0

million, an improvement of 20.6% over 1997.

The Group concentrated on improving shareholders' results through its

land management skills, innovative designs, tight cost controls and

marketing expertise. In consequence the operating margin improved and remains

one of the highest in the industry.

Market conditions for the Group in its areas of operation were steady

throughout the year; falling interest rates in the second half of the year

and improving affordability encouraging people to have the confidence to buy

new homes despite concerns about the economy.

Strategy

The Group has maintained its strategies in pursuance of its policy to

maximise shareholder value. In addition to improving margins on existing

developments the Group has invested in prime locations to strengthen both

the consented and strategic land banks, to allow growth across each of the

regions and Retirement Homes.

Dividends

The board of directors is proposing a final dividend for the year ended

31 December 1998 of 6.67p to be paid on 28 May 1999 to shareholders on the

register at the close of business on 23 April 1999. This dividend when

added to the interim dividend of 3.33p paid on 27 November 1998 totals

10.0p for the year, and is covered 2.76 times by the basic earnings per

share of 27.6p.

The Board

There have been no changes to the constitution of the Board during 1998.

The Chief Executive, Mr Malcolm Harris, and the other executive directors

have led the Company in a positive manner, whilst my non-executive

colleagues, Mr Mark Nicholls and Mr Tim Melville-Ross have provided

independent experience and guidance.

Employees

I would like to thank all employees of the Group for their dedication and

effort in delivering a very good overall performance in 1998.

The Future

The UK economy has undoubtedly slowed over the last year but the influence

of lower European interest rates should help to keep UK affordability at

very favourable levels in 1999, given that current rates of increase in

annual earnings and underlying inflation stay broadly unchanged.

The Group has an excellent land bank, an attractive range of homes, a

well motivated work force and with a clear strategy to achieve its

objectives. With these attributes in place the Board has reason to be

confident going forward.

Sir Nigel Mobbs

Chairman

Chief Executive's operational review

The Market

Housing affordability has remained favourable throughout the 12 month

period with progressive improvement following interest rate cuts and

increased earnings. The Halifax monthly index showed UK home prices increasing

by 4.5% in 1998, broadly in line with the increase in annual earnings.

Total property transactions in England and Wales, however, showed a

reduction of approximately 6% compared with the previous year.

Performance

Faced with relatively stable trading conditions I am pleased to be able

to advise you that 1998 was a year of encouraging progress as far as Bovis

Homes was concerned, with improvements to operating margin and return on

average capital employed. Also, there was a significant improvement in the

quality and size of our land holdings. Furthermore, we believe that the

Group's strategy of focusing upon these key areas will enable us to deliver

our objectives of annual growth in profits and earnings per share.

Bovis Homes' operating margin of 19.3% (1997: 15.4%) reflects the

combined benefits derived from the introduction of new products, improved

specification, skilful marketing, good land management, strong cost

controls and value engineering exerted throughout the Group.

These initiatives helped us to increase our average selling price per

square foot by 7.0% net of incentive and part exchange costs, and contain the

increase in average building cost per square foot to less than 1.0%,

including specification enhancements, compared with the previous year.

All regions and Retirement Homes improved their profitability and

operating margins compared with 1997 and are now achieving above average

operating margins for the industry.

Regional operating margin analysis

Year ended 31 December 1998 1997

% %

--------------------------------- ----- -----

South East 23.3 19.0

South West 13.7 12.1

Central 15.5 10.5

Retirement Homes 23.9 19.7

--------------------------------- ----- -----

Group 19.3 15.4

--------------------------------- ----- -----

Turning to another key measurement of performance, the Group increased

its return on average capital employed to 20.2% compared with 18.8% in

1997, notwithstanding major investments in land during the year.

Product mix and average selling price

Further progress was made with the expansion of our social housing

business which increased from 8.0% to 15.0% of our volume,

demonstrating our competitiveness in the social house building market during

a period of reduced activity in this sector.

The average selling price per unit increased to #96,800 from #92,600 in

1997, resulting from the following product mix and regional unit completion

analyses:

Product mix analysis

Year ended 31 1998 1997 1998 1997 1998 1997

December

unit unit average average

completions completions selling selling

price price

House type % % # #

----------------- ----------- ----------- ---- ----- ------- -------

One and two

bedrooms 484 477 21 19 67,500 65,400

Three bedrooms 534 761 23 30 84,100 73,400

Four bedrooms 744 841 32 33 122,900 118,000

Five or more

bedrooms 65 103 3 4 228,400 177,700

Social Housing 347 202 15 8 56,000 53,000

Retirement* 129 172 6 6 153,000 124,200

----------------- ----------- ----------- ---- ----- -------- -------

Total 2,303 2,556 100 100 96,800 92,600

----------------- ----------- ----------- ---- ----- -------- -------

* Of the total completions in 1997, 146 were sales made by the Retirement

Homes operation. The balance of the retirement units sold comprises sales

made by the other three regions of homes for the elderly which do not have

very sheltered housing facilities.

Regional unit completion profile

Year ended 31 December 1998 1998 1997 1997

unit unit

completions completions

% %

-------------------------- ------------ ------- ---------- ------

South East 1,012 44 1,104 43

South West 595 26 677 26

Central 567 24 629 25

Retirement Homes 129 6 146 6

-------------------------- ------------ ------- ---------- ------

Total 2,303 100 2,556 100

-------------------------- ------------ ------- --------- ------

The regions and Retirement Homes have broadly maintained their proportion

of total unit completions.

Land and planning

One of the major strengths of Bovis Homes is an expertise in land

management. During the past twelve months we have successfully invested

in prime sites strengthening our consented and strategic land holdings.

Plots held with planning consent for immediate development increased from

8,296 plots at the start of the year to 9,466 plots at 31 December 1998,

representing over four years' land supply at 1998 legal completion

level, one of the strongest positions in the industry. We were successful

in implementing our policy of acquiring developments in good locations,

improving the quality of our investments, including 1,014 plots from our

strategic holdings which were transferred during the year following

planning consent being granted.

Our average plot cost as at 31 December 1998, excluding social housing,

was #22,100, which was 21.2% of our average selling price excluding social

housing, and reflected the high weighting of plots in the South East of

England.

Consented land bank

Analysis by region and Retirement Homes as at 31 December

1998 1998 1997 1997

Plots % plots %

-------------------------- ----------- ------- --------- ---------

South East 3,725 39 3,013 36

South West 2,525 27 2,351 29

Central 2,905 31 2,572 31

Retirement 311 3 360 4

-------------------------- ----------- ------- --------- -----------

Total 9,466 100 8,296 100

-------------------------- ----------- ------- --------- -----------

At 31 December 1998, the Group also controlled strategic holdings which

are capable, subject in most cases to planning consent, of providing 16,445

plots of building land as follows:

Strategic land bank

Total potential plots as at 31 December

1998 1997

Plots Plots

----------------------------- -------- -------

South East 9,626 7,730

South West 3,648 2,570

Central 3,025 2,664

Retirement Homes 146 43

----------------------------- -------- -------

Total 16,445 13,007

----------------------------- -------- -------

The Group is promoting this land through the planning process, and at the

year end 9,175 of these potential plots were included in 'growth locations'.

Strategic land bank

Potential plots in 'growth locations' as at 31 December

1998 1997

Plots Plots

--------------------------- -------- ------------

South East 6,224 6,326

South West 1,403 678

Central 1,402 1,254

Retirement Homes 146 43

--------------------------- --------- ------------

Total 9,175 8,301

--------------------------- --------- ------------

'Growth locations': areas designated for development within draft or

adopted development plans by local, county or unitary planning authorities.

Potential plots in 'growth locations' are a component of the strategic land

bank.

During the financial year, 37% (1997: 32%) of the Group's development profit

was achieved from units built on land promoted through its strategic holdings.

Also, during the financial year, 34% of the Group's production was

based upon previously used land (1997: 30%).

The land management team has continued to acquire interests in prime areas

at prices that are acceptable to meet the Group's requirements and to

provide a strong base for our continued expansion and prosperity. Despite

the procedural difficulties of obtaining planning consents, we anticipate an

increase in the number of consented plots derived from our strategic land

bank over the coming years.

Our planned expansion into the North of England is progressing well and a

new area office at Wilmslow is due to be opened during April. Additional

sites with planning consent have been acquired for immediate development

in Nantwich; Cheshire, and, Wakefield and Beverley; Yorkshire. Furthermore,

Retirement Homes have started building at Port Sunlight and Hoylake, in

addition to their development in Huyton.

Office relocations

Our office at Lansdown Road, Cheltenham was sold during the year and a

new freehold office acquired at Bishops Cleeve on the outskirts of

Cheltenham. The new office has been refurbished and a major extension is

under construction, which we anticipate being completed by summer 1999,

whereupon the remaining staff will transfer to Bishops Cleeve which will

then become the Company's new Registered Office. The move provides improved

accommodation and lower running costs. Also, it has released approximately

#1.4 million of cash for investment in the business.

Castle Bromwich Hall offices are currently being marketed with the objective

of us moving to a new office in the Birmingham area, again with an aim of

reducing capital employed and a saving as regards running costs.

Health, safety and environmental matters

Bovis Homes promotes all aspects of safety and environmental

awareness throughout its operations in the interests of employees, purchasers,

contractors and visitors to its sites and premises. The Company views this as

an essential element in the success of the business. Clear policies,

procedures and systems operate throughout the Group with a particular

emphasis upon innovation, practical implementation and continuous

improvement.

Bespoke training and proprietary equipment has been developed and installed

and performance standards set for health, safety and environmental concerns.

Working with external professional consultants performance is monitored

and reviewed including audits.

In 1998 the Company's achievements were recognised by a national award from

the British Safety Council and a Gold Award from the Royal Society

for the Prevention of Accidents.

Outlook for 1999

We enter the new year with UK employment at an all time high and

the unemployment rate close to a twenty year low.

Base interest rates have fallen and there are likely to be further

reductions. Average earnings are increasing by approximately 4% per annum,

roughly in line with the projected average increase in house prices

(Halifax's latest forecast). Affordability is therefore likely to be at its

most advantageous since records began.

We anticipate a steady housing market with significant regional variations

to both sales rates and prices, reflecting the level of local economic

activity.

We started 1999 with an additional number of prime outlets which we

will progressively increase during the next twelve months. Our product range

is being expanded with new, exciting designs and specification improvements.

We have the benefits of high calibre, well motivated employees throughout

the organisation and a wider geographic spread of sites. We are confident

that our policies will deliver further positive results for our shareholders.

Malcolm Harris

Chief Executive

Financial review

The Group has taken advantage of its extensive financial resources to

strengthen its trading assets. Both the land bank and work in progress on

site have been significantly increased from the start of the year and

provided a solid base as we moved forward into 1999. This has been achieved

in conjunction with a return on average capital employed of 20.2% in 1998,

and adjusted earnings per share growth of 21.0% over 1997.

Review of results

The operating profit of #45.1 million improved by 18% compared with 1997

(#38.3 million) on turnover of #234.3 million (1997: #248.9 million). This

was driven by the focus on maximising margins rather than volume. This

increased level of profitability was based on 2,303 unit completions at an

average selling price of #96,800, as against 2,556 unit completions at an

average selling price of #92,600 in the previous year. Land sale

turnover, coupled with a relatively small amount of other income, amounted

to #11.4 million (1997: #12.2 million). Land sales generated a profit less

option costs of #2.2 million (1997: #0.2 million).

The operating profit has continued to benefit from the greater proportion

of value-engineered products, procurement policies, and cost effective

marketing procedures. The gross margin has risen to 28.4% of turnover compared

with 23.5% in the prior year, and the operating margin to 19.3% (1997: 15.4%).

Interest payable less receivable during the year was not significant at

#0.1 million (1997: #1.0 million) due to a positive net cash position for a

part of the year.

Profit before tax of #45.0 million showed an improvement of 20.6% over

1997 (#37.3 million). Corporation tax absorbed #13.9 million (1997: #11.6

million), to leave profit on ordinary activities after tax of #31.1 million

(1997: #25.7 million). Dividends paid and proposed for the year are covered

2.76 times by profits earned and absorb a further #11.3 million.

Review of balance sheet

Shareholders' funds have increased by 9.5% from #208.7 million at the start

of the year to #228.5 million at the close. This was after deducting #11.3

million in respect of dividends paid and proposed for the year. Based on

the issued share capital of 112.8 million shares throughout the year the net

asset value per share rose from 185p to 203p.

During 1998 the net book value of fixed assets has reduced from #9.6 million

to #7.1 million, largely reflecting the sale of our freehold office at

Lansdown Road, Cheltenham, and net current assets have increased from #212.0

million to #239.0 million. The most substantial movements in the book

value of current assets are as follows:

* Land held for development has increased by #52.1 million.

* Other stocks and work in progress have risen by #24.4 million.

* Cash and short term deposits have reduced by #29.6 million.

It should also be noted that creditors under and over one year amounting

to #114.1 million (1997: #86.2 million) included deferred land payments of

#51.1 million compared with #38.0 million at the end of 1997.

Overall, this represents a significant strengthening of the balance sheet.

Review of cash flow

Net borrowings at 31 December 1998 amounted to #6.8 million and represented

a debt/equity position of 3%. The surplus cash on deposit at the start of the

year was essentially invested in development land and work in progress during

1998, particularly in the second half of the year.

At 31 December 1998 the Group held bilateral committed revolving loan

facilities totalling #100.0 million from five banks, of which #5.0 million had

been drawn. These facilities and uncommitted bonding facilities of #55.0

million mature on 2 November 2002. In addition the Group has #10.0 million of

overdraft facilities available.

The strong balance sheet with the modest level of gearing, coupled with

the borrowing facilities outlined above put the Group in a very sound

financial position.

Ron Walford

Finance Director

Group profit and loss account

Continuing operations

For the year ended 31 December 1998

1998 1997

#000 #000

-------------------------------------------- --------- ----------

Turnover 234,285 248,878

Cost of sales (167,818) (190,350)

-------------------------------------------- --------- ----------

Gross profit 66,467 58,528

Administrative expenses (21,339) (20,270)

-------------------------------------------- --------- ----------

Operating profit 45,128 38,258

Interest receivable and similar income 555 322

Interest payable and similar charges (661) (1,243)

-------------------------------------------- --------- ----------

Profit on ordinary activities before taxation 45,022 37,337

Taxation on profit on ordinary activities (13,900) (11,600)

-------------------------------------------- --------- ----------

Profit on ordinary activities after taxation 31,122 25,737

Dividends paid and proposed (11,280) (29,000)

Transfer from reserves - 3,263

-------------------------------------------- --------- ----------

Retained profit for the financial year 19,842 -

-------------------------------------------- --------- ----------

-------------------------------------------- --------- ----------

Basic earnings per ordinary share 27.6p #2.71

-------------------------------------------- --------- ----------

Diluted earnings per ordinary share 27.5p #2.71

-------------------------------------------- --------- ----------

Adjusted earnings per ordinary share 27.6p 22.8p

-------------------------------------------- --------- ----------

Adjusted earnings per ordinary share is calculated on the basis of the

112.8 million ordinary shares in issue at 31 December 1998 as if they had

been in issue throughout the two years ended 31 December 1998. Both the

basic and diluted earnings per share for 1997 are affected by the relatively

low number of ordinary shares in issue prior to flotation in December 1997.

Consequently, the Board believes that for comparison purposes, adjusted

earnings per share presents a more appropriate measure.

In both the current and preceding financial periods there was no

material difference between the historical cost profits and losses and those

reported in the profit and loss account.

Group balance sheet

At 31 December 1998

1998 1997

#000 #000

---------------------------------------------- ----------- ------------

Fixed assets

Tangible assets 7,121 9,588

Investments 24 24

---------------------------------------------- ----------- ------------

7,145 9,612

---------------------------------------------- ----------- ------------

Current assets

Stocks and work in progress 320,201 243,696

Debtors due within one year 10,981 8,090

Debtors due after more than one year 3,957 3,597

Cash and short term deposits 370 29,988

---------------------------------------------- ----------- ------------

335,509 285,371

---------------------------------------------- ----------- ------------

Creditors: amounts falling due within one year (96,533) (73,355)

---------------------------------------------- ----------- ------------

Net current assets 238,976 212,016

---------------------------------------------- ----------- ------------

Total assets less current liabilities 246,121 221,628

Creditors: amounts falling due after more than

one year (17,604) (12,886)

---------------------------------------------- ----------- ------------

Net assets 228,517 208,742

---------------------------------------------- ----------- ------------

Capital and reserves

Called up share capital 56,399 56,399

Share premium 132,103 132,103

Revaluation reserve 817 884

Profit and loss account 39,198 19,356

---------------------------------------------- ----------- ------------

Equity shareholders' funds 228,517 208,742

---------------------------------------------- ----------- ------------

Group cash flow statement

For the year ended 31 December 1998 1998 1997

#000 #000

---------------------------------------------- ----------- ------------

Net cash (outflow)/inflow from operating

activities (20,285) 51,580

Returns on investments and servicing of finance

Interest received 555 322

Interest paid (1,002) (1,506)

---------------------------------------------- ----------- ------------

(447) (1,184)

---------------------------------------------- ----------- ------------

Taxation paid (11,288) (6,707)

---------------------------------------------- ----------- ------------

Capital expenditure and financial investment

Sale of tangible fixed assets 3,324 506

Purchase of tangible fixed assets (2,288) (2,897)

---------------------------------------------- ----------- ------------

1,036 (2,391)

---------------------------------------------- ----------- ------------

Equity dividend paid (3,756) (29,000)

---------------------------------------------- ----------- ------------

Cash (outflow)/inflow before management

of liquid resources and financing (34,740) 12,298

Management of liquid resources

Movement in short term deposits 29,618 (29,988)

Movement in short term borrowings 5,000 -

---------------------------------------------- ----------- ------------

34,618 (29,988)

---------------------------------------------- ----------- ------------

Financing

Issue of ordinary share capital - 188,492

Repayment of P&O loans - (169,492)

---------------------------------------------- ----------- ------------

- 19,000

---------------------------------------------- ----------- ------------

(Decrease)/increase in cash (122) 1,310

---------------------------------------------- ----------- ------------

Group statement of total recognised gains and losses

For the year ended 31 December 1998 1998 1997

#000 #000

---------------------------------------------- ----------- ------------

Profit for financial year 31,122 25,737

Impairment loss on revalued asset (67) -

---------------------------------------------- ----------- ------------

Total recognised gains relating to the year 31,055 25,737

---------------------------------------------- ----------- ------------

Group reconciliation of movements in shareholders' funds

For the year ended 31 December 1998 1998 1997

#000 #000

---------------------------------------------- ----------- ------------

Opening shareholders' funds 208,742 23,494

Disposal of revalued property - 19

Issue of share capital - 188,492

Total recognised gains and losses for the year 31,055 25,737

Dividends paid and proposed (11,280) (29,000)

---------------------------------------------- ----------- ------------

Closing shareholders' funds 228,517 208,742

---------------------------------------------- ----------- ------------

Group reconciliation of operating profit to operating cash flows

For the year ended 31 December 1998 1998 1997

#000 #000

---------------------------------------------- ----------- ------------

Operating profit 45,128 38,258

Depreciation 1,290 1,139

Loss/(profit) on disposal of tangible fixed

assets 74 (124)

(Increase)/decrease in stocks (76,505) 7,116

(Increase)/decrease in debtors (2,819) 1,952

Increase in creditors 12,547 3,239

---------------------------------------------- ----------- ------------

Net cash (outflow)/inflow from operating

activities (20,285) 51,580

---------------------------------------------- ----------- ------------

Group reconciliation and analysis of net debt

For the year ended 31 December 1998 1998 1997

#000 #000

--------------------------------------------- ---------- ------------

(Decrease)/increase in cash in the year (122) 1,310

Movement in short term deposits (29,618) 29,988

Movement in short term borrowings (5,000) -

Cash outflow from movement in interest

bearing loan with P&O - 4,000

Cash outflow from movement in interest free

loan with P&O - 165,492

--------------------------------------------- ---------- ------------

Change in net funds (34,740) 200,790

Opening net funds/(debt) 27,899 (172,891)

--------------------------------------------- ---------- ------------

Closing net (debt)/funds (6,841) 27,899

--------------------------------------------- ---------- ------------

Split:

Bank overdraft (2,211) (2,089)

Short term borrowings (5,000) -

Short term deposits 370 29,988

--------------------------------------------- ---------- -----------

(6,841) 27,899

--------------------------------------------- ---------- ------------

Notes to the accounts

1 Basis of preparation

The Group accounts include the accounts of the Company and its

subsidiary undertakings all of which are made up to 31 December 1998.

The financial information included within this statement does not constitute

the Company's statutory accounts for the year ended 31 December 1998 or 1997.

The information contained in this statement has been extracted from the

statutory accounts of Bovis Homes Group PLC for the year ended 31 December

1998, which have not yet been filed with the Registrar of Companies, on

which the auditors have given an unqualified audit report, not containing

statements under section 237(2) or (3) of the Companies Act 1985.

2 Earnings per ordinary share

Basic earnings per ordinary share for the year ended 31 December 1998

is calculated on profit after tax of #31,122,000 (1997: #25,737,000) over

the weighted average of 112,798,032 (1997: 9,495,586) ordinary shares in

issue during the year.

Diluted earnings per ordinary share is calculated on profit after tax

of #31,122,000 (1997: #25,737,000) over the diluted weighted average of

113,183,650 (1997: 9,501,781) ordinary shares potentially in issue during

the year. The diluted average number of shares is calculated in

accordance with FRS 14 Earnings Per Share. The dilutive effect relates

to those potential ordinary shares, currently held under option, which would

be issued for nil consideration after first applying the total share option

exercise consideration in purchasing a number of ordinary shares at full

market value. The market value has been calculated using the average

ordinary share price during the year. For 1997, the average ordinary

share price has been calculated over the period during which the Company

was listed. Only share options which have met their cumulative

performance criteria have been included in the dilution calculation.There is

no dilutive effect on the profit after tax used in the diluted earnings

per share calculation.

Adjusted earnings per ordinary share is calculated on profit after tax

of #31,122,000 (1997: #25,737,000) over the 112,798,032 ordinary shares in

issue at 31 December 1998 as if they had been in issue throughout the two

years ended 31 December 1998. The proceeds of the issue of shares were

applied in repaying an interest free loan due to P&O, hence no adjustment has

been made to earnings in respect of interest. The Board believes that

adjusted earnings per share is the most appropriate basis for comparing

earnings per share throughout the period.

3 Taxation

The rate of corporation tax applied was 31% for the year to 31 December 1998

and 31.5% for the year to 31 December 1997.

The effective corporation tax payable for the year ended 31 December 1997

was reduced by brought forward tax losses.

4 Dividends

The proposed final dividend of 6.67 pence net per ordinary share will be paid

on 28 May 1999 to holders of ordinary shares on the register at the

close of business on 23 April 1999. The dividend when added to the already

paid interim dividend of 3.33 pence, totals 10.0 pence for the year.

5 Year 2000

The directors recognise the importance of the year 2000 issue and the Group

has programmes in place to identify and mitigate risks associated with

potential year 2000 problems. These programmes are progressing and it is not

anticipated that material costs will be incurred. However, this is a

complex issue and therefore there is no absolute guarantee that problems

will not be encountered.

END

FR JTMPBLLTBBPL

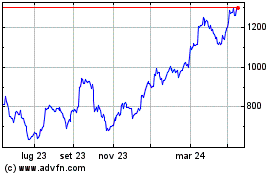

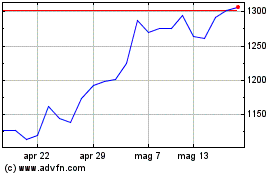

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024