TIDMWEB

RNS Number : 9139Q

Webis Holdings PLC

24 February 2023

For immediate release 24 February 2023

Webis Holdings plc

("Webis" or "the Group")

Interim Report and Financial Statements for the period ended 30

November 2022

Webis Holdings plc, the global gaming group, today announces its

unaudited Interim Report and Accounts for the period ended 30

November 2022.

Denham Eke, Non-executive Chairman stated:

"Our principal subsidiary, WatchandWager.com ("WatchandWager"),

had a mixed start to the first six months of the financial year.

Trading was strong during the summer months, where we enjoyed

excellent commission levels from Saratoga (NY) and Del Mar (CA). On

a less positive note, trading was difficult during the months of

September, October, and November. Group amounts wagered were US$

38.2 million, turnover was US$ 6.23 million, resulting in a loss on

the period of US$ 0.33 million, largely due to the exceptionally

adverse weather conditions. I remain extremely confident as we

approach the spring months that trading will improve in line with

expectations, especially as we roll out our new Business to

Customer marketing strategy".

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ("MAR"), and is disclosed in accordance with the Company's

obligations under Article 17 of MAR.

For further information:

Webis Holdings plc Beaumont Cornish Limited

Denham Eke Roland Cornish/James Biddle

Tel: 01624 639396 Tel: 020 7628 339

Group at a Glance

Webis Holdings plc (the "Company") and its subsidiary companies

(together the "Group") operates two primary segments: -

WatchandWager.com Ltd and WatchandWager.com LLC - Advanced

Deposit Wagering ("ADW")

WatchandWager.com LLC - Cal Expo Harness Racetrack

WatchandWager.com Ltd is regulated in the Isle of Man and

operates a totalisator wagering hub through its United States Tote

supplier, which enables it to conduct its ADW business by passing

wagers directly into global racetrack betting pools in real

time.

WatchandWager.com LLC has its operational base in Lexington,

Kentucky, with its head office in Larkspur, California, and

provides pari-mutuel wagering, or pool-betting, services through a

number of distribution channels to a global client base. The

company holds United States pari-mutuel licences for its ADW

business in the USA, including a multi-jurisdictional licence

issued by the States of North Dakota, and individual licences for

the States of California, Maryland, Colorado, Minnesota, New York,

Washington, and Kentucky. The business provides wagering

opportunities predominantly on horse racing and is contracted with

a significant number of prestigious racetrack partners within the

United States, namely Churchill Downs Inc, Monarch Content

Management, the New York Racing Association, Penn Gaming and all

other major track operators in the USA. Internationally, the

company has contracts with Hong Kong, France, Canada, United

Kingdom, Ireland, Australia, and South Africa amongst many others.

The service provides wagering facilities to customers through its

interactive website, watchandwager.com, as well as offering a

business-to-business wagering product.

WatchandWager.com LLC also operates Cal Expo Harness Racetrack

in Sacramento, California, under a licence issued by the California

Horse Racing Board. This 'bricks and mortar' presence in the

largest State economy in the USA continues to provide leverage for

our related global pari-mutuel operations. The current lease at Cal

Expo extends to 2030.

As part of the requirements for the Isle of Man licence, client

funds for the Isle of Man licensed companies are held in fully

protected segregated client accounts within an Isle of Man

regulated bank.

Chairman's Statement

Introduction

Our principal subsidiary, WatchandWager.com ("WatchandWager"),

has had a mixed start to the first six months of the year. Trading

was strong during the summer months, where we enjoyed excellent

commission levels from Saratoga (NY) and Del Mar (CA). In addition,

we received better than expected "dark money" commissions (being

statutory revenues from wagers placed by Californian residents on

global content) from our licensed racetrack at Cal Expo. During the

period when we were not physically racing, under California Horse

Racing Board rules, we are entitled to a percentage of revenues

derived from Californian residents. On a less positive note,

trading was difficult during the months of September, October, and

November. These conditions continued into the winter, principally

due to unprecedented severe weather conditions leading to a lack of

content, experienced both by us and by many of our global racetrack

partners.

Nevertheless, we remain optimistic about the future of the

operation. Following a number of test marketing campaigns, we are

particularly encouraged by the growth in our B2C division, where we

are experiencing a consistent increase in the prior years' levels

of wagers placed. This has been helped by our recently signed

contract with Monarch Content Management, as previously announced,

with more detail below. As a result, we have developed a new

marketing strategy which we will implement in the second quarter of

this year, following which we expect trading to improve

significantly in the spring and summer of 2023.

Half Year Results Review

Group amounts wagered were US$ 38.2 million, down 4% on prior

year (2021: US$ 39.9 million). Turnover reported was US$ 6.23

million (2021: US$ 6.80 million), with gross profit achieved of US$

1.99 million (2021: US$ 2.18 million). This resulted in a loss on

the period of US$ 0.33 million (2021: loss of US$ 0.07

million).

Operating costs showed a small increase to US$ 2.31 million

(2021: US$ 2.22 million), arising from a general increase in cost

of living. Cash and cash equivalents stand at US$ 2.80 million (31

May 2022: US$ 3.06 million).

Operations Update

Business-to-Consumer (B2C)

This division performed well over the period and continues to do

so. Most importantly, it now contributes the majority (75% over the

period) of our gross margin as compared to the Business-to-Business

division.

We have experimented with a variety of online marketing

techniques to promote our website and mobile operation,

particularly through Facebook and other channels. We specifically

targeted high-margin states, most notably Florida, with tailored

content. This derived a positive return on investment. However,

given the downturn in our other business streams later in the

period, we temporarily paused these initiatives, but we fully

intend to roll out the entire programme with effect from April

2023.

Whilst not neglecting other sectors of business, the Board now

recognises that the growth of the B2C sector is our best avenue of

opportunity, but one that we have neglected in the past. Our stated

objective is to double our player numbers on our platform by the

end of 2024. On known metrics, this would provide a sustainable

level of profitability for the company, on top of all our other

revenue streams.

Business-to-business (B2B)

This continues to be an important sector of our division, but

is, and most probably will continue to be, both difficult to manage

and maximize margin. As stated on several occasions, the market is

simply getting tougher, with the big players dominating and certain

operators willing to take wagers at an almost zero percent margin.

This is not now a model that we are particularly interested in for

obvious reasons. That said, we will not abandon this division and

never knowingly turn down business as long as it is conducted in a

legal, licensed and regulated fashion.

Cal Expo

Following the end of racing in May 2022, we enjoyed very strong

revenue levels from "dark money". We commenced live racing

operations on 5 November 2022, with initial performance being very

strong, both in terms of horse population and the level of wagers

placed. Unfortunately, after that, we experienced torrential

volumes of rainfall throughout northern California. This resulted

in the cancellation of seven race meetings, which obviously had

significant impact on the operation. We have Health and Safety

obligations to our equine and human participants at the track and,

of course, without live racing, revenue levels were below

normal.

On a more positive note, at time of writing, conditions have

significantly improved in California, and we expect very strong

trading through the racetrack until our scheduled end-of-season in

late April.

Licenses

USA

I am pleased to report that we have successfully renewed our

entire portfolio of licenses in the USA. Most importantly, we were

approved by the Californian Horse Racing Board for our Advanced

Deposit Wagering license until the end of 2024. Combined with that,

as shareholders are aware, we have the exclusive right to continue

live operations at Cal Expo until 2030.

Whilst California is our key priority, I can also report that

all our licenses in key states have been further extended, the most

notable of which are in New York, Kentucky, Washington State, and

multiple other important states. We consider our array of licenses

to continue to be a key asset to the Group.

Isle of Man

I am also pleased to report that during the period we renewed

our license with the Isle of Man Gambling Supervision Commission

for a further five years. Whilst we consider the US to be our main

avenue for growth, we also believe as amongst the very first

license holders within the Isle of Man regulatory environment, that

this license is also a key asset to the Group and offers a

significant protection for our customer base.

Content

Based on competitor research, we know that we offer the widest

range of live content of any tote website in the world, both within

the USA and internationally. Unfortunately, we have not yet been

able to properly capitalise upon the extent of this coverage. Given

our stated objective to grow player numbers following the roll-out

of an improved web site and mobile ap, accompanied with renewed

market initiatives, we see no reason why these contractual

relationships should not be extended both middle and long term.

Most importantly, as announced on the 23 December 2022, we

signed a significant agreement with Monarch Management Content

throughout 2023. This has had an immediate and positive impact on

our B2C business, and there is no reason why this relationship

should not continue given our good compliance record and our

current assets in the USA.

Compliance

There were no compliance issues reported to our various

regulators during the period.

Health & Safety

There were no health and safety issues to report across the

entire Cal Expo operation, where equine and participant welfare

remain our highest priority. Clearly, operations have been very

difficult at the racetrack in the recent period, and I would

particularly like to thank all our staff and associated partners

for their commitment to equine and human welfare.

Outlook

Short term

As stated, we have had a difficult period post October 2022.

Despite that, I remain extremely confident as we approach the

spring months that trading will improve in line with

expectations.

In particular, the Board has been very pleased with the

performance of our B2C operations, which has continued to show

consistent year-on-year growth compared to the same period last

year. It is a key focus to continue this momentum going

forward.

Longer term

Arizona Downs project

As previously announced, we have a contract to operate live

racing at this facility with a planned start date of September

2023. At present, we are simply awaiting our license hearing from

the Arizona Gaming Commission. We expect this to be completed no

later than the end of March 2023, but will inform shareholders if

these dates change. We see this as an important revenue earner in

its own right, but also as support for our Cal Expo operations. In

addition, it would provide us with extra leverage outside of

California.

USA Expanded Gaming

During the period, shareholders will be aware of the failure of

Proposition 26 and 27 to approve various forms of sports betting in

California (November 2022). Contrary to general opinion, this was a

very positive result for WatchandWager, as we had been deliberately

excluded from the 26 vote, and the 27 vote made little commercial

sense.

As a licensed operator within California until at least 2030, we

are well positioned in this potential market which is of course

arguably the biggest new growth opportunity for sports betting

globally. We are of the view that public referendums will not work,

and most participants have learned the lesson from this. At time of

writing, we are aware of at least two draft new bills at the Senate

level in Sacramento, only two miles away from our licensed

racetrack. We believe legalised sports betting will inevitably

happen in California for two reasons. Firstly, the market demand is

too strong, and the public want to be able to bet in a legal and

licensed manner, rather than with illegal offshore operators.

Secondly, the economics are compelling, as initiatives in New York,

New Jersey and other states have shown. California is now

predicting a significant budget deficit into 2023 and 2024,

primarily due to the downturn in within the technology, social

media, and other associated industries. Pressure can only mount in

the state Capitol for legalisation and the accompanying tax

revenue. Optimistically, a bill could be live by 2024 and, of

course, will only be permitted to licensed operators including

ourselves.

Strategy

The Board is currently engaged in a strategy review of our key

business sectors. We are convinced the strategy for growth is to

build on our successes in the B2C sector and grow our many licensed

assets. We will be issuing an update to shareholders on this

strategy by end April 2023.

Acquisitions and Mergers

We remain very optimistic regarding the business, especially our

B2C and live racetrack operations in CA, and AZ in the future.

However, we do know that the entire industry is a game of scale

with the big becoming bigger and some of the smaller operators

struggling. We are aware that we are probably in the middle of the

pack, and we remain open to all discussions with credible licensed

operators throughout the world in relation to merger and

acquisition opportunities at an operating business level, providing

they operate in a licensed and regulated environment and pass due

diligence.

Finally, I would like to thank all our shareholders, customers,

and our staff in the various jurisdictions for their loyalty and

support of the business.

Denham Eke

Non-executive Chairman

23 February 2023

Condensed Consolidated Statement of Comprehensive Income

For the period ended 30 November 2022

Period to

30 November

Period to 2021

30 November

2022 (unaudited) (unaudited)

Note US$000 US$000

-------------------------------------------- ----- ------------------- --------------

Amounts wagered 38,241 39,849

-------------------------------------------- ----- ------------------- --------------

Turnover 3 6,226 6,795

Cost of sales (4,185) (4,566)

Betting duty paid (52) (53)

-------------------------------------------- ----- ------------------- --------------

Gross profit 1,989 2,176

-------------------------------------------- ----- ------------------- --------------

Operating costs (2,307) (2,220)

Other gains / (losses) 12 (3)

-------------------------------------------- ----- ------------------- --------------

Other income 62 39

Operating loss (244) (8)

-------------------------------------------- ----- ------------------- --------------

Finance costs 4 (81) (62)

-------------------------------------------- ----- ------------------- --------------

Loss before income tax (325) (70)

-------------------------------------------- ----- ------------------- --------------

Income tax expense 5 - -

-------------------------------------------- ----- ------------------- --------------

Loss for the period (325) (70)

-------------------------------------------- ----- ------------------- --------------

Other comprehensive income for the period - -

-------------------------------------------- ----- ------------------- --------------

Total comprehensive loss for the period (325) (70)

-------------------------------------------- ----- ------------------- --------------

Basic and diluted earnings per share for

loss attributable to the equity holders of

the Company during the period (cents) 6 (0.08) (0.02)

-------------------------------------------- ----- ------------------- --------------

Condensed Consolidated Statement of Financial Position

As at 30 November 2022

As at Year ended

30 November 2022 31 May 2022

(unaudited) (audited)

Note US$000 US$000

------------------------------------------- ----- -------------------- --------------

Non-current assets

Intangible assets 7 11 11

Property, equipment and motor vehicles 674 724

Bonds and deposits 100 100

------------------------------------------- ----- -------------------- --------------

Total non-current assets 785 835

------------------------------------------- ----- -------------------- --------------

Current assets

Bonds and deposits 883 883

Trade and other receivables 1,033 1,190

Cash, cash equivalents and restricted cash 8 3,904 4,1 39

------------------------------------------- ----- -------------------- --------------

Total current assets 5,820 6,212

------------------------------------------- ----- -------------------- --------------

Total assets 6,605 7,047

------------------------------------------- ----- -------------------- --------------

Equity

Called up share capital 6,334 6,334

Share option reserve 42 42

Retained losses (5,383) (5,058)

------------------------------------------- ----- -------------------- --------------

Total equity 993 1,318

------------------------------------------- ----- -------------------- --------------

Current liabilities

Trade and other payables 3,526 3,640

Loans, borrowings and lease liabilities 9 99 1 09

------------------------------------------- ----- -------------------- --------------

Total current liabilities 3,625 3,749

------------------------------------------- ----- -------------------- --------------

Non-current liabilities

Loans, borrowings and lease liabilities 9 1,987 1,980

Total non-current liabilities 1,987 1,980

------------------------------------------- ----- -------------------- --------------

Total liabilities 5,612 5,729

------------------------------------------- ----- -------------------- --------------

Total equity and liabilities 6,605 7,0 47

------------------------------------------- ----- -------------------- --------------

Condensed Consolidated Statement of Changes in Equity

For the period ended 30 November 2022

Called up Share option Retained Total

share capital reserve earnings equity

US$000 US$000 US$000 US$000

Balance as at 31 May

2021 (audited) 6,334 42 (4,684) 1,692

Total comprehensive income

for the period:

Loss for the period - - (70) (70)

Balance as at 30 November

2021 (unaudited) 6,334 42 (4,754) 1,622

--------------------------- --------------- ------------- ---------- --------

Called up Share option Retained Total

share capital reserve earnings equity

US$000 US$000 US$000 US$000

Balance as at 31 May

2022 (audited) 6,334 42 (5,058) 1,318

Total comprehensive income

for the period:

Loss for the period - - (325) (325)

Balance as at 30 November

2022 (unaudited) 6,334 42 (5,383) 993

--------------------------- -------------- ------------ --------- -------

Condensed Consolidated Statement of Cash Flows

For the period ended 30 November 2022

Period to Period to

30 November 30 November

2022 2021

(unaudited) (unaudited)

Note US$000 US$000

------------------------------------------------------------- ---- -------------- --------------

Cash flows from operating activities

Loss before income tax (325) (70)

Adjustments for:

* Depreciation 50 49

* Amortisation of intangible assets 3 4

* Loan interest paid 4 51 50

* (Increase) / decrease in movement of restricted cash* (27) 752

* Increase in lease liabilities 30 12

* Other foreign exchange movements (168) (5)

Changes in working capital:

* Decrease in receivables 157 476

* Decrease in payables (114) (1,336)

Cash flows used in operations (343) (68)

Bonds and deposits utilised in the course

of operations - -

Net cash used in operating activities (343) (68)

------------------------------------------------------------- ---- -------------- --------------

Cash flows from investing activities

Purchase of intangible assets (3) -

Purchase of property, equipment and motor

vehicles - -

Net cash used in investing activities (3) -

------------------------------------------------------------- ---- -------------- --------------

Cash flows from financing activities

Loan interest paid 4 (51) (50)

Increase / (payment) of lease liabilities

- principal 7 (8)

Payment of lease liabilities - interest 4 (30) (12)

Repayment of loans and borrowings (10) (3)

Net cash used in financing activities (84) (73)

------------------------------------------------------------- ---- -------------- --------------

Net decrease in cash and cash equivalents (430) (141)

Cash and cash equivalents at beginning of

year 3,062 3,238

Exchange gains on cash and cash equivalents 168 3

Cash and cash equivalents at end of period 2,800 3,100

------------------------------------------------------------- ---- -------------- --------------

*(Increase) / decrease in movement of restricted cash, has been

reclassified to Operating activities from Cash and cash

equivalents. The reclassification has been made to achieve better

presentation, as the restricted cash relates to player liabilities,

which is part of the operating activity of the Group. The impact of

this reclassification on net cash used in operating activities is a

decrease of USD 0.752 million on the total as previously reported

of USD 0.820 million for the period to 30 November 2021.

Notes to the Unaudited Condensed Consolidated Interim Financial

Statements

For the period ended 30 November 2022

1 Reporting entity

Webis Holdings plc (the "Company") is a company domiciled in the

Isle of Man. The address of the Company's registered office is

Viking House, Nelson Street, Douglas, Isle of Man, IM1 2AH. The

Webis Holdings plc unaudited condensed consolidated interim

financial statements as at and for the period ended 30 November

2022 consolidate those of the Company and its subsidiaries

(together referred to as the "Group").

1.1 Basis of accounting

The unaudited condensed consolidated financial statements of the

Group (the "Financial Information") are prepared in accordance with

Isle of Man law and UK Adopted - International Accounting Standards

post Brexit. The financial information in this report has been

prepared in accordance with the Group's accounting policies. Full

details of the accounting policies adopted by the Group are

contained in the consolidated financial statements included in the

Group's annual report for the year ended 31 May 2022 which is

available on the Group's website: www.webisholdingsplc.com.

The accounting policies and methods of computation and

presentation adopted in the preparation of the Financial

Information are consistent with those described and applied in the

consolidated financial statements for the year ended 31 May

2022.

The unaudited condensed consolidated financial statements do not

constitute statutory financial statements. The statutory financial

statements for the year ended 31 May 2022, extracts of which are

included in these unaudited condensed consolidated financial

statements, were prepared under UK Adopted - International

Accounting Standards post Brexit and have been filed at Companies

Registry.

1.2 Use of judgements and estimates

The preparation of the Financial Information requires management

to make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and

liabilities, income and expenses. Actual results could differ

materially from these estimates. In preparing the Financial

Information, the critical judgements made by management in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the consolidated

financial statements as at and for the year ended 31 May 2022 as

set out in those financial statements.

1.3 Functional and presentation currency

Items included in the unaudited condensed consolidated financial

statements are measured using the currency of the primary economic

environment in which the entity operates ('the functional

currency'). As the primary activities of the Group and the primary

transactional currency of the Group's customers are carried out in

US Dollars, the unaudited condensed consolidated financial

statements have been presented in US Dollars. The determination of

the presentation currency does not involve significant judgement as

the primary activities of the Group are in US Dollars.

1.4 Going Concern

As noted within the statutory financial statements for the year

ended 31 May 2022, the Directors have continued to undertake

several strategies to support and sustain the Group as a going

concern. These include, seeking to broadening its client base and

expand its business to customer base, renewing various US state

licenses, along with continuing to develop and expand the Cal Expo

racetrack operations, and monitoring the status of sports betting

legislation within the State of California, all of which remain key

priorities for the Group in achieving its goal of profitability and

maintaining adequate liquidity in order to continue its operations.

While the Directors continue to assess all strategic options in

this regard, the ultimate success of strategies adopted remains

difficult to predict.

Based on the above, along with the continued support of the

Company's principal shareholder, via Galloway Limited, a related

party, the Directors believe that the Group has adequate resources

to meet its obligations as they fall due.

2 Operating Segments

A. Basis for segmentation

The Group has the below two operating segments, which are its

reportable segments. The segments offer different services in

relation to various forms of pari-mutuel racing, which are managed

separately due to the nature of their activities.

Reportable segments and operations provided

Racetrack operations - hosting of races through the management

and operation of a racetrack facility, enabling patrons to attend

and wager on horse racing, as well as utilise simulcast

facilities.

ADW operations - provision of online ADW services to enable

customers to wager into global racetrack betting pools.

The Group's Board of Directors review the internal management

reports of the operating segments on a monthly basis.

B. Information about reportable segments

Information relating to the reportable segments is set out

below. Segment revenue along with segment profit / (loss) before

tax are used to measure performance as management considers this

information to be a relevant indicator for evaluating the

performance of the segments.

Reportable segments

Corporate

operating

Racetrack ADW costs Total

Period to 30 November 2022 (unaudited) US$000 US$000 US$000 US$000

----------------------------------------- ----------- -------- ---------- -------

External revenues 5,101 1,125 - 6,226

Segment revenue 5,101 1,125 - 6,226

----------------------------------------- ----------- -------- ---------- -------

Segment profit / (loss) before

tax 75 (315) (85) (325)

Finance costs (30) (1) (50) (81)

Depreciation and amortisation (31) (21) (1) (53)

Period to 30 November 2022 (unaudited)

----------------------------------------- ----------- -------- ---------- -------

Segment assets 2,396 2,795 1,414 6,605

----------------------------------------- ----------- -------- ---------- -------

Segment liabilities 1,504 2,627 1,481 5,612

----------------------------------------- ----------- -------- ---------- -------

Reportable segments

Corporate

operating

Racetrack ADW costs Total

Period to 30 November 2021 (unaudited) US$000 US$000 US$000 US$000

--------------------------------------- ----------- -------- ---------- -------

External revenues 5,530 1,265 - 6,795

Segment revenue 5,530 1,265 - 6,795

--------------------------------------- ----------- -------- ---------- -------

Segment profit / (loss) before

tax 155 (155) (70) (70)

Finance costs (10) (3) (49) (62)

Depreciation and amortisation (29) (22) (2) (53)

--------------------------------------- ----------- -------- ---------- -------

Period to 31 May 2022 (audited)

--------------------------------------- ----------- -------- ---------- -------

Segment assets 2,324 3,387 1,336 7,047

--------------------------------------- ----------- -------- ---------- -------

Segment liabilities 1,522 2,779 1,428 5,729

--------------------------------------- ----------- -------- ---------- -------

C. Reconciliation of reportable segments profit or loss

Period to Period to

30 November 30 November

2022 2021

(unaudited) (unaudited)

US$000 US$000

---------------------------------------------- ------------- ------------

Loss before tax

Total loss before tax for reportable segments (240) -

Loss before tax for other segments (85) (70)

---------------------------------------------- ------------- ------------

Consolidated loss before tax (325) (70)

---------------------------------------------- ------------- ------------

3. Revenue

The Group's operations and main revenue streams are those

described in the last annual financial statements. The Group's

revenue is derived from contracts with customers.

Disaggregation of revenue

In the following tables, revenue is disaggregated by primary

geographical market, major services lines and timing of revenue

recognition. The tables also include a reconciliation of the

disaggregated revenue with the Group's reportable segments (see

Note 2).

Reportable segments

Racetrack ADW Total

Period to 30 November 2022 (unaudited) US$000 US$000 US$000

--------------------------------------- --------- ------- -------

Primary geographic markets

North America 5,101 881 5,982

British Isles - 243 243

Caribbean - 1 1

Segment revenue 5,101 1,125 6,226

--------------------------------------- --------- ------- -------

Major service lines

ADW wagering 3,708 1,125 4,833

Race hosting 1,393 - 1,393

5,101 1,125 6,226

--------------------------------------- --------- ------- -------

Timing of revenue recognition

Services transferred at a point

in time 5,101 1,125 6,226

--------------------------------------- --------- ------- -------

Revenue from contracts with customers 5,101 1,125 6,226

--------------------------------------- --------- ------- -------

External revenue as reported

in Note 2 5,101 1,125 6,226

--------------------------------------- --------- ------- -------

Reportable segments

Racetrack ADW Total

Period to 30 November 2021 (unaudited) US$000 US$000 US$000

--------------------------------------- --------- ------- -------

Primary geographic markets

North America 5,530 969 6,499

British Isles - 296 296

Segment revenue 5,530 1,265 6,795

--------------------------------------- --------- ------- -------

Major service lines

ADW wagering 4,116 1,265 5,381

Race hosting 1,414 - 1,414

5,530 1,265 6,795

--------------------------------------- --------- ------- -------

Timing of revenue recognition

Services transferred at a point

in time 5,530 1,265 6,795

--------------------------------------- --------- ------- -------

Revenue from contracts with customers 5,530 1,265 6,795

--------------------------------------- --------- ------- -------

External revenue as reported

in Note 2 5,530 1,265 6,795

--------------------------------------- --------- ------- -------

4 Finance costs

Period to Period to

30 November 30 November

2022 2021

(unaudited) (unaudited)

US$000 US$000

--------------------------------- ------------- ------------

Loan interest payable (51) (50)

Lease liability interest payable (30) (12)

--------------------------------- ------------- ------------

Finance costs (81) (62)

--------------------------------- ------------- ------------

5 Income tax expense

(a) Current and Deferred Tax Expenses

The current and deferred tax expenses for the period were US$

Nil (30 November 2021: US$ Nil). Despite having made losses in the

past, no deferred tax was recognised as there is no reasonable

expectation that the Group will recover the resultant deferred tax

assets.

(b) Tax Rate Reconciliation

Period to Period to

30 November 30 November

2022 2021

(unaudited) (unaudited)

US$000 US$000

-------------------------------------------- ------------- ------------

Loss before tax (325) (70)

Tax charge at IOM standard rate (0%) - -

Adjusted for:

Tax credit for US tax losses (at 21%) (70) (24)

Add back deferred tax losses not recognised 70 24

-------------------------------------------- ------------- ------------

Tax charge for the period - -

-------------------------------------------- ------------- ------------

The maximum deferred tax asset that could be recognised at

period end is approximately US$ 1,055,000 (30 November 2021: US$

918,000). The Group has not recognised any asset as it might not be

recoverable within the allowed period.

6 Earnings per ordinary share

The calculation of the basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the period.

The calculation of diluted earnings per share is based on the

basic earnings per share, adjusted to allow for the issue of

shares, on the assumed conversion of all dilutive share

options.

An adjustment for the dilutive effect of share options and

convertible debt in the previous period has not been reflected in

the calculation of the diluted loss per share, as the effect would

have been anti-dilutive.

Period to Period to

30 November 30 November

2022 2021

(unaudited) (unaudited)

US$000 US$000

-------------------- ------------- --------------

Loss for the period (325) (70)

-------------------- ------------- ------------

No. No.

----------------------------------------------- ----------- -------------

Weighted average number of ordinary shares

in issue 393,338,310 393,338,310

Dilutive element of share options if exercised 14,000,000 14,000,000

----------------------------------------------- ----------- -------------

Diluted number of ordinary shares 407,338,310 407,338,310

----------------------------------------------- ----------- -------------

Basic earnings per share (cents) (0.08) (0.02)

----------------------------------------------- ----------- -----------

Diluted earnings per share (cents) (0.08) (0.02)

----------------------------------------------- ----------- -----------

The earnings applied are the same for both basic and diluted

earnings calculations per share as there are no dilutive effects to

be applied.

7 Intangible assets

Intangible assets include goodwill which relates to the

acquisition of the pari-mutuel business which is both a cash

generating unit and a reportable segment, including goodwill

arising on the acquisition in 2010 of WatchandWager.com LLC, a US

registered entity licenced for pari-mutuel wagering in North

Dakota.

The Group tests intangible assets annually for impairment, or

more frequently if there are indicators that the intangible assets

may be impaired. The goodwill balance was fully impaired in the

financial year ended 31 May 2015.

8 Cash, cash equivalents and restricted cash

Period to Year ended

30 November

2022 31 May 2022

(unaudited) (audited)

US$000 US$000

------------------------------------------------- -------------- ------------

Cash and cash equivalents - company and other

funds 2,800 3,062

Restricted cash - protected player funds 1,104 1,077

Total cash, cash equivalents and restricted cash 3,904 4,139

------------------------------------------------- -------------- ------------

The Group holds funds for operational requirements and for its

non-Isle of Man customers, shown as 'company and other funds' and

on behalf of its Isle of Man regulated customers and certain USA

state customers, shown as 'protected player funds'.

Protected player funds are held in fully protected client

accounts within an Isle of Man regulated bank and in segregated

accounts within a USA regulated bank.

9 Loans, borrowings and lease liabilities

Current liabilities

Period to Year ended

30 November 2022 31 May 2022

(unaudited) (audited)

US$000 US$000

------------------------------------ ------------------- ------------

Unsecured loan (current portion) 21 20

Lease liabilities (current portion) 78 89

99 109

--------------------------------------- ------------------- ------------

Non-current liabilities

Period to Year ended

30 November 2022 31 May 2022

(unaudited) (audited)

US$000 US$000

---------------------------------------- ------------------- ------------

Unsecured loan (non-current portion) 36 47

Lease liabilities (non-current portion) 601 583

Secured loans - Galloway Ltd 1,350 1,350

1,987 1,980

------------------------------------------- ------------------- ------------

Terms and repayment schedule

Period to Year ended

30 November 31 May

2022 2022

Nominal (unaudited) (audited)

interest Year of US$000

rate maturity US$000

--------------------------- --- --- --- ---------- ----------- --------------- -----------

Unsecured loans 1.00-8.90% 2025 57 67

Lease liabilities 6.00-9.50% 2023-30 679 672

Secured loan - Galloway

Ltd 7.75% 2027 500 500

Secured loan - Galloway

Ltd 7.00% 2024 350 350

Secured loan - Galloway

Ltd 7.00% 2025 500 500

------------------------------------------ ---------- ----------- --------------- -----------

Total loans and borrowings 2,086 2,089

------------------------------------------ ---------- ----------- --------------- -----------

The secured loans from Galloway Ltd are secured over the

unencumbered assets of the Group.

10 Related party transactions

Identity of related parties

The Group has a related party relationship with its

subsidiaries, and with its Directors and executive officers, and

with Burnbrae Ltd (significant shareholder).

Transactions with and between subsidiaries

Transactions with and between the subsidiaries in the Group

which have been eliminated on consolidation are considered to be

related party transactions.

Transactions with entities with significant influence over the

Group

Rental and service charges of US$ 16,883 (30 November 2021: US$

23,868) and Directors' fees of US$ 17,230 (30 November 2021: US$

13,834) were charged in the period by Burnbrae Ltd of which Denham

Eke is a common Director and Katie Errock is an employee. The Group

also had a loan of US$ 1,350,000 (31 May 2022: US$ 1,350,000) from

Galloway Ltd, a company related to Burnbrae Limited by common

ownership and Directors (see note 9).

Transactions with other related parties

There were no transactions with other related parties during the

period.

11 Subsequent events

There were no significant subsequent events identified after 30

November 2022.

12 Approval of interim statements

The interim statements were approved by the Board on 23 February

2023. The interim report is expected to be available for

shareholders on 24 February 2023 and will be available from that

date on the Group's website www.webisholdingsplc.com.

The Group's nominated adviser and broker is Beaumont Cornish

Limited, Building 3, Chiswick Park, 566 Chiswick High Road, London

W4 5YA.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGZZRFRGFZM

(END) Dow Jones Newswires

February 24, 2023 02:00 ET (07:00 GMT)

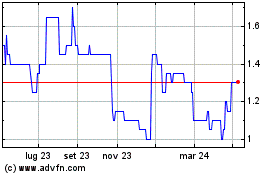

Grafico Azioni Webis (LSE:WEB)

Storico

Da Ott 2024 a Nov 2024

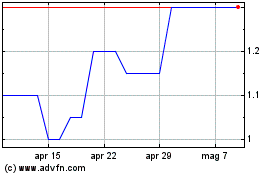

Grafico Azioni Webis (LSE:WEB)

Storico

Da Nov 2023 a Nov 2024