Lerach Coughlin Stoia Geller Rudman & Robbins LLP Files Class Action Suit against Allot Communications Ltd.

01 Maggio 2007 - 9:49PM

Business Wire

Lerach Coughlin Stoia Geller Rudman & Robbins LLP (�Lerach

Coughlin�) (http://www.lerachlaw.com/cases/allot/) today announced

that a class action lawsuit has been commenced in the United States

District Court for the Southern District of New York on behalf of

investors of Allot Communications Ltd. (�Allot� or the �Company�)

(NASDAQ:ALLT) who purchased the common stock of Allot pursuant

and/or traceable to the Company�s Registration Statement and

Prospectus for its initial public offering on November 15, 2006,

(the �IPO�), seeking to pursue remedies under the Securities Act of

1933 (the �Securities Act�). If you wish to serve as lead

plaintiff, you must move the Court no later than 60 days from

today. If you wish to discuss this action or have any questions

concerning this notice or your rights or interests, please contact

plaintiff�s counsel, Samuel H. Rudman or Mario Alba, Jr. of Lerach

Coughlin at 800/449-4900 or 619/231-1058 or via e-mail at

wsl@lerachlaw.com. If you are a member of this class, you can view

a copy of the complaint as filed or join this class action online

at http://www.lerachlaw.com/cases/allot/. Any member of the

purported class may move the Court to serve as lead plaintiff

through counsel of their choice, or may choose to do nothing and

remain an absent class member. The complaint charges Allot and

certain of its officers, directors and underwriters with violations

of the Securities Act of 1933. Allot is a designer, developer,

marketer, and seller of broadband service optimization solutions.

The Company�s solutions provide broadband service providers and

enterprises with real-time visibility into, and control of, network

traffic. The Complaint alleges that the Registration Statement and

Prospectus issued in connection with the IPO were negligently

prepared and, as a result, contained untrue statements of material

facts; omitted to state other facts necessary to make the

statements made therein not misleading; and were not prepared in

accordance with the rules and regulations governing their

preparation. Specifically, the Complaint alleges, among other

things, that the Registration Statement and Prospectus included

representations that the Company would achieve its goal in becoming

the leader in its industry through its ability to market and sell

its products to end-customers through its channel partners. In

fact, according to the Complaint, the Registration Statement and

Prospectus failed to disclose that Allot was experiencing declining

sales in its indirect distribution channels, such as enterprise,

education and smaller ISP customers, in North America. On April 2,

2007, Allot issued a press release announcing that revenues and

earnings for the first quarter of 2007 and the 2007 fiscal year

would be lower than its previous guidance � given less than two

months ago. The Company attributed the lower guidance to �weakness

in sales from some of the Company�s distributors, principally in

the Americas, which are focused on sales to enterprise, education,

and smaller ISPs.� In response to the announcement about the

Company�s revised guidance, on April 2, 2007, the price of Allot

stock declined precipitously falling from $9.15 per share to $7.11

per share � approximately 40% below the IPO price � on heavy

trading volume. Plaintiff seeks to recover damages on behalf of all

those who purchased the common stock of Allot pursuant and/or

traceable to the Company�s Registration Statement and Prospectus

for its IPO on November 15, 2006. The plaintiff is represented by

Lerach Coughlin, which has expertise in prosecuting investor class

actions. Lerach Coughlin, a 180-lawyer firm with offices in San

Diego, San Francisco, Los Angeles, New York, Boca Raton,

Washington, D.C., Houston, Philadelphia and Seattle, is active in

major litigations pending in federal and state courts throughout

the United States and has taken a leading role in many important

actions on behalf of defrauded investors, consumers, and companies,

as well as victims of human rights violations. Lerach Coughlin

lawyers have been responsible for more than $20 billion in

aggregate recoveries. The Lerach Coughlin Web site

(http://www.lerachlaw.com) has more information about the firm.

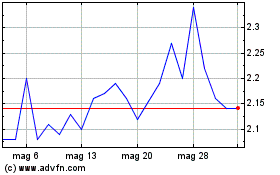

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Lug 2023 a Lug 2024