-Revenues increase 4% over first quarter 2007- HOD HASHARON,

Israel, Aug. 8 /PRNewswire-FirstCall/ -- Allot Communications Ltd.

(NASDAQ:ALLT), a leader in IP service optimization solutions based

on deep packet inspection (DPI) technology, today announced

financial results for the second quarter ended June 30, 2007.

Revenues for the second quarter of 2007 totaled $8.6 million,

representing a 4% increase over the $8.3 million in revenues

reported for the first quarter of 2007 and a 6% increase from the

$8.2 million of revenues reported in the second quarter of 2006. On

a GAAP basis, the net loss for the second quarter of 2007 was $592

thousand, or $0.03 per share, as compared with a net loss of $434

thousand, or $0.02 per share, for the first quarter of 2007 and net

income of $53 thousand, or $0.00 per diluted share, in the second

quarter of 2006. For the first six months of 2007, revenues reached

$16.9 million, representing a 7% increase over $15.7 million in

revenues for the first half of 2006. On a GAAP basis, the net loss

for the first six months of 2007 totaled $1.0 million, or $0.05 per

share, as compared with net income of $58 thousand, or $0.00 per

diluted share, for the first half of 2006. On a non-GAAP basis,

excluding the impact of share-based compensation expense in both

periods, and the impact of expenses related to a law suit in the

second quarter of 2007, the non-GAAP net loss for the second

quarter of 2007 totaled $299 thousand, or $0.01 per share, as

compared with a non-GAAP net loss of $112 thousand, or $0.00 per

share, for the first quarter of 2007 and non-GAAP net income of

$324 thousand, or $0.02 per diluted share, for the second quarter

of 2006. For the first six months of 2007, the non-GAAP net loss,

excluding the impact of the share-based compensation and the impact

of the legal expenses, totaled $411 thousand, or $0.02 per share,

as compared with net income of $411 thousand, or $0.03 per diluted

share for the first half of 2006. These non-GAAP measures should be

considered in addition to, and not as a substitute for, comparable

GAAP measures. Reconciliation between GAAP and non-GAAP measures is

provided in the accompanying Table 2 of this press release. Allot

provides these non-GAAP financial measures because they present a

better measure of the Company's core business and management uses

the non-GAAP measures internally to evaluate the Company's ongoing

performance. Accordingly, the Company believes that they are useful

to investors in enhancing an understanding of Allot's operating

performance. "We were pleased to see that channel sales are

beginning to improve, particularly in the Americas, during the

second quarter," commented Rami Hadar, Allot Communications'

President and Chief Executive Officer. "We believe that this

initial improvement, along with our focus on the carrier market

presents significant growth opportunities for Allot over the middle

to long term. "The announcement of our new Service Gateway has

generated significant interest within our current customer base as

well as in the carrier markets worldwide. This new carrier class

platform, which remains on track for trials in the current quarter

and is presently scheduled to be generally available in the fourth

quarter of 2007, will offer Allot customers what we believe is the

fastest product available in the market, delivering true 10 GB/s

full duplex capability, or over 20 GB/s total throughput. The

service gateway is based on an open architecture platform which

enables carriers to easily expand and deploy additional value added

services while leveraging their current infrastructure investments.

By utilizing Allot's best-of-breed DPI technology, carriers can

offer flexible, personalized subscriber services to generate

significant new revenue streams. While the migration from 1GB/s to

10 GB/s interface products may delay purchasing decisions among

several of our customers, we believe that the initial demand we are

seeing for the new platform will contribute to revenue growth as

early as the fourth quarter of this year," concluded Mr. Hadar.

During the second quarter, key highlights included the following

achievements: -- Allot unveiled the industry's first DPI-based

Service Gateway supporting more than 20 Gigabits per second (GB/s)

of traffic; -- Continued demand among Tier 2 service providers;

recently announced customers include Vodafone Iceland, Telefonica

del Sur in Chile, and Cablemas in Mexico; -- Sales in North and

South America reached $2.8 million, a 17% increase over the first

quarter; and -- Allot commenced a second commercial DPI deployment

with a major wireless operator. As of June 30, 2007, Allot's cash

and cash equivalents, including short and long-term deposits and

investments in marketable securities, totaled $78.5 million.

Financial Guidance With the anticipated general availability and

market acceptance of the Service Gateway during the fourth quarter

of 2007, the Company maintains its previous guidance for the year

2007, and anticipates that net revenues will total approximately

$40 million. Conference Call & Webcast The Allot management

team will host a live conference call and webcast today at 8:30 AM

EDT to discuss the financial results as well as management's

outlook for the business. To access the conference call, please

dial one of the following numbers: US: 1-866-966-9446,

International: +44-1452-567-098, Israel: 1-809-213-849. A replay of

the conference call will be available from 12:01 am EDT on August

9, 2007 through August 15, 2007, at 11:59 pm EDT. To access the

replay, please dial: US: 1-866-247-4222, International:

+44-1452-55-0000. Access code for both: 10403945#. A live webcast

of the conference call can be accessed on the Allot Communications

website at http://www.allot.com/ . The webcast will also be

archived for replay on the investor relations section of the Allot

corporate website following the conference call. About Allot

Communications Allot Communications Ltd. (NASDAQ:ALLT) is a leading

provider of intelligent IP service optimization solutions. Designed

for carriers, service providers and enterprises, Allot solutions

apply deep packet inspection (DPI) technology to transform

broadband pipes into smart networks. This creates the visibility

and control vital to manage applications, services and subscribers,

guarantee quality of service (QoS), contain operating costs and

maximize revenue. Allot believes in listening to customers and

provides them access to its global network of visionaries,

innovators and support engineers. For more information, please

visit http://www.allot.com/ . Safe Harbor Statement Information

provided in this press release may contain statements relating to

current expectations, estimates, forecasts and projections about

future events that are "forward-looking statements" as defined in

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements generally relate to the Allot's plans,

objectives and expectations for future operations, including

expected performance characteristics of the Service Gateway

platform, the timing of general commercial availability or the

level of revenues to be generated therefrom, and are based upon

management's current estimates and projections of future results or

trends. Actual future results may differ materially from those

projected as a result of certain risks and uncertainties. These

factors include, but are not limited to, those discussed under the

heading "Risk Factors" in Allot's annual report on Form 20-F filed

with the Securities and Exchange Commission. These forward-looking

statements are made only as of the date hereof, and we undertake no

obligation to update or revise the forward- looking statements,

whether as a result of new information, future events or otherwise.

TABLE - 1 ALLOT COMMUNICATIONS LTD. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (U.S. dollars in thousands,

except share and per share data) Three Months Ended Six Months

Ended June 30, June 30, 2007 2006 2007 2006 (Unaudited) (Unaudited)

Revenues $8,601 $8,152 $16,877 $15,723 Cost of revenues 2,036 1,746

4,010 3,446 Gross profit 6,565 6,406 12,867 12,277 Operating

expenses: Research and development, net 2,165 1,953 4,618 3,835

Sales and marketing 4,566 3,749 8,760 7,242 General and

administrative 1,438 710 2,481 1,319 Total operating expenses 8,169

6,412 15,859 12,396 Operating loss (1,604) (6) (2,992) (119)

Financial and other income, net 825 62 1,782 183 Income (loss)

before income tax expenses (benefit) (779) 56 (1,210) 64 Income tax

expenses (benefit) (187) 3 (184) 6 Net income (loss) $(592) 53

$(1,026) 58 Basic net earnings (loss) per share $(0.03) $0.00

$(0.05) $0.00 Diluted net earnings (loss) per share $(0.03) $0.00

$(0.05) $0.00 Weighted average number of shares used in computing

basic net earnings (loss) per share 21,253,700 13,286,779

21,131,702 13,036,329 Weighted average number of shares used in

computing diluted net earnings (loss) per share 21,253,700

15,084,192 21,131,702 14,692,920 TABLE - 2 ALLOT COMMUNICATIONS

LTD. AND ITS SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP

CONSOLIDATED STATEMENTS OF OPERATIONS (U.S. dollars in thousands,

except per share data) Three Months Ended Six Months Ended June 30,

June 30, 2007 2006 2007 2006 (Unaudited) GAAP net income (loss) as

reported $(592) $53 $(1,026) $58 Non-GAAP adjustments Expenses

recorded for stock-based compensation Cost of revenues 12 3 23 3

Research and development costs, net 46 25 96 39 Sales and marketing

(10) 157 109 203 General and administrative 177 86 319 108 Expenses

related to a law suit General and administrative 68 - 68 - Total

adjustments 293 271 615 353 Non-GAAP net income (loss) $(299) $324

$(411) $411 Non-GAAP basic net earnings (loss) per share $(0.01)

$0.02 $(0.02) $0.03 Non-GAAP diluted net earnings (loss) per share

$(0.01) $0.02 $(0.02) $0.03 TABLE - 3 ALLOT COMMUNICATIONS LTD. AND

ITS SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (U.S. dollars in

thousands) June 30, December 31, 2007 2006 (Unaudited) ASSETS

CURRENT ASSETS: Cash and cash equivalents $9,930 $7,117 Marketable

securities and short term deposit 64,587 70,423 Trade receivables

8,976 5,856 Other receivables and prepaid expenses 2,998 1,961

Inventories 4,117 3,337 Total current assets 90,608 88,694

LONG-TERM ASSETS: Marketable securities 3,995 5,750 Severance pay

fund 2,891 2,648 Other assets 1,484 1,054 Total long-term assets

8,370 9,452 PROPERTY AND EQUIPMENT, NET 4,137 2,939 GOODWILL 211 99

Total assets $103,326 $101,184 LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES: Short-term bank credit and current maturities,

net $- $6 Trade payables 3,470 4,415 Deferred revenues 4,806 3,788

Other payables and accrued expenses 5,722 4,833 Total current

liabilities 13,998 13,042 LONG-TERM LIABILITIES: Deferred revenues

1,691 1,578 Accrued severance pay 2,728 2,377 Total long-term

liabilities 4,419 3,955 SHAREHOLDERS' EQUITY 84,909 84,187 Total

liabilities and shareholders' equity $103,326 $101,184 DATASOURCE:

Allot Communications Ltd. CONTACT: Investor Relations, Jay Kalish,

Executive Director Investor Relations of Allot Communications Ltd.,

+972-9-761-9365, Web site: http://www.allot.com/

Copyright

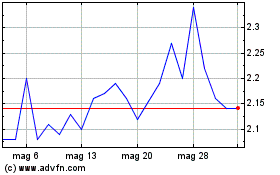

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Lug 2023 a Lug 2024