HOD HASHARON, Israel, Feb. 12 /PRNewswire-FirstCall/ -- Allot

Communications Ltd. (NASDAQ:ALLT), a leader in IP service

optimization solutions based on deep packet inspection (DPI)

technology, today announced financial results for the fourth

quarter and full year ended December 31, 2007. Total revenues for

the fourth quarter of 2007 reached $8.7 million, a 9% decrease from

the $9.6 million of revenues reported in the fourth quarter of

2006, and a 25% increase over the $7.0 million revenues reported

for the third quarter of 2007. On a GAAP basis, the net loss for

the fourth quarter of 2007 was $5.5 million, or $0.25 per diluted

share, which includes a $3.7 million impairment charge on account

of certain securities held by the Company as described below, as

compared with net profit of $53 thousand, or $0.00 per diluted

share, in the fourth quarter of 2006, and a net loss of $2.2

million, or $0.10 per diluted share, for the third quarter of 2007.

For the full year 2007, revenues reached $32.5 million,

representing a 5% decline from $34.1 million in revenues in 2006.

On a GAAP basis, net loss in 2007 totaled $8.7 million, or $0.41

per diluted share, as compared with net income of $616 thousand, or

$0.04 per diluted share, in 2006. On a non-GAAP basis, excluding

the impact of share-based compensation expense, the impact of

expenses related to a law suit and the impact of the impairment

charge related to certain securities, non-GAAP net loss for the

fourth quarter of 2007 totaled $1.4 million, or $0.06 per diluted

share, as compared with net income of $732 thousand, or $0.04 per

diluted share, for the fourth quarter of 2006. For the year 2007,

non-GAAP net loss, excluding the impact of the share-based

compensation, the impact of expenses related to a law suit and the

impact of the impairment charge related to certain securities,

totaled $3.5 million, or $0.16 per diluted share, as compared with

net income of $2.0 million, or $0.12 per diluted share, in 2006.

These non-GAAP measures should be considered in addition to, and

not as a substitute for, comparable GAAP measures. A full

reconciliation between non- GAAP and GAAP net income is provided in

the accompanying Table 2. The Company provides these non-GAAP

financial measures because management believes that they present a

better measure of the Company's core business and management uses

the non-GAAP measures internally to evaluate the Company's ongoing

performance. Accordingly, the Company believes that they are useful

to investors in enhancing an understanding of the Company's

operating performance. "During 2007, the DPI market continued to

evolve," commented Rami Hadar, Allot's President and Chief

Executive Officer. "Although this has been a challenging year for

us, we have made significant progress in building our product

portfolio and in organizing our sales force to meet the demands in

the telecom space. "With the successful commercial introduction of

the new 10G Service Gateway-Omega, we are well-positioned to meet

the needs of telecom operators and are already seeing a healthy

pipeline for this new and exciting platform. Allot's acquisition of

Esphion, with its security products, adds an important component to

this platform. "During 2007, we continued to expand our worldwide,

diverse customer base, with balanced sales between the Americas,

Europe and the Far East. These customers include several major new

telecom operators, with DSL, mobile, cable and WiFi deployments,

along with our traditional service provider and enterprise

customers. We believe that this provides us with a solid basis to

resume revenue growth during 2008," concluded Hadar. Balance Sheet

Items As of December 31, 2007, net of allowance for devaluation of

$4.9 million, Allot's cash and cash equivalents, including short

and long-term deposits and investments in marketable securities,

totaled $70.8 million. As of December 31, 2007, the Company had

$40.3 million of principal invested in Auction Rate Securities

(ARS) ranked AAA and AA at the time of purchase, and there had been

no change in their rating, except for one security with a par value

of $0.9 million. All securities continue to pay interest in

accordance with their stated terms. However, since these ARS have

experienced multiple failed auctions due to a lack of liquidity in

the market for these securities, based on initial third party

indications, the Company has revalued its ARS portfolio. As a

result, it has recorded an impairment charge of $3.7 million on the

profit and loss statement with respect to ARS of $6.6 million in

par value, the devaluation of which is considered "other than

temporary." For the balance of ARS holdings of $33.7 million in par

value, the Company has recorded an unrealized loss of $1.2 million

in other comprehensive income as a reduction of shareholders'

equity. Based on initial third party indications, the Company

currently believes that this impairment is temporary. All of these

ARS were classified as long term assets. The accounting treatment

and final results for 2007 may change based upon final third party

valuations regarding these securities. If uncertainties in the

credit and capital markets continue, these markets deteriorate

further or the Company experiences any ratings downgrades on any

ongoing investments in its portfolio (including on ARS), the

Company may incur additional impairments to its investment

portfolio, which could negatively affect the Company's financial

condition, cash flow and results of operations. The Company

believes that based on its current cash, cash equivalents and

marketable securities balances at December 31, 2007 and expected

operating cash flows, the current lack of liquidity of these

securities will not have a material impact on the Company's

liquidity, cash flow or its ability to fund its operations. Details

reconciling these non-GAAP amounts with GAAP amounts including

specified items are provided in Table 2 attached. Conference Call

& Webcast The Company's management team plans to host a live

conference call and webcast today 8:30 AM EST to discuss the

financial results as well as management's outlook for the business.

To access the conference call, please dial one of the following

numbers: US: 1-866-966-5335, International: +44-20-3003-2666,

Israel: 1-809-216-213. A replay of the conference call will be

available from 12:01 am EST on February 13, 2008 through March 12,

2008 at 11:59 pm EST. To access the replay, please dial:

+44-20-8196-1998, access code: 650204# A live webcast of the

conference call can be accessed on the Allot Communications website

at http://www.allot.com/. The webcast will also be archived on the

website following the conference call. About Allot Communications

Allot Communications Ltd. (NASDAQ:ALLT) is a leading provider of

intelligent IP service optimization solutions for DSL, wireless and

mobile broadband carriers, service providers, and enterprises.

Allot's rich portfolio of hardware platforms and software

applications utilizes deep packet inspection (DPI) technology to

transform broadband pipes into smart networks that can rapidly and

efficiently deploy value added Internet services. Allot's scalable,

carrier-grade solutions provide the visibility, security,

application control and subscriber management that are vital to

managing Internet service delivery, guaranteeing quality of

experience (QoE), containing operating costs, and maximizing

revenue in broadband networks. For more information, visit

http://www.allot.com/. Safe Harbor Statement Information provided

in this press release may contain statements relating to current

expectations, estimates, forecasts and projections about future

events that are "forward-looking statements" as defined in the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements generally relate to the Allot's plans,

objectives and expectations for future operations, including

revenue guidance for the fiscal year, the Company's belief as to

whether any impairment to the ARS is temporary, and the Company's

belief that based on its current cash, cash equivalents and

marketable securities balances and expected operating cash flows,

the current lack of liquidity of the ARS will not have a material

impact on its liquidity, cash flow or its ability to fund its

operations. These forward-looking statements are based upon

management's current estimates and projections of future results or

trends. Actual future results may differ materially from those

projected as a result of certain risks and uncertainties. These

factors include, but are not limited to: the continued uncertainty

in the credit and capital markets that may result in these markets

deteriorating further or the Company experiencing additional

ratings downgrades on any ongoing investments in its portfolio

(including on ARS) and the Company incurring additional impairments

to its investment portfolio; changes in the accounting treatment

and final results for 2007 resulting from final third party

valuations of the ARS; the current lack of liquidity of the ARS

having a material impact on the Company's liquidity, cash flow or

its ability to fund its operations; the audit of the Company's

annual financial statements; other changes in general economic and

business conditions and, specifically, a decline in demand for the

Company's products; the Company's inability to timely develop and

introduce new technologies, products and applications; loss of

market; and other factors discussed under the heading "Risk

Factors" in Allot's annual report on Form 20-F filed with the

Securities and Exchange Commission. These forward-looking

statements are made only as of the date hereof, and the Company

undertakes no obligation to update or revise the forward-looking

statements, whether as a result of new information, future events

or otherwise. TABLE - 1 ALLOT COMMUNICATIONS LTD. AND ITS

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (U.S. dollars in

thousands, except share and per share data) Three Months Ended Year

Ended December 31, December 31, 2007 2006 2007 2006 (Unaudited)

(Unaudited) (Audited) Revenues $8,673 $9,567 $32,502 $34,144 Cost

of revenues 2,196 2,190 8,019 7,597 Gross profit 6,477 7,377 24,483

26,547 Operating expenses: Research and development costs, net

2,491 1,887 9,384 7,529 Sales and marketing 5,010 4,598 18,081

15,457 General and administrative 1,606 1,204 5,583 3,464 Total

Operating expenses 9,107 7,689 33,048 26,450 Operating income

(loss) (2,630) (312) (8,565) 97 Financial and other income (loss),

net (2,584) 401 356 630 Income (loss) before income tax expenses

(benefit) (5,214) 89 (8,209) 727 Income tax expenses 325 36 530 111

Net income (loss) (5,539) 53 (8,739) 616 Basic net earnings (loss)

per share $(0.25) $0.00 $(0.41) $0.04 Diluted net earnings (loss)

per share $(0.25) $0.00 $(0.41) $0.04 Weighted average number of

shares used in computing basic net earnings (loss) per share

21,945,602 17,077,444 21,525,822 14,402,338 Weighted average number

of shares used in computing diluted net earnings (loss) per share

21,945,602 19,864,395 21,525,822 16,423,227 TABLE - 2 ALLOT

COMMUNICATIONS LTD. AND ITS SUBSIDIARIES RECONCILIATION OF GAAP TO

NON-GAAP CONSOLIDATED STATEMENTS OF OPERATIONS (U.S. dollars in

thousands, except per share data) Three Months Twelve Months Ended

Ended December 31, December 31, 2007 2006 2007 2006 (Unaudited)

(Unaudited) GAAP net income (loss) as reported $(5,539) $53

$(8,739) $616 Non-GAAP adjustments Expenses recorded for

stock-based compensation Cost of revenues 13 7 48 15 Research and

development costs, net 70 60 231 157 Sales and marketing 140 320

340 649 General and administrative 218 292 742 540 Expenses related

to a law suit General and administrative 20 - 154 - Impairment of

auction rate securities Financial and other income (loss), net

3,680 - 3,680 - Total adjustments 4,141 679 5,195 1,361 Non-GAAP

net income (loss) $(1,398) $732 $(3,544) $1,977 Non- GAAP basic net

earnings (loss) per share $(0.06) $0.04 $(0.16) $0.14 Non-GAAP

diluted net earnings (loss) per share $(0.06) $0.04 $(0.16) $0.12

TABLE - 3 ALLOT COMMUNICATIONS LTD. AND ITS SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (U.S. dollars in thousands) December

31, 2007 2006 (Unaudited) (Audited) ASSETS CURRENT ASSETS: Cash and

cash equivalents $28,101 $7,117 Marketable securities and short

term deposits 7,305 70,423 Trade receivables 6,645 4,178 * Other

receivables and prepaid expenses 3,915 1,961 Inventories 4,789

3,337 Total current assets 50,755 87,016 LONG-TERM ASSETS:

Marketable securities 35,371 5,750 Severence pay fund 3,302 2,648

Other assets 1,169 1,054 Total long-term assets 39,842 9,452

PROPERTY AND EQUIPMENT, NET 4,619 2,939 GOODWILL AND INTANGIBLE

ASSETS, NET 239 99 Total assets $95,455 $99,506 LIABILITIES AND

SHAREHOLDERS' EQUITY CURRENT LIABILITIES: Short-term bank credit

and current maturities, net $- $6 Trade payables 3,409 4,415

Deferred revenues 3,760 2,580 * Other payables and accrued expenses

5,791 4,833 Total current liabilities 12,960 11,834 LONG-TERM

LIABILITIES: Deferred revenues 2,135 1,108 * Accrued severence pay

3,175 2,377 Total long-term liabilities 5,310 3,485 SHAREHOLDERS'

EQUITY 77,185 84,187 Total liabilities and shareholders' equity

$95,455 $99,506 * reclassified DATASOURCE: Allot Communications

Ltd. CONTACT: Investor Relations, Jay Kalish, Executive Director

Investor Relations of Allot Communications Ltd., +972-9-761-9365,

Web site: http://www.allot.com/

Copyright

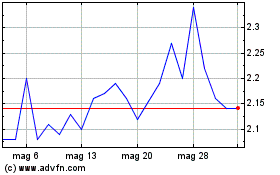

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Lug 2023 a Lug 2024