HOD HASHARON, Israel, February 12 /PRNewswire-FirstCall/ -- - 2008

Revenues Increase by 14% over 2007 Key highlights: - Fourth quarter

revenues were $9.6 million, representing a 10% increase over fourth

quarter of 2007 - Fourth quarter non-GAAP operating loss narrowed

to $1.2 million, a decrease of 20% from $1.5 million operating loss

for the third quarter 2008 - Fourth quarter non-GAAP net loss

declined to $1.1 million, or ($0.05) per diluted share, from $1.6

million, or ($0.07) per diluted share, in the third quarter 2008 -

Cash, cash equivalents and short term deposits and investments

increased to $42.1 million, while ARS portfolio further devalued by

$2.8 million - Addition of five Tier 1 mobile operators during 2008

Allot Communications Ltd. (NASDAQ:ALLT), a leader in IP service

optimization solutions based on deep packet inspection (DPI)

technology, today announced financial results for the fourth

quarter and full year ended December 31, 2008. Total revenues for

the fourth quarter of 2008 reached $9.6 million, a 10% increase

from the $8.7 million of revenues reported in the fourth quarter of

2007, and a 2% decrease from the $9.8 million revenues reported for

the third quarter of 2008. On a GAAP basis, net income for the

fourth quarter of 2008 was $1.0 million, or $0.05 per share (basic

and diluted), which includes a net gain of $2.5 million in respect

of auction rate securities as described below. This compares with a

net loss of $6.7 million, or $0.31 per share (basic and diluted),

in the fourth quarter of 2007, and a net loss of $9.0 million, or

$0.41 per share (basic and diluted), for the third quarter of 2008.

For the full year 2008, revenues reached $37.1 million,

representing a 14% increase over the $32.5 million in revenues in

2007. On a GAAP basis, net loss in 2008 totaled $16.5 million, or

$0.75 per share (basic and diluted), as compared with a net loss of

$9.9 million, or $0.46 per share (basic and diluted), in 2007. On a

non-GAAP basis, excluding the impact of share-based compensation,

ARS devaluation and recoveries, certain legal expenses and

amortization of acquired core technology, non-GAAP net loss for the

fourth quarter of 2008 totaled $1.1 million, or $0.05 per share

(basic and diluted), as compared with a non-GAAP net loss of $1.4

million, or $0.06 per share (basic and diluted), for the fourth

quarter of 2007 and a non-GAAP loss of $1.6 million, or $0.07 per

share (basic and diluted), for the third quarter of 2008. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, comparable GAAP measures. A full reconciliation

between GAAP and non-GAAP net loss is provided in the accompanying

Table 2. The Company provides these non-GAAP financial measures

because it believes that they present a better measure of the

Company's core business and management uses the non-GAAP measures

internally to evaluate the Company's ongoing performance.

Accordingly, the Company believes that they are useful to investors

in enhancing an understanding of the Company's operating

performance. "We were pleased with the growth which Allot reported

in 2008," commented Rami Hadar, Allot Communications' President and

Chief Executive Officer. "We were particularly proud of our

continued leadership position in the mobile markets, which we see

as a significant opportunity going forward. The record results for

2008 were attained despite the challenging economic conditions, and

demonstrate Allot's attractive value proposition of optimizing our

customers' networks in the near term while enabling opportunities

to monetize their networks in the future. While our short term

results may be affected by the evolving macroeconomic conditions,

we believe that we are well-positioned to address the potential of

the market in the long term." Recently, the Company achieved the

following significant goals: - Addition of five Tier 1 mobile

operators during 2008, four of which have more than 10 million

subscribers; - During the quarter, concluded 12 large deals with

service providers, of which six represented new customers and six

represented expansion deals; and - Allot's Service Gateway has been

deployed with 12 service providers, and is the most widely deployed

system providing true 10 Gbps performance. As of December 31, 2008,

cash, cash equivalents, deposits and investments in marketable

securities totaled $57.5 million. During the fourth quarter, the

Company monetized $6.6 million of ARS at par value, recording a

gain of $5.3 million on a GAAP basis. Recent external valuations

showed a further devaluation of ARS in the Company's portfolio as

of the end of the fourth quarter. As a result, the Company recorded

an additional impairment charge of $2.8 million in its statement of

operations on a GAAP basis, in respect of ARS, the devaluation of

which is considered "other than temporary", leaving the Company

with a total of $15.3 million in ARS at the end of the quarter. As

a result of all of the above the Company has recorded a net gain of

$2.5 million on a GAAP basis during the fourth quarter. Conference

Call & Webcast The Allot management team will host a conference

call to discuss its fourth quarter and full year 2008 results on

Thursday, February 12, 2009, at 8:30 AM EST, 3:30 PM Israel time.

The quarterly results will be published prior to the conference

call. To access the conference call, please dial one of the

following numbers: US: 1-866-966-5335, International:

+44-20-3003-2666, Israel: 1-809-216-213. A replay of the conference

call will be available from 12:01 am EST on February 13, 2009

through March 12, 2009 at 11:59 pm EST. To access the replay,

please dial: +44-20-8196-1998, access code: 650204#. A live webcast

of the conference call can be accessed on the Allot Communications

website at http://www.allot.com/. The webcast will also be archived

on the website following the conference call. About Allot

Communications Allot Communications Ltd. (NASDAQ:ALLT) is a leading

provider of intelligent IP service optimization solutions. Designed

for carriers, service providers and enterprises, Allot solutions

apply deep packet inspection (DPI) technology to transform

broadband pipes into smart networks. This creates the visibility

and control vital to manage applications, services and subscribers,

guarantee quality of service (QoS), contain operating costs and

maximize revenue. Allot believes in listening to customers and

provides them access to its global network of visionaries,

innovators and support engineers. For more information, please

visit http://www.allot.com/. Safe Harbor Statement Information

provided in this press release may contain statements relating to

current expectations, estimates, forecasts and projections about

future events that are "forward-looking statements" as defined in

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements generally relate to the Company's plans,

objectives and expectations for future operations. These

forward-looking statements are based upon management's current

estimates and projections of future results or trends. Actual

results may differ materially from those projected as a result of

certain risks and uncertainties. These factors include, but are not

limited to: changes in general economic and business conditions

and, specifically, a decline in demand for the Company's products;

the Company's inability to develop and introduce new technologies,

products and applications; loss of market; and other factors

discussed under the heading "Risk Factors" in the Company's annual

report on Form 20-F filed with the Securities and Exchange

Commission. These forward-looking statements are made only as of

the date hereof, and the Company undertakes no obligation to update

or revise the forward-looking statements, whether as a result of

new information, future events or otherwise. TABLE - 1 ALLOT

COMMUNICATIONS LTD.AND ITS SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS (U.S. dollars in thousands, except share and per share

data) Three Months Ended Year Ended December 31, December 31, 2008

2007 2008 2007 (Unaudited) (Unaudited) (Audited) Revenues $ 9,562 $

8,673 $ 37,101 $ 32,502 Cost of revenues 2,448 2,196 9,696 8,019

Gross profit 7,114 6,477 27,405 24,483 Operating expenses: Research

and development costs, net 2,777 2,491 11,886 9,384 Sales and

marketing 4,588 5,010 19,859 18,081 General and administrative

1,363 1,606 6,174 5,583 In - process research and development - -

244 - Total Operating expenses 8,728 9,107 38,163 33,048 Operating

Loss (1,614) (2,630) (10,758) (8,565) Financial and other income

(loss), net 2,730 (3,785) (5,517) (845) Income (loss) before income

tax expenses 1,116 (6,415) (16,275) (9,410) Income tax expenses 82

325 220 530 Net Income (Loss) 1,034 (6,740) (16,495) (9,940) Basic

net earnings (loss) per share $ 0.05 $ (0.31) $ (0.75) $ (0.46)

Diluted net earnings (loss) per share $ 0.05 $ (0.31) $ (0.75) $

(0.46) Weighted average number of shares used in computing basic

net earnings (loss) per share 22,065,556 21,945,602 22,054,211

21,525,822 Weighted average number of shares used in computing

diluted net earnings (loss) per share 22,225,288 21,945,602

22,054,211 21,525,822 TABLE - 2 ALLOT COMMUNICATIONS LTD. AND ITS

SUBSIDIARIES RECONCILATION OF GAAP TO NON-GAAP CONSOLIDATED

STATEMENTS OF OPERATIONS (U.S. dollars in thousands, except per

share data) Three Months Ended Year Ended December 31, December 31,

2008 2007 2008 2007 (Unaudited) (Unaudited) GAAP net income (loss)

as $ 1,034 $ (6,740) $ (16,495) $ (9,940) reported Non-GAAP

adjustments: Expenses recorded for stock-based compensation Cost of

revenues 6 13 52 48 Research and development costs, net 84 70 321

231 Sales and marketing 64 140 465 340 General and administrative

218 218 855 742 In-process research and development - - 244 - ARS

and law suit litigation expenses General and administrative - 20

197 154 Core technology amortization- cost of revenues 30 - 119 -

Total adjustments to operating loss 402 461 2,253 1,515 Impairment

of auction rate securities Financial and other (income) loss, net

(2,507) 4,881 7,681 4,881 Total adjustments (2,105) 5,342 9,934

6,396 Non-GAAP net Loss $ (1,071) $ (1,398) $ (6,561) $ (3,544)

Non- GAAP basic net Loss per share $ (0.05) $ (0.06) $ (0.30) $

(0.16) Non-GAAP diluted net Loss per share $ (0.05) $ (0.06) $

(0.30) $ (0.16) TABLE - 3 ALLOT COMMUNICATIONS LTD. AND ITS

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (U.S. dollars in

thousands) December 31, 2008 2007 (Unaudited) (Audited) ASSETS

CURRENT ASSETS: Cash and cash equivalents $ 40,029 $ 28,101

Marketable securities and short term deposits 2,121 7,305 Trade

receivables 6,163 6,122 Other receivables and prepaid expenses

1,498 3,799 Inventories 4,259 4,789 Total current assets 54,070

50,116 LONG-TERM ASSETS: Marketable securities 15,319 35,371

Severence pay fund 3,402 3,302 Other assets 839 1,008 Total

long-term assets 19,560 39,681 PROPERTY AND EQUIPMENT, NET 4,970

4,619 GOODWILL AND INTANGIBLE ASSETS, NET 4,264 239 Total assets $

82,864 $ 94,655 LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables $ 2,902 $ 3,409 Deferred revenues 4,475

3,968 Other payables and accrued expenses 6,466 5,514 Total current

liabilities 13,843 12,891 LONG-TERM LIABILITIES: Deferred revenues

2,293 1,404 Accrued severence pay 3,536 3,175 Total long-term

liabilities 5,829 4,579 SHAREHOLDERS' EQUITY 63,192 77,185 Total

liabilities and shareholders' equity $ 82,864 $ 94,655 Investor

Relations Contact: Jay Kalish, Executive Director Investor

Relations, International access code +972-54-221-1365, DATASOURCE:

Allot Communications Ltd. CONTACT: Investor Relations Contact: Jay

Kalish, Executive Director Investor Relations, International access

code +972-54-221-1365,

Copyright

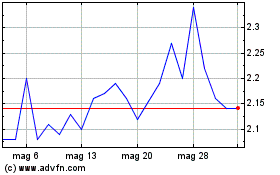

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Lug 2023 a Lug 2024