Record Quarterly Revenues Reported; Non-GAAP Loss Reduced by 50%

HOD HASHARON, Israel, August 12 /PRNewswire-FirstCall/ -- Allot

Communications Ltd. (NASDAQ:ALLT), a leader in IP service

optimization solutions based on deep packet inspection (DPI)

technology, today reported a continued improvement in its quarterly

results with the announcement of its financial results for the

second quarter ended June 30, 2009. Key highlights: - Second

quarter revenues totaled $10.0 million, representing a 7% increase

over first quarter of 2009 - Non-GAAP loss continues to decline,

with second quarter non-GAAP net loss totaling $0.4 million, or

$0.02 per basic and diluted share, from $0.8 million, or $0.04 per

basic and diluted share, in the first quarter of 2009, and from

$1.9 million, or $0.09 per basic and diluted share, in the second

quarter of 2008 - As of June 30, 2009, cash, cash equivalents,

deposits and investments in marketable securities totaled $54.8

million - The Company received approximately $5 million in orders

to date from a global Tier 1 mobile operator under a new frame

agreement. Total revenues for the second quarter of 2009 reached

$10.0 million, a 6% increase from the $9.5 million of revenues

reported in the second quarter of 2008 and a 7% increase from the

$9.4 million of revenues reported for the first quarter of 2009. On

a GAAP basis, net loss for the second quarter of 2009 was $1.0

million, or $0.05 per share (basic and diluted). This compares with

a net loss of $3.8 million, or $0.17 per share (basic and diluted),

in the second quarter of 2008, and a net loss of $2.9 million, or

$0.13 per share (basic and diluted), in the first quarter of 2009.

On a non-GAAP basis, excluding the impact of share-based

compensation, auction-rate securities (ARS) devaluation, certain

legal expenses and amortization of acquired core technology, net

loss for the second quarter of 2009 totaled $0.4 million, or $0.02

per share (basic and diluted), as compared with a non-GAAP net loss

of $0.8 million, or $0.04 per share (basic and diluted), for the

first quarter of 2009 and a non-GAAP net loss of $1.9 million, or

$0.09 per share (basic and diluted), for the second quarter of

2008. These non-GAAP measures should be considered in addition to,

and not as a substitute for, comparable GAAP measures. A full

reconciliation between GAAP and non-GAAP net loss is provided in

the accompanying Table 2. The Company provides these non-GAAP

financial measures because it believes that they present a better

measure of the Company's core business and management uses the

non-GAAP measures internally to evaluate the Company's ongoing

performance. Accordingly, the Company believes that they are useful

to investors in enhancing an understanding of the Company's

operating performance. "While we continue to grow in the

traditional service provider market, the primary growth engine we

are currently seeing is in the mobile market, which was highlighted

by our signing a frame agreement towards the end of the quarter

with a global Tier 1 mobile operator group, which led to initial

orders of approximately $5 million to date," commented Allot

President and CEO Rami Hadar. "A study we published recently

demonstrates the significant growth in mobile data traffic, and the

need for Allot's solution to enable service providers to manage

their networks in the short term, while providing them with the

means to drive additional revenues from their networks going

forward. "We are pleased with our continued sales growth in the

quarter, highlighted by the record sales we achieved. Coupled with

our strong cash position, we believe that we are well positioned to

meet the growing opportunities in our target markets," concluded

Hadar. Recently, the Company achieved the following significant

goals: - More than 20 service providers worldwide using the Service

Gateway platform; - During the quarter, concluded 15 large deals

with service providers, of which 6 represented new customers and 9

represented expansion deals; - Release of the MediaSwift as part of

the Company's value added services offering. As of June 30, 2009,

cash, cash equivalents, deposits and investments in marketable

securities totaled $54.8 million. Recent external valuations showed

an increase in value of certain ARS in the Company's portfolio as

of the end of the second quarter. As a result, the Company recorded

an unrealized net gain of $1.2 million to the other comprehensive

income in its shareholders' equity, leaving the Company with a

total of $15.4 million in ARS at the end of the quarter. To date,

our ARS have paid all their interest payments. Conference Call

& Webcast The Allot management team will host a conference call

to discuss its second quarter 2009 earnings results on Wednesday,

August 12, 2009, at 8:30 AM EDT, 3:30 PM Israel time. The quarterly

and annual results will be published prior to the conference call.

To access the conference call, please dial one of the following

numbers: US: 1-866-966-5335, International: +44-20-3003-2666,

Israel: 1-809-216-213. A replay of the conference call will be

available from 12:01 am EST on Aug 13, 2009 through September 13,

2009 at 11:59 pm EST. To access the replay, please dial:

+44-20-8196-1998, access code: 650204#. A live webcast of the

conference call can be accessed on the Allot Communications website

at http://www.allot.com/. The webcast will also be archived on the

website following the conference call. About Allot Communications

Allot Communications Ltd. (NASDAQ:ALLT) is a leading provider of

intelligent IP service optimization solutions. Designed for

carriers, service providers and enterprises, Allot solutions apply

deep packet inspection (DPI) technology to transform broadband

pipes into smart networks. This creates the visibility and control

vital to manage applications, services and subscribers, guarantee

quality of service (QoS), contain operating costs and maximize

revenue. Allot believes in listening to customers and provides them

access to its global network of visionaries, innovators and support

engineers. For more information, please visit

http://www.allot.com/. Safe Harbor Statement Information provided

in this press release may contain statements relating to current

expectations, estimates, forecasts and projections about future

events that are "forward-looking statements" as defined in the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements generally relate to the Company's plans,

objectives and expectations for future operations. These

forward-looking statements are based upon management's current

estimates and projections of future results or trends. Actual

results may differ materially from those projected as a result of

certain risks and uncertainties. These factors include, but are not

limited to: changes in general economic and business conditions

and, specifically, a decline in demand for the Company's products;

the Company's inability to develop and introduce new technologies,

products and applications; loss of market; and other factors

discussed under the heading "Risk Factors" in the Company's annual

report on Form 20-F filed with the Securities and Exchange

Commission. These forward-looking statements are made only as of

the date hereof, and the Company undertakes no obligation to update

or revise the forward-looking statements, whether as a result of

new information, future events or otherwise. TABLE 1 ALLOT

COMMUNICATIONS LTD. AND ITS SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS (U.S. dollars in thousands, except share and per share

data) Three Months Ended Six Months Ended June 30, June 30, 2009

2008 2009 2008 (Unaudited) (Unaudited) ___________ ___________

Revenues $ 10,009 $ 9,461 $ 19,378 $ 17,720 Cost of revenues 2,784

2,488 5,310 4,630 _____ _____ ______ _____ Gross profit 7,225 6,973

14,068 13,090 _____ _____ ______ _____ Operating expenses: Research

and Development costs, net 2,100 3,123 4,507 6,220 Sales and

marketing 4,853 5,476 9,257 10,520 General and administrative 1,466

1,610 2,859 3,109 In-process research and development - - - 244

_____ _____ _____ _____ Total Operating expenses 8,419 10,209

16,623 20,093 _____ _____ _____ _____ Operating loss (1,194)

(3,236) (2,555) (7,003) Financial and other income (expenses), net

312 (444) (1,212) (1,459) _____ _____ ______ ______ Loss before

income tax expenses (882) (3,680) (3,767) (8,462) Income tax

expenses 112 70 116 101 _____ _____ ______ _____ Net loss $ (994) $

(3,750) $ (3,883) $ (8,563) ===== ===== ====== ===== Basic and

diluted net loss per share $ (0.05) $ (0.17) $ (0.18) $ (0.39)

====== ===== ====== ===== Weighted average number of shares used in

computing basic and diluted net loss per Share 22,070,416

22,058,963 22,069,909 22,042,867 ========== ========== ==========

========== TABLE 2 ALLOT COMMUNICATIONS LTD. AND ITS SUBSIDIARIES

RECONCILATION OF GAAP TO NON-GAAP CONSOLIDATED STATEMENTS OF

OPERATIONS (U.S. dollars in thousands, except per share data) Three

Months Ended Six Months Ended June 30, June 30, 2009 2008 2009 2008

(Unaudited) (Unaudited) ___________ ___________ GAAP net loss as

reported $ (994) $ (3,750) $ (3,883) $ (8,563) _______ ________

_________ _________ Non-GAAP adjustments: Expenses recorded for

stock-based compensation Cost of revenues 28 16 53 30 Research and

development costs, net 89 81 178 156 Sales and marketing 197 162

306 290 General and administrative 292 213 579 421 In-process

research and development - - - 244 Expenses related to a law suit -

general and administrative - 25 - 46 Core technology Amortization -

cost of revenues 30 30 58 58 ____ _____ _____ ____ Total

adjustments to operating loss 635 527 1,174 1,245 Impairment of

auction rate securities - financial and other income (expenses),

net - 1,285 1,575 3,435 ____ ______ ______ ______ Total adjustments

635 1,812 2,749 4,680 ____ ______ ______ ______ Non-GAAP net loss $

(359) $ (1,938) $ (1,134) $ (3,883) ===== ====== ====== ====== Non-

GAAP basic and diluted net loss per share $ (0.02) $ (0.09) $

(0.05) $ (0.18) ====== ====== ====== ====== TABLE 3 ALLOT

COMMUNICATIONS LTD. AND ITS SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (U.S. dollars in thousands) June 30, December 31, 2009 2008

(Unaudited) (Audited) __________ _________ ASSETS CURRENT ASSETS:

Cash and cash equivalents $ 35,323 $ 40,029 Short term deposits and

restricted deposits 4,120 2,121 Trade receivables 8,122 6,163 Other

receivables and prepaid expenses 1,356 1,959 Inventories 4,737

4,259 ______ ______ Total current assets 53,658 54,531 ______

______ LONG-TERM ASSETS: Marketable securities 15,364 15,319

Severance pay fund 3,295 3,402 Other assets 887 874 ______ ______

Total long-term assets 19,546 19,595 ______ ______ PROPERTY AND

EQUIPMENT, NET 4,733 4,970 ______ ______ GOODWILL AND INTANGIBLE

ASSETS, NET 3,698 3,755 ______ ______ Total assets $ 81,635 $

82,851 ====== ====== LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables $ 3,041 $ 2,902 Deferred revenues 4,971

4,475 Other payables and accrued expenses 7,355 6,466 ______ ______

Total current liabilities 15,367 13,843 ______ ______ LONG-TERM

LIABILITIES: Deferred revenues 2,209 2,293 Accrued severance pay

3,264 3,536 ______ _____ Total long-term liabilities 5,473 5,829

______ _____ SHAREHOLDERS' EQUITY 60,795 63,179 ______ _____ Total

liabilities and shareholders' equity $ 81,635 $ 82,851 ======

====== Investor Relations Contact: Jay Kalish Executive Director

Investor Relations International dial +972-54-221-1365 DATASOURCE:

Allot Communications Ltd. CONTACT: Investor Relations Contact: Jay

Kalish, Executive Director Investor Relations, International dial

+972-54-221-1365,

Copyright

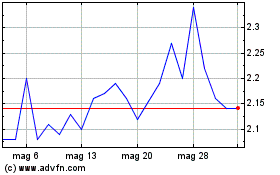

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Lug 2023 a Lug 2024