false 0001681087 0001681087 2024-01-30 2024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 30, 2024

AVROBIO, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38537 |

|

81-0710585 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

100 Technology Square

Sixth Floor

Cambridge, MA 02139

(Address of principal executive offices, including zip code)

(617) 914-8420

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

AVRO |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

On January 30, 2024, AVROBIO, Inc., a Delaware corporation (“AVRO”) and Tectonic Therapeutic, Inc., a Delaware corporation (“Tectonic”), hosted a live webcast presentation to discuss the transactions contemplated by the Agreement and Plan of Merger and Reorganization, dated as of January 30, 2024, by and among AVRO, Tectonic and Alpine Merger Subsidiary, Inc., a Delaware corporation (“Merger Sub”), pursuant to which Merger Sub will merge with and into Tectonic, with Tectonic continuing as a wholly owned subsidiary of AVRO and the surviving corporation of the merger (the “Merger”). A webcast of the presentation and associated slides will be available on the Investors & Media section of AVRO’s website at https://investors.avrobio.com and a replay will be archived for 30 days following the presentation. Furnished as Exhibit 99.1 hereto and incorporated herein by reference is the investor presentation that will be used by AVRO and Tectonic in connection with the Merger, including in the webcast described above.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AVROBIO, INC. |

|

|

|

|

| Date: January 30, 2024 |

|

|

|

By: |

|

/s/ Erik Ostrowski |

|

|

|

|

|

|

Erik Ostrowski |

|

|

|

|

|

|

President, Interim Chief Executive Officer, Chief Financial Officer and Treasurer |

Exhibit 99.1 Transforming the Discovery of Novel GPCR- Targeted

Therapies J A N U A R Y 2 0 2 4

DISCLAIMER This communication contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, express or implied statements regarding the structure, timing and completion of

the proposed Merger; the combined company’s listing on Nasdaq after closing of the proposed Merger; expectations regarding the ownership structure of the combined company; the anticipated timing of closing; each company’s and the

combined company’s expected cash position at the closing of the proposed Merger and cash runway of the combined company; the future operations of the combined company; the nature, strategy and focus of the combined company; the development and

commercial potential and potential benefits of TX45; anticipated preclinical and clinical drug development activities and related timelines, including the expected timing for data and other clinical results; the competitive landscape of the combined

company; and other statements that are not historical fact. All statements other than statements of historical fact contained in this communication are forward-looking statements. These forward-looking statements are made as of the date they were

first issued, and were based on the then-current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which

involve factors or circumstances that are beyond AVROBIO's, Tectonic’s or the combined company’s control. Actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors,

including but not limited to (i) the risk that the conditions to the closing of the proposed Merger are not satisfied, including the failure to timely obtain shareholder approval for the transaction, if at all; (ii) uncertainties as to the timing of

the consummation of the proposed Merger and the ability of each of AVROBIO and Tectonic to consummate the proposed Merger; (iii) risks related to AVROBIO's ability to manage its operating expenses and its expenses associated with the proposed merger

pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed Merger; (v) the risk that as a result of adjustments to the exchange

ratio, AVROBIO shareholders and Tectonic stockholders could own more or less of the combined company than is currently anticipated; (vi) risks related to the market price of AVROBIO’s common stock relative to the value suggested by the

exchange ratio; (vii) unexpected costs, charges or expenses resulting from the transaction; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Merger; (ix) the

uncertainties associated with Tectonic’s platform technologies, as well as risks associated with the clinical development and regulatory approval of product candidates, including potential delays in the commencement, enrollment and completion

of clinical trials; (x) risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance these product candidates and its preclinical programs; (xi) uncertainties in obtaining successful clinical

results for product candidates and unexpected costs that may result therefrom; (xii) risks related to the failure to realize any value from product candidates and preclinical programs being developed and anticipated to be developed in light of

inherent risks and difficulties involved in successfully bringing product candidates to market; (xiii) risks associated with the possible failure to realize certain anticipated benefits of the proposed Merger, including with respect to future

financial and operating results; (xiv) risks associated with AVROBIO’s financial close process; (xv) the risk that the private financing is not consummated, among others. Actual results and the timing of events could differ materially from

those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in filings that AVROBIO makes and will make with the SEC in connection with the

proposed Merger, including the Proxy Statement described below under “Additional Information and Where to Find It.” You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as

of the dates indicated in the forward-looking statements. AVROBIO, Tectonic and the combined company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to

reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based. Tectonic obtained the industry, market and competitive position data used throughout this

presentation from its own internal estimates and research, as well as from industry and general publications, and research, surveys and studies conducted by third parties. Internal estimates are derived from publicly available information released

by industry analysts and third-party sources, Tectonic’s internal research and its industry experience, and are based on assumptions made by Tectonic based on such data and its knowledge of the industry and market, which it believes to be

reasonable. In addition, while Tectonic believes the industry, market and competitive position data included in this presentation is reliable and based on reasonable assumptions, Tectonic has not independently verified any third-party information,

and all such data involve risks and uncertainties and are subject to change based on various factors. This presentation contains trademarks, services marks, trade names and copyrights of Tectonic and other companies, which are the property of their

respective owners. The use or display of third parties’ trademarks, service marks, trade name or products in this presentation is not intended to, and does not imply, a relationship with Tectonic, or an endorsement of sponsorship by Tectonic.

Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the company will not assert, to

the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade name.

DISCLAIMER (continued) Participants in the Solicitation This

communication relates to the proposed merger transaction involving AVROBIO and Tectonic and may be deemed to be solicitation material in respect of the proposed merger transaction. In connection with the proposed merger transaction, AVROBIO will

file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 (the “Form S-4”) that contains a proxy statement (the “Proxy Statement”) and

prospectus. This communication is not a substitute for the Form S-4, the Proxy Statement or for any other document that AVROBIO may file with the SEC and or send to AVROBIO’s shareholders in connection with the proposed merger transaction.

BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF AVROBIO ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT AVROBIO, THE PROPOSED MERGER TRANSACTION AND RELATED MATTERS. Additional Information and Where to Find It Investors and security holders may obtain free copies of the Form S-4, the Proxy Statement and other

documents filed by AVROBIO with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed by AVROBIO with the SEC are also available free of charge on AVROBIO’s website at www.avrobio.com. AVROBO,

Tectonic, and their respective directors and certain of their executive officers may be considered participants in the solicitation of proxies from AVROBIO's shareholders with respect to the proposed merger transaction under the rules of the SEC.

Information about the directors and executive officers of AVROBIO is set forth in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 23, 2023, and in subsequent documents filed with the SEC.

Additional information regarding the persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, are also included in the Form S-4, the Proxy

Statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of this document as described above. No Offer or Solicitation This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities nor a solicitation of any vote or approval with respect to the proposed transaction or otherwise. No offering of securities shall be made except by means of a prospectus meeting the requirements of

Section 10 of the U S. Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Transforming the Discovery of Novel GPCR-Targeted Therapies J A N U A R

Y 2 0 2 4

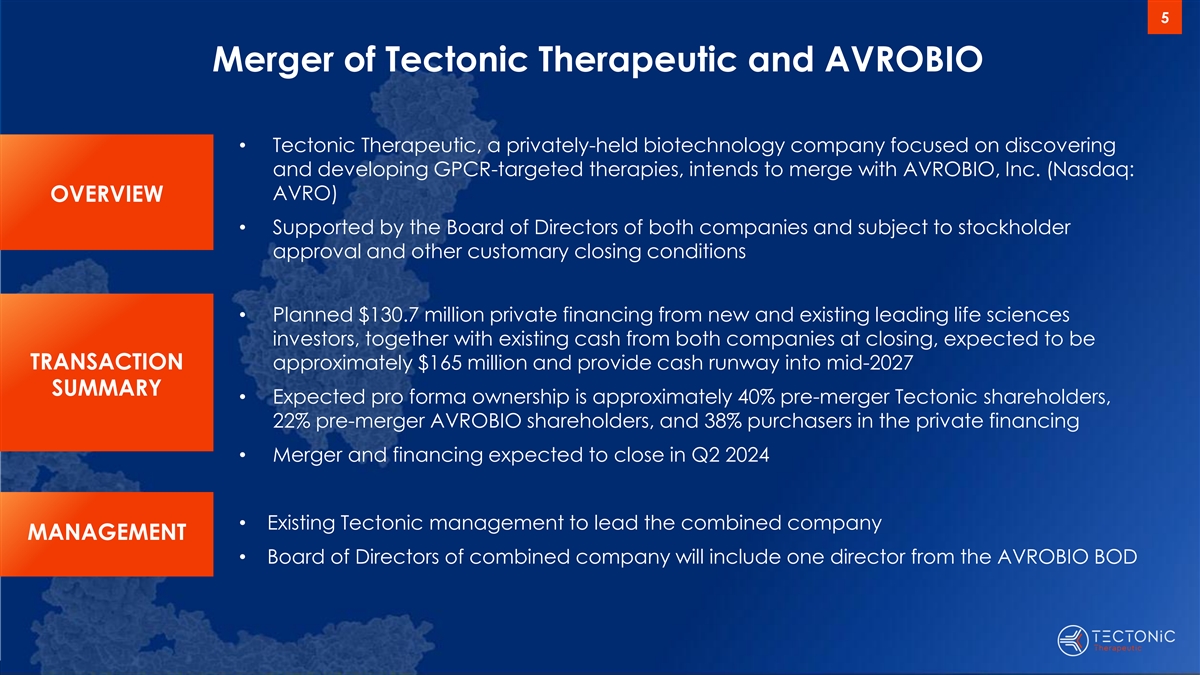

5 Merger of Tectonic Therapeutic and AVROBIO • Tectonic

Therapeutic, a privately-held biotechnology company focused on discovering and developing GPCR-targeted therapies, intends to merge with AVROBIO, Inc. (Nasdaq: AVRO) OVERVIEW • Supported by the Board of Directors of both companies and subject

to stockholder approval and other customary closing conditions • Planned $130.7 million private financing from new and existing leading life sciences investors, together with existing cash from both companies at closing, expected to be

TRANSACTION approximately $165 million and provide cash runway into mid-2027 SUMMARY • Expected pro forma ownership is approximately 40% pre-merger Tectonic shareholders, 22% pre-merger AVROBIO shareholders, and 38% purchasers in the private

financing • Merger and financing expected to close in Q2 2024 • Existing Tectonic management to lead the combined company MANAGEMENT • Board of Directors of combined company will include one director from the AVROBIO BOD

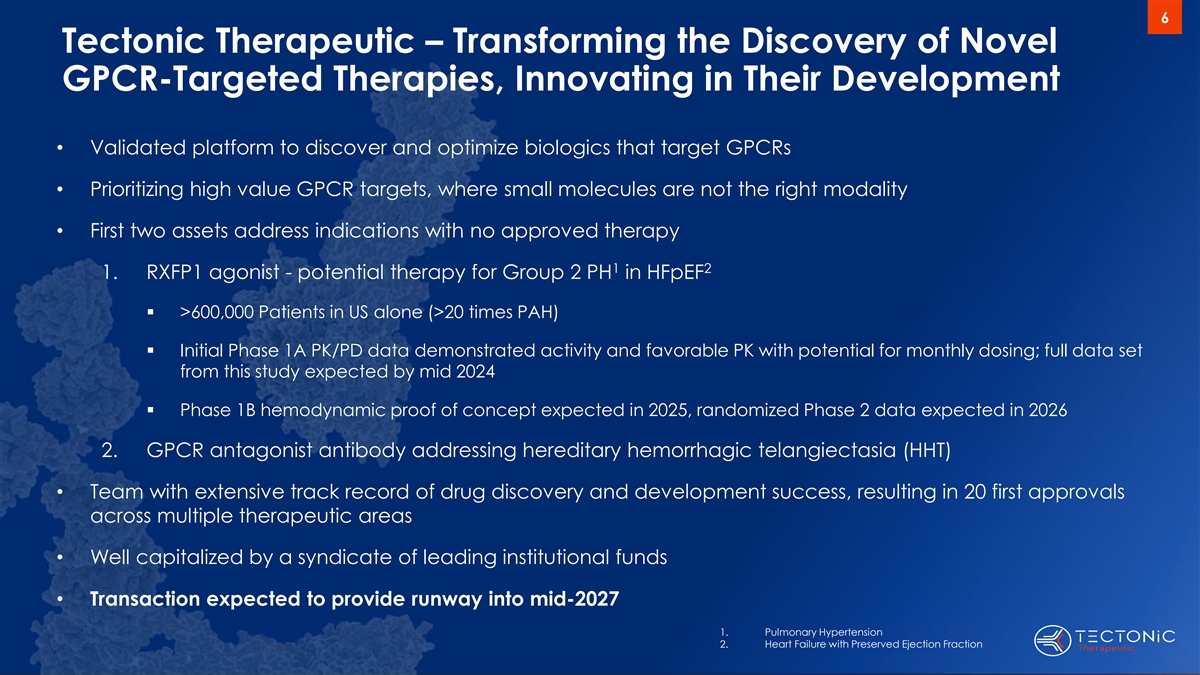

6 Tectonic Therapeutic – Transforming the Discovery of Novel

GPCR-Targeted Therapies, Innovating in Their Development • Validated platform to discover and optimize biologics that target GPCRs • Prioritizing high value GPCR targets, where small molecules are not the right modality • First two

assets address indications with no approved therapy 1 2 1. RXFP1 agonist - potential therapy for Group 2 PH in HFpEF ▪ >600,000 Patients in US alone (>20 times PAH) ▪ Initial Phase 1A PK/PD data demonstrated activity and favorable

PK with potential for monthly dosing; full data set from this study expected by mid 2024 ▪ Phase 1B hemodynamic proof of concept expected in 2025, randomized Phase 2 data expected in 2026 2. GPCR antagonist antibody addressing hereditary

hemorrhagic telangiectasia (HHT) • Team with extensive track record of drug discovery and development success, resulting in 20 first approvals across multiple therapeutic areas • Well capitalized by a syndicate of leading institutional

funds • Transaction expected to provide runway into mid-2027 1. Pulmonary Hypertension 2. Heart Failure with Preserved Ejection Fraction

7 Our Team Has Delivered for Patients and Investors Alise Christian

Peter Anthony Marcella Marc Reicin, M.D. Cortis, Ph.D. McNamara, Ph.D. Muslin, M.D. Ruddy, M.D. Schwabish, Ph.D. CEO, Director COO CSO CDO CMO CBO FOUNDED MULTIPLE GPCR EXPERT, SUCCESSFUL COMPANIES FORBES ”30 under 30” Timothy Andrew

LeukoSite Springer, Ph.D. Kruse, Ph.D. Co-Founder Co-Founder Multiple Awards and Fellowships 2022 Lasker Award (Biomedical Research, NIH, Amgen, Sloan Research)

8 Biologics Offer Advantages Over Small Molecules in Targeting GPCRs in

Multiple Settings ~12% >18%* Approved remain When difficult to drug with small molecules drugs target unexploited Biologic captures complexity of ligand / receptor engagement 100 GPCRs If target site similar to domains of different proteins

Biologic minimizes off target binding to improve safety / tolerability Non- 800+ Sensory Orphan GPCRs If use case requires tissue /compartment targeting GPCRs (~20%) Sensory Engineer biologic to target or exclude compartment as needed GPCRs (~50%)

When multi-modal action needed Bispecific approach enables dual target engagement ➢ >470 Approved drugs (~33% of all) ➢ >$180B in annual sales ➢ Predominantly small molecules ➢ Address broad range of therapeutic

areas ➢ Only 3 are antibodies (*) Hauser, A.S. et al., Cell. 2018 Jan 11; 172(1-2): 41–54.e19. * 18% = 100% - 12% (approved drug targets) – 50% (sensory) – 20% (non-sensory, orphan)

9 Our Unique Pipeline Opportunities are Enabled by Biologic Targeting

of GPCRs GROUP 2 PULMONARY HEREDITARY HEMORRHAGIC FIBROSIS HYPERTENSION (Group 2 PH) TELANGIECTASIA (HHT) First in Class & Indication Bi-specific Approach 2 2 Potential Best-in-Class GPCR Antagonist GPCR Antagonist 1 (anti-angiogenic)

(anti-fibrotic) RXFP1 Agonist Supporting clinical data Target pathway linked to disease Supporting clinical data for one genetics component of bispecific Scale of POC studies: ~50-200 patients per indication 3-6 months treatment 1. Fusion protein

– lead molecule in-licensed from Harvard U., optimized using GEODe platform 2. GPCR targeted mAbs discovered internally using GEODe platform

10 Post Close Cash to Support Pipeline Progression Into Mid-2027 and

Several Key Inflection Points Tectonic Pipeline and Expected Readouts RXFP1 • Complete PK/PD Data: mid 2024 Phase 1a • Ph 1b hemodynamic proof of concept data: 2025 Agonist • Randomized Ph 2 data: 2026 (TX45 – Fc-relaxin)

GPCR • Start of Ph 1: Q4 2025 / Q1 2026 Development Antagonist Candidate Selection • Start of randomized studies: ~Q4 2026 (HHT Program) GPCR Discovery • Develop internally or partner Antagonist (Fibrosis Program) GPCR

Discovery• Develop internally or partner Modulators (Undisclosed) 1 Includes in vivo HHT validation

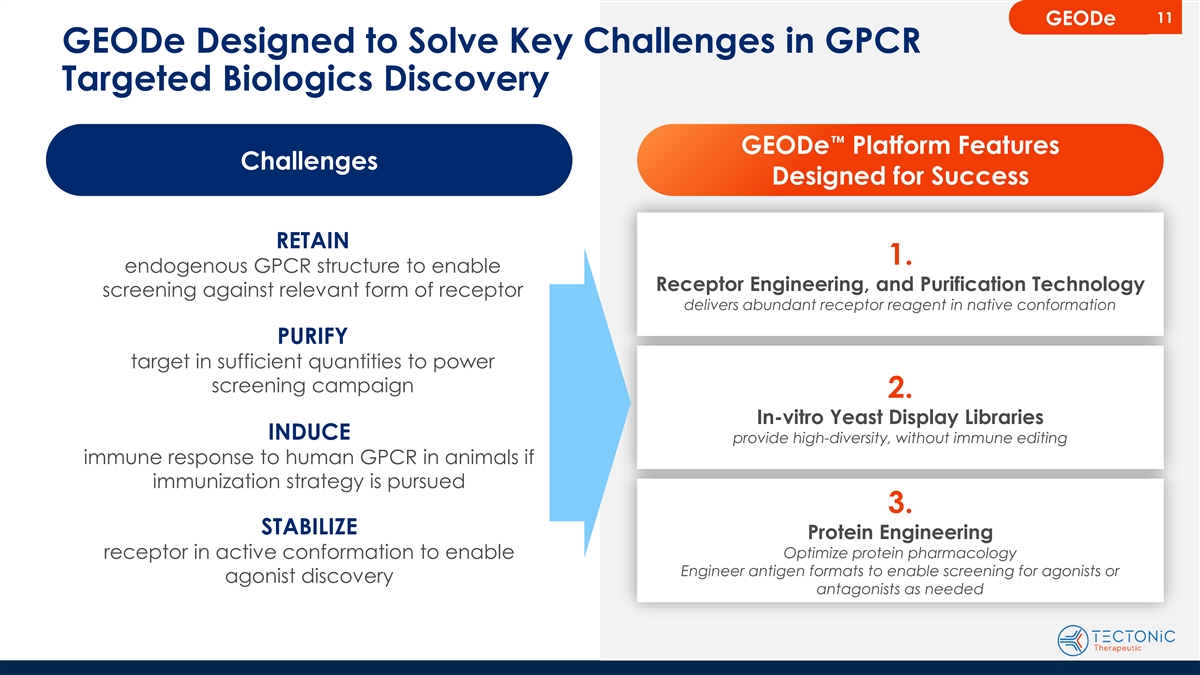

11 GEODe GEODe Designed to Solve Key Challenges in GPCR Targeted

Biologics Discovery GEODe™ Platform Features Challenges Designed for Success RETAIN 1. endogenous GPCR structure to enable Receptor Engineering, and Purification Technology screening against relevant form of receptor delivers abundant receptor

reagent in native conformation PURIFY target in sufficient quantities to power screening campaign 2. In-vitro Yeast Display Libraries INDUCE provide high-diversity, without immune editing immune response to human GPCR in animals if immunization

strategy is pursued 3. STABILIZE Protein Engineering receptor in active conformation to enable Optimize protein pharmacology Engineer antigen formats to enable screening for agonists or agonist discovery antagonists as needed

TX45: Fc-RELAXIN FUSION PROTEIN RXFP1 agonist with differentiated

profile

13 TX45 Hemodynamic and Anti-fibrotic Properties of Relaxin

Demonstrated by its Role in Pregnancy Pharmacology Facilitates Gestation AGONIST PULMONARY AND SYSTEMIC VASODILATOR Increases cardiac output to Natural Ligand of RXPF1 accommodate the Receptor increased demand from developing fetus No RXFP1

internalization from relaxin agonism → ANTIFIBROTIC no desensitization with chronic therapy Prepares musculoskeletal tissues for pregnancy and childbirth Relaxin upregulated in Local resolution cryo-EM map of full-length RXFP1–Gs complex

BioRxiv: https://doi.org/10.1101/2022.01.22.477343 pregnancy Pharmacologic properties of relaxin hold promise as a potential treatment for cardio- pulmonary and renal disease, but its short half-life has impeded its development

14 TX45 Evidence of Serelaxin’s Safety and Benefit in Acute

Heart Failure (AHF) • A meta-analysis of 6 studies and >11,000 patients demonstrated that a 2-day infusion of serelaxin was safe and resulted in a 23% decrease in 5-day worsening heart failure • One of two pivotal studies include in

meta-analysis, RELAX-AHF-2, failed to achieve the co- primary endpoints, and we believe that two factors contributed to this outcome – It was ambitious to expect that a two-day infusion of serelaxin, with its short half-life and mechanism of

action, would demonstrate clinical benefit at day 5 and, more puzzlingly at 6 months – Operational challenges with patient enrollment may also have had an impact • Limitations of serelaxin's PK inhibited further development, but its

clinical performance supports advancement of TX45 whose PK profile permits chronic dosing for chronic diseases such as pulmonary hypertension and heart failure * Teerlink J.R. et al. Eur. J. Heart Fail. 2019; 22: 315-329; patients from RELAX-AHF-JP

(N=30 total) not listed in table

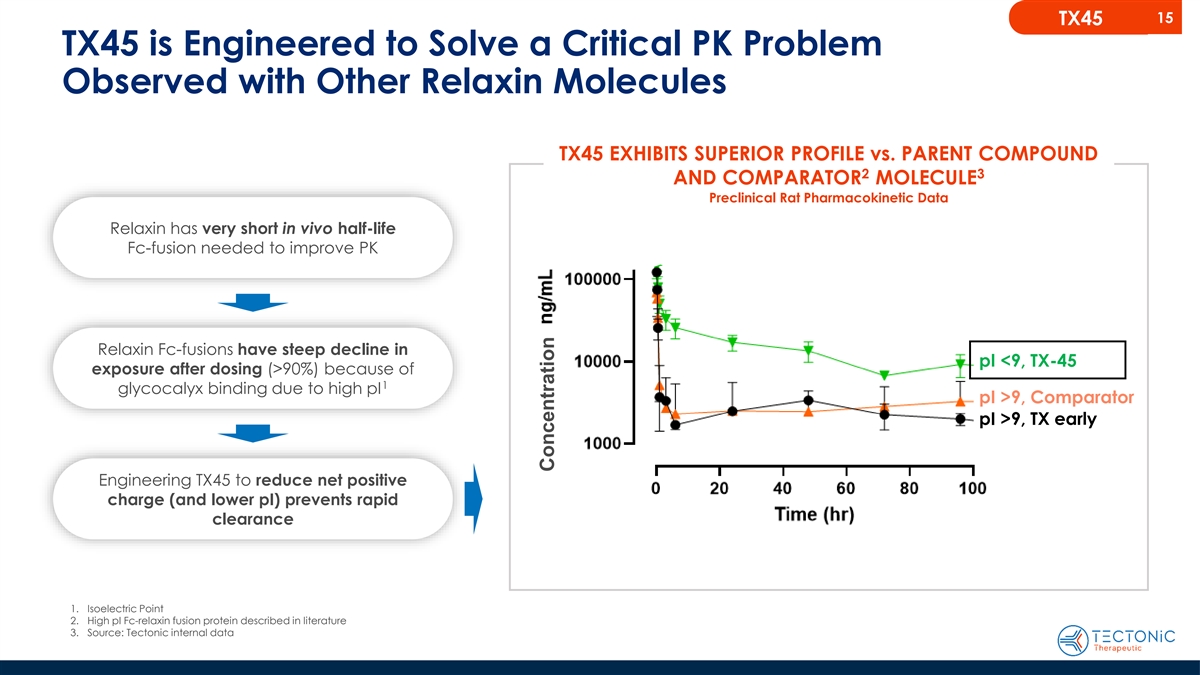

15 TX45 TX45 is Engineered to Solve a Critical PK Problem Observed

with Other Relaxin Molecules TX45 EXHIBITS SUPERIOR PROFILE vs. PARENT COMPOUND 2 3 AND COMPARATOR MOLECULE Preclinical Rat Pharmacokinetic Data Relaxin has very short in vivo half-life Fc-fusion needed to improve PK Relaxin Fc-fusions have steep

decline in pI <9, TX-45 exposure after dosing (>90%) because of 1 glycocalyx binding due to high pI pI >9, Comparator pI >9, TX early Engineering TX45 to reduce net positive charge (and lower pI) prevents rapid clearance 1. Isoelectric

Point 2. High pI Fc-relaxin fusion protein described in literature 3. Source: Tectonic internal data Concentration

16 TX45 TX45 Reflects Significant Protein Engineering to Optimize Its

Pharmacology 1 TX45 results in ~10x greater in vivo potency over comparator molecule than predicted based on PK 2 and in vitro activity – potentially from reduced trapping of drug in glycocalyx, resulting in increased free drug available to

activate RXFP1 in tissues Superior efficacy (Renal Blood Flow) in TX45 vs. Relative in Relative in Expected in Observed in 3 High PI Comparator Molecule at Same Dose vivo exposure vitro potency vivo activity at vivo activity at at same dose on

receptor same dose same dose 1X 10X 10X 1X 10X 10X 1X 10X TX45 0.3mpk TX45 0.03 mpk Comparator 0.3 mpk Vehicle Comp TX45 Comp TX45 Comp TX45 Comp TX45 2. ~0.03 mpk of TX45 has 1. High pI Fc-relaxin fusion protein described in literature 3. Source:

Tectonic internal data similar efficacy as 0.3 mpk of Comparator

17 TX45 TX45 – Optimized RXFP1Agonist for Group 2 PH in HFpEF

✓ Potential Best-in-Class Relaxin • Protein engineering has extended pharmacologic half-life to support monthly dosing Agonist with Optimized PK • No approved therapy ✓ High Unmet Need in Group 2 • >600,000

patients in US 1 PH with HFpEF • High 5-year high mortality • Pulmonary + systemic vasodilation, cardiac relaxation ✓ Mechanism may be Ideal to • Reversal of fibrosis in pulmonary vasculature and heart Address Group 2 PH

• Anti-inflammatory ✓ Supporting Clinical and Pre-• Hemodynamic benefit in studies of serelaxin in AHF • Clear benefit observed with TX45 in rodent PH and CHF models clinical Data • No outcome study needed ✓

Streamlined Development • Enrichment strategy for CpcPH where there is greatest unmet need Strategy • Enables potential early launch relative to congestive heart failure • Other PH Groups, Heart failure, renal disease ✓

Potential to Expand Indications 1. Heart Failure with preserved Ejection Fraction

18 TX45 Pulmonary Hypertension Consists of 5 Distinct Diseases Group 2

PH is of Greatest Interest for TX45’s Initial Indication Group 1 Group 2 Group 4 Group 5 (“PAH”) Group 3 1 (>600,000 ) (“CTEPH”) (Misc.) 1 (~25,000 ) • Idiopathic• Due to left heart • Due to lung

disease • Chronic thrombo-• Miscellaneous or hypoxia embolic pulmonary group with causes disease (HFpEF, • Hereditary HFrEF) or valvular hypertension –i.e., unclear or multiple • May be due to heart disease as a

consequence underlying factors • Connective tissue COPD, interstitial of blood clots disease-associated 2 • CAD, HTN, T2DM , lung disease (i.e., high cholesterol are IPF) or obstructive • Congenital heart risk factors sleep apnea

disease-associated • Two Subtypes: • Drug-induced CpcPH / IpcPH 1. US Prevalence 2. CAD: Coronary Artery Disease, HTN: Hypertension, T2DM: Type 2 Diabetes Mellitus Nat. Pul. Hypertension Unit, Ireland

19 TX45 Our Focus is on the Group 2 PH Subset of Heart Failure with

Preserved EF (HFpEF) Clinical Program Designed to Enable Evaluation of Efficacy in Each Subgroup IpcPH (Isolated, post capillary PH) Heart Increased Left Ventricle Filling Pressures HFpEF Normal Ô HFpEF 1,2 Increased Pulmonary Venous Pressures

(Several million pts.) Ô Passive Pressure Backflow Ô Pulmonary Hypertension Group 2 PH 3 (>600K) IpcPH CpcPH CpcPH (Combined, pre- and post capillary PH) (>500K) (>100K) Chronic PH and/or Other Drivers Pulmonary Vasculature Ô

Permanent Vascular Changes, e.g. Pulmonary Artery Remodeling Ô Increased Vascular Resistance Ô Normal PAH-like Right Heart Failure 1. US prevalence numbers. Estimates based on data from 2. Kapelios, C. et al., Cardiac Failure Review

2023;9:e14 3. Sera F. et al. Heart 2023;109:626–633

20 TX45 Relaxin Multimodal MOA Addresses Pathways Implicated in Group

2 PH Pathophysiology Mechanisms Implicated in Group 2 PH 1 Activation of ET-1 pathway(*) 2 Reduced NO pathway activity(*) Activation of TGFβ pathway 3 (*) Most active in CpcPH subset Effects of RXFP1 Activation by Relaxin ✓ Pulmonary and

systemic arterial vasodilation ✓ Favorable remodeling: anti-fibrotic effect in heart and pulmonary vasculature ✓ Anti-inflammatory

21 TX45 Relaxation and Anti-Fibrotic Effects of Relaxin Have Potential

for Disease Modification in Group 2 PH • Heart, and vascular dysfunction contribute to disease pathology • Renal dysfunction also present in many of these patients CHARACTERISTICS OF GROUP 2 PH IpcPH CpcPH ANTICIPATED RELAXIN EFFECTS

Pulmonary Vasodilation Pulmonary artery narrowing, thickening, ✓ stiffening, fibrotic remodeling Anti-inflammatory, anti-fibrotic Right Ventricular Dysfunction Right ventricular remodeling ✓✓ Peripheral vasodilation, cardiac

Thickening and stiffening of Left Ventricle ✓✓ relaxation, left ventricular remodeling Compromised kidney function Improvement in kidney function ✓✓ Balanced vasodilation in pulmonary and peripheral vasculature needed for

safety and efficacy

22 TX45 Group 2 PH vs. PAH • Significant opportunity for a

first-in-indication therapy • Highly motivated physicians and patients 6 US PREVALENCE >> PAH 5 YEAR SURVIVAL < PAH NO THERAPEUTIC OPTIONS 1-3 >600,000 No approved Multiple drugs/ 50% therapies mechanisms 45% approved … ET1R

IpcPH Limited antagonists (>500K) pipeline PDE5 inhibitors 23% GC stimulators PAH Drugs have failed in Group 2 ACTRII-Trap PH with the exception of CpcPH 4 <25,000 PDE5i in CpcPH (>100K) cpcPH IpcPH PAH Group 2 PH PAH PAH Group 2 PH Group 2

PH Multi-$ Billion Market >$4 Billion Market in 5 Opportunity US Today 1. US prevalence numbers. Estimates based on data from 2. Kapelios, C. et al., Cardiac Failure Review 2023;9:e14 3. Sera F. et al. Heart 2023;109:626–633 4.

www.pahinitiative.com 5. GlobalData 6. https://doi.org/10.1371/journal.pone.0199164.g003

23 TX45 PDE5 Inhibitors Affect Only One of Several Pathways Addressed

by Relaxin PDE5 inhibitors demonstrated (1-3) efficacy across 3 studies including: ✓Reduction in PVR ✓Improvement in exercise capacity PDE5i Effects ✓Decrease in heart failure hospitalizations TX45 anticipated to be effective in

both Cpc-PH and Ipc-PH because it targets additional anti-fibrotic and anti-inflammatory mechanisms on top of activation of the NO pathway 1. Guazzi et al. 2011 2. Belyavskiy et al. 2020 3. Kramer et al. 2019

24 TX45 Relaxin Improves Hemodynamics in Heart Failure Balanced

pulmonary and peripheral vasodilation, and increased cardiac output relevant to Group 2 PH p<0.0001 • Above: serelaxin infusion for 20hrs in Acute Heart Failure patients with elevated pulmonary artery pressure (PAP) rapidly * lowered mPAP,

pulmonary vascular resistance (PVR), systemic vascular resistance (SVR) and improved renal function • Not shown: serelaxin also improved additional hemodynamic parameters including pulmonary capillary wedge pressure (PCWP), right atrial

pressures (RAP) and cardiac index (CI) ** • In a similar study in patients with chronic CHF, a reduction in PCWP and an increase in cardiac output was demonstrated * Ponikowski P. et al. Eur. Heart J. 2014, **Dschietzig T. et. Al. Ann NY Acad

Sci 2009

25 TX45 TX45 Development Program Overview Planned readouts in

mid-2024, 2H 2025, 2026 2024 2026 2025 Mid-2024 Phase 1A Healthy • Safety Safety, Volunteers • PK tolerability, (ongoing) • PD (Renal Blood Flow) PK/PD Phase 1B 2025 Group 2 PH • mPAP RHC study to establish with HFpEF•

PVR hemodynamic proof of • CO concept 2026 Phase 2 Group 2 PH with HFpEF • Primary: PVR Randomized, 6-month (enriched for CpcPH) • Secondary: mPAP, 6MWT study RHC: Right Heart Catheter mPAP: Mean Pulmonary Arterial Pressure PVR:

Pulmonary Vascular Resistance CO: Cardiac Output 6MTW: 6-Minute Walk Test

Preliminary PK/PD Analysis After TX45 Administration in Healthy

Volunteers January 2024

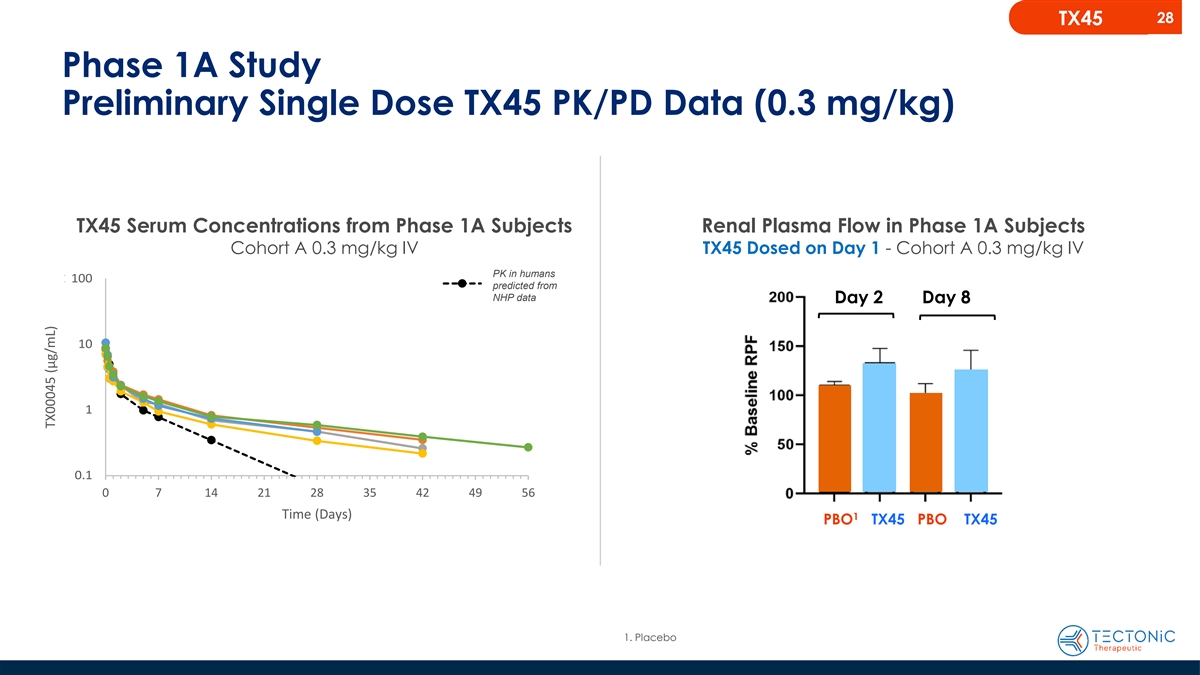

27 TX45 1 Summary of preliminary data from TX45 SAD study Cohort A

(0.3 mg/kg IV) and Cohort C (150 mg SC) • Well tolerated with minimal adverse events, TX45 SAD Dose Escalation Plan no drug-related SAEs • Pharmacokinetics – Low intersubject variability in serum concentrations (≤ 20%)

– No evidence of immune mediated clearance • Pharmacodynamics from 0.3 mg/kg cohort (lowest dose) – ~38% increase in renal plasma flow on Day 2 post dose persisting at least until Day 8 post dose *Cohorts F and G are optional

– Consistent with serelaxin’s effect – Meets “go criteria” Based on preliminary data, we anticipate Q4W dosing at optimal SC dose 1. As of Jan 18, 2024 P R O P R I E T A R Y A N D C O N F I D E N T I A L

28 TX45 Phase 1A Study Preliminary Single Dose TX45 PK/PD Data (0.3

mg/kg) TX45 Serum Concentrations from Phase 1A Subjects Renal Plasma Flow in Phase 1A Subjects Cohort A 0.3 mg/kg IV TX45 Dosed on Day 1 - Cohort A 0.3 mg/kg IV 0.3 15 m0 mg g/kg IV SC PK in humans 100.0 100 Predicted predicted from NHP data Day 2

Day 8 10.0 10 1.0 1 0.1 0.1 0 7 14 0 7 14 21 28 35 42 49 56 Tim Tim e (D e ay (Day s) s) 1 PBO TX45 PBO TX45 1. Placebo TX00045 (µg/mL) TX00045 (µg/mL)

29 TX45 PK Modeling based on Preliminary Data Suggests TX45 Can be

Given Monthly 150 mg SC q4w Target (1.7 μg/mL) 1 Mo Target (0.6 μg/mL) 16• A model was constructed using observed data from both 0.3 mg/kg IV and 150 mg SC cohorts to predict 14 trough concentrations of 150 mg SC Q4W • Terminal

t is based on 0.3 mg/kg IV cohort as data 1/2 12 beyond 14 days from 150 mg SC cohort was not available for accurate half life determination 10 Model assumptions 8 150 mg SC q4w Target (0.6 µg/mL) ▪ Steady state terminal t similar for IV

and SC 1/2, Target (1.7 µg/mL) 6▪ Terminal t of 16.7 days, observed in 0.3mg/kg IV cohort is 1/2 maintained in additional cohorts 4 2 Target Exposure Range Predicted to Provide Maximal Efficacy based on Preclinical Models 0 0 4 8 12 16 20

24 28 32 36 40 44 48 52 56 Time (weeks) TX00045 (µg/mL)

30 TX45 Significant Pharma Interest in Relaxin Tectonic has Potential

Best-in-Class Molecule Expected Dosing Company Format Formulation Frequency Fc-Fusion SubQ Engineered for optimal PK, Q4 Weeks biodistribution, high [C] High [C] achievable formulation Fc-Fusion SubQ Q2 Weeks SubQ h-Albumin-mAb-Fusion Q Weekly

Injection site reactions

31 Summary

32 Uniquely Positioned to Deliver on Value Creating Milestones Strong

Balance Sheet Accomplished Team Pipeline of Uniquely Anticipated Post World-leader Founders Differentiated Assets Transaction st ~$165 Million 20 1 Approvals Multiple Inflection Points >3 Year Runway >$50 Billion in Annual Sales 2024, 2025,

2026 Address important clinical Leadership with Well positioned problems, underserved Proven Track Record to execute patient populations

Transforming the Discovery of Novel GPCR-Targeted Therapies J A N U A

R Y 2 0 2 4

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Grafico Azioni AVROBIO (NASDAQ:AVRO)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AVROBIO (NASDAQ:AVRO)

Storico

Da Dic 2023 a Dic 2024